Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Kepco v. CIR

Caricato da

Dhan SamsonDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Kepco v. CIR

Caricato da

Dhan SamsonCopyright:

Formati disponibili

Kepco v. CIR G.R. No.

179961 January 31, 2011 Facts: Kepco is a domestic corporation engaged in the independent production of of energy. It sells its electricity to NaPoCor, who is a VAT exempt entity. In 1999, Kepco incurred input VAT amounting to PhP 10.5 Million on its domestic purchase of goods and services used in the production and sale of electricity to Napocor. Kepco filed an administrative claim for refund on the unutilized input taxes. The CTA denied Kepcos claim for refund for failure to substantiate its effectively zero-rated sales during the taxable year. The CTA held that Kepco failed to comply with the invoicing requirements. The CTA reasoned that Kepcos failure to comply with the requirement of imprinting the words zero-rated on its official receipts resulted in non-entitlement to the benefit of VAT zero-rating and denial of Kepcos claim for refund of input tax. Issue: Whether or not Kepcos failure to imprint the words zero-rated on its VAT official receipts issued to NPC is fatal to its claim for refund of unutilized input tax credits. Held: Yes Ratio: For the effective zero rating of such services, however, the VAT -registered taxpayer must comply with invoicing requirements under Sections 113 and 237 of the 1997 NIRC as implemented by Section 4.108-1 of R.R. No. 7-95, thus:

Sec. Persons. 113. Invoicing and Accounting Requirements for VAT-Registered

(A) Invoicing Requirements. A VAT-registered person shall, for every sale, issue an invoice or receipt. In addition to the information required under Section 237, the following information shall be indicated in the invoice or receipt: (1) A statement that the seller is a VAT-registered person, followed by his taxpayers identification number; and (2) The total amount which the purchaser pays or is obligated to pay to the seller with the indication that such amount includes the value-added tax. (B) Accounting Requirements. Notwithstanding the provisions of Section 233, all persons subject to the value-added tax under Sections 106 and 108 shall, in addition to the regular accounting records required, maintain a subsidiary sales journal and subsidiary purchase journal on which the daily sales and purchases are recorded. The subsidiary journals shall contain such [10] information as may be required by the Secretary of Finance. (Emphasis supplied) Sec. 237. Issuance of Receipts or Sales or Commercial Invoices. All persons subject to an internal revenue tax shall, for each sale or transfer of merchandise or for services rendered valued at Twenty-five pesos (P25.00) or more, issue duly registered receipts or sales or commercial invoices, prepared at least in duplicate, showing the date of transaction, quantity, unit cost and description of merchandise or nature of service: Provided, however, That in the case of sales, receipts or transfers in the amount of One Hundred Pesos ( P100.00) or more, or regardless of amount, where the sale or transfer is made by a person liable to value-added tax to another person also liable to value-added tax; or where the receipt is issued to cover payment made as rentals, commissions, compensations or fees, receipts or invoices shall be issued which shall show the name, business style, if any, and address of the purchaser, customer or client; Provided, further, That where the purchaser is a VAT-registered person, in addition to the information herein required, the invoice or receipt shall further show the Taxpayer Identification Number (TIN) of the purchaser. The original of each receipt or invoice shall be issued to the purchaser, customer or client at the time the transaction is effected, who, if engaged in business or in the exercise of profession, shall keep and preserve the same in his place of business for a period of three (3) years from the

close of the taxable year in which such invoice or receipt was issued, while the duplicate shall be kept and preserved by the issuer, also in his place of b usiness, for a like period. The Commissioner may, in meritorious cases, exempt any person subject to an internal revenue [11] tax from compliance with the provisions of this Section. Section 4.108-1. Invoicing Requirements. All VAT-registered persons shall, for every sale or lease of goods or properties or services, issue duly registered receipts or sales or commercial invoices which must show: 1. The nam e, TIN and address of seller; 2. Date of transaction; 3. Quantity, unit cost and description of merchandise or nature of service; 4. The name, TIN, business style, if any, and address of the VAT-registered purchaser, customer or client; 5. The word "zero-rated" imprinted on the invoice covering zero-rated sales; 6. The invoice value or consideration. In the case of sale of real property subject to VAT and where the zonal or market value is higher than the actual consideration, the VAT shall be separately indicated in the invoice or receipt. Only VAT-registered persons are required to print their TIN followed by the word "VAT" in their invoices or receipts and this shall be considered as "VAT Invoice." All purchases covered by invoices other than "VAT Invoice" shall not give rise to any input tax. If the taxable person is also engaged in exempt operations, he should issue separate invoices or receipts for the taxable and exempt operations. A "VAT Invoice" shall be issued only for sales of goods, properties or services subject to VAT imposed in Sections 100 and 102 of the code. The invoice or receipt shall be prepared at least in duplicate, the original to be given to the buyer and the duplicate to be retained by the seller as part of his accounting records. (Emphases supplied)

