Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Economic Profit 2

Caricato da

rohirajtritDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Economic Profit 2

Caricato da

rohirajtritCopyright:

Formati disponibili

Welcome, guest!

Login Join eNotes

Top of Form

co

Bottom of Form

Search

LITERATURE QUESTION & ANSWER DISCUSSION DOCUMENTS TEACHERS COLLEGE REFERENCE

Topics & Authors Science Law & Politics History Business Social Sciences Arts Health

Get immediate homework help! We have live tutors standing by. Home > Encyclopedia of Business > Economic Profit

Encyclopedia of Business About Get help in the Business Group

A B C D E F G H I J K L M N O P Q R S T U V W

X Y Z

Top of Form

cs

biz-encyclopedia

Search Encyclopedia of Business:

Bottom of Form

Economic Profit

1. Printable Version 2. Download PDF 3. Cite this Page

4. Share

DEFICIENCIES OF TRADITIONAL ACCOUNTING MEASURES CALCULATING ECONOMIC PROFIT MARKET VALUE ADDED USING ECONOMIC PROFIT MEASURES FURTHER READING:

Also known as residual income, economic profit is a managerial accounting concept that considers how well a business is performing by, among other things, deducting the firm's capital costs from its profits. What is left is known as an economic profit, as opposed to the familiar accounting profit that appears on corporate income statements, and some believe this better suggests how well the company is using capital to build economic value. Managers, in turn, use this information to deploy corporate resources in ways that enhance economic value. Economic value-based strategic planning techniques, which tie business level competitive strategies to the corporation's stock price, have achieved increasing recognition among financial managers. These models evaluate business strategies in terms of their ability to create value for the shareholders, and attempt to ensure that business-level competitive strategies are related to the fundamental objective of maximizing the return to the company's shareholders. Interest in economic value creation is intertwined with a number of other popular management practices and trends related to competitive strategy and information technology. Specifically, improved access to detailed operational data has enabled corporate executives to focus on very precise value-related targets, be they cost reductions, new investments, or other resource allocation decisions. A supporting trend has been the popularity of so-called activity-based costing and activity-based management, which juxtapose the value of each step in a manufacturing or service process with its costs. This information, coupled with overall strategic objectives, allows companies to focus on activities that create the most value and, conversely, to avoid devoting inordinate amounts of resources to activities that produce little value. Such efforts are by no means synonymous with economic profit, but like it, they are concerned with maximizing returns on resources, and can in fact lead to greater economic profit. However, there is no single definition of what constitutes economic profit or how it should be figured; for large corporations, in particular, it remains somewhat of an abstraction that cannot be computed as easily as, say, net income. Hence, there are competing theories on how best to measure economic profit. Perhaps the best known technique is Economic Value Added (EVA),

which was developed by the consulting firm Stern Stewart & Co. Indeed, Stern Stewart has claimed a trademark on the acronym, prompting other agencies to devise new names like "economic value management" for essentially the same methods. According to the EVA approach, managers should be evaluated by the economic returns they generate for shareholders. Strategies that are expected to create the greatest sustainable competitive advantage are those that also generate the largest value for the firm's shareholders. Only investments providing positive economic returns should be undertaken. Positive economic returns are generated when the returns on an investment are greater than the market cost of capital. The market cost of capital reflects what the business could earn on an investment of similar risk.

DEFICIENCIES OF TRADITIONAL ACCOUNTING MEASURES Traditionally, the most popular methods of evaluating company performance have been through profitability measures such as earnings per share (EPS) and return on equity (ROE). These measures, however, can be misleading in that they are often poor indicators of shareholder value creation. Accounting numbers can be manipulated to the detriment of the interests of shareholders since management has flexibility in how it records transactions. For example, several different ways exist to record sales and costs. The method employed can have a significant impact on the recognition of revenues and expenses, and therefore, the net income of the firm. Accountants do not measure economic profits. Generally accepted accounting principles (GAAP) deduct only the interest on debt, but not the cost of equity capital in arriving at net income. Nevertheless, the right of shareholders to receive an economic return on their investment is as legitimate as a creditor's right to receive interest. Risk is of central importance in calculating the economic value of assets. Assets seldom offer both high returns and safety. However, conventional accounting reports, such as income statements, fail to consider the level of business and financial risk associated with generating a given level of earnings. Therefore, accounting-based measures can be inaccurate measures of the financial performance of a company. Earnings calculations also ignore the time value of money. The economic value of an investment is the discounted (or present) value of the forecast cash flows produced by the investment. The discount rate used in computing the economic value of an investment includes a premium for bearing risk as well as a premium for expected inflation. Finally, earnings-based measures fail to incorporate the ongoing investment requirements of a firm. As the business grows, there generally will be an associated growth in both working capital and fixed investment. For a business to remain competitive, these incremental working and fixed capital expenditures must be funded in a timely manner. In contrast to accounting-related measures, economic profit incorporates risk and considers the time value of money. Furthermore, the value-based technique considers the cost of equity capital, working capital, and capital expenditure investment requirements. CALCULATING ECONOMIC PROFIT Economic profit measures recognize that a business must not only break even on an accounting basis but also have sufficient earnings to cover the cost of the capital used in financing its operations. The business unit is earning an economic profit only if it is generating a return on its capital that is greater than the firm's total cost of capital. Thus, the economic break-even point exceeds the accounting break-even point, which excludes capital costs.

