Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

P1 - Corporate Reporting April 11

Caricato da

Abdurrazaq PanhwarDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

P1 - Corporate Reporting April 11

Caricato da

Abdurrazaq PanhwarCopyright:

Formati disponibili

PROFESSIONAL 1 EXAMINATION - APRIL 2011

You are required to answer Questions 1, 2 and 3. You are also required to answer either Question 4 or 5. (If you provide answers to both Questions 4 and 5, you must draw a clearly distinguishable line through the answer not to be marked. Otherwise, only the first answer to hand for Questions 4 or 5 will be marked.) Note: Students have optional use of the Extended Trial Balance, which if used, must be included in the answer booklet.

CORPORATE REPORTING

NOTES:

PRO-FORMA STATEMENT OF COMPREHENSIVE INCOME BY NATURE, STATEMENT OF COMPREHENSIVE INCOME BY FUNCTION AND STATEMENT OF FINANCIAL POSITION ARE PROVIDED.

TIME ALLOWED: INSTRUCTIONS:

3.5 hours, plus 10 minutes to read the paper. During the reading time you may write notes on the examination paper but you may not commence writing in your answer book. Please read each Question carefully. Marks for each question are shown. The pass mark required is 50% in total over the whole paper. Start your answer to each question on a new page.

You are reminded that candidates are expected to pay particular attention to their communication skills and care must be taken regarding the format and literacy of the solutions. The marking system will take into account the content of the candidates' answers and the extent to which answers are supported with relevant legislation, case law or examples where appropriate. List on the cover of each answer booklet, in the space provided, the number of each question(s) attempted.

The Institute of Certified Public Accountants in Ireland, 17 Harcourt Street, Dublin 2.

THE INSTITUTE OF CERTIFIED PUBLIC ACCOUNTANTS IN IRELAND

CORPORATE REPORTING

PROFESSIONAL 1 EXAMINATION APRIL 2011

Time allowed 3.5 hours, plus 10 minutes to read the paper. You are required to answer Questions 1, 2 and 3. You are also required to answer either Question 4 or 5. (If you provide answers to both Questions 4 and 5, you must draw a clearly distinguishable line through the answer not to be marked. Otherwise, only the first answer to hand for Questions 4 or 5 will be marked.)

1.

Muscle PLC, an Irish listed company, acquired 24 million ordinary shares in Oyster Ltd on 1 January 2010. Details of the purchase consideration are as follows: (i) (ii) (iii)

You are required to answer Questions 1, 2 and 3.

Based on Muscle PLCs cost of capital at 1 January 2010, 1 received in 2012 can be taken to have a present value of 0.80 (taken as 12% cost of capital per annum). Muscle PLC has only recorded the cash payment made at date of acquisition. The Draft Statements of Financial Position of the two companies at 31 December 2010 are shown below: m Muscle PLC m 242 45 10 297 51 348 200 25 25 250 60 m Oyster Ltd

A share exchange of two shares in Muscle PLC for three shares in Oyster Ltd. The market price of Muscle PLCs shares at 1 January 2010 was 2 per share. A cash payment at the date of acquisition of 10 million. A cash payment of 12 million payable on 1 January 2012.

Current liabilities Trade payables Taxation Total Equity and Liabilities

Non-current liabilities 12% loan note

Equity and Liabilities Equity Ordinary shares of 1 each Share premium Retained earnings

Current assets Inventory Trade receivables Bank Total assets

Non-current assets Property, plant and equipment Intangibles (note 3) Investment in Oyster Ltd

m 54 10 64

19 24 8

24 20 12

56 120 30 10 5 45

40 21 14 35 120

18 20

38 348

Page 1

1.

The following information is relevant:

2.

The profit after tax of Muscle PLC and Oyster Ltd for the year to 31 December 2010 were 10 million and 4 million respectively. Muscle PLC have a policy of revaluing property to fair value. At the date of acquisition, Oyster Ltds property had a fair value of 6 million higher than the book value. Additional depreciation of 500,000 needs to be recognised in the post-acquisition period. The fair value has not been reflected in the Oyster Ltds Statement of Financial Position.

3. 4. 5. 6. 7.

Included in Oyster Ltds intangibles is a development project with a capitalised cost of 3 million. Muscle PLCs Directors are of the opinion that this development project, at 31 December 2010, does not meet the criteria set out in IAS 38 Intangible Assets for recognition as an asset. Oyster Ltd sold goods to Muscle PLC during the year totalling 4m. One quarter of these goods are still in the inventory of Muscle PLC at 31 December 2010. Goods are sold at cost plus one third. A cheque for 2m from Muscle PLC sent to Oyster Ltd before the end of the financial year was not received until January 2011.

Muscle PLCs policy is to value the non-controlling interest using fair value at the date of acquisition. The market price of Oyster Ltds shares at the date of acquisition was 1. Year 1 - 0.8929 Year 2 - 0.7972 12% Present Value Factor:

REQUIREMENT: (a)

(b) (c)

Prepare the Consolidated Statement of Financial Position of the Muscle Group as at 31 December 2010. (19 marks) Presentation (1 mark)

Explain the treatment of a gain on a bargain purchase under IFRS 3 (revised) Business Combinations. (4 marks) Lobster PLC operates in the same market as Muscle PLC and holds the following investments: (i) 6,000 of the 20,000 1 ordinary shares in Shrimp Ltd. These were recently acquired, as the Directors of Lobster PLC believe that Shrimp Ltd has excellent growth prospects for the future. However, the market in which Shrimp Ltd operates is very small and specialised and, therefore, Lobster PLC has decided not to take part in the running of Shrimp Ltd. Lobster PLC intends to hold its shares for a couple of years but not to influence the board in any way.

(ii)

Discuss the nature of each of the above holdings and state the method of accounting that should be used in the group accounts of Lobster PLC under IAS 27 Consolidated and Separate Financial Statements and IAS 28 Investments in Associates. (6 marks) [Total: 30 MARKS]

8,500 of the 20,000 1 ordinary shares in Prawn Ltd, a manufacturing company with nine Directors on the Board, five of whom have been appointed by Lobster PLC. 4,000 of the remaining shares are held by Clam Ltd. Lobster PLC is a major supplier to Clam Ltd and the Board of Directors of Clam Ltd have agreed to vote with Lobster PLC on all matters concerning Prawn Ltd.

