Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

First Assessment in Income Taxation

Caricato da

Chavilita VallesTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

First Assessment in Income Taxation

Caricato da

Chavilita VallesCopyright:

Formati disponibili

FIRST ASSESSMENT IN INCOME TAXATION

CHAVILITA VALLES BSBA- 2E

1. Which of the following is not a determinant of the place of taxation?

A. Source of the income

B. Citizenship of the taxpayer

C. Residence of the taxpayer

D. Amount of tax to be imposed

2. The tax imposed should be proportionate to the taxpayer’s ability to pay.

A. Fiscal adequacy

B. Equality or theoretical justice

C. Administrative feasibility

D. Intellectual sensitivity

3.Taxation as distinguished from police power and power of eminent domain.

A. Property is taken to promote the general welfare

B. Maybe exercised only by the government

C Operates upon the whole citizenry

D There is generally no limit as to the amount that maybe imposed

4.A tax system where the revenues are supplied mostly by indirect taxes.

A. Schedular

B. Progressive

C. Proportional

D. Regressive

5. This is a constitutional limitation on the power of taxation.

A. Tax laws must be applied within the territorial jurisdiction of the state.

B. Exemption of government agencies and instrumentalities from taxation

C. No appropriation of public money for religious purposes.

D. Power to tax cannot be delegated to private persons or entities.

6. Which of the following statement is not correct.

A. An inherent limitation of taxation maybe disregarded by the application of a constitutional

limitation.

B. The property of an educational institution operated by a religious order isexemp from

property tax, but its income is subject to income tax.

C. The prohibition of delegation by the state of the power of taxation will still allow the BIR

to modify the rules in time for filing of returns and payment of taxes.

D. The power of taxation is shared by the legislative and executive departments of the

government.

7. The power to acquire private property up on payment of just compensation for

public purpose.

A. Power of taxation

B. Police power

C. Power of imminent domain

D. Power of recall

8. A tax system where the greater bulk of the tax revenues is derived by direct taxes.

A. Schedular

B. Progressive

C. Proportional

D. Regressive

9. Which of the following is a nature of taxation?

A. The power is granted by legislative action

B. It is essentially an administrative function

C. It is generally payable in money

D. Without it the state can continue to exist

10. The exist independent of the constitution being fundamental powers of the state

except.

A. Power of taxation

B. Police power

C. Power of imminent domain

D. Power of recall

11. Basic principles of a sound tax system except.

A. Fiscal adequacy

B. Equality or theoretical justice

C. Administrative feasibility

D. Intellectual sensitivity

12. It is the privilege of not being imposed a financial obligation to which others are

subject.

A. Tax incentive

B. Tax exemption

C. Tax amnesty

D. Tax credit

13. Which is not an essential characteristics of a tax?

A. It is unlimited as to amount

B. It is payable In money

C. It is proportionate in character

D. It is an enforced contribution

14. Special assessment is an enforced proportional contribution from owners of land

especially benefited by public improvement. Which one of the following is not

considered as one of its characteristics?

A. It is levied on land

B. It is based on the governments need of money to support its legitimate objective

C. It is not a personal liability of the persons assessed

D. It is based solely on the benefit derived by the owners of the land.

15. The power to demand proportionate contributions from persons and property

to defray the expenses of the government.

A. Power taxation

B. Police power

C. Power of imminent domain

D. Power of recall

16. As to scope of the legislative power to tax. Which is not correct.

A. Where, there are no constitutional restrictions, and provided the subjects are within the

territorial jurisdiction of the state, congress has unlimited discretion of the persons,

property or occupations to be taxed.

B. In the absence of any constitutional prohibition, congress has the right to levy a tax of any

amount it sees fit.

C. The discretion of congress in imposing taxes extends to the mode, method or kind of tax,

unless restricted by the constitution.

D. The sole arbiter of the purpose or which taxes shall believed is congress, provided the

purpose is public and the courts may not review the levy of the tax to determine

whether or not the purpose is public.

