Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Executive Summary (Autosaved) .Docx 1

Caricato da

Mahesh AllannavarDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Executive Summary (Autosaved) .Docx 1

Caricato da

Mahesh AllannavarCopyright:

Formati disponibili

EXECUTIVE SUMMARY

INTRODUCTION: Place your finger randomly on any Map of the world, is it developed, underdeveloped or a developing place. It is to find out one has to just study economic standing, if you find it to be a growing you can be sure that there in that place existence of excellent network of banks to offer very good banking services. Bank is nerve centers of economy and vital infrastructure facility they mobilize for accelerating economic growth. The progress of an individual or a society makes as whole depends on quality of banking services. But unfortunately in India as developing nation there is a lack of good network off banking to provide financial assistance to small farmers, small traders, & laborers as they don t come under previewed of commercial bank. This leads to a Co-Op credit movement in India has been essentially a child of distress. It is to emerge out of that turmoil and dissatisfaction which prevailing during last century. Her was a growing pressure of land rural debt was increasing, the economic position of famers were deteriorating, then Government felt that farmer could be helped through some type of Co-Op efforts. This leads to vast development of Co-Op societies in India to meet their set of mutual objective. Late Shri.Divandahadhur S. V. Mensinkai and Late Shri. Raobahabhur R. C. Artal are founded Karnataka Central Cooperative Bank ltd, Dharwad in the year 1916 with the share capital of Rs, 30000/under the provisions of Cooperative Act 1912. With an objective to provide financial assistance to agricultural and its allied activities. But in last 10 years the bank has advanced agricultural and nonagricultural loans without proper security. So the recovery was becoming granding halt, which severely has effected on the financial position. Such a position that bank was not able to pay depositors money at least meager amount. Though, the study of financial analysis of KCCB, Dharwad is conducted for 30 days based on financial statement and information given by the bank people. I have made a sincere effort to find out the financial efficiency of the bank based on ratio analysis and elicit the financial deficiency of the bank and forwarded a possible suggestion to strengthen the working of the bank.

BANK PROFILE

Name of the Bank :

: Karnataka Central Cooperative Bank Ltd,Dharwad

Address:

: Karnataka Central Cooperative Bank Ltd,Dharwad Subhash Road,Dharwad

Phone number

: (0836) 2443365

Office Hours

: 10:30am To 2:30pm 3:00pm To 5:30pm

Weekly holiday

: Sunday

Type of Industry

: Service Industry

Main input

: Cash

History of cooperative Bank

The history of cooperative movement concerns the origins and history of cooperatives .The cooperative movement began in Europe in the 19th century, primarily in Britain and France. Robert Owen (1771-1858) considered the father of the cooperative movement. A Welshman who made his fortune in the cotton trade, Owen believed in putting his workers in a good environment with access to education for themselves and their children. These ideas were put into effect successfully in the cotton mills of New Lanark, Scotland. It was hear that the first co-operative store was opened. A cooperative (also co-operative; often referred to as a co-op or coop) is defined by the International Co-operative Alliance s statement on the Co-operative Identity as an autonomous association Statement on the Co-operative Identity as an autonomous association of persons united voluntarily to meet their common economic, social, and cultural needs and aspirations through a jointly-owned and democratically-controlled enterprise. TYPES OF COOPERATIVES 1. By Governance: Worker Cooperative. Purchasing Cooperative. 2. By Purpose: Cooperative Banking, Housing Cooperative, Agricultural Cooperative, Utility Cooperative, Mutual education , Mutual insurance

Cooperative are based on the co-operative values of self-help, self-responsibility, democracy and equality, equality and solidarity and the co-operative principles of voluntary and open membership; democratic member control; member economic participation; autonomy and independence; education and training; co-operation among co-operatives; and concern for community .

The co-operative bank has a history of almost 100 years. The co-operative banks are an important constituent of the Indian Financial System. The co-operative movement originated in the west. The co-operative banks in rural areas mainly finance agricultural based activities including farming, cattle, milk, hatchery, personal finance etc. along with some small scale industries and selfemployment driven activities, the co-operative banks in urban areas mainly finance various categories of people for self-employment, industries, small scale units, home finance, consumer finance , personal finance, etc. Though registered under the co-operative societies Act of the Respective States (where formed originally) the banking related activities of the co-operative banks are also regulated by the Reserve Bank Of India. They are governed by the Banking Regulations Act 1949 and Banking Laws (Cooperative Societies) Act,1956.

