Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Security Analysis and Portfolio Management Blown Up Syllabus

Caricato da

Rupa H GowdaDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Security Analysis and Portfolio Management Blown Up Syllabus

Caricato da

Rupa H GowdaCopyright:

Formati disponibili

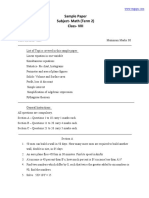

Blown Up Syllabus for MFA II SEM 2.

4 Securities Analysis and Portfolio Management

Objectives: 1) To enable the student to develop skills in analyzing various types of securities. 2) To make the student apply the knowledge of portfolio theory in portfolio management. Module 1: Investment management Nature and scope of Investment, Features, Investment objectives Investment process Investment planning Ingredients of successful investment strategy, Investment Constraints Investment avenues - Financial forms of investment (marketable forms- Bonds, Debentures, Equity Shares, Mutual funds, government securities) and Non-financial forms of investment (non marketable forms Bank deposits, post office, time deposit, monthly income scheme of post office, Kisan vikas patra, National Saving Certificate, Company Deposit, Employee Provided Fund scheme, Public Provident Fund Scheme, Ten year social security certificates, Indra Vikas Patra, Twelve year National Savings Annuity Certificates), Real Assets- Property, Precious Stones, Artifacts Components of investment risk- Meaning Primary and Secondary Market, BSE, NSE, OTCEI, SEBI, SENSEX 12 hrs 10Hrs

Module 2: Valuation of Securities

Time Value of Money Future Value of Single amount, Present Value of single amount, Future Value of an annuity, Present Value of an annuity- (Numericals) Risk and return- Analysis of risk & return, concept of total risk, factors contributing to total risk, systematic and unsystematic risk, default risk, interest rate risk, market risk, management risk, purchasing power risk.

Measures of Risk Standard Deviation, Coefficeint of Variation, Co-Variance, Correlation, Beta (Numercials) Valuation of Fixed income securities- Bonds (Numercials in Value of Bond and YTM

only) Bonds - Types of Bonds, Bond Prices -bond pricing theorems, Duration of bond, Immunization of interest risk, term structure of interest rate, determination of yield curves, basic numericals on bond valuation (Numericals on duration or immunization not included). Valuation of equity shares-dividend discount model-single period valuation model,multi period valuation model, zero growth model, constant growth model(Gordon Model),two stage growth model, H-Model, Earnings multiplier approach, basic numericals on equity valuation and preference shares(Dividend & CAPM)- (Numericals) Module 3: Securities Analysis - Analysis of Variable income securities Fundamental Analysis Concept of Intrinsic Value - Objectives and Beliefs Steps o Tools of monetary policies Macro economic analysis Industry analysis industry life cycle analysis study of structure of analysis of industry profit potential of industries o Company analysis Valuation multiples (Price to Earning ratio, Price to Book value ratio) Evaluation of management o Estimation of intrinsic values Expectation risk index obstacles in the way of an analyst Technical Analysis of equity stock Meaning- Differences between fundamental and technical analysis- Assumptions of Technical analysis- Uses o Charting techniques - Dow Theory, line chart, points and figures chart, bar chart and RSA, RSI, Moving average analysis, Japanese Candlesticks o Technical Indicators and Evaluation of technical analysis Behavior of stock market prices meaning of Efficient Market, the Efficient Market Hypothesis - empirical evidence o Forms of Efficient Market Hypothesis -Weak Form, Semi-Strong Form, Strong Form o Weak form (serial correlation test, run test, filter rules test), empirical evidence Economy -Industry -Company framework 14hrs

o Semi strong form (Event study, portfolio study) Emphircal evidence o Strong form( price over reactions, calendar anonalies, excess volatility, interest rates, stock behavior), Implications of efficient market hypothesis Module 4: Portfolio theory Calculation of portfolio risk: 2 security case, efficient frontier, optimal portfolio (Numercials) Utility analysis assumptions indifference curve, efficient portfolio and efficient frontier Markowitzs Portfolio analysis - Modern portfolio theory Asset allocation decision. Dominant & Efficient portfolio simple diversification, Markowitz Model (Numericals) Assumptions Portfolio analysis (portfolio return and portfolio risk- co variance, correlation, standard deviation, minimum and zero risk portfolio) Selection of portfolio - Selecting an optimal portfolio William Sharpes Model (single index model)- portfolio return and portfolio risk( no numericals), Determination of corner portfolio, selection of optimal portfolio (Numericals- Sharpes Optimization model ) Asset pricing theories - Capital Asset Pricing model (Basic numericals) Assumptions, Capital market line, Security market line, relationship between CML and SML Portfolio insurance and Portfolio management for individual and institutions. Portfolio performance evaluation - Sharpes portfolio performance measure, Treynors portfolio performance measure, Jensens investment performance measure (Numericals on Performance Evaluation) Portfolio management, Phases of portfolio, Portfolio management Process Plan, Implement, Monitor Portfolio revision Active and passive strategies & Types of formula plans in portfolio revision 16 hrs

