Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Steel Industry Update #263

Caricato da

Michael LockerCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Steel Industry Update #263

Caricato da

Michael LockerCopyright:

Formati disponibili

Steel Industry Update/263

Locker Associates, 225 Broadway, Suite 2625 New York NY 10007

June 2011

Tel: 212-962-2980

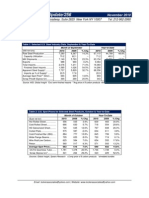

Table 1: Selected U.S. Steel Industry Data, April & Year-to-Date, 2011

(000 net tons)

Raw Steel Production ............... Capacity Utilization ................. Mill Shipments .......................... Exports ..................................... Total Imports............................. Finished Steel Imports ............ Apparent Steel Supply*............. Imports as % of Supply* ......... Average Spot Price** ($/ton) ...... Scrap Price# ($/gross ton) ..........

Month of April 2011 2010 7,772 7,667 74.2 7,259 1,027 2,549 1,929 8,161 23.6 $920 $442 74.0 7,058 1,126 2,078 1,678 7,609 22.0 $740 $372

% Chg 1.4% -2.8% -8.8% 22.7% 15.0% 7.3% -24.3% 18.8%

2011 31,195 74.4 29,761 4,169 8,976 6,936 32,527 21.3 $881 $443

Year-to-Date 2010 29,260 70.6 27,595 4,119 7,377 5,837 29,313 19.9 $677 $353

% Chg 6.6% -7.8% 1.2% 21.7% 18.8% 11.0% -30.2% 25.3%

Sources: AISI, SteelBenchmarker *Excl semi-finished imports **Avg price of 4 carbon products #steel scrap-shredded

Table 2: U.S. Spot Prices for Selected Steel Products, June & Year-to-Date, 2011

($ per net ton)

Hot Rolled Band.... Cold Rolled Coil....... Coiled Plate.................. Average Spot Price.... OCTG Seamless Tube*... #1 Heavy Melt... Scrap Steel-Shredded. #1 Busheling.

Month of June 2011 2010 % Chg 771 642 20.1% 860 748 15.0% 1,062 814 30.5% $898 $1,915 403 442 483 $735 $1,789 296 317 415 22.2% 7.0% 36.1% 39.4% 16.4%

2011 828 919 1,010 $919 $1,825 403 440 472

Year-to-Date 2010 648 753 760 $720 $1,674 314 346 419

% Chg 27.8% 22.1% 32.9% 27.6% 9.0% 28.3% 27.4% 12.6%

Sources: World Steel Dynamics SteelBenchmarker, Spears Research; OCTG data is May, 2011

email: lockerassociates@yahoo.com | Website: www.lockerassociates.com

Steel Industry Update/263

Table 3: World Crude Steel Production, April & Year-to-Date, 2011 Month of April Year-to-Date (000 metric tons) Region 2011 2010 % Chg 2011 2010 European Union. 15,767 15,428 2.2% 61,424 58,112 Other Europe. 3,043 2,592 17.4% 11,873 9,342 C.I.S. North America South America... Africa... Middle East. Asia.. Oceania...... Total Country China....... Japan... United States.. India(e). Russia(e). South Korea.... Germany. Ukraine(e).... Brazil (e). Turkey.. All Others.... 59,032 8,419 7,098 6,150 5,960 5,885 3,816 2,950 2,940 2,757 21,939 55,141 8,987 6,955 5,831 5,650 5,079 3,882 3,045 2,707 2,412 21,231 7.1% -6.3% 2.1% 5.5% 5.5% 15.9% -1.7% -3.1% 8.8% 14.3% 3.3% 229,711 36,123 28,346 24,379 23,617 22,345 15,204 11,638 11,404 10,693 86,228 212,070 35,498 26,544 22,580 21,510 18,636 14,815 11,262 10,674 8,470 80,784 8.3% 1.8% 6.8% 8.0% 9.8% 19.9% 2.6% 3.3% 6.8% 26.2% 6.7% 9,600 9,782 4,080 1,102 1,662 81,196 714 126,946 9,395 9,548 3,462 1,416 1,665 76,766 647 120,920 2.2% 2.4% 17.8% -22.2% -0.2% 5.8% 10.4% 5.0% 37,978 38,883 15,765 4,577 6,920 319,465 2,803 499,688 35,253 36,808 13,855 5,546 6,358 294,871 2,599 462,843

