Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Laffont Marchimort Excersises

Caricato da

Kota MurayamaDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Laffont Marchimort Excersises

Caricato da

Kota MurayamaCopyright:

Formati disponibili

INTRODUCTION TO INCENTIVE THEORY

Jean-Jacques Laont & David Martimort

October 21, 2003

2

EXERCISES

I- ADVERSE SELECTION

Lending with adverse selection

There is a continuum of risk neutral borrowers with no personal wealth and limited

liability. A proportion of borrowers (called type 1) have sure projects with return h for

an investment of 1. A proportion 1 of borrowers (called type 2) have (stochastically

independent) projects with return h only with probability in (0, 1) and return 0 with

probability 1 , for an investment of 1. If he does not apply for a loan, the borrower

has an outside opportunity utility level of u.

There is a single risk neutral bank available for loans which has a nancing cost of r.

The bank oers contracts to maximize its expected prot. For simplicity, we assume that

all projects are socially valuable, i.e.,

h > r + u

1- Explain why there is no loss of generality in considering the menus of contracts

(r

1

, P

1

), (r

2

, P

2

) where P

i

is the probability of obtaining a loan and r

i

is the repayment to

the bank when the investment succeeds if the borrower announces that he is of type i.

2- Write the maximization program of the bank which chooses the menu {(r

1

, P

1

); (r

2

, P

2

)}

to maximize its expected prot under the borrowers participation and incentive con-

straints (for simplicity assume that if a borrower applies for a loan he loses his outside

opportunity u).

3- Show that the optimal contract entails a non-random allocation of loans (i.e., P

i

is

either 0 or 1, i = 1, 2). Characterize the optimal contract. Discuss its properties.

3

4 EXERCISES

Bundling with Asymmetric Information

We consider a continuum of consumers who have the following independent willing-

nesses to pay for goods 1 and 2 and desire only one unit of each good. For each good, a

consumer has an equal probability of having valuations , or + (with > ).

The two goods are sold by a monopolist who has a zero marginal cost for each of them.

1- Determine the optimal pricing policy for each good and the associated revenue. In this

exercise consider only deterministic pricing strategies.

2- Suppose that the monopolist can oer only a bundle of the two goods at a price P

B

.

Determine the optimal P

B

and show conditions under which it raises more revenue than

the optimal single good prices.

3- Show that there exist prices for the bundle of the goods which improve revenue even in

the presence of the optimal single good prices. (Hint: Draw the table of the surpluses that

the dierent types of consumers derive from the optimal single prices with the associated

prots of the monopoly. Exhibit a price for the bundle which attracts some consumers

and makes more revenue from these consumers than the optimal single good prices).

5

Incentives and aid

We consider the problem of the North willing to aid the poor in the South.

The utility function of a representative agent in the North is

V

N

= q

N

+ n

P

v(q

P

), v

> 0, v

< 0

where q

N

is the consumption, n

P

is the number of poor in the South and q

P

is the per

capita consumption of the poor in the South. Each agent of the North has an endowment

of y

N

. The consumption of the poor exerts a positive externality on the rich in the North

who are n

N

in number.

The representative rich of the South has the utility function

U = q

R

+ n

P

v(q

P

)

where q

R

is his consumption and in {,

} a parameter describing how altruistic the rich

in the South are. There are n

R

rich in the South, each one with an endowment of y

R

.

The preference parameter is private information of the rich in the South. Given

that the North must use the rich in the South as an intermediary (because they control

the government) to help the poor we want to study how the incomplete information on

aects the optimal level of aid chosen by the North.

1- Suppose rst that the South lives in autarky and that the poor of the South are only

helped by the rich in the South. We assume that the poor have no endowment.

Determine the optimal level of aid q

A

P

when it is determined by a representative rich

of the South. The corresponding level of utility obtained by the rich will be called the

status quo utility level U

A

(). Special case : v() = log().

2- Suppose rst that the North knows and brings to the South a level of aid n

R

a

to increase the incentives of the rich in the South to help the poor. Show that if a

is unconditional it does not aect the level of aid. Determine the optimal level of aid

when a can be made conditional on the consumption level of the poor q

P

. Special case :

v() = log()

3- Assume now that the North does not know and let = Pr( =

). Determine the

optimal menu of contracts ( a, q

P

); (a, q

P

), specifying aid conditional on the consumption

of the poor, which maximizes the expected utility of the North under the incentive and

participation constraints of the South. Discuss. Special case : v() = log()

6 EXERCISES

Downsizing a Public Firm

We consider a public rm which is producing a public good with a continuum of

workers of mass 1. Each worker produces one unit of public good. A mass q in [0, 1] of

workers produces an output q which has social value

S(q), with S

> 0 and S

< 0.

New outside opportunities appear for workers, calling for a downsizing of the public

rm. Let

i

the outside utility level that worker i can obtain.

i

can take one of two

positive values {,

} with =

> 0. These outside opportunities are identically

and independently distributed between workers on {,

} with = Pr(

i

= ) and 1 =

Pr(

i

=

).

A new allocation of labor is characterized by the proportions p (resp. p) of workers of

type (resp.

) who remain in the public rm. Assuming that workers are risk-neutral,

a downsizing mechanism can be viewed as a pair of contracts {(p, t); ( p,

t)} specifying for

each announcement or

, a probability to remain in the public rm and a payment

(unconditional on remaining or not in the public rm).

Total production of the public rm is then q = p +(1 ) p. Let us rst assume that

the values of outside opportunities are public knowledge. In other words the government

is under complete information. The workers accept to play the downsizing mechanism

if the government pays them, t for type ,

t for type

and satises their participation

constraints

t + (1 p) , or t p,

t + (1 p)

, or

t p

.

If there is a cost 1 + of public funds, social welfare is equal to:

S(p + (1 ) p) Social value of the public good

(1 + )(t + (1 )

t) Social cost of transfers

+(t + (1 p)) Welfare of workers.

+(1 )(

t + (1 p)

)

If > 0, the participation constraints are binding and social welfare can be reduced

to

S(p + (1 ) p) (1 + )(p + (1 ) p

) + + (1 )

.

7

The social optimum is then characterized by:

if S

() > (1 + )

,

S

( + (1 ) p) = (1 +)

and p = 1,

if (1 + )

> S

() > (1 + ),

p = 1 and p = 0,

if S

() < (1 + ),

S

(p) = (1 +) and p = 0.

From now on, we suppose that the values of the outside opportunities are observed by

the workers, and not by the government.

A downsizing mechanism {(p, t); ( p,

t)} is incentive compatible if and only if

t + (1 p)

t + (1 p)

t + (1 p)

t + (1 p).

It satises the participation constraint if

t + (1 p)

t + (1 p) .

1- Discuss these constraints and show that one condition is redundant with the other

three conditions.

2- We will say that an allocation of labor (p, p) can be implemented if there exists a

pair of transfers (t,

t) such that the downsizing mechanism {(p, t); ( p,

t)} satises all the

incentive compatibility and participation constraints.

a) Show that (p, p) can be implemented if and only if p p.

b) For any implementable (p, p), what is the pair of transfers (t,

t) that minimizes the

social cost of transfers?

3- Determine the allocation of labor and the transfers that maximize expected social

welfare. Distinguish three cases according to the value of S

().

4- Is it possible to structure the payments in such a way that each type does not regret

to have participated in the mechanism? (Hint: dierentiate the payments between those

who stay and those who leave)

5- Suppose that workers dier by the quality of their production in the public rm. A

type

worker produces units of public good while a type worker still produces one

8 EXERCISES

unit. Characterize the allocation of labor which maximizes expected social welfare when

>

.