Page 2

2.

After closing off the ledger accounts for the year ended 31 December 2010, the following balances were extracted from the nominal ledger of Peter Ltd. Dr Cr 000 000 Land at valuation 4,200 Buildings at cost 6,300 Equipment at cost 1,400 Accumulated depreciation at 1 January 2010 on: Buildings 1,900 Equipment 430 Inventory 1 January 2010 2,100 Investment property valuation at 1 January 2010 10,000 Trade receivables 830 Trade payables 612 Other receivables 64 Income tax 10 Deferred taxation 12 8% loan stock (redeemable 2018) 890 Revenue 14,600 Purchases 4,193 Wages and salaries 90 Administrative expenses 42 Selling and distribution expenses 32 Operating expenses 140 Allowance for doubtful debts 70 Grants 5 Bank 622 Warranties - 1 January 2010 20 Interest paid 18 Investment income 60 Preference share capital -7% irredeemable 1 shares 300 Ordinary share capital 10,000 Revaluation reserve 690 Retained earnings 1 January 2010 452 30,041 30,041

The following notes are relevant: 1.

2. 3.

Buildings are to be depreciated over the next 50 years. At 1 January 2010 they were revalued to 5 million. This has not been reflected to date in the balances above. Depreciation is to be charged at 30% to administration expenses and 70% to cost of sales. Peter Ltd adopts a fair value method for its investment property. Its value at 31 December 2010 has been assessed by a quantity surveyor at 11m.

4. 5.

The loan stock was issued on 1 July 2010. Interest is payable half-yearly on 30 September and 31 March. The interest payable on 30 September 2010 was paid on the due date. Accrued interest at 31 December 2010 has not yet been accounted for.

The estimated income tax liability for the year ended 31 December 2010 is 82,000.

Equipment is depreciated at 15% on the reducing balance basis. Depreciation is to be charged to cost of sales. Included in the above figures is an item of equipment that was disposed of on 1 July 2010 for 20,000 and which had a cost of 75,000 on 1 January 2008. A government grant was received on its purchase and was being recognised in the Statement of Comprehensive Income in equal amounts over four years. In accordance with the terms of the grant, Peter Ltd is to repay 3,000 of the grant on the disposal of the equipment. No record of the disposal or repayment of part of the grant has been made to date. A full years depreciation is to be charged in the year of acquisition and none in the year of disposal.

Page 3

6. 7. 8. 9. 10. 11. (a)

Peter Ltd provides a two year warranty on all its products. The balance on the warranties account represents the provision for future warranty costs as estimated at 1 January 2010. The balance as at 31 December 2010 should be increased to 28,000.

Inventories held at 31 December 2010 are valued at a cost of 790,000. This includes 50,000 of Product A which has been discontinued due to lack of demand. The expected realisable value of Product A is 19,000. Included within operating expenses is 25,000 that the company spent on exhibiting its product range at a major trade fair in London in June 2010. No orders have been received as a result of the fair, although the Sales Director has argued that attendance at this particular fair will generate sales over the next three years.

Peter Ltds revenue includes 1.2m of revenue for credit sales on a sale or return basis at 31 December 2010. Customers, who had not paid for the goods at the year end, have the right to return goods costing 400,000. Mark up on cost is 25%. In the past, customers have sometimes returned goods under this type of arrangement. Peter Ltd is to make an allowance for doubtful debts amounting to 8% of year-end receivables. On 19 January 2011 the company received notification that one of its customers, owing 85,000 at 31 December 2010, had gone into receivership and would only realise twenty cents per euro on outstanding balances. Provision has not yet been made for the preference dividend.

REQUIREMENT:

(b)

Prepare Peter Ltds Statement of Comprehensive Income for the year ended 31 December 2010 and a Statement of Financial Position as at that date. Your answer should be presented in accordance with IAS1 (revised) Presentation of Financial Statements. (Notes to the financial statements are not required but you should show any workings). (21 marks) (1 mark presentation) Explain, and justify, your accounting treatment in relation to items 6, 8 and 9 above. [Total: 30 MARKS] (8 marks)

Page 4

3.

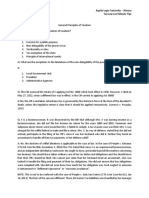

REQUIREMENT: Give your answer to each section in the answer sheet provided. 1.

The following multiple choice question contains eight sections, each of which is followed by a choice of answers. Only one of each set of answers is strictly correct. [Total: 20 MARKS]

On 1 January 2009 Star Ltd entered into a finance lease for a machine with a fair value of 140,000. Lease payments of 40,000 per annum are payable in advance for five years, starting on 1 January 2009. Star Ltd allocates finance charges on a sum-of-the-digits basis.

According to IAS 17 Leases what is Star Ltds non-current liability in respect of this finance lease as at 31 December 2010? (a) (b) (c) (d) 96,000 74,000 102,000 62,000

2.

Jonathon Ltds Statement of Comprehensive Income for the year ended 31 December 2010 showed a profit before tax of 840,000. In early 2011, before the financial statements were authorised for issue, the following events arose: (i) (ii)

(iii) (iv)

In accordance with IAS 10 Events After the Reporting Period, what is Jonathon Ltds profit for 2010 after making appropriate adjustments for the above events? (a) (b) (c) (d) 880,000 843,000 855,000 870,000

An insurance claim by Jonathon Ltd for 40,000 was agreed on 14 January 2011 for compensation for a flood in May 2010 which damaged part of the inventory. The Directors declare a dividend of 15 cents per ordinary share on 9 February 2011. Jonathon Ltd has 2m ordinary 1 shares in issue. Inventory valued at 85,000 in the Statement of Financial Position was sold for 60,000. A customer, with an outstanding balance of 12,000 was declared bankrupt.

3.

