Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

MCQ Afa

Caricato da

shikha143Descrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

MCQ Afa

Caricato da

shikha143Copyright:

Formati disponibili

MULTIPLE CHOICE QUESTIONS OF ACCOUNTING AND FINANCIAL ANALYSIS Q1.

Real accounts are related to: a) b) c) d) Assets Expenses and loses Debtors and creditors Income and gain

Q2. Prepaid expenditure is shown as a) b) c) d) An asset A liability An expense None of these

Q3. The primary objective of Current ratio is: a) b) c) d) To measure the use of debt To measure the liquidity To measure the effectiveness of capital To measure the profitability of the company

Q4. Net working capital is -------- of total current assets and total current liabilities: a) b) c) d) Aggregate Difference Total Maximum

Q5.long term creditor of the company is interested in: a) b) c) d) Profitability of the company Long term solvency on the company Cash position of the company All of the above

Q6. In Fund Flow Statement, fund means: a) b) c) d) Working Capital Current Assets Cash only None of the above

Q7. Current Assets are Rs.3,00,000; Current Liabilities are Rs.1,50,000;the debtors realized Rs.20,000. Its impact on working capital would be: a) b) c) d) Increase working capital by 20,000 Decrease working capital Rs.20,000 No change in working capital Cannot be determined

Q8.Debenture is: a) b) c) d) Long term liability Short term liability Asset None of the above

Q9.Intrest on Drawings is---a) b) c) d) Expenditure for the business. Expenses for the business. Gain for the business. Loss for the Business.

Q10. The Diminishing value Method means a method by which-------a) b) c) d) The rate of depreciation falls year by year The amount on which depreciation is calculated falls year by year The rate as well as the amount to which it is applied falls year by year None of the above

Q11. In the balance sheet of the company the item Goodwill is shown under the headings------. a) b) c) d) Current assets Loans and advances Liability Fixed asset.

Q12. In a cash flow statement which of the following would appear as a cash outflow. a) b) c) d) The payment for investments purchased Amount received on issue of new shares Debentures held as investment being converted into shares None of the above.

Q13. The assets of a business on 31st march, 2010 are worth Rs. 50,000 and its capital is Rs.35, 000. Its liability on that date shall be a) b) c) d) 85,000 15,000 35,000 10,000

Q13.outstanding salaries are shown in a) b) c) d) Trading account(debit side) Profit and loss account(credit side) Balance sheet (asset side) Balance sheet (liability side)

Q14. Which of the following transactions will result in fund flow? a) Cash collected from debtors b) Purchase of machinery by issue of debentures c) Old furniture, the book value of which is 5000 discarded and written off in the profit and loss account. d) None of the above transactions will result in funds flow.

Q15. According to the Business Entity Concept a) Transactions between the business and its owners are not recorded. b) Transactions between the business and its owners are recorded considering them to be a one single entity. c) Transactions between the business and its owners are recorded from the business point of view. d) None of the above

Q16. According to the cost concept a) b) c) d) Assets are recorded at the value paid for acquiring it. Assets are recorded by estimating the market value at the time of purchase. Assets are recorded at lower of cost and market value. None of the above

Q17. According to going concern concept, a business is viewed as having a) b) c) d) a limited life a very long life an indefinite life none of these

Q18. Which of the following equation is correct? a) b) c) d) Assets + capital =Liabilities Liabilities+ capital= Assets Assets+ Liabilities=capital Assets-Liabilities=Capital

Q19. The trial balance shows a) b) c) d) Both debit and credit balances Credit balances Debit balances None of these

Q20. Which of the following accounts will be credited on giving cash donation? a) b) c) d) Cash account Donation account Purchase account Stock account

Q21. Depreciation arises because of a) b) c) d) Wear and tear Inflation Fall in the value of the assets None of these

Q22.straight line method of depreciation is that method under which a) b) c) d) Depreciation is charged at a fixed percentage on the book value of the asset Depreciation is charged at a fixed percentage on the original cost of the asset. Depreciation is charged on original cost of asset but the depreciation rate changes. All of the above

