Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Global Economics - India

Caricato da

api-37123670 valutazioniIl 0% ha trovato utile questo documento (0 voti)

39 visualizzazioni2 pagineIndia's merchandise trade deficit unexpectedly narrowed to US$4. Billion in September 2007. Exports grew 19.3%oya in September, topping the 18.5% average of the previous five months. The rise in crude oil import bill, strong non-oil imports and slower export growth are likely to widen the trade deficit further in the rest of 2007-08.

Descrizione originale:

Copyright

© Attribution Non-Commercial (BY-NC)

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoIndia's merchandise trade deficit unexpectedly narrowed to US$4. Billion in September 2007. Exports grew 19.3%oya in September, topping the 18.5% average of the previous five months. The rise in crude oil import bill, strong non-oil imports and slower export growth are likely to widen the trade deficit further in the rest of 2007-08.

Copyright:

Attribution Non-Commercial (BY-NC)

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

39 visualizzazioni2 pagineGlobal Economics - India

Caricato da

api-3712367India's merchandise trade deficit unexpectedly narrowed to US$4. Billion in September 2007. Exports grew 19.3%oya in September, topping the 18.5% average of the previous five months. The rise in crude oil import bill, strong non-oil imports and slower export growth are likely to widen the trade deficit further in the rest of 2007-08.

Copyright:

Attribution Non-Commercial (BY-NC)

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 2

JPMorgan Chase Bank, Singapore Economic Research

Rajeev Malik Global Data Watch

November 9, 2007

JPMorgan Chase Bank, Mumbai

Gunjan Gulati

India Indian crude oil basket price and WPI inflation

US$ per barrel %oya

• Merchandise trade deficit narrowed in September

owing to slower growth of imports 80 15

WPI energy Indian crude oil basket

• Fiscal and revenue deficits of the central government

70 10

exceeded midyear target of 45% of the annual budget

• Expect a marginal hike in retail prices of domestic 60 5

fuels; oil companies to bear most of the burden

50 Overall WPI 0

Economic attention this week focused largely on the

government’s reaction to rising global crude oil prices. Do- 40 -5

2005 2006 2007

mestic retail prices of fuels are administered by the govern-

Merchandise trade balance

ment, and changes in global oil prices are not automatically

US$ billion/month, 3mma

passed to the domestic market. Separately, the merchandise

0

trade deficit unexpectedly narrowed in September owing to

-1

significantly slower growth of non-oil imports.

-2

-3

Merchandise trade deficit shrinks

-4

India’s merchandise trade deficit unexpectedly narrowed to

-5

US$4.4 billion in September 2007, much lower than the

-6

average of US$6.1 billion in the first five months of the

current fiscal year (which began April 1). Significantly -7

2000 2001 2002 2003 2004 2005 2006 2007

lower import growth relative to the previous few months

slimmed the deficit for September. The trade deficit for the

first half of the fiscal year thus stands at US$36.9 billion. Fiscal deficit exceeds midyear target

The federal government’s fiscal deficit, during the first half

Exports grew 19.3%oya in September, topping the 18.5% of the fiscal year that started in April, stood at Rs812 bil-

average of the previous five months. Export growth so far lion, 53.8% of the budget estimate for the full year. The

has been masking the underlying weakness likely to result fiscal deficit in April-September fell 6.1% below the

from this year’s rupee appreciation. Import growth moder- Rs865bn figure recorded during the same period of the pre-

ated to 2.3%oya, owing to a surprise deceleration in non-oil vious fiscal year. The revenue (operating) deficit totaled

imports (-0.1%). Non-oil imports had grown at a buoyant Rs611bn in this fiscal year’s first half—85.5% of the bud-

42.7%oya during April to August. The cause of geted target for the entire year. Note that the Fiscal Re-

September’s deceleration is unclear and there are no compo- sponsibility and Budget Management (FRBM) Act man-

nent details available. Also unclear is why, despite higher dates the government to restrict midyear targets for the fis-

global oil prices, the oil import bill in September rose only cal and revenue deficits to 45% of the full-year budget esti-

8%oya; less than the April-August figure of 9.3%. mates. The latter were set at 3.3% of GDP for the fiscal

deficit, and 1.5% of GDP fore the revenue deficit.

