Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Stock C

Caricato da

Henry HoDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Stock C

Caricato da

Henry HoCopyright:

Formati disponibili

Stock Options

WHAT IS A STOCK OPTION?

A stock option is a financial contract based on single underlying stock which is traded on the Stock Exchange and cleared through its Clearing House. There are two types of options:

CALL

A call option buyer has the right to buy the underlying stock at the strike price (i.e. pre-determined price) on or before the expiry day, while a call option seller has the obligation to sell the underlying stock at the strike price upon exercise on or before the expiry day.

PUT

A put option buyer has the right to sell the underlying stock at the strike price on or before the expiry day, while a put option seller has the obligation to buy the underlying stock at the strike price upon exercise on or before the expiry day.

OPTION PREMIUM

The cost of an option is option premium, which is quoted on a per share basis. The buyer of a stock option pays the option premium, while the seller receives the option premium (margin requirements apply to stock option sellers).

INVESTMENT RETURN

The return of a stock option position depends on the price of the underlying stock. A diagram illustrating the profit / loss profile of a stock option position at expiration in relation to the underlying stock price is called an option expiration payoff diagram. The expiration payoff diagrams of four basic option positions are as follows:

Long Call

Profit

Long Put

Profit

0

Loss

Stock Price

Premium paid

0

Loss

Stock Price Strike Price

Premium paid

Strike Price

Hong Kong Exchanges and Clearing Limited 12/F, One International Finance Centre, 1 Harbour View Street, Central, Hong Kong 12 Tel : +852 2522 1122 Fax : +852 2295 3106 Website: www.hkex.com.hk E-mail: info@hkex.com.hk March 2011 20113

A call option buyer is subject to potential profit on the upside and potential loss is limited to the call premium.

A put option buyer is subject to potential profit on the downside and the potential loss is limited to the put premium.

Short Call

Profit

Short Put

Profit

Strike Price

Premium received

Strike Price

0

Loss

Stock Price

0

Loss

Premium received

Stock Price

A call option seller is subject to potential profit limited to the call premium and a potential loss on the upside.

A put option seller is subject to potential profit limited to the put premium and a potential loss on the downside.

USES OF STOCK OPTIONS

Stock options can assist investors in meeting different investment objectives, including: Leveraged trading on the upside or downside, e.g. long call or long put Transaction cost reduction, e.g. long call as a trading substitute for its underlying stock Hedging market risk, e.g. long put for protection on the downside Yield enhancement, e.g. short call to receive the premium Lock-in a stock profit, e.g. long put to protect the floating profit Setting a stock purchase price, e.g. short put to target stock purchase at the strike price Meeting trading needs in bullish, bearish, stagnant or volatile markets, e.g. options combination trades

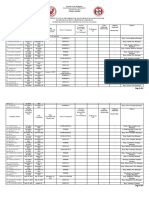

CONTRACT SUMMARY OF STOCK OPTIONS

Option Types Contract Size (in terms of shares) Contracted Value Contract Months Minimum Fluctuation Option Premium Strike Prices (HK$) Puts and calls Refer to the stock option class list Option Premium multiplied by the Contract Size Spot, the next two calendar months & the three quarter months# # HK$0.01 Quoted in HK dollars on a per share basis $0.01 Up to $2 $2 to $5 $5 to $10 $10 to $20 $20 to $50 $50 to $100 $100 to $200 $200 to $300 $300 to $500 9:30 a.m. 12:00 p.m. and 1:30 p.m. 4:00 p.m. 93012 1304 Business day immediately preceding the last business day of the contract month Options can be exercised at any time up to 6:45 p.m. on any business day up to and including the last trading day 645 HK$2.00 Physical delivery of underlying shares on exercise and settlement periods are: T + 1 (options premium, payable in full); or T + 2 (stock transfer following exercise) T+1 T+2 Tier 1 HK$3.00 Negotiable Tier 2 HK$1.00 $0.05 $0.10 $0.25 $0.50 $1.00 $2.50 $2.50 $5.00 $10.00

Trading Hours (Hong Kong time) Expiry Day Exercise Style (American) Exercise Fee Settlement

Trading Tariff (Combined trading and clearing fee) Brokerage Commission

# #

The Exchange may introduce any other longer-dated expiry month in selected stock option classes as it deems necessary.

