Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Fundamentals of Corporate Finance, Slide

Caricato da

YIN SOKHENGCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Fundamentals of Corporate Finance, Slide

Caricato da

YIN SOKHENGCopyright:

Formati disponibili

Preah Kossomak Polytechnic Institute (PPI)

FUNDAMENTALS OF

CORPORATE FINANCE

Eighth Edition @2008

Stephen A. Ross

Randolph W. Westerfield

Bradford D. Jordan

Prepared and Taught by Lecturer: YIN SOKHNG

E-mail: yin_sokheng@yahoo.com

Chapter 1 Introduction to Corporate Finance

Chapter 2 Financial Statements, Taxes, and Cash Flow

Chapter 3 Working with Financial Statements

Chapter 4 Long-Term Financial Planning and Growth

Chapter 5 Introduction to Valuation: The Time Value of Money

Chapter 6 Discounted Cash Flow Valuation

Chapter 7 Interest Rates and Bond Valuation

Chapter 8 Stock Valuation

Chapter 9 Net Present Value and Other Investment Criteria

Table of Contents

Instructed by YIN SOKHENG, Master in Finance

Chapter 1

Introduction to Corporate Finance

Chapter Outline

1.1 Corporate Finance and the Financial Manager

1.2 Corporate Firm/Forms of Business Organization

1.3 Corporate Securities as Contingent Claims on

Total Firm Value

1.4 The Goal of Financial Management

1.5 The Agency Problem and Control of the

Corporation

1.6 Financial Markets and the Corporation

3

Instructed by YIN SOKHENG, Master in Finance

Corporate finance is the study of financial

decision-making in business organizations.

1.1 What is Corporate Finance?

Corporate Finance is the activity of providing :

- money to corporations for investment, and

- the ways that corporations' use this money.

Corporate Finance branch of economics concerned

with how businesses raise and spend their money.

4

Instructed by YIN SOKHENG, Master in Finance

Financial Management Decisions

Capital

Budgeting

Capital Structure

Working Capital

Management

5

Instructed by YIN SOKHENG, Master in Finance

Corporate Finance addresses the following three

questions:

1. What long-term investments should the firm engage

in?

2. How can the firm raise the money for the required

investments?

3. How much short-term cash flow does a company

need to pay its bills?

Financial Management Decisions

6

Instructed by YIN SOKHENG, Master in Finance

The Capital Budgeting Decision

1. What long-term investments should the firm engage

in?

Type and proportions of assets the firm need tend

to be set by the nature of the business.

Use the terms capital budgeting and capital

expenditure to making and managing expenditures

on long-lived assets.

7

Instructed by YIN SOKHENG, Master in Finance

The Capital Structure Decision

2. How can the firm raise the money for the required

investments?

The answer to this involves the capital

structure, which represents the proportions of :

the firms financing from current debt,

the firms financing from long-term debt, and

the firms financing from equity

8

Instructed by YIN SOKHENG, Master in Finance

The Net Working Capital Investment

Decision

3. How much short-term cash flow does a company

need to pay its bills?

The answer to this involves :

the firms net working capital,

the subject of short-term finance,

the firms short-term management cash flow, and

the timing of cash inflows and cash outflows.

9

Instructed by YIN SOKHENG, Master in Finance

Hypothetical Organization Chart

Chairman of the Board and

Chief Executive Officer (CEO)

Board of Directors

President and Chief

Operating Officer (COO)

Vice President and

Chief Financial Officer (CFO)

Treasurer Controller

Cash Manager

Capital Expenditures

Credit Manager

Financial Planning

Tax Manager

Financial Accounting

Cost Accounting

Data Processing

10

Instructed by YIN SOKHENG, Master in Finance

The Financial Manager

A member of the top manager team (CFO)

responsible for:

Providing the timely and relevant data to

support planning and control activities.

Preparing financial statement for external

users.

The treasurer is responsible for:

handing cash flows,

managing capital expenditures decisions, and

making financial plans.

11

Instructed by YIN SOKHENG, Master in Finance

The Financial Manager

To create value from the firms capital budgeting,

financing, and net working capital activities, the

financial manager should:

1. Try to make smart investment decisions (try to buy

assets that generate more cash than cost).

2. Try to make smart financing decisions (sell bonds or

stocks and other financing instruments that raise

more cash than cost).

12

Instructed by YIN SOKHENG, Master in Finance

The Firm and the Financial Markets

Cash flow

from firm (C)

T

a

x

e

s

(

D

)

Firm

Government

Firm issues securities (A)

Retained

cash flows (F)

Dividends and

debt payments (E)

Financial

markets

Invests

in assets

(B)

Current assets

Fixed assets

Short-term debt

Long-term debt

Equity shares

13

Instructed by YIN SOKHENG, Master in Finance

1.2 The Corporate Firm

The corporate form of business is the standard

method for solving the problems encountered

in raising large amounts of cash.

However, businesses can take other forms.

14

Instructed by YIN SOKHENG, Master in Finance

Forms of Business Organization

The Sole Proprietorship

The Partnership

General Partnership

Limited Partnership

The Corporation

Advantages and Disadvantages

Liquidity and Marketability of Ownership

Control

Liability

Continuity of Existence

Tax Considerations

15

Instructed by YIN SOKHENG, Master in Finance

A Comparison of Partnership

and Corporations

Corporation Partnership

Liquidity Shares can easily be

exchanged.

Subject to substantial

restrictions.

Voting Rights Usually each share gets

one vote

General Partner is in

charge; limited partners

may have some voting

rights.

Taxation Double Partners pay taxes on

distributions.

Reinvestment and

dividend payout

Broad latitude All net cash flow is

distributed to partners.

Liability Limited liability General partners may

have unlimited liability.

Limited partners enjoy

limited liability.

Continuity Perpetual life Limited life

16

Instructed by YIN SOKHENG, Master in Finance

1.3 Corporate Securities as Contingent

Claims on Total Firm Value

17

Instructed by YIN SOKHENG, Master in Finance

Bonds Compared to Stock

Bondholders are

creditors

Bonds a liability

Interest is fixed

charge

Interest is expense

Interest tax

deductible

No voting

Stockholders are

owners

Stock is equity

Dividends not fixed

charges

Dividends not

expense

Dividends not tax

deductible

Voting

18

Instructed by YIN SOKHENG, Master in Finance

Corporate Securities as Contingent Claims

on Total Firm Value

The basic feature of a debt is that it is a promise by the

borrowing firm to repay a fixed dollar amount of by a

certain date.

The shareholders claim on firm value is the residual

amount that remains after the debtholders are paid.

If the value of the firm is less than the amount

promised to the debtholders, the shareholders get

nothing.

19

Instructed by YIN SOKHENG, Master in Finance

Debt and Equity as Contingent Claims

Payoff to

debt holders

Value of the firm (X)

Debt holders are promised $F.

If the value of the firm is less than $F, they get the

whatever the firm if worth.

If the value of the firm is

more than $F, debt holders

get a maximum of $F.

Payoff to

shareholders

Value of the firm (X)

If the value of the firm is

less than $F, share holders

get nothing.

If the value of the firm is

more than $F, share holders

get everything above $F.

Algebraically, the bondholders claim is:

Min[$F,$X]

Algebraically, the shareholders claim is:

Max[0,$X $F]

20

Instructed by YIN SOKHENG, Master in Finance

$F

$F

Combined Payoffs to debt holders

and shareholders

Value of the firm (X)

Debt holders are promised

$F.

Payoff to debt

holders

Payoff to

shareholders

If the value of the firm is less than

$F, the shareholders claim is:

Max[0,$X $F] = $0 and the debt

holders claim is Min[$F,$X] =

$X.

The sum of these is = $X

If the value of the firm is more

than $F, the shareholders claim

is: Max[0,$X $F] = $X $F and

the debt holders claim is:

Min[$F,$X] = $F.

The sum of these is = $X

Combined Payoffs to Debt and Equity

21

Instructed by YIN SOKHENG, Master in Finance

1.4 Goals of the Corporate Firm

The traditional answer is that the managers of

the corporation are obliged to make efforts to

maximize shareholder wealth.

22

Instructed by YIN SOKHENG, Master in Finance

Managerial Goals

Managerial goals may be different from

shareholder goals

Survival

Independence

Minimize costs and Maximize profits.

Increased growth and size are not necessarily

the same thing as increased shareholder

wealth.

