Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

630 Long Questions

Caricato da

wqas_akramDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

630 Long Questions

Caricato da

wqas_akramCopyright:

Formati disponibili

Question No: 43 ( Marks: 3 ) What is the relationship between risk and return?

Risk and potential return need to be analyzed together throughout the investment decision-making process. Considering their relationship is a big part of what investment advisers get paid to do. The Direct Relationship: The fundamental relationship between risk and return is well known to those who have studied the market. The more risk someone bears, the higher are their expected return. It also points out that some rate of return can be earned without bearing any risk, and is called the riskless rate of interest or the risk free rate in finance theory. Two important points should be noted. First, the risk-return relationship is based on expected return. Expected return is a before the fact, not after the fact concept. It is not correct to say that riskier securities have higher returns, although people often make this statement. If riskier securities always had a higher return they would not be risky. Sometimes an investor is hurt by a risk taken that resulted in a negative return. Such is the essence of risk. The second important point is that the risk we are talking about is unavoidable, or undiversifiable, risk. An investor is not generally rewarded for bearing risk that could have been diversified away. Empirical financial research reveals clear evidence of the direct relationship between systematic risk and expected return. Riskier portfolios, on average, earn higher. Additionally, returns on well diversified portfolios tend to plot in a generally linear fashion. The point of this discussion is that whether looking ahead to possible future returns or looking back at realized results, a person can usually observe this direct relationship between risk and return. Once again, though, it is not accurate to conclude that higher risk means higher return. Risky investments often lose money for their owners over the short run. They may also earn less than safer investments.

Question No: 44 ( Marks: 3 ) Define a zero coupon bond? Zero Coupon: A zero coupon bond has a specific maturity date when it returns the bond principal, but it pays no periodic income. In other words, the bond has only a single cash inflow the par value returned at maturity. An investor might pay $450 for a bond that promises to return $1,000 in 7.5 years. The investor's return comes from the $550 increase in value over the seven-and-one-half years. These types of bonds are still relatively new in the United States. The retail department store JCPenney (JCP, NYSE) issued the first publicly offered zero coupon bond in 1982. Chase Manhattan Bank (CMB, NYSE) and McDonald's (MCD, NYSE) followed suit later that year.

Question No: 45 ( Marks: 3 ) Describe how derivatives are used as a risk management tool.

Question No: 46 ( Marks: 5 ) Bonds are 100% risk free investments. Do you agree with this statement? Justify your answer in either case.

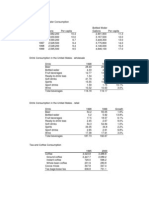

BOND RISKS: Statements Such as "stock is risky, bonds are not," are not accurate. Bonds do carry risk, although the nature of their risk; is different from that of an equity security. To properly manage a group of bonds, an investor must understand the types of -risk they bear. Price Risks: The price of a bond can change ever)' day as the "net chg" column in Figure 4-2 indicates. The two components of price risk are default risk and interest rate risk.

Default Risk: The possibility that a firm will be unable to pay the principal and interest on a bond in accordance with the bond indenture is known as the default risk. Standard & Poor's and Moody's are the two leading advisor)' services reporting on the default risk of individual bond issues. Standard & Poor's gives bonds a rating based on a scale of AAA (least risk) to D (bonds in default). The ratings from AA to CCC may carry a plus or minus. Table 4-5 shows the complete set of ratings. An investment grade bond is rated BBB or higher; any bond with a lower rating is known as a junk bond. .Many fiduciaries are limited by law to bonds that are investment grade. Some bonds originate with an investment grade, but are later downgraded below BBB. Such a bond is a fallen angel. Salomon Brothers uses the term zombie bond to refer to a highly speculative bond, once thought long dead, that shows signs of life by a price run-up. Standard & Poor's has a separate description for each of the ratings AAA, AA, A, and BBB. Junk bonds, however, are all covered by a single definition, the salient portion of which states that these bonds are

regarded on balance, as predominately speculative with respect to capacity to pay interest and repay principal in accordance with the terms of the obligation. Interest Rate Risk:

Bonds also carry interest rate risk, which is the chance of loss because of changing interest rates. If someone buys a bond with a 10.4% yield to maturity and market interest rates rise a week later, the market price of this bond will fall. It would fall because risk-averse investors will always prefer a higher yield for a given level of risk. Newly issued, equally risky bonds will yield more after the interest rate rise, and investors will only be willing to purchase the old bonds if their price is reduced. Relative to the purchase price, a bondholder has a paper

Question No: 47 ( Marks: 5 ) The key to maximize profits is diversification . Do you agree with this statement?

Question No: 48 ( Marks: 10 ) Explain the indicators used to measure the fluctuations in equity market.

Question No: 49 ( Marks: 10 ) What is diversification? Describe the impact of diversification on Risk?