STOCK OPTION CLASS LIST *

*

a) Stock Option Classes with Contract Size More Than One Underlying Board Lot Shares

SEHK Code

1288 1299 2601 2823 2827

Underlying Stock Name

HKATS Code HKATS

ABC AIA CPI A50 CS3

Contract Size (shares) ()

10,000 1,000 1,000 5,000 1,000

Number of Board Lots

10 5 5 50 5

Tier No.

1 2 1 1 1

Agricultural Bank of China Limited AIA Group Limited China Pacific Insurance (Group) Co., Ltd. () iShares FTSE A50 China Index ETF* iShares A50ETF * * (* This is a synthetic ETF) W.I.S.E. - CSI 300 China Tracker * 300* (* This is a synthetic ETF) (*

b) Stock Option Classes with Contract Size Equal to One Underlying Board Lot Shares

SEHK Code Underlying Stock Name

1 2 3 4 5 6 11 12 13 16 17 19 23 66 267 293 330 358 386 388 390 494 688 700 728 762 857 883 902 939 941 998 1088 1171 1186 1211 1398 1800 1898 1919 2038 2318 2328 2388 2600 2628 2777 2800 2899 3328 3968 3988 * * Cheung Kong (Holdings) Ltd. CLP Holdings Ltd. The Hong Kong and China Gas Co. Ltd. The Wharf (Holdings) Ltd. HSBC Holdings Plc. Power Assets Holdings Ltd. Hang Seng Bank Ltd. Henderson Land Development Co. Ltd. Hutchison Whampoa Ltd. Sun Hung Kai Properties Ltd. New World Development Co. Ltd. Swire Pacific Ltd. A The Bank of East Asia, Ltd. MTR Corporation Ltd. CITIC Pacific Ltd. Cathay Pacific Airways Ltd. Esprit Holdings Ltd. Jiangxi Copper Company Ltd. China Petroleum & Chemical Corporation (Sinopec) Hong Kong Exchanges and Clearing Ltd. China Railway Group Ltd. Li & Fung Ltd. China Overseas Land & Investment Ltd. Tencent Holdings Ltd. China Telecom Corporation Ltd. China Unicom (Hong Kong) Ltd. PetroChina Co. Ltd. CNOOC Ltd. Huaneng Power International, Inc. China Construction Bank Corporation China Mobile Ltd. China CITIC Bank Corporation Ltd. China Shenhua Energy Company Ltd. Yanzhou Coal Mining Company Ltd. China Railway Construction Corporation Ltd. BYD Company Ltd. Industrial and Commercial Bank of China Ltd. China Communications Construction Company Ltd. China Coal Energy Company Ltd. China COSCO Holdings Company Ltd. Foxconn International Holdings Ltd. Ping An Insurance (Group) Co. of China, Ltd. PICC Property and Casualty Company Ltd. BOC Hong Kong (Holdings) Ltd. Aluminum Corporation of China Ltd. (Chalco) China Life Insurance Company Ltd. Guangzhou R&F Properties Co., Ltd. Tracker Fund of Hong Kong Zijin Mining Group Company Ltd. Bank of Communications Co., Ltd. China Merchants Bank Co., Ltd. Bank of China Ltd.

HKATS Code HKATS

CKH CLP HKG WHL HKB HEH HSB HLD HWL SHK NWD SWA BEA MTR CIT CPA ESP JXC CPC HEX CRG LIF COL TCH CTC CHU PEC CNC HNP CCB CHT CTB CSE YZC CRC BYD ICB CCC CCE CCS FIH PAI PIC BOC ALC CLI RFP TRF ZJM BCM CMB BCL

Contract Size (shares)

1,000 500 1,000 1,000 400 500 100 1,000 1,000 1,000 1,000 500 200 500 1,000 1,000 100 1,000 2,000 100 1,000 2,000 2,000 100 2,000 2,000 2,000 1,000 2,000 1,000 500 1,000 500 2,000 500 500 1,000 1,000 1,000 500 1,000 500 2,000 500 2,000 1,000 400 500 2,000 1,000 500 1,000

Tier No.