23

Instructed by YIN SOKHENG, Master in Finance

1.5 The Agency Problem

The agency relationship

Will managers work in the shareholders

best interests?

Agency costs

Direct agency Costs

Indirect agency Costs

Control of the firm

How do agency costs affect firm value (and

shareholder wealth)?

24

Instructed by YIN SOKHENG, Master in Finance

1.6 Financial Markets

Financial markets are composed of the money

markets and capital markets.

Money Markets

For debt securities that will pay off in the short

term.

Usually less than one year.

Capital Markets

For long-term debt (equity securities).

With maturity at over one yare.

For equity shares.

25

Instructed by YIN SOKHENG, Master in Finance

Money Market

Capital Markets

Non-government securities:

Debt securities:

-Certificate of Deposits (CDs)

-Commercial Paper (CP)

-Repurchase Agreements (Repo.)

-Bankers acceptances (BAs)

Non-government securities:

- Corporate bond/ Bond

payable

Stock/Equity shares:

-Preferred stock

- Common stock

Financial Instruments

Government securities:

-Treasury notes (T-notes)

-Long-term Municipal Bonds

-Treasury bonds (T-bonds)

Government securities:

- Treasury bills (T-bills)

- Short term Municipal

bonds

26

Instructed by YIN SOKHENG, Master in Finance

Financial Markets

The function of market in financial market are

divided two (transaction) markets:

Primary Market

When a corporation issues securities, cash flows

from investors to the firm.

Usually an underwriter is involved

Secondary Markets

Involve the sale of used securities from one

investor to another.

Securities may be exchange traded or trade over-

the-counter (OTC) in a dealer market.

27

Instructed by YIN SOKHENG, Master in Finance

Financial Markets

Firms

Investors

Secondary Market

money

securities

Stocks and

Bonds

Money

Primary Market

SBUs

28

Instructed by YIN SOKHENG, Master in Finance

SBUs

29

The Public Issue

The Basic Procedure

Management gets the approval of the Board of

Directors.

The firm prepares and files a registration

statement with the SEC.

The SEC studies the registration statement during

the waiting period.

The firm prepares and files an amended

registration statement with the SEC.

Instructed by YIN SOKHENG, Master in Finance

30

Exchange Trading of Listed Stocks

Auction markets are different from dealer

markets in two ways:

Trading in a given auction exchange takes place at

a single site on the floor of the exchange.

Transaction prices of shares are communicated

almost immediately to the public.

Instructed by YIN SOKHENG, Master in Finance

Chapter 2

Financial Statements, Taxes, and

Cash Flow

Prepared and Taught by Lecturer: YIN SOKHNG

E-mail: yin_sokheng@yahoo.com

Chapter Outline

2.1The Balance Sheet

2.2 The Income Statement

2.3 Net Working Capital

2.4 Taxes

2.5 Cash Flow

2

Instructed by YIN SOKHENG, Master in Finance

3

Figure 2.1

2.1 The Balance Sheet

Instructed by YIN SOKHENG, Master in Finance

4

Assets 2006 2007 Liabilities and Equity 2006 2007

Current Assets Current Liabilities

Cash $ 104 $ 160 Accounts Payable $ 232 $ 266

A/R 455 688 Notes Payable 196 123

Inventory 553 555 Total $ 428 $ 389

Total $1,112 $1,403

Long-term Debt $ 208 $ 454

Fixed Assets

Net Fixed Assets$1,644 $1,709

Stockholders Equity

Common Stock and

Paid in Surplus $ 600 $ 640

Retained Earnings 1,320 1,629

Total $ 1,920 $ 2,269

Total Assets $2,756 $3,112 Total Claims $ 2,756 $ 3,112

US Corporation

Balance Sheet ($ in millions) Table 2.1

Instructed by YIN SOKHENG, Master in Finance

5

Balance Sheet Analysis

When analyzing a balance sheet, the

financial manager should be aware of three

concerns:

1.Accounting liquidity

2.Debt versus equity

3.Value versus cost

Instructed by YIN SOKHENG, Master in Finance

6

Accounting Liquidity

Refers to the ease and quickness with which

assets can be converted to cash.

Current assets are the most liquid.

Some fixed assets are intangible.

Liquid assets frequently have lower rates of

return than fixed assets.

Instructed by YIN SOKHENG, Master in Finance

7

Debt versus Equity

Generally, when a firm borrows it gives the

bondholders first claim on the firms cash flow.

Thus shareholders equity is the residual

difference between assets and liabilities.

Assets Liabilities = Stockholders equity

Instructed by YIN SOKHENG, Master in Finance

8

Value versus Cost

Under GAAP audited financial statements of

firms in the U.S. carry assets at cost.

Market value is a completely different concept.

In fact, managements job is to create a value

for the firm that is higher than its cost.

Many users of financial statement, including

managers and investors, want to know the

value of the firm, not its cost

Instructed by YIN SOKHENG, Master in Finance

9

Table 2.2

2007

2.2 The Income Statement

Instructed by YIN SOKHENG, Master in Finance

10

Income Statement Analysis

There are three things to keep in mind when

analyzing an income statement:

1. GAAP

2. Non Cash Items

3. Time and Costs

Instructed by YIN SOKHENG, Master in Finance

11

Generally Accepted Accounting Principles

1. GAAP

The matching principal of GAAP dictates that

revenues be matched with expenses.

Thus, income is reported when it is earned,

even though no cash flow may have occurred

Instructed by YIN SOKHENG, Master in Finance

12

Income Statement Analysis

2. Non Cash Items

Depreciation is the most apparent. No firm

ever writes a check for depreciation.

Another noncash item is deferred taxes, which

does not represent a cash flow.

Instructed by YIN SOKHENG, Master in Finance

13

Income Statement Analysis

3. Time and Costs

In the short run, certain equipment, resources, and

commitments of the firm are fixed, but the firm can

vary such inputs as labor and raw materials.

In the long run, all inputs of production (and hence

costs) are variable.

Financial accountants do not distinguish between

variable costs and fixed costs. Instead, accounting

costs usually fit into a classification that

distinguishes product costs from period costs.

Instructed by YIN SOKHENG, Master in Finance

14

2.3 Taxes

Federal income tax rate increases with

the level of taxable income.

Marginal vs. average tax rates

Marginal Rate the percentage paid

on the next dollar earned

Average Rate the tax bill / taxable

income

Instructed by YIN SOKHENG, Master in Finance

15

Corporate Tax Rate

Taxable Income Tax rate

0 - 50,000 15%

50,001-75,000 25%

75,001-100,000 34%

100,001-335,000 39%

335,001-10,000,000 34%

10,000,001-15,000,000 35%

15,000,001-18,333,333 38%

18,333,333+ 35%

Instructed by YIN SOKHENG, Master in Finance

16

Example: Marginal Vs. Average Rates

Suppose our corporation has a taxable

income of $200,000.

What is the firms tax liability?

What is the average tax rate?

What is the marginal tax rate?

Instructed by YIN SOKHENG, Master in Finance

17

Example: Marginal Vs. Average Rates

The firms tax liabilities

0 - 50,000 x 15% = $7,500

50,000-75,000 x 25% = $6,250

75,000-100,000 x 34% = $8,500

100,000-200,000 x 39% = $39,000

$61,250

Average tax rate = 61,250/200,000 = 30.625%

If we made one more dollar, the tax rate on that dollar

would be 39%, so our marginal is 39%.

Instructed by YIN SOKHENG, Master in Finance

18

2.4 Net Working Capital (NWC)

Net working capital is current assets minus current

liabilities.

Net working capital is positive when current assets are

greater than current liabilities.

Net Working Capital = Current Assets Current

Liabilities

NWC is usually growing with the firm.

Instructed by YIN SOKHENG, Master in Finance

19

2.5 Financial Cash Flow

In finance, the most important item that can be

extracted from financial statements is the actual

cash flow of the firm.

The cash from received from the firms assets

must equal the cash flows to the firms creditors

and stockholders.

