Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

SDP Articles

Caricato da

Statesman JournalDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

SDP Articles

Caricato da

Statesman JournalCopyright:

Formati disponibili

Registry No.

319620-95 RESTATED ARTICLES OF INCORPORATION OF Salem Downtown Partnership (an Oregon Non-Profit Corporation) The Corporation adopts the following Restated Articles of Incorporation: ARTICLE I Name of Corporation The name of the corporation is Salem Downtown Partnership (the Corporation). ARTICLE II Registered Agent The registered agent for service of process is Carole Smith. ARTICLE III Address of Registered Agent The address of the registered agent for service of process is 363 Court St. NE, Salem , OR 97301. ARTICLE IV Address for Mailing Notices The address for mailing notices is: 187 High St. NE, Salem, OR 97301. ARTICLE V Additional Provisions 5.1 General Purpose. The Corporation is a business league, chamber of commerce, real-estate board, or board of trade not organized for profit. 5.2 Primary Purposes. The primary purposes of the Corporation are to: 5.2.1 Create an accountable, representative organization that will work towards the betterment of downtown Salem (downtown) through the inclusion of downtown property owners, businesses, residents, and customers and provide a forum and vehicle to solicit, create and implement actions beneficial to downtown. 5.2.2 Advocate on behalf of downtown property and business owners and residents on matters involving the City of Salem, Marion County, the State of Oregon, and outside organizations and persons that may impact downtown. 5.2.3 Promote and market downtown.

Page 1 of 3: Restated Articles of Incorporation of Salem Downtown Partnership

Registry No. 319620-95 5.2.4 Contract with governments, businesses, or others, to manage and administer funds, including funds resulting from the creation of any economic or business improvement district, or other revenue raising plans downtown. 5.3 Net Earnings. No part of the net earnings of the Corporation shall inure to the benefit of, or be distributable to its members, directors, officers, or other private persons, except that the corporation shall be authorized and empowered to pay reasonable compensation for services rendered and to make payments and distributions in furtherance of the purposes of this corporation. 5.4 General Restrictions. 5.4.1 No substantial part of the activities of the Corporation shall be the carrying on of propaganda, or otherwise attempting to influence legislation, and the corporation shall not participate in, or intervene in (including the publishing or distribution of statements) any political campaign on behalf of or in opposition to any candidate for public office. 5.4.2 Notwithstanding any other provision of these Articles, the Corporation shall not carry on any other activities, or use any part of the Corporations assets in any manner, not permitted to be carried on by a corporation exempt under Section 501(c)(6) of the Internal Revenue Code, or the corresponding section of any future federal tax code. 5.5 Business Committee. The Board of Directors shall empower the Business Committee to exercise the authority of the Board to the extent necessary to manage and administer any funds if the Corporation is or will be party to a contract to receive improvement district funds. 5.6 Limitation of Liability. The personal liability of each member of the Board of Directors, each uncompensated officer, and each member of the Corporation, for monetary or other damages, for conduct as a director, officer, or member shall be eliminated to the fullest extent permitted by current or future law. ARTICLE VI Type of Corporation The Corporation is a mutual benefit corporation organized under Section 501(c)(6) of the Internal Revenue Code. ARTICLE VII Members of Corporation The Corporation will have members.

Page 2 of 3: Restated Articles of Incorporation of Salem Downtown Partnership

Registry No. 319620-95 ARTICLE VIII Distribution of Assets on Dissolution Upon the dissolution of the Corporation the Board of Directors shall, after the paying or making provisions for the payment of all of the liabilities of the Corporation, distribute the assets of the Corporation for one or more exempt purposes within the meaning of Section 501(c)(3) of the Internal Revenue Code, or the corresponding section of any future federal tax code, or shall distribute the assets to the federal government, or to a state or local government, for a public purpose. Any such assets not so disposed of shall be disposed of by the court of appropriate jurisdiction of the county in which the principal office of the Corporation is then located, exclusively for such purposes or to such organization or organizations as that court shall determine, which are organized and operated exclusively for such purposes.

IN WITNESS WHEREOF, the undersigned Directors have executed these Restated Articles of Incorporation on the 30th day of August, 2011, with the approval of the Members, intending that they be effective upon filing.

_____________________________________ _____________________________________ _____________________________________

____________________________________ ____________________________________ ____________________________________

_____________________________________ _____________________________________ _____________________________________ _____________________________________

____________________________________ ____________________________________ ____________________________________ ____________________________________

Page 3 of 3: Restated Articles of Incorporation of Salem Downtown Partnership

Potrebbero piacerti anche

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

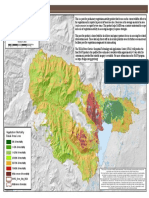

- Cedar Creek Vegitation Burn SeverityDocumento1 paginaCedar Creek Vegitation Burn SeverityStatesman JournalNessuna valutazione finora

- Salem Police 15-Year Crime Trends 2007 - 2021Documento10 pagineSalem Police 15-Year Crime Trends 2007 - 2021Statesman JournalNessuna valutazione finora

