Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Correlations: One-Year - Bloomberg

Caricato da

api-87733769Descrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Correlations: One-Year - Bloomberg

Caricato da

api-87733769Copyright:

Formati disponibili

CORRELATIONS

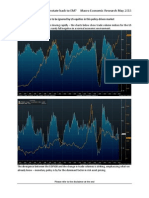

As we are all aware, since July 26th 2011 sentiment has driven the market down aggressively, with volatility at historical levels. Investor concern is at extremely high levels. The VIX currently sits at 43.05 having been as low as 15.12 on July 1st. More notably from a technical angle the long term downward trend line on the VIX chart running from the height of the credit crunch has broken to the upside which is a particularly bearish signal.

One-Year - Bloomberg

As traders it is possible to generate a tendency to become somewhat habitual with how we perceive market correlations, which in turn can have an effect on the way we ultimately trade, particularly intraday. It is worth considering correlations specific to market sentiment and beyond, specific market conditions, which in turn should assist us in avoiding costly errors when considering correlations whilst trading. As standard I know that I have a tendency for my mind to be almost programmed to assume the typical Bund moving up, stocks moving down, risk assets (EURUSD for example)moving down etc. In as much as this may ultimately continue to transpire to be the case when we look at longer term charts in 6 months time, at the moment correlations have been capable of falling out of our assumed typical movements. For example, intraday, of late we have seen moves whereby the S&P 500 / stocks in general have moved down, The Bund has moved up, however that has been followed by an upward move in EURUSD. That is not to say that today or tomorrow that correlation trend will continue, it is more to say that we should be aware that correlations can change, and therefore part of our technical analysis Intraday should be to keep this in mind.

With this in mind I have created a number of charts, shown below, to show the current correlations working in the current market conditions.

DAILY CHART

COLOUR OPEN HIGH LOW CLOSE MOVE CRUDE 99.17 100.62 75.71 82.26 DOWN - 17.1% - ($17.33) GOLD 1613.78 1878.77 1602.51 1852.12 UP - 12.9% - $238.34 S&P 500 1333.5 1339.75 1109.5 1123.75 DOWN - 16.8% - (209.75 pts) EURUSD 143.73 145.25 140.56 143.96 UP - 0.14% - 23 pips BUND 127.98 135.26 127.76 135.43 UP - 6.5% - 745 pts You can see above that post July 26th the correlations have been true to form With Stocks & Crude moving down, Gold & the Bund moving north, however the one that had the capability to cost a trader vital P&L here has been the EURUSD. The EURUSD is by in large flat. The reality here is USD weakness of late rather than EURO strength. Personally I am a EURO bear however the US debt ceiling debacle, continued poor economic data (note that the negative sentiment may be overdone on that score with the data showing an overall slowdown in the US economy, but not numbers

suggesting a double dip just yet), an increase in the belief that QE3 is on the way, the Fed stating interest rates (Federal funds target rate) will remain at the current historically low levels until 2013, and of course the fact that the ECB at the time of writing remain on a rate hiking cycle, all go against the USD when looking at this currency pair.

Monthly Chart

DAX, ESTOXX 50, BUND, 10 YEAR T-NOTE, CRUDE, S&P 500, EURUSD Simply for your information, below is a monthly view of the correlations post credit crunch to date on a monthly chart of the above asset classes.

Continuing on the monthly theme, to give a clearer view of particular markets, below is the monthly view of 10 YR T-NOTES, BUND, S&P 500, & EURUSD

Keeping with the same asset classes, the chart below is a daily view, showing us the correlations in 2011 up until July 26th, & then those same correlations post July 26th to date.

In the event that it is of interest I have also added a Daily chart below showing S&P500, Bobl, Schatz, 10 YR T-notes, & EURUSD.

I hope this helps with your trading. Personally paying closer attention to correlations than simply assuming the status-quo certainly goes some way to increasing the probability of positive trading P&L! For anyone unsure of how to do this with ProRealTime I have detailed some instructions below. How to set-up a security comparison in PROREALTIME 1. 2. 3. 4. Open any chart, say EURUSD Spot Right Click on the chart Select compare security (6th option down below change security) Then simply search for your security in the search box as you would when creating a list. Say you wanted S&P 500, simply type S&P 500 and select the one you want from the list that appears. 5. To change from candlestick to line is you want the chart to be clearer, right click on any candle, and then change from candlestick to a line chart. This can all be changed back. 6. To save a chart, click on print at the bottom right of the screen, and then click save, you can then save your chart to your desktop / c: drive etc.