9

Labor Contracts

A rm designs a labor contract for a worker. The utility function of the worker is,

U

A

= u(c) l, where c is consumption and l is labor supply, in {,

} is the preference

parameter known to the worker and u() in an increasing concave function; <

. The

proportion of workers with low disutility of eort, = , is . The agents optimal choice

must satisfy the budget restriction c t, where t is the payment he receives from the

rm. The rm has the following utility function: U

P

= f(l)t, where f(l) is a decreasing

returns to scale production function.

1- Assume the rm knows . Characterize the solution to the rms problem which

maximizes its utility function under the participation constraint of the worker. Call this

solution the First-Best solution.

2- Now assume that labor supply is observed by the employer (and is veriable), but

neither U nor are observed by him. Show that the First-Best solution is not imple-

mentable. The rm can now oer menus of contracts: (

t,

l) and (t, l), where (

t,

l) is the

contract chosen by the worker with disutility of eort

and (t, l) is the contract for l.

Find the optimal contract. Compare this (Second-Best) solution to the First-Best.

3- Now suppose that the worker with low disutility of eort has an outside opportunity

that gives him a utility level of V . Characterize the rst-best and second-best (asymmetric

information) solutions in this case. Take into account that the solution will depend on the

size of V . For =

, consider the cases in which

l

SB

V (SB = second-best),

l

SB

V t

( = rst-best),

l

V l

and V l

. Which are the

binding constraints in each case and what type of distortion is needed?

10 EXERCISES

Control of a Self-Managed Firm

Consider a rm that has a production function

y = l

1/2

,

where l is the number of workers (considered to be a continuous variable: l in R

+

) and

> 0 is a productivity parameter known by the rm. There are xed costs of production

A. Let p be the price of the good produced competitively by the rm.

1- Assume that the rm is managed by the workers and that its objective function is

U

SM

=

py A

l

.

Determine the optimal size (for workers) of the self-managed rm.

2- Let w be the competitive wage rate in the rest of the economy, so that w is the

opportunity cost of labor in this economy. What is the optimal allocation of labor? What

happens if w is too large? Why is the size of the self-managed rm not optimal in general?

3- Assume that the government knows . Consider the case in which w is small enough

to justify the presence of a self-managed rm. Compute the per unit tax on the good

produced by the rm that restores the optimal allocation of labor. Show that we could

also use a lump-sum tax T on the revenue of the self-managed rm to achieve the same

objective. (Assume that the rm is of negligible size with respect to the rest of the

economy).

4- Suppose now that the government does not know which can take one of two values

or

with =

> 0. It uses a regulatory mechanism (l(

), t(

)) which associates

a labor input l(

) and a transfer t(

) to the rms announcement

. The rms objective

is now

U

SM

=

p(l(

))

1/2

+ t(

) A

l(

)

.

Characterize the set of regulatory mechanisms which induce truthful revelation of .

Derive the implementability condition on .

5- Assume that = Pr( = ). Suppose that the government wishes to maximize the

expectation of

U

G

= pl

1/2

wl.

Show that the solution of this problem does not satisfy the implementability condition;

so that the rst-best is not implementable even if transfers are costless to the government.

11

What is then the optimal regulatory mechanism, when the labor managed rm has a zero

outside opportunity level of utility?

12 EXERCISES

Information and Incentives

An agent (natural monopoly) produces a quantity q of a good at a variable cost q

with in {,

}, =

. The principal gets an utility S(q)(S

> 0, S

< 0) from this

production and gives a transfer t to the agent.

The principals utility function is V = S(q) t and the agents utility function is

U = t q. Furthermore, the agents status quo utility payo is normalized at 0.

1- Characterize the optimal contract of the principal under complete information about

.

2- is now private information of the agent and = Pr( = ). Characterize the

optimal contract of the principal under incomplete information with interim participation

constraints of the agent (suppose here and later that the value of the project is large

enough so that the principal always wants to obtain a positive level of production).

3- Suppose now that the principal has access to the information technology which allows

him to receive a signal in {, } with

= Pr( = | = ) = Pr( = | =

)

1

2

.

Determine the updated principals beliefs about the eciency of the agent, that is

= Pr( = | = ); = Pr( = | = ).

Characterize the optimal contract for each .

4- Show that an increase of corresponds to an improvement of information in the sense

of Blackwell.

5- Show that an increase of has two eects on the principals expected utility, the

classical eect (that we will call the Blackwell eect) and an eect due to the direct

impact of on the expected utility of the principal conditional on .

6- Show that nevertheless the expected utility of the principal increases with .

13

The Bribing Game

We consider an administration which is supposed to deliver with some xed delay a

service to the citizens (passport, permits,...). With the normal functioning of the admin-

istration, citizens derive a benet u

0

which depends on their valuation of time.

With some additional eort the ocial can deliver the service with a shorter delay.

Let us call q the decrease of delay that the ocial can provide at a cost

(qQ)

2

2

for him

where Q is a constant.

We assume that there is a proportion (resp. 1 ) of type 1 (resp. type 2) citizens

who derive a benet from a decrease q of delay equal to q(

q). Citizens are willing to

bribe the ocial to decrease of delays.

Characterize the optimal bribing contract that the ocial will oer to the citizens.

14 EXERCISES

Regulation of Pollution

We consider a rm which has a revenue R, but creates a level of pollution x from

its activities. The damage created by the level of pollution x is D(x) with D

(x) >

0, D

(x) 0. The production cost of the rm is C(x, ), with C

x

< 0, C

xx

> 0 and is

a parameter known only to the rm. can take two values {,

} and = Pr( = ) is

common knowledge.

1- The level of pollution x

() corresponding to the complete information optimum is

characterized by

D

(x) + C

x

(x, ) = 0.

Show that, if the regulator is not obliged to satisfy a participation constraint of the rm,

he can implement x

() by asking a transfer equal to the cost of damage up to a constant.

2- Suppose now that the rm can refuse to participate (but in this case has a zero utility

level) and assume that the regulator has (up to a constant) the following objective function

W = D(x) (1 + )t + t C(x, ) (1)

where t is the transfer from the regulator to the rm and 1 + is the opportunity cost of

social funds. When the regulator must satisfy the rms participation constraint

t C(x, ) 0 for all ,

characterize the decision rule x(), in {,

}, which maximizes W under complete infor-

mation. Compare with question 1.

3- We assume in addition that C

< 0 and C

x

< 0. Determine the menu of contracts

(t, x), (

t, x) which maximizes the expectation of (1) under participation and incentive

constraints of the rm.

4- Optional. Same problem when is distributed according to the distribution F() with

density f() on the interval [,

] with

d

d

1 F()

f()

< 0, C

xx

0 and C

x

0.

15

Taxation of a Monopoly

We consider a monopoly facing a continuum [0, 1] of consumers. Each consumer is

characterized by his utility function, log q + x, where x is his consumption of good 1

(chosen as the numeraire) and q is his consumption of good 2 produced by the monopoly.

The parameter can take two values or

with

= 1 and let be the common

knowledge proportion of type consumers.

Consumers have large resources in good 1, x

, so that their behavior is always char-

acterized by the rst-order conditions of their optimization programs.

The monopoly has a variable cost function C(q) = cq and must incur a xed cost K.

1- Explain why the prole of consumption q

(), in {,

} which corresponds to an

interior Pareto optimal allocation is the solution of:

max [ log q() + x()] + (1 )

log q(

) + x(

,

subject to

x() + (1 )x(

) = x c

q() + (1 )q(

K.

Determine q

().