17. The power to regulate liberty and property to promote the general welfare.

A. Power of taxation

B. Police power

C. Power of imminent domain

D. Power of recall

18. The tax laws must be capable of convenient, just and effective administration.

A. Fiscal adequacy

B. Equality or theoretical justice

C. Administrative feasibility

D. Intellectual sensitivity

19. The sources of revenue as a whole, should be sufficient to meet the demands of

public expenditures.

A. Fiscal adequacy

B. Equality or theoretical justice

C. Administrative feasibility

D. Intellectual sensitivity

20. This is an inherent limitation on the power of taxation.

A. Rule on uniformly and equity in taxation

B. Due process of law and equal protection of the laws.

C. Non-impairment of the jurisdiction of the supreme court in tax cases

D. Tax must be for the public purpose

Potrebbero piacerti anche

- The Economic Policies of Alexander Hamilton: Works & Speeches of the Founder of American Financial SystemDa EverandThe Economic Policies of Alexander Hamilton: Works & Speeches of the Founder of American Financial SystemNessuna valutazione finora

- Tax Reviewer General PrinciplesDocumento28 pagineTax Reviewer General PrinciplesLouiseNessuna valutazione finora

- Taxation Review - General PrinciplesDocumento6 pagineTaxation Review - General PrinciplesKenneth Bryan Tegerero Tegio0% (1)

- Income Taxation - Quiz1Documento3 pagineIncome Taxation - Quiz1lindsay boncodinNessuna valutazione finora

- Assignment 1 Answer KeyDocumento3 pagineAssignment 1 Answer KeyRonna Mae DungogNessuna valutazione finora

- Asiignment 1 in TAX ADocumento3 pagineAsiignment 1 in TAX ARonna Mae DungogNessuna valutazione finora

- 1 CPA Review School of The Philippines Manila General Principles of Taxation Dela Cruz/De Vera/Lopez/LlamadoDocumento20 pagine1 CPA Review School of The Philippines Manila General Principles of Taxation Dela Cruz/De Vera/Lopez/LlamadoJolianne SalvadoOfcNessuna valutazione finora

- GENERAL PRINCIPLES PracticeDocumento13 pagineGENERAL PRINCIPLES PracticeMarielle AzaresNessuna valutazione finora

- TAX Principles (THEORIES)Documento13 pagineTAX Principles (THEORIES)W-304-Bautista,PreciousNessuna valutazione finora

- (Cpar2016) Tax-8001 (General Principles of Taxation)Documento16 pagine(Cpar2016) Tax-8001 (General Principles of Taxation)Ralph SantosNessuna valutazione finora

- General Principles of TaxationDocumento3 pagineGeneral Principles of TaxationRussel Saez ReyNessuna valutazione finora

- Special QuizDocumento2 pagineSpecial QuizKristine LumanaogNessuna valutazione finora

- 1.reviewer CparDocumento31 pagine1.reviewer CparMinie KimNessuna valutazione finora

- Taxation 101 This Is For All The Students PadayonDocumento12 pagineTaxation 101 This Is For All The Students PadayonKendall JennerNessuna valutazione finora

- Icare TaxxxxDocumento84 pagineIcare TaxxxxInny Agin100% (3)

- TaxationDocumento27 pagineTaxationDesiree Rae BaniquedNessuna valutazione finora

- MCQs - TAX - General PrinciplesDocumento24 pagineMCQs - TAX - General PrinciplesElaineJrV-Igot100% (1)

- Taxation Principles and Constitutional LimitationsDocumento3 pagineTaxation Principles and Constitutional LimitationsRyanKingNessuna valutazione finora

- 93-01 General Principles QuestionnaireDocumento12 pagine93-01 General Principles QuestionnaireJuan Miguel UngsodNessuna valutazione finora

- Tax 01-General PrinciplesDocumento9 pagineTax 01-General PrinciplesDin Rose Gonzales0% (1)