According to IAS 37 Provisions, Contingent Liabilities and Contingent Assets, which of the following statements are correct? (i) (ii) (iii) (iv)

(a) (b) (c) (d)

A legal claim for compensation filed against the business should be recognised when legal advice states that there is a high probability of a successful claim. Provisions should be made for legal obligations only. A contingent asset should be disclosed as a note, if it is probable that it will arise. A provision for restructuring assets should not include retraining costs for existing staff. All statements are correct. (i), (iii) and (iv) are correct. (i), (ii) and (iii) are correct. (i), (ii) and (iv) are correct.

Page 5

4.

Sean Ltd prepares financial statements to 31 December. At 31 December 2009, it had 200,000 8% preference shares and 800,000 1 ordinary shares in issue.

In 2009 Sean Ltds profit after tax was 300,000, and in 2010 it was 400,000. On 1 July 2010, Sean Ltd issued 200,000 1 ordinary shares at full market price. Calculate the EPS for 2010 and the corresponding figure for 2009 as per IAS 33 Earnings Per Share. (a) (b) (c) (d) 2010 42.67 cents 40.00 cents 42.67 cents 38.40 cents 2009 31.5 cents 31.5 cents 35.5 cents 35.5 cents

5.

Marian Ltd prepares financial statements to 28 February each year. There was an overprovision of 125,000 tax for the year ended 28 February 2009. During the year to 28 February 2010, 750,000 was paid in respect of tax for 2010. The tax due for the year ended 28 February 2010 is 940,000. What is the current tax expense that should be shown in the Statement of Comprehensive Income and the current tax liability to be included in the Statement of Financial Position for the year to 28 February 2010? (a) (b) (c) (d) Tax Charge 940,000 815,000 1,065,000 815,000 Liability 65,000 65,000 190,000 190,000

6.

Parkside Ltd sells three different products and you have been provided with the following information at the companys year end. Cost price of inventory Estimated selling price of inventory Further selling and distribution costs to be incurred to sell Product X 10,000 9,800 1,000 Y 6,000 8,200 600 Z 14,000 14,600 400

In accordance with IAS 2 Inventories, at what amount should inventories be stated in the Statement of Financial Position at the end of the year? (a) (b) (c) (d) 28,800 30,600 30,000 29,600

7.

Happy PLC acquired 25% of the shares of Glum Ltd several years ago and this investment has been accounted for as an associate in Happy PLCs consolidated financial statements. Both Happy PLC and Glum Ltd have an accounting year end of 31 December. Happy PLC has no other investments in any other associated companies. Glum Ltds Statement of Comprehensive Income for the year ended 31 December 2010 showed a net profit for the year of 150,000. Happy PLCs Consolidated Statement of Financial Position at 31 December 2010 recorded investments in associates of 390,000 (2009 360,000). In accordance with IAS 7 Statement of Cash Flows, what amount will be recorded as dividends received from associates in the Statement of Consolidated Cash Flows for year ended 31 December 2010? (a) (b) (c) (d) 7,500 37,500 120,000 35,500

Page 6

8.

Harpenden Ltd has a current ratio of 0.3. The Managing Director is of the opinion that this is too low and has instructed the Financial Controller to borrow more short term funds which will increase current liabilities by 50%. The loan funds are to be lodged to the companys bank account. What will happen to the current ratio of Harpenden Ltd.? (a) (b) (c) (d) It It It It will will will will be affected only in the following financial period. increase. remain unchanged. decrease.

Page 7

4.

IAS 16 Property, Plant and Equipment and IAS 40 Investment Property deals with the accounting treatment of tangible non-current assets. You have recently been appointed as the Financial Accountant of Norfolk PLC, and are currently involved in the preparation of the financial statements for the year ended 31 October 2010. You have been provided with the following information in relation to transactions relating to property, plant and equipment which took place during the year:

Answer either Question 4 or Question 5

(1)

New factory premises were completed and ready for occupation on 1 April 2010. Production was not transferred to the factory until 30 September 2010 due to an industrial dispute arising from a decision by the company to make some compulsory redundancies. Capital expenditure in relation to the new factory premises is recorded in the Statement of Financial Position for the year ended 31 October 2009 at 1.4 million (including land of 800,000). The following costs, which also relate to the new factory premises, have been incurred during the year to 31 October 2010: Additional construction costs Professional fees (legal and architects) General and administrative overheads Relocation of staff to new factory 000 104 20 55 15

(2)

On 1 April 2010, new machinery for a highly automated production line became available for use within the factory. Costs of the new machinery amounted to 620,000 and, in addition, the company also incurred the following: Allocated supervisory costs of 9,500. 25,000 was incurred in testing the new process. 10,000 of this was incurred in relation to putting on an open day for customers to view the new machinery. Installation costs of 50,000 were incurred. These were 10% higher than originally budgeted due to an unofficial strike action. Fees of 3,000 were paid to Casement Haulage for the cost of transporting the machinery to the factory.

(3)

(4)

Norfolk PLCs headquarters building was acquired on 1 November 2003 for 2.5 million and depreciated at 4% per annum. On 1 November 2007, it was revalued to 3 million. Following this revaluation, the company did not make any reserve transfers for additional depreciation. As a consequence of the recent financial downturn, professional valuers have advised that as at 31 October 2010, the building was worth 2 million.

(5) (a)

REQUIREMENT:

Norfolk PLC uses the straight line method of depreciation, and depreciates buildings at 4% per annum and machinery at 20%. The company values investment properties using the fair value model.

Norfolk PLC also has a leasehold property held under a finance lease and leased out under an operating lease. The carrying value of the property at 1 November 2009 was 2 million and during the year Norfolk PLC spent 300,000 in extending the rented floor capacity of the property. An independent valuer valued the property at 3.2 million on 31 October 2010.

(b) (c)

Comment briefly on your accounting treatment in relation to item (4) above.

Page 8

Prepare extracts from the Statement of Financial Position in relation to the above transactions as at 31 October 2010 and draft the note showing movements on property, plant and equipment for the year ending 31 October 2010 (working to the nearest 000). (14 marks) [Total: 20 MARKS] (3 marks)

Distinguish between the cost model and the revaluation model for the measurement of property, plant and equipment subsequent to its initial recognition. (3 marks)

5.

