Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Telecom Sector Result Updated

Caricato da

Angel BrokingDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Telecom Sector Result Updated

Caricato da

Angel BrokingCopyright:

Formati disponibili

GSM subscriber analysis | Telecom

August 26, 2011

Telecom sector

Decline in net subscriber addition continues

Cellular Operators Association of India (COAI) reported GSM subscriber data for July 2011, which continued its declining trend in this month as well. GSM subscriber net addition data was reported to be weak on a mom basis across all the telecom operators (except BSNL). The net subscriber addition number stood at 7.6mn, down 11% mom, taking the total GSM subscriber base to 606.4mn in July 2011.

Srishti Anand

+91 22 3835 7800 Ext: 6820 srishti.anand@angelbroking.com

Ankita Somani

+91 22 3835 7800 Ext: 6819 ankita.somani@angelbroking.com

Weakness across the board

Net addition run rate on mom basis for all operators (except BSNL) dropped steeply (Refer Exhibit: 5 and 6) in July 2011. Among the incumbents, Bharti and Vodafone reported significant decline in net subscriber addition numbers with net addition numbers dropping to 1.5mn for both, down 28.8% mom from 2.1mn in June 2011. Idea as well continued its declining trend in net subscriber addition numbers in this month as well by adding just 1.0mn subscribers, down 26.0% mom. BSNL emerged as the dark horse by showing strong growth in net subscriber addition numbers and added 1.8mn subscribers, which led to inch up in its subscriber market share by 10bp mom to 14.9%. Subscriber market share of Vodafone remained stable mom at 23.6%, however, market share of Bharti and Idea declined by 20bp and 10bp to 28.1% and 15.8%, respectively. Among new operators, Videocon reported net decline of 0.1mn subscribers it its subscriber base. Net subscriber addition of S Tel and Uninor grew by 21.4% and 12.1% on a mom basis, with addition numbers of 0.2mn and 1.1mn. Subscriber market share of all new operators remained flat on mom basis expect for Uninor. Uninor managed to increase its share by 10bp mom to 4.5%.

Circle-wise highlights

In July 2011, the net addition run rate of Metro circle increased to 0.9mn vs. 0.7mn in June 2011. In the Metro circle, in this month again Vodafone had the highest net additions at 0.29mn, followed by Bharti and Idea reporting 0.14mn and 0.13mn net subscriber additions, respectively. Subscriber addition run rate of A circle, which bounced back in June 2011, again declined to 2.6mn from 3.0mn in June 2011. This led to decline in the net subscriber addition market share of A circle to 34.4% from 35.0%. Subscriber additions in B and C circles also fell to 2.7mn and 1.3mn from 2.7mn and 1.5mn in June 2011, respectively.

Recommendation summary

Company Bharti Airtel Idea Cellular RCom Reco. Accumulate Neutral Neutral CMP (`) 399 96 72 Tgt. price (`) 451 Upside (%) 13.1 FY2013E P/BV (x) 2.4 2.2 0.5 FY2013E P/E (x) 17.3 29.3 10.7 FY2011-13E EPS CAGR (%) 20.4 9.5 2.4 FY2013E RoCE (%) 12.3 9.6 4.4 FY2013E RoE (%) 14.0 7.6 3.3

Source: Company, Angel Research

Please refer to important disclosures at the end of this report

GSM subscriber analysis | July 2011

Incumbents uphold market share in subscriber addition

In July 2011, the total GSM subscriber base touched 606.4mn, up merely 1.3% mom as the net subscriber addition was very low at 7.6mn.

Exhibit 1: GSM subscriber base and net additions Pan India

650 600 550

(mn)

17.2 16.8 15.1 13.6 12.5 12.6 11.1 9.5 8.6 7.6 14.7 14.5

18 16 14

(mn)

500 450 400 350

Oct-10 Nov-10 Feb-11 Sep-10

12 10 8 6 4

May-11

Dec-10

Jan-11

Apr-11

Jun-11

Aug-10

Total GSM subscribers

Source: Company, Angel Research

Exhibit 2: Total GSM subscribers Incumbents

180 156 150 127 120 159 131 162 135 165 137 167 139 169 142 171 143

Exhibit 3: Total GSM subscribers New players

30 25 20 20

(mn)

Mar-11

Total net additions

Jul-11

26 27 7 7 34 1 1 Jul-11 DB Etisalat

22

23

24

25

(mn)