Q24. A machinery which cost Rs.2, 00,000 is depreciated at 25% per year using the written down value method. At the end of three years, it will have a net book value of. a) b) c) d) Rs.1,50,000 Rs. 84,375 Rs.1, 12,500. Rs.1,00,000

Q25. Which of the following is non-current liability? a) b) c) d) Mortgage loan Bank overdraft Outstanding wages Bills payable

Q26.which of the following will not change working capital: a) b) c) d) Purchase of goods for cash Purchase of machine for cash Purchase of machine against cheque Sale of old machine against cheque

Q27. Which of the following is an application of fund? a) b) c) d) Payment of dividend Writing-off goodwill Sale of goods for cash Refund of income tax

Q28.while calculating funds from operations, which of the following item is deducted from the net profit: a) b) c) d) Loss on sale of fixed assets Non operating incomes Depreciation on fixed assets None of these

Q29. A transaction does not result into flow of funds: a) b) c) d) When a current asset is converted into another current asset When a fixed asset is bought out of current asset When a long term liability is paid out of current asset None of these.

Q30.which of the following is not a cash inflow: a. b. c. d. purchased of fixed assets sale of goods issue of debentures sale of fixed assets

Q31.According toAS-3 (revised) purchase of fixed assets is treated as: a) b) c) d) operating activity investing activity financing activity none of these

Q32.Total sale Rs.2, 00,000; debtors at the beginning Rs.15, 000; Debtors at the end ding Rs.28, 000; cash sales will be: a) Rs.1,87,000 b) Rs.2,13,000 c) Rs.2,15,000 d) Rs.2,10,000 Q33. Cash from operation will decrease due to: a) b) c) d) Increase in current asset Decrease in current asset Increase in current liabilities none of these

Q34. Cash flow statement is prepared from: a) b) c) d) balance sheet profit and loss a/c additional information all of these

Q35. If the net operating profit of a business is Rs.90, 000 and the debtors have decreased during the year by Rs.30, 000.cash from operation equals to a) b) c) d) Rs.90,000 Rs. 1,20,000 Rs.60,000 Rs.30,000

Q36. Ideal current ratio is: a) b) c) d) 1:1 2:1 1:2 2:2

Q37. Quick ratio does not include: a) b) c) d) Cash Bank balance Debtors Stock

Q38. Debt-equity ratio is: a) b) c) d) Liquidity ratio Solvency ratio Profitability ratio None of these

Q39. Current ratio is some time referred to as: a) b) c) d) Working capital ratio Solvency ratio Financial ratio None of these

Q40. Ratios, which are usually calculated in times, are: a) b) c) d) Activity ratios Profitability ratios Financial position ratios Solvency ratio

Q41. Higher, the ratio, the more favorable it is. This does not apply to: a) b) c) d) Operating ratio Stock turnover Net profit ratio None of these

Q42. The most rigorous test of liquidity is: a) b) c) d) Quick ratio Current ratio Absolute liquid ratio None of these

Q43. A transactions involving a very small amount, does not need to be recorded under a separate

head because of: a) b) c) d) Dual concept Materiality Revenue recognition concept Cost concept

Q44. Land and building is a a) Current assets b) fixed assets c) Current Liabilities d) fixed liabilities Q45.______________is an intangible asset. a) b) c) d) Goodwill Debtors Furniture Cash

Q46. Salary is an example of a) Personal account b) real account c) Nominal account Q47. Real Account s is used to represent: a) b) c) d) Assets and liabilities Only Assets Only Liabilities Income and Assets

Q48. Cost of sales is equal to

a) b) c) d) Opening stockpurchase Opening stockpurchase+ closing stock Opening stock +purchase Opening stock +purchases + direct expensesclosing stock