2- Let {(q, t); ( q,

t)} the direct revelation mechanism which elicits the parameters from

consumers. Characterize the direct revelation mechanisms which are truthful.

3- Write the optimization program of the monopoly when he is constrained to provide a

non negative utility level to each consumer

log q() t() 0 for in {,

}.

Characterize the truthful direct revelation mechanism which is optimal for the monopoly.

4- The government uses now a linear tax on the consumption of good 2 to control the

monopoly. Assuming that the government maximizes a weighted average of consumers

utility functions (with a weight 1), of the monopolys prots (with a weight larger than

1) and of taxes (with a weight > 0 such that ), show that the optimal tax is

negative.

5- Optional. Questions 2 and 3 when is distributed according to the distribution F()

with positive density f() on the interval [,

] with

d

d

1F()

f()

< 0. Consider the special

case of a uniform distribution on [2, 3] and c = 1 and obtain the associated nonlinear

price.

16 EXERCISES

Shared Information Goods, Majority Voting and Op-

timal Pricing

We consider a group of three consumers who share or not an information good sold

by a monopolist who has a zero marginal cost.

Let

i

q

q

2

2

t the utility function of consumer i, i = 1, 2, 3 where q is the quantity of the

good and t the payment. The

i

are independently drawn from the uniform distribution

on [1, 2] and private information of the consumers.

1- Assuming rst that the monopolist can prevent the consumers to share the good, char-

acterize the optimal pricing policy of the monopolist (under the simplifying assumption

that almost all consumers must have a non-zero consumption level).

2- Suppose now that consumers share the good and the payment. Assuming that demand

is determined by the median consumer, characterize the optimal pricing policy of the

monopolist (hint 1: assume that, for the optimal pricing, consumers have single peaked

preferences and check it ex post), (hint 2: the distribution function G() of the median of

three independent draws from the distribution F() is: G(x) = [F(x)]

2

[3 2F(x)]).

3- Show that the expected prot of the monopolist is higher when consumers share the

good.

17

Labor Contract with Adverse Selection

We consider a principal-agent relationship in which the principal is an employer and

the agent is a worker.

For a production level y the worker of type ( in {,

}) suers a disutility of working

equal to

(y).

In other words, a worker of type must work units of labor (with = y) which

create a disutility of labor (),

() > 0,

() 0.

If he receives a compensation t from the employer his net utility is U = t (y).

The employers utility function is V = y t.

1- Apply the Revelation Principle and characterize the truthful direct revelation mecha-

nisms.

2- Assume now that (resp. (1 )) equals the probability that the worker is of type

(resp.

). Characterize the optimal contract of an employer who maximizes his expected

utility under the incentive and interim participation constraint of the worker.

18 EXERCISES

II- MORAL HAZARD

Lending with moral hazard

We consider a cashless entrepreneur who wants to borrow and carry out the following

project. With an investment normalized to 1 unit he will get an output of z with prob-

ability

P > 0 if he exerts an eort level of e and with probability P > 0 (

P > P) if he

exerts no eort, and nothing otherwise. Let the cost of eort e for the entrepreneur.

Furthermore his status quo utility level is normalized to 0 and Pz < r.

A monopolistic bank with cost of fund r oers a loan of 1 unit for a reimbursement of

z x when the project is successful, where x is the share of production retained by the

agent.

Determine the optimal loan contract of a bank which maximizes its expected prot

under the incentive and participation constraints of the entrepreneur.

19

Moral Hazard and Monitoring

An entrepreneur who has no cash and no assets wants to nance a project which

costs I > 0. The project yields R with probability p and 0 with probability 1 p. This

probability of success depends upon the eort e in {e

H

, e

L

} of the entrepreneur: it is p

H

if eort is high (e

H

) and p

L

if e = e

L

; 1 > p

H

> p

L

= 0. A loan contract species a given

payment P if the income is R and 0 if the income is 0.

The entrepreneur enjoys a private benet B > 0 if eort is low and 0 if eort is high.

There is a competitive loan market and the economys rate of interest is equal to 0.

1- Show that the project is nanced if and only if

p

H

R B + I (1)

2- Suppose that (1) is not satised but p

H

R > I. Introduce a monitoring technology.

By spending m > 0, the lender can catch the entrepreneur if the eort is low and reverse

the decision to obtain a high level of eort; in this case the entrepreneur is punished and

receives 0. The lender and the entrepreneur choose simultaneously whether to monitor

and whether to select a high eort level. The expected payo matrix for this game is

thus:

e e

Monitor p

H

P m, p

H

(R P)) (p

H

R m, 0)

Not monitor (p

H

P, p

H

(R P)) (0, B)

Assume m < p

H

R < B.

a. Show that the only equilibrium for P < R is in mixed strategies. Find the

equilibrium strategies.

b. Argue that the project is nanced if and only if:

p

H

R m + I.

20 EXERCISES

Inducing Information Learning

We consider a principal-agent problem in which the risk-neutral principal wants to

delegate to a cashless risk-neutral agent protected by limited liability, the acquisition of

soft information about the quality of a risky project as well as the decision to engage or

not in the risky project.

There is a safe project which yields 0 to the principal with probability 1. There is also

a risky project. In the absence of information, the risky project yields

S with probability

and S with probability 1 . We will assume that

S + (1 )S = 0.

By incurring an eort with cost , the agent can learn a signal {, } on the

future realization of the risky project.

We will assume that Pr( |

S) = Pr(|S) = , with ]

1

2

, 1] being interpreted as the

precision of the signal.

1- As a benchmark, suppose that the principal uses the technology for information gath-

ering himself. Show that the project is done only when is observed. Write the condition

under which the learning of information is optimal.

2- Suppose now that the agent decides to adopt or not the risky project. The principal

uses a contract (

t, t, t

0

) to incentivize the agent.

t (resp. t) is the transfer received by the

agent if he chooses the risky project and

S (resp. S) realizes. t

0

is the transfer he receives

if he chooses the safe project. Write the incentive constraints needed to have the risky

project being chosen if and only if is observed.

3- Write the incentive constraint needed to induce the agent to learn information.

4- Find the optimal contract oered to the agent and determine the

t, t

0

and t which

induce information learning.

5- Find the second-best rule followed by the principal.

21

Optimal Contract and Limited Liability

We consider a risk-neutral principal who delegates a task to a risk-neutral agent

protected by limited liability. His eort e is a continuous variable which costs him

(e) (

> 0,

> 0). The return to the principal q follows the distribution (F(|e)

with density f(|e) on [0, q] such that the MLRP property

f

e

(q|e)

f(q|e)

> 0

holds. The principal benets from q t(q) where t(q) is the transfers he makes to the

agent.

1- Characterize the rst-best eort.

2- Write the agents incentive and participation constraints when e is non observable by

the principal. Use the rst-order approach.

3- Write the Lagrangian of the principals problem and optimize when the transfer t(q)

belongs to [0, q]. Show that the optimal contract involves a cut-o q

such that t(q) = 0

for q < q

and t(q) = q for q > q

.

22 EXERCISES

The Value of Information under Moral Hazard

We consider the simple model of contracting with limited liability of Section 5.1.2

except that the probability of success writes as

+ e where

is a random variable with

zero mean.

1- Suppose that the agent chooses his eort before knowing the realization of

. Compute

the second-best optimal eort e

SB

.

2- Suppose that the agent wants to guarantee a probability of success R, but can ne

tune the choice of his eort as a function of the realized state of nature that he observes.

Show that

> 0 and

> 0 imply that the second best optimal eort R

SB

< e

SB

.

Conclude.