Karnataka Central Cooperative Bank Ltd, Dharwad

KCC Bank Ltd, Dharwad is established on 23rd November, 1916 by R.B.Menasinakai. It was started with 41 shareholders and 71 cooperatives society s members. It initial investment was in working capital was Rs 30,000 /-. KCC Banks/district central cooperative banks are establishment with 4 head offices. 1. Bijapur 2. karwar 3. Belgaum 4. Dharwad Regional offices are 1. Dharwad 2. Gadag 3. Haveri In the year 2001 there were 94 branches were operating, present there are 35 branches is functioning. These branches are as follows 1. Dharwad-12 2. Gadag-12 3. Haveri-11 It s members are 526 co-operative credit societies , 6 spinning mills, 3 oil mills, 3 sugar factories, 17 APMCs, 38 city co-operative banks, 1463 other co-operative societies.

Branches of KCC Bank Ltd. Dharwad

SI.no 1 2 3 4 5 6 7 8 9 10 11 12 Total

Dharwad district H.O. Branch Malmaddi Alnavar Mr. Nagar Hubli Unakal Hebsur Kalaghatagi Navalgund Annigeri Kundagol Saunshi 12

Gadag district Gadag Mulgund Mundargi Ron Naregal Hole-Alur Gajendragad Soodi Itagi Nargund Shrahatti Laxmeshwar 12

Haveri district Haveri Byadagi Hirerkrur Rattihalli Haunshbhavi Chikkerur Ranebennur Savanur Shiggaon Hangal Akki-Alur 11

Objectives of KCC Bank:

The main objectives of KCC Bank is to improve and develop the agricultural sector

Sources of funds:

Shares-17 crore 72 lakhs Deposit-2128 lakhs Individual Deposit-56 crore 57 lakhs

BY, observing all above graphs we can conclude that most of the customers are dissatisfied with services of KCC bank so bank has to take following measures to improve it s condition. They are, 1. The bank has designed a business development plan branch wise, season wise and fixed the targets at the branch level, this business development plan was by the staff themselves. 2. The bank disbursed 100% agriculture lone and complied with seasonality, linked up with fertilizer business. 3. The bank insisted on over the counter payment of loans to the Luanne farmers themselves, their SB/CD accounts made up to date with photo etc. 4. The recovery of the loans in the principal waiver below and above 25000 was 621916 lakhs and the recovery under the interest waiver scheme was 36%. 5. The bank has started advancing fresh loan to strengthen the confidence building measures. The loan are advanced for gold, vehicle, go down receipts, salary based etc (scheduled will be given). 6.Recovery of these freshly advanced loans is monitored on weekly basis, one officer is to visit one branch per week, meaning one branch is covered per day and a visit note is taken and compliance is followed. 7. Out of 35 branches, 30 branches are managing the affairs satisfactorily. 5 branches are extended support to manage the depositors demand. The minimum balance maintained in accounts has given liquidity, in addition there has been opening of fresh accounts and mobilization of short term deposits to maintain liquidity (Branch wise list will be given). 8. During meetings of staff, a training session is arranged by the audit, administration staff and also senior staff of the bank on topics of everyday use. 9. The staff has been given I.D cards which they were regularly, the attainders wear uniform and also the drivers are provided uniforms. 10. The bank has obtained consent letters for the conversion of 50 crore into share from the urban banks. 11. The recovery in the non farm sector is quite encouraging very old loans having required. 12. Efforts are made at the level of principal sec to obtain the necessary permissation and the G O for the action plan.

13. An MOU has been drafted for the implementation of the action plan. The MOU will be signed by the RCS, KCC BANK and FED OF URBAN CO-OPERATIVE BANKS. 14. The bank is maintaining CCR, SLR the investment portfolio is monitored daily. 15. The bank is celebrating national festivals to inculcate public faith. 16. Training is giving through NABARD. 17. Section 65 inspection work shop was arranged and inspection of major borrows was ordered. 18. The Apex bank has given 76 lakhs towards the computerization of the bank. Waiting for new DIGC rates, now rates are available, computerization with be affected on shimoga DCC bank model with the help of the district level NIC Officer. 19. A website of the bank is designed to assist the recovery as well as give information and is ready for commissioning.