Module 5:

08 hrs

Analysis of alternative investments- Hedging and Arbitrage pricing theories Meaning,

Assumptions (No numericals) Factor model Single factor model, Multiple Factor model- Meaning and Assumptions (No Numericals) Financial futures- Meaning (No Numericals) Option Pricing Model- Black and Scholes Model (Only Numericals on Black and Scholes Model) International portfolio management and Emerging opportunities

CORE BOOKS 1. Security Analysis and Portfolio Management S Kevin Prentice Hall 2. Investment Analysis and Portfolio management Prasanna Chandra TMH - 2nd Edition, 2005 RECOMMENDED BOOKS 1. Security Analysis & Portfolio Management, Donald E. Fischer and Ronald J. Jordon Prentice Hall 2. Security Analysis & Portfolio Management - V K Bhalla 3. Investment Management, Preeti Singh HPH REFERENCE BOOKS 1. Stanley S.C. Huang Maury Stall: Investment Analysis and Management, Allyn and Bacon Inc., Massachusetts. 2. Timoty E. Johnson: Investment Principles, Prentice Hall, New Jersey. 3. Jerome B. Cohen and Edward D. Zinbarg etal: Investment Analysis and Portfolio Management, Richard D. Irwon Ind., Illinois. 4. William F. Sharps: Portfolio Theory and Capital Markets, McGraw Hill, New York. 5. J.C. Francis: Investment Analysis and Management. 6. Haim Levy and Marshall Sarnat: Portfolio and Investment Selection Theory and Practice, Prentice Hall, International New Jersey. 7. Graham B. D. Dodd and S. Bolts: Securities Analysis, McGraw Hill, New York. 8. Pandyan Puneethavathy, Securities Analysis & Portfolio Management, Vikas Pub. House. 9. Fuller & Farrel, Modern Investments and Security Analysis, McGraw Hill International. 10. Strong R.A, Portfolio Management Handbook. 11. A. Brahmiah & P. Subba Rao, Financial Futures and Options, HPH. 12. Hampton John: Modern Financial Theory, Perfect and Imperfect Markets, Roston Publishing Co., New Delhi.

13. Chandra Prasanna, Managing Investments, Tata McGraw Hill. 14. Punithavathy

Potrebbero piacerti anche

- Security Analysis & Portfolio Management Syllabus MBA III SemDocumento1 paginaSecurity Analysis & Portfolio Management Syllabus MBA III SemViraja GuruNessuna valutazione finora

- Security Analysis & Portfolio ManagementDocumento3 pagineSecurity Analysis & Portfolio ManagementNeelam PandeyNessuna valutazione finora

- Security Analysis and Portfolio ManagementDocumento4 pagineSecurity Analysis and Portfolio ManagementRaHul Rathod100% (1)

- Sapm 2 Total 90 PagesDocumento91 pagineSapm 2 Total 90 PagesPochender VajrojNessuna valutazione finora

- Strategy Analysis and ChoiceDocumento10 pagineStrategy Analysis and ChoiceMichelle EsternonNessuna valutazione finora

- Sapm NotesDocumento305 pagineSapm Notesrajvinder deolNessuna valutazione finora

- Unit-2 Security AnalysisDocumento26 pagineUnit-2 Security AnalysisJoshua JacksonNessuna valutazione finora

- Derivative MarketDocumento30 pagineDerivative MarketSujan NeupaneNessuna valutazione finora

- Investment Analysis and Portfolio ManagementDocumento53 pagineInvestment Analysis and Portfolio Managementjoydippagla33% (3)

- Resume Format of PimrDocumento1 paginaResume Format of PimrApurva ShiralkarNessuna valutazione finora