23

Raising Liability Rule

We consider a lender-borrower relationship under moral hazard. The risk-neutral

borrower wants to borrow I from a lender to nance a project with safe return V . The

project may with probability 1 e harm a third-party. The amount of safety care e costs

(e) to the borrower with (

> 0,

> 0,

> 0). The harm has value h. A nancial

contract is a pair (t,

t) where t (resp.

t) is the borrowers reimbursement to the bank if

there is no (resp. one) environmental damage.

1- Suppose that e is observable. Compute the rst-best level of safety care and assume

that the project is socially valuable when the interest rate is r.

2- Suppose now that e is not observable. We suppose that the bank is competitive and

that the borrower has sucient liability. Show that the rst-best is still implementable if

the bank must reimburse h to the third-party in case of an accident.

3- Suppose that the bank must reimburse c < h to the third-party. We denote by w the

initial assets of the borrower. Show that as w diminishes, the rst-best level of eort can

no longer be implemented.

4- Compute the second-best optimal level of eort maximizing the borrowers expected

payo subject to the banks zero prot constraint, the borrowers incentive constraint and

his limited liability constraint.

5- Show that raising the banks liability c leads to a lower expected welfare.

6- Show that this result no longer holds when the bank is a monopoly.

24 EXERCISES

Risk-Averse Principal and Moral Hazard

Suppose that a risk-averse principal delegates a task to a risk-neutral agent. With

probability e (resp. 1e) the outcome is q (resp. q < q). The risk-averse principal utility

is v(q t) where t is the agents transfer and v() is a CARA von Neumann-Morgenstern

utility function. Eort costs (e) to the agent (

> 0,

> 0).

1- Suppose that e is not observable, compute the optimal contract with a risk-neutral

agent.

2- Suppose that the agent is protected by limited liability. Compute the second-best level

of eort.

3- Analyze the two limiting cases where the principal is innitely risk-averse and where

he is risk-neutral. Explain your ndings.

25

Poverty, Health Care and Moral Hazard

We consider an economy composed of a continuum [0, 1] of identical agents. The

income of an healthy agent is w. Each agent becomes (independently) sick with probability

0

, in which case he has only a survival income of w. Let the proportion of sick agents

who benet from a medical treatment which costs m per capita: then, these agents recover

their normal income w. Finally, the utility function of an healthy agent or of a sick agent

who has received a treatment is u() with u

> 0, u

< 0. The utility function of a sick

agent who has not been treated is u

M

() with u

M

> 0, u

M

< 0.

1- Let p the insurance premium that only healthy and treated sick agents can pay. We

have potentially three types of agents:

a proportion 1

0

of healthy agents with utility level u(w p),

a proportion

0

of treated sick agents with utility level u(w p),

a proportion (1 )

0

of non treated sick agents with utility level u

M

(w).

Suppose income redistribution and price discrimination of insurance are not possible.

Write thee optimization program of a utilitarian social welfare maximizer who must satisfy

budget balance of the health sector. Write and interpret the rst order conditions of this

program with respect to and p (assume an interior solution). Determine the comparative

statics of the optimal solution with respect to m, w and

0

. Let W(

0

, p

(

0

),

(

0

))

denote optimal social welfare.

2- Suppose now that with a non observable non monetary cost of health care any agent

can decrease his probability of becoming sick from

0

to

1

, with =

0

1

.

Determine the various regimes obtained when the expected social welfare is maximized

under the budget constraint and the moral hazard constraint that agents nd valuable to

spend in order to decrease their probability of being sick.

3- We consider now pairs of agents who observe each others eort of health care, and we

assume that agents can perfectly coordinate their health care behavior. Assuming now

that everybody is treated, let t

11

the insurance premium of an healthy agent paired with

a healthy agent, t

12

(resp. t

21

) the one paid by a healthy (resp. sick) agent paired with a

sick (resp. healthy) agent and t

22

the one paid by a sick agent paired with a sick agent.

Maximize the expected social welfare of a pair of agents under the incentive constraints

that the pair prefers exerting two eorts of health care rather than zero or one and under

26 EXERCISES

an expected budget balance equation (guess that the local incentive constraint is binding

and that the other incentive constraint is satised for u(x) =

2x). Show that the

solution obtained dominates the solution with individual contracts.

27

Group Lending with Moral Hazard

We consider two entrepreneurs each of whom can carry out a project with the following

characteristics. Investing 1 generates a stochastic output which can take two values, z > 0

or 0. The probability of success (i.e., of getting z) depends in the entrepreneurs eort, e,

which can take also two values e > 0 or 0. The probability of success is p for a high level

of eort e and p for no eort with p > p > 0. The disutility of eort is for e and zero

for e = 0.

Each entrepreneur has no wealth and must borrow to invest. He can only repay his

loan if he succeeds. Denoting by x the entrepreneurs share of output, his expected utility

is

px if he exerts eort e,

px if he exerts no eort.

Funds are supplied by a prot-maximizing bank which has a cost of funds r. We

assume that:

pz > r > pz.

1- Determine the optimal contract oer to an entrepreneur when there is a single en-

trepreneur.

2- There are now two entrepreneurs who do not observe each others eort level. A

group lending contract calls for a payment x when the partner succeeds and y when it

fails. Consider a group lending contract which induces eort of both entrepreneur as a

Nash equilibrium. Show that a group lending contract does not perform better than the

individual contracts considered in question 1.

3- We suppose now that entrepreneur observe each others eort level and coordinate

their eort levels. Consider the program of the bank which implements eort by both

entrepreneurs with group lending contracts:

max p

2

(2z 2x) + p(1 p)(2z 2y) 2r

s.t.

2 p

2

x + 2 p(1 p)y 2 2p

2

x + 2p(1 p)y (1)

2p px + p(1 p)y + p(1 p)y (2)

0, (3)

28 EXERCISES

x 0, y 0.

Find the optimal contract. Show that it is better than individual contracts for the

bank. Explain why.

29

Incentives and Discovery

We consider a principal-agent relationship in which a principal delegates to an agent

the search for a resource of unknown magnitude over which the principal has property

rights.

The principals utility function is u(q) + t with u

> 0, u

< 0, u(0) = 0 and where q

is the quantity of the resource obtained by the principal and t is the monetary payment

made by the agent to the principal for being allowed to search.

The agents utility function is u( q) t.

1- Under complete information about , determine the optimal contract oered to the

agent by a principal who maximizes his utility under the participation constraint of the

agent

u( q) t 0.

2- can take one of two values {,

} with respective probabilities (1 , ), with

=

> 0 and is now private information of the agent. Suppose that the prin-

cipal oers a contract to the agent before the agents search, i.e., before the agent learns

. Characterize the optimal contract that the principal oers to the agent when he maxi-

mizes his expected utility under the agents incentive constraints and the agents ex ante

participation constraint.

3- We assume now that the contract is imperfectly enforced. When the agent discovers

(resp. ), he can exit the relationship with a quantity (resp. 0) of the resource.

Therefore, the principal is faced with the following ex post participation constraints:

u( q) t 0 (1)

u(

q)

t u(), (2)

if he wants to maintain both types of agent in the relationship.

Show that the regime with the participation constraint of the inecient type , and

the incentive constraint of the ecient type

cannot be optimal (hint: assume the

contrary).

4- Consider the regime where only the participation constraints (1) and (2) are binding

(i.e. the incentive constraints are slack). Show that this is the relevant regime when

> . Characterize the optimal contract and denote W() the principals expected

welfare.

30 EXERCISES

5- We assume now that by exerting an eort which costs him the agent increases the

probability of a

-discovery from

0

to

1

>

0

with =

1

0

. Show that W() is

decreasing in . Write the program of a principal who selects a contract which discourages

eort. Solve it when u() <

. Discussion.

