Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Arend, Douglas - Gann Analysis On Point and Figure Charts

Caricato da

ezmereldaDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Arend, Douglas - Gann Analysis On Point and Figure Charts

Caricato da

ezmereldaCopyright:

Formati disponibili

Stocks & Commodities V.

7:12 (449-452): Gann analysis on point and figure charts by Douglas Arend

Gann analysis on point and figure charts

by Douglas Arend

f the many analytical techniques attributed to W.D. Gann, perhaps none is more widely followed

than the so-called geometric angles. Although applied generally to historical and intraday bar charts, this method also can be used with point and figure or, as they are sometimes called, reversal charts. In this case, the emphasis is on price alone rather than the combination of price and time. P&F basics Constructing daily point and figure (P&F) charts starts by determining the scale of the box (number of price ticks per square) and reversal (number of boxes necessary to change from advancing to declining). Using these parameters, plot only price changes that are greater than or equal to the box size and disregard movements of lesser amounts. Advances are indicated by columns of Xs and declines by Os. Although this technique also can record intraday price changes, I am focusing here on daily movements. If prices have been advancing lately then a column of Xs is building. At the conclusion of each day record increases of at least the box size by adding the appropriate number of Xs in progressively higher boxes within the current column. If prices do not increase by one box size or more and, instead, decline by at least the reversal amount, move one column to the right and begin charting Os in the same manner, beginning one square below the highest X in the preceding column and moving progressively lower. Continue to record price changes in this way, ignoring movements of less than the box size and intraday fluctuations. Assume you are charting soybean futures and have selected a 2-cent box size and 6-cent reversal (Figure 1). This is equivalent to an 8-tick box and 24-tick reversal since grain futures at the Chicago Board of Trade move in 1/4-cent ticks. Standard nomenclature for this chart is 26 (cents) or 824 (ticks). Assume further that prices have been advancing recently and you begin the graph when the contract is trading at $8.50 per bushel. Place an X beside the price of $8.50. On the following day, prices trade in a range from $8.54 to $8.42. Because the high was four cents above the last recorded price, add another two Xs to the chart, each one representing a 2-cent move.

Article Text

Copyright (c) Technical Analysis Inc.

Stocks & Commodities V. 7:12 (449-452): Gann analysis on point and figure charts by Douglas Arend

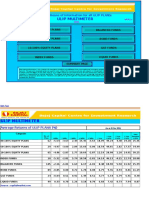

FIGURE 1: A soybean futures price series beginning at 8.50, plotted with a 2-cent box and 6-cent reversal.

FIGURE 2: Because P&F axes are the same scale, drawing Gann lines becomes a matter of counting squares in the chart's grid.

Stocks & Commodities V. 7:12 (449-452): Gann analysis on point and figure charts by Douglas Arend

The procedure is to first identify the "correct" price-time ratio and then generate angle lines based on this proportion.

On the next day, prices ranged from $8.55 to $8.40. With only a one-cent increase from the previous high, you cannot add another X because this is less than the box size. But prices did decline from the previous high of $8.54 by more than the six-cent reversal amount. So, move to the right and start a column of Os beginning at $8.52 (one square below the recorded high) and ending at the new low of $8.40. This same procedure is followed after each new trading day. While P&F charts do not relate price with time, it is nevertheless helpful to maintain some perspective on the period over which the charts are constructed. For this reason, a monthly designator (1,2. . .12) is sometimes substituted for an X or O to designate the beginning of a new month. Gann angles Gann focused on the spatial relationship between price and time in many of his methods. To him, market movement was determined by the interaction of these two elements and he sought ways to correlate them with each other. Gann placed particular emphasis on past high and low prices, because he felt these were important indicators both in themselves and in the way they could be used to forecast future key points in the market. He introduced a series of techniques to derive such points from previous highs and lows. Many of his methods are based on a system of eighths. The justification for this seems in part historical and in part empirical. In his book, How to Make Profits in Commodities, Gann noted: "[People] have become used to dividing the dollar into eighths, and they want to buy and sell on this basis." Gann selected a low or high price on a commodity chart and projected angle lines originating from it. These lines are supposed to indicate levels of support when drawn from a low price and resistance when plotted from a high. The angles, themselves, represent a correlation between price and time. This relationship is fixed for each commodity and does not vary with a change in the price scale. The procedure is to first identify the "correct" price-time ratio and then generate angle lines based on this proportion. On a typical bar chart, price is represented along the Y axis and time is measured on the X axis. Accurate angles measure one unit of time spanning the same distance as one unit of price. If scale for the two axes is not the same then an adjustment is necessary to compensate for any difference. Angles are sometimes formed by counting up and over a given number and over a given number of units from a low price or down and over from a high, assuming an equal scale between the two coordinate axes. If dissimilar scales are used, then the count must be changed to correct for any difference. Figure 2 shows the number of horizontal and vertical units needed to construct the most common angles of 7-1/2, 15, 45, 63-3/4, 75 and 82-1/2 degrees on a 1:1 scale. The unit count can be used as a shorthand reference for the individual angles. Using a 1:1 scale, the 7-1/2 degree line is drawn eight units over and one unit up, so it is called the 81 line. The 45-degree angle, representing equal price and time combinations, is known as the 11 line. The other angles can be described similarly.