- Ch-09 Findings, Suggestions & Conclusion GayathriDocumento4 pagineCh-09 Findings, Suggestions & Conclusion Gayathrirgkusumba0% (1)

- Sharma KomalDocumento11 pagineSharma KomalMoktar Tall ManNessuna valutazione finora

- Industry and Life Cycle AnalysisDocumento31 pagineIndustry and Life Cycle AnalysisASK ME ANYTHING SMARTPHONENessuna valutazione finora

- ICFAI University, Dehradun: Business Strategy and PoliciesDocumento4 pagineICFAI University, Dehradun: Business Strategy and PoliciesPankaj ShuklaNessuna valutazione finora

- Topic 5 FORMS OF ORGANIZATIONAL STRUCTURE PDFDocumento15 pagineTopic 5 FORMS OF ORGANIZATIONAL STRUCTURE PDFlolipopzeeNessuna valutazione finora

- Chapter 1 Part 1 Investment Speculation GamblingDocumento29 pagineChapter 1 Part 1 Investment Speculation GamblingNAVEEN GARG100% (1)

- SAPM Study MaterialsDocumento72 pagineSAPM Study MaterialsShyam SinghNessuna valutazione finora

- Unit 10 Financial MarketsDocumento9 pagineUnit 10 Financial MarketsDURGESH MANI MISHRA PNessuna valutazione finora

- Financial Management in Psu'sDocumento14 pagineFinancial Management in Psu'sAkshaya Mali100% (1)

- Investment Analysis & Portfolio ManagementDocumento60 pagineInvestment Analysis & Portfolio Managementdalaljinal0% (1)

- Asg 1 Role of Finance ManagerDocumento2 pagineAsg 1 Role of Finance ManagerRokov N ZhasaNessuna valutazione finora

- Security Analysis and Portfolio ManagementDocumento2 pagineSecurity Analysis and Portfolio Managementgarima50% (2)

- Jntuk Mba III Sem r13Documento26 pagineJntuk Mba III Sem r13j2ee.sridhar7319Nessuna valutazione finora

- 20773d1259766411 Financial Services M y Khan Ppts CH 1 NBFC M.y.khanDocumento54 pagine20773d1259766411 Financial Services M y Khan Ppts CH 1 NBFC M.y.khanPriyanka VashistNessuna valutazione finora

- Unit4 SAPMDocumento11 pagineUnit4 SAPMBhaskaran BalamuraliNessuna valutazione finora

- Chapter 5 Digital Marketing Strategy Definition - Fundamentals of Digital Marketing, 2 - e - Dev TutorialsDocumento54 pagineChapter 5 Digital Marketing Strategy Definition - Fundamentals of Digital Marketing, 2 - e - Dev TutorialsViruchika PahujaNessuna valutazione finora

- Ratio Analysis of It Companies Five Infosys Wipro Tcs MahindraDocumento14 pagineRatio Analysis of It Companies Five Infosys Wipro Tcs MahindrakharemixNessuna valutazione finora

- Sapm Unit 5Documento49 pagineSapm Unit 5Alavudeen Shajahan100% (1)

- Portfolio Diversification &MPTDocumento23 paginePortfolio Diversification &MPTRuchika JainNessuna valutazione finora

- 20 Tie-Up TraumaDocumento6 pagine20 Tie-Up Traumaaneetamadhok9690Nessuna valutazione finora

- 3rd Sem MBA - International FinanceDocumento1 pagina3rd Sem MBA - International FinanceSrestha ChatterjeeNessuna valutazione finora

- Business Economics PPT Chap 1Documento18 pagineBusiness Economics PPT Chap 1Pitabash BeheraNessuna valutazione finora

- Case Study For 2nd Year Students PDFDocumento3 pagineCase Study For 2nd Year Students PDFArjun JosNessuna valutazione finora

- Futures and Options in IndiaDocumento13 pagineFutures and Options in IndiaAsmita SodekarNessuna valutazione finora

- Bond ImmunisationDocumento29 pagineBond ImmunisationVaidyanathan RavichandranNessuna valutazione finora

- Summer Placement Presentation Final 1Documento16 pagineSummer Placement Presentation Final 1deepanshu lakhyaniNessuna valutazione finora

- Managing Personal Finance NotesDocumento32 pagineManaging Personal Finance NotesMonashreeNessuna valutazione finora