CF(A)= CF(B) + CF(S)

CF(A)= OCF NCS Change in NWC

Instructed by YIN SOKHENG, Master in Finance

20

Table 2.5

Instructed by YIN SOKHENG, Master in Finance

21

Cash flow from assets

Operating cash flow:

EBIT $ 694

+ Depreciation + 65

Taxes 212 $ 547

Change in net working capital:

Ending net working capital $ 1,014

Beginning net working capital 684 $ 330

Net capital spending:

Ending non-current assets $ 1,709

Beginning non-current assets 1,644

+ Depreciation + 65 $ 130

Cash flow from assets: $ 87

US Corporation

Financial Cash Flow ($ in millions)

Instructed by YIN SOKHENG, Master in Finance

22

Cash flow to debtholders and shareholders

Cash flow to debtholders:

Interest paid $ 70

Net new borrowing 46 $ 24

Cash flow to shareholders:

Dividends paid $ 103

Net new equity raised 40 $ 63

Cash flow to debtholders and shareholders $ 87

Instructed by YIN SOKHENG, Master in Finance

Chapter 3

Working with

Financial Statements

Prepared and Taught by Lecturer : YIN SOKHNG

E-mail: yin_sokheng@yahoo.com

Chapter Outline

3.1 Cash Flow and Financial Statements

3.2 Standardized Financial Statements

3.3 Ratio Analysis

3.4 The Du Pont Identity

3.5 Using Financial Statement Information

2

Instructed by YIN SOKHENG, Master in Finance

3

3.1 Cash Flow and Financial Statements

Chapter 2: Financial cash flow:

Cash flow from assets

= Cash flow to creditor + Cash flow to owners

This Chapter: Identify cash flow activities:

1. Statement of Cash Flows and

2. SOURCES and USES OF CASH

Instructed by YIN SOKHENG, Master in Finance

4

Reading the Balance Sheet on page 50.

Table 3.1

Reading the Income Statement on page 51.

Table 3.2

Prufrock Corporation

Instructed by YIN SOKHENG, Master in Finance

5

6

Identification of Cash Flows

The identification of cash flows involves the

accounting statement to :

1. Obtain information.

2. Financial analysis.

3. Extract cash flow information.

Instructed by YIN SOKHENG, Master in Finance

7

Risk of Cash Flows

The firm must consider risk depends on:

1. Amount of cash flows.

2. Timing of cash flows.

3. Mismatching of cash inflows and outflows.

Instructed by YIN SOKHENG, Master in Finance

8

The Statement of Cash Flows

The three components of the statement of

cash flows are:

Cash flow from operating activities

Cash flow from investing activities

Cash flow from financing activities

Instructed by YIN SOKHENG, Master in Finance

9

Indirect Statement of Cash Flows

Operating activities

+ Net income

+ Depreciation

- Increase in A/R

- Increase in Inventory

+ Increase in accounts payable

+ Increase in accruals

Investment activities (cash going out)

+ Ending fixed assets

Beginning fixed assets

+ Depreciation

+ Increase in marketable securities

Instructed by YIN SOKHENG, Master in Finance

10

Indirect Statement of Cash Flows

Financing activities

+ Increase in notes payable

+ Increase in long-term debt

+ Increase in common stock

Dividends paid

=> The answers about cash flows of Prufrock

Corporations on page 52.

Table 3.3 & 3.4

Instructed by YIN SOKHENG, Master in Finance

11

3.2 Standardized Financial Statements

In this section, we describe two different ways of

standardizing financial statement along these lines:

1. COMMON-SIZE Statement: The standardizing

financial statement is to express each item as a

percentage. Looking at Table 3.5 & 3.6

2. COMMON-BASE YEAR Statement:

The standardizing financial statement in this case is to

choose a base year and then express each item as a

percentage relative to base amount.

Looking at Table 3.7

Instructed by YIN SOKHENG, Master in Finance

12

3.3 Ratio Analysis

Ratios also allow for better comparison

through time or between companies

As we look at each ratio, ask yourself what

the ratio is trying to measure and why is that

information important

Ratios are used both internally and externally

Instructed by YIN SOKHENG, Master in Finance

13

Categories of Financial Ratios

Short-Term Solvency or Liquidity

Ability to pay bills in the short-run

Long-Term Solvency

Ability to meet long-term obligations

Asset Management

Intensity and efficiency of asset use

Profitability

Market Value

Going beyond financial statements

Instructed by YIN SOKHENG, Master in Finance

14

Short-Term Solvency or Liquidity Ratios

Current ratio =

Current assets - Inventory

Quick ratio =

Current liabilities

Cash

Cash ratio =

Current liabilities

NWC

NWC to total assets =

Total assets

Current assets

Interval measure =

Average daily operating costs

Current assets

Current liabilities

Instructed by YIN SOKHENG, Master in Finance

15

Long-Term Solvency

Total assets - Total equity

Total debt ratio =

Total assets

Debtequity ratio = Total debt / Total equity

Equity multiplier = Total assets / Total equity

EBIT

Times interest earned ratio =

Interest

EBIT + depreciation

Cash coverage ratio =

Interest

Total assets - Total equity

Total debt ratio =

Total assets

Instructed by YIN SOKHENG, Master in Finance

16

Cost of goods sold

Inventory turnover =

Inventory

Sales

Fixed asset turnover =

Net fixed assets

365 days

Days sales in inventory =

Inventory turnover

Sales

Total asset turnover =

Total assets

Sales

Receivables turnover =

Accounts receivable

Days sales in receivables = 365 days / A/R turnover

NWC turnover = Sales / NWC

Asset Utilization or Turnover Ratios

Instructed by YIN SOKHENG, Master in Finance

17

Profitability Ratios

Net income

Profit margin =

Sales

Net income

Return on assets (ROA) =

Total assets

Net income

Return on equity (ROE) =

Total equity

ROE = (N.I. / Sales) x (Sales / T. A.). x (T. A. / Equity)

Instructed by YIN SOKHENG, Master in Finance

18

Market Value Ratios

Price per share

Price earnings ratio =

Earnings per share

Market value per share

Market-to-book ratio =

Book value per share

Instructed by YIN SOKHENG, Master in Finance

19

Instructed by YIN SOKHENG, Master in Finance

20

Return on equity (ROE) can be decomposed as follows:

ROE = Net income / Total equity

= Profit margin x Total asset turnover x Equity multiplier

= (N.I. / Sales) x (Sales / T. A.). x (T. A. / Equity)

= ROA x Equity multiplier

Profitability (or the lack thereof!) thus has three parts:

Operating efficiency

Asset use efficiency

Financial leverage

3.4 The Du Pont Identity

Table 3.3

Instructed by YIN SOKHENG, Master in Finance

21

3.5 Using Financial Statement

Information

For analyzing financial statements

Why evaluate financial statement?

Looking at accounting information

Looking at market value information

To comparing ratios for one business

For INTERNAL & EXTERNAL Users.

Instructed by YIN SOKHENG, Master in Finance

Chapter 4

Long-Term Financial Planning and

Growth

Prepared and Taught by Lecturer : YIN SOKHNG

E-mail: yin_sokheng@yahoo.com

Chapter Outline

4.1 What is Corporate Financial Planning?

4.2 Financial Planning Model: The Ingredient

4.3 The Percentage of Sales Approach

4.4 External Financing and Growth

4.5 Uses of the Sustainable Growth Rate

2

Instructed by YIN SOKHENG, Master in Finance

Financial Plan

To develop an explicit financial plan, manager

must establish certain basic elements of the

firms financial policy:

The firms needed investment in new assets

The degree of financial leverage the firm chooses

to employ

The amount of cash the firm think is necessary

and appropriate to pay shareholders

The amount of liquidity and working capital the

firm needs on an going basis.

3

Instructed by YIN SOKHENG, Master in Finance

4

4.1 What is Corporate Financial

Planning?

It formulates the method by which financial goals are to

be achieved.

There are two dimensions:

1. A Time Frame

Short run is probably anything less than a year.

Long run is anything over that; usually taken to be a two-year to five-

year period.

2. A Level of Aggregation

Each division and operational unit should have a plan.

As the capital-budgeting analyses of each of the firms divisions are

added up, the firm aggregates these small projects as a big project.

Instructed by YIN SOKHENG, Master in Finance

5

What Will the Planning Process

Accomplish?

Interactions

The plan must make explicit the linkages between

investment proposals and the firms financing

choices.

Options

The plan provides an opportunity for the firm to

weigh its various options.

Feasibility

Avoiding Surprises

Nobody plans to fail, but many fail to plan.

Instructed by YIN SOKHENG, Master in Finance

6

4.2 A Financial Planning Model:

1. Sales forecast

2. Pro forma statements

3. Asset requirements

4. Financial requirements

5. Plug

6. Economic assumptions

Instructed by YIN SOKHENG, Master in Finance

7

Sales Forecast

All financial plans require a sales forecast.

