Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

CRM Data

Caricato da

Mishal TahirDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

CRM Data

Caricato da

Mishal TahirCopyright:

Formati disponibili

Importance of CRM Customer relationship management is a broad approach for creating, maintaining and expanding customer relationships.

CRM is the business strategy that aims to understand, anticipate, manage and personalize the needs of an organizations current and potential customers. At the heart of a perfect strategy is the creation of mutual value for all parties involved in the business process. It is about creating a sustainable competitive advantage by being the best at understanding, communicating, and delivering and developing existing customer relationships in addition to creating and keeping new customers. So the concept of product life cycle is giving way to the concept of customer life cycle focusing on the development of products and services that anticipate the future need of the existing customers and creating additional services that extend existing customer relationships beyond transactions. Present and Future of CRM in banking Bank merely an organization it accepts deposits and lends money to the needy persons, but banking is the process associated with the activities of banks. It includes issuance of cheque and cards, monthly statements, timely announcement of new services, helping the customers to avail online and mobile banking etc. Huge growth of customer relationship management is predicted in the banking sector over the next few years. Banks are aiming to increase customer profitability with any customer retention. This paper deals with the role of CRM in banking sector and the need for it is to increase customer value by using some analytical methods in CRM applications. It is a sound business strategy to identify the banks most profitable customers and prospects, and devotes time and attention to expanding account relationships with those customers through individualized marketing, pricing, discretionary decision making. In banking sector, relationship management could be defined as having and acting upon deeper knowledge about the customer, ensure that the customer such as how to fund the customer, get to know the customer, keep in tough with the customer, ensure that the customer gets what he wishes from service provider and understand when they are not satisfied and might leave the service provider and act accordingly. CRM in banking industry entirely different from other sectors, because banking industry purely related to financial services, which needs to create the trust among the people. Establishing customer care support during on and off official hours, making timely information about interest payments, maturity of time deposit, issuing credit and debit cum ATM card, creating awareness regarding online and e-banking,

adopting mobile request etc are required to keep regular relationship with customers. The present day CRM includes developing customer base. The bank has to pay adequate attention to increase customer base by all means, it is possible if the performance is at satisfactory level, the existing clients can recommend others to have banking connection with the bank he is operating. Hence asking reference from the existing customers can develop their client base. If the base increased, the profitability is also increase. Hence the bank has to implement lot of innovative CRM to capture and retain the customers. There is a shift from bank centric activities to customer centric activities are opted. The private sector banks in India deployed much innovative strategies to attract new customers and to retain existing customers. CRM in banking sector is still in evolutionary stage, it is the time for taking ideas from customers to enrich its service. The use of CRM in banking has gained importance with the aggressive strategies for customer acquisition and retention being employed by the bank in todays competitive milieu. This has resulted in the adoption of various CRM initiatives by these banks. Steps to follow The following steps minimize the work regarding adoption of CRM strategy. These are: Identification of proper CRM initiatives Implementing adequate technologies in order to assist CRM initiative Setting standards (targets) for each initiative and each person involved in that circle Evaluating actual performance with the standard or benchmark Taking corrective actions to improve deviations, if any Conclusion Customer Relationship Management is concerned with attracting, maintaining and enhancing customer relationship in multi service organizations. CRM goes beyond the transactional exchange and enables the marketer to estimate the customers sentiments and buying intentions so that the customer can be provided with products and services before the starts demanding. Customers are the backbone of any kind of business activities, maintaining relationship with them yield better result

INCORPORATING CUSTOMER RELATIONSHIP MANAGEMENT The effective use of CRM principles requires a three-pronged approach. First, all CRM efforts should begin with a well-defined strategy. Second, an infrastructure must be developed to achieve appropriate objectives. Specifically, the infrastructure should align product and sales goals to meet customer needs, according to their preferences, in the most cost-efficient manner. Third, continuous analytic intelligence should be used to determine and modify customer interaction. In addition to the above approach, implementing CRM involves collecting and reviewing the most relevant customer data. Relevant customer data can uncover needed information about behavior patterns and attitudes. Once identified, the customer data should be incorporated into the infrastructure so that effective marketing plans can be developed. The execution of marketing plans is driven both by analytic insights obtained about customers and by any existing marketing communication plans. These drivers can be used to place customers in pre-identified groups or to support triggers and scores that identify specific individual behavior patterns. After appropriate customer data analysis and marketing plan development is complete, the multi-channel customer contact strategies can be implemented within the CRM technology infrastructure. CUSTOMER RELATIONSHIP MANAGEMENT COMPONENTS There is an evolutionary approach to CRM that focuses heavily on customer equity assets management. This approach begins with business strategy development. Next, a data infrastructure is created that supports customer interactions. Then, a technology infrastructure is designed to produce CRM results. Finally, customer communication channel strategies are created, and strategy execution technology is used to create an on-going dialog with the customers.

http://www2.sas.com/proceedings/sugi29/180-29.pdf

CRM Design 4 Company Analysis Step 1: Define the existing customer relationship management processes within the company Step 2: Determine the perceptions of how the company manages their customer relationships both internally and externally Step 3: Design the ideal customer relationship management solutions relative to the company or industry Step 4: Deliver a strategy for the implementation of the recommendations based on the findings

