Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Copper Smelter

Caricato da

Kashif AfzalDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Copper Smelter

Caricato da

Kashif AfzalCopyright:

Formati disponibili

MONGOLIAN COPPER SMELTER PROJECT

Prepared by: Industrial Corporation of Mongolia 2009

CONTENT

PROJECT SUMMARY MARKET OVERVIEW MONGOLIAN COPPER INDUSTRY COMCENTARES SOURCES ERDENET MINING CORPORATION PLANT CAPACITY TECHNOLOGY AUSMELT TECHNOLOGY COPPER EXPERIENCE PLANT LOCATION FINANCIAL PROJECTIONS SUMMARY

I. PROJECT SUMMARY

The main business concept is to establish a copper smelter in Mongolia to produce readily saleable commodities such as copper matte or blister with purpose to export to Chinese or other markets. The projects primary objective is to establish a smelter with a capacity of producing 120.000 tpa of copper concentrates produces by Erdenet copper mine and soon-to-be operated Oyu Tolgoi copper mine. Smelting and converting operations will occur in a single Ausmelt furnace. The products will be 29,642 t/y blister copper, 127,700 t/y sulphuric acid (98%) and a discardable slag A comprehensive Feasibility Study of establishing copper smelter in Mongolia was carried out by Australian AUSMELT Limited.

II. MARKET OVERVIEW

China is a primary market of Mongolian copper. Although China is worlds second largest producer of refined copper, ranked only after Chile, it is also the number one consumer in the world accounting for some 20% of the global market. Since 1999, Chinese domestic consumption copper has increased by an average of almost 20% per year. Meanwhile, Chinas domestic copper mine production has managed to grow only at 4% per annum while production of refined copper grew only by 11% per annum. The remaining substantial gap in copper demand has been mostly filled in by imports of refined copper. Although during the last 5 years Chinas domestic production of refined copper has been steady rising, its dependence of imported raw materials has similarly remained strong. In 2004, China had a copper imbalance of close to a million tons and cathodes shortage 1.5 ml tons. With purpose to fulfill the shortage of copper, China has been resourcing copper concentrates mostly from Australia, Mongolia, Peru, Chile and Indonesia. Mongolia was the second largest exporter of copper concentrates to China in course of this period

III. MONGOLIAN COPPER INDUSTRY

Copper is a primary industry of a Mongolian mining sector. Mongolian copper industry is dominated by a well known large enterprise Erdenet Mining Corporation (EMC) developed with a technical assistance of former Soviet Union in early 70s.

Mongolian copper export consists of two types of commodities, namely copper in concentrates produced Erdenet copper mine and cathode copper produced by Erdmin Company, a Mongolian and American joint venture.

III. CONCENTRATES SOURCES - ERDENET MINING CORPORATION

VI. PLANT CAPACITY

The plant will treat 120,000 tons per year dry tons of copper concentrate to produce 33,500 tons per year blister copper. The plant can be expanded to treat 240,000 and 360,000 tons per year of copper concentrates by construction of a dedicated smelting furnace and increasing the levels of oxygen enrichment. The initial Ausmelt furnace will be dedicated to the converting duty.

IV. TECHNOLOGY

Ausmelt Copper technology has been implemented in eight projects with three more currently construction and design phases which treat range of materials to produce blister copper or copper matte.

The Ausmelt Technology bath smelting system for treating copper materials is predominantly based on bath reactions between the sulphuric and metallic components of the feed material, oxygen and ferric oxide and oxygen injection via the Ausmelt lance.

V. AUSMELT TECHNOLOGY COPPER EXPERIENCE

Commercial Copper Plants Using Ausmelt Technology

VI. PLANT LOCATION

The plant location is near Sainshand city of Umnu-Gobi city is on province. Trans-

Sainshand

Mongolian Railway, and 420 km to the south-east of Ulaanbaatar.

The distance to the Chinese border is

CopperPlant

about 200 km. this site is very convenient to the project, very close to water source, electricity and developed infrastructure.