1 1 2 1 1 2 2 1 1 1 1 1 2 2 1 1 2 2 2 1 2 1 1 2 2 2 2 2 2 2 1 2 2 1 2 1 2 2 2 2 1 2 2 2 2 2 2 2 2 2 2 2

The most updated stock options contract specifications, stock options classes and board lot sizes are set forth at www.hkex.com.hk.

www.hkex.com.hk

LIST OF INFORMATION VENDORS AND ACCESS CODES

Information Vendor Access Codes AAStocks.com Ltd 6 digits code starting with 340 340 ACTIV Financial Systems, Inc. AFE Solutions Limited HKATS Trading Code HKATS 7 + 5 digits SEHK Code + Contract Month (1 = spot month, 2 = 2nd month, 3 = 3rd month and etc.) e.g. 7000011 Cheung Hong Stock Options (spot month) 7 + + 1 = 2 = 3 = 4 = 5 = - 7000011 Stock code HK Equity OMON <GO>, e.g. 5 HK Equity OMON <GO> (for Options on HSBC) HK Equity OMON <GO>e.g. 5 HK Equity OMON <GO> Hit option on menu bar, select Stock Options Quotation and then select the underlying option Stock Options Quotation Finet FME/FIE/FFE: Select "Options" button Finet PowerStation: "Derivatives" "HK Options" Access Code in the Options Panel FME/FIE/FFE: "Options""Futures & Options" "HK Options Market""Option Panel" HKATS Trading Code HKATS 0#stock code*.HK, e.g. 0#0005*.HK (for Options on HSBC) 0#*.HKe.g. 0#0005*.HK <Class code> <y><m><c/p><strike>,278 e.g. HKB59C125,278 (for options on HSBC/) (Class code=HKATS code, y=year, m=month, c=Call, p=Put, strike=strike Price) Class code=HKATS y=m=c=p=strike= HKATS Trading Code + "0" [Month][Year] HKATS + "0" [][] Alt+O -> <stock code> Alt+O -> <> <Class code> <y><m><strike> Class code=HKATSy=m=strike=

Bloomberg L.P. ET Net Limited Finet Holdings Limited

Infocast Limited Reuters Ltd, a Thomson Reuters Company Six Telekurs Ltd

Telequote Date Int'l Ltd. Tele-Trend Ltd Tenfore Systems Ltd

For the most updated information, please visit: http://www.hkex.com.hk/eng/market/dv_tradfinfo/infovendor.htm http://www.hkex.com.hk/eng/market/dv_tradfinfo/infovendor.htm

TERMINOLOGY

Intrinsic Value Intrinsic value is the amount received when the option is exercised. This is measured by the difference between the strike price of an option and the market price of the underlying stock. If the difference is positive, it has positive intrinsic value; otherwise the intrinsic value is zero. Time Value Time value is the extra amount of value apart from the intrinsic value in the option premium; it is determined by six factors: underlying stock price, strike price, volatility, time to expiration, interest rates and dividends. At-The-Money (ATM) The strike price of call or put is equal to or close to the underlying stock price. In-The-Money (ITM) The state when the strike price of a call option is lower than the underlying stock price or the strike price of a put option is higher than the underlying stock price. Out-Of-The-Money (OTM) The state when the strike price of a call option is higher than the underlying stock price, the strike price of a put option is lower than the underlying stock price. Volatility (%) Volatility represents the annualized standard deviation of the return of the underlying stock. It reflects the degree to which % the price of a stock tends to fluctuate over a specified period of time. The higher the volatility, the higher the option premium.

Risks of Trading Options

Options involve a high degree of risk. Losses from options trading can exceed your initial margin funds and you may be required to pay additional margin funds on short notice. Failure to do so may result in your position being liquidated and you being liable for any resulting deficit. You must therefore understand the risks of trading in options and should assess whether they are right for you. You are encouraged to consult a broker or financial adviser on your suitability for options trading in light of your financial position and investment objectives before trading.

Hong Kong Exchanges and Clearing Limited (HKEx)

All rights reserved. Nothing herein is to be construed as a recommendation to purchase or sell options contracts or to provide investment advice. While efforts are made to ensure the accuracy of information contained in this publication, HKEx and its subsidiaries do not warrant its accuracy, timeliness, completeness or fitness for a particular purpose and do not assume any liability for any errors or omissions or any action taken on the basis of such information.