- IncomeTax Banggawan2019 Ch1Documento22 pagineIncomeTax Banggawan2019 Ch1Noreen Ledda100% (2)

- Midterm exam questions on taxationDocumento3 pagineMidterm exam questions on taxationMon TeeNessuna valutazione finora

- Chapter 26 Inherent Powers of The StateDocumento9 pagineChapter 26 Inherent Powers of The StateMonii OhNessuna valutazione finora

- TAX_Review_-GP_Ex-2Documento4 pagineTAX_Review_-GP_Ex-2duguitjinky20.svcNessuna valutazione finora

- Compilation of QuizzesDocumento37 pagineCompilation of QuizzesHazel MoradaNessuna valutazione finora

- Principles of Taxation2Documento8 paginePrinciples of Taxation2Daniel DialinoNessuna valutazione finora

- CPA Review School of The Philippines Manila General Principles of Taxation Dela Cruz/De Vera/LlamadoDocumento12 pagineCPA Review School of The Philippines Manila General Principles of Taxation Dela Cruz/De Vera/LlamadoEdma Glory MacadaagNessuna valutazione finora

- 1st Exam - TaxDocumento4 pagine1st Exam - TaxAlvin YercNessuna valutazione finora

- Week 1 and 2: Aug. 24 To September 7: Tax 1 (Bsoa and Bsma) Activity Materials Two (2) WEEKSDocumento18 pagineWeek 1 and 2: Aug. 24 To September 7: Tax 1 (Bsoa and Bsma) Activity Materials Two (2) WEEKSMiconNessuna valutazione finora

- Reviewer (Book) Chapter 1-3Documento41 pagineReviewer (Book) Chapter 1-3Noeme Lansang50% (2)

- Tax1 4compiDocumento49 pagineTax1 4compiAnne Marieline Buenaventura100% (1)

- Reviewer For QuizDocumento18 pagineReviewer For QuizDell OleahNessuna valutazione finora

- CPA Review School of The Philippines Manila General Principles of Taxation Dela Cruz/De Vera/LlamadoDocumento10 pagineCPA Review School of The Philippines Manila General Principles of Taxation Dela Cruz/De Vera/LlamadoAbraham Marco De GuzmanNessuna valutazione finora

- Tax 11-20Documento3 pagineTax 11-20Jer RamaNessuna valutazione finora

- Tax 1 - GPDocumento7 pagineTax 1 - GPJayson ChanNessuna valutazione finora

- Principles of Income Tax Test Bank No AnswerDocumento9 paginePrinciples of Income Tax Test Bank No AnswerCheska DizonNessuna valutazione finora

- 94-01 General Principles QuestionnaireDocumento12 pagine94-01 General Principles QuestionnaireEpfie SanchesNessuna valutazione finora

- 1 Fundamental Principles of TaxationDocumento13 pagine1 Fundamental Principles of TaxationAlted AluraNessuna valutazione finora

- State Powers and Taxation PrinciplesDocumento16 pagineState Powers and Taxation PrinciplesJolianne SalvadoOfcNessuna valutazione finora

- CPA Review School of The Philippines Manila General Principles of Taxation Dela Cruz/De Vera/LlamadoDocumento13 pagineCPA Review School of The Philippines Manila General Principles of Taxation Dela Cruz/De Vera/LlamadomichNessuna valutazione finora

- TAXATION 1 - Income Taxation PrinciplesDocumento6 pagineTAXATION 1 - Income Taxation PrinciplesCrizel A. AggasigNessuna valutazione finora

- Handout 01Documento7 pagineHandout 01Josua PagcaliwaganNessuna valutazione finora

- QUIZ 1 Principles of TaxationDocumento6 pagineQUIZ 1 Principles of TaxationHector Quillo Ladua Jr.Nessuna valutazione finora

- Sample Exam Questionnaire and Answer in TaxationDocumento6 pagineSample Exam Questionnaire and Answer in TaxationKJ Vecino Bontuyan75% (4)