Q49. Closing stock in adjustment is recorded in the a) b) c) d) Balance sheet and trading A/c Balance sheet Profit and loss A/c trading A/c

Q50. Commission received appearing in trial balance is shown a) b) c) d) On the debit side of Profit and loss A/C On the credit side of Profit and loss A/C On the asset side of Balance sheet On the liabilities side of balance sheet

Discuss the principles of Accounting with suitable examples

Potrebbero piacerti anche

- Sample QP 2 Jan2020Documento23 pagineSample QP 2 Jan2020M Rafeeq100% (1)

- MCQS 8Documento6 pagineMCQS 8Muhammad Usama KhanNessuna valutazione finora

- Ni Act MCQDocumento7 pagineNi Act MCQParthNessuna valutazione finora

- Introduction To AccountingDocumento12 pagineIntroduction To AccountingJasmine SainiNessuna valutazione finora

- Section 2 (4) Section 4 (2) Section 3 (1) Section 1 (3) A-CDocumento5 pagineSection 2 (4) Section 4 (2) Section 3 (1) Section 1 (3) A-CNaqeeb Ur RehmanNessuna valutazione finora

- Multiple Choices - Fin081Documento2 pagineMultiple Choices - Fin081RovicNessuna valutazione finora

- Advanced Auditing - MCQ Full SyallabusDocumento21 pagineAdvanced Auditing - MCQ Full Syallabussonali ghatvilkarNessuna valutazione finora

- Exit Model (Fundamental of Accounting)Documento6 pagineExit Model (Fundamental of Accounting)aronNessuna valutazione finora

- Business Law MCQ...Documento38 pagineBusiness Law MCQ...Anseeta SajeevanNessuna valutazione finora

- NPO MCQ QuestionDocumento5 pagineNPO MCQ QuestionBikash SahooNessuna valutazione finora

- MCQ - Computerised Accounting - Fy B Com Sem II - CH IDocumento7 pagineMCQ - Computerised Accounting - Fy B Com Sem II - CH IrtNessuna valutazione finora

- Financial Management Mcqs With AnswersDocumento53 pagineFinancial Management Mcqs With Answersviveksharma51Nessuna valutazione finora

- Saleofgoodsact MCQDocumento5 pagineSaleofgoodsact MCQashwani1883Nessuna valutazione finora

- Answer: BDocumento15 pagineAnswer: BTrinh LêNessuna valutazione finora

- Accounting Principles #038 Procedures MCQs (Set-I) For FPSC Senior AuditoDocumento10 pagineAccounting Principles #038 Procedures MCQs (Set-I) For FPSC Senior AuditoAdiBalochNessuna valutazione finora

- Chapter 3 MCQs On DepreciationDocumento14 pagineChapter 3 MCQs On DepreciationGrace StylesNessuna valutazione finora

- Model Question Paper - IGST Act.: (2 Marks Each) Multiple Choice QuestionsDocumento25 pagineModel Question Paper - IGST Act.: (2 Marks Each) Multiple Choice QuestionsShyam Prasad100% (1)

- FAM MCQs Solved (Adnan UA)Documento15 pagineFAM MCQs Solved (Adnan UA)arsalanssgNessuna valutazione finora

- Chapter#03 Mcqs Project Management: PersonalityDocumento11 pagineChapter#03 Mcqs Project Management: PersonalityIrfan GondalNessuna valutazione finora

- Financial Accounting Iii Sem: Multiple Choice Questions and AnswersDocumento24 pagineFinancial Accounting Iii Sem: Multiple Choice Questions and AnswersRamya Gowda100% (1)

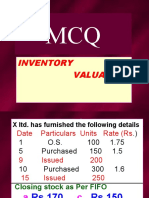

- MCQ Inventory Valuation LBSIMDocumento49 pagineMCQ Inventory Valuation LBSIMSumit SharmaNessuna valutazione finora

