Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Net Wala Topic

Caricato da

Gayatri NabarDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Net Wala Topic

Caricato da

Gayatri NabarCopyright:

Formati disponibili

introduction: A bank is afinancial intermediarythat acceptsdepositsand channels thosedeposits intolendingactivities, either directly or throughcapital markets. A b a n k c o n n e c t s c u s t o m e r s w i t h c a p i t a l d e f i c i t s t o c u s t o m e r s w i t h c a p i t a l surpluses.

B a n k i n g i s g e n e r a l l y a highly regula tedi n d u s t r y , a n d g o v e r n m e n t restrictions on financial activities by banks have varied o v e r t i m e a n d locationT h e w o r d bank w a s b o r r o w e d i n Middle EnglishfromMiddle Fr ench banque, from OldItalianbanca, fromOld High German banc, bank "bench,c o u n t e r " . B e n c h e s w e r e u s e d a s d e s k s o r e x c h a n g e c o u n t e r s d u r i n g t h e RenaissancebyF lorentinebankers, who used to make their transactions atopdesks covered by green tablecloths. HISTORY OF BANKING Before we look into the knittyg r i t t y o f b a n k i n g s e c t o r r e f o r m s process , we must have a proper perspective of what i s t h e h i s t o r y o f o u r banking system in India

and also understand the rationale of why reform isnecessary and what reforms are essential. Like in many other aspects, Indiahad a long tradition of banking. Evidence regarding the existence of moneylending operations in India is found in the literature of the Vedic times, i.e.2000 to 1400 B.C. The literature of the Buddhist period, for e.g., the jatakas,and recent archaeological discoveries supply evidence of the existence of sresthis, or bankers. Form the laws of menu. It appears that money-lendingand allied problems had assumed considerable importance in ancient India.What were the interests? They were prescribed by almost all Hindulaw-givers, Menu, Vasistha, Yajnavalkya, Gautama and Baudhayana as alsoKautilya. A common base number was 15 per cent annum what the banker economist Dr. Thingalaya calls Hindu rate of interest. Incidentally, this isc l o s e t o c u r r e n t P r i m e L e n d i n g R a t e ( P L R ) o f m a n y b a n k s . H o w e v e r , Chanakya gives a different approach. The interest works out for 15 percenta n n u m f o r g e n e r a l a d v a n c e s . The traders are charged a rate of 60 % p . a . Where the merchandise has to pass through forests, the traders have to pay120 % while those engaged in the export-import business handling seabornec a r g o h a v e t o p a y 2 4 0 % p . a . Chanakyas interest rate structure is

risk w e i g h t e d ; t h e r a t e o f i n t e r e s t i n c r e a s e s w i t h t h e r i s k i n v o l v e d i n t h e borro wers business. Again, it is not everyone who could take up banking business. The Dharmashastra laid down the rates according to the castes of the borrowers, and the eligibility of men belonging to Vaishya caste alonec o u l d t a k e u p t h e m o n e y lending profession. In other words, in ancie n t times, your caste gives you license to banking; not RBI!!! TYPES OF BANKS

UBLIC SECTOR BANK Public sector banks are those banks r u n u n d e r t h e c o n t r o l o f government and their prime motive is the welfare of the general public. A public sector bank also looks for funding developmental work in the countryas the government has a majority share in it.T h e f i r s t o b j e c t i v e w o u l d a l w a y s b e t o m a k e p r o f i t . e v e r y organization whether private or public is here to make profits so that it could justify their existence. but public sector banks involves public also. Public here means common people like us. This refers to banks that have their shares listed in the stock exchanges NSE and BSE and also the government of India holds majoritystake. It is as good as the government running the bank. Since the publicdecide on who runs the government.All the nationalised banks are public sector but all public sector banksare not nationalized The following are the list of Public Sector Banks in India