31

III- MIXED MODELS

Political Economy of Regulation

We consider a rm which realizes two projects, of gross value S

1

and S

2

for the

consumers. The rm can provide an eort e

i

in order to reduce the cost associated with

project i, i = 1, 2. The cost function of the rm for project i is:

C

i

= e

i

where is the eciency parameter of the rm. The eciency of the rm is the same for

both projects.

Parameter can take values in two values {,

} with = Pr( = ).

The cost reducing eorts create a disutility to the rm equal to

(e

1

, e

2

) =

1

2

(e

2

1

+ e

2

2

) + e

1

e

2

, > 0.

A regulator reimburses the observable costs C

1

and C

2

and pays a net transfer t to

the rm which has utility

U = t (e

1

, e

2

).

Social welfare is

S

1

+ S

2

(1 + )(t + C

1

+ C

2

) + U.

1- Determine the optimal regulation under complete information.

2- Determine the optimal regulation under incomplete information when is private

information of the rm.

3- We assume now that the regulatory mechanism is determined by the political majority.

Agents are of two types. Either they are stakeholders in the regulated rm, i.e., they share

the rent of the regulated rm. Or they are non-stakeholders and do not share the rent.

Let the proportion of stakeholders. If > 1/2 the majority belongs to stakeholders

who choose regulation to maximize their objective function:

(S

1

+ S

2

(1 + )(t

1

+ C

1

+ t

2

+ C

2

)) + U.

32 EXERCISES

If < 1/2 the majority belongs to non-stakeholders who choose regulation to maximize

instead:

(1 )(S

1

+ S

2

(1 + )(t

1

+ C

1

+ t

2

+ C

2

)).

Determine in each case the optimal regulation under incomplete information.

33

Regulation of Quality

We consider a natural monopoly which has the cost function C = ( +s e)q where q

is the production level, e is the eort level of the manager, s is the quality of the product

and in {,

} is a cost parameter.

We assume that the regulator observes only the cost C and the rms revenue, and, in

addition, pays a transfer t net of cost and revenue. If (e) (with

> 0,

> 0,

0)

is the disutility of eort for the manager, it implies that the net utility of the manager is

U = t (e). His outside opportunity utility level is normalized at zero.

We assume that the consumers get a gross surplus from the consumption of q units

equal to

S(q, s, ) = (A + ks h)q

B

2

q

2

(ks h)

2

2

where A, B, h, k are positive constants and in {,

} is a demand parameter known by

the rm, but not by the regulator.

Let p(q) the inverse demand function. The utility derived by consumers is then:

V = S(q, s, ) p(q)q (1 + )(t + C p(q)q)

where 1 + is the opportunity cost of public funds.

1- We consider a utilitarian regulator who wants to maximize expected social welfare

(V + U). Show that the adverse selection problem with two parameters and can be

reduced to a one dimensional adverse selection problem with the parameter = +

h

k

.

2- Assume that is distributed according to a uniform distribution. Write the maxi-

mization problem of the regulator under the incentive and participation constraints of the

rm.

3- Show that the optimal regulation can be implemented with indirect mecanisms which

are functions of a variable which aggregates the cost and quality dimensions.

4- Study the dependence of the optimal regulatory mechanism with respect to the concern

for quality.

34 EXERCISES

Enforcement and Regulation

We consider a natural monopoly which, in addition to a xed cost F which is common

knowledge, has a variable cost function

C = ( e)q,

where q is the production level, is an adverse selection parameter in {,

} with =

Pr( = ) and e is a moral hazard variable which decreases cost, but creates to the

manager a disutility (e) with

> 0,

> 0,

0.

Consumers derive an utility S(q), S

> 0, S

< 0 from the consumption of the natural

monopolys good. Let p() the inverse demand function and

t the transfer to the rm

from the regulator. The rms net utility is:

U =

t + p(q)q ( e)q F (e).

We assume that cost is ex post observable by the regulator as well as the price and the

quantity. So, we can make the accounting assumption that revenues and cost are incurred

by the regulator, who pays a net transfer t =

t + p(q)q ( e)q F. Accordingly, the

participation constraint of the rm can be written:

U = t (e) 0.

To nance the transfer t, the government must raise taxes with a cost of public funds

1 + , > 0. Hence, consumers net utility is

V = S(q) p(q)q (1 + )

t.

Utilitarian social welfare writes then:

W = U + V = S(q) + p(q)q (1 + )(( e)q + F + (e)) U.

1- Under complete information, the regulator maximizes social welfare under the rms

participation constraint. Characterize the optimal solution.

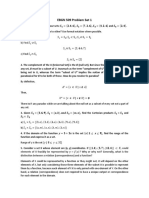

2- Suppose now that the regulator cannot observe the eort level e and does not know

. However, he can oer a contract to the rm before the latter discovers its type (see

Figure 1 for the timing).

35

E

Time

The regulator

oers the

regulatory contract.

The rm

accepts or not

the contract.

The rm

discovers

its type.

Production

and transfer

take place.

Figure 1

Explain why the regulator can restrict his contract to a pair {(t, c); (

t, c)} (where c =

C

q

is average cost) which satisfy incentive constraints.

Write the incentive constraints and the rms ex ante participation constraint. Solve

for the optimal contracts.

3- We assume now that if the rm has a negative ex post utility (as rm

in question

3) it attempts to renegotiate its regulatory contract. However, with a probability (c),

the regulator is able to impose the implementation of the agreed upon contract. This

probability depends on the expenses c incurred to set up an enforcement mechanism.

We assume that (0) = 0,

> 0,

< 0 with the Inada conditions

(0) = and

lim

c+

(c) = 1.

With probability 1 (c) the regulator is forced to accept a renegotiation. To model

this renegotiation we use the Nash bargaining solution but assume that renegotiation is

costly (because it takes time say). The status quo payos which obtain if the negotiation

fails are determined as follows: The rm loses its xed cost F. The regulator is also

penalized by a loss of reputation and obtains the utility level H.

Assume that it is only the inecient type

which wants to renegotiate. Therefore,

costly bargaining takes place under complete information. Its outcome solves:

max

{ q, e,

U

E

}

(

U

E

+ F)(

W( q, e,

)

U

E

+ H)

where in (0, 1) models the cost of renegotiation and

W( q, e,

) = S( q) + p( q) q (1 + )((

e) q + F + ( e)).

Compute the outcome of renegotiation ( q

E

, e

E

,

U

E

).

4- Write the rms new participation constraint which takes into account that with prob-

ability 1 (c) there will be renegotiation.

Substitute the outcome of renegotiation into the regulators objective function and

solve for the optimal contract and the optimal level of enforcement expenses c. Discuss.

36 EXERCISES

Regulation of a Risk Averse Firm

We consider a utilitarian regulator who wishes to realize a public project which has

social value S. A single rm can undertake the project for a cost, C = e, where in

{,

} is an eciency parameter and e is a level of eort which creates a disutility (e)

(

> 0,

> 0,

0) for the rms manager.

The cost C is observed by the regulator who can give a transfer t to the rm with a

cost of public funds 1 + .

The manager of the rm is risk averse, and has the utility function u(t (e)) with

u

> 0, u

< 0).

e and are not observable by the regulator, but it is common knowledge that =

Pr( = ).

1- For the revelation mechanism {t(

) =

t, C(

) =

C; t() = t, C() = C}, write the

incentive and participation constraints of the rm.

2- Expected social welfare is dened as

W = S (1 + )

(t + C) + (1 )(

t +

C)

+ u

1

(u() + (1 )u( )) ,

with = t ( C) and =

t (

C).

