Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Case Study On Eyetex

Caricato da

Santosh KumarDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Case Study On Eyetex

Caricato da

Santosh KumarCopyright:

Formati disponibili

Introduction : Colour cosmetics are the fastest growing segment, valued at $60 million.

The maj or products in colour cosmetics market are foundation, compacts, eye make-up, li psticks, nail enamels, blush-on, etc. Lipsticks and Nail Enamel account for 65% of the Color cosmetic segment. The nail polish segment is valued at Rs. 1.25 bil lions followed by the lipstick market at Rs 7 millions. All the categories in th is segment are growing at around 25-30%. Gone are the days when cosmetics were viewed as expensive and self-indulgent ite ms. Greater access to television, increased advertisement, growing awareness of western world, and greater product choice and availability have resulted in grow ing demand for cosmetic products in India. A case study on a similar company : Aravind Laboratories is the flagship of the Group of Companies engaged in the manufacture of cosmetics since 1938, when Sri Vasudevan started to make Kajal un der this Brand. Initially he manufactured Kajal (Kanmye / Katuka / Kankappu / Ka nmashi/Kohl etc.,) and Kumkum (Bindi) Chandu liquid in glass bottles. With superio r quality and unique preparations, the Brand Eyetex gained immense popularity & was sold in the then Madras State only. The Kajal was so popular that the brand became synonymous with Kajal. Cosmetics : The cosmetics market can be segregated into talcum powder, colour cosmetics (lip , eye, face, and nail care products), deodorants, and perfumes. The cosmetics ma rket has been growing at the rate of 15-20% for the last few years. The sector h as witnessed growth mainly from medium and low priced category that accounts for 90% of the cosmetic market. In March 1958, the current Promoter s family headed by Late Sri A.V. Srinivasan ac quired the business. Their business expanded considerably with the launch of Kum kum (Bindi) preparations (Liquid Kumkum, Kumkum Paste, Kumkum Powder, Sticker Ku mkum, Multi-color Kumkum liquid, Kumkum pencils), Eyebrow Pencils and Eyeliner l iquid all under the brand name . The Firm expanded its range with attractive Pla stic Containers and introduced the concept of Multi Coloured Kumkum in Liquid, P aste and Powder forms. Sales Expansion : Since the 1960s the firm expanded their sales in South India by appointing the d istributors in Andhra Pradesh, Kerala and Karnataka. From mid seventies, the Fir m extended its marketing reach in North India by entering Maharashtra, Madhya Pr adesh, Orissa and Gujarat. Introduction of new product : Early seventies saw the introduction of liquid Kumkum in Plastic containers of d ifferent sizes. Matt Finish Kumkum was launched in Plastic Tubes in two sizes in mid seventies. Results : Gradually the Brand gained the top position amongst the Trade & the consumers f or these varieties; nearly 18 million pieces are sold every year in three sub br ands Poornima, Divyaa and Pallavi. Introduction of another new product with a new strategy: Mid eighties saw the launch of Kumkum Stickers under Pallavi sub Brand. Strategy adopted : Buy 1 get 1 free. This became so popular over the years that other leading brand

s have followed them by offering 2in1 Packs. New concept : The Firm upgraded the quality of the Pallavi Kumkum Stickers in 1997 by switchin g over to an exclusive non-woven based flocked fabric (only Brand in India to do so till date) & doing away with the harmful PVC based flock fabric. The manufac turing procedure was so upgraded that no part of the human skin retained any tra ces of the adhesive applied on the fabric. The adhesive never gets transferred t o the skin on the forehead and the pH of the adhesive matched that of the skin a voiding any chances of skin irritation. What they have achieved by this move : Gradually, the Brand gained immense popularity and trust from the millions of w omen who had become its loyal consumers. A variety of attractive packs, excellen t quality of the products, regular coverage of the markets with excellent after sales services resulted in becoming the market leaders in town after town and st ate after state. How did they do it : Customers experienced their marketing, sales personnel, he customer's impression of ke product performance, and brand in numerous ways: products, packaging, price, etc. Each of these contacts or touchpoints moulded t the brand. Some of these touchpoints are obvious, li one-on-one customer interactions.

