Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Yes Bank

Caricato da

Angel BrokingDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Yes Bank

Caricato da

Angel BrokingCopyright:

Formati disponibili

1QFY2012 Result Update | Banking

July 21, 2011

Yes Bank

Performance Highlights

Particulars (` cr) NII Pre-prov. profit PAT 1QFY12 354 325 216 4QFY11 349 349 203 % chg (qoq) 1.6 (6.8) 6.2 1QFY11 262 249 156 % chg (yoy) 35.1 30.6 38.2

ACCUMULATE

CMP Target Price Investment Period

Stock Info Sector Market Cap (` cr) Beta 52 Week High / Low Avg. Daily Volume Face Value (`) BSE Sensex Nifty Reuters Code Bloomberg Code Banking 11,057 1.3 388/234 3,68,075 10 18,436 5,542 YESB.BO YES@IN

`318 `353 12 Months

Source: Company, Angel Research

For 1QFY2012, Yes Bank reported a strong performance with net profit growth of 38.2% yoy (6.2% qoq) to `216cr, marginally above our estimate of `212cr. Profit growth was driven by sequentially stable NIMs and a sharp drop in provisioning expenses (due to write-back of `15cr), which offset the lower-than-expected noninterest income. The bank seemed to have moderated growth for maintaining NIMs. We maintain our Accumulate recommendation on the stock. Business growth moderates; steady NIMs and strong asset quality: During the quarter, the bank seemed to have moderated its balance sheet growth to maintain NIMs, as evident from the sequential decline in advances of 3.7%. Consequently, deposit accretion also declined by 5.1% qoq. CASA deposits continued to grow at a brisk pace of 49.8% yoy, leading to an improvement in CASA ratio to 10.9% from 10.5% in 1QFY2011. The bank surprised positively with sequentially stable NIMs at 2.8% on the back of a 90bp rise in yield on advances, which offset the 70bp qoq increase in cost of funds. With advances growth moderating, non-interest income growth came down to 14.9% yoy. Asset quality of the bank continued to be in a sweet spot, with best-in-the-industry gross and net NPA ratios of 0.17% and 0.01%, respectively, coupled with provision coverage (excluding technical write-offs) of 95.2%. Branch expansion plans were on track, with addition of 41 branches to take the network to 255 branches. Outlook and valuation: Structurally, as the banks balance sheet continues to grow rapidly, we believe there may be downside risks to the banks RoA. On the liabilities side, building a savings deposit franchise involves execution risks. However, as we believe that we are very close to the peak of the current interest rate cycle and as liquidity has improved compared to the extreme tightness during the last few quarters, the environment is expected to be relatively more conducive for banks such as Yes Bank. The stock is trading at of 2.0x FY2013E ABV. We maintain Accumulate on the stock with a target price of `353. Key financials

Y/E March (` cr) NII % chg Net profit % chg NIM (%) EPS (`) P/E (x) P/ABV (x) RoA (%) RoE (%)

Source: Company, Angel Research

Shareholding Pattern (%) Promoters MF / Banks / Indian Fls FII / NRIs / OCBs Indian Public / Others 26.5 7.0 53.7 12.8

Abs. (%) Sensex Yes Bank

3m (5.3) (3.9)

1yr 2.6 6.7

3yr 33.1 170.9

FY2010 788 54.1 478 57.2 2.8 14.1 22.6 3.5 1.6 20.3

FY2011 1,247 58.2 727 52.2 2.7 20.9 15.2 2.9 1.5 21.1

FY2012E 1,531 22.8 897 23.3 2.4 25.8 12.3 2.4 1.4 21.4

FY2013E 1,860 21.4 1,031 14.9 2.3 29.7 10.7 2.0 1.2 20.6 Shrinivas Bhutda

022 3935 7800 Ext: 6845 shrinivas.bhutda@angelbroking.com

Vaibhav Agrawal

022 3935 7800 Ext: 6808 vaibhav.agrawal@angelbroking.com

Varun Varma

022 3935 7800 Ext: 6847 varun.varma@angelbroking.com

Please refer to important disclosures at the end of this report

Yes Bank | 1QFY2012 Result Update

Exhibit 1: 1QFY2012 performance summary

Particulars (` cr) Interest earned - on Advances / Bills - on investments - on balance with RBI & others - on others Interest Expended Net Interest Income Other income - Financial markets - Financial advisory - Transaction banking - Retail and others Operating income Operating expenses - Employee expenses - Other Opex Pre-provision Profit Provisions & Contingencies PBT Provision for Tax PAT Effective Tax Rate (%)