90 60 30

84 84 52

87 85 54

90 86 55

92 87 56

94 88 57

95 88 58

96 90 59

15 10 5 0 3 3 7 3 0 3 3 1 3 7 3 1 3 7 33 7 3 1 1 3

Jan-11

Feb-11 Bharti

Mar-11 Vodafone

Apr-11 Idea

May-11 BSNL

Jun-11 Aircel

Jul-11

Jan-11

Feb-11

Mar-11 Stel

Apr-11 Uninor

May-11 Videocon

Jun-11

Loop Mobile

Source: Company, Angel Research

Source: Company, Angel Research

August 26, 2011

GSM subscriber analysis | July 2011

Exhibit 4: Total GSM subscribers

Company (mn) Bharti Vodafone BSNL Idea Aircel MTNL Loop Mobile S Tel Uninor Videocon DB Etisalat Total Jan-11 155.8 127.4 83.6 84.3 51.8 5.2 3.1 2.5 20.3 6.0 0.5 540.4 Feb-11 159.0 130.9 85.1 86.8 53.5 5.2 3.1 2.7 21.6 6.6 0.7 555.1 Mar-11 162.2 134.6 86.5 89.5 54.8 5.2 3.1 2.8 22.8 7.1 1.0 569.6 Apr-11 164.6 137.0 87.1 92.0 56.0 5.2 3.1 3.0 24.2 7.2 1.2 580.7 May -11 167.1 139.4 87.6 93.8 57.1 5.2 3.1 3.2 25.4 7.1 1.3 590.2 Jun-11 169.2 141.5 88.5 95.1 58.0 5.2 3.1 3.3 26.3 7.1 1.4 598.8 July-11 170.7 143.0 90.2 96.1 58.6 5.3 3.2 3.5 27.4 7.0 1.4 606.4

Source: Company, Angel Research

In July 2011, net subscriber addition stood highest for BSNL which added 1.8mn subscribers. Bharti and Vodafone, each added 1.5mn subscribers (lowest level since last couple of years), taking their total subscriber base to 170.7mn and 143.0mn, respectively. This was followed by Idea and Aircel, which added 1.0mn and 0.6mn subscribers, taking their total subscriber base to 96.1mn and 58.6mn, respectively. Among the new players, Uninor added 1.1mn subscribers, leaving behind incumbents such as Idea and Aircel. Other players such as S Tel and DB Etisalat added 0.2mn and 0.1mn subscribers, respectively.

Exhibit 5: GSM subscriber net addition Incumbents

4.0 3.5 3.0

(mn)

2.5 2.0 1.5 1.0 0.5 Jan-11 Feb-11

Bharti

Mar-11

Vodafone

Apr-11

Idea

May-11

BSNL

Jun-11

Aircel

Jul-11

Source: Company, Angel Research

August 26, 2011

GSM subscriber analysis | July 2011

Exhibit 6: Operator-wise net subscriber additions

Company (mn) Bharti Vodafone BSNL Idea Aircel MTNL Loop Mobile S Tel Uninor Videocon DB Etisalat Total Jan-11 3.3 3.1 2.2 2.5 1.7 0.0 0.0 0.2 1.8 (2.4) 0.2 12.6 Feb-11 3.2 3.6 1.5 2.5 1.7 0.0 0.0 0.2 1.3 0.6 0.2 14.7 Mar-11 3.2 3.6 1.4 2.7 1.3 0.0 0.0 0.1 1.2 0.5 0.3 14.5 Apr-11 2.4 2.4 0.7 2.5 1.1 0.0 0.0 0.2 1.5 0.1 0.2 11.1 May -11 2.5 2.4 0.5 1.8 1.1 0.0 0.0 0.2 1.1 (0.2) 0.1 9.5 Jun-11 2.1 2.1 0.8 1.4 0.9 0.0 0.0 0.2 0.9 0.1 0.1 8.6 July-11 1.5 1.5 1.8 1.0 0.6 0.0 0.0 0.2 1.1 (0.1) 0.1 7.6

Source: Company, Angel Research

BSNL, which was reporting a declining trend in net subscriber additions since January 2011, reversed the trend again in July 2011 by adding strong 1.8mn subscribers vs. 0.8mn in June 2011. This led to a jump in its net subscriber addition market share to 23.2% from 9.8% in June 2011.