Brand became a living legend for Traditional or Religious range of Cosmetics. The ir foray into the Colour Cosmetic segment began in 1985, with the introduction of Eyeliner. Since 2002, the firm launched a wide range of Colour Cosmetics such as Mascara, Nail Polish, Lipstick, Lip Gloss, Liquid Makeup, Compact Powder, Nail Polish Remover, Liquid Lip Colour, Lip Gel, Face Powder, Talcum Powder, Eyeshado w, Combination Packs etc, under the sub brand . The Reasons For Its Success : Quality products Constant upgradation of the manufacturing processes, packaging & labelling on a regular basis. They delivered More Value for Less Money to the millions of Customers. Brand Popularity : Apart from 22 states in India the products are available in markets around the w orld where Indians are settled. Brand Extension : In 2010 Dazzler moves into personal care. Why Talcum Powder : Talcum powder is one of the most popular cosmetic products in India. Its market is valued at Rs 3.5 billions and is growing at the rate of 12% per annum. Its pe netration level is 45.4% and 25.2% in urban and rural areas respectively. Dazzler brand which is endorsed by Eyetex has moved into personal care cateogry by launching its range of Talcum powders. The brand owners - Arvind Laboratories has been investing behind this brand which is targeting the youth. Dazzler so f ar was focusing on color-cosmetics. Talcum powder is one of the most popular cosmetic products in India. Its market is valued at Rs 3.5 billions and is growing at the rate of 12% per annum. Its pe netration level is 45.4% and 25.2% in urban and rural areas respectively. Ponds dominates talcum powder market with a market share of 70%, followed by Johnson & Johnson with a market share of 15%. Dazzler has been luring the customers with its hip-hop advertisement campaigns a

nd very competitive pricing. The endorsement from Eyetex brand also helped Dazzl er to gain acceptance from the customers. The move of Dazzler to launch a talcum powder is a surprising one. The move can be qualified to be called as a brand e xtension ( category extension) because talcum powder belongs to a different cate gory (personal care) while Dazzler's products were primarily in the cosmetics se gment. Brand extensions are always tricky and these extensions will succeed only if the parent brand is significantly powerful. Dazzler itself derives support f rom the Eyetex brand and has not yet become independent. The move for this extension may be part of a larger plan to develop Dazzler as a personal care + cosmetic brand in future. Brands like Pond's, Lakme etc has suc cessfully developed themselves to be family brands endorsing a large number of p roducts across various categories. Personal care is different from color cosmeti cs interms of attributes. Dazzler may find it difficult to manage these two cate gories using same set of attributes. Having said that, Dazzler may have to set a clear direction interms of the positioning. Now Dazzler color cosmetic campaign s are depending heavily on imagery to do the talking. The entire brand is revolv ing around the " Dazzler Girl " who is imaged as a modern, stylish, fashionable and thus radiates the brand's attributes. The same imagery is shown in the Dazzl er's Talcum Powder advertisement. Dazzler now should move to become an independent brand with a clear positioning. The use of " Dazzler Girl " will give brand imagery but along with that, the br and should communicate some very relevant attributes that will support the posit ioning of a trendy fashionable brand. Competitors and their market share : Ponds dominates talcum powder market with a market share of 70%, followed by Joh nson & Johnson with a market share of 15%.

Potrebbero piacerti anche

- Dokumen - Pub - Bobs Refunding Ebook v3 PDFDocumento65 pagineDokumen - Pub - Bobs Refunding Ebook v3 PDFJohn the First100% (3)

- Obective of The ProjectDocumento31 pagineObective of The ProjectShreya Handoo100% (1)

- Project Report On LakmeDocumento19 pagineProject Report On LakmeShashikant Mishra71% (14)

- Marketing LakmeDocumento14 pagineMarketing LakmeVasudha9775% (4)

- Methods of Recording Retruded Contact Position in Dentate PatientsDocumento15 pagineMethods of Recording Retruded Contact Position in Dentate PatientsYossr MokhtarNessuna valutazione finora

- Grade 7 ExamDocumento3 pagineGrade 7 ExamMikko GomezNessuna valutazione finora

- Consumers' Brand Preference and Buying Behaviour of Cosmetic Products at Coimbatore CityDocumento8 pagineConsumers' Brand Preference and Buying Behaviour of Cosmetic Products at Coimbatore CityBhanu TejaNessuna valutazione finora