Also, as correctly noted by the CTA En Banc, in Kepcos approved Application/Certificate for Zero Rate issued by the CIR on January 19, 1999, the imprinting requirement was likewise specified, viz:

Valid only for sale of services from Jan. 19, 1999 up to December 31, 1999 unless sooner revoked. [12] Note: Zero-Rated Sales must be indicated in the invoice/receipt.

Indeed, it is the duty of Kepco to comply with the requirements, including the imprinting of the words zero-rated in its VAT official receipts and invoices in order for its sales of electricity to NPC to qualify for zero-rating. It must be emphasized that the requirement of imprinting the word zero-rated on the invoices or receipts under Section 4.108-1 of R.R. No. 7-95 is mandatory as ruled by the CTA En Banc, citing Tropitek International, Inc. v. Commissioner of Internal [13] [14] In Kepco Philippines Corporation v. Commissioner of Internal Revenue, the Revenue. CTA En Banc explained the rationale behind such requirement in this wise:

The imprinting of zero-rated is necessary to distinguish sales subject to 10% VAT, those that are subject to 0% VAT (zero -rated) and exempt sales, to enable the Bureau of Internal Revenue to properly implement and enforce the other provisions of the 1997 NIRC on VAT, namely: 1. 2. 3. 4. Zero-rated sales [Sec. 106(A)(2) and Sec. 108(B)]; Exempt transactions [Sec. 109] in relation to Sec. 112(A); Tax Credits [Sec. 110]; and Refunds or tax credits of input tax [Sec. 112] xxx

Potrebbero piacerti anche

- Additonal Disclosure RR 15 2010Documento5 pagineAdditonal Disclosure RR 15 2010Emil A. MolinaNessuna valutazione finora

- Evidence - Cercado-Siga To PP v. Ibanez - BeldadDocumento8 pagineEvidence - Cercado-Siga To PP v. Ibanez - BeldadBernadette Luces BeldadNessuna valutazione finora

- Value-Added Tax: Vat On Sale of Goods or PropertiesDocumento11 pagineValue-Added Tax: Vat On Sale of Goods or PropertiesJune Baricanosa AlvarezNessuna valutazione finora

- Commissioner of Internal Revenue vs. Seagate Technology (Philippines)Documento33 pagineCommissioner of Internal Revenue vs. Seagate Technology (Philippines)Giuliana FloresNessuna valutazione finora

- Remedies 1 AssessmentDocumento1 paginaRemedies 1 AssessmentBetson CajayonNessuna valutazione finora

- CIR Vs Toshiba Information EquipmentDocumento1 paginaCIR Vs Toshiba Information EquipmentKayee KatNessuna valutazione finora

- 1 BIR - TRAIN - TOT - Briefing - Introduction To TRAIN2Documento24 pagine1 BIR - TRAIN - TOT - Briefing - Introduction To TRAIN2Jordan Tagao ColcolNessuna valutazione finora

- RULE 108 - Rules of Court (Correction of Civil Registry)Documento1 paginaRULE 108 - Rules of Court (Correction of Civil Registry)Gerald MesinaNessuna valutazione finora

- Panasonic Communications Imaging Corp. v. CIRDocumento3 paginePanasonic Communications Imaging Corp. v. CIRAbigayle RecioNessuna valutazione finora

- Tax Administration and Remedies-1Documento67 pagineTax Administration and Remedies-1Van TisbeNessuna valutazione finora

- RMC No. 108-2020 Annex ADocumento3 pagineRMC No. 108-2020 Annex AJoel SyNessuna valutazione finora

- Taxation I Case DigestsDocumento4 pagineTaxation I Case DigestsAntonio Borja50% (2)