The rising crude oil import bill, strong non-oil imports, and

slower export growth are likely to widen the trade deficit Total receipts during the first six months grew 43%oya to

further in the rest of 2007-08. In our revised forecasts, we Rs2367 billion. Net tax revenue remained buoyant, grow-

expect the trade deficit to deteriorate to US$102.2 billion ing 23.5%oya, strengthened by strong collections of per-

this year from US$64.9bn in 2006-07. The wider trade gap sonal income tax (up 35.3%) and corporate tax (38.6%).

is likely to more than offset the sizable surplus in invisible Nontax revenue grew 19.2%oya. Total expenditure grew

trade—which reflects strong remittances from Indians 26.2%oya to Rs3179 billion. Recent political uncertainty

working abroad and software exports. The current account has increased the probability of a general election before

(CA) deficit is thus expected to worsen to US$22.2bn in the deadline of May 2009. The possibility of increased

2007-08 (1.9% of GDP) from US$9.6bn (1.1% of GDP) populist spending in the runup to an election is a key risk to

last year. However, financing the wider CA deficit will not achieving the fiscal and operating deficit targets.

be a problem as capital inflows, especially foreign direct

investment, will more than offset the CA shortfall. The India data watch is published biweekly, next on November 23.

73

JPMorgan Chase Bank, Singapore Economic Research

Rajeev Malik India

November 9, 2007

JPMorgan Chase Bank, Mumbai

Gunjan Gulati

Politics of oil Mon Foreign exchange reserves

Nov 1 2 US$ billion

With the international crude oil price hovering close to Aug Sep Oct Nov 19

$100 per barrel, the government’s dilemma in deciding Total foreign reserves 229.3 247.8 262.5 ___

whether to raise domestic prices has intensified signifi- Fx reserves ex gold 221.5 240.4 255.1 ___

cantly. India imports more than 75% of its crude oil re-

Mon Industrial production

quirements. Further, state-run oil refineries control about

Nov 12 %oya, nsa

90% of the domestic fuel market. Any increase in interna- Jun Jul Aug Sep

tional crude prices hurts these oil marketing companies

Overall 9.0 7.5 10.7 9.4

(OMCs) significantly, since the domestic retail price of key %m/m, sa -0.3 -0.9 2.0 1.6

fuels is administered by the government. Mining 1.5 3.7 17.1 ___

Manufacturing 9.9 7.9 10.4 ___

Electricity 6.8 7.5 9.2 ___

The willingness of the government to announce a price

hike is affected by the likely negative impact of such action Fri Wholesale prices

on the ruling coalition’s political fortunes in a general elec- Nov 16 %oya

tion—increasingly likely to be held ahead of schedule—as Aug Sep Oct Nov 3

well as elections in two states in the near future. The gov- Overall 4.0 3.4 3.0 ___

ernment may announce a small price hike next week, but Primary 9.2 7.1 5.4 ___

Energy group -2.0 -2.5 -1.7 ___

the majority of the burden is likely to fall on the OMCs. Manufactured products 4.6 4.3 4.0 ___

Less than a month ago, the government agreed to issue

bonds totaling US$5.8 billion whose proceeds would par-

tially offset the revenue forgone from state-owned oil com-

panies selling local fuels at subsidized prices. That revenue Review of past week’s data

loss could amount to around 1.6% of GDP. The govern- Merchandise trade (Nov 1)

ment could also opt to cut the excise duty (at point of pro- US$ billion, nsa

duction) on gasoline and diesel fuel, thereby reducing the Jul Aug Sep

difference between the selling price and the product price. Trade balance -5.0 -6.9 -7.3 -4.4