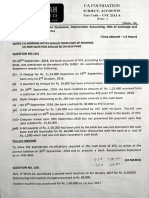

The list of LOANS

& ADVANCES which have not been collected and got converted NPA as follows

Particulars Loans & Advances Gross NPA NPA Provision

30-03-2008 23380.47 11267.53 8088.04

31-03-2009 22237.28 10603.79 8088.04

31-03-2010 22877.00 9031.41 8088.04

31-03-2011 29596.59 6060.97 8088.04

% of NPA to Total Loans & Advances

48.19

47.68

39.48

20.48

Potrebbero piacerti anche

- Introduction of The Study: Meaning and Importance of FinanceDocumento69 pagineIntroduction of The Study: Meaning and Importance of FinanceJeevitha MuruganNessuna valutazione finora

- Regional Rural Banks of India: Evolution, Performance and ManagementDa EverandRegional Rural Banks of India: Evolution, Performance and ManagementNessuna valutazione finora

- A Summer Project Report On Banking and SchemesDocumento79 pagineA Summer Project Report On Banking and Schemessimran jeet67% (12)

- State Co-Operative Bank LatestDocumento29 pagineState Co-Operative Bank LatestAhana SenNessuna valutazione finora

- Fund Management and Performance Analysis of Veliyam BankDocumento12 pagineFund Management and Performance Analysis of Veliyam BankAswani B RajNessuna valutazione finora

- CAMELS Project of Axis BankDocumento47 pagineCAMELS Project of Axis Bankjatinmakwana90Nessuna valutazione finora

- Report On Sutex BankDocumento55 pagineReport On Sutex Bankjkpatel221Nessuna valutazione finora

- Banking Report on Punjab State Cooperative BankDocumento30 pagineBanking Report on Punjab State Cooperative BankSupreet PurbaNessuna valutazione finora

- Project Cooperative BankDocumento33 pagineProject Cooperative BankPradeepPrinceraj100% (1)

- Indian Banking Sector ReformsDocumento131 pagineIndian Banking Sector Reformsanikettt50% (2)

- Comparative Analysis On NBFC & Banks NPADocumento33 pagineComparative Analysis On NBFC & Banks NPABHAVESH KHOMNENessuna valutazione finora

- ProjectDocumento70 pagineProjectnramkumar00775% (4)

- A Study on Working Capital Management in SBIDocumento58 pagineA Study on Working Capital Management in SBIPoonamNessuna valutazione finora

- Credit SaraswatDocumento76 pagineCredit Saraswatsahil1508100% (1)

- MCB Loan Report AnalysisDocumento67 pagineMCB Loan Report AnalysisPrakash Hajare100% (2)

- Co Operative BankDocumento52 pagineCo Operative BankDevendra SawantNessuna valutazione finora

- Banking Industry and Co-operative Banks in IndiaDocumento64 pagineBanking Industry and Co-operative Banks in IndiaJagadish KumarNessuna valutazione finora

- A Study of Citizens Urban Co-Op Bank's Banking ProceduresDocumento55 pagineA Study of Citizens Urban Co-Op Bank's Banking ProceduresAnkitNessuna valutazione finora

- Non-Performing Asset of Public and Private Sector Banks in India A Descriptive Study SUSHENDRA KUMAR MISRADocumento5 pagineNon-Performing Asset of Public and Private Sector Banks in India A Descriptive Study SUSHENDRA KUMAR MISRAharshita khadayteNessuna valutazione finora

- Sip Project of UbiDocumento75 pagineSip Project of UbiArgha MondalNessuna valutazione finora

- Review of LiteratureDocumento8 pagineReview of LiteratureFurkan BelimNessuna valutazione finora

- Kovaidccb Project Report FinalDocumento42 pagineKovaidccb Project Report FinalNandakumar KsNessuna valutazione finora

- Report On Organisation Study Cover Page1 DeekshaDocumento51 pagineReport On Organisation Study Cover Page1 Deekshadeeksha jNessuna valutazione finora

- A Study On The Urban Cooperative Banks Success and Growth in Vellore DistrictDocumento4 pagineA Study On The Urban Cooperative Banks Success and Growth in Vellore DistrictSrikara AcharyaNessuna valutazione finora

- Co - Operative Banks in Kerala - An OverviewDocumento27 pagineCo - Operative Banks in Kerala - An Overviewmalayali100100% (1)

- Kittur Rani Channamma Urban Credit Souharda Sahakari LTDDocumento11 pagineKittur Rani Channamma Urban Credit Souharda Sahakari LTDshivaraj goudarNessuna valutazione finora

- NPA and its impact on JK Bank performanceDocumento44 pagineNPA and its impact on JK Bank performanceHuza if50% (2)

- 3.1 Industry Profile 3.1.1 Banking Industry in IndiaDocumento25 pagine3.1 Industry Profile 3.1.1 Banking Industry in IndiaUma MaheshwariNessuna valutazione finora

- Credit SaraswatDocumento77 pagineCredit Saraswatsahil1508Nessuna valutazione finora

- Growth in Banking SectorDocumento30 pagineGrowth in Banking SectorHarish Rawal Harish RawalNessuna valutazione finora

