Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Mvat f231

Caricato da

pgotaphoeTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Mvat f231

Caricato da

pgotaphoeCopyright:

Formati disponibili

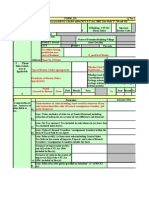

FORM 231

Return-cum-chalan of tax payable by a dealer under M.V.A.T. Act 2002

( See rule 17,18 and 45 )

MVAT R.C. No. 2) Personal Information

1)

Holding CST RC, Please tick

Separate Return Code

Name of Dealer Address Block / Flat Street / Road City Name of Premise / Building / Village Area / Locality District E-mail id of the dealer Telephone No. Original Monthly Fresh Quarterly Revised Six-monthly Pin Code

Location of Sales Tax office having jurisdiction over place of business

3) Type of Return ( Tick appropriate )

Periodicity of return ( Tick appropriate ) Newly registered dealers filling First return

First Return ( Tick, if applicable) Last Return ( Tick, if applicable) Year To Date Month Year

In Case of Cancellation of RC-for period ending with date of cancellation

4)

Period covered by the return

From

Date

Month

5) Computation of net turnover of sales liable to tax

Particulars Amount (Rs.)

a) Gross turnover of sales including, taxes as well as turnover of non sales transactions like value

of Branch Transfers/ Consignment transfers , job work charges etc. Less:-Value of Goods Return (inclusive of tax), including reduction of sale price on account of b) rate difference and discount. Less:-Net Tax amount ( Tax included in sales shown in (a) above less Tax included in (b) c) above)

d) Less:-Value of Branch Transfers/ Consignment transfers within the State e)

Less:-Sales u/s 8 (1) i.e. Interstate Sales including Central Sales Tax, Sales in the course of imports, exports and value of Branch Transfers/ Consignment transfers outside the State Turnover of export sales u/s 5(1) and 5(3) of the CST Act 1956 included in Box (e) Turnover of sales in the course of import u/s 5(2) of the CST Act 1956 included in Box (e) Rs. Rs.

f) Less:-Sales of tax-free goods specified in Schedule A of MVAT Act g)

Less:-Sales of taxable goods fully exempted u/s. 8 other than sales under section 8(1) and covered in Box 5(e)

h) Less:-Labour/Job work Charges i) Less:- Other allowable deductions, if any viz. j) Total deductions [ b+c+d+e+f+g+h+I ] k) Net turnover of Sales liable to tax [a - j] Printed From the Website : http://www.meraconsultant.com

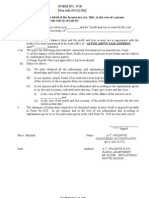

Form No. 231

Page No. 2

6) Computation of tax payable under the MVAT Act

Rate of Tax Turnover of Sales liable to Tax (Rs.) Tax Amount (Rs.)

a) b) c) d) e) f)

Total

6A) Sales tax collected in excess of the amount tax payable 7) Computation of purchases eligible for set-off

Particulars Amount (Rs.)

a) Total turnover of purchases including taxes, value of Branch Transfers/ Consignment transfers

received and Labour/job work charges Less:-Value of Goods Return (inclusive of tax), including reduction of purchase price on b) account of rate difference and discount .

c) Less:-Imports (High seas purchases) d) Less:-Imports (Direct) e) Less:-Inter-State purchases f) Less:-Inter-State Branch Transfers, Consignment transfers received g) Less:-Within the State Branch Transfers, Consignment transfers received h) Less:-Within the State purchases of taxable goods from un-registered dealers.

