Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

MSDNo Bid 2011

Caricato da

James BruggersTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

MSDNo Bid 2011

Caricato da

James BruggersCopyright:

Formati disponibili

Time: 08-06-2011 22:47

User: ccathcart

PubDate: 08-07-2011 Zone: IN

Edition: 1 Page Name: A 1 Color:

Black Yellow Magenta Cyan

SPORTS | C1

LOOKING GOOD

Cardinals Victor Anderson shows his old razzle-dazzle

$220

$2.00

INDIANA EDITION

LOUISVILLE, KENTUCKY

courier-journal.com

S U N D AY , A U G U S T 7 , 2 0 11

USPS 135560

U.S. SUFFERSinclude SEAL unit tied to binTOLL RECORD Laden raid 30 American deaths in Afghanistan

By Laura King, Ken Dilanian and David S. Cloud

Los Angeles Times

KABUL, Afghanistan Their name conjures up the most celebrated moment of Americas postSept. 11 military campaigns. Now the Navy SEALs belong to a grimmer chapter in history: the most deadly incident for U.S. forces in the 10-year Afghanistan war. Three months after they killed al-Qaida leader Osama bin Laden in neighboring Pakistan and ce-

The deaths are a reminder of the extraordinary sacrifices made by the men and women of our military, President Obama said.

mented their place in military legend, the SEALs suffered a devastating loss when nearly two dozen were among 30 Americans who died when their helicopter was shot down early Saturday.

It was the largest number of American troops killed in a single day in the war. U.S. officials said the helicopter appeared to have been felled by enemy fire, and the Taliban quickly claimed responsibility. Eight Afghan commandos also were killed, Afghan President Hamid Karzai said. President Barack Obama said the deaths are a reminder of the extraordinary price the U.S. military is paying in the war. Obama, who learned of the incident at Camp David, issued a

statement saying his thoughts and prayers go out to the families of those who perished. Their deaths are a reminder of the extraordinary sacrifices made by the men and women of our military and their families, including all who have served in Afghanistan, the president said. We will draw inspiration from their lives, and continue the work of securing our country and standing up for the values that they embodied. See AFGHAN, A8, col. 1

UZB. TURKMEN.

IRAN

Wardak province

TAJIK.

Kabul

AFGHANISTAN

Fatal helicopter crash

PAKISTAN

SOURCE: ESRI

0 0 100 mi 100 km

AP

Beshear hails troops No-bid approach on bond fees as Williams jabs him costs Louisville

State pays lower rate to attorneys

By James Bruggers

jbruggers@courier-journal.com The Courier-Journal

FANCY FARM PICNIC

SUNDAY PRINT EXCLUSIVE

Galbraith, others assail governors speech

By Joseph Gerth

jgerth@courier-journal.com The Courier-Journal

Members of the lively crowd at the Fancy Farm Picnic show their support for Republican candidates Saturday. The candidates who spoke took on each other as well as hecklers.

By Jim Roshan, Special to The Courier-Journal

Louisvilles government agencies and utilities are paying legal rates for its public bonds that are six to nine times higher than the more competitive rates paid by the state, costing taxpayers and customers hundreds of thousands of dollars, according to a Courier-Journal analysis. Instead of using competitive bidding, Louisville metro government, the Louisville Water Co. and the Metropolitan Sewer District relied on their finance or legal staff to select and negotiate with a law firm or firms to do the work for bond issues that cover long-term debts, according to See BONDS, A10, col. 1

documents The Courier-Journal obtained through Kentuckys open-records law. The bonds have been sold to finance capital projects such as sewer and water system improvements, road and building construction, and park development. Specifically, the newspaper found: Kentucky paid its bond attorneys just 0.02 percent of the $3.7 billion it borrowed since 2009 on 25 bond issues, totaling $594,218 in legal fees. By comparison, metro government paid bond attorneys 0.19 percent of the $355 million it has borrowed since 2006 on 11 bond issues, totaling $679,452 in legal fees. That rate is 9.5 times higher than the states rate. MSD paid 0.15 percent of the $1.1 billion it has borrowed

STEVE BESHEAR

I was on the ground with these troops, and I know what they are going through.

FANCY FARM, Ky. Republicans and an independent bashed Gov. Steve Beshear at the 131st Fancy Farm Picnic in Graves County on Saturday, and the Democratic governor, fresh off an overseas trip to visit Kentucky ON THE WEB soldiers, didnt fight back. Instead, he talked about his Go to www.couritrip to Afghanistan and Iraq and er-journal.com to about the Kentucky National see a gallery of photos of the Guard troops he visited. I know the great tradition of activities at the Fancy Farm. I know that there Fancy Farm Picnic. should be great, fiery, partisan political rhetoric here and quite honestly, I was prepared to give just one of those speeches, he told the crowd, which didnt quite know how to react as he launched into an eight-minute salute to the troops and veterans. Ill tell you something, my heart and mind are not with partisan politics, he said. See PICNIC, A8, col. 1

Credit downgrade rattles fiscal faith

Obama: We must do better on debt

Associated Press

DAVID WILLIAMS

By Paul Wiseman

You did the wrong thing when you wouldnt leave the Oaks to go to Fort Campbell.