Article Text

Copyright (c) Technical Analysis Inc.

Stocks & Commodities V. 7:12 (449-452): Gann analysis on point and figure charts by Douglas Arend

Figure 4 shows lines of support originating from a commodity low. Resistance angles are formed the same way by reversing the vertical direction from up to down and counting from a high price. In his own grain charts, Gann used a daily time scale on the X axis and a vertical price scale equal to one cent. A movement of one unit over and one unit up or down therefore represented one cent per day. If, for example, the Y axis was instead scaled in 4-cent intervals, then a move one square over and one square up would be equivalent to a 14 line of 75 degrees. Why is it so important that the two scales on the chart be equivalent? One explanation relies on the Gann principle known as squaring price with time: a number of points up or down balancing with an equal number of time periods (hours, days, weeks, months or years). If a price range covered 30 cents, then a critical timing point on a daily chart should occur 30 days in the future. This 1:1 relationship can be plotted directly, provided the two coordinate axes are scaled equivalently. Gann used a construction like the one shown in Figure 3 to calculate price and time combinations. He named this his Master Price and Time Chart. It is generated by a clockwise spiral emanating from the center in one-point increments. The horizontal and vertical lines form a pattern sometimes called the Ordinal Cross. This configuration, together with the diagonals occurring at a 45-degree rotation to it, indicate key areas of support and resistance. These numbers can be combined with the prices along angle lines on bar charts to forecast probable turning points in the market. Because the Master Chart increases in one-unit intervals, it is important that the price chart follow a similar scale. Among the several Gann angles, the 45-degree line is accorded the greatest weight. It represents movement in which one unit of time equals one unit of price. Above this line, we know that prices are advancing at a rate greater than (or declining at a rate less than) one unit for each unit of time. This indicates buying strength in the market. The opposite holds true when prices lie below the 45-degree line. When angle lines intersect there is increased likelihood of an approaching market reversal. However, if prices break through such an area, this suggests that the current direction will continue further before a pullback occurs. Angles on P&F charts The focus shifts somewhat when projecting Gann angles on P&F charts. Since both axes on a P&F chart represent price, thereby assuring identical scaling, Gann angles can be drawn easily by connecting the appropriate number of squares. Care must be exercised, however, when interpreting Gann angles on P&F charts. Because time is not an element of the chart, lines of support and resistance only signal the price levels of possible price reversals. The identical X and Y scale on these charts allows the construction of accurate angles without need for adjustment. Like many techniques, the angles can be given greater weight when confirmed by other indicators. Many traders are familiar with the 11 line on P&F although most do not seem to recognize its equivalence to the Gann 45-degree angle. Perhaps for this reason, few traders construct the other Gann lines on P&F charts. This is an unfortunate omission, because frequently the remaining angles will confirm levels of support and resistance indicated by 45-degree lines drawn from other points.

Article Text

Copyright (c) Technical Analysis Inc.

Stocks & Commodities V. 7:12 (449-452): Gann analysis on point and figure charts by Douglas Arend

FIGURE 3: Master price and time chart

FIGURE 4: The 14 angle line drawn from the low of $6.80 on this chart with a 5-cent box size and 15-cent reversal forecasts support.