Central Bank is a government-owned bank, is one of the oldest andlargest commercial banks in India based in Mumbai. The bank currently has3,168 branches and 270 extension counters across 27 Indian states RESERVE BANK OF INDIA Reserve Bank of India is also known as India's Central Bank. It wasestablishe d on 1st April 1935. Although the bank w a s i n i t i a l l y o w n e d privately, it has been taken up the Government of India ever since, it wasn a t i o n a l i z e d . T h e b a n k h a s b e e n v e s t e d with immense responsibility of reviewing a nd reconstructing the economic stability of t h e c o u n t r y b y formulating economic policies and ensuring a proper exchange of currency.I n t h i s regard, the Reserve Bank of India is also k n o w n a s t h e b a n k e r o f banks. PRIVATE SECTOR BANK

Private Banks in India started way back. Private banking in India was practiced since the beginning of banking system in India. In India the year of 1935 the reserve bank of India was build and it became the centreof all the other banks taking the imperial responsibilities that includes thetransfer of commercial banking completelyThe first private bank in India to be set up in Private Sector Banks inIndia was IndusInd Bank. It is one of the fastest growing Bank PrivateSector Banks in India. IDBI ranks the tenth largest development bank inthe world as Private Banks in India.The first Private Bank in India to receive an in principle approvalf r o m t h e R e s e r v e B a n k o f I n d i a w a s H o u s i n g D e v e l o p m e n t F i n a n c e Corporation Limited, to set up a bank in the private sector banks in Indiaas part of the RBI's liberalisation of the Indian Banking Industry. It was i n c o r p o r a t e d i n August 1994 as HDFC Bank Limited with r e g i s t e r e d office in Mumbai and commenced operations as Scheduled CommercialBank in January 1995. List of Private Sector Bank

Documentation

Latest 3 month Bank Statement 3 Latest Salary slips Proof of Continuity current job(Form 16/ Company appointmentletter) Proof of Identity Passport/ Driving Licence/ Voters ID. Proof of Residence Ration Card/ LIC Policy Receipt Proof of Qualification Highest Degree. IDBI PERSONAL LOAN

Key Features Loan upto Rs. 10 lakhs Attractive Interest Rate Low Processing Fees & Documentation Charges Faster Approval & Minimum Documentation Repayment period up to 60 months No collateral/ security Eligibility Salaried IndividualsE l i g i b i l i t y M i n i m u m M a x i m u m A m o u n t ( I N R ) R s 5 0 0 0 0 R s 1 0 , 0 0 , 0 0 0 R e p a y m

e t n o g 2 r t d

n h t n e y 3 s

t 1 h t

M 2 6 h 2 r ( e o o 0 s

o m A 3 s y A n f a

n o m

l n ) Documentaion

Salaried Individuals Photograph Age Proof Identity and Signature proof Salary slip Latest form 16 Credit Card statemnt or repayment track record Interest Rate and Other Charges Interest Rate: 16% to 18% Processing Fees: 1.5% Documentaion Charges: 0.5% FIELD STUDY What are the principal types of loans made by your bank?

http://www.scribd.com/doc/60004641/Personal-Loan

Potrebbero piacerti anche

- Banking India: Accepting Deposits for the Purpose of LendingDa EverandBanking India: Accepting Deposits for the Purpose of LendingNessuna valutazione finora

- Introduction To Private and Public BankDocumento17 pagineIntroduction To Private and Public BankAbhishek JohariNessuna valutazione finora

- Project: Comparative Study Between Privatesector Banks Anp Public Sector BanksDocumento24 pagineProject: Comparative Study Between Privatesector Banks Anp Public Sector BanksRama RaoNessuna valutazione finora

- Understanding the Nigerian Financial System for Secondary School StudentsDa EverandUnderstanding the Nigerian Financial System for Secondary School StudentsNessuna valutazione finora

- A Study On Project Report On Commercial BankDocumento8 pagineA Study On Project Report On Commercial BankGAME SPOT TAMIZHANNessuna valutazione finora

- Black BookDocumento104 pagineBlack BookSoni PalNessuna valutazione finora

- Comparative Study Between Private Sectors Bank and Public Sector BanksDocumento36 pagineComparative Study Between Private Sectors Bank and Public Sector BanksjudeNessuna valutazione finora

- Banking Law NotesDocumento8 pagineBanking Law NotesGeetika DhamaNessuna valutazione finora