% Chg 5.7% 27.1% 7.7% 5.6% 13.8% -17.5% 8.8% 8.3% 7.9% 8.0%

Source: World Steel Association, 5/11; e=estimate

Graph 1: World Crude Steel Production

Source: World Steel Association, 4/11; in million metric tons

-2-

Steel Industry Update/263

Graph 2: World Steel Capacity Utilization Ratio

Source: World Steel Association, 4/11; in million metric tons

Table 4: Global Stainless Crude Steel Output, 1st Quarter 2011 Region Western Europe/Africa Eastern Europe The Americas Asia w/o China China Total World Q1 '11 2,215 79 779 2,238 3,076 8,387 Q1 '10 2,081 73 728 2,235 2,607 7,724 % Chg 6.4% 8.4% 6.9% 0.2% 18.0% 8.6% Q1 '11 2,215 79 779 2,238 3,076 8,387 Q4 '10 1,857 88 568 2,293 2,943 7,749 % Chg 19.2% -9.7% 37.0% -2.4% 4.6% 8.2%

Source: International Stainless Steel Forum, 5/24/11; in 000 tonnes

Steel Industry Update (ISSN 1063-4339) published 12 times/year by Locker Associates, Inc. Copyright 2011 by Locker Associates, Inc. All rights reserved. Reproduction in any form forbidden w/o permission. Locker Associates, Inc., 225 Broadway Suite 2625 New York NY 10007.

-3-

Steel Industry Update/263

Table 5: Top 10 Steel Producers Share of Global Production Year 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 Total Global Steel Production 788.3 847.7 850.3 904.0 970.0 1,069.1 1,146.7 1,251.2 1,351.3 1,329.1 1,211.5 1,413.6 Top 10 Production 197.1 210.6 212.8 234.0 257.3 280.6 298.2 331.6 363.1 376.1 285.3 na Top 10 Share of Production 25.0% 24.8% 25.0% 25.9% 26.5% 26.2% 26.0% 26.5% 26.9% 28.3% 23.5% na

Source: Forward, May-June 2011; in million metric tons

Table 6: Top 10 Steelmakers Share of Global Production 2004 Rank 1 Arcelor 2 Mittal 3 Nippon Steel 4 JFE 5 POSCO 6 Baosteel 7 US Steel 8 Corus Group 9 Nucor 10 ThyssenKrupp

Source: Forward, May-June 2011

2009 Rank 1 ArcelorMittal 2 Baosteel 3 POSCO 4 Nippon Steel 5 JFE 6 Jiangsu Shagang 7 Tata Steel 8 Ansteel 9 Severstal 10 Evraz

Table 7: Global Metal Company M&A Deals, 2008 - 1st Quarter, 2011 2q Number of deals Total deal value (US$ bil) Avg deal value (US$ bil) 44 18.2 0.4 2008 3q 35 22.2 0.6 2009 4q 27 16.3 0.6 1q 18 11.8 0.7 2q 17 63.1 3.7 3q 24 7.5 0.3 4q 37 10.2 0.3 1q 24 6.3 0.3 2010 2q 21 16.8 0.8 3q 32 53.2 1.7 4q 26 14.0 0.5 2011 1q 26 12.9 0.5

Source: PriceWaterhouseCoopers Forging Ahead, 1st quarter, 2011

-4-

Steel Industry Update/263

Table 8: US Steel Mill Product Imports, April, 2011

Canada EU Korea Mexico Brazil Japan Australia Others India Turkey China Russia Ukraine South Africa Indonesia Total

Apr '11 554 309 309 240 196 186 138 137 126 118 97 94 12 10 9 2,533

Apr 10 587 407 197 279 18 91 34 109 40 86 61 155 6 8 2,078

YTD '11 1,990 1,344 951 1,117 734 659 299 528 250 273 273 287 176 57 24 8,960

YTD '10 2,402 1,247 555 1,050 181 425 206 303 171 201 233 366 12 19 6 7,377

% Chg -17% 8% 71% 6% 306% 55% 45% 74% 46% 36% 17% -22% na 200% 297% 22%

Source: American Institute for International Steel (AIIS), May 284, 2011; in 000 tonnes