- How Lakme Is Influencing Its ConsumersDocumento8 pagineHow Lakme Is Influencing Its ConsumersKrunal PatelNessuna valutazione finora

- NTCCDocumento71 pagineNTCCakanksha singhNessuna valutazione finora

- Jpowui 0Documento13 pagineJpowui 0RevathiNessuna valutazione finora

- Research Report On (A Product of Hindustan Unilever LTD) : LakmeDocumento67 pagineResearch Report On (A Product of Hindustan Unilever LTD) : LakmeYAMINI AGRAWALNessuna valutazione finora

- Project Report On LakmeDocumento167 pagineProject Report On LakmeArchana JaiswalNessuna valutazione finora

- A Project On Lakme CosmeticsDocumento16 pagineA Project On Lakme CosmeticsJanvi KapoorNessuna valutazione finora

- Vatika Shampoo ProjectDocumento64 pagineVatika Shampoo ProjectToufique Kazi0% (1)

- Project Report On MKT Segmentation of Lux SoapDocumento25 pagineProject Report On MKT Segmentation of Lux Soapsonu sahNessuna valutazione finora

- PROJECT On Stress Management by Karan Pathak FinalDocumento85 paginePROJECT On Stress Management by Karan Pathak FinalKaran pathakNessuna valutazione finora

- Lakme CosmeticsDocumento27 pagineLakme CosmeticsKritika SinghNessuna valutazione finora

- HulDocumento84 pagineHulSubhash Bajaj75% (4)

- Synopsis ON: Emotional Intelligence Among Young Employees in Heston Kuwait"Documento9 pagineSynopsis ON: Emotional Intelligence Among Young Employees in Heston Kuwait"Vilas_123Nessuna valutazione finora

- (Final Project) 7Documento106 pagine(Final Project) 7Usman MalikNessuna valutazione finora

- LakmeDocumento9 pagineLakmeAanchal MahajanNessuna valutazione finora

- Kshitiksha Foundation: Social InternshipDocumento12 pagineKshitiksha Foundation: Social InternshipRishabh Niketa100% (1)

- Buying Behaviour Fairness Creams ProjectDocumento10 pagineBuying Behaviour Fairness Creams ProjectSushmitha Serarajan0% (1)

- Human Capital Management - LupinDocumento4 pagineHuman Capital Management - LupinLAKSHMI BALAKRISHNAN MBA19-21Nessuna valutazione finora

- Final Research Project Consumer Perception Towards Bathing Soaps (Lux, Dove, Pears)Documento86 pagineFinal Research Project Consumer Perception Towards Bathing Soaps (Lux, Dove, Pears)Siddharth AnandNessuna valutazione finora

- A Project On Lakme CosmeticsDocumento16 pagineA Project On Lakme Cosmeticspriyanka386Nessuna valutazione finora

- PatanjaliDocumento23 paginePatanjaliPranav TimseNessuna valutazione finora

- Workers Participation Case IDocumento3 pagineWorkers Participation Case IAlka JainNessuna valutazione finora

- Case Studies Mba 1 AssignmentDocumento2 pagineCase Studies Mba 1 Assignmentayushi aggarwalNessuna valutazione finora

- OS at DC BooksDocumento57 pagineOS at DC BooksJiss George Mancherikalam0% (1)

- Concepts and Techniques of Value Analysis To Effectively Control CostDocumento112 pagineConcepts and Techniques of Value Analysis To Effectively Control CostKelly Kinney100% (2)

- Amity Business School: Submitted by Tanya Sharma M.B.A (HR) 2008-2010 (A0102308288)Documento68 pagineAmity Business School: Submitted by Tanya Sharma M.B.A (HR) 2008-2010 (A0102308288)Chaiten GuptaNessuna valutazione finora

- The Performance Appraisal System of HDFC SLIC by Parshuram Sahoo IILM BS HYDDocumento78 pagineThe Performance Appraisal System of HDFC SLIC by Parshuram Sahoo IILM BS HYDsahoo_iilm80% (5)

- Amway Corporation in India (Marketing Research)Documento81 pagineAmway Corporation in India (Marketing Research)Ankit JainNessuna valutazione finora