- Part 1introduction1 SismaDocumento25 paginePart 1introduction1 Sismaanupa bhattaraiNessuna valutazione finora

- Innovative Services in Banking SectorDocumento32 pagineInnovative Services in Banking SectormeghkumawatNessuna valutazione finora

- Project On Banking, Tanmoy SanyalDocumento21 pagineProject On Banking, Tanmoy SanyalTanmoy SanyalNessuna valutazione finora

- Chapter 1Documento20 pagineChapter 1Bhumik KachaNessuna valutazione finora

- 08 - Chapter 1 PreambleDocumento25 pagine08 - Chapter 1 PreambleAnonymous Q6EAsy3mSNessuna valutazione finora

- A Project Report On History of SbiDocumento57 pagineA Project Report On History of SbiMitali AmagdavNessuna valutazione finora

- Industry Profile: Rajkot Nagarik Sahakari BankDocumento117 pagineIndustry Profile: Rajkot Nagarik Sahakari BankBhavika PatelNessuna valutazione finora

- "A Summer Project Report On Banking and Schemes ": Master of Business Administration (2009-2011)Documento82 pagine"A Summer Project Report On Banking and Schemes ": Master of Business Administration (2009-2011)Raman AhitanNessuna valutazione finora

- Problem and Prospect of Coperative BankDocumento42 pagineProblem and Prospect of Coperative BankJayne CopelandNessuna valutazione finora

- Project - Loans and AdvancesDocumento60 pagineProject - Loans and AdvancesRajendra Gawate75% (12)

- Impact of Fraud On The Indian Baking Sector.Documento43 pagineImpact of Fraud On The Indian Baking Sector.Hani patelNessuna valutazione finora

- Banking Industry 123Documento10 pagineBanking Industry 123rahulvishwakarmaNessuna valutazione finora

- Meaning of Banking - A Case Study On NCC BLDocumento46 pagineMeaning of Banking - A Case Study On NCC BLFahim ShafiNessuna valutazione finora

- Merchant BankingDocumento43 pagineMerchant BankingIrisha AnandNessuna valutazione finora

- Bbi NpaDocumento58 pagineBbi NpavarunNessuna valutazione finora

- Financial AnalysisDocumento155 pagineFinancial AnalysisChetanTejani100% (2)

- Introduction To Ozone Layer DepletionDocumento35 pagineIntroduction To Ozone Layer DepletionPlease let me knowNessuna valutazione finora

- Comparative Study Between Private Sector Banks and Public Sector BanksDocumento68 pagineComparative Study Between Private Sector Banks and Public Sector BanksRhytz Singh100% (1)

- An Analytical Study of Reforms and Their Impact On Indian Banking SectorDocumento31 pagineAn Analytical Study of Reforms and Their Impact On Indian Banking SectorWasil AliNessuna valutazione finora

- An Analytical Study of Reforms and Their Impact On Indian Banking SectorDocumento26 pagineAn Analytical Study of Reforms and Their Impact On Indian Banking SectorWasil AliNessuna valutazione finora

- Personal Loans Offered by Public AND Private Sector Bank"Documento49 paginePersonal Loans Offered by Public AND Private Sector Bank"revahykrish93Nessuna valutazione finora

- Sania SST PPT 2Documento10 pagineSania SST PPT 2Sania SharmaNessuna valutazione finora

- Nature and Development of Banking LawDocumento4 pagineNature and Development of Banking Lawarti50% (2)

- Project Report On Financial Products and Services of HDFC BankDocumento74 pagineProject Report On Financial Products and Services of HDFC BankAreeb Khan100% (1)

- BankingDocumento101 pagineBankingvipul5290Nessuna valutazione finora

- HRM IndustryDocumento31 pagineHRM IndustryRizzy PopNessuna valutazione finora

- Executive Summary: SECTOR BANKS AND PUBLIC SECTOR BANKS" Aims To Analyze Various ServicesDocumento42 pagineExecutive Summary: SECTOR BANKS AND PUBLIC SECTOR BANKS" Aims To Analyze Various ServicesSidharth GeraNessuna valutazione finora