Exports 12.5 12.7 11.8 12.8

%oya 18.5 18.9 14.5 19.3

Retail fuel prices were last changed in Feb 2007, when the Imports 17.5 19.6 19.1 17.2

prices of gasoline and diesel fuel were cut Rs2/liter and %oya 20.4 32.6 22.1 2.3

Rs1/liter, respectively, by way of a reduction in customs Oil 5.0 6.0 ___ 5.5

Non-oil 12.5 13.5 ___ 11.7

and excise duties. Currently, the rupee price of India’s im-

port basket of crude oil has surged nearly 60% since the Federal government fiscal balance (Oct 31)

last revision in the local prices of gasoline and diesel fuel. INR billion

However, political considerations continue to prolong the Jul Aug Sep

life of the oil subsidies, which are mainly off-budget. Total receipts 311.6 693.7 __ 686.6

Revenue 308.6 687.9 __ 338.7

Tax (net) 224.4 194.5 __ 611.4

Nontax 84.2 493.5 __ -272.7

Total expenditure 481.6 433.0 __ 465.2

Plan 119.2 125.1 __ 144.3

Data releases and forecasts Nonplan 362.5 308.0 __ 320.9

Interest payments 146.6 141.0 __ 97.8

Fiscal deficit 170.0 -260.7 __ -221.4

Weeks of November 12 - 23

Revenue deficit 137.5 -288.9 __ 76.1

Primary deficit 23.4 -401.7 __ -319.2

During wk Core infrastructure index

of Nov 12 %oya, nsa

Jun Jul Aug Sep

Overall 3.8 6.8 9.0 __

%m/m, sa -0.8 2.1 0.7 __

Electricity 6.8 7.5 8.7 __

Coal 1.3 1.1 8.7 __

Finished steel -0.1 9.6 8.5 __

Crude petroleum -1.8 0.9 6.4 __

Petroleum refining 9.9 4.7 8.2 __

Cement 5.6 9.0 16.2 __

74

Potrebbero piacerti anche

- Food Outlook: Biannual Report on Global Food Markets: November 2022Da EverandFood Outlook: Biannual Report on Global Food Markets: November 2022Nessuna valutazione finora

- MENAP Oil-Exporting Countries: Feeling The Impact of Lower and More Volatile Oil PricesDocumento12 pagineMENAP Oil-Exporting Countries: Feeling The Impact of Lower and More Volatile Oil PricesSara SimoesNessuna valutazione finora

- ENMPOOCT19 KuwaitDocumento2 pagineENMPOOCT19 KuwaitfdsfdsaNessuna valutazione finora

- Task-7 Crude Oil: Impact of Crude Oil Fluctuations in Different Sectors Refiners and Oil Marketing CompaniesDocumento17 pagineTask-7 Crude Oil: Impact of Crude Oil Fluctuations in Different Sectors Refiners and Oil Marketing Companiessnithisha chandranNessuna valutazione finora

- Macroeconomic Update Nov 2018Documento11 pagineMacroeconomic Update Nov 2018Dana GaithNessuna valutazione finora

- Management Discussion Analysis 2009Documento6 pagineManagement Discussion Analysis 2009himanshu2400Nessuna valutazione finora

- Economic Indicators Report August 2021Documento36 pagineEconomic Indicators Report August 2021Dheeraj DhondNessuna valutazione finora

- Godrej Consumer Products Limited: Recovery Likely by Q1FY2021Documento5 pagineGodrej Consumer Products Limited: Recovery Likely by Q1FY2021anjugaduNessuna valutazione finora

- Macroeconomic Report May 2020 Economic DivisionDocumento22 pagineMacroeconomic Report May 2020 Economic DivisionTim SheldonNessuna valutazione finora

- Shell Pakistan Stock in Trade: Horizontal AnalysisDocumento12 pagineShell Pakistan Stock in Trade: Horizontal Analysisfahad pansotaNessuna valutazione finora