- Assignment 2 TAXES, TAX LAWS AND TAX ADMIN ANSWER KEYDocumento2 pagineAssignment 2 TAXES, TAX LAWS AND TAX ADMIN ANSWER KEYRonna Mae DungogNessuna valutazione finora

- 2023 TAX1-General Principles of TaxationDocumento6 pagine2023 TAX1-General Principles of TaxationJaynalyn MonasterialNessuna valutazione finora

- TAX-1-QUIZDocumento6 pagineTAX-1-QUIZJasmine CandidoNessuna valutazione finora

- DAY 1 Part 1 Fundamental Principles of Taxation StudentsDocumento5 pagineDAY 1 Part 1 Fundamental Principles of Taxation StudentsMary Chrisdel Obinque GarciaNessuna valutazione finora

- Pre-Midterm Examination - TaxationDocumento5 paginePre-Midterm Examination - TaxationCarla Jane ApolinarioNessuna valutazione finora

- Q1 Taxation Review Taxation FundamentalsDocumento10 pagineQ1 Taxation Review Taxation Fundamentalsfinn heartNessuna valutazione finora

- Basic Principles QuizzerDocumento16 pagineBasic Principles Quizzerbobo kaNessuna valutazione finora

- TAXATION-REVIEW-QUESTIONSDocumento4 pagineTAXATION-REVIEW-QUESTIONSdanilynbrmdz0602Nessuna valutazione finora

- Exam Drill Problems on Taxation Principles and TheoriesDocumento15 pagineExam Drill Problems on Taxation Principles and TheoriesSerena Van Der Woodsen100% (1)

- Learning to Love Form 1040: Two Cheers for the Return-Based Mass Income TaxDa EverandLearning to Love Form 1040: Two Cheers for the Return-Based Mass Income TaxNessuna valutazione finora

- Hamilton's Economic Policies: Works & Speeches of the Founder of American Financial SystemDa EverandHamilton's Economic Policies: Works & Speeches of the Founder of American Financial SystemNessuna valutazione finora

- Let's Choose Prosperity: Practical Political SolutionsDa EverandLet's Choose Prosperity: Practical Political SolutionsNessuna valutazione finora

- Inspection and AppraisalDocumento12 pagineInspection and AppraisalChavilita VallesNessuna valutazione finora

- Academic PerformancesDocumento19 pagineAcademic PerformancesChavilita VallesNessuna valutazione finora

- Basic Business EnvironmentDocumento2 pagineBasic Business EnvironmentChavilita VallesNessuna valutazione finora

- Student Project Appraisal BasicsDocumento2 pagineStudent Project Appraisal BasicsChavilita VallesNessuna valutazione finora

- Clear TaxDocumento12 pagineClear TaxsrawannathNessuna valutazione finora

- The Pace Makers-4Documento38 pagineThe Pace Makers-4TULI MODAKNessuna valutazione finora

- Presented by Chinnu Gigi Roll No. 10 S1 Mtech CeDocumento12 paginePresented by Chinnu Gigi Roll No. 10 S1 Mtech Cechinnu gigiNessuna valutazione finora

- Tax RemediesDocumento16 pagineTax RemediesJoshua Catalla Mabilin100% (1)

- Deductions From Gross Income: (Sec. 65, Rev. Reg. No. 2)Documento69 pagineDeductions From Gross Income: (Sec. 65, Rev. Reg. No. 2)Brian TorresNessuna valutazione finora

- Taxation Issues For SMEs in GhanaDocumento78 pagineTaxation Issues For SMEs in GhanaWilliamNessuna valutazione finora

- Appointment & Remuneration of Managerial PersonnelDocumento20 pagineAppointment & Remuneration of Managerial PersonnelMuhammed ShabeebNessuna valutazione finora

- 18-Oña v. CIR G.R. No. L-19342 May 25, 1972Documento8 pagine18-Oña v. CIR G.R. No. L-19342 May 25, 1972Jopan SJNessuna valutazione finora