Strategic frame work for CRM "Power and choice are moving to the customer as never before and leading to the commoditisation of products and services in most situations. In this environment, product quality and features are a given, and in many industries are now so undifferentiated as to provide no significant competitive advantage. As a company, you must choose whether to compete on the basis of price in a cutthroat commodity market, or on the basis of customer relationships created through a superior value proposition." This paper proposes a framework from which a CRM strategy can be developed or analysed from a business perspective. The framework highlights the linkages between specific CRM initiatives and desired outcomes. It shows, at a high level, how CRM can contribute to increased revenues, decreased costs, and ultimately to increased profits Companies and brands are supremely successful with customers to the extant that they implement these 10 strategic steps. 1. investment: investment according to customer value 2. relationship : optimize the whole customer relationship 3. reputation : be trustworthy in ethics and brand values 4. relevance : service each customer community 5. value : create enduring value first,tactical worth second 6. touchpoints : manage the relationship at all appropriate touchpoints 7. imagination : bring imagination to the customer experience 8. learning : measure and learn 9. technology : use technology like an artist 10.stakeholders: make it good for everyone

http://www.mycustomer.com/files/siftmedia-mycustomer/idm-009.pdf

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Managing Time Space VisibilityDocumento19 pagineManaging Time Space VisibilityJeffrie Nagara NasutionNessuna valutazione finora

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- QC Daily Technician (QCDT) - PT Lotte Chemical Titan NusantaraDocumento3 pagineQC Daily Technician (QCDT) - PT Lotte Chemical Titan NusantaraDjaloel KhairNessuna valutazione finora

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Islamic Perspectives On LeadershipDocumento15 pagineIslamic Perspectives On LeadershipKasimRanderee100% (1)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- CS Executive Virtual Classes in India by Amit Vohra ClassesDocumento11 pagineCS Executive Virtual Classes in India by Amit Vohra ClassesAmit Vohra ClassesNessuna valutazione finora

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- 2 Upfront and Straightforward Let The Manipulative Game Players Know What You're Really Thinking (PDFDrive)Documento161 pagine2 Upfront and Straightforward Let The Manipulative Game Players Know What You're Really Thinking (PDFDrive)Costin Davidescu33% (3)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- A Doll's House Essay - To What Extent Can The Meaning of A Literary Work Change Over Time?Documento3 pagineA Doll's House Essay - To What Extent Can The Meaning of A Literary Work Change Over Time?chainanimohit100% (1)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Charlotte CV FinalDocumento1 paginaCharlotte CV Finalapi-366863864Nessuna valutazione finora

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Graduation Welcome SpeechDocumento5 pagineGraduation Welcome SpeechJohna Mae Dolar EtangNessuna valutazione finora

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- American Revolution UBD Group 4Documento1 paginaAmerican Revolution UBD Group 4ericslaughter3679Nessuna valutazione finora

- Hope For TransgressorsDocumento6 pagineHope For TransgressorsPizzaCow100% (1)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Cripple of InishmaanDocumento2 pagineThe Cripple of InishmaanDokania Anish0% (2)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Module 4.3 - Joyce TravelbeeDocumento2 pagineModule 4.3 - Joyce Travelbeeidk lolNessuna valutazione finora

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Survival Mentality - The Psychol - Nancy ZarseDocumento91 pagineSurvival Mentality - The Psychol - Nancy ZarseSyed Amir IqbalNessuna valutazione finora

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Freedom and Moral ActDocumento53 pagineFreedom and Moral ActLyra LasangreNessuna valutazione finora

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Components of HRDDocumento5 pagineComponents of HRDKrishna Chaitanya50% (2)

- Establishing A Realtionship: By: Wahyuny Langelo, M.KesDocumento16 pagineEstablishing A Realtionship: By: Wahyuny Langelo, M.KesUthamy LestariNessuna valutazione finora

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- THESISDocumento28 pagineTHESISMilbert Loyloy SalmasanNessuna valutazione finora

- General EthicsDocumento16 pagineGeneral EthicsVincent Quiña PigaNessuna valutazione finora

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Subroto Bagchi 2Documento11 pagineSubroto Bagchi 2wonhowenee8Nessuna valutazione finora

- 02 S Haack Descriptive and Revisionary Metaphysics PDFDocumento5 pagine02 S Haack Descriptive and Revisionary Metaphysics PDFDamian IonutNessuna valutazione finora

- Two Conceptions of Vacuum SedleyDocumento20 pagineTwo Conceptions of Vacuum SedleylicenciaturafilosofiaunilaNessuna valutazione finora

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Self LoveDocumento19 pagineSelf LoveRian Kusuma Dewi100% (2)

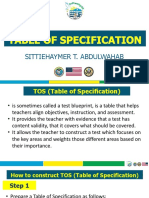

- Sittiehaymer T. AbdulwahabDocumento17 pagineSittiehaymer T. AbdulwahabHymerNessuna valutazione finora

- Problem SolvingDocumento24 pagineProblem SolvingGeorge MathewNessuna valutazione finora

- Face Reading Day 1 HandoutsDocumento10 pagineFace Reading Day 1 HandoutsDaniel Rumana100% (3)

- Academic Microcultures and Student IdentityDocumento8 pagineAcademic Microcultures and Student IdentityGerardo LealNessuna valutazione finora

- Of Mice and Men Unit Plan - Emma DeutschDocumento23 pagineOf Mice and Men Unit Plan - Emma Deutschapi-489797546Nessuna valutazione finora

- Intern Buddy QuestionnaireDocumento3 pagineIntern Buddy QuestionnaireWismoyo Nugraha PutraNessuna valutazione finora

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- pp2 ReflectionDocumento3 paginepp2 Reflectionapi-357661397Nessuna valutazione finora

- Slide-Ology Chapter 04 - Displaying Data PDFDocumento18 pagineSlide-Ology Chapter 04 - Displaying Data PDFEstefany Rey BecerraNessuna valutazione finora

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)