Less:-Purchases of taxablegoods from registered dealers under MVAT Act, and which are not eligible for set-off Less:-Within the State purchases of the of taxable goods which are fully exempted from tax u/s j) 8 but not covered under section 8(1)

i)

k) Less:-Within the State purchases of tax-free goods specified in schedule A l) Less:-Other allowable deductions if any.

viz.

m) Total deductions [ b+c+d+e+f+g+h+i+j+k+l ] n) Balance: Within the State purchases of taxable goods from registered dealers eligible for set-off

[a-m]

8) Tax rate wise break-up of within State purchases from registered dealers eligible for set-off as per Box 7(m) above

Rate of Tax Net Turnover of Purchases (Rs.) Tax Amount (Rs.)

a) b) c) d) e)

Total

Printed From the Website : http://www.meraconsultant.com

Form No. 231

Page No. 3

9) Computation of set-off claimed in this return

Particulars Purchase Value (Rs.) Tax Amount (Rs.)

a) Within the State purchases of taxable goods from registered dealers eligible for set-off as per Box 8 b) Less: Reduction in the amount of set-off u/r 53(1) of the corresponding purchase price of (Sch C, D & E) goods Less: Reduction in the amount of set-off u/r 53(2) of the corresponding purchase price of the (Sch B, C, D, E c) Less: Reduction in the amount of set-off under any other sub rule of Rule 53 d) Total deduction [ b+c ] Balance: Net set off for the period covered under this return [ a-d ] f) Add: Adjustment on account of set-off claimed short in earlier return g) Less: Adjustment on account of excess set-off claimed in earlier return e) h) Set-off available for the period of this return [ (e+f) - g ] 10) Computation of Tax Payable along with return

Particulars Amount (Rs.)

10A)

Aggregate of credit available for the period covered under this return

a)

Set off available as per Box 9 (h)

b) Excess credit brought forward from previous tax period c) d) e) f) Amount already paid ( Details to be entered in Box 10 E) Excess Credit if any, as per Form 234, to be adjusted against the liability as per Form 231 Adjustment of ET paid under Maharashtra Tax on Entry of Goods into Local Areas Act 2002 Refund adjustment order No. ( Details to be entered in Box 10 F)

g) Total available credit (a+b+c+d+e+f) 10B)

Sales tax payable and adjustment of CST / ET payable against available credit

a) b) c)

Sales tax payable as per Box 6 Adjustment of MVAT payable, if any as per Return Form 234 against the excess credit as per Form 231. Adjustment of CST payable as per return for this period

d) Adjustment of ET payable under the Maharashtra Tax on Entry of Goods into Local Areas Act, 2002 Amount of Sales Tax Collected in Excess of the amount of Sales Tax payable, if e) any (As per Box 6A) f) Interest Payable

g) Total [ a+b+c+d+e+f ] h) Balance: Excess credit [ 10A(g) - 10B(g) ] if 10A (g) is more than 10B(g) i) Balance:Amount payable including Tax and Interest [ 10B(g) - 10A(g) ] if 10A(g) is less than 10B(g)

Printed From the Website : http://www.meraconsultant.com

Form No. 231

Page No. 4

10C)

Utilisation of excess credit as per Box 10B(f)

a) 10D)

Excess credit carried forward to subsequent tax period

b) Excess credit claimed as refund as per this return [ Box10B(h) - Box 10C(a) ]

Tax payable with return-cum-challan

a)

Tax payable as per Box 10B(i)

b) Amount paid along with return-cum-chalan [Details to be included in Box10E] c) 10E) Amount paid as per Revised /Fresh return [Details to be included in Box 10E]

Details of the Amount Paid along with this return and or Amount Already Paid Chalan CIN No. Amount(Rs.) Payment Date Name of the Bank Branch Name

TOTAL

10F)

Details of RAO RAO No. Amount Adjusted (Rs.) Date of RAO

TOTAL

The statements contained in this return in Boxes 1 to 10 are true to the best of my knowledge and belief.