An important business issue arises when an entity closes or discontinues a part of its overall business activity. IFRS 5 Non Current Assets Held for Sale and Discontinued Operations provides guidance on the accounting treatment in such circumstances.

OR

Archway PLC, a company that prepares its financial statements to 31 December each year, manufactures light fittings which it sells to the European market. The company has three manufacturing plants based in Limerick, Dublin and Barcelona. Due to increased competition and a change in consumer buying patterns within the Spanish market, the performance of the Barcelona operation has deteriorated over the last twelve months. At a Board meeting on 14 December 2010, the Directors of Archway PLC decided, reluctantly, to cease manufacturing at the Barcelona site and sell the factory. Immediately after the meeting the staff, suppliers and key customers were notified and an announcement was made to the press. You are employed as the Financial Accountant for the company and the Managing Director has let it be known that that the Barcelona operations results should be shown as a discontinued operation in the financial statements for the year ending 31 December 2010. Due to the declining business performance of the Barcelona site on 1 October 2010, Archway PLC increased production capacity at its Limerick site. The following are the extracts from Archway PLCs Statement of Comprehensive Income: 31 December 2010 Dublin Barcelona Limerick 000 000 000 30,000 19,000 4,500 (23,500) (23,180) (3,375) 6,500 (4,180) 1,125 (1,800) (1,100) (225) 4,700 (5,280) 900 Total 000 53,500 (50,055) 3,445 (3,125) 320 31 December 2009 Total 000 61,000 (51,800) 9,200 (2,400) 6,800

Revenue Cost of sales Gross profit/(loss) Operating expenses Profit/(loss) before tax

(a)

REQUIREMENT: (b) (c)

The year ending 2009 figures for the Barcelona operation were: revenue 21.5 million, cost of sales 19 million and operating expenses of 1.5 million. Explain what is meant by a non-current asset for sale and a discontinued operation. (5 marks)

Explain whether the Managing Directors wish to show the results of the Barcelona operation as a discontinued operation is justifiable. (4 marks)

(d)

Explain how the above transaction should be treated in the financial statements for the year ending 31 December 2010. (3 marks) [Total: 20 MARKS]

On 1 October 2010 the Directors of Archway PLC decided to sell a machine, used within the Dublin operation and which was now surplus to requirements. The machine had a cost of 60,000 on 1 January 2008 and was expected to sell for 25,000. A buyer was found on 20 December 2010 at that price, although the sale was not completed until after the year end. On 1 October 2010, the machine met the held for sale criteria of IFRS 5. The company charges depreciation on plant and equipment at 20% on cost.

Assuming the Barcelona operation is to be treated as a discontinued operation, re-draft the extracts from the Statement of Comprehensive Income for the year ended 31 December 2010 (including comparatives) in accordance with the requirements of IFRS 5, and draft a suitable note relating to discontinued operations which would appear in the notes to the financial statements. (8 marks)

END OF PAPER

Page 9

SUGGESTED SOLUTIONS

THE INSTITUTE OF CERTIFIED PUBLIC ACCOUNTANTS IN IRELAND

CORPORATE REPORTING

PROFESSIONAL 1 EXAMINATION APRIL 2011

Solution 1 (a)

Consolidated statement of financial position of Muscle Group as at 31 December 2010 m m 301.50 52.00 10.60 364.10 106.75 470.85

Assets Non- current assets Tangible assets (242+54+6-.5) Development costs (45+10-3) Goodwill (3)

Current Assets Inventory (19+24 - 0.25) Accounts Receivables (24+20-2) Bank(8+12+2) Equity and Liabilities Ordinary share capital (200+16) Share premium (25+16) Retained earnings (w5) Non-controlling interest (w4)

42.75 42 22

Current Liabilities Accounts payables (18+21) Taxation (20+14) W1 Group structure Muscle

Non-current liabilities Loan stock Deferred consideration (9.60+1.1152) (w6)

100.00 10.752 39 34

216.00 41.00 24.048 281.048 6.05 287.098 110.752 73 470.85

Oyster

1 January 2010

80%

Page 10

W2

Net Assets at fair value

Fair value adjustment Land and buildings Depreciation Research and development Unrealised profit on inventory W3 Goodwill on acquisition Cost of investment Cash at acquisition Shares (24/3 * 2)*2 Cash 12 * .80

Share capital Share premium Retained earnings

At acquisition m 30 10 1 41 6 (.5) 47

At reporting period end m 30 10 5 45 (3) 6

(0.25) 47.25

m 10 32 9.6 51.60 6 57.60 47 10.60 6.0

W4

Non-controlling interest at reporting period end Fair value of non- controlling Interest NCI of post acquisition Profits (47.25 - 47) 20% Retained earnings Muscles Plc Subsidiary {(47.25 47 }* 80% Less Unwinding of Deferred consideration

Fair value of subsidiary net assets Goodwill

Non controlling interest 6m*1

W5

0.05 6.05 25

(1.152) 24.048

25.20

0.2

Dr

W6 Cr

Consolidated retained earnings 9.6*12% Deferred consideration

Unwinding of Deferred consideration

1.152 1.152

Marks are awarded for altenative methods (b)

A gain on a bargain purchase arises if the fair value of the net assets acquired exceeds the total of the consideration transferred and the value of any non-controlling interest, i.e. there is negative goodwill.

Page 11

IFRS 3 (revised) any excess of the consideration transferred plus the value of any non-controlling interest over the fair value of any net assets acquired should be described as goodwill and recognised as an asset.

(c)

Lobster holds 42.5% of the equity shares in Prawn Ltd which carry significant influence, suggesting that Prawn Ltd is an associate. However, the following indicates that Prawn Ltd is in fact a subsidiary of Lobster PLC:

Lobster PLC holds 30% of the ordinary shares in Shrimp Ltd. Under IAS 28 significant influence is deemed to exist when a holding reaches 20%; however, this can be rebutted in the light of further evidence. Lobster takes no part in the decision making of Shrimp Ltd. The holding company is purely held for its investment potential and the substance of the holding is better reflected as a trade investment. On consolidation, Lobster PLCs investment would be shown at cost as a non-current asset investment.