- Merchant BankingDocumento43 pagineMerchant BankingAbhishek Sanghvi100% (1)

- Untitled 1Documento14 pagineUntitled 1Tushar BhatiNessuna valutazione finora

- Online Banking IncompleteDocumento31 pagineOnline Banking IncompleteRavi Kashyap506Nessuna valutazione finora

- Final ProjectDocumento64 pagineFinal ProjectVarun JainNessuna valutazione finora

- Research ReportDocumento66 pagineResearch ReportSuraj DubeyNessuna valutazione finora

- Financial Analysis SBIDocumento87 pagineFinancial Analysis SBIChandrashekhar Joshi0% (1)

- Personal LoanDocumento49 paginePersonal Loantodkarvijay50% (6)

- Dhiraj's Final ReportDocumento93 pagineDhiraj's Final Reportraazoo19Nessuna valutazione finora

- NPA PROJECT For Surat Dist Co-Op BankDocumento62 pagineNPA PROJECT For Surat Dist Co-Op BankVijay Gohil33% (3)

- Executive SummaryDocumento57 pagineExecutive SummarySony BhagchandaniNessuna valutazione finora

- Importance of Banking Sector On The Growth of NationDocumento22 pagineImportance of Banking Sector On The Growth of NationFaizan MemonNessuna valutazione finora

- Bank Traning Project Report On IOB BankDocumento76 pagineBank Traning Project Report On IOB BankLokeshlion89% (9)

- Finance Project BsDocumento48 pagineFinance Project BsBhavyaNessuna valutazione finora

- Project On SBI BankDocumento48 pagineProject On SBI BankArvind Mahandhwal80% (5)

- Ms. Nidhi Malhotra SoniaDocumento87 pagineMs. Nidhi Malhotra SoniaShalini ThakurNessuna valutazione finora

- Supervisor Certificate: 2016, Jagannath International Management School, GGSIPU Has Written A, Project TitledDocumento38 pagineSupervisor Certificate: 2016, Jagannath International Management School, GGSIPU Has Written A, Project TitledAravind SelvakumarNessuna valutazione finora

- A Study On Deposit Mobilisation of CSBDocumento33 pagineA Study On Deposit Mobilisation of CSBDeepthi Radhakrishnan100% (2)

- Finance ProjectDocumento61 pagineFinance Projecthiren9090Nessuna valutazione finora

- Reform in Banking SectorDocumento59 pagineReform in Banking SectorRaKesh KuMarNessuna valutazione finora

- Indian Banking Industry: C A Project Report OnDocumento54 pagineIndian Banking Industry: C A Project Report OnYogesh WaghelaNessuna valutazione finora

- Merchant Banking and Financial ServicesDocumento41 pagineMerchant Banking and Financial ServicesknpunithrajNessuna valutazione finora

- Banking and Working System of BanksDocumento25 pagineBanking and Working System of BanksMohitJangidNessuna valutazione finora

- Axis Bank Debit and Credit Card1234Documento81 pagineAxis Bank Debit and Credit Card1234VaishnaviNessuna valutazione finora

- Punjab State Cooperative BankDocumento58 paginePunjab State Cooperative BankRavneet Singh75% (4)

- Golf Course Business Plan - Union College 2009Documento48 pagineGolf Course Business Plan - Union College 2009flippinamsterdam100% (2)

- Anup TransactionsDocumento6 pagineAnup TransactionsNirupam DewanjiNessuna valutazione finora

- SK Illustrative Problems - For All SessionsDocumento6 pagineSK Illustrative Problems - For All SessionsLea Mae JenNessuna valutazione finora

- Solved Twelve Years Ago Marilyn Purchased Two Lots in An UndevelopedDocumento1 paginaSolved Twelve Years Ago Marilyn Purchased Two Lots in An UndevelopedAnbu jaromiaNessuna valutazione finora

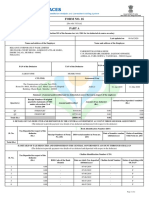

- Form No. 16: Part ADocumento8 pagineForm No. 16: Part AParikshit ModiNessuna valutazione finora