WASHINGTON The real danger from the downgrade of U.S. government debt by Standard & Poors isnt higher interest rates. Its the hit to the nations fragile economic psyche and rattled financial markets. S&Ps decision to strip the See DEBT, A10, col. 5 U.S. of its sterling AAA credit rating for the first time and move it down one notch, to

AA+, deals a blow to the confidence of consumers and businesses at a dangerous time, economists say. The agency is striking at the heart of what makes the global economy tick, said Chris Rupkey, chief financial economist for the Bank of Tokyo-Mitsubishi UFJ. It isnt just dollars and cents. One economist, Paul Dales of Capital Economics, worried Saturday that the downgrade could trigger another financial crisis

BREAKING NEWS ON YOUR CELL PHONE

Text CJNEWS to 44636 (4INFO) for the local news alerts

WEATHER | B2

36-HOUR FORECAST

Southern Indiana: Partly sunny and humid with heat index over 100. Partly sunny and humid tomorrow.

IN

SUN

Arts I-1 Business D1 Class. F1, G1, J1 Forum H1 Features E1 Indiana B1 Movies I-2

INDEX

98 PAGES

WITH PURCHASE OF LARGE HOT-N-READY PIZZA, CRAZY BREAD & CRAZY SAUCE

CJ-0000302329

FREE PEPSI 2-LITER

PEPPERONI, SAUSAGE OR CHEESE,

899

Available for a limited time at participating locations. Prices may vary. 2011 LCE, Inc. 32670

Time: 08-06-2011 21:42 User: ccathcart

PubDate: 08-07-2011 Zone: KY Edition: 1 Page Name: A 10 Color:

Black Yellow Magenta Cyan

A10 |

SUNDAY, AUGUST 7, 2011 | THE COURIER-JOURNAL

FROM PAGE ONE |

courier-journal.com

KY-

Continued from A1

BONDS | City doesnt use competitive bidding

since 2006, totaling $1.6 million in legal fees on seven bond issues. That rate is 7.5 times as much as the states rate. Louisville Water paid 0.12 percent of the $287 million it has borrowed since 2006 on two bond issues, totaling $351,396 in legal fees. That rate is six times as much as the states rate. Louisville Metro Councilman Jerry Miller, R-19th District, has been calling for more competitive bidding, and he said the newspapers findings illustrate why thats so important. Its just not being fiscally responsible not to bid, Miller said. MSD, whose legal fees and executive leadership have come under the scrutiny of the Kentucky state auditor, defended its practice for handpicking attorneys, including two Louisville firms that do all of its bond work: The Zielke Law Firm and Wyatt, Tarrant & Combs. Each firm has collected $1.09 million for the work since 2006. The MSD board chooses to maintain a long-term relationship with our co-bond counsel and our financial adviser, who have years of working together as a team to produce excellent financial results for our customers, MSD senior engineer Brian Bingham said in a statement. The same results would not have been possible if MSD replaced its bond counsel each time another law firm submitted an artificially low bid to do the work, but then needed years to learn what the existing bond team already knows about MSD. Bingham agreed that competitive bidding might indeed result in lower fees measured as a percentage of the principal amount of each bond issue, but he said that would not assure immediate and continuous access to the bond counsel experience and expertise MSD needs to manage its financial planning before, during, and after every bond issue. He speculated that it would result in higher overall costs to the community. MSDs board chairman, Arnold Celentano, said the board relied on the agencys recently retired finance director, Marion Gee, to decide how to hire bond attorneys. Gee has moved and couldnt be reached for comment. Celentano said he was relieved to hear that MSD which has accumulated a bond debt of $2.7 billion including interest payments was pretty much in line with the water (company) and (Louisville) metro, in terms of the lawyer fees.

Attorney charge for bond work based on the dollar amount of a government agency bond issue. Competitive bidding has helped the state of Kentucky reduce the rate it pays for hiring attorneys to do bond counsel work. MSD, Louisville Metro and Louisville Water have not used competitive bidding.