If the gain still remains once these reassessments have been made, then it is attributable to a bargain purchase. The gain must be recognised as part of equity via recognition within profit/loss for the period. (4 marks)

IFRS 3 (revised) is based on the assumption that this usually arises because of errors in the measurement of the acquirees net assets and or/consideration transferred. So the first action is always to reassess the identification and measurement of the net assets and the measurement of the consideration transferred, checking in particular whether the fair values of the net assets acquired correctly reflect future costs arising in respect of the acquiree.

In the absence of any evidence to the contrary, Prawn Ltd should be accounted for as a subsidiary and consolidated using the acquisition method of accounting. (6 marks) [Total: 30 Marks]

Lobster controls the board of Prawn Ltd, appointing five of the board members, and can therefore control the operating and financial decision making within the company. Furthermore, Clam Ltd has agreed to vote its 20% alongside Lobster PLC, thus giving Lobster effective voting control.

Page 12

SOLUTION 2

Revenue (14,600-400) Cost of sales Gross profit Operating expenses Distribution costs Administrative expenses Profit from operations Finance costs Investment income Grant Gain on investment Loss on disposal of equipment Profit before taxation Income tax expense Profit for the year Other comprehensive income Revaluation gain Total comprehensive income

Peter Ltd Statement of Comprehensive Income for the year ended 31 December 2010

000 14,200 (5,519.40) 8,680.60 (115) (84) (72) 8,409.60 (35.60) 60 2 1,000 (34) 9,402 (92) 9,310 600 9,910

Peter Ltd Statement of Financial Position for the year ended 31 December 2010 000

ASSETS Non-current assets Property, plant and equipment (4,200+4,900+778.60) Investment property Current assets Inventories Trade and other receivables (333+64) Bank (622-3+20)

000 9,878.60 11,000.00 20,878.60 2,115.00

1,079 397 639

Total assets EQUITY AND LIABILITIES Equity Ordinary share capital Preference share capital (irredeemable) Revaluation surplus (690+600) Retained earnings Non-current liabilities 8% loan stock Deferred tax Current liabilities Trade and other payables (612+17.6) Preference dividend payable Warranty Taxation Total equity and liabilities

22,993.60

10,000 300 1,290 9,741.00 890 12

21,331.00 902.00

629.6 21 28 82

22,993.60

760.60

Page 13

Workings Allocation of costs Cost of sales Admin/Selling Opening inventory Purchases Warranty Wages and salaries Trade fair Bad and doubtful debts (68 -41) Depreciation: Buildings W Equipment Closing inventory W1 Balance Revaluation 000 2,100 4,193 8 90 70 137.40 (1,079) 5,519.40 Cost 6,300 600 6,900

Admin 000 42

Selling & Distribution 000 32

30 72

25 27

Depreciation on buildings 5,000,000/50=100,000 pa W2 Equipment Disposal 916 @ 15% =

Depreciation charge

6,900

1,900 100 2,000

Acc. Dep 1,900

NBV 5,000

84

4,900

Cost 1,400,000 (75,000) 1,325,000 137,400

Acc. Dep 430,000 (20,812.50) 409,187.50

NBV 916

Depreciation on disposal 75,000 11,250 = 63,700 9,562.50 = 54,187.50 Accumulated depreciation = 75,000 54,187.50 = 20,812.50 Loss on disposal: NBV = 54,187.50 Proceeds = 20,000 34,187.50 W3 Inventory Plus sale or return* Less write off

Less bad debt

W4 Bad and doubtful debts Accounts receivable Less sale or return

790,000 320,000 31,000 1,079,000 (*would accept 400,000) 830,000 400,000 430,000 68,000 (80 cent per euro) 362,000 28,960

Provision @ 8%

70,000-28,960 =

41,040

Page 14

Income tax Under-provision W4 Interest accrual 6 months Paid 8% of 890,000

W3 SCI taxation

82,000 10,000 92,000

Therefore accrue 17,600 at 31 December 2010. W6 Retained earnings

35,600 18,000

71,200

Brought forward Preference dividend Profit for the year At 31 December 2010 (b)

000 452 (21) 9,310 9,741

The warranty provision meets the criteria for recognition as set out in IAS 37: There is a present obligation It is probable that a payment will have to be made; and It is possible to estimate the obligation reliably.

Candidates should describe and justify their accounting treatment.

(21 Marks) Presentation 1 mark

The unsold element of inventory held on a sale or return basis should be excluded from sales and accounts receivable and recognised as closing inventory. This is in accordance with the prudence and realisation conventions. (8 marks) [Total: 30 Marks]

There are no specific accounting rules in relation to the trade fair. However, it is unlikely that the company could justify doing anything other than writing off the cost because the there is no reason to believe that the costs will be fully recovered. It would be a different matter if the company had obtained firm orders from the fair. The 25,000 should be treated as selling and distribution expenses as opposed to cost of sales.

The increase in the warranty of 8,000 should be recognised as an expense in the SCI under cost of sales.

Page 15

1. (d) Year ended 31.12.2009 31.12. 2010 31.12.2011 31.12.2012 31.12.2013 SOTD:

SOLUTION 3 B/F 140,000 124,000 102,000 74,000 40,000 Payment (40,000) (40,000) (40,000) (40,000) (40,000) Capital 100,000 84,000 62,000 34,000 --Interest 24,000 18,000 12,000 6,000 --C/F 124,000 102,000 74,000 40,000 ---

2009 : 4/10 * 60,000=24,000 2010: 3/10*60,000= 18,000 2.

40,000* 5= 200,000-140,000= 60,000 interest.

4+3+2+1= 10

3. 4.

(b) 840,000 25,000 + 40,000 12,000 = 843,000

(c) Profit Preference dividend Shares Opening balance Issued 200,000* 6/12 EPS

(b) incorrect as provisions for constructive obligations are also required. 2010 400,000 (16,000) 384,000 800,000 100,000 900,000 2009 300,000 (16,000) 284,000 800,000 --800,000

5. 6. 7.

