Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

All About Cholesky Matrix

Caricato da

MarioImprontaDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

All About Cholesky Matrix

Caricato da

MarioImprontaCopyright:

Formati disponibili

25/3/2011

Risk Latte - All About the Cholesky Ma

Meet the CFE Community on Facebook

Home Articles Videos Blogs Quizzes Case Studies Library Interviews Education CFE

risklatte.com//PT_12.php

1/6

25/3/2011

Risk Latte - All About the Cholesky Ma

Risk Latte All About the Cholesky Matrix

risklatte.com//PT_12.php 2/6

25/3/2011

Risk Latte - All About the Cholesky Ma

Team Latte Aug 09, 2005

More From Articles Installment Warrant Valuation using Gaussian Quadrature Methods From Stochastic Variance to Stochastic Volatility - Another look at the Heston's Process Laplace Transforms and the Time Value of Money - I Levy Processes for valuation of Equity & FX Derivatives - Explaining the fat tails

Quantitative Finance FE Problem Sets Does it Matter Financial Derivatives Portfolio Analysis Features The Brave Economist On A Tangent Exotics The Analyst Simply Complex Brownian Motion In almost all of our training programmes where we have used Monte Carlo simulation technique to either price a multi asset product or a structure or do a value at risk (VaR) analysis, we have been quizzed extensively by our trainees on the concept of Cholesky matrix.

Cholesky decomposition method is a important technique for carrying out Monte Carlo simulation on assets and risk factors and it is certainly far easier to implement - in an code (Excel/VBA, C++, etc.) as well as to understand mathematically. It is certainly easier to understand (at least we feel so) than say, eigenvalues and eigenvectors analysis which is another way of doing Monte Carlo simulation.

risklatte.com//PT_12.php 3/6

25/3/2011

Risk Latte - All About the Cholesky Ma

In one of our training session, a trainee, with a formal mathematics and physics background challenged the cholesky decomposition method and instead wanted us to go the PCA (eigenvalues & eigenvectors) route for simulating a family of risk factors. We complied with him and carried out the MC simulation schedule using PCA. Afterwards, we used cholesky method as well - using the real life correlations and volatilities in the variance-covariance matrix - and compared the results. The results were more or less same and it took far less time to implement a cholesky decomposition than it took us to do the PCA (using Jacobi method to find the eigenvalues and eigenvectors). But what was more important was that other trainees from the same group, with lesser or no formal mathematics background, appreciated the Cholesky method more. It was far more intuitive!

So, what is this Cholesky matrix?

A cholesky is a matrix A such that A times its transpose is equal to the variance covariance matrix. Or more formally, if is the variance covariance matrix then cholesky matrix A, by construction is:

AAT =

Finding the elements of A is simple matrix algebra and is almost trivial if A is say, a 2 X 2 or 3 X 3 in dimension. Even for higher dimensions, say a 10 X 10 or a 50 X 50, A can be easily estimated by writing a simple code in VBA.

The problem is that most finance textbooks, including the good ones, delve too much into the algebraic decomposition of A (cholesky matrix) and relate it to the stochastic processes for the assets (or risk factors). This, to some, at least the ones who are not mathematically motivated, makes cholesky a mental block.

That needn't be the case. We believe that if you cannot intuitive understand a mathematical concept then it is pointless to apply it to a model and simply get some results.

If you look at the above simple mathematical equation, you will see that, in matrix notation, Cholesky matrix, A, is simply a square root matrix. It is the square root matrix of the VCV (variance covariance) matrix . This is the intuitive explanation of Cholesky matrix. In a single asset (or a single risk factor) case, the formal as well as workable measure of risk is the volatility and not the variance of the asset. It is the volatility that goes as an input in the fundamental stochastic equation for an asset (along with the mean, but the mean is not a risk measure and under random walk scenario the mean drops out of the stochastic price equation).

risklatte.com//PT_12.php

4/6

25/3/2011

Risk Latte - All About the Cholesky Ma

Volatility is the sole and fundamental measure of risk of an asset (or a risk factor). For the two or more asset case, variance of an asset is replaced by the variance-covariance matrix (VCV). But since VCV contains the square terms, a square root (matrix) needs to be calculated for VCV so that the measure of risk is standardized just like the single asset case.

This square root matrix is the Cholesky matrix.

Disclaimer "Risk Latte uses proprietary and non-proprietary mathematical and empirical models to measure the volatility and estimate the direction of the market. There is no guarantee of any particular outcome happening and readers must exercise caution while interpreting the conclusions of this article. Risk Latte Company is not a registered stock broker or an SFC registered entity and readers must take advise from their financial advisors, stock brokers, research analysts and bankers while making any buying or selling decisions. Risk Latte Company is not in the business of making stock or asset forecasts whether explicitly or implicitly and shall not be responsible for and/or liable for any losses arising out of any trading decisions based on the above article."