- PDFDocumento4 paginePDFJanvi MandaliyaNessuna valutazione finora

- Portfolio Performance EvaluationDocumento15 paginePortfolio Performance EvaluationMohd NizamNessuna valutazione finora

- A Project On Capital Market: Submitted To: Punjab Technical University, JalandharDocumento95 pagineA Project On Capital Market: Submitted To: Punjab Technical University, JalandharSourav ChoudharyNessuna valutazione finora

- Financial Statement Analysis 2Documento2 pagineFinancial Statement Analysis 2Deepak KumarNessuna valutazione finora

- Mutual FundDocumento23 pagineMutual FundDhruti BhatiaNessuna valutazione finora

- Mutual Funds IndustryDocumento36 pagineMutual Funds IndustryMaster HusainNessuna valutazione finora

- Nature and Significance of Capital Market ClsDocumento20 pagineNature and Significance of Capital Market ClsSneha Bajpai100% (2)

- Innovative Financial ServicesDocumento9 pagineInnovative Financial ServicesShubham GuptaNessuna valutazione finora

- Economic AnalysisDocumento12 pagineEconomic AnalysiszaryNessuna valutazione finora

- AFM Question Bank For 16MBA13 SchemeDocumento10 pagineAFM Question Bank For 16MBA13 SchemeChandan Dn Gowda100% (1)

- MNCDocumento10 pagineMNCvinoth_17588Nessuna valutazione finora

- SAPM Full NotesDocumento305 pagineSAPM Full NotesDeeKsha BishnoiNessuna valutazione finora

- DerivativesDocumento66 pagineDerivativesJai GaneshNessuna valutazione finora

- Value Chain Management Capability A Complete Guide - 2020 EditionDa EverandValue Chain Management Capability A Complete Guide - 2020 EditionNessuna valutazione finora

- Gamification in Consumer Research A Clear and Concise ReferenceDa EverandGamification in Consumer Research A Clear and Concise ReferenceNessuna valutazione finora

- Investment ManagementDocumento2 pagineInvestment ManagementRocky KumarNessuna valutazione finora

- Investment ManagementDocumento3 pagineInvestment Management29_ramesh170Nessuna valutazione finora

- Security Analysisand Portfolio ManagementDocumento3 pagineSecurity Analysisand Portfolio ManagementSenthil KumarNessuna valutazione finora

- Investment ManagementDocumento28 pagineInvestment ManagementseemaagiwalNessuna valutazione finora

- Mba III Investment Management (14mbafm303) NotesDocumento119 pagineMba III Investment Management (14mbafm303) NotesSyeda GazalaNessuna valutazione finora

- Proposed Syllabus - Security Analysis & Portfolio ManagementDocumento3 pagineProposed Syllabus - Security Analysis & Portfolio ManagementRahul RajagopalanNessuna valutazione finora

- Security Analysis SyllabusDocumento2 pagineSecurity Analysis SyllabusTaksh DhamiNessuna valutazione finora

- Mba-Iii-Investment Management Notes PDFDocumento121 pagineMba-Iii-Investment Management Notes PDFNaveen KumarNessuna valutazione finora

- Jeevan Dhara Full Details For IonDocumento2 pagineJeevan Dhara Full Details For IonRupa H GowdaNessuna valutazione finora

- HedgingDocumento19 pagineHedgingRupa H GowdaNessuna valutazione finora

- HedgingDocumento19 pagineHedgingRupa H GowdaNessuna valutazione finora

- Variable Annuity Life InsuranceDocumento11 pagineVariable Annuity Life InsuranceRupa H GowdaNessuna valutazione finora

- Over View of Micro Finance in IndiaDocumento8 pagineOver View of Micro Finance in IndiaRupa H GowdaNessuna valutazione finora

- Problems and Solutions For Complex AnalysisDocumento259 pagineProblems and Solutions For Complex AnalysisMete Torun91% (34)

- ECE 531: Detection and Estimation Theory: Natasha Devroye Devroye@ece - Uic.edu Spring 2011Documento15 pagineECE 531: Detection and Estimation Theory: Natasha Devroye Devroye@ece - Uic.edu Spring 2011prasanthiNessuna valutazione finora

- Practicals OS GTU For PracticeDocumento34 paginePracticals OS GTU For PracticeAashish JanardhananNessuna valutazione finora

- Objective Mapping and Kriging: 5.1 Contouring and Gridding ConceptsDocumento24 pagineObjective Mapping and Kriging: 5.1 Contouring and Gridding Conceptsforscribd1981Nessuna valutazione finora