(a) (a)

(d) Tax charge: Liability: 940,000 750,000=190,000

384,000 900,000 42.67 cents

284,000 800,000 35.5 cents 940,000 - 125,000 = 815,000

000 Bal b/d IS (150 x 25%) 8.

Investments in Associates 360 37.5 397.5

Dividends from associates (bal) Bal c/d

(b) Increase if current liabilities are 100 and current assets 30 then an increase of 50% in current liabilities will increase the current ratio to 0.53 (80/150).

000 7.5 390 397.5

Page 16

SOLUTION 4 (a) Under cost model, an item of PPE is carried at cost (i.e. initial cost plus subsequent expenditure) less accumulated depreciation. Under the revaluation model (fair value model), an item of PPE is carried at revalued amount, being fair value less accumulated depreciation.

(b)

Notes to the financial statements Property plant and equipment

Equity Revaluation surplus (900 -640)

The choice of model is an Accounting Policy choice, which must be applied across an entire class of PPE. (3 marks) Financial Statement Extracts Statement of financial position as at 31 October 2010 000 Non current assets Property, plant and equipment (see note) 4,110 Investment property 3,200 260

Cost/valuation At 1 November 2009 Additions (W2 & W3) Revaluation loss (W1) At 31 October 2010 Depreciation At 1 November 2009 Charge for year (W4) Revaluation loss At 31 October 2010 Carrying amount At 31 October 2010 At 1 November 2009

Head office 000 3,000 (1,000) 2,000 240 120 (360) 2,000 2,760

Plant and equipment 000 683 683 80 80 603 -

Assets in the course of construction/factory premises 000 1,400 124 1,524 17 17 1,507 1,400

Total 000 4,400 807 (1,000) 4,207 240 217 (360) 97 4.110 4,160

Workings

W1 Head office revaluation

Original cost Depreciation (4 years at 4%) Carrying value 1 November 2007 Revaluation gain Revalued amount 1 November 2007 Depreciation (2 years at 4%) Balance at 1 November 2009 Depreciation (4%) Revaluation loss

Page 17

000 2,500 (400) 2,100 900 3,000 (240) 2,760 (120) (640) 2,000

W2 Construction costs Professional fees W3 Additions to plant and equipment Invoice costs Labour- installation (50,000 x 100/110) Testing costs Transport costs

000 104 20 124 620 45 15 3 683 120 17 80 (14 marks)

W4 Depreciation Head office (W1) New factory (1,524 - 800) x 4% x 7/12) Plant and equipment (683 x 20% x 7/12) (c)

This property is an investment property under IAS 40 and should be included within the SFP at its fair value of 3.2 million. The gain of 900,000 should be recognised within the SCI for the year ending 31 October 2010. (3 marks) [Total: 20 Marks]

Page 18

SOLUTION 5 (a) IFRS 5 Non Current Assets Held for Sale and Discontinued Operations defines non current assets held for sale as those assets (or a group of assets) whose carrying amounts will be recovered principally through a sale transaction rather than through continuing use. For this to be the case the assets must be available for immediate sale and sale must be highly probable (e.g. completed within next 12 months).

A discontinued operation is a component of an entity that has either been disposed of, or is classified as held for re-sale and (i) (ii) (iii) Represents a separate major line of business or geographical area of operations Is part of a single co-ordinated plan to dispose of such or is a subsidiary acquired exclusively for sale.

(b)

(c)

Timing of the board meeting and consequent actions and notifications is within the accounting period ended 31 December 2010. Notification of suppliers and the press is indicative that a sale will be highly probable and the directors are committed to a plan to sell assets and are actively locating a buyer. From the financial information provided in the question it appears that Barcelonas operations and cash flows can be clearly distinguished from its other operations. The assets of the Barcelona operation appear to meet the definition of non current assets held for sale. The major issue is a separate geographical area of operations, and it is clear that the Barcelona operation meets this criteria. So the closure does meet the definition of a discontinued business. (4 marks) Archway plc statement of comprehensive income year ended 31 December 2010 000 34,500 (26,875) 7,625 (2,025) 5,600 (5,280) 320 31 December 2009 000 39,500 (32,800) 6,700 (900) 5,800 1,000 6,800

IFRS 5 says that a component of an entity must have operations and cash flows that can be clearly distinguished from the rest of the entity and will in all probability be cash generating unit whilst held for use. This definition also means that a discontinued operation will also fall to be treated as a disposal group as defined in IFRS 5. (5 marks)

Analysis of discontinued operations Revenue Cost of sales Gross profit (loss) Operating expenses Profit/(loss) from discontinued operations (d)

Continuing operations Revenue Cost of sales Gross profit Operating expenses Profit/(loss) from continuing operations Discontinued operations Profit/(loss) from discontinued operations Profit for the period

19,000 (23,180) (4,180) (1,100) (5,280)

21,500 (19,000) 2,500 (1,500) 1,000

Work out depreciation for year and include at carrying value under non-current assets held for sale in the statement of financial position. No gain/loss to be included in current year. (2 marks) [Total: 20 Marks]

(9 marks)

Page 19

Potrebbero piacerti anche

- 9609 Specimen Paper Answers Paper 4 (For Examination From 2023)Documento13 pagine9609 Specimen Paper Answers Paper 4 (For Examination From 2023)Aryan ShethNessuna valutazione finora

- Cluster 1 (Financial Acctg)Documento11 pagineCluster 1 (Financial Acctg)Carl Angelo100% (1)

- Common Stocks and Uncommon Profits NEW PDFDocumento7 pagineCommon Stocks and Uncommon Profits NEW PDFUIIC Shahada100% (1)

- Unit 3 - CostOFCapital (LN.... )Documento7 pagineUnit 3 - CostOFCapital (LN.... )mis gunNessuna valutazione finora

- Financial Accounting and Reporting: Blank PageDocumento28 pagineFinancial Accounting and Reporting: Blank PageMehtab NaqviNessuna valutazione finora

- PL Financial Accounting and Reporting Sample Paper 1Documento11 paginePL Financial Accounting and Reporting Sample Paper 1karlr9Nessuna valutazione finora

- Cost of Capital1Documento33 pagineCost of Capital1Mark Levi CorpuzNessuna valutazione finora

- P1 - Corporate Reporting April 09Documento21 pagineP1 - Corporate Reporting April 09IrfanNessuna valutazione finora