Interpret this social welfare function and, assuming that it is concave in (, ), de-

termine the optimal regulation under incomplete information when the regulator oers a

contract at the interim stage.

3- Compare the result of question 2 with the case where the rms manager is risk neutral.

4- Consider the special case

u(x) =

1

(1 e

x

).

Show that the eort level required from type

is decreasing in .

37

Technological versus Informational Advantage

We consider a project which has value S for consumers. This project can be realized

by two dierent rms run by two dierent managers.

Firm 1 has the cost function C

1

=

1

e

1

where

1

is an eciency parameter which

is common knowledge and e

1

is the managers eort level which creates a disutility

1

4

e

2

1

for him. Ex ante

1

is unknown for everybody and drawn from {2, 3} with Pr(

1

= 2) =

Pr(

1

= 3) = 1/2.

Firm 2 has the cost function C

2

= k

2

e

2

, k 1, where

2

is also drawn ex ante

(independently of

1

) from {2, 3} with Pr(

2

= 2) = Pr(

2

= 3) = 1/2. However, the

value of

2

is only observed by the manager of rm 2; e

2

is the managers eort level

which creates a disutility

1

4

e

2

2

for him.

C

1

and C

2

are observed by the regulator. The outside opportunity utility levels are

normalized to zero for both rms. The timing of events is summarized below:

E

t

ex ante interim

1

observed

by all,

2

observed by

rm 2

Regulator

oers

contracts

Firms

accept

or

reject

Contracts

are

executed

The regulator is utilitarian and can use transfers with a price of public funds 1 + ,

> 0.

1- Assuming that the regulator oers a contract only to rm 1, at the interim stage, what

is the optimal regulation?

2- Assuming that the regulator oers only a contract to rm 2 at the interim stage, what

is the optimal regulation?

3- Assuming that the regulator selects the rm at the ex ante stage, characterize the

values of and k such that rm 2 is chosen.

4- Assuming that the regulator selects the rm at the interim stage, characterize the

values of , k and

1

such that rm 2 is chosen.

5- Suppose that k can be chosen ex ante at the cost

(1+)(3k)

2

2

by the regulator; what is

the optimal strategy of the regulator at the ex ante stage?

38 EXERCISES

Piracy and Optimal Pricing

We consider a rm which can buy from a monopoly with marginal cost c software in

quantity q

0

at price p

0

or pirate software in quantity q

c

at a random cost c which includes

the illegal reproducing cost itself and a random ne. The value for the rm of these

purchases is

R(q

0

+ q

c

) with [0, 1].

The rm has a utility function with constant absolute risk aversion so that his utility

is

e

[R(q

0

+qc)p

0

q

0

cqc]

.

1- Assuming that c is a normal random variable with mean and variance

2

, compute

the demand functions q

0

(p

0

), q

c

(p

0

) of a rm maximizing its expected utility. What is the

optimal monopoly price p

M

0

? Study the dependence of p

M

0

with respect to ,

2

, , , c.

Suppose

R(q

0

+ q

c

) = a(q

0

+ q

c

)

1

2

b(q

0

+ q

c

)

2

.

2- For a social welfare function W which adds prot to the certainty equivalent of the

consumers utility level, characterize the (constrained) optimal q

0

and q

c

. Study the

comparative statics of W with respect to , ,

2

, c (Hint: use the envelop theorem).

Let

W be social welfare under monopoly. Obtain

W

. Let = c

0

+ f where c

0

is the

reproducing cost and f an expected ne. Supposing that the cost of implementing the

ne f is

1

2

f

2

, determine the optimal ne.

3- What is the optimal two part tari of the monopolist?

4- Assume that is private information of the rm and can take two values or with

> and = Pr( = ).

We will look for the optimal nonlinear price or the optimal direct revelation mechanism

(t, q

0

,

t, q

0

). First show that the Spence-Mirrlees property holds for the surrogate utility

function:

V (t

0

, q

0

, ) = max

qc

R(q

0

+ q

c

) t

0

q

c

1

2

2

q

2

c

.

Write the rms incentive constraints for the function V . Solve for the optimal direct

revelation mechanism. Discuss.

39

Gathering information before signing a contract

We consider a principal agent problem in which the agent produces a quantity q of a

good at a cost q with in {,

},

> . Let t be the transfer from the principal to the

agent ; then, the agents utility is U = t q.

The principals utility is

V = S(q) t with S

> 0, S

< 0 and S(0) = 0.

At date 1 the principal oers a menu of contracts (t, q), (

t, q).

At date 2 the agent decides to learn at a cost or not. Let e be this decision : e = 1

if he learns, e = 0 if not. e is a moral hazard variable not observed by the principal.

At date 3 he accepts or not the contract.

At date 4 the agent learns if he has decided not to learn it at date 2.

At date 5 the contract is executed.

We will consider two sets of contracts : those (class C

1

) which induce the agent to

choose e = 0 and those (class C

2

) which induce the agent to choose e = 1.

1- Write the optimization program of a principal who maximizes his expected utility

under the incentive and participation constraints of the agent, either in the class C

1

or in

the class C

2

of contracts.

2- Show that a lower bound for the principal is obtained by constraining contracts to

t q 0 ;

t

q 0. Derive from this result that the interesting contracts to consider

entail

t

q 0. Show that the principal can always mimic a contract in the class C

2

with a contract in the class C

1

.

3- Determine the optimal contract in the class C

1

. (Distinguish three cases depending on

whether the ex ante participation constraint is binding, the moral hazard constraint is

binding or both constraints are binding according to the value of ).

40 EXERCISES

Better Information Structures and Incentives

We consider a natural monopoly which realizes a public project valued S at a cost

C = e when in {,

} is a parameter which is privately known by the manager with

=

> 0 and = Pr( = ) is the common knowledge probability that the rm is

a low cost rm; e is the managers eort which has a disutility (e) with

> 0,

> 0,

0. The cost C is observable by the regulator and reimbursed to the monopoly.

Accordingly the rms utility is

U = t (e)

where t is the net monetary transfer from the regulator to the rm and consumers welfare

is

V = S (1 + )(t + e)

where > 0 is the social cost of public funds.

Social welfare is dened as U + V .

1- Characterize the regulation which maximizes expected social welfare under the rms

incentive and participation constraints (it is assumed that the regulatory contract is of-

fered to the rm at the interim stage and that its status quo utility level is zero).

2- The regulator benets ex ante from an information structure J with a set =

{

1

,

2

, . . . ,

I

} of signals and conditional probabilities Pr(

i

|) i = 1, . . . , I. Denote

i

the posterior belief that the rm has a low cost after signal

i

, i.e.,

i

= Pr( = |

i

),

i = 1, . . . , I.

Characterize for each

i

the optimal eort level e

i

requested from the high cost rm

and denote e

i

= Z

i

1

i

the solution e

i

as a function of the ratio

i

1

i

.

Show that, if after each

i

, the regulator wants to keep both types of rms, and if Z

is concave, the expected power of incentives decreases when the regulator has access to

the information structure J.

Discuss the more general case where after some signals the regulator may want to shut

down the high cost rm.

41

Competitive Pressure and Incentives

We consider the case of a monopoly (producing good 1 in quantity q

1

) with a com-

petitive fringe producing a dierentiated good 2 in quantity q

2

. The consumers utility

function is

S(q

1

+ q

2

) + q

1

q

2

where is a measure of complementarity of the two goods.

The monopolys cost function is

C

1

= ( e)q

1

,

where in {,

},

> , is an adverse selection parameter (with = Pr( = )) and e

is an eort level which decreases cost with a disutility for the manager of (e),

> 0,

> 0,

0.