- Auditing Principles and Practice 17UCO514 K1-Level Questions Unit - IDocumento18 pagineAuditing Principles and Practice 17UCO514 K1-Level Questions Unit - Iabebetgst teka1234Nessuna valutazione finora

- Sem5 MCQ MangACCDocumento8 pagineSem5 MCQ MangACCShirowa ManishNessuna valutazione finora

- Top Senior Auditor Solved MCQs Past PapersDocumento12 pagineTop Senior Auditor Solved MCQs Past PapersAli100% (1)

- Accountin& Auditing Paper'sDocumento12 pagineAccountin& Auditing Paper'sSaqib MunirNessuna valutazione finora

- Unit 1: Indian Financial System: Multiple Choice QuestionsDocumento31 pagineUnit 1: Indian Financial System: Multiple Choice QuestionsNisha PariharNessuna valutazione finora

- BusinessenvioronmentDocumento28 pagineBusinessenvioronmentshamsnpalamNessuna valutazione finora

- MCQ-Financial Account-SEM VDocumento52 pagineMCQ-Financial Account-SEM VVishnuNadarNessuna valutazione finora

- 6-Cash Book Multiple Choice Questions With Answers PDFDocumento14 pagine6-Cash Book Multiple Choice Questions With Answers PDFHammadkhan Dj89Nessuna valutazione finora

- BCom SY 200 MCQ Business Management 204 2Documento53 pagineBCom SY 200 MCQ Business Management 204 2Muhammad Muzammal Muhammad YaseenNessuna valutazione finora

- MCQS Trail BalanceDocumento2 pagineMCQS Trail BalanceSai KrishnaNessuna valutazione finora

- Ppra McqsDocumento8 paginePpra McqsBEENANessuna valutazione finora

- Company Basic Concept MCQ'sDocumento3 pagineCompany Basic Concept MCQ'sFaizan ChNessuna valutazione finora

- FD MCQ 2Documento2 pagineFD MCQ 2ruchi agrawal100% (1)

- Cost Accounting.3 PDFDocumento38 pagineCost Accounting.3 PDFCLAUDINE MUGABEKAZINessuna valutazione finora

- MCQ Test AbdDocumento3 pagineMCQ Test AbdRahul Ghosale100% (1)

- Financial Accounting - BRS McqsDocumento39 pagineFinancial Accounting - BRS McqsDivya SriNessuna valutazione finora

- SRO 655 and 656 (In Flow Charts)Documento5 pagineSRO 655 and 656 (In Flow Charts)MinhajacaNessuna valutazione finora

- FA MCQ On PrinciplesDocumento9 pagineFA MCQ On Principlestiwariarad100% (1)

- Mid Project Compiled QuestionsDocumento14 pagineMid Project Compiled QuestionsgunadiishNessuna valutazione finora

- Mcqs On Basic Concept of Income Tax, Residential Status & Exempt IncomeDocumento6 pagineMcqs On Basic Concept of Income Tax, Residential Status & Exempt IncomePradeep SethyNessuna valutazione finora

- System of Financial Control & Budgeting 2006 (Updated October 2018)Documento51 pagineSystem of Financial Control & Budgeting 2006 (Updated October 2018)usman ziaNessuna valutazione finora

- T.Y. B. Com Auditing (MCQ'S) by Asst. Prof. Pravin Kad (M. Com., SET, NET) 8788167249 (Documento13 pagineT.Y. B. Com Auditing (MCQ'S) by Asst. Prof. Pravin Kad (M. Com., SET, NET) 8788167249 (Kadam KartikeshNessuna valutazione finora

- CA CPT Accountancy Sample QuestionsDocumento11 pagineCA CPT Accountancy Sample QuestionsyuthikasNessuna valutazione finora

- PAPER 3 Revised PDFDocumento37 paginePAPER 3 Revised PDFDeepa BhatiaNessuna valutazione finora

- Chapter 1 MCQs On Income Tax Rates and Basic Concept of Income TaxDocumento28 pagineChapter 1 MCQs On Income Tax Rates and Basic Concept of Income TaxMeenal Luther100% (1)