VII. FINANCIAL PROJECTIONS SUMMARY

The total estimated investment for the Project implementation including inventory and start-up costs are approx. US$80 millions (whereas the construction estimate is US$68.9 millions)

Due to high absorbing capacity of the market and ever increasing demand for copper the terms and goals of the business strategies outlined here and its related projections presented in this document are subject to improvements and adjustments in course of the implementation of the copper smelter project.

Potrebbero piacerti anche

- India's Iron & Steel Industry: A Brief HistoryDocumento17 pagineIndia's Iron & Steel Industry: A Brief HistoryEMJAY100% (1)

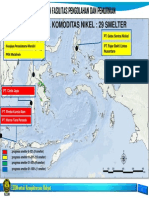

- Indonesia's Nickel, Bauxite, Iron and Other Metal SmeltersDocumento8 pagineIndonesia's Nickel, Bauxite, Iron and Other Metal SmeltersOki Hermansyah FebriantoNessuna valutazione finora

- Marcona Copper ProjectDocumento5 pagineMarcona Copper ProjectGeorgi SavovNessuna valutazione finora

- Hpal Failures and Successs Nickel-CobaltDocumento48 pagineHpal Failures and Successs Nickel-CobaltabrahanNessuna valutazione finora

- Alufer - Bauxite Factsheet PDFDocumento2 pagineAlufer - Bauxite Factsheet PDFRaraNessuna valutazione finora

- Coal Trading - Part 1 Information For Sourcing Coal.Documento4 pagineCoal Trading - Part 1 Information For Sourcing Coal.DayalNessuna valutazione finora

- Energy Efficiency Copper HydrometallurgyDocumento41 pagineEnergy Efficiency Copper Hydrometallurgyalexis diaz0% (1)

- Taganito HPAL ProjectDocumento5 pagineTaganito HPAL ProjectWahyu Dwi SulaksoNessuna valutazione finora

- IOP Conference Series: Earth and Environmental Science - High pressure acid leaching: a newly introduced technology in IndonesiaDocumento7 pagineIOP Conference Series: Earth and Environmental Science - High pressure acid leaching: a newly introduced technology in IndonesiaHilman DarojatNessuna valutazione finora

- Ferrous Processing and Trading Yard Operations and TransportationDocumento6 pagineFerrous Processing and Trading Yard Operations and TransportationfptscrapNessuna valutazione finora

- ECOSMELT BF150 Twin Blast Furnace for Nickel Pig Iron ProductionDocumento16 pagineECOSMELT BF150 Twin Blast Furnace for Nickel Pig Iron Productionzmahfudz100% (1)

- INR - Ed-1 Feb 2020Documento41 pagineINR - Ed-1 Feb 2020Dirga DanielNessuna valutazione finora

- Carbo BrochureDocumento4 pagineCarbo BrochureArup DasNessuna valutazione finora

- Copper ProcessingDocumento26 pagineCopper ProcessingDiego GaliciaNessuna valutazione finora

- High Pressure Acid Leach & Pressure Oxidation TestingDocumento4 pagineHigh Pressure Acid Leach & Pressure Oxidation TestingReece100% (1)

- Evaluation of The Justa Mine PDFDocumento48 pagineEvaluation of The Justa Mine PDFMilthon ChambiNessuna valutazione finora

- Silica Sand Mining FinalDocumento43 pagineSilica Sand Mining FinalChusnadiNessuna valutazione finora

- Copper Case StudyDocumento46 pagineCopper Case StudysupertierraNessuna valutazione finora

- Emission Estimation Technique Manual For Nickel Concentrating, Smelting and RefiningDocumento69 pagineEmission Estimation Technique Manual For Nickel Concentrating, Smelting and RefiningErden SizgekNessuna valutazione finora

- 9-Coal Mining CompleteDocumento60 pagine9-Coal Mining CompleteAchmad Rasyidi89% (9)