- Quarterly July2017Documento18 pagineQuarterly July2017Sahludheen N HNessuna valutazione finora

- Insights Bullish Near Term OutlookDocumento62 pagineInsights Bullish Near Term OutlookHandy HarisNessuna valutazione finora

- Oil PricesDocumento7 pagineOil PricesSrikara SimhaNessuna valutazione finora

- Applied Economics AssignmentDocumento1 paginaApplied Economics AssignmentAnonymous tgYyno0w6Nessuna valutazione finora

- Sector Comment Oil Gas Cross Region 27may20Documento5 pagineSector Comment Oil Gas Cross Region 27may20Pedro MentadoNessuna valutazione finora

- AngelTopPicks Aug 2022Documento13 pagineAngelTopPicks Aug 2022vijay kumarNessuna valutazione finora

- India Export and Import PDFDocumento43 pagineIndia Export and Import PDFKARTIK PANPALIA 22DM122Nessuna valutazione finora

- Monetary Policy ReportDocumento75 pagineMonetary Policy Reportpls2019Nessuna valutazione finora

- Section 1Documento10 pagineSection 1Imran RazaNessuna valutazione finora

- Chartbook - September 2022Documento13 pagineChartbook - September 2022Shama ShaikNessuna valutazione finora

- Financial Markets - Trading Report - 2Documento5 pagineFinancial Markets - Trading Report - 2Usman AhmadNessuna valutazione finora

- Diwali Muhurat Fundamental 2021Documento22 pagineDiwali Muhurat Fundamental 2021Swasthyasudha AyurvedNessuna valutazione finora

- Qe Co ForecastDocumento9 pagineQe Co ForecastJudithRavelloNessuna valutazione finora

- Macro Outlook: United Arab Emirates: PublicDocumento2 pagineMacro Outlook: United Arab Emirates: PublicahatttNessuna valutazione finora

- Oil Demand Uncertainties Linger: Economic and Financial AnalysisDocumento6 pagineOil Demand Uncertainties Linger: Economic and Financial AnalysisOwm Close CorporationNessuna valutazione finora

- Oil Sector PDFDocumento15 pagineOil Sector PDFRochak AgarwalNessuna valutazione finora

- Nigerian-Oil-And-Gas-Update-Quarterly-Newsletter - Edition-2021Documento3 pagineNigerian-Oil-And-Gas-Update-Quarterly-Newsletter - Edition-2021cyrilNessuna valutazione finora

- Question: Impact of Currency Devaluation On Foreign Trade/ Oil and Gas Industry. Answer: Overview of Currency DevaluationDocumento3 pagineQuestion: Impact of Currency Devaluation On Foreign Trade/ Oil and Gas Industry. Answer: Overview of Currency DevaluationRIYA MODINessuna valutazione finora

- RIG April 2013Documento40 pagineRIG April 2013cuntingyouNessuna valutazione finora

- GEMD Jan09Documento5 pagineGEMD Jan09Jamie WebsterNessuna valutazione finora

- Market Outlook - May 2011Documento4 pagineMarket Outlook - May 2011alohia82Nessuna valutazione finora

- SeminarDocumento13 pagineSeminarManoj YadavNessuna valutazione finora

- Bangladesh Economic Prospects 2019Documento14 pagineBangladesh Economic Prospects 2019Silvia RozarioNessuna valutazione finora

- AngelTopPicks Oct 2022Documento12 pagineAngelTopPicks Oct 2022dipyaman patgiriNessuna valutazione finora

- Caie As Economics 9708 Model Answers v1Documento11 pagineCaie As Economics 9708 Model Answers v1Uzair siddiqui100% (1)

- MP Statement NovDocumento14 pagineMP Statement NovZainab BadarNessuna valutazione finora

- Kuwait Economic Brief 2009 Part4Documento1 paginaKuwait Economic Brief 2009 Part4mazenkhodr1983Nessuna valutazione finora