Stocks & Commodities V. 7:12 (449-452): Gann analysis on point and figure charts by Douglas Arend

Figure 4 is the P&F chart for November 1988 soybean futures with a 5-cent box size and 15-cent reversal. Areas of support forecast by the 14 angle line drawn from the low of $6.80. I would expect buying to enter the market near points A, B and C. In fact, the market did fall to or near A and B, but broke through at C.

Among the several Gann angles, the 45-degree line is accorded the greatest weight.

The same phenomenon occurred on the short side at points C and D. The 12 resistance line extending from the high of $10.45 correctly forecasts breaks at $10.20 and $8.85. Resistance at point C was strengthened by the intersection of the 12 down from the high with the 14 above the low. While the significance of this point was increased by this intersection, we did not know whether it would act as support or resistance until prices neared it. Because the market was trading below the intersection in the column before C, I interpreted the point as resistance and could have taken short positions against it. A penetration of intersection areas signals a continuation in direction. Point E is the intersection of the 14 resistance line from the high and the 12 support line from the low. The break in price below this level suggested that further downside movement was ahead and, in fact, prices continued to fall another $1.15/bushel before encountering support. I have found that applying Gann angles to P&F charts is a helpful component in overall commodity price analysis. By filtering out small fluctuations, P&F charts facilitate tracking larger moves and the Gann lines better identify these moves as they develop. Douglas Arend holds degrees in economics and law and is a CTA, registered AP and a principal in Darrowby Holdings Ltd ., Chicago Board of Trade Bldg., Suite 1701-A, Chicago, IL 60604, (800) 552-9093 or (312) 922-6765. He furnishes daily commentary as the soybean products analyst for Bonneville Telecommunications, Inc. and specializes in customized strategies for the commodities and options markets.

References Cohen, A.W. [1987], "How To Use the Three-Point Reversal Method of Point & Figure Stock Market Trading," 9th ed., New Rochelle, NY: Chartcraft. Gann, W.D. [1976 (Originally 1942)], "How to Make Profits in Commodities," Pomeroy, WA: Lambert-Gann. Jacobs, Larry B. [1986], "How to Make and Use Time/Price Overlays," Springfield, MO: Halliker's. Kahn, Phyllis [1980], Who was W.D. Gann?, Commodities (now Futures), January. Kansas City Board of Trade [1985] "How To Use Your New Opportunity Angles Tool," Kansas City: KCBOT. Kaufman, F.J. [1978] "Commodity Trading System and Methods," New York: John Wiley & Sons.

Figures

Copyright (c) Technical Analysis Inc.

Potrebbero piacerti anche

- Gann Breadth PDFDocumento12 pagineGann Breadth PDFukxgerardNessuna valutazione finora

- 10 D HL and Murrey Math ExcelDocumento10 pagine10 D HL and Murrey Math ExcelNihilisticDelusionNessuna valutazione finora

- FTI Fibonacci LevelsDocumento6 pagineFTI Fibonacci LevelsSundaresan SubramanianNessuna valutazione finora

- Jeff Cooper Square of 9 EbookDocumento57 pagineJeff Cooper Square of 9 EbookKitNessuna valutazione finora

- Gann Master Forex Course 13Documento54 pagineGann Master Forex Course 13Trader RetailNessuna valutazione finora

- RM FormulaDocumento1 paginaRM FormulaCharles Amadeo Thomas Manrique NugentNessuna valutazione finora

- Reversal Time PeriodsDocumento2 pagineReversal Time PeriodsGer DonnellyNessuna valutazione finora

- Triple 40 Timing ModelDocumento29 pagineTriple 40 Timing ModelBrandi WallaceNessuna valutazione finora

- Ganns Financial Time Table Extended PublicDocumento4 pagineGanns Financial Time Table Extended PublicMukeshChauhanNessuna valutazione finora

- Smart Charting Tools in Timing SolutionDocumento53 pagineSmart Charting Tools in Timing SolutionDinesh CNessuna valutazione finora

- Price Headley Trade King Webinar SlidesDocumento15 paginePrice Headley Trade King Webinar Slidesbigtrends100% (2)