- Directory of World Copper Mines and PlantsDocumento163 pagineDirectory of World Copper Mines and PlantsxichengrenNessuna valutazione finora

- Pre-Feasibility Report: ApplicantDocumento24 paginePre-Feasibility Report: ApplicantLubilo MateNessuna valutazione finora

- Bahan Presentasi PT Indonesia Puqing PDFDocumento18 pagineBahan Presentasi PT Indonesia Puqing PDFDex TerNessuna valutazione finora

- Technical Note: What is BauxiteDocumento4 pagineTechnical Note: What is BauxiteBiju SebastianNessuna valutazione finora

- Shenhua Coal Conversion DevelopmentDocumento51 pagineShenhua Coal Conversion Developmentstavros7Nessuna valutazione finora

- Market Survey - Manganese OreDocumento235 pagineMarket Survey - Manganese Oremujib uddin siddiqui100% (1)

- Copper Physical Trading and Supply Chile and Perú JLCDocumento57 pagineCopper Physical Trading and Supply Chile and Perú JLCJosé Luis Cuevas50% (2)

- Thiess Contractors Indonesia: Leading Mining Services ProviderDocumento15 pagineThiess Contractors Indonesia: Leading Mining Services ProviderYusuf ShalahuddinNessuna valutazione finora

- Delong Holdings Annual Report 2008Documento92 pagineDelong Holdings Annual Report 2008WeR1 Consultants Pte LtdNessuna valutazione finora

- Smelter AnalysisDocumento8 pagineSmelter AnalysisDavid Budi Saputra100% (1)

- MDKA Investor Presentation Jan 2021 EnglishDocumento34 pagineMDKA Investor Presentation Jan 2021 EnglishbagsNessuna valutazione finora

- PTVI Process Plant Introduction 2013Documento11 paginePTVI Process Plant Introduction 2013tanzi tri wahdiyatNessuna valutazione finora

- Coke OvenDocumento15 pagineCoke Ovendebashis2008Nessuna valutazione finora

- Uses of Zinc: General Galvanizing. Fasteners Can Also Be Immersed and Then Centrifuged Whilst The Coating Is StillDocumento8 pagineUses of Zinc: General Galvanizing. Fasteners Can Also Be Immersed and Then Centrifuged Whilst The Coating Is StillardiansyahhandikaNessuna valutazione finora

- Application of The SART Process To Heap Leaching of Gold Copper Ores at Maricunga Chile by Kevan J. R. Ford, Chris A. FlemingDocumento20 pagineApplication of The SART Process To Heap Leaching of Gold Copper Ores at Maricunga Chile by Kevan J. R. Ford, Chris A. FlemingFerudun AkyolNessuna valutazione finora

- Vdocument - in - Hanking Molore Smelter Plant Project Lisbonrev1Documento25 pagineVdocument - in - Hanking Molore Smelter Plant Project Lisbonrev1Aman EgaNessuna valutazione finora

- Pt. Jayeon SejahteraDocumento52 paginePt. Jayeon SejahteraTrends Property100% (1)

- Iron OreDocumento15 pagineIron Orevinkumar_hbtiNessuna valutazione finora

- Understanding Ferronickel Smelting From Laterites Through Computational Thermodynamics ModellingDocumento15 pagineUnderstanding Ferronickel Smelting From Laterites Through Computational Thermodynamics Modellingفردوس سليمانNessuna valutazione finora

- Metal Works Trading Company Profile SampleDocumento12 pagineMetal Works Trading Company Profile SampleAbel ZeitaNessuna valutazione finora

- Coal Outlook 2019 - Webinar Alumni Tambang ITB - Sandro H S PDFDocumento32 pagineCoal Outlook 2019 - Webinar Alumni Tambang ITB - Sandro H S PDFhipsterzNessuna valutazione finora

- HPAL Upping The PressureDocumento26 pagineHPAL Upping The PressureardiansyahhandikaNessuna valutazione finora