- Letter To Judge Hernandez From Rural Oregon LawmakersDocumento4 pagineLetter To Judge Hernandez From Rural Oregon LawmakersStatesman JournalNessuna valutazione finora

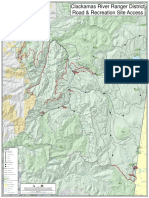

- Roads and Trails of Cascade HeadDocumento1 paginaRoads and Trails of Cascade HeadStatesman JournalNessuna valutazione finora

- Salem Police 15-Year Crime Trends 2007 - 2015Documento10 pagineSalem Police 15-Year Crime Trends 2007 - 2015Statesman JournalNessuna valutazione finora

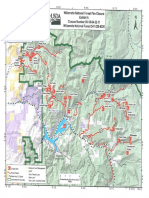

- Cedar Creek Fire Aug. 16Documento1 paginaCedar Creek Fire Aug. 16Statesman JournalNessuna valutazione finora

- Complaint Summary Memo To Superintendent Re 8-9 BD Meeting - CB 9-14-22Documento4 pagineComplaint Summary Memo To Superintendent Re 8-9 BD Meeting - CB 9-14-22Statesman JournalNessuna valutazione finora

- Cedar Creek Fire Soil Burn SeverityDocumento1 paginaCedar Creek Fire Soil Burn SeverityStatesman JournalNessuna valutazione finora

- School Board Zones Map 2021Documento1 paginaSchool Board Zones Map 2021Statesman JournalNessuna valutazione finora

- Windigo Fire ClosureDocumento1 paginaWindigo Fire ClosureStatesman JournalNessuna valutazione finora

- Matthieu Lake Map and CampsitesDocumento1 paginaMatthieu Lake Map and CampsitesStatesman JournalNessuna valutazione finora

- BG 7-Governing StyleDocumento2 pagineBG 7-Governing StyleStatesman JournalNessuna valutazione finora

- Cedar Creek Fire Sept. 3Documento1 paginaCedar Creek Fire Sept. 3Statesman JournalNessuna valutazione finora

- Mount Hood National Forest Map of Closed and Open RoadsDocumento1 paginaMount Hood National Forest Map of Closed and Open RoadsStatesman JournalNessuna valutazione finora

- Revised Closure of The Beachie/Lionshead FiresDocumento4 pagineRevised Closure of The Beachie/Lionshead FiresStatesman JournalNessuna valutazione finora

- Social-Emotional & Behavioral Health Supports: Timeline Additional StaffDocumento1 paginaSocial-Emotional & Behavioral Health Supports: Timeline Additional StaffStatesman JournalNessuna valutazione finora

- Salem Police Intelligence Support Unit 15-Year Crime TrendsDocumento11 pagineSalem Police Intelligence Support Unit 15-Year Crime TrendsStatesman JournalNessuna valutazione finora

- LGBTQ Proclaimation 2022Documento1 paginaLGBTQ Proclaimation 2022Statesman JournalNessuna valutazione finora

- Salem-Keizer Discipline Data Dec. 2021Documento13 pagineSalem-Keizer Discipline Data Dec. 2021Statesman JournalNessuna valutazione finora

- Failed Tax Abatement ProposalDocumento8 pagineFailed Tax Abatement ProposalStatesman JournalNessuna valutazione finora

- Proclamation Parent & Guardian Engagement in Education 1-11-22 Final, SignedDocumento1 paginaProclamation Parent & Guardian Engagement in Education 1-11-22 Final, SignedStatesman JournalNessuna valutazione finora

- WSD Retention Campaign Resolution - 2022Documento1 paginaWSD Retention Campaign Resolution - 2022Statesman JournalNessuna valutazione finora

- Salem-Keizer Parent and Guardian Engagement in Education Month ProclamationDocumento1 paginaSalem-Keizer Parent and Guardian Engagement in Education Month ProclamationStatesman JournalNessuna valutazione finora

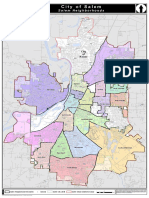

- All Neighborhoods 22X34Documento1 paginaAll Neighborhoods 22X34Statesman JournalNessuna valutazione finora

- Oregon Annual Report Card 2020-21Documento71 pagineOregon Annual Report Card 2020-21Statesman JournalNessuna valutazione finora

- All Neighborhoods 22X34Documento1 paginaAll Neighborhoods 22X34Statesman JournalNessuna valutazione finora

- Zone Alternates 2Documento2 pagineZone Alternates 2Statesman JournalNessuna valutazione finora

- SB Presentation SIA 2020-21 Annual Report 11-9-21Documento11 pagineSB Presentation SIA 2020-21 Annual Report 11-9-21Statesman JournalNessuna valutazione finora

- SIA Report 2022 - 21Documento10 pagineSIA Report 2022 - 21Statesman JournalNessuna valutazione finora