- P1 - Corporate Reporting August 10Documento18 pagineP1 - Corporate Reporting August 10IrfanNessuna valutazione finora

- MockDocumento6 pagineMockZohair SiddiquiNessuna valutazione finora

- April 2013 PDFDocumento22 pagineApril 2013 PDFJasonSpringNessuna valutazione finora

- 2009-Financial Reporting Main EQP and CommentariesDocumento46 pagine2009-Financial Reporting Main EQP and CommentariesBryan SingNessuna valutazione finora

- Financial Accounting: Formation 2 Examination - April 2008Documento11 pagineFinancial Accounting: Formation 2 Examination - April 2008Luke ShawNessuna valutazione finora

- P1 - Corporate Reporting April 08Documento25 pagineP1 - Corporate Reporting April 08IrfanNessuna valutazione finora

- F6uk 2012 Dec QDocumento13 pagineF6uk 2012 Dec QSaad HassanNessuna valutazione finora

- Taxation (United Kingdom) : Monday 6 June 2011Documento14 pagineTaxation (United Kingdom) : Monday 6 June 2011tayabkhalidNessuna valutazione finora

- Summer 2010 QuestionsDocumento5 pagineSummer 2010 QuestionstaubushNessuna valutazione finora

- (N11) Advisory ACTDocumento8 pagine(N11) Advisory ACTMuguti EriazeriNessuna valutazione finora

- Financial Accounting December 2009 Exam PaperDocumento10 pagineFinancial Accounting December 2009 Exam Paperkarlr9Nessuna valutazione finora

- Accounting Accn3: General Certificate of Education Advanced Level Examination June 2010Documento8 pagineAccounting Accn3: General Certificate of Education Advanced Level Examination June 2010Sam catlinNessuna valutazione finora

- Taxation (United Kingdom) : Tuesday 12 June 2012Documento12 pagineTaxation (United Kingdom) : Tuesday 12 June 2012Iftekhar IfteNessuna valutazione finora

- Book-Keeping and Accounts/Series-4-2011 (Code2007)Documento16 pagineBook-Keeping and Accounts/Series-4-2011 (Code2007)Hein Linn Kyaw100% (1)

- c6 Question BankDocumento25 paginec6 Question BankWaseem Ahmad QurashiNessuna valutazione finora

- Tutorial 2 AFAR MMUDocumento2 pagineTutorial 2 AFAR MMUyuyin.gohyyNessuna valutazione finora

- Retained EarningsDocumento4 pagineRetained EarningsHaru Haru100% (1)

- 2010 LCCI Bookkeeping and Accounts Series 3Documento8 pagine2010 LCCI Bookkeeping and Accounts Series 3Fung Hui Ying75% (4)

- Albion: Albion Development VCT PLC Development VCT PLCDocumento36 pagineAlbion: Albion Development VCT PLC Development VCT PLCalbionventuresNessuna valutazione finora

- 2010 LCCI Level 3 Series 2 Question Paper (Code 3012)Documento8 pagine2010 LCCI Level 3 Series 2 Question Paper (Code 3012)mappymappymappyNessuna valutazione finora

- P1 - Financial Accounting April 07Documento23 pagineP1 - Financial Accounting April 07IrfanNessuna valutazione finora

- Going Concern & Subsequent Events Q1-Q2Documento3 pagineGoing Concern & Subsequent Events Q1-Q2Venniah MusundaNessuna valutazione finora

- 34 Tongwell PLCDocumento2 pagine34 Tongwell PLCxichristinaNessuna valutazione finora

- Albion Technology & General VCT PLCDocumento70 pagineAlbion Technology & General VCT PLCalbionventuresNessuna valutazione finora

- CSF Annual Report 2011Documento60 pagineCSF Annual Report 2011red cornerNessuna valutazione finora

- F6 InterimDocumento7 pagineF6 InterimSad AnwarNessuna valutazione finora

- Albion Venture Capital Trust PLCDocumento50 pagineAlbion Venture Capital Trust PLCalbionventuresNessuna valutazione finora

- Study Cases Share Based PaymentDocumento2 pagineStudy Cases Share Based PaymentAnisya IntaningtyasNessuna valutazione finora

- Nfjpia Mockboard 2011 p1 - With AnswersDocumento12 pagineNfjpia Mockboard 2011 p1 - With AnswersRhea SamsonNessuna valutazione finora

- Financial Accounting June 2013 Exam Paper ICAEWDocumento8 pagineFinancial Accounting June 2013 Exam Paper ICAEWMuhammad Ziaul HaqueNessuna valutazione finora

- Soal Kuis Uas - AklDocumento3 pagineSoal Kuis Uas - AklBastian Nugraha SiraitNessuna valutazione finora

- AC1025 ZA d1Documento12 pagineAC1025 ZA d1Amna AnwarNessuna valutazione finora

- Afa Revision - Final Session Activities QsDocumento2 pagineAfa Revision - Final Session Activities Qshaddad2020Nessuna valutazione finora

- CPA IRELAND Accounting Framework April 07Documento14 pagineCPA IRELAND Accounting Framework April 07Luke ShawNessuna valutazione finora

- (N11) Advisory OMBDocumento8 pagine(N11) Advisory OMBMuguti EriazeriNessuna valutazione finora

- F7uk 2010 Jun QDocumento9 pagineF7uk 2010 Jun QKathleen HenryNessuna valutazione finora

- DGSDFSBCSDHSFSDDocumento8 pagineDGSDFSBCSDHSFSDbabylovelylovelyNessuna valutazione finora

- Revision QuestionsDocumento3 pagineRevision QuestionsKA Mufas100% (1)

- F2 March 2011Documento20 pagineF2 March 2011Dhanushka SamNessuna valutazione finora

- Investments Test BankDocumento6 pagineInvestments Test BankAna Mae Hernandez33% (3)

- Book Keeping and Accounts Past Paper Series 2 2011Documento6 pagineBook Keeping and Accounts Past Paper Series 2 2011Aggelos Ispirli0% (1)

- ACCOUNTING 4 Retained EarningsDocumento2 pagineACCOUNTING 4 Retained EarningsJoy ConsigeneNessuna valutazione finora