- Tax 2 Case Digest 5Documento1 paginaTax 2 Case Digest 5Leo NekkoNessuna valutazione finora

- Midterm Examination NegoDocumento4 pagineMidterm Examination NegoPrinsesani GiananNessuna valutazione finora

- Dizon v. Court of Tax Appeals (Bries)Documento3 pagineDizon v. Court of Tax Appeals (Bries)Lesly BriesNessuna valutazione finora

- ARRAIGNMENTDocumento21 pagineARRAIGNMENTCesyolly SecretariaNessuna valutazione finora

- Domingo v. Domingo, 42 SCRA 131Documento8 pagineDomingo v. Domingo, 42 SCRA 131Cza PeñaNessuna valutazione finora

- CASE #17 People of The Philippines Vs Fabian Mabalato, Julio Cartuciano and Allan Canatoy G.R. No. 227195 July 29, 2019 FactsDocumento1 paginaCASE #17 People of The Philippines Vs Fabian Mabalato, Julio Cartuciano and Allan Canatoy G.R. No. 227195 July 29, 2019 FactsHarlene HemorNessuna valutazione finora

- CIR vs. BatangasDocumento2 pagineCIR vs. BatangasanniNessuna valutazione finora

- Testimonial of Good Moral Character: CertifyDocumento2 pagineTestimonial of Good Moral Character: CertifyMarivic Soriano100% (1)

- EXIBIT G - SPA Locally ExecutedDocumento3 pagineEXIBIT G - SPA Locally ExecutedMaia CastañedaNessuna valutazione finora

- Geodetic Engineer Certificate Form Ge0313 PDFDocumento1 paginaGeodetic Engineer Certificate Form Ge0313 PDFAlvin Abangan100% (1)

- Q: What Is The Difference Between These Administrative and Judicial Remedies?Documento11 pagineQ: What Is The Difference Between These Administrative and Judicial Remedies?Kharen ValdezNessuna valutazione finora

- CIR V San Roque Power CorporationDocumento5 pagineCIR V San Roque Power CorporationJemima FalinchaoNessuna valutazione finora

- Exempt Transaction Vs Exempt PartyDocumento5 pagineExempt Transaction Vs Exempt PartyMa Alyssa Rea NuñezNessuna valutazione finora

- 3 CIR V SEAGATEDocumento15 pagine3 CIR V SEAGATEjahzelcarpioNessuna valutazione finora

- Affidavit of Adjudication by Sole Heir Lot SampleDocumento3 pagineAffidavit of Adjudication by Sole Heir Lot SampleMark AmistosoNessuna valutazione finora

- Nursery Care Corp Vs City of ManilaDocumento2 pagineNursery Care Corp Vs City of ManilaCarlu YooNessuna valutazione finora

- Protest of AssessmentDocumento3 pagineProtest of AssessmentMarmiana DyanNessuna valutazione finora

- Affidavit of CohabitationDocumento2 pagineAffidavit of CohabitationTan JunNessuna valutazione finora

- Deed of Chattel Mortgage - Jesus RullanDocumento2 pagineDeed of Chattel Mortgage - Jesus RullanHarold EstacioNessuna valutazione finora

- 01 CD Special ProceedingsDocumento7 pagine01 CD Special ProceedingsRmLyn MclnaoNessuna valutazione finora

- Tax Digests VATDocumento27 pagineTax Digests VATBer Sib JosNessuna valutazione finora

- Cases To Be Digest TAX 2 ATTY LIM No. 1 - 17 OnlyDocumento131 pagineCases To Be Digest TAX 2 ATTY LIM No. 1 - 17 OnlyAngelo FulgencioNessuna valutazione finora

- Calansanz DigestDocumento2 pagineCalansanz DigestErnesto NeriNessuna valutazione finora

- C - Tang Ho Vs CA CirDocumento1 paginaC - Tang Ho Vs CA Circeilo coboNessuna valutazione finora

- Letter Request (SC)Documento1 paginaLetter Request (SC)Concia Fhynn San Jose100% (1)

- Fria ReviewerDocumento19 pagineFria ReviewerViner VillariñaNessuna valutazione finora

- Chapter 13 - Succession and Estate TaxDocumento7 pagineChapter 13 - Succession and Estate TaxCamila MolinaNessuna valutazione finora