Perfect foreknowledge is impossible since

sales depend on the uncertain future state of

the economy.

Businesses that specialize in macroeconomic

and industry projects can be help in estimating

sales.

Instructed by YIN SOKHENG, Master in Finance

8

Pro Forma Statements

The financial plan will have a forecast balance

sheet, a forecast income statement, and a

forecast sources-and-uses-of-cash statement.

These are called pro forma statements or pro

formas.

Instructed by YIN SOKHENG, Master in Finance

9

Asset Requirements

The financial plan will describe projected

capital spending.

In addition it will the discuss the proposed

uses of net working capital.

Instructed by YIN SOKHENG, Master in Finance

10

Financial Requirements

The plan will include a section on financing

arrangements.

Dividend policy and capital structure policy

should be addressed.

If new funds are to be raised, the plan should

consider what kinds of securities must be sold

and what methods of issuance are most

appropriate.

Instructed by YIN SOKHENG, Master in Finance

11

Plug

After the has a sales forecast and an estimate of the

required spending on assets, some amount of new

financing will often be necessary because project

total assets will exceed projected total liabilities and

equity (in other words, the balance sheet will no

longer balance).

The plug is the designated source or sources of

external financing needed to deal with any shortfall

(or surplus) in financing and thereby bring the

balance sheet into balance sheet.

Instructed by YIN SOKHENG, Master in Finance

12

Economic Assumptions

The plan must explicitly state the economic

environment in which the firm expects to

reside over the life of the plan.

Interest rate forecasts are part of the plan.

Instructed by YIN SOKHENG, Master in Finance

13

The Steps in Estimation of Pro Forma Balance Sheet:

1. Express balance-sheet items that vary with

sales as a percentage of sales.

2. Multiply the percentages determine in step 1

by projected sales to obtain the amount for

the future period.

3. When no percentage applies, simply insert the

previous balance-sheet figure into the future

period.

Instructed by YIN SOKHENG, Master in Finance

14

The Steps in Estimation of Pro Forma Balance Sheet

Present retained earnings

+ Projected net income

Cash dividends

Projected retained earnings

5. Add the asset accounts to determine projected assets.

Next, add the liabilities and equity accounts to determine

the total financing; any difference is the shortfall. This

equals the external funds needed.

6. Use the plug to fill EFN.

4. Computer Projected retained earnings as

Instructed by YIN SOKHENG, Master in Finance

15

A Brief Example

The Rosengarten Corporation is think of acquiring a

new machine. The machine will increase sales from

$20 million to $22 million10% growth.

The firm believes that its assets and liabilities grow

directly with its level of sales. Its profit margin on

sales is 10%, and its dividend-payout ratio is 50%.

Will the firm be able to finance growth in sales with

retained earnings and forecast increases in debt?

Instructed by YIN SOKHENG, Master in Finance

16

Current Balance Sheet

Current assets $6

Fixed assets $24

Total assets $30

Short-term debt

$10

Long-term debt $6

Common stock $4

Retained Earnings

$10

Total financing $30

Pro forma Balance Sheet

Explanation

$6.6

$26.4 120% of sales

$33 150% of sales

$11 50% of sales

$6.6 30% of sales

$4 Constant

$11.1 Net Income

External Funds Needed

$32.7

$300,000

(millions) (millions)

30% of sales

Instructed by YIN SOKHENG, Master in Finance

17

4.3 The Percentage of Sales Approach: EFN

The external funds needed for a 10% growth in

sales:

) 1 ( Sales) Projected ( Sales

Sales

Debt

Sales

Sales

Assets

d p

p = Net profit margin = 0.10

d = Dividend payout ratio = 0.5

Sales = Projected change in sales = $2 million

m m 2 5 . 1 2

20 $

30 $

Sales

Sales

Assets

= =

8 . 0

20 $

16 $

Sales

Debt

= =

Instructed by YIN SOKHENG, Master in Finance

18

The Percentage Sales Method: EFN

The external funds needed

Instructed by YIN SOKHENG, Master in Finance

19

4.4 External Financing and Growth

What Determines Growth?

The firms ability to sustain growth depends on

explicitly on the following four factors:

1. Profit margin

2. Dividend policy

3. Financial policy

4. Total asset turnover

Instructed by YIN SOKHENG, Master in Finance

20

EFN and Growth, looking at Table 4.6 & 4.7

What Determines Growth?

Change in assets = Change in debt + Change in equity

The growth ratio equation:

New equity + Borrowing = Capital spending

Instructed by YIN SOKHENG, Master in Finance

21

Table 4.9

Instructed by YIN SOKHENG, Master in Finance

22

The Sustainable Growth Rate in Sales is given by:

) 1 ( ) 1 ( (

) 1 ( ) 1 (

0

E

D

d p T

E

D

d p

S

S

+

+

=

T = ratio of total assets to sales

p = net profit margin on sales

d = dividend payout ratio

L = debt-equity ratio (D/E)

S

0

= Current sales

S = Change in sales

)] 1 ( ) 1 ( [(

) 1 ( ) 1 (

0

L d p T

L d p

S

S

+

+

=

Instructed by YIN SOKHENG, Master in Finance

23

4.5 Uses of the Sustainable Growth Rate

A commercial lender would want to compare a

potential borrowers actual growth rate with

their sustainable growth rate.

If the actual growth rate is much higher than

the sustainable growth rate, the borrower runs

the risk of growing broke and any lending

must be viewed as a down payment on a much

more comprehensive lending arrangement than

just one round of financing.

Instructed by YIN SOKHENG, Master in Finance

24

Increasing the Sustainable Growth Rate

A firm can do several things to increase its

sustainable growth rate:

Sell new shares of stock

Increase its reliance on debt

Reduce its dividend-payout ratio

Increase profit margins

Decrease its asset-requirement ratio

Instructed by YIN SOKHENG, Master in Finance

Chapter 5,6

Time Value of Money

Prepared and Taught by Lecturer : YIN SOKHNG

E-mail: yin_sokheng@yahoo.com

Chapter Outline

5.1 The One-Period Case

5.2 The Multiperiod Case

5.3 Compounding Periods & Continuous

Compounding

5.4 Valuing Level Cash Flows: Annuities and

Perpetuities

5.5 Loan Amortization

2 Instructed by YIN SOKHENG, Master in Finance

3

5.1 The One-Period Case:

Future Value

If you were to invest $10,000 at 5-percent interest for

one year, your investment would grow to $10,500

$500 would be interest ($10,000 .05)

$10,000 is the principal repayment ($10,000 1)

$10,500 is the total due. It can be calculated as:

$10,500 = $10,000(1.05).

The total amount due at the end of the investment is

call the Future Value (FV).

Instructed by YIN SOKHENG, Master in Finance

4

In the one-period case, the formula for FV

can be written as:

FV = C

0

(1 + r)

T

Where C

0

is cash flow today (time zero) and

r is the appropriate interest rate.

Instructed by YIN SOKHENG, Master in Finance

5

Present Value

If you were to be promised $10,000 due in one

year when interest rates are at 5-percent, your

investment be worth $9,523.81 in todays

dollars.

05 . 1

000 , 10 $

81 . 523 , 9 $ =

The amount that a borrower would need to set aside

today to to able to meet the promised payment of

$10,000 in one year is call the Present Value (PV) of

$10,000.

Note that $10,000 = $9,523.81(1.05).

Instructed by YIN SOKHENG, Master in Finance

6

In the one-period case, the formula for PV can be

written as:

r

C

PV

+

=

1

1

Where C

1

is cash flow at date 1 and

r is the appropriate interest rate.

Instructed by YIN SOKHENG, Master in Finance

7

5.2 The Multiperiod Case:

Future Value

The general formula for the future value of an

investment over many periods can be written as:

FV = C

0

(1 + r)

T

Where

C

0

is cash flow at date 0,

r is the appropriate interest rate, and

T is the number of periods over which the cash is

invested.

Instructed by YIN SOKHENG, Master in Finance

8

Suppose that Jay Ritter invested in the initial

public offering of the Modigliani company.

Modigliani pays a current dividend of $1.10,

which is expected to grow at 40-percent per

year for the next five years.

What will the dividend be in five years?