Any comments and queries can be sent through our web-based form.

More On Portfolio Analysis >>

back to top

Contact Us / About Us / Terms of Use / Privacy Policy / Feedback / Advertising / Site Map

risklatte.com//PT_12.php

5/6

25/3/2011

Risk Latte - All About the Cholesky Ma

Copyright 2002-2010 Risk Latte Company Limited. All Rights Reserved

risklatte.com//PT_12.php

6/6

Potrebbero piacerti anche

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

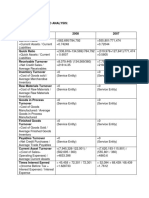

- Ratio Analysis Comparison Liberty Medical GroupDocumento3 pagineRatio Analysis Comparison Liberty Medical GroupAprile AnonuevoNessuna valutazione finora

- Risk Return Analysis of InvestmentDocumento3 pagineRisk Return Analysis of InvestmentAnju PrakashNessuna valutazione finora

- Differential Voting Rights ExplainedDocumento20 pagineDifferential Voting Rights ExplainedRohit Sharma100% (1)

- FIN-469 Investments Analysis Practice Set SolutionsDocumento7 pagineFIN-469 Investments Analysis Practice Set SolutionsGilbert Ansah YirenkyiNessuna valutazione finora

- FS For SKDocumento53 pagineFS For SKRaymond S. PacaldoNessuna valutazione finora

- Training ExercisesDocumento4 pagineTraining ExercisesnyNessuna valutazione finora

- Markets With Frictions: Banks: Guido MenzioDocumento36 pagineMarkets With Frictions: Banks: Guido MenzioDaniel GavidiaNessuna valutazione finora

- Long QuestionsDocumento18 pagineLong Questionssaqlainra50% (2)

- F&N StrengthDocumento232 pagineF&N StrengthMat ProNessuna valutazione finora

- Prudential Financial and Asset Liability ManagementDocumento13 paginePrudential Financial and Asset Liability ManagementYash Agarwal0% (2)

- PSABDocumento3 paginePSABHotman JeffersonNessuna valutazione finora

- Interloop LimitedDocumento7 pagineInterloop LimitedHamza SiddiquiNessuna valutazione finora

- Dr. SchekterDocumento5 pagineDr. SchekterRaja Shaban Qamer Mukhlis100% (1)

- FRP FinalDocumento88 pagineFRP Finalgeeta44Nessuna valutazione finora

- Financing Methods in Professional Football: Dr. Zoltán Imre NagyDocumento19 pagineFinancing Methods in Professional Football: Dr. Zoltán Imre NagyaldywsNessuna valutazione finora

- Interim Order in The Matter of Real Vision International Limited.Documento13 pagineInterim Order in The Matter of Real Vision International Limited.Shyam SunderNessuna valutazione finora

- Introduction To Finance 1Documento11 pagineIntroduction To Finance 1skrzakNessuna valutazione finora

- What Are The Stocks You Have in Your Long Term Portfolio - QuoraDocumento3 pagineWhat Are The Stocks You Have in Your Long Term Portfolio - QuoraAchint KumarNessuna valutazione finora

- A Students Guide To Group Accounts PDFDocumento15 pagineA Students Guide To Group Accounts PDFSyed Ahmad100% (1)

- Financialreportingdevelopments Bb2634 Equitymethodinvestments 15october2013Documento150 pagineFinancialreportingdevelopments Bb2634 Equitymethodinvestments 15october2013tieuquan42Nessuna valutazione finora

- Yell FinalDocumento10 pagineYell Finalbumz1234100% (2)

- Derivatives Interview QuestionsDocumento14 pagineDerivatives Interview Questionsanil100% (3)

- Financial Management - PPT - 2011Documento183 pagineFinancial Management - PPT - 2011ashpika100% (1)

- Exchange Traded Funds: There Are Safer Ways To Invest in Stocks Rebounding Up From LowsDocumento1 paginaExchange Traded Funds: There Are Safer Ways To Invest in Stocks Rebounding Up From LowsRajeshbhai vaghaniNessuna valutazione finora

- 4 5917794287629633159Documento44 pagine4 5917794287629633159alexbemuNessuna valutazione finora

- Bonus Assignment 2Documento4 pagineBonus Assignment 2Zain Zulfiqar67% (3)

- Brigade Enterprises LimitedDocumento36 pagineBrigade Enterprises LimitedAnkur MittalNessuna valutazione finora

- Error RecognitionDocumento9 pagineError RecognitionRisa Nanda YusarNessuna valutazione finora

- LN10 Titman 479536 Valuation 03 LN10Documento48 pagineLN10 Titman 479536 Valuation 03 LN10Sta Ker100% (1)