Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Bba Amity Accounts

Caricato da

Deepak BatraDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Bba Amity Accounts

Caricato da

Deepak BatraCopyright:

Formati disponibili

FINANCIAL ACCOUNTING II

Course Code: Course Objective:

To provide an understanding of the basics of financial statement analysis and statement of cash flow statement. To give a detailed understanding of accounting for different types of organizations like partnership and company, accounting for re-organization of the business in case of Amalgamation, absorption and reconstruction.

BBFFN 10201

Credit Units: 04

Course Contents:

Module I: Financial Statement Analysis Introduction, objectives of financial statement analysis, Techniques-Ratio analysis, Comparative analysis and limitations of financial statement analysis.AS-20(no numerical) Module II: Statement of Cash Flows Purpose, use and structure of the Statement of Cash Flows, Preparation of the statement of cash flows, Reporting cash flows and Interpreting the statement of cash flows.AS-3(no numerical) Module III: Accounting For Partnership Introduction to partnership accounts, partnership deed. Admission of a new partner-Revaluation account, Computation of new profit sharing ratio and sacrificing ratio, Proportionate capital, Treatment of goodwill in partnership accounts and its valuation. Retirement and Death of a partner: Determining the gaining ratio, Revaluation of assets and liabilities, Reserve, Final payment to retiring partner, Treatment and adjustment of goodwill. Numericals on preparation of various accounts in case of retirement and death of a partner. Dissolution of the firm: Circumstances leading to dissolution of partnership, Settlement of the accounts, Capital ratio on insolvency, Insolvency of all partners and Garner Vs Murray decision. Module IV: Company Accounts Company Accounts: Characteristics and types of shares. Accounting for issue of shares at par, premium and discount. Numericals on calls in arrear, calls in advance, forfeiture of shares, reissue of forfeited shares in case of pro rata allotment and determining the amount to be transferred to capital reserve. Accounting for debentures: Classification of Debentures. Differentiate Debentures from shares. Numericals on issue of debentures for cash and for consideration other than cash. Issue of debentures as collateral security. Redemption of debentures and numericals on the same. Module V: Amalgamation Absorption and Reconstruction of Companies Determining purchase consideration. Numericals on accounting treatment of amalgamation, absorption, internal and external reconstruction. Understanding inter company holdings and numericals on the inter company holdings.AS-14(no numerical)

Examination Scheme:

Components Weightage (%) P-1 10 C-1 10 CT-1 20 EE-1 60

Text & References:

Text: Maheshwari, S. N. Advanced Accountancy Volume-II Ninth Edition, Vikas Publishing House Pvt. Ltd. References: Grewal, T.S., Shukla, M. C., Advanced Accountancy Sixteenth Edition, Sultan Chand and Sons. Tulsian, P.C., Financial Accounting, Volume II, Pearson Education

Potrebbero piacerti anche

- Term Wise Syllabus (Session 2019-20) Class-XII Subject-Accountancy (Code No. 055)Documento5 pagineTerm Wise Syllabus (Session 2019-20) Class-XII Subject-Accountancy (Code No. 055)Ashutosh GargNessuna valutazione finora

- Accounting For Not-For-Profit Organisations, Partnership, Firms and Companies. (Periods 124)Documento2 pagineAccounting For Not-For-Profit Organisations, Partnership, Firms and Companies. (Periods 124)singhankit257Nessuna valutazione finora

- 15% Weightage: Accounting For Partnership Firms - Reconstitution and DissolutionDocumento1 pagina15% Weightage: Accounting For Partnership Firms - Reconstitution and DissolutionKhushiNessuna valutazione finora

- ACCOUNTANCY (Code No. 055) : RationaleDocumento10 pagineACCOUNTANCY (Code No. 055) : RationaleAshish GangwalNessuna valutazione finora

- CBSE Class 12 Accountancy Syllabus 2022 23Documento8 pagineCBSE Class 12 Accountancy Syllabus 2022 23SanakhanNessuna valutazione finora

- CBSE 2015 Syllabus 12 Accountancy NewDocumento5 pagineCBSE 2015 Syllabus 12 Accountancy NewAdil AliNessuna valutazione finora

- Grade 12 AccountancyDocumento8 pagineGrade 12 AccountancyPeeyush VarshneyNessuna valutazione finora