Source: Company, Angel Research

1QFY12 4QFY11 % chg (qoq) 1QFY11 % chg (yoy) 1,400 1,026 365 8 1 1,045 354 165 25 83 42 16 519 194 110 85 325 2 324 108 216 33.2 1,223 888 327 6 1 874 349 187 24 77 65 20 535 186 103 83 349 43 306 102 203 33.4 14.5 15.5 11.6 33.2 (56.0) 19.6 1.6 (11.5) 2.5 7.4 (35.8) (21.9) (2.9) 4.2 6.6 1.3 (6.8) (96.5) 5.9 5.3 6.2 (21)bp 739 558 177 3 2 477 262 144 23 76 34 11 406 157 81 76 249 13 236 80 156 33.9 89.3 83.9 106.6 173.3 (67.4) 119.1 35.1 14.9 9.3 8.9 22.4 44.0 28.0 23.8 35.2 11.6 30.6 (88.0) 36.9 34.4 38.2 (63)bp

Exhibit 2: 1QFY2012 Actual vs. estimates

Particulars (` cr) Net interest income Other income Operating income Operating expenses Pre-prov. profit Provisions & cont. PBT Prov. for taxes PAT

Source: Company, Angel Research

Actual 354 165 519 194 325 2 324 108 216

Estimates 365 189 553 211 342 27 314 102 212

Var. (%) (2.8) (12.4) (6.1) (8.1) (4.9) (94.5) 2.9 5.4 1.7

July 21, 2011

Yes Bank | 1QFY2012 Result Update

Exhibit 3: 1QFY2012 performance analysis

Particulars Balance sheet Advances (` cr) Deposits (` cr) Credit-to-Deposit Ratio (%) CASA deposits (` cr) CASA ratio (%) CAR (%) Tier 1 CAR (%) Profitability Ratios (%) Yield on advances Cost of funds Reported NIM Cost-to-income ratio Asset quality Gross NPAs (` cr) Gross NPAs (%) Net NPAs (` cr) Net NPAs (%) Provision Coverage Ratio (%)

Source: Company, Angel Research

1QFY12 4QFY11 % chg (qoq) 1QFY11 % chg (yoy) 33,104 43,576 76.0 4,764 10.9 16.2 9.6 11.6 8.5 2.8 37.4 56 0.2 3 0.0 95.2 34,364 45,939 74.8 4,751 10.3 16.5 9.7 10.7 7.8 2.8 34.8 81 0.2 9 0.0 88.6 (3.7) (5.1) 117bp 0.3 59bp (28)bp (10)bp 90bp 70bp 0bp 258bp (30.5) (6)bp (70.8) (2)bp 659bp 26,257 30,239 86.8 3,181 10.5 16.6 10.3 9.6 6.3 3.1 38.7 60 0.2 11 0.0 81.4 26.1 44.1 (1,086)bp 49.8 42bp (35)bp (72)bp 200bp 220bp (30)bp (126)bp (6.3) (6)bp (75.9) (3)bp 1,380bp

Business growth moderates

Taking into account its relatively weaker funding profile in the current high interest rate environment, the bank seemed to have moderated its growth momentum to protect NIMs. The bank had decided to consolidate during the quarter by taking off few bulky low-yielding loans. During the quarter, advances growth slowed to 26.1% yoy and declined by 3.7% qoq. Slow advances growth can be primarily attributed to the corporate and institutional banking segment (which accounts for over 63% of the total loan book) whose outstanding advances grew by just 8.6% yoy and declined by 6.5% qoq. On a sequential basis, advances of only the commercial segment grew and that too by muted 2.6%.

Exhibit 4: Business momentum moderates

1QFY11 120.0 100.0 80.0 60.0 40.0 2QFY11 3QFY11 4QFY11 1QFY12

Exhibit 5: Share of branch banking improving

Corp. and Insti. Banking Commercial Banking Branch Banking 100 5 10 11 12 12 22 80 20 22 23 24 60 40 73 70 68 65 63

107.2

106.6

86.3

66.3

54.8

97.1

79.0

71.4

26.1

20.0 -

44.1

20 -

Advances yoy growth (%)

Source: Company, Angel Research

Deposits yoy growth (%)

1QFY11

2QFY11

3QFY11

4QFY11

1QFY12

Source: Company, Angel Research

July 21, 2011

Yes Bank | 1QFY2012 Result Update

Deposit growth also declined because of the slower advances growth. Overall, deposits declined sequentially by 5.7% (up by 44.1% yoy). CASA deposits accretion remained strong albeit moderating at 49.8% yoy (almost flat sequentially). However, despite such a healthy increase, CASA ratio continued to remain at 10.9%, gaining marginal 60bp qoq. The share of Certificate of Deposits (CDs) increased to 13.4% of deposits from 10.9% in 4QFY2011.