The fringes cost function is

C(q

2

) = cq

2

where c is common knowledge.

Let p

1

(q

1

, q

2

) the inverse demand function of good 1.

1- Show that for a utilitarian social welfare maximizer the social welfare function can be

written as

S(q

1

+ q

2

) + q

1

q

2

+ p

1

(q

1

, q

2

)q

1

(1 + )((e) + ( e)q

1

) cq

2

U,

where U = t (e) is the utility of the monopoly where t is the net transfer (in addition

to reimbursement of cost) from the regulator to the rm.

2- Characterize the optimal regulation under asymmetric information when the monopolys

status quo utility level is zero.

3- We say that the two goods are strategic complements (substitutes) if S

q

1

+S

+ >

0(< 0).

Show that if the two goods are strategic substitutes a reduction in marginal cost c

reduces eort for the regulated rm. If the products are strategic complements and is

large enough, then a reduction in c increases eort for the regulated rm.

4- Show that, if the two goods are strategic complements then eort of the regulated rm

decreases with an increase in the degree of substitution ( decreases). If the products are

strong enough substitutes, the eort of the regulated rm increases with the degree of

substitution.

42 EXERCISES

SOLUTIONS

I- ADVERSE SELECTION

Lending with Adverse Selection

1- It is a principal-agent problem with adverse selection. The principal is the bank and

the agent is the borrower. The agent has two possible types: Type 1 obtains h for sure for

an investment of 1. Type 2 obtains h with probability in (0, 1) and zero with probability

1 for an investment of 1. The action space is the probability granting a loan and,

when a loan is granted, the level of repayment if the project succeeds (if the project does

not succeed the borrower has no revenue and no wealth). So we have

A = {(P, r) : P [0, 1]; r IR

+

}

where P is the probability of receiving a loan and r is the repayment (in case of success).

From the Revelation Principle (Proposition 2.2), we know that we can restrict the

analysis to truthful direct revelation mechanisms, i.e., pairs {(P

1

, r

1

); (P

2

, r

2

)} which are

incentive compatible :

P

1

(h r

1

) P

2

(h r

2

) (1)

P

2

(h r

2

) P

1

(h r

1

). (2)

2- The bank maximizes its expected prot under the incentive and participation con-

straints, i.e., solves

max

{(P

1

,r

1

);(P

2

,r

2

)}

P

1

(r

1

r) + (1 )P

2

(r

2

r)

s.t. (1), (2) and

P

1

(h r

1

) u (3)

P

2

(h r

2

) u (4)

43

44 SOLUTIONS

if it wishes to give a loan with positive probability to both types (case 1). Alternatively,

it might oer a loan only accepted by type 1 (case 2).

3- Let us rst consider case 1 where the bank contracts with both types of borrowers.

Dividing (2) by , (1) and (2) imply

P

1

(h r

1

) = P

2

(h r

2

). (5)

Since is in (0, 1), (4) is binding and not (3). From (4) we have

r

2

= h

u

P

2

if P

2

= 0.

From (5) we have

r

1

= h

u

P

1

.

Substituting these expressions into the banks expected prot we get

P

1

(h r) + (1 )P

2

(h r)

u

(1 )u.

Since h > r, maximizing with respect to P

1

and P

2

gives P

1

= P

2

= 1 and r

1

= r

2

=

h

u

.

Therefore, we obtain a pooling contract with an expected prot for the bank of

h r

u

+ (1 )(h r u).

Type 1s ex post information rent is h r

1

u =

(1)

u.

Consider now case 2. The bank oers a loan intended only for type 1. It is only

constrained by type 1s participation constraint. The bank will obviously make this

constraint binding, leave no information rent to type 1, and provide a loan with probability

one:

r

1

= h u

with an expected prot for the bank (h r u).

Case 2 is better for the bank than case 1 if and only if

(h r u) >

h r

u

+ (1 )(h r u)

or

(1 )(h r u) <

(1 )

u,

i.e., the expected revenue made with type 2 borrowers is less than the expected rent which

must be given up to type 1s borrowers because of the presence of type 2 borrowers.

45

Why do we obtain a pooling contract if the principal wants both agents to participate?

The utility function of the agent can be written

U(P, r, ) = P(h r).

The Spence-Mirrlees condition writes

U

U

P

U

r

=

U

(h r)

P

= 0

and we obtain pooling because there is no way to screen apart both types. Indierences

curves of the two types in the (P, r) plan do not cross.

De Meza and Webb (1987), Stiglitz and Weiss (1981), Laont (2003).

46 SOLUTIONS

Bundling with Asymmetric Information

1- Since consumers want to consume only one unit and since only deterministic mech-

anisms are considered, there is no way to screen types with either the quantities they

consume or the probabilities of receiving the good. The seller can only post a price that

a subset of consumers accept to pay.

Given the willingnesses to pay, the three relevant prices that can be posted are ,

or + , for each good.

If p = + only 1/3 of the consumers buy and revenue is

1

3

( +). If p = ,

2

3

of the

consumers buy and revenue is

2

3

. If p = all consumers buy and revenue is .

Since < , the optimal single good price is (for each good):

p

= if 3

= if > 3

with a total revenue for both goods

R

=

4

3

if 3

= 2( ) if > 3.

2- Suppose now that the monopolist can oer a price P

B

for a bundle made of one unit

of each good. Since the willingnesses to pay for the two goods are independent, we have

six possible types of consumers with the following aggregate willingnesses to pay.

Population Preferences Aggregate willingness to pay

1

9

{ + , + } 2 + 2

2

9

{ + , } 2 +

1

9

{, } 2

2

9

{ + , } 2

2

9

{, } 2

1

9

{ , } 2 2

Again, the relevant posted prices for the bundle correspond to the willingnesses to

47

pay. It is immediate to see that

P

B

= 2 if 2

= 2 if [2, 5]

= 2 2 if 5,

with respective revenues worth

4

3

if 2

16

9

8

9

if [2, 5]

2 2 if 5.

Therefore, for in [2, 5], P

B

= 2 provides more revenue than the optimal single

good prices.

3- For the optimal prices p

we can obtain the surplus made by each type of consumer

and the associated revenue of the monopolist:

p

= p

=

Population Preferences Surplus Prot Surplus Prot

1

9

{ + , + } 2 2 4 2( )

2

9

{ + , } 2 3 2( )

1

9

{, } 0 2 2 2( )

2

9

{ + , } 2 2( )

2

9

{, } 0 2( )

1

9

{ , } 0 0 0 2( )

A successful bundle price must attract some consumers and make more prot with

them than with the optimal single good prices.

Consider the case where < 3 and p

= .

A bundle price of 2 makes positive prot since > and attracts all consumers

except the ( , ) types. It also makes more prot than the optimal single good

prices when

8

9

(2 ) >

4

9

i.e. > 2.

Adams and Yellen (1976).

48 SOLUTIONS

Incentives and Aid

1- The rich in the South solve

max

{q

R

,q

A

P

}

q

R

+ n

P

v(q

A

P

)

subject to

n

R

q

R

+ n

P

q

A

P

= n

R

y

R

hence

n

R

v

(q

A

P

) = 1, (1)

with a status quo utility level of

y

R

n

P

n

R

q

A

P

+ n

P

v(q

A

P

) = U

A

().

For v() = log(),

q

A

P

= n

R

,

U

A

() = y

R

+ n

P

(log n

R

1).

2- The rich of the South solve

max

{q

R

,q

A

P

}

q

R

+ n

P

v(q

A

P

)

n

R

q

R

+ nq

A

P

= n

R

y

R

+ n

R

a

with the same result for the consumption of the poor. Unconditional aid is ineective in

helping the poor.