Exhibit 7: Operator-wise market share in net additions

100 80 60 13.2 17.4 19.9 24.6 15.3 11.4 10.3 17.1 24.2 21.8 Feb-11 Bharti 15.4 9.3 9.4 18.6 25.2 22.1 Mar-11 Vodafone 18.4 10.0 6.2 22.1 21.7 21.7 Apr-11 Idea 13.1 11.7 4.9 18.9 25.7 14.6 10.7 9.8 15.8 24.4 16.5 8.0 23.2 13.1 19.5 19.8 Jul-11

(%)

40 20 0

26.1 (1.1) Jan-11

25.7 May-11 Aircel

24.7 Jun-11 Others

(20) BSNL

Source: Company, Angel Research

In June 2011, BSNL improved its subscriber market share to 14.9% from 14.8% in June 2011. Vodafone managed to sustain its subscriber market share to 23.6% on a mom basis, however Bharti and Idea posted decline in their subscriber market share to 28.1% and 15.8% from 28.3% and 15.9%, respectively.

August 26, 2011

GSM subscriber analysis | July 2011

Exhibit 8: Operator-wise subscriber market share

100 80 60 (%) 40 20 0 Jan-11 Feb-11

Bharti

6.9 9.6 15.5 15.6 23.6

7.2 9.6 15.3 15.6 23.6

7.4 9.6 15.2 15.7 23.6

7.6 9.6 15.0 15.8 23.6

7.7 9.7 14.8 15.9 23.6

7.8 9.7 14.8 15.9 23.6

7.9 9.7 14.9 15.8 23.6

28.8

28.6

28.5

28.3

28.3

28.3

28.1

Mar-11

Vodafone

Apr-11

Idea

May-11

BSNL Aircel

Jun-11

Others

Jul-11

Source: Company, Angel Research

In July 2011, the net addition run rate of Metro circle increased to 0.9mn vs. 0.7mn in June 2011, taking its total subscriber base to 73.2mn. In the Metro circle, in this month again Vodafone had the highest net additions at 0.29mn, followed by Bharti and Idea reporting 0.14mn and 0.13mn net subscriber additions, respectively. Aircel added 0.07mn subscribers in the Metro circle. Subscriber addition run rate of A circle, which bounced back in June 2011, again declined to 2.6mn from 3.0mn in June 2011, taking its total subscriber base to 208.5mn. This led to decline in the net subscriber addition market share of A circle to 34.4% from 35.0%. Subscriber addition was primarily led by BSNL, which added 0.70mn subscribers in July 2011 in A circle, followed by Idea, Bharti and Vodafone, which added 0.56mn, 0.46mn and 0.43mn subscribers, respectively. B and C circles witnessed addition of 2.7mn and 1.3mn subscribers, taking their total subscriber base to 237.5mn and 87.2mn, respectively.

Exhibit 9: GSM subscriber base Circle wise

280 240 200 216 193 223 197 227 200 231 203 235 206 238 208

210 187

(mn)

160 120 80 40 Jan-11 Feb-11

Metro

68

76

69

78

71

81

71

82

72

84

72

86

73

87

Mar-11

A circle

Apr-11

May-11

Jun-11

Jul-11

B circle

C circle

Source: Company, Angel Research

August 26, 2011

GSM subscriber analysis | July 2011

Exhibit 10: Circle-wise subscriber net additions

7 6 5 6.1 5.8 5.1 3.8 2.1 1.4 2.4 1.6 4.0 2.4 1.4 1.0 (0.4) Jan-11 Feb-11 Metro Mar-11 A circle Apr-11 B circle May-11 C circle Jun-11 Jul-11 0.7 6.5 4.9 3.9 4.0 3.4 3.0 2.4 2.1 1.5 0.9

Exhibit 11: Circle-wise share of net additions

100 15.4 80 60 2.7 2.6 1.3 44.0 39.7 44.8 50.5 41.9 39.2 35.8 16.2 16.5 14.3 22.4 17.7 17.4

(mn)

4 3 2 1 0

(%)

1.8

40 20 0 27.6 13.1 Jan-11 34.5 9.5 Feb-11 Metro 27.4 11.3 Mar-11 A circle (4.4) Apr-11 39.7 25.4 10.4 May-11 35.0 8.1 Jun-11 C circle 34.4 12.4 Jul-11

(1)

(20) B circle

Source: Company, Angel Research

Source: Company, Angel Research

Valuation

For Bharti and Idea, such a decline in net subscriber additions was along expected lines, thus our estimates remain unchanged. The driving force for the overall sector is increase in tariff rates as well as increasing use of value added services, which will, in turn, lead to higher ARPUs of all the players, thereby aiding profitability. Bharti continues to be a better bet due to its low-cost integrated model (owned tower infrastructure), potential opportunity to scale up in Africa, established leadership in revenue and subscriber market share and relatively better KPIs. However, overall we remain Neutral on the telecom sector.