- Treasury Bonds A Longer Term Perspective: by Robert R. LussierDocumento31 pagineTreasury Bonds A Longer Term Perspective: by Robert R. LussierGajini Satish100% (1)

- Miner R. Form and Pattern As A Trading Tool 1991Documento9 pagineMiner R. Form and Pattern As A Trading Tool 1991Om PrakashNessuna valutazione finora

- Good Man Intro Return PDFDocumento29 pagineGood Man Intro Return PDFclaudioww1100% (1)

- Tutorials in Applied Technical Analysis: Managing ExitsDocumento15 pagineTutorials in Applied Technical Analysis: Managing ExitsPinky BhagwatNessuna valutazione finora

- Ehlers (Bandpass)Documento7 pagineEhlers (Bandpass)Jim Baxter100% (1)

- Square Root TheoryDocumento11 pagineSquare Root TheoryRachit Arora100% (3)

- Time & Price 1Documento4 pagineTime & Price 1tirou1953Nessuna valutazione finora

- Ilango TADocumento760 pagineIlango TAThe599499Nessuna valutazione finora

- Gann LevelDocumento44 pagineGann LevelViji SambasivamNessuna valutazione finora

- Hurst CyclesDocumento5 pagineHurst CyclesPravin Yeluri100% (1)

- ExtremeHurst For Bloomberg GuideDocumento23 pagineExtremeHurst For Bloomberg GuideAlex BernalNessuna valutazione finora

- Notes: by Felipe Tudela © Felipe TudelaDocumento6 pagineNotes: by Felipe Tudela © Felipe TudelaSamado ZOURENessuna valutazione finora

- Baeyens, Walter - RSI Logic, Signals & Time Frame Correlation-Đã Nén (PDF - Io) PDFDocumento66 pagineBaeyens, Walter - RSI Logic, Signals & Time Frame Correlation-Đã Nén (PDF - Io) PDFthang dNessuna valutazione finora

- Dynamic Trader Daily Report: Protective Stop AdjustmentDocumento5 pagineDynamic Trader Daily Report: Protective Stop AdjustmentBudi MulyonoNessuna valutazione finora

- Options Open Interest Analysis SimplifiedDocumento15 pagineOptions Open Interest Analysis SimplifiedNaveenNessuna valutazione finora

- Fibonacci Analysis and Elliott Wave TheoryDocumento4 pagineFibonacci Analysis and Elliott Wave Theoryirsanli3mNessuna valutazione finora

- Ferrera D. 2002 Forecasting With The CycleDocumento4 pagineFerrera D. 2002 Forecasting With The CyclethepaganntraderNessuna valutazione finora

- Gann Nine Amibroker CodeDocumento6 pagineGann Nine Amibroker Codemaddy_i5Nessuna valutazione finora

- How To Use FibonacciDocumento6 pagineHow To Use FibonaccihiteshaNessuna valutazione finora

- Krishnapvm 2Documento6 pagineKrishnapvm 2palharjeetNessuna valutazione finora

- The Tillman MethodDocumento5 pagineThe Tillman MethodssNessuna valutazione finora

- MurreyMathCalculator, Version 1.3Documento3 pagineMurreyMathCalculator, Version 1.3ChomoolungmaNessuna valutazione finora

- Murray Maths With Patterns Modified IntradayDocumento10 pagineMurray Maths With Patterns Modified Intradaymaddy_i5Nessuna valutazione finora

- CHAPTER 7 - Basic Characteristic of VolumeDocumento32 pagineCHAPTER 7 - Basic Characteristic of VolumeKiMi MooeNaNessuna valutazione finora

- The System Is EasyDocumento3 pagineThe System Is EasySalim MarchantNessuna valutazione finora

- Soumya Rajan Essential of TradingDocumento48 pagineSoumya Rajan Essential of TradingRaj Malhotra100% (1)

- Prashant Shah - RSIDocumento5 paginePrashant Shah - RSIIMaths PowaiNessuna valutazione finora

- ADX DMI Indicator - AflDocumento2 pagineADX DMI Indicator - AflsureshNessuna valutazione finora