Exhibit 6: CASA deposits growth continues to be strong

(%) 140.0 105.0 70.0 35.0 1QFY11 2QFY11 3QFY11 4QFY11 1QFY12 118.2 118.2 80.5

Exhibit 7: But CASA ratio remains low

(%) 12.0 10.5 10.0 10.1 10.2 10.3 10.9

68.6 49.8 8.0

6.0 4QFY10 1QFY11 2QFY11 3QFY11 4QFY11

Source: Company, Angel Research

Source: Company, Angel Research

NIMs sustained on the back of higher yields

Reported NIMs were flat sequentially at 2.8%, despite a 70bp qoq rise in the banks cost of funds due to the recent increase in interest rates for the system as a whole and the banks wholesale-based funding mix. Higher rise in lending yields (90bp qoq) helped in offsetting funding cost pressures. The comforting fact has been the maintaining of NIMs at 2.8% over the past consecutive three quarters despite a sharp rise in interest rates across the board over such a period. Consequently, NII posted healthy growth of 35.1% yoy. With virtually having more than 90% of its loan book on a floating rate basis, the bank was well placed to pass on any pressure on cost of funds. However, on a conservative basis, we have built in NIMs to decline by 2530bp in FY2012 over FY2011 levels.

Exhibit 8: Spike in yield on advances...

(%) 12.0 11.0 10.0 9.0 8.0 1QFY11 2QFY11 3QFY11 4QFY11 1QFY12 10.0 9.6 9.5 10.7 11.6

Exhibit 9: ...aids in sustaining NIMs

(%) 3.2 3.0 2.8 2.6 2.4 1QFY11 2QFY11 3QFY11 4QFY11 1QFY12 3.1 3.0 2.8 2.8 2.8

Source: Company, Angel Research

Source: Company, Angel Research

July 21, 2011

Yes Bank | 1QFY2012 Result Update

Non-interest income growth moderates

The banks non-interest income growth also came down to 14.9% yoy and was below our estimates of a stronger rise. With branch network expansion gaining traction, fee income from retail and others continued the momentum, registering 44.0% yoy growth.

Exhibit 10: Overall fee income growth muted

Particulars (` cr) Financial markets Financial advisory Transaction banking Retail and others Other income

Source: Company, Angel Research

1QFY12 4QFY11 % chg (qoq) 1QFY11 % chg (yoy) 25 83 42 16 165 24 77 65 20 187 2.5 7.4 (35.8) (21.9) (11.5) 23 76 34 11 144 9.3 8.9 22.4 44.0 14.9

Strong asset quality

On the asset quality front, the bank continued to be in a sweet spot with best-in-the-industry gross and net NPA ratios of 0.17% and 0.01%, respectively. The already strong provision coverage ratio improved further to 95.2%, even without taking into account the technical write-offs. Restructured advances stood marginal at 0.26% of gross advances (`87cr) in 1QFY2012 as compared to 0.24% of gross advances in 4QFY2011. Provisioning expenses for the quarter were substantially low at just `2cr (down 96.5% qoq and 88.0% yoy) on account of writing back of `15cr provision on an NPA account, which had been fully written-off earlier and got settled during the quarter.

Exhibit 11: Provision coverage improves further

Gross NPA (` cr, LHS) 100 80 60 40 20 60 11 1QFY11 68 17 2QFY11 73 17 3QFY11 81 9 56 3 60 81 75 76 80 89 Net NPA (` cr, LHS) NPA coverage % (RHS) 95 100

4QFY11

1QFY12

Source: Company, Angel Research

July 21, 2011

Yes Bank | 1QFY2012 Result Update

Operating costs under control

Cost-to-income ratio remained healthy at sub-40% levels on the back of healthy operating performance and relatively lower 11.6% growth in other operating expenses on a yoy basis. Going forward as well, management plans to contain the cost-to-income ratio within 40%. Employee costs increased by 6.6% qoq and 35.2% yoy on account of a 27.2% increase in headcount and salary revisions. Other operating expenses were flat sequentially and grew by relatively lower 11.6% yoy in spite of adding over 100 branches in the past one year. Branch addition gained traction during the quarter, with opening of 41 branches to take the branch network to 255. In the last two quarters, the bank has added over 70 branches, indicating increased focus on strengthening the retail franchise. Going forward, management expects to maintain the run-rate of adding 3040 branches each quarter.