- Comparitive Analysis of Public Sector and Private Sectors Banks PDFDocumento67 pagineComparitive Analysis of Public Sector and Private Sectors Banks PDFAnonymous y3E7ia100% (1)

- Bhavin kkkkkkkkk38Documento87 pagineBhavin kkkkkkkkk38Sandip ChovatiyaNessuna valutazione finora

- Neelam ReportDocumento86 pagineNeelam Reportrjjain07100% (2)

- Study On Financial Statement Analysis With Reference To Cooperative BankDocumento63 pagineStudy On Financial Statement Analysis With Reference To Cooperative BankIrfana kNessuna valutazione finora

- Sip Report On Punjab National BankDocumento75 pagineSip Report On Punjab National BankIshaan YadavNessuna valutazione finora

- Project On NBFCDocumento67 pagineProject On NBFCkumar12925359Nessuna valutazione finora

- Management of NPA in BankingDocumento29 pagineManagement of NPA in BankingNagireddy KalluriNessuna valutazione finora

- CC BANK FINAL PROJECT UpdatedDocumento27 pagineCC BANK FINAL PROJECT UpdatedabhishekNessuna valutazione finora

- Impact of SBI merger on financial performanceDocumento22 pagineImpact of SBI merger on financial performanceRohan PrakashNessuna valutazione finora

- Chapter - 01 Introduction of BankDocumento37 pagineChapter - 01 Introduction of BankJeeva JeevaNessuna valutazione finora

- Comparative Study of Home Loans of Abhyudaya Co-Operative Bank and NKGSB Co-Operative Bank .Documento85 pagineComparative Study of Home Loans of Abhyudaya Co-Operative Bank and NKGSB Co-Operative Bank .meenakshi dange100% (1)

- Banking Project Topics-2Documento4 pagineBanking Project Topics-2Mike KukrejaNessuna valutazione finora

- Factors Influencing Deposit Mobilisation in Rural AreasDocumento2 pagineFactors Influencing Deposit Mobilisation in Rural AreasShams SNessuna valutazione finora

- Comparative Study of The Public Sector Amp Private Sector BankDocumento70 pagineComparative Study of The Public Sector Amp Private Sector BankSetuAgrawalNessuna valutazione finora

- Corporate BankingDocumento63 pagineCorporate BankingRicha SinhaNessuna valutazione finora

- Project Reports On Non Performing Assets NPAs in Banking IndustryDocumento72 pagineProject Reports On Non Performing Assets NPAs in Banking IndustryRajpal Sheoran67% (6)

- TNSC Bank History and ServicesDocumento15 pagineTNSC Bank History and ServicesHemnath140 Shift1Nessuna valutazione finora

- Shri Siddheshwar Co-Operative BankDocumento11 pagineShri Siddheshwar Co-Operative BankPrabhu Mandewali50% (2)

- Co Operative Banking ProjectDocumento55 pagineCo Operative Banking Projectamit9_prince91% (11)

- Project SynopsisDocumento8 pagineProject SynopsisKaushik AdhikariNessuna valutazione finora

- 11 Chapter 1Documento39 pagine11 Chapter 1Divyanshi JainNessuna valutazione finora

- MDCC Bank Provides Agricultural Assistance and Vehicle LoansDocumento84 pagineMDCC Bank Provides Agricultural Assistance and Vehicle LoansNamrathaNessuna valutazione finora

- Proect Rural Banking in IndiaDocumento108 pagineProect Rural Banking in IndiaRohitRana100% (5)

- Finincial Analysis of Tumkur Grain Merchants Co-Operative BankDocumento110 pagineFinincial Analysis of Tumkur Grain Merchants Co-Operative BankPrashanth PB50% (2)

- This Paper Entitled 'RURAL FINANCING' Throws Light On The Following AspectsDocumento6 pagineThis Paper Entitled 'RURAL FINANCING' Throws Light On The Following AspectshazursaranNessuna valutazione finora

- Project On Rural Banking in India 15-01-2023Documento74 pagineProject On Rural Banking in India 15-01-2023Praveen ChaudharyNessuna valutazione finora

- NABARD Organisational Set Up and Functions 556Documento7 pagineNABARD Organisational Set Up and Functions 556sauravNessuna valutazione finora

- Saga of SuccessDocumento8 pagineSaga of SuccessbindulijuNessuna valutazione finora

- Banking Report on Coimbatore District Central Cooperative BankDocumento31 pagineBanking Report on Coimbatore District Central Cooperative BankAravindNessuna valutazione finora