Date of Filing of Return Name of Authorised Person Designation E-mail id Phone No. Signature of Tax payer or Authorised signatory Date Month Year Place

For Bank / Treasury Use Amount Received (Fig.) Chalan / CIN No. Amount Received (Words) Date of Entry Date Month Year

Space for Bank's / Treasury's Stamp

Treasury Accountant / Treasury Officer / Agent / Manager's Signature

Printed From the Website : http://www.meraconsultant.com

Form No. 231 Part-II

Page No. 5

FORM 231

Chalan for Treasury

Part-III

FORM 231

Chalan for Tax Payer

Return-cum-chalan of tax payable by a dealer under M.V.A.T. Act 2002 (See rule 17,18 and 45) 00400192 - Sales Tax Receipts under M.V.A.T. Act, 2002 Tax collection Periodicity of return Type of return MVAT R.C. No. C.S.T. R.C. No. Period covered by the return Date From Month Year Date To Month Year Monthly Original Quarterly Fresh Six-monthly Revised

Return-cum-chalan of tax payable by a dealer under M.V.A.T. Act 2002 (See rule 17,18 and 45) 00400192 - Sales Tax Receipts under M.V.A.T. Act, 2002 Tax collection Periodicity of return Type of return MVAT R.C. No. C.S.T. R.C. No. Period covered by the return Date From Month Year Date To Month Year Monthly Original Quarterly Fresh Six-monthly Revised

Name and address of the dealer Name Address

Name and address of the dealer Name Address

PIN Tax Interest Penalty Total ( in figures ) Total ( in words ) Crore Lakh Rs. Rs. Rs. Rs. Thousands Hundreds Tens Tax Interest Penalty Total ( in figures ) Total ( in words ) Crore Lakh

PIN Rs. Rs. Rs. Rs. Thousands Hundreds Tens

Date Place Signature of the Deposito For Bank / Treasury use only Amount Received (In Figures) Amount Received (In words) Date of Entry Chalan No. Rs. Rupees

Date Place Signature of the Deposito For Bank / Treasury use only Amount Received (In Figures) Amount Received (In words) Date of Entry Chalan No. Rs. Rupees

Treasury Accountant / Treasury Officer Agent / Manager

Space for stamp

Treasury Accountant / Treasury Officer Agent / Manager

Space for stamp

Printed From http://www.meraconsultant.com

Printed From http://www.meraconsultant.com

Potrebbero piacerti anche

- 1 67 8 (A) Tax Amount in Box 8 (A) 2 68 8 (A) Tax Amount in Box 8 (A) 3 67,68 8 Duplicate Tax Rates in Line Nos 67,68Documento12 pagine1 67 8 (A) Tax Amount in Box 8 (A) 2 68 8 (A) Tax Amount in Box 8 (A) 3 67,68 8 Duplicate Tax Rates in Line Nos 67,68Ganesh ChavanNessuna valutazione finora

- Form 231 Errors Sno Error Line No Error BOX No Error Box DescriptionDocumento9 pagineForm 231 Errors Sno Error Line No Error BOX No Error Box DescriptionNishant GoyalNessuna valutazione finora

- Form 231Documento9 pagineForm 231sanjay jadhav100% (5)

- Form VAT - 17: Return by A Registered PersonDocumento3 pagineForm VAT - 17: Return by A Registered PersonYf WoonNessuna valutazione finora

- New VAT Audit FormatDocumento12 pagineNew VAT Audit FormatparulshinyNessuna valutazione finora

- FORM 202: Popular EnterpriseDocumento4 pagineFORM 202: Popular Enterprisesam3461Nessuna valutazione finora

- Monthly Value-Added Tax Declaration: Kawanihan NG Rentas InternasDocumento4 pagineMonthly Value-Added Tax Declaration: Kawanihan NG Rentas InternasjamquintanesNessuna valutazione finora

- Monthly Value-Added Tax DeclarationDocumento17 pagineMonthly Value-Added Tax DeclarationMIRAHNELNessuna valutazione finora

- Quarterly Tax Value-Added Return: Kawanihan NG Rentas InternasDocumento5 pagineQuarterly Tax Value-Added Return: Kawanihan NG Rentas InternasStephanie LayloNessuna valutazione finora

- Form VAT-R2: (See Rule 16 (2) ) DdmmyyDocumento4 pagineForm VAT-R2: (See Rule 16 (2) ) DdmmyyPRAHLAD_KUMAR8424Nessuna valutazione finora