Exhibit 12: Branch expansion gaining traction

260 220 180 140 100 60 1QFY11 2QFY11 3QFY11 4QFY11 1QFY12 153 171 214 185 255

Exhibit 13: Opex ratios flat on a yoy basis

Opex to avg assets (%, RHS) 40.0 37.5 35.0 32.5 30.0 1.6 1.4 1.3 1.3 1.3 38.7 36.6 37.4 35.8

34.8

Cost-to-income ratio (%) 2.0 1.5 1.0 0.5 -

1QFY11 2QFY11 3QFY11 4QFY11 1QFY12

Source: Company, Angel Research

Source: Company, Angel Research

Capital adequacy continues to be strong

The banks capital adequacy ratio (CAR) continued to be strong at 16.2%, with tier-I ratio at 9.6%. Total capital funds grew by 35.7% to `7,090cr as of 1QFY2012. The bank has planned to raise tier-I capital in the near future, depending on market conditions, to fund its next phase of growth. As of now the bank has headroom of `1,200cr1,300cr in the form of tier-II capital.

Exhibit 14: Capital adequacy remains healthy

Tier-I CAR (%) 25.0 20.0 15.0 10.0 5.0 1QFY11 2QFY11 3QFY11 4QFY11 1QFY12 10.3 11.0 10.4 9.7 9.6 19.4 16.6 6.3 8.4 18.2 Tier-II CAR (%)

16.5 6.8

16.2 6.6

7.8

Source: Company, Angel Research

July 21, 2011

Yes Bank | 1QFY2012 Result Update

Investment arguments

A-list management and ability to raise capital

Yes Bank has an A-list top management team, which brings to the table rich experience from the best banks in India, including Bank of America, ABN AMRO, Citibank, ICICI Bank, Rabo India and HDFC Bank. The banks performance also benefits from managements ability to raise equity capital (at increasing, book-accretive premiums).

Strong asset quality

The bank has successfully maintained strong asset quality in spite of growing at a fast clip over the past few years. Proportion of stressed loans for the bank possibly remained at the lowest levels in the industry. Even in the latest results, the banks gross and net NPA ratios were stable at 0.17% and 0.01%, respectively. The provision coverage ratio even without inclusion of technical write-offs improved further to 95.2% as of 1QFY2012. Restructured advances remained marginal at 0.26% of gross advances, indicating the strength of the portfolio.

Investment concerns

Medium-term downside risks to RoAs

The banks credit market share has steadily increased on the back of a robust credit CAGR of 53.9% over FY200811, which at 0.9% represents an increasingly meaningful market share. The bank has so far managed to source loans with relatively above-average profitability, keeping its NIMs above 2.7% since FY2009, in spite of just 10% CASA ratio. Going forward though, as the size of the balance sheet increases, we believe RoA compression remains a risk to the bank. Moreover, with interest rates rising, even cyclically, the cost of funds would rise at a faster rate for the bank, given its largely wholesale-based funding mix.

Execution risks in retail expansion plans

The bank has expanded its network at a fairly rapid pace from 67 branches in FY2008 to 255 branches as of 1QFY2012. Management is planning to take the branch network to 325 branches by the end of FY2012, with new branches directed towards improving its retail franchise. In our view though, considering the experience of the past several quarters, the inherent challenges of building a retail franchise are substantial despite managements high pedigree.

Outlook and valuation

The banks growth as well as managements track record has been excellent, so far. However, as the banks balance sheet size continues to increase at a fast pace, it remains to be seen whether it can continue to source as profitable lending opportunities as its current loan portfolio. On the liabilities side, building a savings deposit franchise involves execution risks. Given our expectation that that we are very close to the peak of the current interest rate cycle and as liquidity has improved compared to the extreme tightness during the last few quarters, the environment is expected to be relatively more conducive for banks such as Yes Bank.

July 21, 2011

Yes Bank | 1QFY2012 Result Update

At the CMP, the stock is trading at of 2.0x FY2013E ABV. We maintain our Accumulate recommendation on the stock with a target price of `353, based on a target multiple of 2.25x FY2013E ABV. A QIP over the next 1215 months (as planned by management) could provide an upside trigger to the stock.

Exhibit 15: Key assumptions

Particulars (%) Credit growth Deposit growth CASA ratio NIMs Other income growth Growth in staff expenses Growth in other expenses Slippages Treasury gain/(loss) (% of investments)

Source: Angel Research

Earlier estimates FY2012 28.0 26.0 11.6 2.4 37.6 38.3 38.3 0.4 0.1 FY2013 25.0 25.0 12.6 2.4 26.2 30.0 30.0 0.5 0.1

Revised estimates FY2012 28.0 26.0 11.6 2.4 33.1 33.8 33.8 0.3 0.1 FY2013 25.0 25.0 12.6 2.3 24.9 30.0 30.0 0.4 0.1

Exhibit 16: Change in estimates

Particulars (` cr) NII Non-interest income Operating income Operating expenses Pre-prov. profit Provisions & cont. PBT Prov. for taxes PAT

Source: Angel Research

FY2012 FY2013 Earlier Revised Earlier Revised Var. (%) Var. (%) estimates estimates estimates estimates