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- CONTRACT II Rough Draft ScriibdDocumento19 pagineCONTRACT II Rough Draft ScriibdNitish JoshiNessuna valutazione finora

- Nenaco - Dis As of December 2017 - 17apr2018. - FBB3C PDFDocumento182 pagineNenaco - Dis As of December 2017 - 17apr2018. - FBB3C PDFPaula Del Castillo ArichetaNessuna valutazione finora

- 2021 Pre Week Notes in Commercial Law Based On Reduced SyllabusDocumento97 pagine2021 Pre Week Notes in Commercial Law Based On Reduced SyllabusMich FelloneNessuna valutazione finora

- EY Real Estate Investments Trends and Outlook - Jul19 PDFDocumento28 pagineEY Real Estate Investments Trends and Outlook - Jul19 PDFBaniNessuna valutazione finora

- Business Structure Sample PDFDocumento5 pagineBusiness Structure Sample PDFAnujAggarwalNessuna valutazione finora

- Advance Corporate Accounting Syllabus IDocumento2 pagineAdvance Corporate Accounting Syllabus IJøël JøëlNessuna valutazione finora

- What Is Investment Banking (IB) ? (What Do Investment Bankers Do?)Documento41 pagineWhat Is Investment Banking (IB) ? (What Do Investment Bankers Do?)Chuột Sâu KiuNessuna valutazione finora

- Project Finance EMBA - NandakumarDocumento63 pagineProject Finance EMBA - NandakumarKrishna SinghNessuna valutazione finora

- List of Companies of Canada - WikipediaDocumento46 pagineList of Companies of Canada - WikipediaNUTHI SIVA SANTHANNessuna valutazione finora

- Vaccination Status BSC ProgramDocumento6 pagineVaccination Status BSC ProgramDedray Marsada HernandezNessuna valutazione finora

- Sweet Child O Mine SunghaDocumento8 pagineSweet Child O Mine SunghaGMalone2Nessuna valutazione finora

- Sebi Guidelines Related To Green Shoe OptionDocumento4 pagineSebi Guidelines Related To Green Shoe OptionPriyesh ChoureyNessuna valutazione finora

- Sol Man Chapter 2 Bus Com Part 2Documento14 pagineSol Man Chapter 2 Bus Com Part 2Halt DougNessuna valutazione finora

- Bank CertificateDocumento1 paginaBank CertificateUCO BANKNessuna valutazione finora

- Edge Xonsulting Shootcamp PlanningDocumento5 pagineEdge Xonsulting Shootcamp PlanningKshitiz KumarNessuna valutazione finora

- Fast Track Mergers Under Companies Act 2013Documento18 pagineFast Track Mergers Under Companies Act 2013Abhinand ErubothuNessuna valutazione finora

- Bse Listed Top 100 Compnies-2586jDocumento4 pagineBse Listed Top 100 Compnies-2586jsriguruNessuna valutazione finora

- ACCOUNT ACTIVITYDocumento20 pagineACCOUNT ACTIVITYcrkriskyNessuna valutazione finora

- Ananlysis Equity Shares of Axis BankDocumento17 pagineAnanlysis Equity Shares of Axis BankbluechelseanNessuna valutazione finora

- Post Merger IntegrationDocumento22 paginePost Merger Integrationharshnika100% (1)

- Midterm Q and ADocumento33 pagineMidterm Q and ACloieRjNessuna valutazione finora

- Advanced Financial Accounting (Acfn3151)Documento2 pagineAdvanced Financial Accounting (Acfn3151)alemayehu100% (4)

- Monthly Portfolios For March 2020 - 1Documento487 pagineMonthly Portfolios For March 2020 - 1Randeep SinghNessuna valutazione finora

- A Note On Valuation For Venture CapitalDocumento14 pagineA Note On Valuation For Venture Capital/jncjdncjdnNessuna valutazione finora

- Stock Valuation ProblemsDocumento4 pagineStock Valuation Problemsfahad haxanNessuna valutazione finora

- S2 Rev1Documento24 pagineS2 Rev1sesma1100% (1)

- 14 Zutter Smart MFBrief 15e Ch14 RevDocumento106 pagine14 Zutter Smart MFBrief 15e Ch14 RevhaiNessuna valutazione finora

- Basic Consol - Tutorial Q 82022Documento10 pagineBasic Consol - Tutorial Q 82022ZhaoYing TanNessuna valutazione finora

- CORPORATIONCONTACTDETAILSDocumento16 pagineCORPORATIONCONTACTDETAILSSaran vjNessuna valutazione finora

- The Committee To Scam New YorkDocumento31 pagineThe Committee To Scam New YorkpublicaccountabilityNessuna valutazione finora