Graph 3: U.S. Flat Rolled Shipments, 2001-2007 & 2011e End Year Flat Rolled Capacity

Source: Goldman Sachs United States: Steel Report, May 16, 2011

-5-

Steel Industry Update/263

Table 9: E.U. Crude Steel Production, April 2011

Country

Austria Belgium Bulgaria Czech Republic Finland France Germany Greece Hungary Italy Luxembourg Netherlands Poland Romania Slovakia Slovenia Spain Sweden United Kingdom Other E.U. (27) Total - E.U. (27)

Apr'11

630 750 75 461 403 1,446 3,816 170 146 2,462 270 591 800 340 350 59 1,504 479 839 180 15,767

Apr'10

632 708 85 476 289 1,451 3,882 132 149 2,242 221 441 775 332 431 48 1,596 452 904 182 15,428

% Chg

-0.3% 5.9% -11.8% -3.2% 39.4% -0.3% -1.7% 28.8% -2.0% 9.8% 22.2% 34.0% 3.2% 2.4% -18.8% 22.9% -5.8% 6.0% -7.2% -1.1% 2.2%

J-A'11

2,251 2,551 276 1,796 1,320 5,190 14,815 615 529 8,684 910 1,976 2,610 1,168 1,579 193 5,880 1,654 3,463 631 58,090

J-A'10

2,591 3,006 280 1,883 1,522 5,283 15,204 678 553 9,419 1,015 2,374 2,848 1,225 1,535 231 5,956 1,862 3,281 684 61,425

Source: Worldsteel.org, May 24, 2011; in 000 tonnes

Table 10: C.I.S. Crude Steel Production, April 2011

Country Byelorussia Kazakhstan Moldova Russia Ukraine Uzbekistan Total - C.I.S. (6)

Apr'11 220 410 5,960 2,950 60 9,600

Apr'10 223 362 50 5,650 3,045 65 9,395

% Chg -1.3% 13.3% 5.5% -3.1% -7.7% 2.2%

J-A'11 864 1,604 0 23,461 11,638 241 37,807

J-A'10 838 1,271 132 21,511 11,271 243 35,262

Source: Worldsteel.org, May 24, 2011; in 000 tonnes

-6-

Steel Industry Update/263

Table 11: Top 40 U.S. Importers Via Ocean Container Transport, 2010 # 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 38 40 Company Walmart Stores Target Home Depot Lowe's Sears Holdings Dole Food Heineken USA Philips Electronics N America Chiquita Brands International Samsung America LG Group Ikea International J.C. Penney Costco Wholesale Ashley Furniture Industries Jarden General Electric Red Bull North America Nike Whirlpool Family Dollar Stores Dollar TreeStores Gap Stores Williams-Sonoma Big Lots Kohl's Dorel Industries Panasonic Corp. of N. America Staples Sony Corp. of America Nestle USA/Nestle Waters Bridgestone Americas Rooms to Go Toys 'R' Us Dollar General Michaels Stores Toyota Tsusho America Mattel Michelin North America Best Buy Headquarters Bentonville, AR Minneapolis, MN Atlanta, GA Mooresville, NC Hoffman Estates, IL Westlake Village, CA White Plains, NY Andover, MA Cincinnati, OH Ridgefield Park, NJ Englewood Cliffs, NJ Conshohocken, PA Plano, TX Issaquah, WA Arcadia, WI Rye, NY Fairfield, CT Santa Monica, CA Beaverton, OR Benton Harbor, MI Matthews, NC Chesapeake, VA San Francisco, CA San Francisco, CA Columbus, OH Menomonee, WI Montreal, Canada Secaucus, NJ Framingham, MA New York, NY Los Angeles, CA/Greenwich, CT Nashville, TN Seffner, FL Wayne, NJ Goodlettsville, TN Irving, TX Florence, KY El Segundo, CA Greenville, SC Richfield, MN TEUs* Sector 696,000 Retail 455,500 Retail 286,700 Retail 221,600 Retail 212,800 Retail 211,200 Diversified 129,000 Beverages 127,200 Electronics 117,100 Food 109,100 Conglomerate 101,500 Conglomerate 95,700 Retail 89,900 Retail 83,000 Retail 77,300 Furniture 77,100 Home Goods 76,700 Conglomerate 74,000 Beverages 72,300 Footwear and Apparel 64,100 Appliances 58,700 Retail 56,100 Retail 55,200 Retail 52,700 Retail 49,287 Closeout Retail 47,600 Retail 47,300 Furniture/Bicycles 43,300 Electronics 41,500 Retail 39,500 Electronics 38,800 Food/Beverages/Pet 37,900 Tires 37,700 Retail 36,100 Toys/Retail 35,600 Retail 35,000 Retail 33,300 Conglomerate 33,000 Toys/Retail 33,000 Tires 30,800 Retail