Recent bond attorney fees

Percent of bonds issued 0.20% 0.19% 0.18% 0.16% 0.15%

0.14% 0.12% 0.10% 0.08% 0.06% 0.04% 0.02% 0

0.12% 0.02%

Sources: The agencies

Metro

MSD

LouWater

The Courier-Journal

State

Process debated

But Celentano said the board might make some changes, pending the outcome of the review by State Auditor Crit Luallen, who has promised a close look at how MSD contracts its professional services. What we are going to do is follow the recommendations of Luallen, said Celentano, a retired engineer who has been on the MSD board since 2007, became chairman in March after another controversy prompted the former chairman and two other board members to resign. Kentucky law allows government agencies to avoid competitive bidding for certain professional services, such as law work. But in general, competitive bidding is a good practice, said James Chen, the dean of the Brandeis School of Law at the University of Louisville. It strikes me that what you have is a situation where the agencies are acting within the law, though one could argue that they should consider competitive bidding as a way of keeping rates low, Chen said. While MSD awaits the outcome of Luallens audit, the city is already moving toward more competitive bidding, including for legal services associated with any new bond issues, said the citys chief financial officer, Steve Rowland. Mayor Greg Fischer, who took office in January, is committed to a competitive process, Rowland said. We are interested in paying market rates, and we believe that through bidding and through competitive negotiation, you can save taxpayers dollars. State finance officials said they maintain a list of qualified law firms and put out a request for proposals when state agencies seek to borrow money by issuing bonds. With national competition along with local, you get a very competitive price, said F. Thomas Howard, executive director of the Kentucky Office of Financial Management. They are pretty aggressive.

A firm is selected based on a combination of technical factors, which are weighted 75 percent, and the dollar amount of the bid, which accounts for 25 percent of a bidders score. Although Howard said the low bidder doesnt always win, the process introduces an element of competition that often results in lower costs. Its a smart thing to do, said Pat Brennan, Omahabased spokesman for Kutak Rock, a law firm with offices in 16 cities that has won 12 of the last 25 bondcounsel contracts with the state. I am sure its brought fees down, Brennan said of the bidding. He said he works on his firms business proposals nationally and such competition is very typical. State and local officials acknowledge it can be difficult to compare the legal fees associated with bond work. Some types of bonds can be more complicated than others, they said. And Howard said law firms like the prestige of listing state governments among their clients, which may help give Kentucky an edge in securing competitive rates. Often the larger value of the bond issues, like many of those done for the state, tend to be more complex and demand more work by lawyers, Chen said. But in many instances, its just as expensive to prepare a small but complex issue as it is to work on a big bond.

Questions remain

State may have edge

Rowland said he didnt work for the city when it issued previous bonds and couldnt explain why it didnt use competitive bidding. He and the mayors spokesman, Chris Poynter, directed questions about finance policies in recent years to the citys former top finance officer, Jane Driskell, who now works as commissioner of finance and administration for Lexington. Driskell said the city maintained a list of qualified law firms and then spread the business around, as bonds needed to be issued. She said they would Reporter James Bruggers can be factor in the skills of each reached at (502) 582-4645.

law firm to match the citys bond needs. It was just the system we had in place, she said, adding that the issue hasnt come up for her in Lexington. The Louisville Water Co., which the city owns, defended its practice of handpicking its bond attorneys, but a spokesman said it would consider competitive bidding the next time it issued bonds. There is a lot of value in making sure you have a legal team that is very familiar with your structure and how you operate and what your culture is, Vince Guenthner said. If you are just looking at a competitive bid, where you are just looking at the lowest price, you might be sacrificing on quality somewhat. At MSD, the mayor also makes board appointments and both the MSD executive director and chief engineer serve at the mayors pleasure. Still, Poynter said the mayor leaves decisions such as competitive bidding to MSD officials. Poynter noted, however, that Fischer called for the management audit of MSD by Luallen after the newspaper reported questionable MSD spending practices and alleged conflicts of interest. Luallen has said her audit will include an examination of MSDs procurement policies as well as looking into a 2008 internal audit that questioned the large role that MSDs longtime outside attorney, Larry Zielke, plays in the agency, and the billing practices of Zielkes former law firm. The newspaper has reported that Zielke and his past and current firm have been paid at least $5.9 million by MSD since Jan. 1, 2006, including the $1.09 million for bond counsel work. Zielke and the Wyatt firm work together as cobond counsels, with Zielke and Wyatt attorney Stephen Berger previously saying they divide the tasks. Berger, an attorney for the Wyatt firm, which has also handled some of the bond counsel work for Louisville Metro, declined to answer questions. He said MSD officials told him to defer to Binghams statement. Zielke didnt return telephone calls or emails. Bingham wrote that MSDs top finance and legal staff members are in frequent contact with our two co-bond counsel firms to verify the reasonableness of their fees in relation to the value of the work they perform for us, to manage and coordinate the division of labor between them, and to evaluate their performance.