August 26, 2011

GSM subscriber analysis | July 2011

Research Team Tel: 022 - 3935 7800

E-mail: research@angelbroking.com

Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Analyst ownership of the stock Bharti Airtel Idea Cellular RCom No No No Angel and its Group companies ownership of the stock No No No Angel and its Group companies' Directors ownership of the stock No No No Broking relationship with company covered No No No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%) Reduce (-5% to 15%)

Accumulate (5% to 15%) Sell (< -15%)

Neutral (-5 to 5%)

August 26, 2011

GSM subscriber analysis | July 2011

6th Floor, Ackruti Star, Central Road, MIDC, Andheri (E), Mumbai- 400 093. Tel: (022) 39357800

Research Team Fundamental: Sarabjit Kour Nangra Vaibhav Agrawal Shailesh Kanani Srishti Anand Bhavesh Chauhan Sharan Lillaney V Srinivasan Yaresh Kothari Shrinivas Bhutda Sreekanth P.V.S Hemang Thaker Nitin Arora Ankita Somani Varun Varma Technicals: Shardul Kulkarni Derivatives: Siddarth Bhamre Jaya Agarwal Institutional Sales Team: Mayuresh Joshi Abhimanyu Sofat Meenakshi Chavan Gaurang Tisani Akshay Shah Production Team: Simran Kaur Dilip Patel Research Editor Production simran.kaur@angeltrade.com dilipm.patel@angeltrade.com VP - Institutional Sales AVP - Institutional Sales Dealer Dealer Dealer mayuresh.joshi@angeltrade.com abhimanyu.sofat@angeltrade.com meenakshis.chavan@angeltrade.com gaurangp.tisani@angeltrade.com akshayr.shah@angelbroking.com Head - Derivatives Derivative Analyst siddarth.bhamre@angeltrade.com jaya.agarwal@angeltrade.com Sr. Technical Analyst shardul.kulkarni@angeltrade.com VP-Research, Pharmaceutical VP-Research, Banking Infrastructure IT, Telecom Metals & Mining Mid-cap Research Associate (Cement, Power) Research Associate (Automobile) Research Associate (Banking) Research Associate (FMCG, Media) Research Associate (Capital Goods) Research Associate (Infra, Real Estate) Research Associate (IT, Telecom) Research Associate (Banking) sarabjit@angelbroking.com vaibhav.agrawal@angelbroking.com shailesh.kanani@angelbroking.com srishti.anand@angelbroking.com bhaveshu.chauhan@angelbroking.com sharanb.lillaney@angelbroking.com v.srinivasan@angelbroking.com yareshb.kothari@angelbroking.com shrinivas.bhutda@angelbroking.com sreekanth.s@angelbroking.com hemang.thaker@angelbroking.com nitin.arora@angelbroking.com ankita.somani@angelbroking.com varun.varma@angelbroking.com

Angel Broking Ltd: BSE Sebi Regn No : INB 010996539 / CDSL Regn No: IN - DP - CDSL - 234 - 2004 / PMS Regn Code: PM/INP000001546 Angel Securities Ltd:BSE: INB010994639/INF010994639 NSE: INB230994635/INF230994635 Membership numbers: BSE 028/NSE:09946 Angel Capital & Debt Market Ltd: INB 231279838 / NSE FNO: INF 231279838 / NSE Member code -12798 Angel Commodities Broking (P) Ltd: MCX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX : Member ID 00220 / FMC Regn No: NCDEX / TCM / CORP / 0302

August 26, 2011

Potrebbero piacerti anche

- Telecom Sector Result UpdatedDocumento8 pagineTelecom Sector Result UpdatedAngel BrokingNessuna valutazione finora

- Telecom Sector UpdateDocumento8 pagineTelecom Sector Updateprapti22Nessuna valutazione finora

- Telecom Sector Result UpdatedDocumento8 pagineTelecom Sector Result UpdatedAngel BrokingNessuna valutazione finora