- TRAINING. NOTES Commercial TaxDocumento116 pagineTRAINING. NOTES Commercial TaxVipin Thomas100% (1)

- New Form 2550 Q - Quarterly VAT Return P 1-2 (2005 Version)Documento4 pagineNew Form 2550 Q - Quarterly VAT Return P 1-2 (2005 Version)Michelle G. Minor0% (1)

- Monthly Value-Added Tax Declaration: Kawanihan NG Rentas InternasDocumento9 pagineMonthly Value-Added Tax Declaration: Kawanihan NG Rentas InternasAdriel Torreda NaturalNessuna valutazione finora

- Punjab Vat NoteDocumento12 paginePunjab Vat NoteSuraj SinghNessuna valutazione finora

- Comtax - Up.nic - in - cSTAct - CST UP Form-1 With AnnexureDocumento4 pagineComtax - Up.nic - in - cSTAct - CST UP Form-1 With Annexuresaurabh261050% (2)

- 2550MDocumento9 pagine2550MAngel AlfaroNessuna valutazione finora

- FORM - 704: Audit Report Under Section 61 of The Maharashtra Value Added Tax Act, 2002, Part - 1Documento26 pagineFORM - 704: Audit Report Under Section 61 of The Maharashtra Value Added Tax Act, 2002, Part - 1S Kumar SharmaNessuna valutazione finora

- New Form 16 AY 11 12Documento4 pagineNew Form 16 AY 11 12Sushma Kaza DuggarajuNessuna valutazione finora

- All About GST Annual ReturnsDocumento9 pagineAll About GST Annual ReturnsinfoNessuna valutazione finora

- Acknowledgement Sept To March 2010 Return 231Documento1 paginaAcknowledgement Sept To March 2010 Return 231Mrunali kadamNessuna valutazione finora

- Department of Commercial Taxes, Government of Uttar Pradesh: Upvat - XxivDocumento11 pagineDepartment of Commercial Taxes, Government of Uttar Pradesh: Upvat - Xxivpradeepji392Nessuna valutazione finora

- New VAT Audit FormatDocumento12 pagineNew VAT Audit FormatTarifNessuna valutazione finora

- New Form 2550 M - Monthly VAT Return P 1-2Documento3 pagineNew Form 2550 M - Monthly VAT Return P 1-2Pearl Reyes64% (14)

- Tnvat Form WW Fy 15-16Documento30 pagineTnvat Form WW Fy 15-16samaadhuNessuna valutazione finora

- CST AppealDocumento3 pagineCST AppealvnbanjanNessuna valutazione finora

- Department of Commercial Taxes, Government of Uttar Pradesh: Upvat - XxivDocumento11 pagineDepartment of Commercial Taxes, Government of Uttar Pradesh: Upvat - Xxivrajiv29Nessuna valutazione finora

- Returns: FAQ'sDocumento25 pagineReturns: FAQ'smun1barejaNessuna valutazione finora

- NNNDocumento4 pagineNNNJemely BagangNessuna valutazione finora

- Form No. 21Cc A F C R O I T R U: The Kerala Value Added Tax Rules, 2005Documento2 pagineForm No. 21Cc A F C R O I T R U: The Kerala Value Added Tax Rules, 2005najub6Nessuna valutazione finora

- Form 231Documento14 pagineForm 231Jignesh Dinesh MewadaNessuna valutazione finora

- Form2FandInstructions 06062006Documento11 pagineForm2FandInstructions 06062006Mnaoj PatelNessuna valutazione finora

- Form XxiiiDocumento2 pagineForm XxiiiJIYA KEJRIWALNessuna valutazione finora

- Monthly VAT ReturnDocumento34 pagineMonthly VAT ReturnEdris MatovuNessuna valutazione finora

- Form No. 16: Finotax 1 of 3Documento3 pagineForm No. 16: Finotax 1 of 3dugdugdugdugiNessuna valutazione finora