- Taxation Pilot QuestionsxDocumento14 pagineTaxation Pilot QuestionsxEmmanuel ObafemmyNessuna valutazione finora

- In The USA, Personal Income Tax IllegalDocumento10 pagineIn The USA, Personal Income Tax IllegalArnulfo Yu LanibaNessuna valutazione finora

- Further Clarifications On The Retirement20210424-12Documento3 pagineFurther Clarifications On The Retirement20210424-12rian.lee.b.tiangcoNessuna valutazione finora

- E Filing Income Tax Return OnlineDocumento53 pagineE Filing Income Tax Return OnlineMd MisbahNessuna valutazione finora

- Philippines Supreme Court Case on Deficiency Income Tax AssessmentDocumento6 paginePhilippines Supreme Court Case on Deficiency Income Tax AssessmentJec Luceriaga BiraquitNessuna valutazione finora

- Basic Concepts of Corporate Taxation & Tax TreatiesDocumento35 pagineBasic Concepts of Corporate Taxation & Tax TreatiesYash SharmaNessuna valutazione finora

- Tax Evasion Case Vs Pacquiao Mulled - Manila Bulletin - Latest Breaking News - News PhilippinesDocumento12 pagineTax Evasion Case Vs Pacquiao Mulled - Manila Bulletin - Latest Breaking News - News PhilippinesJulia JohnsonNessuna valutazione finora

- CIR v. PinedaDocumento3 pagineCIR v. PinedaTheresa BuaquenNessuna valutazione finora

- Treasury Rules Vol-II PDFDocumento300 pagineTreasury Rules Vol-II PDFAneela TabassumNessuna valutazione finora

- Taxation Knowbility Semi Final DraftDocumento16 pagineTaxation Knowbility Semi Final DraftKj WhiteNessuna valutazione finora

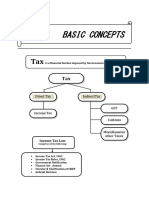

- Basic Concepts: Direct Tax Indirecttax GST Customs Miscellaneous Other Taxes Income TaxDocumento227 pagineBasic Concepts: Direct Tax Indirecttax GST Customs Miscellaneous Other Taxes Income TaxRaj DasNessuna valutazione finora

- Oman Investment Handbook: Key Industries and IncentivesDocumento19 pagineOman Investment Handbook: Key Industries and IncentivesTreeSix SolutionsNessuna valutazione finora

- Income Taxation ExplainedDocumento15 pagineIncome Taxation ExplainedJustin Andre SiguanNessuna valutazione finora

- State Investment Vs CitibankDocumento2 pagineState Investment Vs CitibankJohn Dexter FuentesNessuna valutazione finora

- Investment Allowance Notes SummaryDocumento12 pagineInvestment Allowance Notes SummaryTriila manillaNessuna valutazione finora

- R450215048 and R450215037 Tax ProDocumento13 pagineR450215048 and R450215037 Tax ProSankarSinghNessuna valutazione finora

- TAXATION QUIZDocumento8 pagineTAXATION QUIZiamnumberfourNessuna valutazione finora

- Waiver of Statute of LimitationsDocumento13 pagineWaiver of Statute of LimitationsFrancis PunoNessuna valutazione finora

- Supreme Court Rules Limited Partnership Not Dissolved by Marriage of PartnersDocumento3 pagineSupreme Court Rules Limited Partnership Not Dissolved by Marriage of PartnersJoffrey UrianNessuna valutazione finora

- UGC Recognizes CA Course as Post GraduationDocumento36 pagineUGC Recognizes CA Course as Post Graduationsunil1287Nessuna valutazione finora

- Module in Income Taxation by Jewelyn C. Espares-CioconDocumento33 pagineModule in Income Taxation by Jewelyn C. Espares-CioconmarkbagzNessuna valutazione finora

- Rules On Conflicting Provisions SummaryDocumento7 pagineRules On Conflicting Provisions SummaryStephanie BasilioNessuna valutazione finora