- Telecom Sector Result UpdatedDocumento8 pagineTelecom Sector Result UpdatedAngel BrokingNessuna valutazione finora

- Telecom Sector Result UpdatedDocumento8 pagineTelecom Sector Result UpdatedAngel BrokingNessuna valutazione finora

- Telecom Sector: GSM Net Subscriber Addition Momentum ImprovesDocumento8 pagineTelecom Sector: GSM Net Subscriber Addition Momentum ImprovesAngel BrokingNessuna valutazione finora

- Telecom Sector: GSM Net Subscriber Addition Cooling OffDocumento8 pagineTelecom Sector: GSM Net Subscriber Addition Cooling OffAngel BrokingNessuna valutazione finora

- Telecom Sector Result UpdatedDocumento8 pagineTelecom Sector Result UpdatedAngel BrokingNessuna valutazione finora

- Press Release May-11Documento15 paginePress Release May-11Gurdishpal SinghNessuna valutazione finora

- GCC Telecom Sector Quarterly - 2Q11: Global Research Sector-Telecommunication August 2011Documento13 pagineGCC Telecom Sector Quarterly - 2Q11: Global Research Sector-Telecommunication August 2011santhosh5948289Nessuna valutazione finora

- GCC Mno StatsDocumento13 pagineGCC Mno StatsahmadsardarNessuna valutazione finora

- Press Release 15 April-11Documento15 paginePress Release 15 April-11Pushkal GuptaNessuna valutazione finora

- Press Release June11Documento15 paginePress Release June11Deepak KhuranaNessuna valutazione finora

- Info Memo 1H2011FinDocumento16 pagineInfo Memo 1H2011FinprakososantosoNessuna valutazione finora

- Event: IIP Data AlertDocumento5 pagineEvent: IIP Data AlertSagar MoradiyaNessuna valutazione finora

- KPCB Internet Trends 2012Documento112 pagineKPCB Internet Trends 2012Kleiner Perkins Caufield & Byers100% (14)

- ICICIdirect Tele-Tracker September2010Documento5 pagineICICIdirect Tele-Tracker September2010akshah2306Nessuna valutazione finora

- KPCB Internet Trends (2011)Documento66 pagineKPCB Internet Trends (2011)Kleiner Perkins Caufield & Byers80% (5)

- Ovum - 2012-01 - Telecom Trends 2012Documento31 pagineOvum - 2012-01 - Telecom Trends 2012reenaharnal100% (1)

- Mary Meeker 2012 State of InternetDocumento112 pagineMary Meeker 2012 State of InternetBrad FowlerNessuna valutazione finora

- Information Note To The Press (Press Release No. 57/2011) Telecom Regulatory Authority of IndiaDocumento16 pagineInformation Note To The Press (Press Release No. 57/2011) Telecom Regulatory Authority of IndiaNeha AggarwalNessuna valutazione finora

- State of The Satellite Industry Report May12 - SIADocumento26 pagineState of The Satellite Industry Report May12 - SIAPho Duc NamNessuna valutazione finora

- Telecom Subscriber Watch Apr'11Documento4 pagineTelecom Subscriber Watch Apr'11nikeshkshahNessuna valutazione finora

- Wipro LTD: Disappointing Writ All OverDocumento6 pagineWipro LTD: Disappointing Writ All OverswetasagarNessuna valutazione finora

- Astra Agro Lestari: AALI's January ProductionDocumento7 pagineAstra Agro Lestari: AALI's January ProductionerlanggaherpNessuna valutazione finora

- Mobile: Markets & Trends Facts & FiguresDocumento70 pagineMobile: Markets & Trends Facts & FiguressebastianbarrosNessuna valutazione finora

- Market Outlook 22nd December 2011Documento4 pagineMarket Outlook 22nd December 2011Angel BrokingNessuna valutazione finora

- Power: in This EditionDocumento22 paginePower: in This EditionSourabh TapariaNessuna valutazione finora

- Indicator Report Sep 11wordDocumento445 pagineIndicator Report Sep 11wordruhiaroraNessuna valutazione finora

- PR-TSD April 01 06 09 PDFDocumento5 paginePR-TSD April 01 06 09 PDFVal CameronNessuna valutazione finora

- Telecom Regulatory Authority of India: Study Paper No.1/2006Documento13 pagineTelecom Regulatory Authority of India: Study Paper No.1/2006mrsanpandeyNessuna valutazione finora

