Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Global To Local: A Perspective of Foreign Banks in India: by Dipasha Sharma

Caricato da

Dipasha SharmaDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Global To Local: A Perspective of Foreign Banks in India: by Dipasha Sharma

Caricato da

Dipasha SharmaCopyright:

Formati disponibili

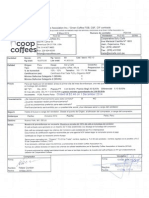

Global to Local: A perspective of foreign banks in India

By Dipasha Sharma

Foreign banks have made their presence in Indian banking system with their innovative financial products and customer oriented services. A foreign bank operates in India as branches of their parent bank and therefore has limited scale of operations and branches, but now the RBI wants to convert them locally incorporated as a wholly owned Indian subsidiary. This article brings forth the issues and concern of the foreign banks about their conversion of Global to Local in Indian market.

In Indian banking system foreign banks are

competitively tapping their feet and grabbing market share. With the reforms and new licensing norms for banking, Indian banking system is witnessing the encouraged professionalism and customer orientation. These changes in Indian banking system are driven by the increase participation of foreign and private banks. But still foreign banks prefer to operate in India as subsidiaries of their parents rather than local branches. According to the RBI discussion paper released on 21st January, RBI wants foreign banks in India to incorporate locally and that it will encourage large foreign banks like Citi bank, Standard Charted bank and HSBC to set up wholly owned Indian subsidiaries which would enable them to open more branches across the country.

Through this subsidiary model (local incorporation of foreign banks as wholly owned Indian subsidiary from branches of their parents) RBI is offering a less restrictive branch expansion policy to large foreign banks. Indian market has been highly profitable market for foreign banks in last financial year. Big players like Citi, HSBC and Standard Charted bank reported increase percentage in profit after tax. Therefore, this can be a good opportunity to foreign banks to expand their operations in India as they will be more liberal to open up new branches across the country. With this subsidiary model foreign banks can get following advantages and incentives as per the RBI discussion paper: Foreign banks converted into a wholly owned subsidiary from a branch would be allowed to acquire

existing banks, subject to holding a maximum of 74% equity post acquisition. Locally incorporated banks will be treated more liberally than foreign banks. Wholly owned Indian subsidiaries of foreign banks would be allowed to issue new financial products such as perpetual debt instruments, preference shares and freely open branches. This subsidiary model to foreign banks offered by RBI seems to be a lucrative opportunity, but on the flip side there are many issue regarding taxes and capital management in front of foreign banks. Following are the main issues concerning foreign banks about transformation of their corporate structure: Treatment of Taxes: Treatment of taxes is an important issue of concern as if a foreign bank incorporates locally, then positively it reduces the burden of taxes, but due to increase in number of branches the amount of capital gains tax in the transactional phase from a branch to parent will be high. Priority sector loan targets: If a foreign bank chooses to incorporate locally, then it has to meet the obligation of 40% lending to priority sector in India, i.e., agriculture, small and medium enterprise, exports and home loans up to 15 lakhs. Not only the priority sector lending, but the

opening of branches in rural areas cannot be so profitable deal for them. Borrowing limits and Capital Management: Borrowing limits and capital management can also be a big challenge for locally incorporated foreign banks as banks in India cannot lend more than 15% of their net worth to a single company and more than 40% to a corporate group. These regulations can create hurdle for their scale of operation. As far as this subsidiary model to foreign banks and its pros and cons are concerning, it is better to adopt it in case of being a big player in the Indian market. This transformation can be fruitful for the foreign banks in the long run only with the wide market coverage and distinguish themselves with innovative business practices and new financial products.

Potrebbero piacerti anche

- Sai NathDocumento6 pagineSai NathLinda MartinNessuna valutazione finora

- Measures and Guidelines for Foreign Banks in IndiaDocumento7 pagineMeasures and Guidelines for Foreign Banks in IndiaprasannarbNessuna valutazione finora

- Exchange Banks-1Documento15 pagineExchange Banks-1Sweta SumanNessuna valutazione finora

- Destination India: An Attractive Opportunity For Foreign BanksDocumento4 pagineDestination India: An Attractive Opportunity For Foreign BanksAbhi MaheshwariNessuna valutazione finora

- The Federation of Universities: SBI LTDDocumento26 pagineThe Federation of Universities: SBI LTDkohinoor_roy5447Nessuna valutazione finora