- Tax 2 Reviewer: A. Transfer TaxesDocumento11 pagineTax 2 Reviewer: A. Transfer TaxesIsay YasonNessuna valutazione finora

- Heirs of Ypon v. Ricaforte (G.R. No. 198680)Documento2 pagineHeirs of Ypon v. Ricaforte (G.R. No. 198680)Hershey Delos SantosNessuna valutazione finora

- Property Case Digest Co-OwnershipDocumento4 pagineProperty Case Digest Co-Ownershipmbendijo15Nessuna valutazione finora

- Letter ElizaldeDocumento1 paginaLetter ElizaldeJohn Eduard GallegoNessuna valutazione finora

- CIR v. The Estate of Benigno P. TodaDocumento2 pagineCIR v. The Estate of Benigno P. TodaKyle DionisioNessuna valutazione finora

- Taxation Law Ust Golden Notes PDF FreeDocumento307 pagineTaxation Law Ust Golden Notes PDF FreeMaris Angelica Ayuyao0% (1)

- Annex (A1)Documento1 paginaAnnex (A1)Jana Jonathan0% (1)

- LTD Procedure Case DoctrinesDocumento6 pagineLTD Procedure Case DoctrinesKylie Kaur Manalon DadoNessuna valutazione finora

- Affidavit of Waiver (MIGUE)Documento2 pagineAffidavit of Waiver (MIGUE)Ben J. AminNessuna valutazione finora

- Value Added TaxDocumento11 pagineValue Added TaxYvette Pauline JovenNessuna valutazione finora

- Doctrine: Ratio:: SEPTEMBER 27, 2018Documento14 pagineDoctrine: Ratio:: SEPTEMBER 27, 2018Rose Ann LascuñaNessuna valutazione finora

- Tax CaseDocumento3 pagineTax CaseSean GalvezNessuna valutazione finora

- Special Power of Attorney: AcknowledgmentDocumento1 paginaSpecial Power of Attorney: AcknowledgmentJoseph Escabosa CañeteNessuna valutazione finora

- Midterm Exam Tax 2Documento8 pagineMidterm Exam Tax 2Jeff Cacayurin TalattadNessuna valutazione finora

- Issuance of New Title Legal Forms SampleDocumento3 pagineIssuance of New Title Legal Forms SampleEric CamposNessuna valutazione finora

- Gross Estate The Value of All The Property, Real or Personal, TangibleDocumento40 pagineGross Estate The Value of All The Property, Real or Personal, TangibleRomz NuneNessuna valutazione finora

- Republic of The Philippines vs. Ma. Imelda "Imee" R. Marcos - Manotoc, Et Al., GR No. 171701, 8 February 2012 DigestDocumento5 pagineRepublic of The Philippines vs. Ma. Imelda "Imee" R. Marcos - Manotoc, Et Al., GR No. 171701, 8 February 2012 DigestAbilene Joy Dela CruzNessuna valutazione finora

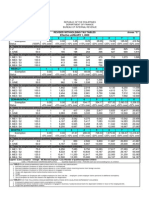

- 2015 BIR Withholding Tax TableDocumento1 pagina2015 BIR Withholding Tax TableJonasAblangNessuna valutazione finora

- CIR Vs WYETH SummaryDocumento2 pagineCIR Vs WYETH SummaryJose VeranoNessuna valutazione finora

- Kepco v. CIRDocumento4 pagineKepco v. CIRWhere Did Macky GallegoNessuna valutazione finora

- Kepco vs. CirDocumento2 pagineKepco vs. CirCaroline A. LegaspinoNessuna valutazione finora

- Handbook of Tax Simplification - Web VersionDocumento258 pagineHandbook of Tax Simplification - Web VersionasoygantengNessuna valutazione finora

- 5T Eur To 5 Box 1T DR.M&P2112Documento7 pagine5T Eur To 5 Box 1T DR.M&P2112seyede.fateme.alaeiNessuna valutazione finora

- US Internal Revenue Service: f1040 - 1991Documento2 pagineUS Internal Revenue Service: f1040 - 1991IRSNessuna valutazione finora

- SMChap 021Documento56 pagineSMChap 021testbank91% (11)