FV = C

0

(1 + r)

T

$5.92 = $1.10(1.40)

5

Instructed by YIN SOKHENG, Master in Finance

9

Future Value and Compounding

Notice that the dividend in year five, $5.92, is

considerably higher than the sum of the

original dividend plus five increases of 40-

percent on the original $1.10 dividend:

$5.92 > $1.10 + 5[$1.10.40] = $3.30

This is due to compounding.

Instructed by YIN SOKHENG, Master in Finance

Future Value and Compounding

10

0 1 2 3 4 5

10 . 1 $

3

) 40 . 1 ( 10 . 1 $

02 . 3 $

) 40 . 1 ( 10 . 1 $

54 . 1 $

2

) 40 . 1 ( 10 . 1 $

16 . 2 $

5

) 40 . 1 ( 10 . 1 $

92 . 5 $

4

) 40 . 1 ( 10 . 1 $

23 . 4 $

Instructed by YIN SOKHENG, Master in Finance

11

Present Value and Compounding

How much would an investor have to set aside today in order to

have $20,000 five years from now if the current rate is 15%?

0 1 2 3 4 5

$20,000 PV

5

) 15 . 1 (

000 , 20 $

53 . 943 , 9 $ =

Instructed by YIN SOKHENG, Master in Finance

12

How Long is the Wait?

If we deposit $5,000 today in an account paying

10%, how long does it take to grow to $10,000?

T

r C FV ) 1 (

0

+ =

T

) 10 . 1 ( 000 , 5 $ 000 , 10 $ =

2

000 , 5 $

000 , 10 $

) 10 . 1 ( = =

T

2 ln ) 10 . 1 ln( =

T

years 27 . 7

0953 . 0

6931 . 0

) 10 . 1 ln(

2 ln

= = = T

Instructed by YIN SOKHENG, Master in Finance

13

What Rate Is Enough?

Assume the total cost of a college education

will be $50,000 when your child enters

college in 12 years. You have $5,000 to invest

today. What rate of interest must you earn on

your investment to cover the cost of your

childs education?

T

r C FV ) 1 (

0

+ =

12

) 1 ( 000 , 5 $ 000 , 50 $ r + =

10

000 , 5 $

000 , 50 $

) 1 (

12

= = + r

12 1

10 ) 1 ( = + r

2115 . 1 2115 . 1 1 10

12 1

= = = r

Instructed by YIN SOKHENG, Master in Finance

14

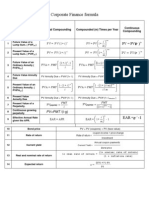

5.3 Compounding Periods & Continuous

Compounding

Compounding an investment m times a year for T

years provides for future value of wealth:

T m

m

r

C FV

|

.

|

\

|

+ = 1

0

For example, if you invest $50 for 3 years at

12% compounded semi-annually, your

investment will grow to

93 . 70 $ ) 06 . 1 ( 50 $

2

12 .

1 50 $

6

3 2

= =

|

.

|

\

|

+ =

FV

Instructed by YIN SOKHENG, Master in Finance

15

Effective Annual Interest Rates

A reasonable question to ask in the above

example is what is the effective annual rate of

interest on that investment?

The Effective Annual Interest Rate (EAR) is

the annual rate that would give us the same

end-of-investment wealth after 3 years:

93 . 70 $ ) 06 . 1 ( 50 $ )

2

12 .

1 ( 50 $

6 3 2

= = + =

FV

93 . 70 $ ) 1 ( 50 $

3

= + EAR

Instructed by YIN SOKHENG, Master in Finance

16

Effective Annual Interest Rates (continued)

So, investing at 12.36% compounded annually

is the same as investing at 12% compounded

semiannually.

93 . 70 $ ) 1 ( 50 $

3

= + = EAR FV

50 $

93 . 70 $

) 1 (

3

= + EAR

1236 . 1

50 $

93 . 70 $

3 1

=

|

.

|

\

|

= EAR

Instructed by YIN SOKHENG, Master in Finance

17

Effective Annual Interest Rates (continued)

Find the Effective Annual Rate (EAR) of an 18%

APR loan that is compounded monthly.

What we have is a loan with a monthly interest

rate of 1 percent.

This is equivalent to a loan with an annual interest

rate of 19.56 percent

19561817 . 1 ) 015 . 1 (

12

18 .

1 1

12

12

= =

|

.

|

\

|

+ =

|

.

|

\

|

+

m n

m

r

Instructed by YIN SOKHENG, Master in Finance

18

Continuous Compounding

The general formula for the future value of an

investment compounded continuously over many

periods can be written as:

FV = C

0

e

rT

Where

C

0

is cash flow at date 0,

r is the stated annual interest rate,

T is the number of periods over which the cash is

invested, and

e is a transcendental number approximately equal to

2.718. e

x

is a key on your calculator.

Instructed by YIN SOKHENG, Master in Finance

19

5.4 Valuing Level Cash Flows: Annuities

and Perpetuities

Annuity finite series of equal payments that

occur at regular intervals

If the first payment occurs at the end of the period,

it is called an ordinary annuity

If the first payment occurs at the beginning of the

period, it is called an annuity due

Perpetuity infinite series of equal payments

Instructed by YIN SOKHENG, Master in Finance

20

Ordinary Annuity vs. Annuity Due

Ordinary Annuity

Annuity starts at

end of period

Annuity Due

Annuity starts

NOW

Instructed by YIN SOKHENG, Master in Finance

21

Annuity

A stream of constant cash flows that lasts for a

fixed number of periods.

Growing annuity

A stream of cash flows that grows at a constant

rate for a fixed number of periods.

Perpetuity

A constant stream of cash flows that lasts forever.

Growing perpetuity

A stream of cash flows that grows at a constant

rate forever.

Instructed by YIN SOKHENG, Master in Finance

22

Ordinary Annuities

(

+

=

(

(

(

(

=

r

r

C FV

r

r

C PV

T

T

1 ) 1 (

) 1 (

1

1

Note: C = PMT

Instructed by YIN SOKHENG, Master in Finance

23

Annuities Due

( )

( ) r

r

r

C FV

r

r

r

C PV

T

T

+

(

+

=

+

(

(

(

(

=

1

1 ) 1 (

1

) 1 (

1

1

Note: C = PMT

Instructed by YIN SOKHENG, Master in Finance

24

Ordinary Annuity

A constant stream of cash flows with a fixed maturity.

The formula for the present value of an ordinary

annuity is:

T

r

C

r

C

r

C

r

C

PV

) 1 ( ) 1 ( ) 1 ( ) 1 (

3 2

+

+

+

+

+

+

+

=

(

+

=

T

r r

C

PV

) 1 (

1

1

0 1

C

2

C

3

C

T

C

Instructed by YIN SOKHENG, Master in Finance

25

Annuity Intuition

An annuity is valued as the difference between two

perpetuities:

one perpetuity that starts at time 1

less a perpetuity that starts at time T + 1

0 1

C

2

C

3

C

T

C

T

r

r

C

r

C

PV

) 1 ( +

|

.

|

\

|

=

Instructed by YIN SOKHENG, Master in Finance

26

Annuity: Example

If you can afford a $400 monthly car payment, how

much car can you afford if interest rates are 7% on 36-

month loans?

59 . 954 , 12 $

) 12 07 . 1 (

1

1

12 / 07 .

400 $

36

=

(

+

= PV

0

1

$400

2

$400

3

$400

36

$400

Instructed by YIN SOKHENG, Master in Finance

27

What is the present value of a four-year annuity of

$100 per year that makes its first payment two years

from today if the discount rate is 9%?

22 . 297 $

09 . 1

97 . 327 $

0

= = PV

0 1 2 3 4 5

$100 $100 $100 $100 $323.97 $297.22

97 . 327 $

) 09 . 1 (

100 $

) 09 . 1 (

100 $

) 09 . 1 (

100 $

) 09 . 1 (

100 $

) 09 . 1 (

100 $

4 3 2 1

4

1

1

= + + + = =

= t

t

PV

Instructed by YIN SOKHENG, Master in Finance

28

Growing Annuity

A growing stream of cash flows with a fixed maturity.