- National Refinery Limited: Brief RecordingsDocumento1 paginaNational Refinery Limited: Brief RecordingsAwad TariqNessuna valutazione finora

- Fitch Report On Edible Oil Sector in IndiaDocumento7 pagineFitch Report On Edible Oil Sector in IndiaprashantNessuna valutazione finora

- Oil & Gas: Difficult Times..Documento4 pagineOil & Gas: Difficult Times..Arvind MeenaNessuna valutazione finora

- Task 7 - Abin Som - 21FMCGB5Documento17 pagineTask 7 - Abin Som - 21FMCGB5Abin Som 2028121Nessuna valutazione finora

- Oinl 14 2 24 PLDocumento6 pagineOinl 14 2 24 PLSanjeedeep Mishra , 315Nessuna valutazione finora

- UAE Economic EnvironmentDocumento51 pagineUAE Economic Environmentafrocircus09Nessuna valutazione finora

- Investor Digest: HighlightDocumento14 pagineInvestor Digest: HighlightYua GeorgeusNessuna valutazione finora

- JPM Reliance Industries 2022-07-20 4150945Documento8 pagineJPM Reliance Industries 2022-07-20 4150945Abhishek SaxenaNessuna valutazione finora

- Current State of Indian Economy: December 2008Documento24 pagineCurrent State of Indian Economy: December 2008samwaltonNessuna valutazione finora

- Weekly Economic and Markets Review: International & MENADocumento2 pagineWeekly Economic and Markets Review: International & MENAVáclav NěmecNessuna valutazione finora

- Crash in Oil Prices, How It Is Impacting IndiaDocumento2 pagineCrash in Oil Prices, How It Is Impacting IndiaChinmay DwivediNessuna valutazione finora

- Eco Cia 3 McomDocumento31 pagineEco Cia 3 McomTHAMERAVARUNI N 1917061Nessuna valutazione finora

- CrudeDocumento23 pagineCrudeMuhammad TohamyNessuna valutazione finora

- Energy Monthly Report - JanuaryDocumento5 pagineEnergy Monthly Report - JanuaryLi ZhangNessuna valutazione finora

- Russia Automotive Market and The CIS 2010Documento24 pagineRussia Automotive Market and The CIS 2010SojanuNessuna valutazione finora

- AngelTopPicks July 2022Documento13 pagineAngelTopPicks July 2022cryovikas1975Nessuna valutazione finora

- Nirmal Bang Berger Paints Q3FY22 Result Update 11 February 2022Documento11 pagineNirmal Bang Berger Paints Q3FY22 Result Update 11 February 2022Shinde Chaitanya Sharad C-DOT 5688Nessuna valutazione finora

- What Drives Crude Oil Prices?Documento23 pagineWhat Drives Crude Oil Prices?prdyumnNessuna valutazione finora

- Indian Oil Corporation (IOCL IN) : Q4FY19 Result UpdateDocumento7 pagineIndian Oil Corporation (IOCL IN) : Q4FY19 Result UpdatePraveen KumarNessuna valutazione finora

- Impact Analysis of Emerging Markets:: Oil Demand in China and India FallingDocumento4 pagineImpact Analysis of Emerging Markets:: Oil Demand in China and India FallingRavi SinghNessuna valutazione finora

- CI2315 Bahrain Economic 2022 ENDocumento23 pagineCI2315 Bahrain Economic 2022 ENMaria VidalNessuna valutazione finora

- Currency Wars: Impact On IndiaDocumento7 pagineCurrency Wars: Impact On IndiaAbhishek TalujaNessuna valutazione finora

- 8086 Cpu ArchitectureDocumento9 pagine8086 Cpu Architectureapi-371236783% (6)

- Fiscal Deficit 2003 FormatDocumento19 pagineFiscal Deficit 2003 Formatapi-3712367Nessuna valutazione finora