- Final+Accountancy+12+March+2023Documento5 pagineFinal+Accountancy+12+March+2023happilyakshitaNessuna valutazione finora

- Final Question Bank Xii Accoutancy-2022-23Documento206 pagineFinal Question Bank Xii Accoutancy-2022-23Khushi Sharma100% (1)

- Accountancy Arihant CBSE TERM 2 Class 12 Question BanksDocumento240 pagineAccountancy Arihant CBSE TERM 2 Class 12 Question BanksAT SPiDY71% (7)

- All Subject Syllabus Class 12 CBSE 2020-21Documento51 pagineAll Subject Syllabus Class 12 CBSE 2020-21Bear BraceNessuna valutazione finora

- 2022 23 Accountancy 12-MinDocumento8 pagine2022 23 Accountancy 12-MinShajila AnvarNessuna valutazione finora

- Accounting and Partnership Firm EssentialsDocumento4 pagineAccounting and Partnership Firm EssentialsAlkaNessuna valutazione finora

- Final Chapter 3.pmdDocumento4 pagineFinal Chapter 3.pmdMANISH SINGHNessuna valutazione finora

- ACCOUNTANCYDocumento176 pagineACCOUNTANCYSUDHA GADADNessuna valutazione finora

- Accountancy (Code No. 055) : Class-XII (2019-20)Documento6 pagineAccountancy (Code No. 055) : Class-XII (2019-20)naveenaNessuna valutazione finora

- H.S. 2nd Year Syllabus For Pre-Final Examination, 2021-22: AccountancyDocumento2 pagineH.S. 2nd Year Syllabus For Pre-Final Examination, 2021-22: AccountancyAnurag DeyNessuna valutazione finora

- ACCOUNTANCY AND BUSINESS STUDIES GUIDEDocumento22 pagineACCOUNTANCY AND BUSINESS STUDIES GUIDEChandrika DasNessuna valutazione finora

- Prachi CUET-UG AccountancyDocumento22 paginePrachi CUET-UG AccountancySmriti Saxena100% (1)

- Cbse Accountancy - SrSec - 2022-23Documento8 pagineCbse Accountancy - SrSec - 2022-23Sneha DubeNessuna valutazione finora

- CBSE Class 12 Accountancy Syllabus 2023 24Documento8 pagineCBSE Class 12 Accountancy Syllabus 2023 24kankariya1424Nessuna valutazione finora

- 12 Revised Accountancy 21Documento10 pagine12 Revised Accountancy 21sarvodayaeducationalgroupNessuna valutazione finora

- Must Do Content Accountancy Class XiiDocumento46 pagineMust Do Content Accountancy Class XiiHigi SNessuna valutazione finora

- Accounting syllabus analysisDocumento7 pagineAccounting syllabus analysisRubesh PanneerselvamNessuna valutazione finora

- Accounting for Not-for-Profit OrganizationsDocumento333 pagineAccounting for Not-for-Profit OrganizationsRaj Rajeshwer Gupta100% (1)

- ACCOUNTANCY CLASS XI AND XII NOTESDocumento10 pagineACCOUNTANCY CLASS XI AND XII NOTESBIKASH166Nessuna valutazione finora

- Acct XIDocumento41 pagineAcct XIsainimanish170gmailcNessuna valutazione finora

- Part B: Computerised AccountingDocumento6 paginePart B: Computerised AccountingSonakshi JainNessuna valutazione finora

- Accountancy (Code No. 055) Class-XII (2018-19)Documento7 pagineAccountancy (Code No. 055) Class-XII (2018-19)saurabhNessuna valutazione finora

- Financial Accounting Website StudyDocumento0 pagineFinancial Accounting Website StudyHozefadahodNessuna valutazione finora

- Cbse Accountancy Class XIi Sample Paper PDFDocumento27 pagineCbse Accountancy Class XIi Sample Paper PDFFirdosh Khan100% (2)

- Higher Secondary AccountancyDocumento8 pagineHigher Secondary Accountancysgangwar2005sgNessuna valutazione finora

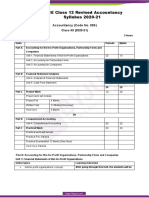

- CBSE Class 12 Revised Accountancy Syllabus 2020-21Documento8 pagineCBSE Class 12 Revised Accountancy Syllabus 2020-21Harry AryanNessuna valutazione finora