The formula for the present value of a growing

annuity:

T

T

r

g C

r

g C

r

C

PV

) 1 (

) 1 (

) 1 (

) 1 (

) 1 (

1

2

+

+

+ +

+

+

+

+

=

(

(

|

|

.

|

\

|

+

+

=

T

r

g

g r

C

PV

) 1 (

1

1

0 1

C

2

C(1+g)

3

C (1+g)

2

T

C(1+g)

T-1

Instructed by YIN SOKHENG, Master in Finance

29

Growing Annuity

A defined-benefit retirement plan offers to pay $20,000

per year for 40 years and increase the annual payment

by three-percent each year. What is the present value at

retirement if the discount rate is 10 percent?

57 . 121 , 265 $

10 . 1

03 . 1

1

03 . 10 .

000 , 20 $

40

=

(

(

|

.

|

\

|

= PV

0 1

$20,000

2

$20,000(1.03)

40

$20,000(1.03)

39

Instructed by YIN SOKHENG, Master in Finance

30

PV of Growing Annuity

You are evaluating an income property that is providing

increasing rents. Net rent is received at the end of each year. The

first year's rent is expected to be $8,500 and rent is expected to

increase 7% each year. Each payment occur at the end of the year.

What is the present value of the estimated income stream over the

first 5 years if the discount rate is 12%?

0 1 2 3 4 5

500 , 8 $

=

2

) 07 . 1 ( 500 , 8 $

095 , 9 $

65 . 731 , 9 $

=

3

) 07 . 1 ( 500 , 8 $

87 . 412 , 10 $

=

4

) 07 . 1 ( 500 , 8 $

77 . 141 , 11 $

$34,706.26

= ) 07 . 1 ( 500 , 8 $

Instructed by YIN SOKHENG, Master in Finance

31

PV of a delayed growing annuity

Your firm is about to make its initial public offering of

stock and your job is to estimate the correct offering price.

Forecast dividends are as follows.

Year: 1 2 3 4

Dividends per

share

$1.50 $1.65 $1.82 5% growth

thereafter

If investors demand a 10% return on investments of this risk

level, what price will they be willing to pay?

Year

0 1 2 3

Cash flow

$1.50 $1.65 $1.82

4

$1.821.05

Instructed by YIN SOKHENG, Master in Finance

32

PV of a delayed growing annuity

Year

0 1 2 3

Cash flow

$1.50 $1.65

$1.82 dividend + P

3

PV of cash flow $32.81

22 . 38 $

05 . 10 .

05 . 1 82 . 1

3

=

= P

81 . 32 $

) 10 . 1 (

22 . 38 $ 82 . 1 $

) 10 . 1 (

65 . 1 $

) 10 . 1 (

50 . 1 $

3 2

0

=

+

+ + = P

= $1.82 + $38.22

Instructed by YIN SOKHENG, Master in Finance

33

Perpetuity

A constant stream of cash flows that lasts forever.

0

1

C

2

C

3

C

The formula for the present value of a perpetuity is:

+

+

+

+

+

+

=

3 2

) 1 ( ) 1 ( ) 1 ( r

C

r

C

r

C

PV

r

C

PV =

Instructed by YIN SOKHENG, Master in Finance

34

Perpetuity: Example

What is the value of a British consol that promises to

pay 15 each year?

The interest rate is 10-percent.

0

1

15

2

15

3

15

150

10 .

15

= = PV

Instructed by YIN SOKHENG, Master in Finance

35

Growing Perpetuity

A growing stream of cash flows that lasts forever.

0

1

C

2

C(1+g)

3

C (1+g)

2

The formula for the present value of a growing perpetuity is:

+

+

+

+

+

+

+

+

=

3

2

2

) 1 (

) 1 (

) 1 (

) 1 (

) 1 ( r

g C

r

g C

r

C

PV

g r

C

PV

=

Instructed by YIN SOKHENG, Master in Finance

36

Growing Perpetuity: Example

The expected dividend next year is $1.30 and dividends

are expected to grow at 5% forever.

If the discount rate is 10%, what is the value of this

promised dividend stream?

0

1

$1.30

2

$1.30(1.05)

3

$1.30 (1.05)

2

00 . 26 $

05 . 10 .

30 . 1 $

=

= PV

Instructed by YIN SOKHENG, Master in Finance

37

5.5 Loan Amortization

1. Interest only loan, the principal is repaid all at once.

e.g. corporate bond, T-note, T-bond

2. Principal and Interest Loans: Interest declines as your

outstanding principal declines (principal fixed).e.g.

small, smallest , and medium loan

3. Fixed payment loan:

loan is repaid with equal (monthly) payments

each payment is combination of principal and interest

e.g. car loan, mortgage loan

Instructed by YIN SOKHENG, Master in Finance

38

Amortization Table:

Principal and Interest Loan

. Interest declines as your outstanding

principal declines (principal fixed).

. Suppose we borrow $5,000 to be repaid in 5

annual payments with a 9% annual interest

rate.

Instructed by YIN SOKHENG, Master in Finance

39

Amortization Schedule

Year Beginning

Balance

Total

Payment

Interest

Paid

Principal

Paid

Ending

Balance

1 $5,000 $ 1,450 $ 450 $ 1,000 $ 4,000

2 $ 4000 $ 1,360 $ 360 $ 1,000 $ 3,000

3 $ 3000 $ 1,270 $ 270 $ 1,000 $ 2,000

4 $ 2000 $ 1,180 $ 180 $ 1,000 $ 1,000

5 $ 1000 $ 1,090 $ 90 $ 1,000 $--0--

Total $ 6,350 $ 1,350 $ 5,000

Instructed by YIN SOKHENG, Master in Finance

40

Amortization Table:

Fixed Payment Loan

Show breakdown of the payment into interest and

principal

Step 1: Determine the amount of each loan payment.

Solve for present value of annuity

Step 2: Determine how much of each payment is

interest versus principal.

Suppose our 5 years, 9 percent, $5,000 loan (car

loan) was amortized. How would the amortization

schedule look?

Instructed by YIN SOKHENG, Master in Finance

41

Fixed Payment Loan

) 1 (

) 1 (

1

1

) 1 (

1

1

r

r

r

PV

PMT

r

r

PV

PMT

T

T

+

(

(

(

(

=

(

(

(

(

=

(Ordinary Annuities)

(Annuities due)

Instructed by YIN SOKHENG, Master in Finance

42

Amortization Schedule

Year Beginning

Balance

Total

Payment(PMT)

Interest

Paid

Principal

Paid

Ending

Balance

1 $5,000.00 $ 1,285.46 $ 450.00 $ 835.46 $ 4,164.54

2 $ 4,164.54 $ 1,285.46 $ 374.81 $ 910.60 $ 3,253.88

3 $ 3,253.88 $ 1,285.46 $ 292.85 $ 992.61 $ 2,261.27

4 $ 2,261.27 $ 1,285.46 $ 203.51 $ 1,081.95 $ 1,179.32

5 $ 1,179.32 $ 1,285.46 $ 106.14 $ 1,179.32 $--0--

Total $6,427.30 $1,427.31 $5,000.00

Instructed by YIN SOKHENG, Master in Finance

Chapter 7

Interest Rates and

Bond Valuation

Prepared and Taught by Lecturer : YIN SOKHNG

E-mail: yin_sokheng@yahoo.com

Chapter Outline

7.1 Bond Definition

7.2 More about Bond Features

7.3 Bond Ratings

7.4 Different Types of Bonds

7.5 Bond Markets

7.6 Inflation and Interest Rates

7.7 Determinants of Bond Yields

7.8 Bond Risky

2 Instructed by YIN SOKHENG, Master in Finance

3

7.1 Bond Definition

The corporation or government are borrow money

from the public by issuing or selling debt securities

that are generically called bonds.

Normally an interest-only loan (when issued at par),

the principal is paid until the end of the loan.

Interest paid in the form of a periodic coupon.

Term basis:

Short term basis

Long term basis.

Instructed by YIN SOKHENG, Master in Finance

4

The Bond Indenture

Contract between the corporation (borrower)

and the creditor (bondholders) that includes

The basic terms of the bonds

The total amount of bonds issued

A description of property used as security, if

applicable

Repayment agreements

Call provisions

Details of protective covenants

7.2 More about Bond Features

Instructed by YIN SOKHENG, Master in Finance

5

The Indenture

Forms of a Bond

Registered Form: The corporation keeps track of the

owner.

Bearer Form: Certificate is the only evidence of ownership.