- DoveDocumento13 pagineDoveVaibhav ShuklaNessuna valutazione finora

- of HR Practices in Reliance IndustriesDocumento17 pagineof HR Practices in Reliance IndustriesVikʌsh SıŋghNessuna valutazione finora

- MBA Project Report On Life InsuranceDocumento2 pagineMBA Project Report On Life Insurancebathula veerahanuman0% (1)

- Lotus Herbals To Roll Out New Products To Spur SalesDocumento4 pagineLotus Herbals To Roll Out New Products To Spur Salesshrikajal100% (1)

- A Report On PEPSODENT.Documento6 pagineA Report On PEPSODENT.Gago67% (3)

- Main AmbaniDocumento28 pagineMain AmbaniankursagarNessuna valutazione finora

- Varunbeverages An Industrial VisitDocumento26 pagineVarunbeverages An Industrial VisitSanyog Sharma100% (1)

- Patanjali Literature ReviewDocumento4 paginePatanjali Literature ReviewKiran Mishra50% (8)

- Agra WalDocumento4 pagineAgra Walsagar bhamareNessuna valutazione finora

- International Marketing Management ProjectDocumento38 pagineInternational Marketing Management ProjectanniekohliNessuna valutazione finora

- Coca-Cola & Pepsi (Comparitive Study Between)Documento71 pagineCoca-Cola & Pepsi (Comparitive Study Between)fukreNessuna valutazione finora

- A Study of Performance Appraisal System Yahama Motors Sandeep KumarDocumento107 pagineA Study of Performance Appraisal System Yahama Motors Sandeep KumarShahzad SaifNessuna valutazione finora

- Lakme Products Price List PDF 2021Documento11 pagineLakme Products Price List PDF 2021fefwNessuna valutazione finora

- MBA's Do Not Make Good Business LeadersDocumento2 pagineMBA's Do Not Make Good Business LeadersSANCHITA KHATTARNessuna valutazione finora

- Marketing Management Project Synopsis - 1Documento3 pagineMarketing Management Project Synopsis - 1Kapil Singh100% (1)

- Human Resource ManagementDocumento23 pagineHuman Resource ManagementNidhi Gupta0% (1)

- Project ReportDocumento50 pagineProject ReportHarsh KapoorNessuna valutazione finora

- Dissertation Report On: Marketing Strategy of Dabur Vatika Hair Oil & Dabur Chyawanprash'Documento54 pagineDissertation Report On: Marketing Strategy of Dabur Vatika Hair Oil & Dabur Chyawanprash'su_pathriaNessuna valutazione finora

- Head & Shoulder in IndiaDocumento10 pagineHead & Shoulder in IndiaKhalid TrussNessuna valutazione finora

- Brand Tracker of Sunsilk To Calculate The Brand ImageDocumento29 pagineBrand Tracker of Sunsilk To Calculate The Brand Imageuma.8987100% (1)

- CavinKare AssignmentDocumento5 pagineCavinKare AssignmentTanvi RastogiNessuna valutazione finora

- SM Report EditDocumento15 pagineSM Report EditnikhilNessuna valutazione finora

- Clinic Is ClearDocumento7 pagineClinic Is Clearrupeshverma491993Nessuna valutazione finora

- Lakme StrategyDocumento13 pagineLakme StrategyMeena YadavNessuna valutazione finora

- SM Report EditDocumento33 pagineSM Report EditnikhilNessuna valutazione finora

- Santoor Marketing Project PDFDocumento47 pagineSantoor Marketing Project PDFshubhi abrol100% (2)

- CT AssignmentDocumento7 pagineCT AssignmentMeena YadavNessuna valutazione finora

- Red Earth Cosmetics ReportDocumento10 pagineRed Earth Cosmetics Reportapi-26838993100% (2)

- Cosmetic ProductsDocumento15 pagineCosmetic ProductsAdvik BoyNessuna valutazione finora

- Crown WF-3000 1.2Documento5 pagineCrown WF-3000 1.2Qirat KhanNessuna valutazione finora

- Role of Personal Finance Towards Managing of Money - DraftaDocumento35 pagineRole of Personal Finance Towards Managing of Money - DraftaAndrea Denise Lion100% (1)

- Bana LingaDocumento9 pagineBana LingaNimai Pandita Raja DasaNessuna valutazione finora