- Form Jvat 409Documento2 pagineForm Jvat 409Suzanne BradyNessuna valutazione finora

- Form - Xxvi: Department of Commercial Taxes, Government of Uttar PradeshDocumento14 pagineForm - Xxvi: Department of Commercial Taxes, Government of Uttar PradeshmgrfaNessuna valutazione finora

- 25-7-21 611 nf-8175 GST QueDocumento4 pagine25-7-21 611 nf-8175 GST QueJignesh NagarNessuna valutazione finora

- Goa VAT LawDocumento23 pagineGoa VAT LawSiddesh ChimulkerNessuna valutazione finora

- SCH 3Documento8 pagineSCH 3suniljaithwarNessuna valutazione finora

- Form 231 Errors Sno Error Line No Error BOX No Error Box DescriptionDocumento9 pagineForm 231 Errors Sno Error Line No Error BOX No Error Box DescriptionnitinnawarNessuna valutazione finora

- Changes VAT 100Documento1 paginaChanges VAT 100rameshbabu_rrb_1Nessuna valutazione finora

- 2011 - ITR2 - r6Documento33 pagine2011 - ITR2 - r6Bathina Srinivasa RaoNessuna valutazione finora

- Form 16, Tax Deduction at Source... Income Tax of IndiaDocumento2 pagineForm 16, Tax Deduction at Source... Income Tax of IndiaDrAnilkesar GohilNessuna valutazione finora

- CST Form 1Documento6 pagineCST Form 1Sarath Disha80% (5)

- Form 231 Sharp EnterprisesDocumento8 pagineForm 231 Sharp Enterprisesqaid_duraiyaNessuna valutazione finora

- 201 Oct To Dec 2011Documento4 pagine201 Oct To Dec 2011Ishan KhandelwalNessuna valutazione finora

- Form 1: VERSION: E-Gov Ver 4.0.0Documento2 pagineForm 1: VERSION: E-Gov Ver 4.0.0slbandyopadhyayNessuna valutazione finora

- Office of The Commissioner of Commercial Taxes: Orissa, CuttackDocumento17 pagineOffice of The Commissioner of Commercial Taxes: Orissa, CuttackJayant JoshiNessuna valutazione finora

- SC Decisions January 2011Documento204 pagineSC Decisions January 2011anmikkimNessuna valutazione finora

- Form No. 3Cb (See Rule 6G (1) (B) )Documento12 pagineForm No. 3Cb (See Rule 6G (1) (B) )Jay MogradiaNessuna valutazione finora

- Upvat Xxvi-A Department of Commercial Taxes, Government of Uttar PradeshDocumento6 pagineUpvat Xxvi-A Department of Commercial Taxes, Government of Uttar PradeshShreya AgarwalNessuna valutazione finora

- 2550Mv 2Documento7 pagine2550Mv 2nelsonNessuna valutazione finora

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionDa EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNessuna valutazione finora

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionDa EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNessuna valutazione finora

- Pawn Shop Revenues World Summary: Market Values & Financials by CountryDa EverandPawn Shop Revenues World Summary: Market Values & Financials by CountryNessuna valutazione finora

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryDa EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNessuna valutazione finora

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionDa EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNessuna valutazione finora

- Qualified Contestable Customers - January 2022 DataDocumento59 pagineQualified Contestable Customers - January 2022 DataDr. MustafaAliNessuna valutazione finora

- Comp Data2312 PDFDocumento338 pagineComp Data2312 PDFkunalNessuna valutazione finora

- Toyota InvoiceDocumento1 paginaToyota InvoiceRita SJNessuna valutazione finora

- Insha Spreadsheet Marketing Contact DataDocumento14 pagineInsha Spreadsheet Marketing Contact DataAbhishek SinghNessuna valutazione finora

- State Wise Installed Capacity As On 30.06.2019Documento2 pagineState Wise Installed Capacity As On 30.06.2019Bhom Singh NokhaNessuna valutazione finora