Source: Journal of Commerce, May, 2010; *TEU: twenty-foot equivalent unit (measurement in container transportation)

-7-

Steel Industry Update/263

Table 12: Top 40 U.S. Exporters Via Ocean Container Transport, 2010 # 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 36 38 39 40 Company America Chung Nam International Paper Koch Industries Weyerhaeuser Dow Chemical Dupont Newport CH International JC Horizon Shintech Allenberg Cotton Potential Industries Exxonmobil Chemical Delong BASF North America Meadwestvaco Denison Intl Cedarwood Young (Allan Co) Military Surface Deployment SIMS Metal Management Cargill Eastman Chemical Army & Air Force Exchange Cellmark Group JBS USA Archer Daniels Midland Procter and Gamble Caterpillar Tyson Foods Rayonier International Forest Products Sabic Innovative Plastics H. Muehlstein/Ravago Amers Advanced Steel Recovery Kimberly-Clark Rio Tinto Minerals Ekman Recycling WM Recycle America Conagra Foods Walmart Stores AJC International Headquarters City of Industry, CA Memphis, TN Wichita, KS Federal Way, WA Midland, MI Wilmington, DE Orange, CA Arcadia, CA Houston, TX Cordova, TN Wilmington, CA Houston, TX Clinton, WI Florham Park, NJ Richmond, VA Diamond Bar, CA Baldwin Park, CA Scott Air Force Base, IL New York, NY Wayzata, MN Kingsport, TN Dallas, TX Corte Madera, CA/Norwalk, CT. Greeley, CO Decatur, IL Cincinnati, OH Peoria, IL Springdale, AR Jacksonville, FL Foxboro, MA Pittsfield, MA Norwalk, CT Fontana, CA Dallas, TX Greenwood Village, CO Brick, NJ Houston, TX Omaha, NE Bentonville, AR Atlanta, GA TEUs Sector 300,800 Paper/ Plastics 128,000 Paper/Forest Products 122,400 Conglomerate 113,900 Forest/Paper Products 109,300 Diversified 93,600 Diversified 93,100 Paper/Metals/Plastics 82,700 Paper/Metals/Plastics 79,800 Chemicals 78,700 Cotton 78,600 Paper/Recyclables 75,700 Chemicals 75,300 Animal Feed/Grain 70,200 Chemicals/ Diversified 63,700 Diversified 61,100 Paper/Recyclables 60,400 Paper/Recyclables 60,200 Military Goods 52,000 Metals/Electronics 51,200 Conglomerate 48,100 Chem/Fibers/Plastics 47,800 Retail 47,400 Paper/Paper Products 46,400 Refrigerated Meats 46,200 Agriculture 44,000 Mfg. Consumer Goods 41,200 Mfg.Machinery 40,300 Refrigerated Meats 36,100 Forest/Paper Products 35,300 Paper/Recyclables 35,200 Chemicals/Plastics 34,800 Chemicals 34,700 Metals/Recyclables 32,200 Mfg. Consumer Goods 31,500 Minerals 28,700 Paper/ Recyclables 28,700 Diversified/ Recycler 28,100 Food-Diversified 28,000 Retail 27,800 Food/Refrigerated

Source: Journal of Commerce, May, 2010; *TEU: twenty-foot equivalent unit (measurement in container transportation)

-8-

Steel Industry Update/263

Locker Associates Steel Track: Spot Prices

U.S. Flat-Rolled Prices

($ per ton)

1100

500

U.S. Scrap Prices

($ per ton)

Plate

1000

450

#1 Busheling

900

400

800

350

Shredded Scrap CR Coil Rebar #1 Heavy Melt

300

700

600

HR Band

500

250

400 '06 '07 '08 '09 1q 2q J A S O N D J F M A M J

200 '07 '08 '09 1q 2q J A S O N D J F M A M J

Locker Associates Steel Track: Performance

10.0 9.0 8.0 7.0 6.0 5.0 4.0 3.0

U.S. Raw Steel Production

(mil net tons)