- CBS NewDocumento92 pagineCBS NewBen MathewsNessuna valutazione finora

- Minutes of Meeting On Response of Meeting Held On (22-4-17)Documento4 pagineMinutes of Meeting On Response of Meeting Held On (22-4-17)Shivam KumarNessuna valutazione finora

- CC C C CCCC CCC C C CCC C CCCCCCCCC CCCCCCCCCC CCCCCCDocumento5 pagineCC C C CCCC CCC C C CCC C CCCCCCCCC CCCCCCCCCC CCCCCCPravin ChavanNessuna valutazione finora

- The World and the Indian Banking Industry: An Analysis of Foreign Entry and RegulationDocumento10 pagineThe World and the Indian Banking Industry: An Analysis of Foreign Entry and RegulationsravanthhhhNessuna valutazione finora

- Abn-Ambro Bank Final 2007Documento60 pagineAbn-Ambro Bank Final 2007Ajay PawarNessuna valutazione finora

- Project Report Credit Schemes SBI and Other Banks in IndiaDocumento13 pagineProject Report Credit Schemes SBI and Other Banks in IndiaDiwakar BandarlaNessuna valutazione finora

- Foreign Banks in India: Ashwini Jerry PGDM'15Documento26 pagineForeign Banks in India: Ashwini Jerry PGDM'15Anika VarkeyNessuna valutazione finora

- Introduction To Banking Sector: Marketing Strategies of ICICI BankDocumento32 pagineIntroduction To Banking Sector: Marketing Strategies of ICICI BankTanoj PandeyNessuna valutazione finora

- Banking Industry Full Overview ProjectDocumento74 pagineBanking Industry Full Overview ProjectramansutharNessuna valutazione finora

- History of Banking in IndiaDocumento17 pagineHistory of Banking in IndiadharinimehtaNessuna valutazione finora

- Abn Ambro Bank Final 19-09-2007Documento85 pagineAbn Ambro Bank Final 19-09-2007Gaurav NathaniNessuna valutazione finora

- AXIS ProjectDocumento59 pagineAXIS ProjectSalim KhanNessuna valutazione finora

- Differentiated Bank Licensing Pros and ConsDocumento3 pagineDifferentiated Bank Licensing Pros and ConsPardeep Singh SainiNessuna valutazione finora

- Role of Foreign Commercial Banks in Indian EconomyDocumento25 pagineRole of Foreign Commercial Banks in Indian EconomySantosh Parashar50% (2)

- Banking LicenceDocumento8 pagineBanking LicenceSahil JoshiNessuna valutazione finora

- A Role of Foreign Banks in IndiaDocumento6 pagineA Role of Foreign Banks in Indiaalishasoni100% (1)

- Retail Banking: NtroductionDocumento13 pagineRetail Banking: NtroductionAmit PandeyNessuna valutazione finora

- Mrutyunjaya Sangresakoppa - MB207683Documento21 pagineMrutyunjaya Sangresakoppa - MB207683Prashanth Y GNessuna valutazione finora

- Sme Project ReportDocumento7 pagineSme Project ReportHuzefa BadriNessuna valutazione finora

- JK Bank Project ReportDocumento74 pagineJK Bank Project ReportSurbhi Nargotra43% (7)

- Indian Banking Industry GrowthDocumento11 pagineIndian Banking Industry GrowthaviNessuna valutazione finora

- India Banking Industry OverviewDocumento6 pagineIndia Banking Industry OverviewBhavik LathiaNessuna valutazione finora

- KPMG ICC Indian Banking The Engine For Sustaining Indias Growth AgendaDocumento52 pagineKPMG ICC Indian Banking The Engine For Sustaining Indias Growth AgendaNekta PinchaNessuna valutazione finora

- Idbi Bank ING Vyasa Bank SBIDocumento16 pagineIdbi Bank ING Vyasa Bank SBINEON29Nessuna valutazione finora

- Wat Is A BankDocumento12 pagineWat Is A BankPratik VernekerNessuna valutazione finora

- Serving Global Indians' Financial NeedsDocumento15 pagineServing Global Indians' Financial NeedsSAGAR BALAGARNessuna valutazione finora

- Licensing New Banks: Stringent RBI GuidelinesDocumento5 pagineLicensing New Banks: Stringent RBI GuidelinesCraig WilliamsNessuna valutazione finora

- GK-Capcule 2015 in EnglishDocumento54 pagineGK-Capcule 2015 in EnglishJyothi SmilyNessuna valutazione finora

- Ndian Banking Industry: An Analysis 1.1industry DefinitionDocumento29 pagineNdian Banking Industry: An Analysis 1.1industry DefinitionRiyas ThelakkadanNessuna valutazione finora