Security

Collateral secured by other securities

Mortgage secured by real property, normally land or

buildings; Chattel Mortgage (mortgage on a specific

property)

Debentures unsecured bond with original maturity of 10

years or more

Notes unsecured bond with original maturity less than 10

years

Instructed by YIN SOKHENG, Master in Finance

6

Bonds Compared to Stock

Bondholders are

creditors

Bonds a liability

Interest is fixed

charge

Interest is expense

Interest tax deductible

No voting

Stockholders are owners

Stock is equity

Dividends not fixed

charges

Dividends not expense

Dividends not tax

deductible

Voting

Instructed by YIN SOKHENG, Master in Finance

7

Bond Term

Par value (face value), F

Coupon rate, R

Coupon payment, C

Maturity date, T

Discount rate or Yield to maturity, r or YTM

Instructed by YIN SOKHENG, Master in Finance

8

7.3 Bond Ratings

Investment Quality

High Grade

Moodys Aaa and S&P AAA capacity to pay is

extremely strong

Moodys Aa and S&P AA capacity to pay is very

strong

Medium Grade

Moodys A and S&P A capacity to pay is strong, but

more susceptible to changes in circumstances

Moodys Baa and S&P BBB capacity to pay is

adequate, adverse conditions will have more impact

on the firms ability to pay

Instructed by YIN SOKHENG, Master in Finance

9

Bond Ratings - Speculative

Low Grade

Moodys Ba, B, Caa and Ca

S&P BB, B, CCC, CC

Considered speculative with respect to capacity to

pay. The B ratings are the lowest degree of

speculation.

Very Low Grade

Moodys C and S&P C income bonds with no

interest being paid

Moodys D and S&P D in default with principal and

interest in arrears

Instructed by YIN SOKHENG, Master in Finance

10

7.4 Different Types of Bonds

zero coupon bonds or discount bonds

e.g. T-bills One year and less, no coupons

fixed payment loans

e.g. mortgages, car loans- Between 3 and 15years

coupon bonds

e.g. -T-notes Between 2 and 10 years,

-T-bonds Longer than 10 years,

-Corporate bonds Longer than 10 years

consols: no maturity date (forever).

Instructed by YIN SOKHENG, Master in Finance

11

Zero coupon bonds

discount bonds

purchased price less than face value, F > P

face value at maturity

no interest payments

(

=

365

) (

1

T r

F P

P = Current price

F = Face value

r = discount rate

T = Number of maturity date

T

r

F

P

) 1 ( +

=

OR

Instructed by YIN SOKHENG, Master in Finance

12

Zero coupon bonds

Yield to maturity, YTM

OR

1

360

|

.

|

\

|

=

d

P

F

r

r =

F - P

P

x

360

d

Instructed by YIN SOKHENG, Master in Finance

13

Fixed-payment loan

loan is repaid with equal (monthly) payment, PMT

each payment is combination of principal and

interest

( )

( ) ( )

T

m m

m

i

PMT

i

PMT

i

PMT

PV

+

+ +

+

+

+

=

1

...

1

1

2

(

(

(

(

=

i

i

m

T

m

PV

PMT

) 1 (

1

1

Instructed by YIN SOKHENG, Master in Finance

14

r is annual rate

(effective annual interest rate, EAR)

but payments are monthly, & compound

monthly

r = (1+ i

m

)

12

-1

i

m

= (1+ r)

1/12

-1

i

m

is the periodic rate

note: APR (annual percentage rate)

APR = i

m

x 12

Instructed by YIN SOKHENG, Master in Finance

15

Coupon Bond

purchase price, PV

promised of a series of payments until maturity

face value at maturity, F (principal, par value)

coupon payments (6 months), C

size of coupon payment

annual coupon rate, R

face value

6 mo. pmt.,C = (F x R)/2

Instructed by YIN SOKHENG, Master in Finance

16

Value of a coupon bond = PV of coupon payment annuity

+ PV of face value

0

C $

1

C $

2

C $

1 T

F C $ $ +

T

Information needed to value coupon bonds:

Coupon payment dates and time to maturity (T)

Coupon payment (C) per period and Face value (F)

Coupon rate (R) and Discount rate (r or YTM)

T T

r

F

r r

C

PV

) 1 ( ) 1 (

1

1

+

+

(

+

=

Instructed by YIN SOKHENG, Master in Finance

17

PV, F and YTM

PV = F then YTM = coupon rate

PV < F then YTM > coupon rate (at a discount)

PV > F then YTM < coupon rate (at a premium)

PV and YTM move in opposite directions

interest rates and value of debt securities move in

opposite directions

if rates rise, bond prices fall

if rates fall, bond prices rise

Instructed by YIN SOKHENG, Master in Finance

18

Interest Rate Risk

Price Risk

Change in price due to changes in interest rates

Long-term bonds have more price risk than short-

term bonds

Reinvestment Rate Risk

Uncertainty concerning rates at which cash flows

can be reinvested

Short-term bonds have more reinvestment rate risk

than long-term bonds

Instructed by YIN SOKHENG, Master in Finance

19

Figure 7.2

Instructed by YIN SOKHENG, Master in Finance

20

Current yield,

approximation of YTM for coupon bonds

i

c

=

annual coupon payment, C

bond price, PV

i

c

Instructed by YIN SOKHENG, Master in Finance

21

Yield-to-maturity

Yield-to-maturity is the rate implied by the current

bond price

Finding the YTM requires trial and error if you do not

have a financial calculator and is similar to the process

for finding r with an annuity

YTM = [C + (F PV)/T]/(F + PV)/2

C = Coupon payment

F = Face/Par value of bond

PV = Current price of bond

T = Maturity date

Instructed by YIN SOKHENG, Master in Finance

22

Holding period return

sell bond before maturity

return depends on

holding period

interest payments

resale price

t

t t

t

P

P P

P

C

RET

+ =

+1

g i RET

c

+ =

Instructed by YIN SOKHENG, Master in Finance

23

Holding period return

RET : Rate of Return at Holding Period

: Current yield

C : Coupon payment

: Price at T period

: Price at T+1 period

g : Rate of Capital Gains or the Change of

Price

i

c

P

t

P

t+1

Instructed by YIN SOKHENG, Master in Finance

24

Consols Bond

0

C $

1

C $

2

C $

... $C

forever

r

C

PV =

Instructed by YIN SOKHENG, Master in Finance

25

7.5 Bond Markets

Primarily over-the-counter transactions with

dealers connected electronically

Extremely large number of bond issues, but

generally low daily volume in single issues

Makes getting up-to-date prices difficult,

particularly on small company or municipal

issues

Treasury securities are an exception

Instructed by YIN SOKHENG, Master in Finance

26

Bond Quotations

Highlighted quote:

ATT 7 06 7.7 554 97.63 -0.38

What company are we looking at?

What is the coupon rate? If the bond has a $1000 face

value, what is the coupon payment each year?

When does the bond mature?

What is the current yield? How is it computed?

How many bonds trade that day?

What is the quoted price?

How much did the price change from the previous day?

Instructed by YIN SOKHENG, Master in Finance

27

Treasury Quotations

Highlighted quote:

9.000 Nov 18133:27 133.28 24 5.78

What is the coupon rate on the bond?

When does the bond mature?

What is the bid price? What does this mean?

What is the ask price? What does this mean?

How much did the price change from the previous

day?

What is the yield based on the ask price?

Instructed by YIN SOKHENG, Master in Finance

28

7.6 Inflation and Interest Rates

Real rate of interest change in purchasing

power

Nominal rate of interest quoted rate of

interest, change in purchasing power and

inflation

The ex ante nominal rate of interest includes

our desired real rate of return plus an

adjustment for expected inflation

Instructed by YIN SOKHENG, Master in Finance

29

Inflation

if inflation is high

lenders demand higher nominal rate, especially

for long term loans

long-term i depends A LOT on inflation

expectations

Instructed by YIN SOKHENG, Master in Finance

30

The Fisher Effect

The Fisher Effect defines the relationship

between real rates, nominal rates and inflation

(1 + R) = (1 + r)(1 + h), where

R = nominal rate

r = real rate

h = expected inflation rate

Approximation

R = r + h

Instructed by YIN SOKHENG, Master in Finance

31

Inflation and Present Value

( )

(

(

(

(

=

r

r

C PV

T

1

1

1

r = Discount rate

Instructed by YIN SOKHENG, Master in Finance

32

Term Structure of Interest Rates

Term structure is the relationship between time

to maturity and yields, all else equal

It is important to recognize that we pull out the

effect of default risk, different coupons, etc.