100% 90% 80% 70% 60% 50% 40%

U.S. Capacity Utilization

2011 2010

2011 2010

30%

2011 7.9 7.4 8.1 7.8 2010 6.9 6.9 7.8 7.7

2011 73% 75% 75% 74% 2010 64% 71% 73% 74%

Steel Mill Products: US Imports, April & Year-to-Date Imports: Country of Origin

(000 net tons)

Canada.. Mexico Other W. Hemisphere.. European Union Other Europe*.. Asia. Oceania. Africa.. Total Imports: Customs District Atlantic Coast Gulf Coast/Mexican Border Pacific Coast. Gr Lakes/Canadian Border. Off Shore

Source: AISI; *includes Russia

Month of April 2011 2010 555 587 241 279 215 31 312 407 227 255 833 476 156 34 11 9 2,549 2,078 257 1083 546 647 17 292 719 329 708 29

% Chg -5.5% -13.6% 593.5% -23.3% -11.0% 75.0% 358.8% 22.2% 22.7% -12.0% 50.6% 66.0% -8.6% -41.4%

2011 1,991 1,118 845 1,347 762 2,507 349 58 8,976 1,106 3,836 1,771 2,192 71

Year-to-Date 2010 % Chg 2,402 -17.1% 1,050 6.5% 249 239.4% 1,247 8.0% 593 28.5% 1,587 58.0% 229 52.4% 20 190.0% 7,377 21.7% 1,014 2,328 1,346 2,604 85 9.1% 64.8% 31.6% -15.8% -16.5%

Update #263 -9-

Locker Associates, Inc.

LOCKER ASSOCIATES is a business-consulting firm that specializes in enhancing the competitiveness of businesses and industries on behalf of unions, corporate and government clients. By combining expert business and financial analysis with a sensitivity to labor issues, the firm is uniquely qualified to help clients manage change by: leading joint labor/management business improvement initiatives; facilitating ownership transitions to secure the long-term viability of a business; conducting strategic industry studies to identify future challenges and opportunities; representing unions in strategic planning, workplace reorganization and bankruptcy formulating business plans for turnaround situations; and performing due diligence for equity and debt investors.

Over the last 28 years, the firm has directed over 225 projects spanning manufacturing, transportation, distribution and mining industries. Typical projects involve in-depth analysis of a firms market, financial and operating performance on behalf of a cooperative labormanagement effort. Locker Associates also produces a widely read monthly newsletter, Steel Industry Update that circulates throughout the U.S. and Canadian steel industry.

MAJOR CLIENTS

United Steelworkers Bank of Boston Congress Financial Santander Investment Securities AEIF-IAM/AK Steel Middletown Prudential Securities US Steel Joint Labor-Mgmt Comm LTV Steel Joint Labor-Mgmt Committee Intl Union of Electrical Workers Bethlehem Joint Labor-Mgmt Comm Inland Steel Joint Labor-Mgmt Comm Northwestern Steel and Wire Boilermakers American Federation of Musicians USS/KOBE Sysco Food Services of San Francisco International Brotherhood of Teamsters Development Bank of South Africa J&L Structural Steel Air Line Pilots Association/Delta Air Lines MEC Sharpsville Quality Products IPSCO International Association of Machinists CSEA/AFSCME United Auto Workers Service Employees International Union American Fed of Television & Radio Artists Supervalu United Mine Workers Algoma Steel North American Refractories UNITE/HERE AFL-CIO George Meany Center Watermill Ventures Wheeling-Pittsburgh Steel Canadian Steel Trade & Employment Congress Minn Gov's Task Force on Mining Special Metals

RECENT PROJECTS

Business Plan for High-Tech Startup (2009-present): drafted detailed business plan to raise capital and promote a new hydrogen battery technology IBT-Supervalu (2010): assist union and management to identify major operational problems impacting warehouse performance and provide recommendations for joint improvement Institute of Scrap Recycling Industries (2010): presented a status report on the U.S. steel market before the Institute of Scrap Recycling Industries Commodities roundtable