- Insurance & Banking ProjectDocumento15 pagineInsurance & Banking Projectfundoo16Nessuna valutazione finora

- Questionnaire For BankDocumento5 pagineQuestionnaire For BankRajendra Patidar100% (1)

- Banking NotesDocumento104 pagineBanking NotesprasanthNessuna valutazione finora

- TTTMDocumento16 pagineTTTMThu HạnhNessuna valutazione finora

- Management Information System of Standard Charterd Bank PVT LTDDocumento17 pagineManagement Information System of Standard Charterd Bank PVT LTDUnscrewing_buks92% (13)

- Financial Services ProjectDocumento32 pagineFinancial Services Projecthimita desaiNessuna valutazione finora

- Jakarta Property Market OverviewDocumento16 pagineJakarta Property Market OverviewIndonesia100% (1)

- I.TAx 302Documento4 pagineI.TAx 302tadepalli patanjaliNessuna valutazione finora

- Cash Management System of Commercial Bank of EthiopiaDocumento44 pagineCash Management System of Commercial Bank of EthiopiaEfrem Wondale88% (8)

- Union Bank of IndiaDocumento58 pagineUnion Bank of Indiadivyesh_variaNessuna valutazione finora

- Chanda Kocchar Conflict of InterestDocumento11 pagineChanda Kocchar Conflict of InterestThe Indian Express100% (2)

- Rural Bank Wins Case Against Central Bank Penalty ChargeDocumento1 paginaRural Bank Wins Case Against Central Bank Penalty ChargechatoNessuna valutazione finora

- 01 CashandCashEquivalentsNotesDocumento7 pagine01 CashandCashEquivalentsNotesVeroNessuna valutazione finora

- Interview questions and answers on e-banking servicesDocumento6 pagineInterview questions and answers on e-banking servicesMega Pop LockerNessuna valutazione finora

- VILLANTE, Stephen U. Bachelor in Public Administration 3-1 Case Study (Midterm Exam) (Open Format)Documento6 pagineVILLANTE, Stephen U. Bachelor in Public Administration 3-1 Case Study (Midterm Exam) (Open Format)Stephen VillanteNessuna valutazione finora

- K - J.K. Shah: TOPICS: Bank ReconclatlonDocumento3 pagineK - J.K. Shah: TOPICS: Bank ReconclatlonJpNessuna valutazione finora

- Basic Theory of Financial AccountingDocumento26 pagineBasic Theory of Financial AccountingArjun SureshNessuna valutazione finora

- Module 2 Conceptual FrameworkDocumento8 pagineModule 2 Conceptual FrameworkEloisa Joy MoredoNessuna valutazione finora

- Electronicbanking Adb2426Documento35 pagineElectronicbanking Adb2426serinNessuna valutazione finora

- CSR ProjectDocumento33 pagineCSR ProjectAdil AslamNessuna valutazione finora

- Cashless Society - The Future of Money or A Utopia?: Nikola FabrisDocumento14 pagineCashless Society - The Future of Money or A Utopia?: Nikola FabrisDominika VitárNessuna valutazione finora

- Work Stress Management Among Bank EmployeesDocumento62 pagineWork Stress Management Among Bank EmployeesPrajjwal KanojiyaNessuna valutazione finora

- Reading 7 Economics of Regulation - AnswersDocumento15 pagineReading 7 Economics of Regulation - Answerstristan.riolsNessuna valutazione finora

- R M G D: ISK Anagement Uidelines For Erivatives (July 1994)Documento17 pagineR M G D: ISK Anagement Uidelines For Erivatives (July 1994)loghanand_muthuramuNessuna valutazione finora

- BRAC BankDocumento64 pagineBRAC BankHumaira HossainNessuna valutazione finora

- 17 Soriano v. BSPDocumento6 pagine17 Soriano v. BSPChester BryanNessuna valutazione finora

- KGSGDocumento7 pagineKGSGAnonymous V9E1ZJtwoENessuna valutazione finora

- Foundations of Financial Management Canadian 10th Edition Block Solutions Manual DownloadDocumento33 pagineFoundations of Financial Management Canadian 10th Edition Block Solutions Manual DownloadPeter Coffey100% (22)

- Role of Central Bank in Developing Economy - A Case Study of IndiaDocumento77 pagineRole of Central Bank in Developing Economy - A Case Study of Indiasheemankhan100% (12)

- Product Mix Decisions and BrandingDocumento32 pagineProduct Mix Decisions and BrandingJayRavasaNessuna valutazione finora

- Sme1st Reso MaybankDocumento9 pagineSme1st Reso MaybankAhmad HazwanNessuna valutazione finora