Downgrades impact may be big or small

Experts are split on bottom line

The Washington Post

Commentators are split as to whether Standard & Poors downgrade of U.S. debt will have major negative consequences for the U.S. and world economy, or whether it will be basically meaningless. Why It Might Matter: If U.S. debt is downgraded, many other debt instruments likely will be downgraded as well. When Moodys put U.S. debt on review for downgrade during the debt ceiling standoff, it also put on notice 7,000 other bonds, worth a total of $130 billion, that rely directly on revenue from federal government payments, such as certain kinds of municipal bonds. Bonds that are indirectly dependent on the federal government, such as those issued by hospitals that receive Medicare payments, or defense firms reliant on Pentagon contracts, could get downgraded as well. In addition, many everyday interest rates such as those for mortgages, car loans and credit cards are pegged to U.S. Treasurys, meaning

that if a downgrade forces up interest rates on U.S. debt (which is likely, but will depend on how the markets react), interest rates for those will shoot up as well. This would raise the cost of borrowing across the system, depressing the economy. Why It Might Not: Ratings generally are used as a proxy to determine the financial health of entities that investors may not know much about. But everyone knows about the health of the U.S. government, and now that the debt ceiling debate has passed, no one thinks it is going to default anytime soon. Thus, investors who might normally be inclined to not buy or keep AA-rated debt could make an exception for U.S. Treasurys. Indeed, some pension and money market funds have considered loosening their rules to allow higher holdings of U.S. debt in the event of a downgrade. Further, AA is still a very high rating. AA firms have statistically identical performance to AAA ones, according to the Fitch rating agency. Just this past January, S&P downgraded Japans debt from AA- to AA, and markets more or less didnt care.

DEBT | Recession fears

Continued from A1

that sends Western economies back into a recession. The Obama administration made its displeasure known quickly after the downgrade was announced Friday. The Treasury Department said S&P had acted on an analysis that had a $2 trillion error. On Saturday, the administration appeared to soften its tone. White House press secretary Jay Carney, without referring directly to the downgrade, said President Barack Obama believes Washington must do better tackling the deficit. The timing of S&Ps decision could hardly be worse for the U.S. The economy added117,000 jobs in July, more than expected. But other economic indicators, including manufacturing, consumer spending and overall growth, are getting weaker. In normal times, in another country, a downgrade in a sovereign debt rating probably would force its government to pay higher interest rates to persuade investors to keep buying its debt. If that happened, it would drive up the rates that consumers pay on mortgages and auto loans, which often are tied to the governments interest rate. But the United States is a special case. Treasury debt is considered the safest investment in the world even after the downgrade. Investors dont doubt the U.S. governments ability to repay the $9.8 trillion it owes. Anytime theres a problem anywhere on the planet, investors come to the safety of the U.S., and they dont go anywhere else, said Mark Zandi, chief economist at Moodys Analytics. Mark Vitner, senior economist at Wells Fargo Securities, agrees that the S&P downgrade is unlikely to drive up interest rates right away. But he says thats partly because the economy is so weak that borrowers arent competing for money and driving rates higher. In three to five years, he says, loan demand will be higher. When that happens, a U.S. Treasury with a dinged credit rating will be vying with private borrowers for loans and invest-

10,000th rescued sea lion released

Calif. center also does research

Associated Press

By Jason Dearen

POINT REYES NATIONAL SEASHORE, Calif. Two juvenile California sea lions paused for a moment at the edge of the sea, each raising their whiskered faces toward the silvery water before sliding in to freedom. For the Marine Mammal Center crew standing behind the rehabilitated pinnipeds on Thursday, it was a significant day: rescued sea lion No. 10,000, nicknamed Milestone, and 10,001, Zodiac Girl, had been nursed back to health and sent back to the wild. Theres always some attachment. Theres always some animal that captures your heart, said Shelbi Stoudt, the center staffer who organizes the regular releases. Its a bittersweet feeling because youre sending them back home but you

Zodiac Girl, left, and Milestone, both California sea lions, are released in northern California on Thursday.

also dont get to see them anymore. Since it opened its doors 36 years ago in the Marin Headlands just north of the Golden Gate Bridge, the nonprofit marine mammal hospital has become famous for nursing sick marine critters back to health but its biggest contribution perhaps has been its role in collecting and storing thousands of tissue and other samples from the animals it rescues along 600

Jason Dearen/Associated Press

miles of California coast. The centers mix of laboratory science, marine zoo and educational outreach has led to dozens of published scientific papers and helped push understanding of effects of toxic algae, disease and the effect of climate change on these coastal denizens. Only about half of the animals the center takes in survive to be released. Still, many of the more than 17,000 marine mammals

including entangled whales, otters and elephant seals the center has aided or taken in have contributed samples that will help further research that can aid threatened and endangered species around the world. Indeed, many of the animals nursed back to health are not facing imminent extinction there are 200,000 California sea lions in the wild but their maladies and their genetic makeup are similar to other species in peril. California sea lions share genetic traits with Steller sea lions, which are a threatened species. The centers researchers say collecting and banking scientific samples from many of the thousands of sea lions the center has treated contributes to efforts to save Stellers. Same goes for elephant seals, which share traits with the endangered Hawaiian monk seals. Milestone and Zodiac Girl had leptospirosis, a bacterial infection that attacks the kidneys and can be fatal.