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- MCB Final ReportDocumento50 pagineMCB Final ReportAhsan AliNessuna valutazione finora

- MGT602 6Documento14 pagineMGT602 6wqas_akramNessuna valutazione finora

- MGT 602Documento8 pagineMGT 602wqas_akramNessuna valutazione finora

- MGT602 8Documento3 pagineMGT602 8wqas_akramNessuna valutazione finora

- MGT602 1Documento3 pagineMGT602 1wqas_akramNessuna valutazione finora

- MGT 602Documento4 pagineMGT 602wqas_akramNessuna valutazione finora

- MGT602Documento9 pagineMGT602wqas_akramNessuna valutazione finora

- MGT602 - 3Documento11 pagineMGT602 - 3wqas_akramNessuna valutazione finora

- MGT 602Documento8 pagineMGT 602wqas_akramNessuna valutazione finora

- MGT602 - 2Documento2 pagineMGT602 - 2wqas_akramNessuna valutazione finora

- MGT602 6Documento14 pagineMGT602 6wqas_akramNessuna valutazione finora

- MGT602 8Documento3 pagineMGT602 8wqas_akramNessuna valutazione finora

- MGT602Documento9 pagineMGT602wqas_akramNessuna valutazione finora

- MGT602 - 3Documento11 pagineMGT602 - 3wqas_akramNessuna valutazione finora

- MGT602 1Documento3 pagineMGT602 1wqas_akramNessuna valutazione finora

- Fin622 QuizDocumento59 pagineFin622 Quizwqas_akramNessuna valutazione finora

- MGT602 - 2Documento2 pagineMGT602 - 2wqas_akramNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- College Algebra FinalsDocumento5 pagineCollege Algebra FinalsLucille Gacutan AramburoNessuna valutazione finora

- The Magic of CompoundingDocumento4 pagineThe Magic of Compoundingmaria gomezNessuna valutazione finora

- History of Larsen and TubroDocumento50 pagineHistory of Larsen and TubroSaumil ShahNessuna valutazione finora

- Internal Control GuideDocumento42 pagineInternal Control GuideOrlando Pineda Vallar100% (1)

- Let ReviewerDocumento5 pagineLet ReviewerJo-Mar Arellano Avena100% (1)

- VARIOUS - Villanueva Final Exam Corporation Law (Villanueva)Documento8 pagineVARIOUS - Villanueva Final Exam Corporation Law (Villanueva)mirandaranielNessuna valutazione finora

- 36.) Carol Mathis Sworn Witness StatementDocumento9 pagine36.) Carol Mathis Sworn Witness StatementFailure of Royal Bank of Scotland (RBS) Risk ManagementNessuna valutazione finora

- TVCN - Venture Capital Guide For TanzaniaDocumento37 pagineTVCN - Venture Capital Guide For TanzaniaAnonymous iFZbkNw100% (1)

- Johnstone 11e 01 SM FinalDocumento28 pagineJohnstone 11e 01 SM Finalsteven afandyNessuna valutazione finora

- Differences Between A Private Vs Public CompanyDocumento7 pagineDifferences Between A Private Vs Public CompanyBilawal MughalNessuna valutazione finora

- Dec 2006 - AnsDocumento13 pagineDec 2006 - AnsHubbak Khan75% (4)

- Market Leader Answer Keys 2Documento21 pagineMarket Leader Answer Keys 2Ale GuzmÁn67% (6)

- Chapter 8 StuDocumento24 pagineChapter 8 StuLakshman RaoNessuna valutazione finora

- Math IADocumento11 pagineMath IAOliver Homa100% (5)

- PEZA Reportorial RequirementsDocumento4 paginePEZA Reportorial RequirementsMV FadsNessuna valutazione finora

- Barclays A Guide To MBS ReportsDocumento33 pagineBarclays A Guide To MBS ReportsguliguruNessuna valutazione finora

- IFRS 9 Part II Classification & Measurement CPD November 2015Documento55 pagineIFRS 9 Part II Classification & Measurement CPD November 2015Nicolaus CopernicusNessuna valutazione finora

- Quizlet CH 1 PDFDocumento1 paginaQuizlet CH 1 PDFAPRATIM BHUIYANNessuna valutazione finora

- Unit Time Value of Money: StructureDocumento15 pagineUnit Time Value of Money: Structurem_vamshikrishna22Nessuna valutazione finora

- Analysis of Mutual Fund & Portfolio Management in Mutual Fund For Motilal Oswal Securities by Kalpa KabraDocumento59 pagineAnalysis of Mutual Fund & Portfolio Management in Mutual Fund For Motilal Oswal Securities by Kalpa KabravishalbehereNessuna valutazione finora

- Accounting As The Language of BusinessDocumento2 pagineAccounting As The Language of BusinessjuliahuiniNessuna valutazione finora

- Honest Tea - Help SpreadsheetDocumento12 pagineHonest Tea - Help Spreadsheetvirgin51100% (1)

- Oslo Innovation Magazine WebDocumento36 pagineOslo Innovation Magazine WebOslo Business MemoNessuna valutazione finora

- Mortgage CalculatorDocumento4 pagineMortgage Calculatorapi-246390576Nessuna valutazione finora

- (LN) West G. - An Introduction To Modern Portfolio Theory (2004) PDFDocumento34 pagine(LN) West G. - An Introduction To Modern Portfolio Theory (2004) PDFSigit WahyudiNessuna valutazione finora

- Overview of Financial Reporting Environment Environment: FRS Course DR Sudershan Kuntluru IIM KozhikodeDocumento35 pagineOverview of Financial Reporting Environment Environment: FRS Course DR Sudershan Kuntluru IIM KozhikodeKumar PrashantNessuna valutazione finora

- Aircraft LeasingDocumento132 pagineAircraft LeasingBenchmarking84100% (1)

- Appraisal RightDocumento10 pagineAppraisal RightkristineroseNessuna valutazione finora

- Max's GroupDocumento29 pagineMax's GroupEnzy Crema100% (1)

- Art Supply Store and Gallery Business PlanDocumento58 pagineArt Supply Store and Gallery Business PlanMagda Neculaescu100% (1)