1,555 858 2,412 940 1,473 137 1,336 433 902 1,531 830 2,361 909 1,452 125 1,327 431 897 (1.5) (3.3) (2.1) (3.3) (1.4) (8.8) (0.6) (0.6) (0.6) 1,874 1,082 2,956 1,222 1,734 204 1,531 497 1,034 1,860 1,037 2,896 1,182 1,714 188 1,526 495 1,031 (0.8) (4.2) (2.0) (3.3) (1.2) (7.6) (0.3) (0.3) (0.3)

July 21, 2011

Yes Bank | 1QFY2012 Result Update

Exhibit 17: P/ABV band

500 400 300 200 100 0 Price (`) 1x 1.5x 2x 2.5x 3x

Dec-05

Aug-07

Mar-07

Dec-10

Apr-09

Jul-05

Oct-06

Jul-10

Oct-11

Nov-08

May-06

Source: Company, Angel Research

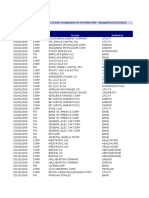

Exhibit 18: Recommendation summary

Company AxisBk FedBk HDFCBk ICICIBk* SIB YesBk AllBk AndhBk BOB BOI CanBk CentBk CorpBk DenaBk IDBI# IndBk IOB J&KBk OBC PNB SBI* SynBk UcoBk UnionBk UtdBk VijBk Reco. Buy Accumulate Neutral Buy Accumulate Accumulate Accumulate Accumulate Accumulate Buy Neutral Neutral Buy Buy Neutral Accumulate Buy Neutral Accumulate Accumulate Buy Buy Accumulate Buy Accumulate Neutral CMP (`) 1,239 457 496 1,041 23 318 209 135 887 408 515 126 522 87 133 230 142 855 350 1,141 2,452 119 87 294 95 69 Tgt. price (`) 1,650 483 1,355 26 353 222 145 1,017 498 640 107 255 166 392 1,235 2,845 139 92 357 107 Upside (%) 33.1 5.7 30.2 11.5 11.0 6.1 7.1 14.6 22.1 22.7 23.1 10.8 17.2 12.1 8.2 16.0 16.9 6.4 21.3 13.0 FY2013E P/ABV (x) 2.0 1.2 3.3 1.9 1.2 2.0 1.0 0.9 1.2 1.1 1.0 0.8 0.8 0.6 0.8 0.9 0.9 0.9 0.8 1.3 1.8 0.8 0.9 1.1 0.8 0.9 FY2013E Tgt P/ABV (x) 2.7 1.3 2.5 1.4 2.3 1.1 1.0 1.4 1.3 1.0 0.8 1.0 1.0 0.9 1.4 2.1 0.9 1.0 1.3 0.9 FY2013E P/E (x) 10.3 9.2 17.3 15.0 7.3 10.7 5.9 5.6 6.7 6.1 5.6 5.7 4.9 4.3 6.1 4.9 5.4 5.7 5.2 6.5 9.1 4.9 4.9 6.2 6.4 6.7 FY2011-13E EPS CAGR (%) 21.0 20.2 30.5 24.5 11.6 19.1 9.2 3.1 10.5 21.6 1.0 (10.9) 6.1 5.1 14.3 10.4 23.5 8.8 13.7 11.7 44.2 14.6 18.9 21.0 6.1 8.6 FY2013E RoA (%) 1.5 1.3 1.7 1.5 0.9 1.2 0.9 1.0 1.1 0.8 1.0 0.5 0.9 0.8 0.7 1.4 0.7 1.2 1.0 1.1 1.1 0.7 0.6 0.8 0.5 0.5 FY2013E RoE (%) 21.0 14.1 20.9 15.6 17.2 20.6 17.8 16.8 19.5 18.5 18.1 15.1 17.9 15.7 14.5 20.4 16.6 17.0 15.8 21.3 22.6 17.0 17.6 18.1 12.5 12.8

Source: Company, Angel Research; Note:*Target multiples=SOTP Target Price/ABV (including subsidiaries), #Without adjusting for SASF