ments, and rates will likely rise. The greater consequences are going to be in the intermediate and longterm, he says. If it didnt mean anything, S&P wouldnt have downgraded us. Already, there were signs that the downgrade itself would become a volatile political issue. Senate Majority Leader Harry Reid, D-Nev., said the S&P decision showed that Democrats preferred solution to long-term debt, a mix of tax increases on the wealthy and budget cuts, was the right answer. House Speaker John Boehner, R-Ohio, said he hoped Democrats would learn they cant tinker around the edges of the U.S. debt problem. And Republican presidential candidates for 2012 laid blame on Obama. S&P had called for $4 trillion in U.S. deficit reduction. The deal cut by Congress last week called for only about $2 trillion in the next decade. The rating agency said it wasnt enough to address Americas debt problem. It also said its decision reflected its loss of confidence in the U.S. political system. Republicans and Democrats didnt reach a deal on debt reduction until hours before the federal governments borrowing limit was to expire, which some say would have trigged a U.S. default on its debt or massive, immediate government cuts. Economists say the downgrade, the first since the U.S. received the top rating in 1917, will rattle already-worried consumers and businesses. Some fear that the Dow Jones industrials, which fell 512 points on Thursday alone because of fears about the economy and European debt, will plummet Monday when investors get to vent their anxiety. An early sign of whats to come may emerge today U.S. time, when Asian markets open. Americas reputation has already taken a hit abroad. China, the largest foreign holder of U.S. debt, on Saturday demanded that the United States tighten its belt and overcome its addiction to debt in the wake of the S&P downgrade.

Potrebbero piacerti anche

- Encyclopedia of Municipal Bonds: A Reference Guide to Market Events, Structures, Dynamics, and Investment KnowledgeDa EverandEncyclopedia of Municipal Bonds: A Reference Guide to Market Events, Structures, Dynamics, and Investment KnowledgeNessuna valutazione finora

- ShardeintrustfundDocumento2 pagineShardeintrustfundJames BruggersNessuna valutazione finora

- Times Leader 08-04-2013Documento73 pagineTimes Leader 08-04-2013The Times LeaderNessuna valutazione finora

- City Limits Magazine, January 1998 IssueDocumento40 pagineCity Limits Magazine, January 1998 IssueCity Limits (New York)Nessuna valutazione finora

- Football Booster Clubs BlitzedDocumento1 paginaFootball Booster Clubs BlitzedAlia MalikNessuna valutazione finora

- Reform the Kakistocracy: Rule by the Least Able or Least Principled CitizensDa EverandReform the Kakistocracy: Rule by the Least Able or Least Principled CitizensNessuna valutazione finora

- 2011-02-03Documento32 pagine2011-02-03Southern Maryland OnlineNessuna valutazione finora

- False Profits: Recovering from the Bubble EconomyDa EverandFalse Profits: Recovering from the Bubble EconomyValutazione: 3 su 5 stelle3/5 (2)

- Sunday's Sin: A Conspiracy to Fix the Big Game: Why Did Boochie Jones Have To Die?Da EverandSunday's Sin: A Conspiracy to Fix the Big Game: Why Did Boochie Jones Have To Die?Nessuna valutazione finora

- Times Leader 07-25-2013Documento40 pagineTimes Leader 07-25-2013The Times LeaderNessuna valutazione finora

- 2012 Democratic Party Opposition Research File For Allen WestDocumento75 pagine2012 Democratic Party Opposition Research File For Allen WestJohn Malcolm100% (1)

- The Daily Union. January 14, 2014Documento14 pagineThe Daily Union. January 14, 2014DUNewsNessuna valutazione finora

- Zielke Bylaws1Documento2 pagineZielke Bylaws1James BruggersNessuna valutazione finora

- Times Leader 05-01-2013Documento33 pagineTimes Leader 05-01-2013The Times LeaderNessuna valutazione finora

- 07-29-2009 EditionDocumento32 pagine07-29-2009 EditionSan Mateo Daily JournalNessuna valutazione finora

- House Hearing, 112TH Congress - U.S. Insurance Sector: International Competitiveness and JobsDocumento250 pagineHouse Hearing, 112TH Congress - U.S. Insurance Sector: International Competitiveness and JobsScribd Government DocsNessuna valutazione finora

- 11-12-05 Criminality at The Top of A Lawless, Bankrupt NationDocumento5 pagine11-12-05 Criminality at The Top of A Lawless, Bankrupt NationHuman Rights Alert - NGO (RA)Nessuna valutazione finora

- Times Leader 07-18-2012Documento40 pagineTimes Leader 07-18-2012The Times LeaderNessuna valutazione finora

- Economic Development Partnership Sours: Sshheelllliinngg KkiillllssDocumento32 pagineEconomic Development Partnership Sours: Sshheelllliinngg KkiillllssSan Mateo Daily JournalNessuna valutazione finora

- Immigration: Madeline ZavodnyDocumento3 pagineImmigration: Madeline ZavodnyAmerican Enterprise InstituteNessuna valutazione finora

- Adventures Abroad: The University Daily KansanDocumento16 pagineAdventures Abroad: The University Daily KansanThe University Daily KansanNessuna valutazione finora