- CV 1Documento3 pagineCV 1suherlanNessuna valutazione finora

- BJs AnnouncementDocumento2 pagineBJs AnnouncementiBerkshires.comNessuna valutazione finora

- LMOR Session 123BLK1Documento85 pagineLMOR Session 123BLK1Seera HarisNessuna valutazione finora

- Swiss Challenge Method by Govt of Madhya Pradesh - SCM11022013FinalDocumento46 pagineSwiss Challenge Method by Govt of Madhya Pradesh - SCM11022013FinalkpindiaNessuna valutazione finora

- Coca ColaDocumento13 pagineCoca Colaramonese100% (2)

- Learnings From DJ SirDocumento94 pagineLearnings From DJ SirHare KrishnaNessuna valutazione finora

- Central Bank-Monetary Policy ReviewDocumento6 pagineCentral Bank-Monetary Policy ReviewAda DeranaNessuna valutazione finora

- Week 012-Presentation Key Concepts of Simple and Compound Interests, and Simple and General Annuities - Part 002Documento18 pagineWeek 012-Presentation Key Concepts of Simple and Compound Interests, and Simple and General Annuities - Part 002Alleona EmbolodeNessuna valutazione finora

- Pi IPSAS Is Cash Still King v5Documento50 paginePi IPSAS Is Cash Still King v5Grecia Dalina Vizcarra VNessuna valutazione finora

- List of Project Topics For Accountancy DDocumento4 pagineList of Project Topics For Accountancy DnebiyuNessuna valutazione finora

- Fiscal Policy of EUROPEDocumento11 pagineFiscal Policy of EUROPEnickedia17Nessuna valutazione finora

- Analysis of Factors Influencing Bank ProfitabilityDocumento35 pagineAnalysis of Factors Influencing Bank ProfitabilityA M DraganNessuna valutazione finora

- Twelve-Month Cash Flo YEAR 1: Jan-18 Fiscal Year BeginsDocumento1 paginaTwelve-Month Cash Flo YEAR 1: Jan-18 Fiscal Year BeginsTun Izlinda Tun BahardinNessuna valutazione finora

- Transfer Pricing II: Rajan Baa 3257Documento15 pagineTransfer Pricing II: Rajan Baa 3257Rajan BaaNessuna valutazione finora

- Ias 2Documento4 pagineIas 2mnhammadNessuna valutazione finora

- Wells Fargo Bank N.A. V Erobobo wNEW YORK 5 2013Documento13 pagineWells Fargo Bank N.A. V Erobobo wNEW YORK 5 2013MackLawfirmNessuna valutazione finora

- IBT MCQ and Essay QuestionsDocumento9 pagineIBT MCQ and Essay QuestionsCristine BilocuraNessuna valutazione finora

- Questionnaire For 2018 Tax Returns: Worksheets AvailableDocumento7 pagineQuestionnaire For 2018 Tax Returns: Worksheets Availableparesh shiralNessuna valutazione finora

- Fund Rankings Sovereign Wealth Fund InstituteDocumento3 pagineFund Rankings Sovereign Wealth Fund Institutelohenci_sammyNessuna valutazione finora

- Chapter 2 Cost Concepts and The Cost Accounting Information SystemDocumento44 pagineChapter 2 Cost Concepts and The Cost Accounting Information Systemelite76Nessuna valutazione finora

- Topeka Adhesives OCRDocumento6 pagineTopeka Adhesives OCRRobert DeGuire100% (2)

- Marketing Strategy For IslamicDocumento16 pagineMarketing Strategy For IslamicTamim Arefi100% (1)

- 2012a Buyback NoticeDocumento4 pagine2012a Buyback Noticekv chandrasekerNessuna valutazione finora

- Kumkum YadavDocumento51 pagineKumkum YadavHarshit KashyapNessuna valutazione finora

- Gap Thesis and The Survival of Informal Financial Sector in NigeriaDocumento6 pagineGap Thesis and The Survival of Informal Financial Sector in NigeriaMadiha MunirNessuna valutazione finora