July 21, 2011

May-11

Mar-12

Sep-09

Feb-10

Jan-08

Jun-08

Yes Bank | 1QFY2012 Result Update

Income statement

Y/E March (` cr) Net Interest Income - YoY Growth (%) Other Income - YoY Growth (%) Operating Income - YoY Growth (%) Operating Expenses - YoY Growth (%) Pre - Provision Profit - YoY Growth (%) Prov. & Cont. - YoY Growth (%) Profit Before Tax - YoY Growth (%) Prov. for Taxation - as a % of PBT PAT - YoY Growth (%) FY07 171 94.6 201 101.1 372 98.0 194 124.7 179 75.4 35 101.3 144 49 34.3 94 FY08 331 92.9 361 79.7 691 85.8 341 76.3 350 96.0 44 24.9 306 106 34.7 200 FY09 511 54.6 435 20.6 946 36.9 419 22.7 528 50.7 62 41.6 466 52.0 162 34.8 304 51.9 FY10 788 54.1 576 32.3 1,363 44.1 500 19.5 863 63.6 137 121.6 726 55.9 249 34.2 478 57.2 FY11 1,247 58.2 623 8.3 1,870 37.2 680 35.9 1,190 37.9 98 (28.2) 1,092 50.3 365 33.4 727 52.2 FY12E 1,531 22.8 830 33.1 2,361 26.3 909 33.8 1,452 22.0 125 26.9 1,327 21.5 431 32.4 897 23.3 FY13E 1,860 21.4 1,037 24.9 2,896 22.7 1,182 30.0 1,714 18.1 188 51.2 1,526 14.9 495 32.4 1,031 14.9

70.1 113.3

70.4 111.9

Balance sheet

Y/E March (` cr) Share Capital Reserves & Surplus Deposits - Growth (%) Borrowings Tier 2 Capital Other Liab. & Prov. Total Liabilities Cash Balances Bank Balances Investments Advances - Growth (%) Fixed Assets Other Assets Total Assets - Growth (%) FY07 280 507 8,220 182.5 867 479 750 11,103 390 903 3,073 6,290 161.3 71 377 11,103 166.7 FY08 296 1,023 13,273 61.5 986 728 677 16,982 959 668 5,094 9,430 49.9 101 730 16,982 52.9 FY09 297 1,327 16,169 21.8 2,189 1,513 1,405 22,901 1,278 645 7,117 12,403 31.5 131 1,327 22,901 34.8 FY10 340 2,750 26,799 65.7 2,564 2,185 1,745 36,383 1,995 678 10,210 22,193 78.9 115 1,191 36,383 58.9 FY11 347 3,447 45,939 71.4 3,333 3,358 2,583 59,007 3,076 420 18,829 34,364 54.8 132 2,186 59,007 62.2 FY12E 347 4,223 57,883 26.0 3,791 4,298 3,097 73,639 3,762 1,473 21,530 43,985 28.0 160 2,728 73,639 24.8 FY13E 347 5,092 72,354 25.0 4,724 5,373 3,868 91,757 4,703 1,835 26,644 54,982 25.0 194 3,399 91,757 24.6

July 21, 2011

10

Yes Bank | 1QFY2012 Result Update

Ratio analysis

Y/E March Profitability ratios (%) NIMs Cost to Income Ratio RoA RoE B/S ratios (%) CASA Ratio Credit/Deposit Ratio CAR - Tier I Asset Quality (%) Gross NPAs Net NPAs Slippages Loan Loss Prov. /Avg. Assets Provision Coverage Per Share Data (`) EPS ABVPS (75% cover.) DPS Valuation Ratios PER (x) P/ABVPS (x) Dividend Yield DuPont Analysis NII (-) Prov. Exp. Adj. NII Treasury Int. Sens. Inc. Other Inc. Op. Inc. Opex PBT Taxes RoA Leverage RoE 2.2 0.5 1.8 0.1 1.9 2.5 4.4 2.5 1.9 0.6 1.2 11.2 13.9 2.4 0.3 2.0 0.4 2.5 2.1 4.6 2.4 2.2 0.8 1.4 13.3 19.0 2.6 0.3 2.3 0.7 3.0 1.4 4.4 2.1 2.3 0.8 1.5 13.6 20.6 2.7 0.5 2.2 0.3 2.5 1.6 4.1 1.7 2.5 0.8 1.6 12.6 20.3 2.6 0.2 2.4 (0.1) 2.3 1.4 3.7 1.4 2.3 0.8 1.5 13.9 21.1 2.3 0.2 2.1 0.0 2.1 1.2 3.4 1.4 2.0 0.6 1.4 15.9 21.4 2.2 0.2 2.0 0.0 2.0 1.2 3.3 1.4 1.8 0.6 1.2 16.5 20.6 94.2 11.3 47.0 7.1 31.0 5.9 22.6 3.5 0.5 15.2 2.9 0.8 12.3 2.4 0.9 10.7 2.0 1.3 3.4 28.1 6.8 44.6 10.2 53.9 14.1 1.5 20.9 2.5 25.8 3.0 29.7 4.0 91.0 109.3 131.6 156.7 0.1 0.0 0.2 0.0 80.0 0.7 0.4 0.9 0.3 48.5 0.3 0.1 0.9 0.3 78.4 0.2 0.0 0.2 0.1 88.6 0.2 0.0 0.3 0.1 88.6 0.1 0.0 0.4 0.2 88.5 5.8 76.5 13.6 8.2 8.5 71.0 13.6 8.5 8.7 76.7 15.7 9.0 10.5 82.8 19.3 12.1 10.3 74.8 15.7 9.2 11.6 76.0 15.6 8.9 12.6 76.0 15.3 8.5 2.3 52.0 1.2 13.9 2.5 49.4 1.4 19.0 2.7 44.2 1.5 20.6 2.8 36.7 1.6 20.3 2.7 36.3 1.5 21.1 2.4 38.5 1.4 21.4 2.3 40.8 1.2 20.6 FY07 FY08 FY09 FY10 FY11 FY12E FY13E