- Junior Copper ReportDocumento59 pagineJunior Copper Reportkaiselk100% (1)

- Report on Consulting Services for Coal Sourcing, Transportation and Handling of Power Plants in BangladeshDocumento497 pagineReport on Consulting Services for Coal Sourcing, Transportation and Handling of Power Plants in Bangladeshদেওয়ানসাহেবNessuna valutazione finora

- IsaMill Carbon Presentation BHPB Nov 07Documento56 pagineIsaMill Carbon Presentation BHPB Nov 07Manuel Leiva CerdaNessuna valutazione finora

- AP Newsletter 2015Documento20 pagineAP Newsletter 2015Prasanta MaityNessuna valutazione finora

- Compro PPA 2023Documento20 pagineCompro PPA 2023imaharNessuna valutazione finora

- Sukses Berkarir Di Industri TambangDocumento32 pagineSukses Berkarir Di Industri TambangFaishol UmarNessuna valutazione finora

- Secondary Sources of Non-Ferrous MetalsDocumento35 pagineSecondary Sources of Non-Ferrous MetalsNitinSrivastava100% (1)

- Australian Mienral Resources - 2013 - Geoscience AustraliaDocumento184 pagineAustralian Mienral Resources - 2013 - Geoscience Australiamsh0004Nessuna valutazione finora

- Britmindogroupcompanyprofile PDFDocumento20 pagineBritmindogroupcompanyprofile PDFSatia Aji PamungkasNessuna valutazione finora

- SilicaDocumento29 pagineSilicaClintJanSumalpongNessuna valutazione finora

- SIS Company Profile 2011Documento28 pagineSIS Company Profile 2011RzAnzoel GlbaNessuna valutazione finora

- UNCTAD Report Analyzes 2008-2010 Iron Ore MarketDocumento99 pagineUNCTAD Report Analyzes 2008-2010 Iron Ore MarketppmusNessuna valutazione finora

- Coal Handling OperationalDocumento12 pagineCoal Handling Operationalmugiraharjo7Nessuna valutazione finora

- FS Rkef 02Documento123 pagineFS Rkef 02فردوس سليمانNessuna valutazione finora

- BHP vs. Rio TintoDocumento54 pagineBHP vs. Rio Tintoeholmes80100% (2)

- 279-286 RhodesDocumento8 pagine279-286 Rhodes约翰Nessuna valutazione finora

- Sponge Iron ManufacturingDocumento14 pagineSponge Iron Manufacturingapi-2604165367% (3)

- Khagendra Kumar Dewangan 13119040 Mechanical Engineering (NITRR) BSP Sem. 2014/2015Documento22 pagineKhagendra Kumar Dewangan 13119040 Mechanical Engineering (NITRR) BSP Sem. 2014/2015manish raiNessuna valutazione finora

- 000-A-Ee-0190469 Rev1 Painting Repair ProcedureDocumento16 pagine000-A-Ee-0190469 Rev1 Painting Repair Procedureonur gunes100% (1)

- OPM National Bicycle Company D1 Section 1Documento19 pagineOPM National Bicycle Company D1 Section 1Tony JosephNessuna valutazione finora

- Bluestar AHUDocumento88 pagineBluestar AHUDhirendra Singh Rathore50% (6)

- Tata MotorsDocumento41 pagineTata MotorsAnu Srivastava0% (1)

- Analysis of Short Run Cost of ProductionDocumento12 pagineAnalysis of Short Run Cost of ProductionPrince KumarNessuna valutazione finora

- Shot Peenning and Grit Blasting Effect On Surface Integrity PDFDocumento6 pagineShot Peenning and Grit Blasting Effect On Surface Integrity PDFmanuNessuna valutazione finora

- CV Eng. Issam JABER - PMDocumento6 pagineCV Eng. Issam JABER - PMissamjaberNessuna valutazione finora