- Class 11 Accounts Syllabus Session 2015-16Documento7 pagineClass 11 Accounts Syllabus Session 2015-16Nikhil MalhotraNessuna valutazione finora

- ACCOUNTANCY (Code No. 055) : RationaleDocumento13 pagineACCOUNTANCY (Code No. 055) : Rationalepiraisudi013341Nessuna valutazione finora

- 12 Accountancy Eng 2023 24Documento5 pagine12 Accountancy Eng 2023 24Gaurav KumarNessuna valutazione finora

- MBAF5004 Financial Accounting and ReportingDocumento2 pagineMBAF5004 Financial Accounting and ReportingRahulNessuna valutazione finora

- 2013 Syllabus 12 AccountancyDocumento4 pagine2013 Syllabus 12 Accountancybhargavareddy007Nessuna valutazione finora

- Account PaperDocumento8 pagineAccount PaperAhmad SiddiquiNessuna valutazione finora

- CBSE Class 12 Accountancy SyllabusDocumento6 pagineCBSE Class 12 Accountancy Syllabusrkmobile58627Nessuna valutazione finora

- Financial Accounting Website Study PDFDocumento412 pagineFinancial Accounting Website Study PDFrudypatil100% (2)

- Lesson PlanDocumento3 pagineLesson PlanMurari NayuduNessuna valutazione finora

- MCA SyllabusDocumento1 paginaMCA SyllabusSenthil KumarNessuna valutazione finora

- Cbse Board Accountancy SyllabusDocumento4 pagineCbse Board Accountancy Syllabusapi-139761950Nessuna valutazione finora

- Xii AccountancyDocumento214 pagineXii AccountancyNeetu Sharma100% (1)

- Accountancy Second Year Revised Syllabus W.E.F. Session 2023 24Documento5 pagineAccountancy Second Year Revised Syllabus W.E.F. Session 2023 24uttamsonowal084Nessuna valutazione finora

- CourseplanDocumento6 pagineCourseplanManleen KaurNessuna valutazione finora

- Xii - 2022-23 - Acc - RaipurDocumento148 pagineXii - 2022-23 - Acc - RaipurNavya100% (1)

- 3rd Year SyllebusDocumento45 pagine3rd Year SyllebusAMIRNessuna valutazione finora

- Account Sylabus Pu 2Documento7 pagineAccount Sylabus Pu 2bhasunagaNessuna valutazione finora

- ACCOUNTANCY (Code No. 055) : RationaleDocumento11 pagineACCOUNTANCY (Code No. 055) : RationaleIshan MittalNessuna valutazione finora

- 502 Final-2Documento22 pagine502 Final-2mrx255803Nessuna valutazione finora

- Accountancy - XII Cbse 2013Documento35 pagineAccountancy - XII Cbse 2013Zeus GhoshNessuna valutazione finora

- 1271 XII Accountancy Study Material Supplementary Material HOTS and VBQ 2014 15 PDFDocumento380 pagine1271 XII Accountancy Study Material Supplementary Material HOTS and VBQ 2014 15 PDFBalaji TkpNessuna valutazione finora

- Module For Fundamentals of AccountingDocumento9 pagineModule For Fundamentals of AccountingJohn Rey Bantay Rodriguez50% (2)

- Accountancy For Dummies PDFDocumento6 pagineAccountancy For Dummies PDFsritesh00% (1)

- CBSE portal provides detailed Accountancy syllabusDocumento10 pagineCBSE portal provides detailed Accountancy syllabusDhanbad TalksNessuna valutazione finora

- Accountancy First Year Revised Syllabus W.E.F. Session 2023 24Documento3 pagineAccountancy First Year Revised Syllabus W.E.F. Session 2023 24sarsengmesNessuna valutazione finora

- The Portable MBA in Finance and AccountingDa EverandThe Portable MBA in Finance and AccountingValutazione: 4 su 5 stelle4/5 (19)

- Maria Eva Jane Dumasapal Learning Activity 3 PDFDocumento4 pagineMaria Eva Jane Dumasapal Learning Activity 3 PDFMika MolinaNessuna valutazione finora

- Timothy - Chap 11Documento24 pagineTimothy - Chap 11Chaeyeon JungNessuna valutazione finora