Potrebbero piacerti anche

- The Art of Currency Trading: A Professional's Guide to the Foreign Exchange MarketDa EverandThe Art of Currency Trading: A Professional's Guide to the Foreign Exchange MarketValutazione: 4.5 su 5 stelle4.5/5 (4)

- Lane Asset Management Stock Market Commentary For October 2013Documento9 pagineLane Asset Management Stock Market Commentary For October 2013Edward C LaneNessuna valutazione finora

- Inner Circle Trader - TPDS 5Documento18 pagineInner Circle Trader - TPDS 5Felix Tout Court100% (1)

- Edition 25 - Chartered 4th March 2011Documento8 pagineEdition 25 - Chartered 4th March 2011Joel HewishNessuna valutazione finora

- How To Trade AudusdDocumento9 pagineHow To Trade AudusdCarlos AlmendraNessuna valutazione finora

- Lane Asset Management Stock Market and Economic Commentary July 2012Documento7 pagineLane Asset Management Stock Market and Economic Commentary July 2012Edward C LaneNessuna valutazione finora

- Forex Seasonal Patterns EBook1Documento21 pagineForex Seasonal Patterns EBook1Mohamed Bahaa100% (2)

- Razor Jack EconomicsDocumento54 pagineRazor Jack Economicsvlad_adrian_7Nessuna valutazione finora

- Lane Asset Management Stock Market Commentary December 2011Documento8 pagineLane Asset Management Stock Market Commentary December 2011Edward C LaneNessuna valutazione finora

- FX Compass: Looking For Signs of Pushback: Focus: Revising GBP Forecasts HigherDocumento25 pagineFX Compass: Looking For Signs of Pushback: Focus: Revising GBP Forecasts HighertekesburNessuna valutazione finora

- The Politico TradeDocumento15 pagineThe Politico TradenomeansumNessuna valutazione finora

- Welcome To Financial Trend ForecasterDocumento48 pagineWelcome To Financial Trend ForecasterPrincess BinsonNessuna valutazione finora

- LAM Commentary July 2011Documento8 pagineLAM Commentary July 2011Edward C LaneNessuna valutazione finora

- There's Nothing Good Here: Views From The Blue RidgeDocumento8 pagineThere's Nothing Good Here: Views From The Blue RidgeZerohedgeNessuna valutazione finora

- Forex Tutorial 0601Documento27 pagineForex Tutorial 0601Tanvir AhmedNessuna valutazione finora

- Stock Market Commentary November 2014Documento7 pagineStock Market Commentary November 2014Edward C LaneNessuna valutazione finora

- TomT Stock Market Model 2012-05-20Documento20 pagineTomT Stock Market Model 2012-05-20Tom TiedemanNessuna valutazione finora

- Lane Asset Management Stock Market Commentary August 2011Documento9 pagineLane Asset Management Stock Market Commentary August 2011Edward C LaneNessuna valutazione finora

- Chart Review - Can We Rotate Back To EM? Macro Economic Research May 2013Documento4 pagineChart Review - Can We Rotate Back To EM? Macro Economic Research May 2013kcousinsNessuna valutazione finora

- FX 20140417Documento2 pagineFX 20140417eliforuNessuna valutazione finora

- Lane Asset Management Stock Market Commentary February 2014Documento8 pagineLane Asset Management Stock Market Commentary February 2014Edward C LaneNessuna valutazione finora

- Lane Asset Management Stock Market and Economic February 2012Documento6 pagineLane Asset Management Stock Market and Economic February 2012Edward C LaneNessuna valutazione finora

- September 27, 2010 PostsDocumento595 pagineSeptember 27, 2010 PostsAlbert L. PeiaNessuna valutazione finora

- Market Commentary 4/25/2012Documento1 paginaMarket Commentary 4/25/2012CJ MendesNessuna valutazione finora

- Seasonal PatternsDocumento14 pagineSeasonal PatternsHồng NgọcNessuna valutazione finora

- 2011 12 06 Migbank Daily Technical Analysis ReportDocumento15 pagine2011 12 06 Migbank Daily Technical Analysis ReportmigbankNessuna valutazione finora

- How To Trade Eurusd PDFDocumento14 pagineHow To Trade Eurusd PDFNil DorcaNessuna valutazione finora

- 5 FPMarkets Fundamental TradingDocumento13 pagine5 FPMarkets Fundamental TradingLouisNessuna valutazione finora

- DailyFX - JPY and XAU CorrelationDocumento3 pagineDailyFX - JPY and XAU Correlationfoyarse1Nessuna valutazione finora

- SEB Report: Investors To Move Away From Dollar, EuroDocumento44 pagineSEB Report: Investors To Move Away From Dollar, EuroSEB GroupNessuna valutazione finora