- 10-11-13 EditionDocumento31 pagine10-11-13 EditionSan Mateo Daily JournalNessuna valutazione finora

- The Saline Reporter Front PageDocumento1 paginaThe Saline Reporter Front PageMichelle RogersNessuna valutazione finora

- Tenants Face Huge Rent Hike: Debts Paid OffDocumento28 pagineTenants Face Huge Rent Hike: Debts Paid OffSan Mateo Daily JournalNessuna valutazione finora

- Moi A3Documento1 paginaMoi A3api-260353457Nessuna valutazione finora

- New Leader: We Can Meet Our Goals': Police Officers PromotedDocumento20 pagineNew Leader: We Can Meet Our Goals': Police Officers PromotedelauwitNessuna valutazione finora

- ParksDocumento1 paginaParksLuke Kerr-DineenNessuna valutazione finora

- 2011-06-02Documento32 pagine2011-06-02Southern Maryland OnlineNessuna valutazione finora

- 2012-03-01 The County TimesDocumento32 pagine2012-03-01 The County TimesSouthern Maryland OnlineNessuna valutazione finora

- Half Moon Bay Orchids Agrees To Pollution Penalty: Heat Nba ChampsDocumento32 pagineHalf Moon Bay Orchids Agrees To Pollution Penalty: Heat Nba ChampsSan Mateo Daily JournalNessuna valutazione finora

- City Limits Magazine, August/September 1991 IssueDocumento24 pagineCity Limits Magazine, August/September 1991 IssueCity Limits (New York)Nessuna valutazione finora

- House Hearing, 112TH Congress - The Impact of Dodd-Frank's Home Mortgage Reforms: Consumer and Market PerspectivesDocumento190 pagineHouse Hearing, 112TH Congress - The Impact of Dodd-Frank's Home Mortgage Reforms: Consumer and Market PerspectivesScribd Government DocsNessuna valutazione finora

- H Inc.: Working Towards Fairer Quality Residential Mortgage StandardsDocumento14 pagineH Inc.: Working Towards Fairer Quality Residential Mortgage StandardsanhdincNessuna valutazione finora

- Senate Hearing, 111TH Congress - Current Trends in Foreclosures and What More Can Be Done To Prevent ThemDocumento135 pagineSenate Hearing, 111TH Congress - Current Trends in Foreclosures and What More Can Be Done To Prevent ThemScribd Government DocsNessuna valutazione finora

- Guaranteed to Fail: Fannie Mae, Freddie Mac, and the Debacle of Mortgage FinanceDa EverandGuaranteed to Fail: Fannie Mae, Freddie Mac, and the Debacle of Mortgage FinanceValutazione: 2 su 5 stelle2/5 (1)

- Sat., Nov. 19 News SummaryDocumento10 pagineSat., Nov. 19 News SummaryTNSenateDemsNessuna valutazione finora

- 6-17-14 US - ECON Total US Debt Soars To Nearly $60 TRN Foreshadows New Recession - RT USADocumento7 pagine6-17-14 US - ECON Total US Debt Soars To Nearly $60 TRN Foreshadows New Recession - RT USAtydeus23Nessuna valutazione finora

- 2013 Front PagesDocumento52 pagine2013 Front PagesLaFollettePress100% (1)

- Cows To KazakhstanDocumento2 pagineCows To KazakhstanpegspirateNessuna valutazione finora

- Nothing Is Too Big to Fail: How the Last Financial Crisis Informs TodayDa EverandNothing Is Too Big to Fail: How the Last Financial Crisis Informs TodayNessuna valutazione finora

- 07 - 10 - 2002 - 01a - MetroDocumento1 pagina07 - 10 - 2002 - 01a - MetroMike HowellNessuna valutazione finora

- 08-20-2013 EditionDocumento32 pagine08-20-2013 EditionSan Mateo Daily JournalNessuna valutazione finora

- 10-17-12 EditionDocumento32 pagine10-17-12 EditionSan Mateo Daily JournalNessuna valutazione finora

- Poker FaceDocumento1 paginaPoker FaceAlissaGroeningerNessuna valutazione finora

- Secrets, Secrets Are No Fun - TPP Should Be Shared With EveryoneDocumento20 pagineSecrets, Secrets Are No Fun - TPP Should Be Shared With EveryoneCWALocal1022Nessuna valutazione finora

- Dissent from the Majority Report of the Financial Crisis Inquiry CommissionDa EverandDissent from the Majority Report of the Financial Crisis Inquiry CommissionNessuna valutazione finora

- Truth in Business and Home Lending DiscriminationDa EverandTruth in Business and Home Lending DiscriminationNessuna valutazione finora

- Browerville Blade - 02/16/2012 - Page 01Documento1 paginaBrowerville Blade - 02/16/2012 - Page 01bladepublishingNessuna valutazione finora