Save the World Air-Marketing (2009-present): developed a marketing plan to help drive

sales of a green technology product, ELEKTRA, an electronic fuel device for trucks that increases fuel economy (mpg's), reduces exhaust emissions and improves engine performance

email: lockerassociates@yahoo.com | Website: www.lockerassociates.com

Potrebbero piacerti anche

- Steel Industry Update #281Documento6 pagineSteel Industry Update #281Michael LockerNessuna valutazione finora

- Steel Industry Update #277Documento9 pagineSteel Industry Update #277Michael LockerNessuna valutazione finora

- Steel Industry Update 283Documento9 pagineSteel Industry Update 283Michael LockerNessuna valutazione finora

- CWA-CVC Investor Briefing Presentation 4-15-13Documento20 pagineCWA-CVC Investor Briefing Presentation 4-15-13Michael LockerNessuna valutazione finora

- Steel Industry Update #280Documento10 pagineSteel Industry Update #280Michael LockerNessuna valutazione finora

- Steel Industry Update #282Documento9 pagineSteel Industry Update #282Michael LockerNessuna valutazione finora

- Steel Industry Update #278Documento9 pagineSteel Industry Update #278Michael LockerNessuna valutazione finora

- Steel Industry Update #276Documento7 pagineSteel Industry Update #276Michael LockerNessuna valutazione finora

- Steel Industry Update #279Documento8 pagineSteel Industry Update #279Michael LockerNessuna valutazione finora

- Steel Industry Update #274Documento8 pagineSteel Industry Update #274Michael LockerNessuna valutazione finora

- Steel Industry Update #272Documento7 pagineSteel Industry Update #272Michael LockerNessuna valutazione finora

- Steel Industry Update #266Documento8 pagineSteel Industry Update #266Michael LockerNessuna valutazione finora

- Steel Industry Update #273Documento8 pagineSteel Industry Update #273Michael LockerNessuna valutazione finora

- Steel Industry Update #270Documento9 pagineSteel Industry Update #270Michael LockerNessuna valutazione finora

- Steel Industry Update #269Documento8 pagineSteel Industry Update #269Michael LockerNessuna valutazione finora

- Steel Industry Update #275Documento9 pagineSteel Industry Update #275Michael LockerNessuna valutazione finora

- Steel Industry Update #271Documento9 pagineSteel Industry Update #271Michael LockerNessuna valutazione finora

- Steel Industry Update #267Documento9 pagineSteel Industry Update #267Michael LockerNessuna valutazione finora

- Steel Industry Update #268Documento13 pagineSteel Industry Update #268Michael LockerNessuna valutazione finora

- Locker RPA Transcript 6-9-11Documento2 pagineLocker RPA Transcript 6-9-11Michael LockerNessuna valutazione finora

- Steel Industry Update #264Documento10 pagineSteel Industry Update #264Michael LockerNessuna valutazione finora

- Steel Industry Update #265Documento7 pagineSteel Industry Update #265Michael LockerNessuna valutazione finora

- Steel Industry Update #261Documento8 pagineSteel Industry Update #261Michael LockerNessuna valutazione finora

- Steel Industry Update #262Documento7 pagineSteel Industry Update #262Michael LockerNessuna valutazione finora

- Steel Industry Update #259Documento10 pagineSteel Industry Update #259Michael LockerNessuna valutazione finora

- Steel Industry Update #260Documento6 pagineSteel Industry Update #260Michael LockerNessuna valutazione finora

- Steel Industry Update #256Documento11 pagineSteel Industry Update #256Michael LockerNessuna valutazione finora

- Steel Industry Update #258Documento8 pagineSteel Industry Update #258Michael LockerNessuna valutazione finora

- Steel Industry Update #257Documento8 pagineSteel Industry Update #257Michael LockerNessuna valutazione finora

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Samsung Galaxy Beam GT I8530 User ManualDocumento172 pagineSamsung Galaxy Beam GT I8530 User ManualFirdaus AhmadNessuna valutazione finora

- I.I.M.U.N. Coimbatore Kids Module 2021Documento7 pagineI.I.M.U.N. Coimbatore Kids Module 2021Midhun Bhuvanesh.B 7ANessuna valutazione finora

- PW 1987 01 PDFDocumento80 paginePW 1987 01 PDFEugenio Martin CuencaNessuna valutazione finora