- Splay TreeDocumento7 pagineSplay TreePraveen YadavNessuna valutazione finora

- Tran2019 PDFDocumento10 pagineTran2019 PDFRamot Hamonangan AgusDian SitompulNessuna valutazione finora

- Model Development and Loads Analysis of An Offshore Wind Turbine On A Tension Leg Platform, With A Comparison To Other Floating Turbine ConceptsDocumento129 pagineModel Development and Loads Analysis of An Offshore Wind Turbine On A Tension Leg Platform, With A Comparison To Other Floating Turbine ConceptsUbani Obinna RanksNessuna valutazione finora

- All Cases of HCF & LCMDocumento10 pagineAll Cases of HCF & LCMmail.kaivalyasharma14Nessuna valutazione finora

- NAPLAN 2008 Final Test Numeracy Year 7 Non Calculator PDFDocumento12 pagineNAPLAN 2008 Final Test Numeracy Year 7 Non Calculator PDFVia RabeNessuna valutazione finora

- Sample Paper Subject-Math (Term 2) Class - VIIIDocumento3 pagineSample Paper Subject-Math (Term 2) Class - VIIIGayathiri BalajiNessuna valutazione finora

- Estimation Bertinoro09 Cristiano Porciani 1Documento42 pagineEstimation Bertinoro09 Cristiano Porciani 1shikha singhNessuna valutazione finora

- MIT 521 Data Structures and AlgorithmDocumento27 pagineMIT 521 Data Structures and AlgorithmAshraf Uzzaman SalehNessuna valutazione finora

- 01 Mathematical Physics QBDocumento14 pagine01 Mathematical Physics QBMathan KalyanasundaramNessuna valutazione finora

- Math IgcseDocumento13 pagineMath IgcseminthantphoneNessuna valutazione finora

- MM 212 Materials Evaluation Techniques Fall Semester 2020, FMCE, GIKIDocumento30 pagineMM 212 Materials Evaluation Techniques Fall Semester 2020, FMCE, GIKIElbert VonVerimNessuna valutazione finora

- Physics 119A Midterm Solutions 1 PDFDocumento3 paginePhysics 119A Midterm Solutions 1 PDFHenry JurneyNessuna valutazione finora

- Nike Case AnalysisDocumento9 pagineNike Case AnalysistimbulmanaluNessuna valutazione finora

- Plant Simulation ManufacturingDocumento3 paginePlant Simulation ManufacturingCarlos MolinaNessuna valutazione finora

- Complex NumbersDocumento87 pagineComplex NumbersPriya DudetteNessuna valutazione finora

- Binomial DistributionDocumento15 pagineBinomial DistributionNelsonMoseMNessuna valutazione finora

- Visual VocabDocumento10 pagineVisual Vocabnellie_74023951Nessuna valutazione finora

- Combine ResultDocumento12 pagineCombine Resultpreeti.2405Nessuna valutazione finora

- Computer Engineering Syllabus Sem IV - Mumbai UniversityDocumento28 pagineComputer Engineering Syllabus Sem IV - Mumbai UniversityDaivik ChaulkarNessuna valutazione finora

- Error DetectionDocumento4 pagineError DetectionJsie HFNessuna valutazione finora

- Unit III Nurbs and Solid ModelingDocumento120 pagineUnit III Nurbs and Solid Modelingpalaniappan_pandian100% (1)

- 5000 Satoshi ScriptDocumento3 pagine5000 Satoshi Scripthar08Nessuna valutazione finora

- Multinomial Logistic Regression Models: Newsom Psy 525/625 Categorical Data Analysis, Spring 2021 1Documento5 pagineMultinomial Logistic Regression Models: Newsom Psy 525/625 Categorical Data Analysis, Spring 2021 1Deo TuremeNessuna valutazione finora

- The "Big Bang" Is Just Religion Disguised As ScienceDocumento6 pagineThe "Big Bang" Is Just Religion Disguised As ScienceSean BarryNessuna valutazione finora

- Assignment: MBA 1 Semester Statistics For Management (Mb0040)Documento10 pagineAssignment: MBA 1 Semester Statistics For Management (Mb0040)Niranjan VijayaraghavanNessuna valutazione finora

- FY 65 - MathematicsDocumento12 pagineFY 65 - MathematicsAstrology StudyNessuna valutazione finora