- Assembler Pass 2Documento5 pagineAssembler Pass 2AnuNessuna valutazione finora

- PhraseologyDocumento14 paginePhraseologyiasminakhtar100% (1)

- Functional DesignDocumento17 pagineFunctional DesignRajivSharmaNessuna valutazione finora

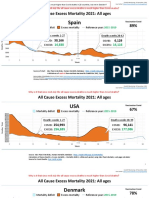

- Countries EXCESS DEATHS All Ages - 15nov2021Documento21 pagineCountries EXCESS DEATHS All Ages - 15nov2021robaksNessuna valutazione finora

- Aptitude Number System PDFDocumento5 pagineAptitude Number System PDFharieswaranNessuna valutazione finora

- The Mantel Colonized Nation Somalia 10 PDFDocumento5 pagineThe Mantel Colonized Nation Somalia 10 PDFAhmad AbrahamNessuna valutazione finora

- Stearns 87700 Series Parts ListDocumento4 pagineStearns 87700 Series Parts ListYorkistNessuna valutazione finora

- WEB DESIGN WITH AUSTINE-converted-1Documento9 pagineWEB DESIGN WITH AUSTINE-converted-1JayjayNessuna valutazione finora

- in Strategic Management What Are The Problems With Maintaining A High Inventory As Experienced Previously With Apple?Documento5 paginein Strategic Management What Are The Problems With Maintaining A High Inventory As Experienced Previously With Apple?Priyanka MurthyNessuna valutazione finora

- Harper Independent Distributor Tri FoldDocumento2 pagineHarper Independent Distributor Tri FoldYipper ShnipperNessuna valutazione finora

- De Thi Hoc Ki 1 Mon Tieng Anh Lop 5 Co File NgheDocumento10 pagineDe Thi Hoc Ki 1 Mon Tieng Anh Lop 5 Co File Nghetuyen truongNessuna valutazione finora

- FDA Approves First Gene Therapy, Betibeglogene Autotemcel (Zynteglo), For Beta-ThalassemiaDocumento3 pagineFDA Approves First Gene Therapy, Betibeglogene Autotemcel (Zynteglo), For Beta-ThalassemiaGiorgi PopiashviliNessuna valutazione finora

- Quantitative Methods For Economics and Business Lecture N. 5Documento20 pagineQuantitative Methods For Economics and Business Lecture N. 5ghassen msakenNessuna valutazione finora

- Tetralogy of FallotDocumento8 pagineTetralogy of FallotHillary Faye FernandezNessuna valutazione finora

- Stress-Strain Modelfor Grade275 Reinforcingsteel With Cyclic LoadingDocumento9 pagineStress-Strain Modelfor Grade275 Reinforcingsteel With Cyclic LoadingRory Cristian Cordero RojoNessuna valutazione finora

- Kahneman & Tversky Origin of Behavioural EconomicsDocumento25 pagineKahneman & Tversky Origin of Behavioural EconomicsIan Hughes100% (1)

- Objective & Scope of ProjectDocumento8 pagineObjective & Scope of ProjectPraveen SehgalNessuna valutazione finora

- Article An Incident and Injury Free Culture Changing The Face of Project Operations Terra117 2Documento6 pagineArticle An Incident and Injury Free Culture Changing The Face of Project Operations Terra117 2nguyenthanhtuan_ecoNessuna valutazione finora

- LetrasDocumento9 pagineLetrasMaricielo Angeline Vilca QuispeNessuna valutazione finora

- Ron Kangas - IoanDocumento11 pagineRon Kangas - IoanBogdan SoptereanNessuna valutazione finora

- Log Building News - Issue No. 76Documento32 pagineLog Building News - Issue No. 76ursindNessuna valutazione finora

- Powerpoint Speaker NotesDocumento4 paginePowerpoint Speaker Notesapi-273554555Nessuna valutazione finora

- Solved Simplex Problems PDFDocumento5 pagineSolved Simplex Problems PDFTejasa MishraNessuna valutazione finora

- Damodaram Sanjivayya National Law University Visakhapatnam, A.P., IndiaDocumento25 pagineDamodaram Sanjivayya National Law University Visakhapatnam, A.P., IndiaSumanth RoxtaNessuna valutazione finora