- Moving To The Right Side of The Dollar SmileDocumento7 pagineMoving To The Right Side of The Dollar SmilecmarojaNessuna valutazione finora

- 2010 - 2011 Stock Market Forecast: Technical Analysis PredictionsDocumento4 pagine2010 - 2011 Stock Market Forecast: Technical Analysis PredictionsIcha86Nessuna valutazione finora

- Forex Seasonal Patterns Ebook1 PDFDocumento21 pagineForex Seasonal Patterns Ebook1 PDFbonkyo100% (3)

- Forex Seasonal PatternsDocumento21 pagineForex Seasonal PatternsUj GumilarNessuna valutazione finora

- Market Cycle Timing and Forecast 2016 2017 PDFDocumento22 pagineMarket Cycle Timing and Forecast 2016 2017 PDFsravanNessuna valutazione finora

- Market Cycle Timing and Forecast 2016 2017 PDFDocumento22 pagineMarket Cycle Timing and Forecast 2016 2017 PDFpravinyNessuna valutazione finora

- Market Cycle Timing and Forecast 2016 2017Documento22 pagineMarket Cycle Timing and Forecast 2016 2017SolomeoParedes100% (1)

- 11/16/12 Market MemoDocumento1 pagina11/16/12 Market Memoapi-80847199Nessuna valutazione finora

- BNP FX WeeklyDocumento22 pagineBNP FX WeeklyPhillip HsiaNessuna valutazione finora

- Big Picture by FMaggioniDocumento7 pagineBig Picture by FMaggioniFrancesco MaggioniNessuna valutazione finora

- Using Currency Correlations To Your AdvantageDocumento5 pagineUsing Currency Correlations To Your Advantagegdpi09100% (2)

- Calling All Traders Get Ready To Make Money Shorting The MarketDocumento5 pagineCalling All Traders Get Ready To Make Money Shorting The MarketMarci HajduNessuna valutazione finora

- Barclays Global FX Quarterly Fed On Hold Eyes On GrowthDocumento42 pagineBarclays Global FX Quarterly Fed On Hold Eyes On GrowthgneymanNessuna valutazione finora

- Lane Asset Management Stock Market Commentary May 2012Documento6 pagineLane Asset Management Stock Market Commentary May 2012Edward C LaneNessuna valutazione finora

- Barclays FX Weekly Brief 20100902Documento18 pagineBarclays FX Weekly Brief 20100902aaronandmosesllcNessuna valutazione finora

- Consulting Our Technical Playbook: MarketDocumento5 pagineConsulting Our Technical Playbook: MarketdpbasicNessuna valutazione finora

- GTA Fax 01 - 03 - 12Documento8 pagineGTA Fax 01 - 03 - 12boreduscstudentNessuna valutazione finora

- Seasonal Patterns - 1 PDFDocumento18 pagineSeasonal Patterns - 1 PDFAdhitya WirambaraNessuna valutazione finora

- 11/14/14 Global-Macro Trading SimulationDocumento17 pagine11/14/14 Global-Macro Trading SimulationPaul KimNessuna valutazione finora

- Lane Asset Management Stock Market Commentary March 2012Documento6 pagineLane Asset Management Stock Market Commentary March 2012Edward C LaneNessuna valutazione finora

- Finance The 2nd AsmDocumento12 pagineFinance The 2nd Asms3878775Nessuna valutazione finora

- Lane Asset Management Stock Market and Economic Commentary February 2016Documento11 pagineLane Asset Management Stock Market and Economic Commentary February 2016Edward C LaneNessuna valutazione finora

- A Project Reort On Technical Analysis OF Tata-MotorsDocumento11 pagineA Project Reort On Technical Analysis OF Tata-MotorsSahil ChhibberNessuna valutazione finora

- Four Pillars Finance Outlook 2012Documento67 pagineFour Pillars Finance Outlook 2012Kanwal Kishore AroraNessuna valutazione finora

- The Ichimoku TraderDocumento11 pagineThe Ichimoku TraderPui SanNessuna valutazione finora

- Seasonal Trends in The Forex MarketDocumento4 pagineSeasonal Trends in The Forex MarketAnonymous Iu5lfMh9Nessuna valutazione finora

- Istilah NFPDocumento6 pagineIstilah NFPHenry AndersonNessuna valutazione finora

- Vital Signs: Death Cross-Dow Theory Warns?Documento4 pagineVital Signs: Death Cross-Dow Theory Warns?GauriGanNessuna valutazione finora

- Lane Asset Management Stock Market Commentary May 2014Documento7 pagineLane Asset Management Stock Market Commentary May 2014Edward C LaneNessuna valutazione finora