- Appendix: Year India China Ratio Year India China RatioDocumento9 pagineAppendix: Year India China Ratio Year India China RatioSawtantar Khurmi VeerpunjabNessuna valutazione finora

- Kddi Corporation: President Takashi TanakaDocumento23 pagineKddi Corporation: President Takashi TanakaHan DavidNessuna valutazione finora

- TRAI-August Press ReleaseDocumento10 pagineTRAI-August Press ReleaseMaulin PandyaNessuna valutazione finora

- Dealwatch Monthly Reports - AprDocumento10 pagineDealwatch Monthly Reports - AprVaibhav KarthikNessuna valutazione finora

- 9m11 PPT FinalDocumento29 pagine9m11 PPT FinalMarcelo FrancoNessuna valutazione finora

- Market Outlook 20th October 2011Documento12 pagineMarket Outlook 20th October 2011Angel BrokingNessuna valutazione finora

- Quarterly Press Release - FinalDocumento11 pagineQuarterly Press Release - FinalDoraiswamy NadarajanNessuna valutazione finora

- AmofullwebfinalDocumento96 pagineAmofullwebfinalParimal PotdarNessuna valutazione finora

- Bharti Airtel: Performance HighlightsDocumento13 pagineBharti Airtel: Performance HighlightsAngel BrokingNessuna valutazione finora

- Market Outlook 13th September 2011Documento4 pagineMarket Outlook 13th September 2011Angel BrokingNessuna valutazione finora

- Market Outlook 11th October 2011Documento5 pagineMarket Outlook 11th October 2011Angel BrokingNessuna valutazione finora

- Indian Telecom Market Crosses 800 Million MarkDocumento5 pagineIndian Telecom Market Crosses 800 Million MarkJaikrishna KumarNessuna valutazione finora

- KPMG Budget BriefDocumento52 pagineKPMG Budget BriefAsad HasnainNessuna valutazione finora

- Global Mobile Sensors Industry Report 2015Documento6 pagineGlobal Mobile Sensors Industry Report 2015api-282708578Nessuna valutazione finora

- Economic Highlights: Broad Monetary Aggregate Inched Up But Loan Growth Moderated in August - 01/10/2010Documento3 pagineEconomic Highlights: Broad Monetary Aggregate Inched Up But Loan Growth Moderated in August - 01/10/2010Rhb InvestNessuna valutazione finora

- Bharti Airtel: Performance HighlightsDocumento12 pagineBharti Airtel: Performance HighlightsPil SungNessuna valutazione finora

- Tel No:-011-2321 7914 Fax: - 011-2321 1998 Email: - Skgupta@trai - Gov.in WebsiteDocumento5 pagineTel No:-011-2321 7914 Fax: - 011-2321 1998 Email: - Skgupta@trai - Gov.in Websitemixedbag100% (1)

- Next Generation Wireless Access-TokyoDocumento33 pagineNext Generation Wireless Access-TokyoNipun TrehanNessuna valutazione finora

- Finance Ministry - Monthly Economic Report - August 2011Documento11 pagineFinance Ministry - Monthly Economic Report - August 2011yasheshthakkarNessuna valutazione finora

- Idea Cellular LTD: Key Financial IndicatorsDocumento4 pagineIdea Cellular LTD: Key Financial IndicatorsGanesh DeshiNessuna valutazione finora

- Economic Highlights - Vietnam: Real GDP Grew at A Faster Pace in January-September 2010 - 29/09/2010Documento3 pagineEconomic Highlights - Vietnam: Real GDP Grew at A Faster Pace in January-September 2010 - 29/09/2010Rhb InvestNessuna valutazione finora

- Telecommunication 261112Documento43 pagineTelecommunication 261112Sonali YadavNessuna valutazione finora

- Fiber Market Report Full IntroDocumento10 pagineFiber Market Report Full IntrophotonicsmattNessuna valutazione finora

- LTE Small Cell Optimization: 3GPP Evolution to Release 13Da EverandLTE Small Cell Optimization: 3GPP Evolution to Release 13Nessuna valutazione finora

- Unloved Bull Markets: Getting Rich the Easy Way by Riding Bull MarketsDa EverandUnloved Bull Markets: Getting Rich the Easy Way by Riding Bull MarketsNessuna valutazione finora