July 21, 2011

11

Yes Bank | 1QFY2012 Result Update

Research Team Tel: 022 - 39357800

E-mail: research@angelbroking.com

Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement 1. Analyst ownership of the stock 2. Angel and its Group companies ownership of the stock 3. Angel and its Group companies' Directors ownership of the stock 4. Broking relationship with company covered

Yes Bank No No No No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%) Reduce (-5% to 15%)

Accumulate (5% to 15%) Sell (< -15%)

Neutral (-5 to 5%)

July 21, 2011

12

Potrebbero piacerti anche

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Gold Investor S ManualDocumento57 pagineGold Investor S Manualdrkwng100% (1)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Jinny Choe Temp Mem CardDocumento1 paginaJinny Choe Temp Mem CardginauineNessuna valutazione finora

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- Underwriting GuidelinesDocumento6 pagineUnderwriting GuidelinesHitkaran Singh RanawatNessuna valutazione finora

- FAKE Atm RECEIPT TEMPLATEDocumento2 pagineFAKE Atm RECEIPT TEMPLATEDrop That Beat50% (2)

- David Widlak Hoped He Had Found An Angel To Help Save His Struggling BankDocumento21 pagineDavid Widlak Hoped He Had Found An Angel To Help Save His Struggling BankReality TV ScandalsNessuna valutazione finora

- Credit Card Error CodesDocumento4 pagineCredit Card Error Codescurbstone Security ServicesNessuna valutazione finora

- Fixed Assets Accounting EntriesDocumento32 pagineFixed Assets Accounting EntriesSuneelTej33% (3)

- International Transport DocumentDocumento13 pagineInternational Transport DocumentGlobal Negotiator100% (1)

- SBI Saving Account - UnlockedDocumento8 pagineSBI Saving Account - UnlockedAryan businessgroupNessuna valutazione finora

- Technical & Derivative Analysis Weekly-14092013Documento6 pagineTechnical & Derivative Analysis Weekly-14092013Angel Broking100% (1)

- 2090-1600-Const-T-03 R1Documento497 pagine2090-1600-Const-T-03 R1sefpl_delhi100% (1)

- Rbi ThesisDocumento51 pagineRbi ThesisAnil Anayath100% (8)

- Section 19. Monopolies and Combinations - EASTERN INSURANCE V LTFRBDocumento2 pagineSection 19. Monopolies and Combinations - EASTERN INSURANCE V LTFRBShinji NishikawaNessuna valutazione finora

- Metal and Energy Tech Report November 12Documento2 pagineMetal and Energy Tech Report November 12Angel BrokingNessuna valutazione finora

- WPIInflation August2013Documento5 pagineWPIInflation August2013Angel BrokingNessuna valutazione finora

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocumento4 pagineRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNessuna valutazione finora

- Special Technical Report On NCDEX Oct SoyabeanDocumento2 pagineSpecial Technical Report On NCDEX Oct SoyabeanAngel BrokingNessuna valutazione finora

- Oilseeds and Edible Oil UpdateDocumento9 pagineOilseeds and Edible Oil UpdateAngel BrokingNessuna valutazione finora

- Commodities Weekly Outlook 16-09-13 To 20-09-13Documento6 pagineCommodities Weekly Outlook 16-09-13 To 20-09-13Angel BrokingNessuna valutazione finora

- Daily Agri Tech Report September 14 2013Documento2 pagineDaily Agri Tech Report September 14 2013Angel BrokingNessuna valutazione finora

- International Commodities Evening Update September 16 2013Documento3 pagineInternational Commodities Evening Update September 16 2013Angel BrokingNessuna valutazione finora

- Daily Agri Report September 16 2013Documento9 pagineDaily Agri Report September 16 2013Angel BrokingNessuna valutazione finora

- Daily Agri Tech Report September 16 2013Documento2 pagineDaily Agri Tech Report September 16 2013Angel BrokingNessuna valutazione finora

- MetalSectorUpdate September2013Documento10 pagineMetalSectorUpdate September2013Angel BrokingNessuna valutazione finora

- Daily Metals and Energy Report September 16 2013Documento6 pagineDaily Metals and Energy Report September 16 2013Angel BrokingNessuna valutazione finora