- Your Tata Docomo Bill Account NoDocumento13 pagineYour Tata Docomo Bill Account NoEduru RaviNessuna valutazione finora

- KM65886349 StatementDocumento42 pagineKM65886349 Statementamal wadekarNessuna valutazione finora

- FEES SCHEDULE 2011 - 2012: Australian International SchoolDocumento2 pagineFEES SCHEDULE 2011 - 2012: Australian International SchoollephammydungNessuna valutazione finora

- Income Tax Compliance, Schemes of Income Taxation and Final Income TaxationDocumento45 pagineIncome Tax Compliance, Schemes of Income Taxation and Final Income TaxationMonica MonicaNessuna valutazione finora

- MobiVAT Frame of ReferenceDocumento34 pagineMobiVAT Frame of ReferencePatrick G. NgabonzizaNessuna valutazione finora

- Chapter 1 General Overview of The Tunisian Tax System: I-IntroductionDocumento5 pagineChapter 1 General Overview of The Tunisian Tax System: I-IntroductionsaiyanNessuna valutazione finora

- IT-02 Residential StatusDocumento26 pagineIT-02 Residential StatusAkshat GoyalNessuna valutazione finora

- Travel For Holiday & Inspecting Rental Property: What Is Deductible?Documento3 pagineTravel For Holiday & Inspecting Rental Property: What Is Deductible?AdrianNessuna valutazione finora

- Income Taxation: Classification of Individual TaxpayersDocumento3 pagineIncome Taxation: Classification of Individual TaxpayersALMA MORENANessuna valutazione finora

- Income Tax Return Form-1 Sahaj - Excel FormatDocumento9 pagineIncome Tax Return Form-1 Sahaj - Excel Formatswapnil007salunkeNessuna valutazione finora

- 80D CertificateDocumento1 pagina80D CertificateJBTechno Solutions100% (1)

- TaxationDocumento5 pagineTaxationThonieroce Apryle Jey Morelos100% (1)

- Fesco Online Bill May 2018Documento2 pagineFesco Online Bill May 2018Ataa Ul MustafaNessuna valutazione finora

- Z134 Your Questions AnsweredDocumento2 pagineZ134 Your Questions AnsweredraosudhNessuna valutazione finora

- White Paper The Business Model of Apple Pay and Apple CardDocumento15 pagineWhite Paper The Business Model of Apple Pay and Apple CardTBeaver BuilderNessuna valutazione finora

- October PayslipDocumento1 paginaOctober PayslipDaniel CarpenterNessuna valutazione finora

- FNF Settlement Guidelines and Ways To Reach Finance: Computation As Per Input F&F Calculation ParametersDocumento1 paginaFNF Settlement Guidelines and Ways To Reach Finance: Computation As Per Input F&F Calculation ParametersVivekMedaramitlaNessuna valutazione finora

- Tax InvoiceDocumento3 pagineTax Invoiceوصية الرحمنNessuna valutazione finora

- MGMT 026 Chapter 09 HW PDFDocumento16 pagineMGMT 026 Chapter 09 HW PDFJm SevallaNessuna valutazione finora

- NetflixDocumento1 paginaNetflixMadhur GoelNessuna valutazione finora

- Img 20200125 0001 PDFDocumento1 paginaImg 20200125 0001 PDFballav sarkarNessuna valutazione finora

- Southern Automobiles LTD.: CNG Station, Dhaka Daily Sales Statement (Shift Wise)Documento1 paginaSouthern Automobiles LTD.: CNG Station, Dhaka Daily Sales Statement (Shift Wise)Arpita NandiNessuna valutazione finora

- SBI Education Loan StatementDocumento2 pagineSBI Education Loan StatementVivek ChandakNessuna valutazione finora

- According To CoinMarketCap: How To Ride The DipDocumento19 pagineAccording To CoinMarketCap: How To Ride The DipMolly Zuckerman80% (5)

- Gentjan Leshaj 59 Park Ridings London N8 0LB United Kingdom: Returns SlipDocumento1 paginaGentjan Leshaj 59 Park Ridings London N8 0LB United Kingdom: Returns SlipnderimNessuna valutazione finora

- 095 Marubeni V CIR (1989) LacsonDocumento2 pagine095 Marubeni V CIR (1989) LacsonKyle SubidoNessuna valutazione finora