- Gann HiLo Activator BarsDocumento2 pagineGann HiLo Activator BarsNeoHoodaNessuna valutazione finora

- Gann Fans PDFDocumento5 pagineGann Fans PDFAnonymous yPWi8p3KkANessuna valutazione finora

- GANN Curtis Arnold'Documento5 pagineGANN Curtis Arnold'analyst_anil14Nessuna valutazione finora

- Bigger Time Frames: Kumo 7,22,44 Pivot PointDocumento1 paginaBigger Time Frames: Kumo 7,22,44 Pivot PointRON 7Nessuna valutazione finora

- Fdocuments - in W D Gann 1878 1955 N Gann Plan L A N D Gann 1878 1955 Gann Plan IfDocumento5 pagineFdocuments - in W D Gann 1878 1955 N Gann Plan L A N D Gann 1878 1955 Gann Plan Ifrashmi100% (1)

- Getting A Better Technical Fix On Market TrendsDocumento4 pagineGetting A Better Technical Fix On Market Trendslector_961Nessuna valutazione finora

- Volume by PriceDocumento26 pagineVolume by PriceshivasharesNessuna valutazione finora

- Gann 50% Rule With Vidy-ADocumento3 pagineGann 50% Rule With Vidy-Aalahgitateur100% (1)

- Volume IndicatorsDocumento6 pagineVolume IndicatorsJonathan SohNessuna valutazione finora

- Integrated Pitchfork Analysis: Basic to Intermediate LevelDa EverandIntegrated Pitchfork Analysis: Basic to Intermediate LevelNessuna valutazione finora

- Lifespan Investing: Building the Best Portfolio for Every Stage of Your LifeDa EverandLifespan Investing: Building the Best Portfolio for Every Stage of Your LifeNessuna valutazione finora

- Cycles In Our History Predict A (Nuclear?) World War: History Cycles, Time FractualsDa EverandCycles In Our History Predict A (Nuclear?) World War: History Cycles, Time FractualsNessuna valutazione finora

- Forex Wave Theory: A Technical Analysis for Spot and Futures Curency Traders: A Technical Analysis for Spot and Futures Curency TradersDa EverandForex Wave Theory: A Technical Analysis for Spot and Futures Curency Traders: A Technical Analysis for Spot and Futures Curency TradersNessuna valutazione finora

- Guppy Trading: Essential Methods for Modern TradingDa EverandGuppy Trading: Essential Methods for Modern TradingValutazione: 4 su 5 stelle4/5 (1)

- Barclay and Hendershott-Price Discovery and Trading After HoursDocumento33 pagineBarclay and Hendershott-Price Discovery and Trading After HoursPulkit GoelNessuna valutazione finora

- 33Rd Degree Freemason Initiation-Deadly Deception, Jim Shaw, 33Rd DegreeDocumento9 pagine33Rd Degree Freemason Initiation-Deadly Deception, Jim Shaw, 33Rd Degreewilsonfrisk100% (15)

- Edgar Allan PoeDocumento1.057 pagineEdgar Allan Poeezmerelda100% (1)

- Aircraft Carrier Climate Control Investigation Team (ACCCIT) HVAC ManualDocumento143 pagineAircraft Carrier Climate Control Investigation Team (ACCCIT) HVAC Manualezmerelda50% (2)

- Tower of BabelDocumento118 pagineTower of BabelXMYSTICPATHX9212100% (2)

- HVAC ManualDocumento107 pagineHVAC ManualWissam JarmakNessuna valutazione finora

- Application and Product Guide - SupermarketDocumento4 pagineApplication and Product Guide - SupermarketezmereldaNessuna valutazione finora

- Illuminati 666Documento116 pagineIlluminati 666Dee Monk100% (5)

- Almanac of Business and Industrial Financial RatiosDocumento14 pagineAlmanac of Business and Industrial Financial Ratiosapi-32128050% (1)

- Cleaning Product Business PlanDocumento4 pagineCleaning Product Business PlanSantosh Arakeri0% (1)

- FB Ad Examples Ebook Aggregate BlogDocumento103 pagineFB Ad Examples Ebook Aggregate Blogbuku catatanmuNessuna valutazione finora