- Currency Daily Report September 16 2013Documento4 pagineCurrency Daily Report September 16 2013Angel BrokingNessuna valutazione finora

- Derivatives Report 8th JanDocumento3 pagineDerivatives Report 8th JanAngel BrokingNessuna valutazione finora

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Documento4 pagineDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNessuna valutazione finora

- Commodities Weekly Tracker 16th Sept 2013Documento23 pagineCommodities Weekly Tracker 16th Sept 2013Angel BrokingNessuna valutazione finora

- Technical Report 13.09.2013Documento4 pagineTechnical Report 13.09.2013Angel BrokingNessuna valutazione finora

- Sugar Update Sepetmber 2013Documento7 pagineSugar Update Sepetmber 2013Angel BrokingNessuna valutazione finora

- Derivatives Report 16 Sept 2013Documento3 pagineDerivatives Report 16 Sept 2013Angel BrokingNessuna valutazione finora

- IIP CPIDataReleaseDocumento5 pagineIIP CPIDataReleaseAngel BrokingNessuna valutazione finora

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocumento1 paginaPress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNessuna valutazione finora

- TechMahindra CompanyUpdateDocumento4 pagineTechMahindra CompanyUpdateAngel BrokingNessuna valutazione finora

- Market Outlook: Dealer's DiaryDocumento13 pagineMarket Outlook: Dealer's DiaryAngel BrokingNessuna valutazione finora

- Market Outlook 13-09-2013Documento12 pagineMarket Outlook 13-09-2013Angel BrokingNessuna valutazione finora

- MarketStrategy September2013Documento4 pagineMarketStrategy September2013Angel BrokingNessuna valutazione finora

- Metal and Energy Tech Report Sept 13Documento2 pagineMetal and Energy Tech Report Sept 13Angel BrokingNessuna valutazione finora

- Daily Agri Tech Report September 06 2013Documento2 pagineDaily Agri Tech Report September 06 2013Angel BrokingNessuna valutazione finora

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocumento6 pagineTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNessuna valutazione finora

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocumento4 pagineJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNessuna valutazione finora

- Issue Date Issue Type Issuer Industry: US$ Bond Issues From High Grade Companies in US (Mar-09) - (Hypothetical Data)Documento10 pagineIssue Date Issue Type Issuer Industry: US$ Bond Issues From High Grade Companies in US (Mar-09) - (Hypothetical Data)ayush jainNessuna valutazione finora

- Report On Recruitment of Life Advisors Bharti AXADocumento84 pagineReport On Recruitment of Life Advisors Bharti AXAmegha140190Nessuna valutazione finora

- M&M First Draft CommentsDocumento43 pagineM&M First Draft CommentsGedionNessuna valutazione finora

- EGF & AppendicesDocumento22 pagineEGF & AppendicesMac C.Nessuna valutazione finora

- Slips Edu 06-2021Documento9.468 pagineSlips Edu 06-2021Umar AzanNessuna valutazione finora

- Satellite Port at Bheemili 04.05.12Documento133 pagineSatellite Port at Bheemili 04.05.12ratnasekhar_gNessuna valutazione finora

- History: Working Capital ManagementDocumento3 pagineHistory: Working Capital ManagementamitNessuna valutazione finora

- Religare Explore Insurance BrochureDocumento2 pagineReligare Explore Insurance BrochurearuvindhuNessuna valutazione finora

- Final FormatingDocumento69 pagineFinal FormatingSyed Munawar Abbas NaqviNessuna valutazione finora

- Co-Operative Banks V/S Commerical Banks Objectives and FunctionsDocumento6 pagineCo-Operative Banks V/S Commerical Banks Objectives and FunctionsAnkit SuranaNessuna valutazione finora

- LOIDocumento9 pagineLOIHelp Desk Rajputana100% (1)

- Avenir 022011monthlyreportDocumento2 pagineAvenir 022011monthlyreportchicku76Nessuna valutazione finora

- Dist AgreementDocumento45 pagineDist AgreementknowsauravNessuna valutazione finora

- List of Market Makers and Primary DealersDocumento38 pagineList of Market Makers and Primary DealersJP Tarud-KubornNessuna valutazione finora

- Pinciples and Life Insurance PDFDocumento23 paginePinciples and Life Insurance PDFKarthik Sundar100% (1)

- United States Court of Appeals, Seventh CircuitDocumento9 pagineUnited States Court of Appeals, Seventh CircuitScribd Government DocsNessuna valutazione finora

- ReportDocumento1 paginaReportumaganNessuna valutazione finora

- Index: A Study of Credit Cards in Indian ScenarioDocumento8 pagineIndex: A Study of Credit Cards in Indian Scenariorohit100% (1)