- How To ComplainDocumento2 pagineHow To Complainapi-87733769Nessuna valutazione finora

- Non-Farm Payrolls Prep: Great View Below of Correlations Between NFP & Initial Jobless Weekly DataDocumento3 pagineNon-Farm Payrolls Prep: Great View Below of Correlations Between NFP & Initial Jobless Weekly Dataapi-87733769Nessuna valutazione finora

- Basel III - Potential Impact On Financial Institutions - Paul Gallacher January 10 2013Documento3 pagineBasel III - Potential Impact On Financial Institutions - Paul Gallacher January 10 2013api-87733769Nessuna valutazione finora

- Re: Account NumberDocumento2 pagineRe: Account Numberapi-87733769Nessuna valutazione finora

- Djia Djia: Dow Jones Industrial Average - Jan 2009 - Nov 2011 Comparison Versus Dec 1934 - Nov 1937Documento1 paginaDjia Djia: Dow Jones Industrial Average - Jan 2009 - Nov 2011 Comparison Versus Dec 1934 - Nov 1937api-87733769Nessuna valutazione finora

- Gold & Silver Daily Outlook 11.22.2011: 22 November 2011 15:44 GMTDocumento2 pagineGold & Silver Daily Outlook 11.22.2011: 22 November 2011 15:44 GMTapi-87733769Nessuna valutazione finora

- Market Over-View: Paul@gmdgroup - Co.ukDocumento58 pagineMarket Over-View: Paul@gmdgroup - Co.ukapi-87733769Nessuna valutazione finora

- Eurusd Intraday Spot Wednesday October 12th 2011 - : Key Levels Strategy-Short Entry 1.3700 Stop 1St Target 2Nd TargetDocumento1 paginaEurusd Intraday Spot Wednesday October 12th 2011 - : Key Levels Strategy-Short Entry 1.3700 Stop 1St Target 2Nd Targetapi-87733769Nessuna valutazione finora

- Technical AnalysisDocumento16 pagineTechnical Analysisapi-87733769Nessuna valutazione finora

- Paul Gallacher, Technical Analysis, November 3Documento64 paginePaul Gallacher, Technical Analysis, November 3api-87733769Nessuna valutazione finora

- Intraday Analysis Strategy Report: Eurusd Intraday Spot Friday October 14th 2011Documento1 paginaIntraday Analysis Strategy Report: Eurusd Intraday Spot Friday October 14th 2011api-87733769Nessuna valutazione finora

- Bullion Report - 13 October 2011 by Paul GallacherDocumento6 pagineBullion Report - 13 October 2011 by Paul Gallacherapi-87733769Nessuna valutazione finora

- S&P 500 Futures Contract E-Mini 12/11Documento1 paginaS&P 500 Futures Contract E-Mini 12/11api-87733769Nessuna valutazione finora

- Eurusd Intraday Spot Monday 11th July 2011: Key Levels Strategy-Short Entry 1.3700 Stop 1St Target 2Nd TargetDocumento1 paginaEurusd Intraday Spot Monday 11th July 2011: Key Levels Strategy-Short Entry 1.3700 Stop 1St Target 2Nd Targetapi-87733769Nessuna valutazione finora

- Analysis Wednesday August 2nd 2011 CloseDocumento7 pagineAnalysis Wednesday August 2nd 2011 Closeapi-87733769Nessuna valutazione finora

- Sunday 31st Jul 2011 - 5pm BST Trading Week Ahead ReportDocumento27 pagineSunday 31st Jul 2011 - 5pm BST Trading Week Ahead Reportapi-87733769Nessuna valutazione finora

- Eurusd Intraday - Us Session Spot Tuesday 12th July 2011Documento1 paginaEurusd Intraday - Us Session Spot Tuesday 12th July 2011api-87733769Nessuna valutazione finora

- Eurusd Intraday - Us Session Spot Tuesday 12th July 2011Documento1 paginaEurusd Intraday - Us Session Spot Tuesday 12th July 2011api-87733769Nessuna valutazione finora

- Accounts Receivable Management in Nonprofit Organizations: Grzegorz MichalskiDocumento14 pagineAccounts Receivable Management in Nonprofit Organizations: Grzegorz MichalskiunhyNessuna valutazione finora

- RM MUBARAK FINANCIAL STATEMENT-dikonversi-diedit PDFDocumento1 paginaRM MUBARAK FINANCIAL STATEMENT-dikonversi-diedit PDFBulan julpi suwelly100% (1)

- Bio Data - Preyanshi Gupta ACMA OLDDocumento5 pagineBio Data - Preyanshi Gupta ACMA OLDPreyanshi GuptaNessuna valutazione finora