- Fintech Vietnam Startups 151126150047 Lva1 App6891Documento59 pagineFintech Vietnam Startups 151126150047 Lva1 App6891Anonymous 45z6m4eE7pNessuna valutazione finora

- Hersheys StrategiesDocumento2 pagineHersheys StrategiesLuisa RaigozoNessuna valutazione finora

- Quantiacs Python Toolbox Documentation PDFDocumento35 pagineQuantiacs Python Toolbox Documentation PDFdarwin_huaNessuna valutazione finora

- MODULE 5 - PbsDocumento17 pagineMODULE 5 - PbsSayanth TkNessuna valutazione finora

- Lecture16 DerivativeMarketsDocumento17 pagineLecture16 DerivativeMarketsRubeenaNessuna valutazione finora

- 6 - Yueh-Hua Lee, Hui-Chiung Lo & Enkhgerel EnkhtuvshinDocumento13 pagine6 - Yueh-Hua Lee, Hui-Chiung Lo & Enkhgerel EnkhtuvshinBige UrbaNessuna valutazione finora

- Overview of Integrated Marketing CommunicationsDocumento40 pagineOverview of Integrated Marketing Communicationshhunter530Nessuna valutazione finora

- Other Percentage Tax Tax Base Tax Rate Under Section: Wheel Animal Driven Vehicles and BancasDocumento4 pagineOther Percentage Tax Tax Base Tax Rate Under Section: Wheel Animal Driven Vehicles and BancasLumingNessuna valutazione finora

- Rose PetalDocumento47 pagineRose Petalzee93% (15)

- Foundations of Modern Finance I: Week 3: Discounting and CompoundingDocumento2 pagineFoundations of Modern Finance I: Week 3: Discounting and CompoundingDapo TaiwoNessuna valutazione finora

- By Satish Kumar MDocumento16 pagineBy Satish Kumar Msumathi psgcasNessuna valutazione finora

- MBA6081 - Unit VI - Hoitu-April 03-SubmitDocumento11 pagineMBA6081 - Unit VI - Hoitu-April 03-SubmitTu HoiNessuna valutazione finora

- The Concept of RiskDocumento3 pagineThe Concept of RiskMickaela GulisNessuna valutazione finora

- Budget Variance Analysis: How To Monitor, Calculate, and AnalyzeDocumento3 pagineBudget Variance Analysis: How To Monitor, Calculate, and AnalyzegreyNessuna valutazione finora

- Receivables Management: Chapter - 4Documento7 pagineReceivables Management: Chapter - 4Hussen AbdulkadirNessuna valutazione finora

- InvoiceDocumento1 paginaInvoiceSalman KhanNessuna valutazione finora

- 5-4 Greek LettersDocumento30 pagine5-4 Greek LettersNainam SeedoyalNessuna valutazione finora

- Drivers of Market GlobalizationDocumento5 pagineDrivers of Market GlobalizationDenise Lara PaduaNessuna valutazione finora

- Real Estate Finance DissertationDocumento4 pagineReal Estate Finance DissertationWriteMyPaperOneDayOmaha100% (1)

- Barings BankDocumento8 pagineBarings Bankishan696969100% (1)

- Private Equity Interview Questions - Answers To The Top PE QuestionsDocumento8 paginePrivate Equity Interview Questions - Answers To The Top PE QuestionsRahul SainiNessuna valutazione finora

- Set A - Problems On Relevant Decision MakingDocumento6 pagineSet A - Problems On Relevant Decision MakingNitin KhareNessuna valutazione finora

- Ulip MultimeterDocumento17 pagineUlip MultimeterRaghu RaoNessuna valutazione finora

- MKTM508 Sales & Distribution: Rajeev GuptaDocumento25 pagineMKTM508 Sales & Distribution: Rajeev GuptaShanu SinghNessuna valutazione finora

- Customer Acquisition TemplateDocumento20 pagineCustomer Acquisition TemplateJia LaoNessuna valutazione finora

- Chapter 8 - Digital MarketingDocumento58 pagineChapter 8 - Digital MarketingReno Soank100% (1)

- Brand Strategy & ExtensionDocumento5 pagineBrand Strategy & ExtensionDevansh PandeyNessuna valutazione finora