- ILEC Unit 4Documento4 pagineILEC Unit 4Nini LomidzeNessuna valutazione finora

- Illustrative Ind As Standalone Financial Statements: XYZ Limited Standalone Balance Sheet As at 31 March 2020Documento1 paginaIllustrative Ind As Standalone Financial Statements: XYZ Limited Standalone Balance Sheet As at 31 March 2020Nanda KumarNessuna valutazione finora

- Working Capital Management OverviewDocumento10 pagineWorking Capital Management OverviewsubhaseduNessuna valutazione finora

- 21 CorfinExerciseDocumento21 pagine21 CorfinExerciseAaryn KasoduNessuna valutazione finora

- Class-4 SA-805Documento4 pagineClass-4 SA-805kunal3152Nessuna valutazione finora

- Manufacturing Company BudgetingDocumento10 pagineManufacturing Company BudgetingSajakul SornNessuna valutazione finora

- Cashflows For Capital BudgetingDocumento1 paginaCashflows For Capital BudgetingSaurabh KumarNessuna valutazione finora

- Hum 2217 (Acc) Cost Statement ProblemDocumento4 pagineHum 2217 (Acc) Cost Statement ProblemNourin TasnimNessuna valutazione finora

- Garlington Technologies IncDocumento2 pagineGarlington Technologies IncRamarayo MotorNessuna valutazione finora

- Hanifah Hilyah Syah - 2062201070 - Akuntansi 1 Shift 1 - Panorama HijauDocumento16 pagineHanifah Hilyah Syah - 2062201070 - Akuntansi 1 Shift 1 - Panorama Hijaureza hariansyahNessuna valutazione finora

- Question 2 of 3 - CHAPTER 1 - END OF CHAPTER ASSIGNMENTDocumento3 pagineQuestion 2 of 3 - CHAPTER 1 - END OF CHAPTER ASSIGNMENTMarina BueyNessuna valutazione finora

- Optimal Capital Structure Mix for Maximum ProfitsDocumento13 pagineOptimal Capital Structure Mix for Maximum Profitssonu kumarNessuna valutazione finora

- Rangkuman Bab 9 Asset Pricing PrinciplesDocumento4 pagineRangkuman Bab 9 Asset Pricing Principlesindah oliviaNessuna valutazione finora

- Accounting Terms in EnglishDocumento16 pagineAccounting Terms in EnglishLela Siti HolilahNessuna valutazione finora

- Accounting for Company Income TaxDocumento15 pagineAccounting for Company Income TaxEhtesham HaqueNessuna valutazione finora

- Mergers and acquisitions multiple choice questionsDocumento2 pagineMergers and acquisitions multiple choice questionsKristel SumabatNessuna valutazione finora

- ResumeDocumento2 pagineResumeantonkaminsky4868Nessuna valutazione finora

- Birla RatioDocumento22 pagineBirla RatioveeraranjithNessuna valutazione finora

- NESTLE BHD Financial Analysis: Group 4Documento14 pagineNESTLE BHD Financial Analysis: Group 4Ct TanNessuna valutazione finora

- CFAS - Final Exam ADocumento11 pagineCFAS - Final Exam AKristine Esplana ToraldeNessuna valutazione finora

- UntitledDocumento479 pagineUntitledshantanuNessuna valutazione finora

- Liquidity and Profitability Study of Nepal BankDocumento46 pagineLiquidity and Profitability Study of Nepal BankBirgunj Online CyberNessuna valutazione finora

- Corporate Income TaxDocumento14 pagineCorporate Income Tax36. Lê Minh Phương 12A3Nessuna valutazione finora

- AMFI Work BookDocumento5 pagineAMFI Work Bookapi-3755316100% (2)

- Payhawk Ebook How To Manage Month End Close Like A ProDocumento11 paginePayhawk Ebook How To Manage Month End Close Like A ProCorneliu Bajenaru - Talisman Consult SRLNessuna valutazione finora

- Ratio Analysis in HDFC BankDocumento82 pagineRatio Analysis in HDFC BankTanvir KhanNessuna valutazione finora

- Prince Pipes DRHPDocumento414 paginePrince Pipes DRHPPuneet367Nessuna valutazione finora

- AFIN1Documento6 pagineAFIN1Abs PangaderNessuna valutazione finora