- DH 1129Documento12 pagineDH 1129The Delphos HeraldNessuna valutazione finora

- 02-25-15 EditionDocumento28 pagine02-25-15 EditionSan Mateo Daily JournalNessuna valutazione finora

- Times Leader 08-10-2011Documento48 pagineTimes Leader 08-10-2011The Times LeaderNessuna valutazione finora

- Times Leader 09-22-2012Documento52 pagineTimes Leader 09-22-2012The Times LeaderNessuna valutazione finora

- Times Leader 03-04-2012Documento77 pagineTimes Leader 03-04-2012The Times LeaderNessuna valutazione finora

- 2009-08-13Documento40 pagine2009-08-13Southern Maryland OnlineNessuna valutazione finora

- Mont Belvieu, Texas Ethane Storage Hub: Warnings For AppalachiaDocumento7 pagineMont Belvieu, Texas Ethane Storage Hub: Warnings For AppalachiaJames BruggersNessuna valutazione finora

- 1 ToxicWorkPlaceDocumento6 pagine1 ToxicWorkPlaceJames BruggersNessuna valutazione finora

- TN AG Letter To OSM Regarding LUM Mining ControversyDocumento3 pagineTN AG Letter To OSM Regarding LUM Mining ControversyJames BruggersNessuna valutazione finora

- 2015-02-23 Court of Appeal OpinionDocumento27 pagine2015-02-23 Court of Appeal OpinionJames BruggersNessuna valutazione finora

- Toxic Air Stories LouisvilleDocumento68 pagineToxic Air Stories LouisvilleJames BruggersNessuna valutazione finora

- 2 ToxicWorkplaceDocumento6 pagine2 ToxicWorkplaceJames BruggersNessuna valutazione finora

- Wieckowski Letter 6.13.19Documento13 pagineWieckowski Letter 6.13.19James BruggersNessuna valutazione finora

- Filed Indictment Armstrong Coal KentuckyDocumento13 pagineFiled Indictment Armstrong Coal KentuckyJames BruggersNessuna valutazione finora

- Mill Creek Ash Pond Inundation AreasDocumento1 paginaMill Creek Ash Pond Inundation AreasJames BruggersNessuna valutazione finora

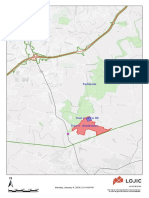

- Oakland Hills Subdivision Expansion, Main MapDocumento1 paginaOakland Hills Subdivision Expansion, Main MapJames BruggersNessuna valutazione finora

- Oakland Hills Subdivision, Secondary MapDocumento1 paginaOakland Hills Subdivision, Secondary MapJames BruggersNessuna valutazione finora

- Oakland Hills and Paklands Location MapDocumento1 paginaOakland Hills and Paklands Location MapJames Bruggers100% (1)

- Slow KYDocumento2 pagineSlow KYJames BruggersNessuna valutazione finora

- Solar KyDocumento2 pagineSolar KyJames BruggersNessuna valutazione finora

- CCR Public Hearing TranscriptDocumento27 pagineCCR Public Hearing TranscriptJames BruggersNessuna valutazione finora

- MSD Special Investigation 6-6-2016 (00202645xC2130)Documento49 pagineMSD Special Investigation 6-6-2016 (00202645xC2130)CincinnatiEnquirerNessuna valutazione finora

- HeatDocumento2 pagineHeatJames BruggersNessuna valutazione finora

- SewageDocumento5 pagineSewageJames BruggersNessuna valutazione finora

- It'S Swimsuit Season: Billboard Proposal Draws IreDocumento2 pagineIt'S Swimsuit Season: Billboard Proposal Draws IreJames BruggersNessuna valutazione finora

- BracingDocumento7 pagineBracingJames BruggersNessuna valutazione finora

- Letter To Landfill OperatorsDocumento1 paginaLetter To Landfill OperatorsJames BruggersNessuna valutazione finora

- MapleStreet 3-8-2016 LandusePlanning Simple1Documento1 paginaMapleStreet 3-8-2016 LandusePlanning Simple1James BruggersNessuna valutazione finora

- MapleStreet 3-8-2016 LandusePlanning SimpleDocumento1 paginaMapleStreet 3-8-2016 LandusePlanning SimpleJames BruggersNessuna valutazione finora

- 16zone1002 Plan 01-11-16Documento1 pagina16zone1002 Plan 01-11-16James BruggersNessuna valutazione finora

- Agreed Order Jan 2104Documento26 pagineAgreed Order Jan 2104James BruggersNessuna valutazione finora

- Letter To MSDDocumento4 pagineLetter To MSDJames BruggersNessuna valutazione finora

- Bluegrass Pipeline Co., LLC v. Kentuckians United To Restrain Eminent Domain, No. 2014-CA-000517 (Ky. App. May 22, 2015)Documento10 pagineBluegrass Pipeline Co., LLC v. Kentuckians United To Restrain Eminent Domain, No. 2014-CA-000517 (Ky. App. May 22, 2015)RHTNessuna valutazione finora