- America, Japan & Asia Pacific: America, Japan & Asia PacificDa EverandAmerica, Japan & Asia Pacific: America, Japan & Asia PacificNessuna valutazione finora

- Fiber Optic Cable World Summary: Market Values & Financials by CountryDa EverandFiber Optic Cable World Summary: Market Values & Financials by CountryNessuna valutazione finora

- Electric Bulk Power Transmission & Control World Summary: Market Values & Financials by CountryDa EverandElectric Bulk Power Transmission & Control World Summary: Market Values & Financials by CountryNessuna valutazione finora

- Cellular & Wireless Telecommunications World Summary: Market Values & Financials by CountryDa EverandCellular & Wireless Telecommunications World Summary: Market Values & Financials by CountryNessuna valutazione finora

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocumento4 pagineRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNessuna valutazione finora

- International Commodities Evening Update September 16 2013Documento3 pagineInternational Commodities Evening Update September 16 2013Angel BrokingNessuna valutazione finora

- Daily Metals and Energy Report September 16 2013Documento6 pagineDaily Metals and Energy Report September 16 2013Angel BrokingNessuna valutazione finora

- WPIInflation August2013Documento5 pagineWPIInflation August2013Angel BrokingNessuna valutazione finora

- Oilseeds and Edible Oil UpdateDocumento9 pagineOilseeds and Edible Oil UpdateAngel BrokingNessuna valutazione finora

- Daily Agri Tech Report September 14 2013Documento2 pagineDaily Agri Tech Report September 14 2013Angel BrokingNessuna valutazione finora

- Daily Agri Report September 16 2013Documento9 pagineDaily Agri Report September 16 2013Angel BrokingNessuna valutazione finora

- Derivatives Report 8th JanDocumento3 pagineDerivatives Report 8th JanAngel BrokingNessuna valutazione finora

- Market Outlook: Dealer's DiaryDocumento13 pagineMarket Outlook: Dealer's DiaryAngel BrokingNessuna valutazione finora

- Currency Daily Report September 16 2013Documento4 pagineCurrency Daily Report September 16 2013Angel BrokingNessuna valutazione finora

- Daily Metals and Energy Report September 12 2013Documento6 pagineDaily Metals and Energy Report September 12 2013Angel BrokingNessuna valutazione finora

- Daily Agri Tech Report September 16 2013Documento2 pagineDaily Agri Tech Report September 16 2013Angel BrokingNessuna valutazione finora

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Documento4 pagineDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNessuna valutazione finora

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocumento6 pagineTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNessuna valutazione finora

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocumento1 paginaPress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNessuna valutazione finora

- Market Outlook: Dealer's DiaryDocumento12 pagineMarket Outlook: Dealer's DiaryAngel BrokingNessuna valutazione finora

- Currency Daily Report September 13 2013Documento4 pagineCurrency Daily Report September 13 2013Angel BrokingNessuna valutazione finora

- Metal and Energy Tech Report Sept 13Documento2 pagineMetal and Energy Tech Report Sept 13Angel BrokingNessuna valutazione finora

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocumento4 pagineJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNessuna valutazione finora

- Metal and Energy Tech Report Sept 12Documento2 pagineMetal and Energy Tech Report Sept 12Angel BrokingNessuna valutazione finora

- Daily Agri Tech Report September 12 2013Documento2 pagineDaily Agri Tech Report September 12 2013Angel BrokingNessuna valutazione finora

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Documento4 pagineDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Market Outlook: Dealer's DiaryDocumento13 pagineMarket Outlook: Dealer's DiaryAngel BrokingNessuna valutazione finora

- Currency Daily Report September 12 2013Documento4 pagineCurrency Daily Report September 12 2013Angel BrokingNessuna valutazione finora

- Daily Agri Report September 12 2013Documento9 pagineDaily Agri Report September 12 2013Angel BrokingNessuna valutazione finora

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Documento4 pagineDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingNessuna valutazione finora

- HT2333I004659173Documento5 pagineHT2333I004659173Tkdevarajan DevaNessuna valutazione finora

- Credit Research Report: Team 545Documento22 pagineCredit Research Report: Team 545D Ban ChoNessuna valutazione finora

- Airtel Launches Special Packages For Teens andDocumento2 pagineAirtel Launches Special Packages For Teens anddeepti077deeptisinghNessuna valutazione finora