- Ifrint 2012 Dec Q PDFDocumento6 pagineIfrint 2012 Dec Q PDFPiyal HossainNessuna valutazione finora

- EC GroupDocumento5 pagineEC Groupsaqlain khanNessuna valutazione finora

- MODAUD1 UNIT 6 - Audit of InvestmentsDocumento7 pagineMODAUD1 UNIT 6 - Audit of InvestmentsJake BundokNessuna valutazione finora

- Financial Accounting Sample Paper 21Documento31 pagineFinancial Accounting Sample Paper 21Jayasankar SankarNessuna valutazione finora

- F2 Questions November 2010Documento20 pagineF2 Questions November 2010Robert MunyaradziNessuna valutazione finora

- P1-Q and As-Advanced Financial Accounting and Reporting - June 2010 Dec 2010 and June 2011Documento93 pagineP1-Q and As-Advanced Financial Accounting and Reporting - June 2010 Dec 2010 and June 2011HAbbuno100% (1)

- F6uk 2011 Dec QDocumento12 pagineF6uk 2011 Dec Qmosherif2011Nessuna valutazione finora

- Legt2751 s2 2009 Final ExamDocumento5 pagineLegt2751 s2 2009 Final ExamYvonne ChanNessuna valutazione finora

- Operating a Business and Employment in the United Kingdom: Part Three of The Investors' Guide to the United Kingdom 2015/16Da EverandOperating a Business and Employment in the United Kingdom: Part Three of The Investors' Guide to the United Kingdom 2015/16Nessuna valutazione finora

- EIB Investment Report 2017/2018: From recovery to sustainable growthDa EverandEIB Investment Report 2017/2018: From recovery to sustainable growthNessuna valutazione finora

- Finance for IT Decision Makers: A practical handbookDa EverandFinance for IT Decision Makers: A practical handbookNessuna valutazione finora

- Current Investment in the United Kingdom: Part One of The Investors' Guide to the United Kingdom 2015/16Da EverandCurrent Investment in the United Kingdom: Part One of The Investors' Guide to the United Kingdom 2015/16Nessuna valutazione finora

- F4glo 2010 Dec QDocumento4 pagineF4glo 2010 Dec QmercuryrakibNessuna valutazione finora

- Spring2022 (July) Exam-Fin Part1Documento8 pagineSpring2022 (July) Exam-Fin Part1Ahmed TharwatNessuna valutazione finora

- Dec 2006 - AnsDocumento13 pagineDec 2006 - AnsHubbak Khan75% (4)

- ABB India 2003 Annual ReportDocumento76 pagineABB India 2003 Annual ReportKunal DesaiNessuna valutazione finora

- Chapter 4 Strategic ManagementDocumento61 pagineChapter 4 Strategic ManagementHafsa KhanNessuna valutazione finora

- FN 601 Financial Management Lecture 4 - Working Capital Management Review and Assignment QuestionsDocumento5 pagineFN 601 Financial Management Lecture 4 - Working Capital Management Review and Assignment QuestionsBaraka100% (1)

- STMT AVSE 001 ASWE000255 Oct2020Documento5 pagineSTMT AVSE 001 ASWE000255 Oct2020Danilo BarbozaNessuna valutazione finora

- All Math pdf2Documento6 pagineAll Math pdf2MD Hafizul Islam HafizNessuna valutazione finora

- Tax Law LMT Aquila Legis FraternityDocumento17 pagineTax Law LMT Aquila Legis FraternityWilbert ChongNessuna valutazione finora

- Ch. 02 Types of FinancingDocumento85 pagineCh. 02 Types of FinancingUmesh Raj Pandeya100% (1)

- Sources of Business Finance Xii Commerce SP New SyllabusDocumento30 pagineSources of Business Finance Xii Commerce SP New SyllabusSanthosh KumarNessuna valutazione finora

- Economic Survey & Union Budget: Priorities & Recommendations Fodder MaterialDocumento87 pagineEconomic Survey & Union Budget: Priorities & Recommendations Fodder MaterialdalesteynNessuna valutazione finora

- Sec Guide To Savings and InvestingDocumento32 pagineSec Guide To Savings and Investing2018 01097Nessuna valutazione finora

- TCS Ratio AnalysisDocumento2 pagineTCS Ratio AnalysisLogesh SureshNessuna valutazione finora

- Financial Accounting Chapter 12 - Business Decisions and Financial Accounting Solutions Answers To Mini-Exercises M1-1 Abbreviation Full DesignationDocumento31 pagineFinancial Accounting Chapter 12 - Business Decisions and Financial Accounting Solutions Answers To Mini-Exercises M1-1 Abbreviation Full DesignationChiến Cao DuyNessuna valutazione finora

- ACCT1002 Assignment 3B 2nd S 2021-2022Documento16 pagineACCT1002 Assignment 3B 2nd S 2021-2022Zenika PetersNessuna valutazione finora

- Paper18b PDFDocumento47 paginePaper18b PDFAnonymous SgD5u8R100% (1)

- Answer Fill in The Missing Words in The Sentences BelowDocumento2 pagineAnswer Fill in The Missing Words in The Sentences BelowVinh Ngo Nhu0% (1)

- Pontoon PLC A Case StudyDocumento6 paginePontoon PLC A Case Studyparthasarathi_inNessuna valutazione finora

- Accounting Standard (As) 13Documento17 pagineAccounting Standard (As) 13shital_vyas1987Nessuna valutazione finora

- CFR Exam GuideDocumento32 pagineCFR Exam GuideNkopane MonahengNessuna valutazione finora

- Latihan 3Documento3 pagineLatihan 3Radit Ramdan NopriantoNessuna valutazione finora

- Assignment of Financial ManagementDocumento7 pagineAssignment of Financial Managementhyder imamNessuna valutazione finora

- Nishant Cipla PDFDocumento164 pagineNishant Cipla PDFNishant MishraNessuna valutazione finora

- Loss Reserving WiserDocumento76 pagineLoss Reserving WiserTeodelineNessuna valutazione finora

- Variable Exam ReviewerDocumento11 pagineVariable Exam ReviewerBryan MorteraNessuna valutazione finora