- Corporate Accounting Solved Mcqs Set 15Documento6 pagineCorporate Accounting Solved Mcqs Set 15Bhupendra Gocher0% (1)

- 3 Sem Core Financial Markets and Operations PDFDocumento22 pagine3 Sem Core Financial Markets and Operations PDFpj04Nessuna valutazione finora

- MRO Procurement Solutions A Complete Guide - 2020 EditionDa EverandMRO Procurement Solutions A Complete Guide - 2020 EditionNessuna valutazione finora

- IPCC Audit MCQs by Vinit Mishra Sir PDFDocumento125 pagineIPCC Audit MCQs by Vinit Mishra Sir PDFPrakash Gaurav100% (3)

- Project ManagementDocumento23 pagineProject Managementsumit sanchetiNessuna valutazione finora

- Objective Questions FinalDocumento48 pagineObjective Questions FinalAvijitneetika Mehta100% (1)

- Sem1 MCQ FinancialaccountDocumento14 pagineSem1 MCQ FinancialaccountVemu SaiNessuna valutazione finora

- Auditing Sem VI MCQsDocumento10 pagineAuditing Sem VI MCQsMayur PadaveNessuna valutazione finora

- TensorDocumento3 pagineTensorDeril_RistianiNessuna valutazione finora

- MCQ - BasicDocumento22 pagineMCQ - BasicLalitNessuna valutazione finora

- Production and Operations Management Solved MCQs (Set-2)Documento6 pagineProduction and Operations Management Solved MCQs (Set-2)Prasanna Kumar100% (1)

- MCQsDocumento3 pagineMCQsMalik ArshadNessuna valutazione finora

- Quiz - Cash FlowDocumento7 pagineQuiz - Cash FlowAfrose KhanNessuna valutazione finora

- Multiples Choice Questions With AnswersDocumento60 pagineMultiples Choice Questions With AnswersVaibhav Rusia100% (2)

- Intro of Managerial Economics.Documento2 pagineIntro of Managerial Economics.shikha143Nessuna valutazione finora

- Working CapitalDocumento5 pagineWorking Capitalshikha143Nessuna valutazione finora

- Working CapitalDocumento5 pagineWorking Capitalshikha143Nessuna valutazione finora

- Unit I (8 Sessions) : Marginal Costing: Marginal Costing Versus Absorption CostingDocumento5 pagineUnit I (8 Sessions) : Marginal Costing: Marginal Costing Versus Absorption Costingshikha143Nessuna valutazione finora

- Classification of ContractsDocumento19 pagineClassification of Contractsshikha143Nessuna valutazione finora

- Free ConsentDocumento18 pagineFree ConsentRajneesh TripathiNessuna valutazione finora

- Inventories: Additional Valuation IssuesDocumento44 pagineInventories: Additional Valuation IssuesjulsNessuna valutazione finora

- Act001 ActivityDocumento7 pagineAct001 ActivitygloryfeilagoNessuna valutazione finora

- Assets, Liabilities, and Owner'S Equity: Tle 9 ReviewerDocumento3 pagineAssets, Liabilities, and Owner'S Equity: Tle 9 ReviewerDavidNessuna valutazione finora

- ACCT550 Homework Week 2Documento5 pagineACCT550 Homework Week 2Natasha Declan100% (2)

- Finance KEOWN CH4 NotesDocumento8 pagineFinance KEOWN CH4 NotesJeongBin ParkNessuna valutazione finora

- T-Accounts E. Tria Systems ConsultantDocumento8 pagineT-Accounts E. Tria Systems ConsultantAnya DaniellaNessuna valutazione finora

- Accounting Chapter 1Documento30 pagineAccounting Chapter 1Jitendra NagvekarNessuna valutazione finora

- Case Study 3: Q1. Choosing Comparable CompaniesDocumento10 pagineCase Study 3: Q1. Choosing Comparable CompaniesMatthew RobinsonNessuna valutazione finora