- Asso PDFDocumento54 pagineAsso PDFneeta chandNessuna valutazione finora

- A Role of Foreign Banks in IndiaDocumento6 pagineA Role of Foreign Banks in Indiak gowtham kumarNessuna valutazione finora

- Strategies For Effective Bank Marketing in IndiaDocumento7 pagineStrategies For Effective Bank Marketing in Indiaatultyagi100Nessuna valutazione finora

- Differential Banking Licenses ExplainedDocumento8 pagineDifferential Banking Licenses ExplainedSakshiNessuna valutazione finora

- Indian Banking Industry: An AnalysisDocumento18 pagineIndian Banking Industry: An Analysismishra29swati1913Nessuna valutazione finora

- Banking Term PaperDocumento18 pagineBanking Term PaperSangeeta ChakiNessuna valutazione finora

- Indian Banking IndustryDocumento25 pagineIndian Banking IndustryAsim MahatoNessuna valutazione finora

- Introduction of Banking IndustryDocumento15 pagineIntroduction of Banking IndustryArchana Mishra100% (1)

- IntroductionDocumento57 pagineIntroductionPrakash JoshuaNessuna valutazione finora

- Project Report "Banking System" in India Introduction of BankingDocumento15 pagineProject Report "Banking System" in India Introduction of BankingshabnammerajNessuna valutazione finora

- Unlocking The Lock-A Mirror Image Effect of Sbi Merger in Indian Banking SystemDocumento4 pagineUnlocking The Lock-A Mirror Image Effect of Sbi Merger in Indian Banking SystemHemaliNessuna valutazione finora

- SBI Small Business Credit Card SchemeDocumento46 pagineSBI Small Business Credit Card SchemeAbhinaw KumarNessuna valutazione finora

- Project On Various Credit Schemes of SBI Back PDFDocumento46 pagineProject On Various Credit Schemes of SBI Back PDFAbhinaw KumarNessuna valutazione finora

- Finance Project On Various Credit Schemes of SBIDocumento46 pagineFinance Project On Various Credit Schemes of SBItaanvi00783% (6)

- Non Banking Financial Company (NBFC) Sector in India - Trends, Regulatory Issues and Way ForwardDocumento13 pagineNon Banking Financial Company (NBFC) Sector in India - Trends, Regulatory Issues and Way ForwardUbaid DarNessuna valutazione finora

- SBI Service Marketing Project ReportDocumento41 pagineSBI Service Marketing Project ReportramsalaNessuna valutazione finora

- Economics ProjectDocumento16 pagineEconomics ProjectYashvardhanNessuna valutazione finora

- Bank of IndiaDocumento22 pagineBank of IndiaLeeladhar Nagar100% (1)

- BK Swain DocumentDocumento11 pagineBK Swain DocumentSatyashil RangareNessuna valutazione finora

- Non Banking Financial Company (NBFC) Sector in India - Trends, Regulatory Issues and Way ForwardDocumento13 pagineNon Banking Financial Company (NBFC) Sector in India - Trends, Regulatory Issues and Way Forwardshubham moonNessuna valutazione finora

- Project Report on Banking System and Credit Schemes in IndiaDocumento9 pagineProject Report on Banking System and Credit Schemes in IndiamanishteensNessuna valutazione finora

- Report On Banking SectorDocumento8 pagineReport On Banking SectorSaurabh Paharia100% (1)

- Banking India: Accepting Deposits for the Purpose of LendingDa EverandBanking India: Accepting Deposits for the Purpose of LendingNessuna valutazione finora

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)Da EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)Nessuna valutazione finora

- Regional Rural Banks of India: Evolution, Performance and ManagementDa EverandRegional Rural Banks of India: Evolution, Performance and ManagementNessuna valutazione finora

- Critical ThinkingDocumento19 pagineCritical ThinkingNijan RaviNessuna valutazione finora

- Dummy and TrendDocumento27 pagineDummy and TrendDipasha SharmaNessuna valutazione finora

- Best Subsets Regression (Menu)Documento5 pagineBest Subsets Regression (Menu)Dipasha SharmaNessuna valutazione finora

- Data Envelopment Analysis: Models and Extensions: Production/Operations ManagementDocumento4 pagineData Envelopment Analysis: Models and Extensions: Production/Operations Managementmithunrecdgp100% (2)

- Best Subset Reg 2Documento9 pagineBest Subset Reg 2Dipasha SharmaNessuna valutazione finora