- Assigenment QuestionsDocumento4 pagineAssigenment Questionsphase_shekhar21Nessuna valutazione finora

- Inventory Control ModelsDocumento20 pagineInventory Control ModelsAdner Cabalo100% (1)

- Myford ML7 Lubrication ChartDocumento6 pagineMyford ML7 Lubrication Chartjimxxx100% (3)

- Microsoft PowerPoint - Deloro Stellite Intro HistoryDocumento42 pagineMicrosoft PowerPoint - Deloro Stellite Intro HistorytakemetovikasNessuna valutazione finora

- Mandar Patil ResumeDocumento1 paginaMandar Patil ResumeSurajit GoswamiNessuna valutazione finora

- Methanol To Gasoline - ExxonMobil EnglishDocumento17 pagineMethanol To Gasoline - ExxonMobil EnglishilhancatakNessuna valutazione finora

- Motorized Pulley GB OKDocumento104 pagineMotorized Pulley GB OKhareudangNessuna valutazione finora

- Metal Forming Processes: Extrusion and Drawing GuideDocumento43 pagineMetal Forming Processes: Extrusion and Drawing GuideSreekumar RajendrababuNessuna valutazione finora

- PEST Analysis Ceramics Industry in PakistanDocumento2 paginePEST Analysis Ceramics Industry in PakistanabubakarNessuna valutazione finora

- Silicone MoldingDocumento6 pagineSilicone Moldingkats2404Nessuna valutazione finora

- Is 6598 - 1972 Specification For Cellular Concrete For Thermal InsulationDocumento12 pagineIs 6598 - 1972 Specification For Cellular Concrete For Thermal InsulationPrapa KaranNessuna valutazione finora

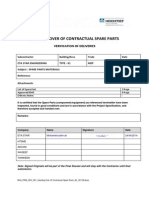

- Spare Parts T01 Electrical Fourth SubmissionDocumento12 pagineSpare Parts T01 Electrical Fourth SubmissionSeyed IbrahimNessuna valutazione finora

- SIA 9 CompositesDocumento0 pagineSIA 9 Compositesjohnj_ramirezNessuna valutazione finora

- Logistics TerminologyDocumento11 pagineLogistics TerminologypatilshashiNessuna valutazione finora

- 2.2.3.1 Buildex® Screw Fasteners: 2.2.3.1.1 Fastener Assembly and DesignationDocumento11 pagine2.2.3.1 Buildex® Screw Fasteners: 2.2.3.1.1 Fastener Assembly and DesignationJoseph BookerNessuna valutazione finora

- Technical Appraisal of An Industrial ProjectDocumento8 pagineTechnical Appraisal of An Industrial ProjectVivek SavaliyaNessuna valutazione finora

- Precise Universal Lathe TC600Documento12 paginePrecise Universal Lathe TC600Salar SalahiNessuna valutazione finora

- Rust Mill Scale and Other Surface Contaminants - ETN-M-5-14 CRSIDocumento8 pagineRust Mill Scale and Other Surface Contaminants - ETN-M-5-14 CRSISayed Diab AlsayedNessuna valutazione finora

- Barlow Formula - Tube Burst PressureDocumento2 pagineBarlow Formula - Tube Burst Pressureshinojbaby4148Nessuna valutazione finora

- 2008 Municipal Ordinance 07Documento50 pagine2008 Municipal Ordinance 07Ernan Baldomero100% (1)

- ASA LI941 Injection Molding Grade for Automotive Radiator GrillsDocumento2 pagineASA LI941 Injection Molding Grade for Automotive Radiator Grillsjitendertalwar1603Nessuna valutazione finora

- Operation and Maintenance DamperDocumento4 pagineOperation and Maintenance DamperBharatsinh ChauhanNessuna valutazione finora

- 5s, Sixsigma, TPM, PQM, Pert Etc.Documento17 pagine5s, Sixsigma, TPM, PQM, Pert Etc.manpreetsodhi08Nessuna valutazione finora