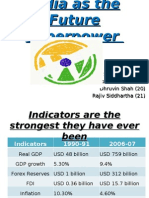

- India As SuperpowerDocumento21 pagineIndia As Superpowerapi-3712367Nessuna valutazione finora

- L & TDocumento9 pagineL & Tapi-3712367Nessuna valutazione finora

- WEight Training ScheduleDocumento2 pagineWEight Training Scheduleapi-3712367100% (1)

- Anti-Inflationary Policy in IndiaDocumento14 pagineAnti-Inflationary Policy in Indiaapi-3712367Nessuna valutazione finora

- Manging Foreign ExchnageDocumento6 pagineManging Foreign Exchnageapi-3712367Nessuna valutazione finora

- Macroeconomics AssignmentsDocumento15 pagineMacroeconomics Assignmentsapi-3712367Nessuna valutazione finora

- Policybrief Nov05Documento6 paginePolicybrief Nov05api-3712367Nessuna valutazione finora

- Report OnDocumento9 pagineReport Onapi-3712367Nessuna valutazione finora

- Manging Foreign ExchnageDocumento6 pagineManging Foreign Exchnageapi-3712367Nessuna valutazione finora

- Macro Economics OutlineDocumento2 pagineMacro Economics Outlineapi-3712367100% (1)

- 72903Documento11 pagine72903api-3712367Nessuna valutazione finora

- Just in TimeDocumento3 pagineJust in Timeapi-3712367Nessuna valutazione finora

- FOREX Management Versus SingaporeDocumento3 pagineFOREX Management Versus Singaporeapi-3712367Nessuna valutazione finora

- Subprime Toxic Debt - Bloomberg July07Documento10 pagineSubprime Toxic Debt - Bloomberg July07api-3712367Nessuna valutazione finora

- FFRChange HistoryDocumento1 paginaFFRChange Historyapi-3712367Nessuna valutazione finora

- US Subprime 070817Documento6 pagineUS Subprime 070817api-3712367Nessuna valutazione finora

- Foreign Exchange Management Policy in IndiaDocumento6 pagineForeign Exchange Management Policy in Indiaapi-371236767% (3)

- D&B Economy Observer November 07Documento3 pagineD&B Economy Observer November 07api-3712367Nessuna valutazione finora

- Fema CDocumento5 pagineFema Capi-3712367Nessuna valutazione finora

- Subprime FinalDocumento34 pagineSubprime Finalapi-3712367Nessuna valutazione finora

- BSC & Knowledge ManagementDocumento3 pagineBSC & Knowledge Managementapi-3712367100% (1)

- SubPrime Mortgage MarketDocumento6 pagineSubPrime Mortgage Marketapi-3712367Nessuna valutazione finora

- SubprimeDocumento31 pagineSubprimeapi-3712367Nessuna valutazione finora

- Sebi TocDocumento33 pagineSebi Tocapi-3712367Nessuna valutazione finora

- Balanced Scorecard 02Documento7 pagineBalanced Scorecard 02api-3712367100% (2)

- Balanced Scorecard Elearning - PresentationDocumento39 pagineBalanced Scorecard Elearning - Presentationapi-3712367Nessuna valutazione finora

- Balanced ScorecardDocumento13 pagineBalanced Scorecardapi-3712367Nessuna valutazione finora

- National Income Accounting and The Balance of PaymentsDocumento29 pagineNational Income Accounting and The Balance of Paymentsanji 1230% (1)

- Module 2Documento41 pagineModule 2bhargaviNessuna valutazione finora

- Nomura Strategy 03 11Documento106 pagineNomura Strategy 03 11Thiago PalaiaNessuna valutazione finora

- Q.No. Question Options AnswerDocumento23 pagineQ.No. Question Options Answerakshaykohli7890Nessuna valutazione finora

- Britain's Middle East Oil and Struggle To Save SterlingDocumento368 pagineBritain's Middle East Oil and Struggle To Save SterlingSohrabNessuna valutazione finora