- The Oxford Handbook of The Trinity (Introducción)Documento12 pagineThe Oxford Handbook of The Trinity (Introducción)casandraentroya100% (1)

- Perfumery in Ancient IndiaDocumento9 paginePerfumery in Ancient IndiaRachel ChittilapillyNessuna valutazione finora

- Against Temple Adverse Possession by Private PersonDocumento12 pagineAgainst Temple Adverse Possession by Private PersonBest NiftyNessuna valutazione finora

- Overhauling Air Compressor On ShipsDocumento12 pagineOverhauling Air Compressor On ShipsTun Lin Naing100% (3)

- Canada's Top 50 FinTech CompaniesDocumento16 pagineCanada's Top 50 FinTech CompaniesTina SmithNessuna valutazione finora

- Trading With The Heikin Ashi Candlestick OscillatorDocumento7 pagineTrading With The Heikin Ashi Candlestick OscillatorDarren TanNessuna valutazione finora

- Very Important General Knowledge MCQs With DetailsDocumento13 pagineVery Important General Knowledge MCQs With DetailsNiaz AsgharNessuna valutazione finora

- 4.08 Intermediate Category of Taxation and Attorney and Own Client CostsDocumento4 pagine4.08 Intermediate Category of Taxation and Attorney and Own Client CostsBarbraNessuna valutazione finora

- Regional Trade Integration in SEE Benefits and ChallengesDocumento178 pagineRegional Trade Integration in SEE Benefits and ChallengesRakip MaloskiNessuna valutazione finora

- Financial Proposal: Cost Summaries For Installation of PV Power SystemsDocumento16 pagineFinancial Proposal: Cost Summaries For Installation of PV Power SystemsSamuel AbebawNessuna valutazione finora

- Statement by The Ukrainian Canadian CongressDocumento1 paginaStatement by The Ukrainian Canadian CongressLevon SevuntsNessuna valutazione finora

- Narrations - Direct and Indirect SpeehesDocumento6 pagineNarrations - Direct and Indirect Speehesskitteringkite100% (1)

- Assessment of The Role of Radio in The Promotion of Community Health in Ogui Urban Area, EnuguDocumento21 pagineAssessment of The Role of Radio in The Promotion of Community Health in Ogui Urban Area, EnuguPst W C PetersNessuna valutazione finora

- Airworthiness Directive: Design Approval Holder's Name: Type/Model Designation(s)Documento4 pagineAirworthiness Directive: Design Approval Holder's Name: Type/Model Designation(s)Kris Wuthrich BatarioNessuna valutazione finora

- Let's DanceDocumento6 pagineLet's DancethierrysteNessuna valutazione finora

- GSPL Annual ReportDocumento190 pagineGSPL Annual Reportjai chaudhariNessuna valutazione finora

- Nosocomial InfectionDocumento31 pagineNosocomial InfectionDr. Ashish Jawarkar0% (1)

- Standard Operating Procedures in Drafting July1Documento21 pagineStandard Operating Procedures in Drafting July1Edel VilladolidNessuna valutazione finora

- Ad3na0ab (COMBI NACCO-ing)Documento30 pagineAd3na0ab (COMBI NACCO-ing)Kaique MelloNessuna valutazione finora

- Java Programming - Module2021Documento10 pagineJava Programming - Module2021steven hernandezNessuna valutazione finora

- LMC - Boundary Dispute CasesDocumento12 pagineLMC - Boundary Dispute CasesLR FNessuna valutazione finora

- RTP Far North QLD Regional Transport PlanDocumento92 pagineRTP Far North QLD Regional Transport Plankidotox247Nessuna valutazione finora

- A Financial Analysis of Alibaba Group Holding LTDDocumento26 pagineA Financial Analysis of Alibaba Group Holding LTDSrinu Gattu50% (4)

- The Doctrine of ForgivenessDocumento6 pagineThe Doctrine of ForgivenessNkor IokaNessuna valutazione finora

- Fiber Optic Color ChartDocumento1 paginaFiber Optic Color Charttohamy2009100% (2)

- Suarez-Eden v. Dickson Et Al - Document No. 3Documento9 pagineSuarez-Eden v. Dickson Et Al - Document No. 3Justia.comNessuna valutazione finora

- Time To Kill PagesDocumento24 pagineTime To Kill PagesFrancisco FerreiraNessuna valutazione finora