- Airtel Black Bill 5Documento9 pagineAirtel Black Bill 5Akshay KharolaNessuna valutazione finora

- Project Report On AirtelDocumento56 pagineProject Report On AirtelHimanshu ChawlaNessuna valutazione finora

- Mobile Money Services Development: Policy Research Working Paper 6786Documento23 pagineMobile Money Services Development: Policy Research Working Paper 6786NapsterNessuna valutazione finora

- Company Profile BSNLDocumento40 pagineCompany Profile BSNLPradeep MonteiroNessuna valutazione finora

- Chapter - I Introduction and Design of The StudyDocumento33 pagineChapter - I Introduction and Design of The StudyYamini Ravi100% (1)

- Indian OTT Landscape ReportDocumento17 pagineIndian OTT Landscape ReportKaushlendraNessuna valutazione finora

- Airtel ZainDocumento11 pagineAirtel Zainarian2026Nessuna valutazione finora

- Fixedline and Broadband Services: This Month'S Charges Your Account SummaryDocumento2 pagineFixedline and Broadband Services: This Month'S Charges Your Account SummaryVijendraNessuna valutazione finora

- Xo' (V (W: + - BG - Hrzo H$S Xo' Am (E Am (E Xo', (V (W Cnam V Am (E Xo', (V (W WJVMZ G - M'Mooz (NN Bo H$M'MDocumento5 pagineXo' (V (W: + - BG - Hrzo H$S Xo' Am (E Am (E Xo', (V (W Cnam V Am (E Xo', (V (W WJVMZ G - M'Mooz (NN Bo H$M'MAkshay Pratap SinghNessuna valutazione finora

- Business Standard English MumbaiDocumento49 pagineBusiness Standard English MumbailovishNessuna valutazione finora

- Study On Employee Engagement at AirtelDocumento28 pagineStudy On Employee Engagement at Airtelvaishali thapaNessuna valutazione finora

- Statement of The ProblemDocumento67 pagineStatement of The ProblemArafath ArnoldNessuna valutazione finora

- Bharti Airtel Case StudyDocumento4 pagineBharti Airtel Case Studysankalp10100% (1)

- Marketing Strategies of AirtelDocumento85 pagineMarketing Strategies of Airtelvishugaba198867% (15)

- Tikona Digital Network SIP ReportDocumento50 pagineTikona Digital Network SIP Reportpatel_akash007100% (2)

- Consumerism Vis-À-Vis Competition in India-The Other Face of Consumer Activism in The Market With An Analysis On Jio' IssueDocumento34 pagineConsumerism Vis-À-Vis Competition in India-The Other Face of Consumer Activism in The Market With An Analysis On Jio' IssueraaziqNessuna valutazione finora

- Sample Data - ET Data Center - SummitDocumento21 pagineSample Data - ET Data Center - SummitJintupathakNessuna valutazione finora

- Project Part A FinalDocumento85 pagineProject Part A FinalManjunath ManjaNessuna valutazione finora

- Airtel - Talent Pipeline - WordDocumento8 pagineAirtel - Talent Pipeline - WordJayNessuna valutazione finora

- BSC Magazine Exclusive July Monthly GA MCQs FinalDocumento50 pagineBSC Magazine Exclusive July Monthly GA MCQs Finalshikharv90Nessuna valutazione finora

- A Study of Telecom Industry: Mithun Ghosh 9163797960Documento27 pagineA Study of Telecom Industry: Mithun Ghosh 9163797960shreya2626Nessuna valutazione finora

- Airtel MNC MCC TrickDocumento2 pagineAirtel MNC MCC TrickSandeep MongaNessuna valutazione finora

- Airtel Black Bill 4Documento7 pagineAirtel Black Bill 4Akshay KharolaNessuna valutazione finora

- Technical FinalDocumento115 pagineTechnical FinalsanjayNessuna valutazione finora

- Acknowledgement: DR. SHAILESH KASANDE, Vishwakarma Institute of Management, Pune, India ForDocumento25 pagineAcknowledgement: DR. SHAILESH KASANDE, Vishwakarma Institute of Management, Pune, India ForHusain GulzarNessuna valutazione finora

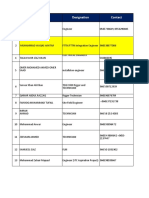

- Candidates ProfileDocumento24 pagineCandidates ProfileFaraz FaiziNessuna valutazione finora