- Crib Midget Day Care Emergency Order of SuspensionDocumento6 pagineCrib Midget Day Care Emergency Order of SuspensionStatesman JournalNessuna valutazione finora

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Professor Federle Exam OutlineDocumento6 pagineProfessor Federle Exam Outlinetherunningman55Nessuna valutazione finora

- Anti Graft and Corrupt Practices ActDocumento16 pagineAnti Graft and Corrupt Practices ActDarwin BonifacioNessuna valutazione finora

- People V CA and OlayonDocumento1 paginaPeople V CA and OlayonApril GuiangNessuna valutazione finora

- PNB V Welch, Fairchild - Co., Inc.Documento11 paginePNB V Welch, Fairchild - Co., Inc.Cathy BelgiraNessuna valutazione finora

- Tanyag v. TanyagDocumento12 pagineTanyag v. TanyagPastel Rose CloudNessuna valutazione finora

- Coa Circular 2009-002Documento21 pagineCoa Circular 2009-002Krizzel SandovalNessuna valutazione finora

- Supreme Court Upholds Espionage Act ConvictionsDocumento16 pagineSupreme Court Upholds Espionage Act ConvictionsNadine BernardinoNessuna valutazione finora

- ForensicDocumento9 pagineForensicishanNessuna valutazione finora

- Inhabitants of Mali FauxDocumento8 pagineInhabitants of Mali FauxЕвгения АлиеваNessuna valutazione finora

- Belgica v. Ochoa G.R. No. 208566, 19 Nov 2013.Documento3 pagineBelgica v. Ochoa G.R. No. 208566, 19 Nov 2013.Gab EstiadaNessuna valutazione finora

- Del Monte Land Transport Bus Company and Narciso O. Morales, V. Carlito T.abergosDocumento1 paginaDel Monte Land Transport Bus Company and Narciso O. Morales, V. Carlito T.abergosMark Anthony ReyesNessuna valutazione finora

- Elmhurst Keeps Disorderly Conduct Report SecretDocumento7 pagineElmhurst Keeps Disorderly Conduct Report SecretDavid GiulianiNessuna valutazione finora

- 1148 Liquidated Damages in Construction ContractsDocumento3 pagine1148 Liquidated Damages in Construction Contractskian hongNessuna valutazione finora

- Nicolas Vs - Ca DigestDocumento3 pagineNicolas Vs - Ca DigestCaroru ElNessuna valutazione finora

- City of Manila Vs Judge LaguioDocumento2 pagineCity of Manila Vs Judge LaguioJessamine Orioque0% (1)

- Meaning and Definition of MaintenanceDocumento3 pagineMeaning and Definition of Maintenancearyan jainNessuna valutazione finora

- NOMINATION FORM - MEMBER GB Election 2021Documento4 pagineNOMINATION FORM - MEMBER GB Election 2021Engr Binish RazaNessuna valutazione finora

- Notes in Remrev 2Documento9 pagineNotes in Remrev 2Richie SalubreNessuna valutazione finora

- Dela Cruz v. People DigestDocumento4 pagineDela Cruz v. People DigestQueen PañoNessuna valutazione finora

- US (Szymoniak) V Ace Doc 243-1 U.S. V Lorraine Brown Plea Agreement 12CR00198 M.D.F.L. Nov. 20, 2012Documento22 pagineUS (Szymoniak) V Ace Doc 243-1 U.S. V Lorraine Brown Plea Agreement 12CR00198 M.D.F.L. Nov. 20, 2012larry-612445Nessuna valutazione finora

- Liability of Conveyancing Solicitors Towards ClientDocumento17 pagineLiability of Conveyancing Solicitors Towards ClientTetuan Afiq Safly & Co.Nessuna valutazione finora

- Labor CasesDocumento3 pagineLabor CasesDuke SucgangNessuna valutazione finora

- Superior Court of California, County Of: FL-300-INFO DV-400-INFODocumento4 pagineSuperior Court of California, County Of: FL-300-INFO DV-400-INFOJay ONessuna valutazione finora

- EnvironmentDocumento9 pagineEnvironmentVasundhara GopaNessuna valutazione finora

- Order Granting Probation C 185 18 To C 187 18. 09 22 22Documento2 pagineOrder Granting Probation C 185 18 To C 187 18. 09 22 22Precy Fax-belusoNessuna valutazione finora

- Power AND Function OF Securitie S Appelate Tribunal: Sandeep ChawdaDocumento19 paginePower AND Function OF Securitie S Appelate Tribunal: Sandeep ChawdaSandeep ChawdaNessuna valutazione finora

- Companies Act 28 of 2004Documento117 pagineCompanies Act 28 of 2004Newaka DesireNessuna valutazione finora

- Criminal Law Hypothetical #2Documento2 pagineCriminal Law Hypothetical #2angelica150388Nessuna valutazione finora

- Chapter 2 Questions and ActivitiesDocumento6 pagineChapter 2 Questions and ActivitiesJennifer AcaNessuna valutazione finora

- CaseeDocumento10 pagineCaseehardworker1821Nessuna valutazione finora