Stern Stewart's EVA enables managers to look at the firm's business operations and determine whether they are becoming more or less valuable to their owners. EVA is computed by subtracting the total annual cost of capital (including both debt and equity) from after-tax operating profit calculated on an economic basis, or where cost of capital is the weighted average percentage cost of debt and equity capital. The adjustment to operating profits involves shifting various costs and sometimes revenues to better portray their economic contributions. For instance, research and development (R&D) costs might be amortized to reflect their relation to ongoing activities. Total capital represents the money invested in long-term fixed assets (such as equipment and real estate) plus working capital, which consists of cash, inventories, and receivables. In addition, the money spent on R&D and on employee training is also defined as capital investment even though accounting rules classify them as expenses. Similar formulas are used to compute other varieties of economic profit. FIGURING CAPITAL COSTS. Most firms employ two major sources of fundsdebt capital and equity capital in financing their operations. Although the cost of borrowed funds or cost of debt capital shows up as interest expense in its income statement, the cost of equity capital typically does not appear in the firm's financial statements. This omission is significant because equity capital is significantly more expensive than debt. The cost of debt capital is the yield to maturity on a firm's debt, adjusted to reflect its tax deductibility. Managers, however, find it quite difficult to estimate the cost of equity capital. One calculating method is to sum the dividend yield and the growth rate in dividends per share where the dividend yield equals the current dividend divided by the share price. An alternative method used by some managers that determines the cost of equity is the capital asset pricing model (CAPM). The CAPM is based on the assumption that the greater the risk in holding a stock the greater must be its required return in the form of dividends and capital appreciation. The calculation begins with the long-term, risk-free rate of return on a U.S. government bond. To this figure is added the risk premium that depends on factors related to economic growth, inflation, and investors' attitudes toward stocks. Historically this premium has run about 7 percent a year. This risk premium is adjusted for the risk of owning a specific stock, and is called the "beta" of that stock. It measures the stock's volatility compared with the rest of the market. To obtain the cost of equity, we multiply the market risk premium by the beta and add the result to the market's risk-free rate. According to the CAPM, business units that are riskier than the overall market would command a higher risk premium, whereas divisions of less than average risk would employ a lower risk premium. Once a business unit has determined the cost of capital for both debt and equity, it then computes the weighted average cost of capital. The weighted average cost of capital is calculated by multiplying the after tax cost of debt by the proportion of debt in the firm's capital structure and adding this figure to the cost of equity times the proportion of equity in the firm's capital structure. The proportions of debt and equity are based on the current market values of the firm's securities rather than the historical book values given in the firm's balance sheet. EXAMPLE. To pull all of these ideas together, consider the following example. Company X has an after-tax operating profit of $90 million (adjusted for economic costs) and net income of $30 million on revenues of $360 million. It relies on equity for 80 percent of its capital and debt for the remaining 20 percent. In the previous fiscal year, the average cost of equity financing was 14

percent and the average for debt was 8 percent (ignoring the tax considerations for the sake of simplicity). If the company figures its total capital is $750 million, economic profit (using the EVA model) would be determined as follows: The average cost of capital would be obtained by taking the weighted average of debt and equity costs. Here, that would be the sum of (0.80 x 14) plus (0.20 x 8), yielding an average cost of 12.8 percent on all capital. This appears in the formula as Thus, even though the company's nominal return on capital (net income divided by total capital) is a modest 4 percent and its net profit margin (net income divided by revenues) is a respectable 8.3 percent, on an economic basis Company X is not breaking even because its profits are not enough to recoup the total cost of capital. INTERPRETING RESULTS. If EVA or another economic profit measure is positive, the business operation is earning more than its cost of capital and thus creating value. If it is negative, however, the operation is destroying value.