- Cbse Questions Change in PSRDocumento4 pagineCbse Questions Change in PSRDeepanshu kaushikNessuna valutazione finora

- CHAPTER 3 MCPROBLEMS, MCTHEORIES, SHORT PROBLEMS, COMPREHENSIVE PROBLEMS - Understanding-Financial-StatementsDocumento99 pagineCHAPTER 3 MCPROBLEMS, MCTHEORIES, SHORT PROBLEMS, COMPREHENSIVE PROBLEMS - Understanding-Financial-StatementsRhedeline LugodNessuna valutazione finora

- Nefas Silk Poly Technic College: Learning GuideDocumento20 pagineNefas Silk Poly Technic College: Learning GuideNigussie BerhanuNessuna valutazione finora

- PDF Sol Man Chapter 10 Cash To Accrual Basis of Acctg - CompressDocumento9 paginePDF Sol Man Chapter 10 Cash To Accrual Basis of Acctg - CompressFrost GarisonNessuna valutazione finora

- Financial and Managerial Accounting 16th Edition Williams Haka Bettner Carcello Solution ManualDocumento14 pagineFinancial and Managerial Accounting 16th Edition Williams Haka Bettner Carcello Solution ManualMuhammad Arham25% (4)

- Mas ReviewerDocumento14 pagineMas ReviewerMichelle AvilesNessuna valutazione finora

- Safal Niveshak Stock Analysis Excel Version 5.0Documento49 pagineSafal Niveshak Stock Analysis Excel Version 5.0mcmaklerNessuna valutazione finora

- Session 1.3. Preparing Financial Statements Income Statement and Balance Sheet Part 2 Sync PDFDocumento57 pagineSession 1.3. Preparing Financial Statements Income Statement and Balance Sheet Part 2 Sync PDFSriNessuna valutazione finora

- Accounting Reviewer Final ExamDocumento7 pagineAccounting Reviewer Final ExamJanina Frances RuideraNessuna valutazione finora

- Power Point (Working Capital)Documento71 paginePower Point (Working Capital)Varun TayalNessuna valutazione finora

- Britannia Industries LTDDocumento4 pagineBritannia Industries LTDMEENU MARY MATHEWS RCBSNessuna valutazione finora

- Practical Accounting 2 Business Combination Lecture NotesDocumento2 paginePractical Accounting 2 Business Combination Lecture NotesPatricia Ann TamposNessuna valutazione finora

- FINMAN Cash-Flow-Analysis-Practice-Problem-2Documento2 pagineFINMAN Cash-Flow-Analysis-Practice-Problem-2stel mariNessuna valutazione finora

- AccountingDocumento2 pagineAccountingJahanzaib ButtNessuna valutazione finora

- Tutorial Principles of Accounting 1Documento9 pagineTutorial Principles of Accounting 1Yus Linda100% (1)

- AIS 301 701 Practice Exam 3 Final VersionDocumento16 pagineAIS 301 701 Practice Exam 3 Final VersionRafaelAlexandrianNessuna valutazione finora

- Vi - Audit of Intangible Assets Problem No. 1Documento24 pagineVi - Audit of Intangible Assets Problem No. 1Castleclash CastleclashNessuna valutazione finora

- KTQTE2Documento172 pagineKTQTE2Ly Võ KhánhNessuna valutazione finora

- PPEDocumento30 paginePPEJohn Kenneth AlicawayNessuna valutazione finora

- Basic of Financial AccountingDocumento34 pagineBasic of Financial Accountingsandeep_s333100% (1)

- Accounting For Single Entry and Incomplete Records PDFDocumento18 pagineAccounting For Single Entry and Incomplete Records PDFCj BarrettoNessuna valutazione finora

- Holy Cross College: B. Cause and EffectDocumento12 pagineHoly Cross College: B. Cause and EffectSam VeraNessuna valutazione finora