Yield curve graphical representation of the

term structure

Normal upward-sloping, long-term yields are

higher than short-term yields

Inverted downward-sloping, long-term yields are

lower than short-term yields

7.7 Determinants of Bond Yields

Instructed by YIN SOKHENG, Master in Finance

33

Figure 7.6.A. Upward-Sloping Yield Curve

Instructed by YIN SOKHENG, Master in Finance

34

Figure7.6. B. Downward-Sloping Yield Curve

Instructed by YIN SOKHENG, Master in Finance

35

7.8 Bond risky

Why are bonds risky?

Default risk

Risk that the issuer fails to make promised payments on

time

Zero for govt debt

Other issuers: corporate, municipal, foreign have some

default risk

Greater default risk means a greater yield

Instructed by YIN SOKHENG, Master in Finance

36

Inflation risk

Most bonds promise fixed dollar payments

Inflation erodes the real value of these payments

Future inflation is unknown

Larger for longer term bonds

Interest rate risk

Changing interest rates change the value (price) of a bond

in the opposite direction.

All bonds have interest rate risk

But it is larger for the long term bonds

Instructed by YIN SOKHENG, Master in Finance

Chapter 8

Stock Valuation

Prepared and Taught by Lecturer : YIN SOKHNG

E-mail: yin_sokheng@yahoo.com

2 Instructed by YIN SOKHENG, Master in Finance

Chapter Outline

8.1 Common Stock Valuation

8.2 The Present Value of Common Stock

8.3 Estimates of Parameters in the Dividend-

Discount Model

8.4 Growth Opportunities

8.5 The Dividend Growth Model and the

NPVGO Model (Advanced)

8.6 Price Earnings Ratio

8.7 The Stock Markets

3

Valuation of Bonds and Stock

First Principles:

Value of financial securities = PV of expected future

cash flows

To value bonds and stocks we need to:

Estimate future cash flows:

Size (how much) and

Timing (when)

Discount future cash flows at an appropriate rate:

The rate should be appropriate to the risk presented by the

security.

Instructed by YIN SOKHENG, Master in Finance

4

Cash Flows to Stockholders

If you buy a share of stock, you can receive cash

in two ways

The company pays dividends

You sell your shares, either to another investor in the

market or back to the company

As with bonds, the price of the stock is the

present value of these expected cash flows

Instructed by YIN SOKHENG, Master in Finance

5

Common stock valuation for one period

P

0

= D

1

/(1 + r) + P

1

/(1 + r)

P

0

= Value of stock at time 0

P

1

= Price of stock at the end of the period

D

1

= Dividend at the end of the period

8.1 Common stock valuation

Instructed by YIN SOKHENG, Master in Finance

6

One Period Example

Suppose you are thinking of purchasing the stock of

Moore Oil, Inc. and you expect it to pay a $2 dividend

in one year and you believe that you can sell the stock

for $14 at that time. If you require a return of 20% on

investments of this risk, what is the maximum you

would be willing to pay?

P

0

= D

1

/(1 + r) + P

1

/(1 + r)

P

0

= 2/(1.2) + 14/(1.2) = $13.33

Instructed by YIN SOKHENG, Master in Finance

7

Common stock valuation for two period

P

0

= D

1

/(1 + r) + D

2

/(1 + r)

t

+P

2

/(1 + r)

t

Now what if you decide to hold the stock for two

years? In addition to the dividend in one year,

you expect a dividend of $2.10 in and a stock

price of $14.70 at the end of year 2. Now how

much would you be willing to pay?

P

0

= 2/(1.2) + 2.1/(1.2)

2

+14.7/(1.2)

2

= $13.33

Instructed by YIN SOKHENG, Master in Finance

8

Three Period Example

Finally, what if you decide to hold the stock for three

periods? In addition to the dividends at the end of years

1 and 2, you expect to receive a dividend of $2.205 at

the end of year 3 and a stock price of $15.435. Now

how much would you be willing to pay?

PV = 2 / 1.2 + 2.10 / (1.2)

2

+ (2.205 + 15.435) / (1.2)

3

=

13.33

Or CF

0

= 0; C01 = 2; F01 = 1; C02 = 2.10; F02 = 1; C03

= 17.64; F03 = 1; NPV; I = 20; CPT NPV = 13.33

Instructed by YIN SOKHENG, Master in Finance

9

Three Period Example

Finally, what if you decide to hold the stock for

three periods? In addition to the dividends at the

end of years 1 and 2, you expect to receive a

dividend of $2.205 at the end of year 3 and a

stock price of $15.435. Now how much would

you be willing to pay?

P

0

= 2 / 1.2 + 2.10 / (1.2)

2

+ 2.205/ (1.2)

3

+ 15.435 /(1.2)

3

= $13.33

Instructed by YIN SOKHENG, Master in Finance

10

Multiple-Period Dividend Valuation Model

P

0

= D

1

/(1+R) + D

2

/(1+R)

2

+ D

3

/(1+R)

3

+..or

P

0

= D

1

/(1+R) + D

2

/(1+R)

2

+.+ D

n

/(1+R)

n

Suppose that the investor is considering purchasing a share of this stock

and holding it for 5 years. Assume that the investor's required rate of

return is still 14 %. Dividends from the stock are expected to be $1 in the

first year, $1 in the second year, $1 in the third year, $1.25 in the fourth

year, and $1.25 in the fifth year. The expected selling price of the stock at

the end of 5 years is $41.

P

0

= 1/ (1 + 0.14) + 1/ (1 + 0.14)

2

+ 1/ (1 + 0.14)

3

+ 1.25/ (1 + 0.14)

4

+

1.25/ (1 + 0.14)

5

+ 41/ (1 + 0.14)

5

P

0

= $24.99 or 25

Instructed by YIN SOKHENG, Master in Finance

11

8.2 The Present Value

of Common Stocks

Dividends versus Capital Gains

Valuation of Different Types of Stocks

Zero Growth

Constant Growth

Differential Growth

Instructed by YIN SOKHENG, Master in Finance

12

Estimating Dividends: Special Cases

Zero growth /Constant dividend

The firm will pay a constant dividend forever

This is like preferred stock

The price is computed using the perpetuity formula

Constant dividend growth

The firm will increase the dividend by a constant percent

every period

Differential /Supernormal growth

Dividend growth is not consistent initially, but settles

down to constant growth eventually

Instructed by YIN SOKHENG, Master in Finance

13

Case 1: Zero Growth

Assume that dividends will remain at the same level

forever

r r r

P

) 1 (

Div

) 1 (

Div

) 1 (

Div

3

3

2

2

1

1

0

+

+

+

+

+

+

=

L

L

= = =

3 2 1

Div Div Div

Since future cash flows are constant, the value of a zero

growth stock is the present value of a perpetuity:

Suppose stock is expected to pay a $0.50 dividend

every quarter and the required return is 10% with

quarterly compounding. What is the price?

P

0

= .50 / (.1 / 4) = $20

r

Div

=

Instructed by YIN SOKHENG, Master in Finance

14

Case 2: Constant Growth

) 1 ( Div Div

0 1

g

+ =

Since future cash flows grow at a constant rate forever,

the value of a constant growth stock is the present

value of a growing perpetuity:

Assume that dividends will grow at a constant rate, g,

forever. i.e.

2

0 1 2

) 1 ( Div ) 1 ( Div Div g g

+ = + =

.

.

3

0 2 3

) 1 ( Div ) 1 ( Div Div g g

+ = + =

.

g - r

Div

g - r

g) 1 ( Div

P

1 0

0

=

+

=

Instructed by YIN SOKHENG, Master in Finance

15

CGDM Example 1

Suppose Big D, Inc. just paid a dividend of $.50.

It is expected to increase its dividend by 2% per

year. If the market requires a return of 15% on

assets of this risk, how much should the stock be

selling for?

P

0

= .50(1+.02) / (.15 - .02) = $3.92

Instructed by YIN SOKHENG, Master in Finance

16

Case 3: Differential Growth

Assume that dividends will grow at different

rates in the foreseeable future and then will grow

at a constant rate thereafter.

To value a Differential Growth Stock, we need

to:

Estimate future dividends in the foreseeable future.

Estimate the future stock price when the stock

becomes a Constant Growth Stock (case 2).

Compute the total present value of the estimated

future dividends and future stock price at the

appropriate discount rate.

Instructed by YIN SOKHENG, Master in Finance

17