The North oers now a contract (q

P

, a) which species the level of aid for a level of

consumption of the poor. It is accepted by the South as long as it gets as much as in the

autarky regime. Hence the program of the North:

max

{q

N

,q

R

,q

P

a}

q

N

+ n

P

v(q

P

)

subject to

n

R

q

R

+ n

P

q

P

= n

R

y

R

+ n

R

a

q

R

+ n

P

v(q

P

) U

A

()

49

n

N

q

N

= n

N

y

N

n

R

a

or

(n

N

+ n

R

)v

(q

P

) = 1. (2)

Comparing (1) and (2) we see that the poor in the South consume more. For v() =

log(),

q

P

= n

N

+ n

R

instead of n

R

.

3- To the previous program we must add incentive constraints. For given a and q

P

, the

richs utility is

y

R

+ a

n

P

n

R

q

P

+ n

P

v(q

P

).

The incentive constraints are

y

R

+ a

n

P

n

R

q

P

+ n

P

v(q

P

) y

R

+ a

n

P

n

R

q

P

+ n

P

v( q

P

)

y

R

+ a

n

P

n

R

q

P

+ n

P

v( q

P

) y

R

+ a

n

P

n

R

q

P

+ n

P

v(q

P

).

Since the status quo utility level U

A

() depends on the type, there is a potential

problem of countervailing incentives. However we will guess that it is, as usual, the

incentive constraint of the one who wants to lie,

, which is binding, as well as the

participation constraint of type .

The problem of the principal becomes

max

{ a, q

P

;a,q

P

}

y

N

n

R

n

N

a + n

P

v( q

P

)

+ (1 )

y

N

n

R

n

N

a + n

P

v(q

P

)

y

R

+ a

n

P

n

R

q

P

+ n

P

v( q

P

) = y

R

+ a

n

P

n

R

q

P

+ n

P

v(q

P

) (3)

y

R

+ a

n

P

n

R

q

P

+ n

P

v(q

P

) = U

A

(). (4)

Solving (3) and (4) for a and a, inserting in the objective function and maximizing

with respect to { q

P

, q

P

} yields

(n

N

+ n

R

)v

( q

P

) = 1

(n

N

+ n

R

)v

(q

P

) = 1 +

1

n

R

v

(q

P

).

Asymmetric information leads to a decrease in the poors consumption when the rich

of the South are of type , i.e., have a low altruistic behavior.

50 SOLUTIONS

With v() = log(), we get:

q

P

= n

N

+ n

R

q

P

= n

N

+ n

R

1

n

R

.

It remains to check that the participation constraint of type

is satised as well as

type s incentive constraint. Note that the above solutions are in fact only valid as long

as a 0, a 0. In fact when is too large, a = 0 and the poor in the South get the

same utility as under autarky. It happens when

n

N

1

n

R

or

n

N

n

N

+ n

R

.

Azam and Laont (2002).

51

Downsizing a Public Firm

1- Let us rewrite the constraints as

U =

t p

t p

= U p (1)

U = t p

t p =

U + p (2)

U =

t p

0 (3)

U = t p 0. (4)

Then, we are back to the familiar formulation and (2) + (3) imply (4). Now, the

good type is the -type.

2- Adding (1) and (2) implies p p. For any implementable pair (p, p), we have the

following constraints

(p p) t

t (p p)

and (3) implies

t p

.

The government minimizes the expected transfers t +(1)

t by choosing

t = p

and

t =

t + (p p) = p + p.

3- Expected social welfare can be rewritten as:

S(p + (1 ) p) (1 + )p (1 + )(1 ) p

p

up to a constant.

If we have

S

() > (1 + )

+

1

,

then, p solves

S

( + (1 ) p) = (1 + )

+

1

(5)

and p = 1.

If we have instead

(1 + )

+

1

> S

() > (1 + )

we get p = 1 and p = 0.

52 SOLUTIONS

If, nally

S

() < (1 + ),

then p solves

S

(p) = (1 + )

and p = 0.

As (5) shows, for low levels of downsizing, asymmetric information () increases the

level of downsizing and leaves it unchanged otherwise.

4- Let w the wage if the worker remains in the rm and s his severance payment if he

quits. By denition

t = pw + (1 p)s = p + p (6)

t = p w + (1 p) s = p

. (7)

A worker does not regret to have participated if his wage in the rm is larger than his

outside opportunity and his severance payment is non-negative.

Taking w = and w =

ensures the rst point. Then, from (6) and (7)

s = 0 and s =

p

1 p

> 0.

5- The incentive constraints remain unchanged so that the optimization program is now

W = S(p + (1 ) p) (1 + )p (1 + )(1 ) p

p

W

p

= [S

(1 + )]

W

p

= (1 )

(1 + )

.

As long as >

+

1+

1

, the solution is as in question 3 except that (5) must

be replaced by

S

( + (1 ) p) = (1 + )

+

1

.

When <

+

1+

1

, the rst-order conditions would call for p < p which is

in conict with the implementability condition p p. Then, we have bunching at the

optimal contract which solves

max

p

S(( + (1 ))p) (1 + )( + (1 )

)p p

53

i.e.,

S

(( + (1 ))p) =

(1 + )( + (1 )

) +

+ (1 )

.

Jeon and Laont (1999).

54 SOLUTIONS

Labor Contracts

1- The rms problem is

max

{l,t}

f(l) t subject to u(t) l 0.

So, for = :

u(t

) = l

(l

) =

u

(t

)

for =

:

u(

) =

) =

)

.

2- The rst-best allocation {(t

, l

); (

)} is not implementable. Suppose this menu were

oered under asymmetric information. Then, the worker will select (

). Indeed, his

utility is then

u(

> 0

instead of zero for (t

, l

).

Under asymmetric information, the optimal contract is the solution of

max

{(

t,

l);(t,l)}

(f(l) t) + (1 )(f(

l)

t),

subject to

u(t) l u(

t)

l

u(

t)

l 0,

where we just consider the relevant incentive and participation constraints.

Let () be the inverse function of u(), i.e., t = (u). The program can be rewritten

as:

max

{( u,

l);(u,l)}

[f(l) (u)] + (1 )[f(

l) ( u)]

u l u

l

u

l 0.

55

The two constraints are binding. Therefore u =

l and u = l +

l. Substituting

these values in the employers objective function and maximizing with respect to (l,

l)

yields

f

(l

SB

) =

u

(t

SB

)

; u(t

SB

) = l

SB

+

l

SB

f

l

SB

) =

t

SB

)

+

1

(t

SB

)

; u(

t

SB

) =

l

SB

.

Since u

(t

SB

) < u

(( l

SB

))

f

(l

SB

)u

(( l

SB

)) > = f

(l

)u

(( l

)),

which implies l

SB

< l

since u

< 0 and f

< 0.

Since

f

l

SB

) >

t)

f

l

SB

)u

((

l

SB

)) >

= f

)u

((

)),

we nally get

l

SB

<

l

.

3- The rms problem is now:

max

{t,l}

f(l) t s.t. u(t) l V

yields

u(t

) = l

+ V

f

(l

) u

(t

) = .

Under asymmetric information, the employers program is now:

max

{( u,

l);(u,l)}

(f(l) (u)) + (1 )(f(

l) ( u))

u l max(V, u

l)

u

l 0.

If

l

SB

V , the solution of question 2 is unchanged, since the rent of asymmetric

information is greater or equal to the outside opportunity level of utility.

56 SOLUTIONS

If

l

SB

< V

l