- Contact Details ICAIDocumento2 pagineContact Details ICAIVikram KumarNessuna valutazione finora

- Singapore IncDocumento7 pagineSingapore IncGinanjarSaputraNessuna valutazione finora

- Nghe HSG 4Documento3 pagineNghe HSG 4GiangNessuna valutazione finora

- Topic 1 Introduction To Malaysian Financial System (S)Documento36 pagineTopic 1 Introduction To Malaysian Financial System (S)pedoqpopNessuna valutazione finora

- Emerging Asian Regionalism: Farizatul AQMA Sena SUH Youngsik KIM Sumi KWON Yeoul KANG Youngbm CHODocumento25 pagineEmerging Asian Regionalism: Farizatul AQMA Sena SUH Youngsik KIM Sumi KWON Yeoul KANG Youngbm CHObuximranNessuna valutazione finora

- 945-Jeevan Umang: Prepared byDocumento7 pagine945-Jeevan Umang: Prepared byVishal GuptaNessuna valutazione finora

- BillDocumento1 paginaBillZeeshan Haider RizviNessuna valutazione finora

- Overview of Energy Systems in Northern CyprusDocumento6 pagineOverview of Energy Systems in Northern CyprushaspyNessuna valutazione finora

- Garden Reach Shipbuilders & Engineers LimitedDocumento63 pagineGarden Reach Shipbuilders & Engineers LimitedSRARNessuna valutazione finora

- #Last Will and TestamentDocumento3 pagine#Last Will and Testamentmatsumoto100% (1)

- Four Steps To Writing A Position Paper You Can Be Proud ofDocumento6 pagineFour Steps To Writing A Position Paper You Can Be Proud ofsilentreaderNessuna valutazione finora

- Macroeconomic Theory and Policy: Pcpadhan@xlri - Ac.inDocumento7 pagineMacroeconomic Theory and Policy: Pcpadhan@xlri - Ac.inManoranjan DashNessuna valutazione finora

- Efektifitas Penerapan Belok Kiri Langsung (Studi Kasus Simpang Tiga Yogya Mall Kota Tegal)Documento11 pagineEfektifitas Penerapan Belok Kiri Langsung (Studi Kasus Simpang Tiga Yogya Mall Kota Tegal)Didit Prasojo secondNessuna valutazione finora

- Admission To Undergraduate Programmes NtuDocumento2 pagineAdmission To Undergraduate Programmes Ntuyen_3580Nessuna valutazione finora

- ConclusionDocumento2 pagineConclusionYuhanis YusofNessuna valutazione finora

- Irma Irsyad - Southwest Case StudyDocumento27 pagineIrma Irsyad - Southwest Case StudyIrma IrsyadNessuna valutazione finora

- Adm ANI 2005Documento15 pagineAdm ANI 2005Paul GalanNessuna valutazione finora

- Company Profile PT BTR 2022 - 220611 - 085254 - 220707 - 113639Documento20 pagineCompany Profile PT BTR 2022 - 220611 - 085254 - 220707 - 11363902171513Nessuna valutazione finora

- Bos 63146Documento40 pagineBos 63146Piyush GoyalNessuna valutazione finora

- EI2 Public Benefit Organisation Written Undertaking External FormDocumento1 paginaEI2 Public Benefit Organisation Written Undertaking External Formshattar47Nessuna valutazione finora

- Report User DSDocumento99 pagineReport User DSPrabuNessuna valutazione finora

- Canara Bank Deposit RatesDocumento3 pagineCanara Bank Deposit RatesvigyaniNessuna valutazione finora

- Global Finance Graduate Programme, Novo NordiskDocumento1 paginaGlobal Finance Graduate Programme, Novo NordiskMylinh VuNessuna valutazione finora

- Managerial. EcoDocumento15 pagineManagerial. EcomohitharlaniNessuna valutazione finora

- Globalization and International BusinessDocumento14 pagineGlobalization and International BusinesskavyaambekarNessuna valutazione finora