- PEA144Documento4 paginePEA144coffeepathNessuna valutazione finora

- JDA Demand - Focus 2012Documento43 pagineJDA Demand - Focus 2012Abbas Ali Shirazi100% (1)

- ABCDocumento18 pagineABCRohit VarmaNessuna valutazione finora

- Marketing Quiz on Product Life Cycle, Pricing Strategies, Distribution Channels, Promotion ToolsDocumento7 pagineMarketing Quiz on Product Life Cycle, Pricing Strategies, Distribution Channels, Promotion ToolsDisha MathurNessuna valutazione finora

- Letter To Builder For VATDocumento5 pagineLetter To Builder For VATPrasadNessuna valutazione finora

- Special Offers to Colombo from London on SriLankan AirlinesDocumento32 pagineSpecial Offers to Colombo from London on SriLankan AirlinesSri Sakthi SumananNessuna valutazione finora

- LPP Mod 2Documento27 pagineLPP Mod 2ganusabhahit7Nessuna valutazione finora

- Nike's Winning Ways-Hill and Jones 8e Case StudyDocumento16 pagineNike's Winning Ways-Hill and Jones 8e Case Studyraihans_dhk3378100% (2)

- Quiz - 1Documento3 pagineQuiz - 1Faiz MokhtarNessuna valutazione finora

- Get Surrounded With Bright Minds: Entourage © 2011Documento40 pagineGet Surrounded With Bright Minds: Entourage © 2011Samantha HettiarachchiNessuna valutazione finora

- Jay Abraham - Let Them Buy Over TimeDocumento2 pagineJay Abraham - Let Them Buy Over TimeAmerican Urban English LoverNessuna valutazione finora

- Cyber Security Assignment - Patent BasicsDocumento6 pagineCyber Security Assignment - Patent BasicsTatoo GargNessuna valutazione finora

- Ghuirani Syabellail Shahiffa/170810301082/Class X document analysisDocumento2 pagineGhuirani Syabellail Shahiffa/170810301082/Class X document analysisghuirani syabellailNessuna valutazione finora

- Quiz For ISO 9001Documento4 pagineQuiz For ISO 9001lipueee100% (1)

- Non Disclosure AgreementDocumento2 pagineNon Disclosure AgreementReginaldo BucuNessuna valutazione finora

- SC upholds conviction for forgery under NILDocumento3 pagineSC upholds conviction for forgery under NILKobe Lawrence VeneracionNessuna valutazione finora

- Lesson 6 EntrepreneurshipDocumento13 pagineLesson 6 EntrepreneurshipRomeo BalingaoNessuna valutazione finora

- Roberto Guercio ResumeDocumento2 pagineRoberto Guercio Resumeapi-3705855Nessuna valutazione finora

- QMS PrinciplesDocumento5 pagineQMS PrinciplesShankar AsrNessuna valutazione finora

- Role of Market ResearchDocumento2 pagineRole of Market ResearchGaurav AgarwalNessuna valutazione finora

- Netflix Inc.Documento12 pagineNetflix Inc.Tanju Whally-JamesNessuna valutazione finora

- Contract CoffeeDocumento5 pagineContract CoffeeNguyễn Huyền43% (7)

- Dynamic Cables Pvt. LTD.: WORKS ORDER-Conductor DivDocumento2 pagineDynamic Cables Pvt. LTD.: WORKS ORDER-Conductor DivMLastTryNessuna valutazione finora

- Annex D Internship Contract AgreementDocumento7 pagineAnnex D Internship Contract AgreementCamille ValdezNessuna valutazione finora

- Basic Economic Questions ExplainedDocumento20 pagineBasic Economic Questions ExplainedRiemann SolivenNessuna valutazione finora

- The Seven Stages of the Entrepreneurial Life CycleDocumento17 pagineThe Seven Stages of the Entrepreneurial Life Cycleshruti latherNessuna valutazione finora

- Cash Flow Statement - QuestionDocumento27 pagineCash Flow Statement - Questionhamza khanNessuna valutazione finora

- Take RisksDocumento3 pagineTake RisksRENJITH RNessuna valutazione finora

- InventoryDocumento53 pagineInventoryVinoth KumarNessuna valutazione finora

- Edvinsson, L. - 1997 - Developing Intellectual Capital at Skandia PDFDocumento10 pagineEdvinsson, L. - 1997 - Developing Intellectual Capital at Skandia PDFreg_kata123Nessuna valutazione finora