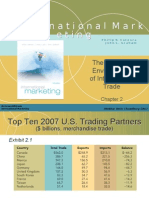

- International Marketing Chapter 2 (The Dynamic Environment of International Trade)Documento39 pagineInternational Marketing Chapter 2 (The Dynamic Environment of International Trade)Nitin Jain0% (1)

- Economic Condition of IndonesiaDocumento38 pagineEconomic Condition of IndonesiaKidal PermonoNessuna valutazione finora

- Foreign Collaborations in IndiaDocumento17 pagineForeign Collaborations in IndiacagopalchaturvediNessuna valutazione finora

- Pob NotesDocumento21 paginePob NotesOneeka Plutoqueenbee Adams91% (11)

- Yemen, Rep. at A Glance: (Average Annual Growth)Documento2 pagineYemen, Rep. at A Glance: (Average Annual Growth)tahaalkibsiNessuna valutazione finora

- Chapter 1 3Documento17 pagineChapter 1 3Hieu Duong Trong100% (3)

- Joachim Becker & Johannes Jaeger - From An Economic Crises To A Crisis of European IntegrationDocumento27 pagineJoachim Becker & Johannes Jaeger - From An Economic Crises To A Crisis of European IntegrationAndraž MaliNessuna valutazione finora

- 122 0704Documento35 pagine122 0704api-27548664Nessuna valutazione finora

- Factors That Influence Exchange RatesDocumento2 pagineFactors That Influence Exchange RatesJoelene ChewNessuna valutazione finora

- Lecture On International Entrepreneurship Opportunities.Documento31 pagineLecture On International Entrepreneurship Opportunities.Rahul Soni100% (2)

- CAD EssayDocumento4 pagineCAD Essayshelterman14Nessuna valutazione finora

- Analysis Central BankingDocumento12 pagineAnalysis Central Bankingjohann_747Nessuna valutazione finora

- 2281 s13 QP 21Documento4 pagine2281 s13 QP 21IslamAltawanayNessuna valutazione finora

- India's Gold Rush Its Impact and SustainabilityDocumento35 pagineIndia's Gold Rush Its Impact and SustainabilitySCRIBDEBMNessuna valutazione finora

- Case Study On NDB and DFCCDocumento34 pagineCase Study On NDB and DFCCRantharu AttanayakeNessuna valutazione finora

- Asian Financial CrisisDocumento7 pagineAsian Financial Crisisdjt10kNessuna valutazione finora

- Economics For Ca-Cpt - Quick Revision VersionDocumento14 pagineEconomics For Ca-Cpt - Quick Revision VersionCA Suman Gadamsetti75% (4)

- Counter TradeDocumento12 pagineCounter TradeRAHULNessuna valutazione finora

- Summer Project ReportDocumento55 pagineSummer Project ReportsunilpratihariNessuna valutazione finora

- International Finance & Forex Management 1Documento102 pagineInternational Finance & Forex Management 1Mr DamphaNessuna valutazione finora

- Bridge Course in EconomicsDocumento17 pagineBridge Course in EconomicsProfessor Tarun DasNessuna valutazione finora

- 3 Years Interim PlanDocumento828 pagine3 Years Interim PlanMenuka ShresthaNessuna valutazione finora

- Fathoming FEMA (Overview of Provisions of Foreign Exchange Management Act, 1999 (FEMA) and Rules and Regulations There Under) by Rajkumar S Adukia 4Documento16 pagineFathoming FEMA (Overview of Provisions of Foreign Exchange Management Act, 1999 (FEMA) and Rules and Regulations There Under) by Rajkumar S Adukia 4Apoorv GogarNessuna valutazione finora

- Full S&P Rating StatementDocumento13 pagineFull S&P Rating StatementFadia SalieNessuna valutazione finora

- Trade Policy Review Pakistan 2015Documento111 pagineTrade Policy Review Pakistan 2015amin jamalNessuna valutazione finora