MARKET VALUE ADDED Most firms that calculate economic profits also examine market value added (MVA). Market value added is the difference between the amount of capital investors have contributed to a company and the company's market capitalization. MVA indicates how well managers have increased the value of capital that investors have entrusted to them. If investors expect the business unit to continue to generate a positive economic profit, the operation will have a positive MVA. To compute MVA, first add up the book value of the firm's liabilities and shareholders' equity. Then examine how the capital market evaluates the company by determining the value of its common stock and adding its debt. Then, MVA is calculated as:

If the company's market value is greater than the book value of all its capital, then it has a positive MVA. This means that the managers have created value. In some cases, however, the market value of a company is actually less than the contributed capital, indicating that the managers have destroyed wealth.

USING ECONOMIC PROFIT MEASURES A firm can increase its economic profit in four basic ways. First, the business can attempt to earn more profit without using more capital through increasing the operating profit margin. Second, the firm can use less capital by abandoning operations with operating profits less than the cost of capital. Third, the business can invest capital in projects yielding returns higher than the market cost of capital. Finally, companies reduce the cost of capital through the judicious use of financial leverage. Generally, the cost of debt is less than the cost of equity. Studies indicate that EVA and other economic profit indicators predict MVA far more reliably than traditional accounting measures such as return on equity and earnings per share growth. The techniques are winning wide acceptance in corporate America. Firms that employ EVA including AT&T, Briggs & Stratton, Coca-Cola, CSX, and Quaker Oatshave often shown strong results, both in the financial markets and on their income statements. According to figures released by Stern Stewart, in the late 1990s some 300 large corporations worldwide used the EVA method specifically. A Stern Stewart study of 67 of these firms indicated that on average

they delivered annual investment returns of nearly nine percentage points higher than competitors that did not use EVA. Successful implementation of economic profit measures requires an explicit commitment on the part of senior executives to the goal of shareholder value creation. Business unit managers must be educated on the concepts of economic profit and MVA. The focus on shareholder value creation must be communicated to all levels of the organization. Instead of hoarding information at top levels of the organization and analyzing it sequentially, successful firms share information across the company. These companies decentralize decision making and ownership by providing incentives that link EVA and managerial compensation. [Robert T Kleiman]

FURTHER READING: Drucker, Peter F. "The Information Executives Truly Need." Harvard Business Review, JanuaryFebruary 1995, 54-62. Erhbar, Al. EVA: The Real Key to Creating Wealth. New York: John Wiley & Sons, 1998. Knight, James A. Value Based Management. New York: McGraw Hill, 1997. McIntyre, Edward V. "Accounting Choices and EVA." Business Horizons, January-February 1999. Tully, Shawn. "The EVA Advantage." Fortune, 29 March 1999.

Join eNotes

Over 3,500 study guides, question and answer forums, literature criticism, reference content, and much more!

Popular

Literature Question & Answer Groups Authors Topics College Shakespeare

Join eNotes

eNotes.com is a resource used daily by thousands of students, teachers, professors and researchers. We invite you to become a part of our community

Join eNotes Become an Enotes Editor

Subject Areas

Literature

History Science Social Sciences College Business Health Law & Politics Arts

Useful

Help About us Contact us Jobs Privacy policy Terms of use Ads by Bookrags Media 2011 eNotes.com, Inc. All Rights Reserved.

Potrebbero piacerti anche

- Legal Aspects and Organizational Policies in RecruitmentDocumento18 pagineLegal Aspects and Organizational Policies in RecruitmentrohirajtritNessuna valutazione finora

- First PageDocumento1 paginaFirst PagerohirajtritNessuna valutazione finora

- How To Create Value From Merger and AcquisitionsDocumento9 pagineHow To Create Value From Merger and AcquisitionsrohirajtritNessuna valutazione finora

- Futures & Forwards: Risk Minimization Using Derivatives Under 40 CharactersDocumento11 pagineFutures & Forwards: Risk Minimization Using Derivatives Under 40 CharactersrohirajtritNessuna valutazione finora

- WimaxDocumento2 pagineWimaxrohirajtritNessuna valutazione finora

- WimaxDocumento2 pagineWimaxrohirajtritNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5783)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- AccountingDocumento69 pagineAccountingakshit_vijNessuna valutazione finora