- FINMAN MIDTERMS StudentsDocumento5 pagineFINMAN MIDTERMS StudentsJennifer RasonabeNessuna valutazione finora

- The Effect of Financial Secrecy and IFRS Adoption On Earnings Quality: A Comparative Study Between Indonesia, Malaysia and SingaporeDocumento24 pagineThe Effect of Financial Secrecy and IFRS Adoption On Earnings Quality: A Comparative Study Between Indonesia, Malaysia and SingaporeMarwiyahNessuna valutazione finora

- 1BUSN603 CGRM Assessment 2 Case Study Semester 1 2017Documento6 pagine1BUSN603 CGRM Assessment 2 Case Study Semester 1 2017Ṁysterious ṀarufNessuna valutazione finora

- Bookkeeping NC 3 Review GuideDocumento6 pagineBookkeeping NC 3 Review GuideCatherine Hidalgo100% (1)

- CS231 - A&H Application For ReinstatementDocumento1 paginaCS231 - A&H Application For ReinstatementLiyan OngNessuna valutazione finora

- 6-7 Strategic CoorporateDocumento50 pagine6-7 Strategic CoorporateMoh SabilNessuna valutazione finora

- Intermediate 1A: Problem CompilationDocumento24 pagineIntermediate 1A: Problem CompilationPatricia Nicole Barrios100% (4)

- Sol. Man. - Chapter 1 - The Accounting Process - Ia Part 1a - 2020 EditionDocumento12 pagineSol. Man. - Chapter 1 - The Accounting Process - Ia Part 1a - 2020 EditionChristine Jean MajestradoNessuna valutazione finora

- Trading The Forex Market: by Vince StanzioneDocumento51 pagineTrading The Forex Market: by Vince StanzioneTiavina Rakotomalala43% (7)

- Obligasi - PembahasanDocumento18 pagineObligasi - Pembahasangaffar aimNessuna valutazione finora

- Motilal Oswal Financial Services LTDDocumento5 pagineMotilal Oswal Financial Services LTDseawoodsNessuna valutazione finora

- CFA Institute Research ChallengeDocumento3 pagineCFA Institute Research ChallengeAritra BhowmikNessuna valutazione finora

- Cibil Report KAILASH CHAND FULARA1564842956149 PDFDocumento3 pagineCibil Report KAILASH CHAND FULARA1564842956149 PDFKaran FularaNessuna valutazione finora

- Treasury ManagementDocumento6 pagineTreasury ManagementJanzel NuñezNessuna valutazione finora

- FS Complete 31 12 2007Documento160 pagineFS Complete 31 12 2007samir dasNessuna valutazione finora

- Four Daewoo Motors Ex-Executives Acquitted of Fraud Charges - The Economic TimesDocumento1 paginaFour Daewoo Motors Ex-Executives Acquitted of Fraud Charges - The Economic TimescreateNessuna valutazione finora

- Rathna Bitotch - ProjectDocumento14 pagineRathna Bitotch - ProjectM SeshadriNessuna valutazione finora

- Business Tax Activity 1Documento10 pagineBusiness Tax Activity 1Michael AquinoNessuna valutazione finora

- Balance InitializationDocumento23 pagineBalance InitializationKrishna ChaitanyaNessuna valutazione finora

- 166-2020 Roi PDFDocumento47 pagine166-2020 Roi PDFANJAN SINGH 3ANessuna valutazione finora

- CAREER TALK Final PresentationDocumento45 pagineCAREER TALK Final Presentationkashyap bhartiNessuna valutazione finora

- Portfolio's KPIs Calculations TemplateDocumento7 paginePortfolio's KPIs Calculations TemplateGARVIT GoyalNessuna valutazione finora

- A Bank Clerk and A Bank CustomerDocumento2 pagineA Bank Clerk and A Bank CustomerADINDA PUSPITA CECILIANessuna valutazione finora

- Opening & Supervision of AccountsDocumento33 pagineOpening & Supervision of AccountsAsad AliNessuna valutazione finora

- Kellogg's Financial Statement Case StudyDocumento10 pagineKellogg's Financial Statement Case StudyKhoa Huynh67% (6)

- CHAPTER 1 (STRUCTuRE OF MALAYSIAN FINANCIAL SYSTEM)Documento13 pagineCHAPTER 1 (STRUCTuRE OF MALAYSIAN FINANCIAL SYSTEM)han guzelNessuna valutazione finora

- EY Commercial Real Estate DebtDocumento16 pagineEY Commercial Real Estate DebtPaul BalbinNessuna valutazione finora