- Trimble Appeals Court RulingDocumento23 pagineTrimble Appeals Court RulingJames BruggersNessuna valutazione finora

- SKMBT 28315012011400 RedactedDocumento7 pagineSKMBT 28315012011400 RedactedJames BruggersNessuna valutazione finora

- MSD Board Members' Reviews of Greg HeitzmanDocumento9 pagineMSD Board Members' Reviews of Greg HeitzmanJames BruggersNessuna valutazione finora

- Tutorial Chapter 3Documento9 pagineTutorial Chapter 3Sirhan HelmiNessuna valutazione finora

- Refill Brand Guidelines 2Documento23 pagineRefill Brand Guidelines 2Catalin MihailescuNessuna valutazione finora

- Linear ProgrammingDocumento37 pagineLinear ProgrammingAlliahData0% (1)

- Heist Story ScriptDocumento3 pagineHeist Story Scriptapi-525637110Nessuna valutazione finora

- QuaverEd Lesson Plan 6-7Documento10 pagineQuaverEd Lesson Plan 6-7zgyleopardNessuna valutazione finora

- Difference Between Distinct and Group byDocumento1 paginaDifference Between Distinct and Group byPavelStrelkovNessuna valutazione finora

- XJ600SJ 1997Documento65 pagineXJ600SJ 1997astracatNessuna valutazione finora

- Social Studies 2014 Qu and AnsDocumento18 pagineSocial Studies 2014 Qu and AnsSaidu H SwarayNessuna valutazione finora

- Fresher Jobs July 31Documento18 pagineFresher Jobs July 31Harshad SonarNessuna valutazione finora

- Designing A 3D Jewelry ModelDocumento4 pagineDesigning A 3D Jewelry ModelAbdulrahman JradiNessuna valutazione finora

- Theories of International TradeDocumento33 pagineTheories of International Tradefrediz79Nessuna valutazione finora

- Life Buds: Audiophile Wireless Earbuds With Immersive Single Point Source AudioDocumento2 pagineLife Buds: Audiophile Wireless Earbuds With Immersive Single Point Source AudioCecy LucasNessuna valutazione finora

- GNDDocumento16 pagineGNDDEAN TENDEKAI CHIKOWONessuna valutazione finora

- How To Write The Introduction of An Action Research PaperDocumento8 pagineHow To Write The Introduction of An Action Research Papergw1qjewwNessuna valutazione finora

- Analog and Digital Electronics (Ade) Lab Manual by Prof. Kavya M. P. (SGBIT, BELAGAVI)Documento74 pagineAnalog and Digital Electronics (Ade) Lab Manual by Prof. Kavya M. P. (SGBIT, BELAGAVI)Veena B Mindolli71% (7)

- Cics Tutorial PDFDocumento23 pagineCics Tutorial PDFNeelay KumarNessuna valutazione finora

- A.R. Meenakshi v. State of Tamil Nadu, (Madras)Documento9 pagineA.R. Meenakshi v. State of Tamil Nadu, (Madras)J VenkatramanNessuna valutazione finora

- Application For Type Aircraft Training: Farsco Training Center IR.147.12Documento1 paginaApplication For Type Aircraft Training: Farsco Training Center IR.147.12benyamin karimiNessuna valutazione finora

- Assessment Form (Indoor)Documento14 pagineAssessment Form (Indoor)Mark Tally0% (1)

- Presentation 2Documento32 paginePresentation 2Jackie LeeNessuna valutazione finora

- Pythonbiogeme: A Short Introduction: Michel Bierlaire July 6, 2016Documento19 paginePythonbiogeme: A Short Introduction: Michel Bierlaire July 6, 2016asasdasdNessuna valutazione finora

- Introduction To Parallel Programming 1st Edition Pacheco Solutions ManualDocumento5 pagineIntroduction To Parallel Programming 1st Edition Pacheco Solutions Manualyvonnewelchdoafexwzcs100% (11)

- Flange ALignmentDocumento5 pagineFlange ALignmentAnonymous O0lyGOShYG100% (1)

- Cir vs. de La SalleDocumento20 pagineCir vs. de La SalleammeNessuna valutazione finora

- HRSGDocumento21 pagineHRSGrabia2090Nessuna valutazione finora

- PROPOSALDocumento4 paginePROPOSALsacheendra singhNessuna valutazione finora

- Complaint Handling Policy of CBECDocumento52 pagineComplaint Handling Policy of CBECharrypotter1Nessuna valutazione finora

- PR Status ReportDocumento28 paginePR Status ReportMascheny ZaNessuna valutazione finora

- Ch10ex10-3 Cost AccountingDocumento2 pagineCh10ex10-3 Cost AccountingRichKingNessuna valutazione finora

- FPO Policy-1Documento96 pagineFPO Policy-1shashanksaranNessuna valutazione finora