- CVP AnalysisDocumento23 pagineCVP Analysisakiwagamorgan100% (1)

- Management: Accounting Technicians Scheme (West Africa)Documento333 pagineManagement: Accounting Technicians Scheme (West Africa)Bello Folakemi100% (2)

- 3 Partnership AccountsDocumento93 pagine3 Partnership AccountsCA K D Purkayastha100% (1)

- Summer Training Report on SBI's Organisational Study and Financial AnalysisDocumento94 pagineSummer Training Report on SBI's Organisational Study and Financial AnalysisPrateek Gour67% (6)

- AgrobankDocumento11 pagineAgrobankEdgy EdgyNessuna valutazione finora

- Book of NB FormsDocumento185 pagineBook of NB FormsAvr PrasadNessuna valutazione finora

- Edexcel IGCSE Economics Official GlossaryDocumento9 pagineEdexcel IGCSE Economics Official GlossaryAshley Lau100% (2)

- Comparative Analysis of The Private Sector and Public Sector in IndiaDocumento15 pagineComparative Analysis of The Private Sector and Public Sector in IndiaHitesh AsnaniNessuna valutazione finora

- Financial Ratio AnalysisDocumento5 pagineFinancial Ratio AnalysisIrin HaNessuna valutazione finora

- Understand the Acknowledgements and Objectives of Shezan International LimitedDocumento48 pagineUnderstand the Acknowledgements and Objectives of Shezan International LimitedMuhbat Ali Junejo0% (1)

- Cost ManagementDocumento41 pagineCost ManagementKang JoonNessuna valutazione finora

- Comparing Financial Performance of HDFC and SBOP BanksDocumento18 pagineComparing Financial Performance of HDFC and SBOP BanksSanket NimbalkarNessuna valutazione finora

- Indian Villages - Our Strength or Our WeaknessDocumento21 pagineIndian Villages - Our Strength or Our WeaknessAnonymous VohpMtUSNNessuna valutazione finora

- The Warehouse Annual Report 2016Documento96 pagineThe Warehouse Annual Report 2016Ngan PhamNessuna valutazione finora

- Heads of Income Tax Under Income Tax Act, 1961Documento15 pagineHeads of Income Tax Under Income Tax Act, 1961Rahul Lahre100% (1)

- Wendy S Strategic AnalysisDocumento31 pagineWendy S Strategic AnalysisGowtham NannapaneniNessuna valutazione finora

- RMP Business OpportunityDocumento8 pagineRMP Business Opportunityavijit10Nessuna valutazione finora

- Final Cost AccountingDocumento10 pagineFinal Cost AccountingAshadur Rahman JahedNessuna valutazione finora

- Management Control SystemDocumento5 pagineManagement Control SystemAnil KoliNessuna valutazione finora

- Emirate Airline 1Documento4 pagineEmirate Airline 1Mohammad Mahdi Gharaee ManeshNessuna valutazione finora

- UG022510 International GCSE in Business Studies 4BS0 For WebDocumento57 pagineUG022510 International GCSE in Business Studies 4BS0 For WebAnonymous 8aj9gk7GCLNessuna valutazione finora

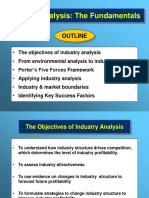

- Industry Analysis: The Fundamentals: OutlineDocumento23 pagineIndustry Analysis: The Fundamentals: OutlinePhu Thien NguyenNessuna valutazione finora

- Berkshire Hathway - Conclusions From LettersDocumento8 pagineBerkshire Hathway - Conclusions From LettersAnonymous yjwN5VAjNessuna valutazione finora

- Mgeb02 FinalDocumento4 pagineMgeb02 FinalexamkillerNessuna valutazione finora

- HBL Strategic ManagementDocumento34 pagineHBL Strategic ManagementChaudhary Hassan Arain75% (4)

- Design of Cumene Producing PlantDocumento57 pagineDesign of Cumene Producing PlantAylin Uçar88% (17)

- B7815 Supply Chain ManagementDocumento16 pagineB7815 Supply Chain ManagementNyah KingsleyNessuna valutazione finora

- Maharashtra Scooter Limited-FinalDocumento87 pagineMaharashtra Scooter Limited-Finalchopra_rishabh12Nessuna valutazione finora

- Retail financial strategyDocumento9 pagineRetail financial strategyNagarjuna ReddyNessuna valutazione finora