Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

P1 - Corporate Reporting August 10

Caricato da

IrfanDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

P1 - Corporate Reporting August 10

Caricato da

IrfanCopyright:

Formati disponibili

PROFESSIONAL 1 EXAMINATION - AUGUST 2010

You are required to answer Questions 1, 2 and 3. You are also required to answer either Question 4 or 5. (If you provide answers to both Questions 4 and 5, you must draw a clearly distinguishable line through the answer not to be marked. Otherwise, only the first answer to hand for Questions 4 or 5 will be marked.) PRO-FORMA STATEMENT OF COMPREHENSIVE INCOME BY NATURE, STATEMENT OF COMPREHENSIVE INCOME BY FUNCTION AND STATEMENT OF FINANCIAL POSITION ARE PROVIDED.

CORPORATE REPORTING

NOTES:

TIME ALLOWED: INSTRUCTIONS:

3.5 hours, plus 10 minutes to read the paper. During the reading time you may write notes on the examination paper but you may not commence writing in your answer book. Please read each Question carefully. Marks for each question are shown. The pass mark required is 50% in total over the whole paper. Start your answer to each question on a new page.

You are reminded that candidates are expected to pay particular attention to their communication skills and care must be taken regarding the format and literacy of the solutions. The marking system will take into account the content of the candidates' answers and the extent to which answers are supported with relevant legislation, case law or examples where appropriate. List on the cover of each answer booklet, in the space provided, the number of each question(s) attempted.

The Institute of Certified Public Accountants in Ireland, 17 Harcourt Street, Dublin 2.

THE INSTITUTE OF CERTIFIED PUBLIC ACCOUNTANTS IN IRELAND

CORPORATE REPORTING

PROFESSIONAL 1 EXAMINATION AUGUST 2010

Time allowed 3.5 hours, plus 10 minutes to read the paper. You are required to answer Questions 1, 2 and 3. You are also required to answer either Question 4 or 5. (If you provide answers to both Questions 4 and 5, you must draw a clearly distinguishable line through the answer not to be marked. Otherwise, only the first answer to hand for Questions 4 or 5 will be marked.)

1.

You are required to answer Questions 1, 2 and 3.

Clock PLC prepares its financial statements to 30 June each year. On 1 July 2008, Clock PLC purchased 75% of the issued share capital of Mouse Ltd by issuing two shares in Clock PLC for every four shares in Mouse Ltd. The market value of Clock PLCs shares at 1 July 2008 was 4 per share. At the date of acquisition, Mouse Ltd had 10 million 1 ordinary shares and retained earnings of 9 million. On 1 January 2009, Clock PLC acquired 30% of the shares of Tick Ltd for 3 each. Tick Ltds issued share capital at 1 January 2009 was 4 million 1 ordinary shares.

The draft Statements of Comprehensive Income for the three companies for the year ended 30 June 2009 are as follows: Clock PLC Mouse Ltd Tick Ltd 000s 000s 000s Revenue Cost of sales Gross profit Other income Operating expenses Operating profit Interest payable and similar charges Profit on ordinary activities Taxation Profit on ordinary activities after taxation 32,600 (18,400) 14,200 3,100 (6,400) 10,900 (1,800) 9,100 (2,100) 7,000 18,200 (11,400) 6,800 1,800 (2,100) 6,500 (1,400) 5,100 (1,800) 3,300 6,000 (2,800) 3,200 200 (1,400) 2,000 (600) 1,400 (300) 1,100

The following information is relevant: 1. The fair value of the net assets of Mouse Ltd at the date of acquisition was equal to their carrying value with the exception of land. The land had a fair value of 1m below its carrying value and this has not changed since the date of acquisition. 2.

3. 4. 5. 6.

All profits and losses are deemed to accrue evenly throughout the year.

Page 1

Clock PLCs policy is to value the non-controlling interest at fair value at the date of acquisition. At the date of acquisition, the goodwill attributable to the non-controlling interest was 200,000.

Included in Mouse Ltds operating expenses is an amount of 500,000 in respect of management charges invoiced and included in revenue by Clock PLC.

Sales by Clock PLC to Mouse Ltd, in the year to 30 June 2009, amounted to 3.2 million. Clock PLC made a profit of cost plus a third on all sales. Mouse Ltds year-end inventory includes 1.2 million in relation to purchases from Clock PLC.

At 30 June 2009, the fair value of Mouse Ltds specialist plant and equipment was 600,000 in excess of its carrying value. The remaining useful life of these assets is four years and Mouse Ltd has not reflected this fair value in its financial statements.

REQUIREMENTS: (a) (b)

Calculate the goodwill arising on the acquisition of Mouse Ltd.

(c)

IAS28, Investments in Associates, deals with the accounting treatment of associated entities. Explain the meaning of the following terms: (i) (ii) Significant influence. Equity method of accounting.

Prepare a consolidated Statement of Comprehensive Income for the Clock group for the year ended 30 June 2009. (19 marks) Presentation (1 mark )

(4 marks)

(3 marks) [Total: 30 marks]

(3 marks)

Page 2

2.

Splash PLC has a number of subsidiaries, one of which, Muck Ltd was acquired during the year ended 31 December 2009. The draft consolidated financial statements for the year ended 31 December 2009 are as follows: Consolidated Statement of Comprehensive Income of Splash PLC for the year ended 31 December 2009 Profit from operations Interest 000 1,210 (100) 1,110 240 1,350 (482) 868 (104) 764

Share of profits of associates Profit before taxation Taxation Non-controlling interest Group profit

Statements of Financial Position are as follows:

Assets Non-current assets Property, plant and equipment Intangibles Investment in associates Current assets Inventories Trade and other receivables Cash and cash equivalents Total assets

Splash PLC consolidated at 31/12/2009 at 31/12/2008 000 000 4,730 350 520 5,600 740 390 40 6,770 1,400 300 1,615 3,315 580 3,895 2,610 310 500 3,420 610 350 85 4,465 1,000 200 865 2,065 610 2,675

Muck Ltd at acquisition 000 610 610 150 85 20 865 500 100 80 680 680 -

Equity and liabilities 1 ordinary shares Share premium Retained earnings

Additional information: 1.

Current liabilities Trade payables Taxation Total Equity and Liabilities

Non-current liabilities Long term loans

Non controlling interest

1,900 520 455 6,770

1,100 480 210 4,465

75 110 865

2.

The property, plant and equipment during the year to 31 December 2009 shows plant with a carrying value of 800,000 which was sold for 680,000. Total depreciation for the year was 782,000.

Page 3

Splash PLC issued 400,000 1 ordinary shares at a premium of 25 cent and paid a cash consideration of 197,500 to acquire 75% of Muck Ltd. At the date of acquisition, Muck Ltds assets and liabilities were recorded at their fair value with the exception of some plant which had a fair value of 90,000 in excess of its carrying value. Goodwill on acquisition was 120,000.

REQUIREMENTS: (a)

(b)

Prepare a consolidated statement of cash flows in accordance with IAS 7 Statement of Cash Flows for the year ended 31 December 2009. (21 marks) Presentation (1 mark) The Managing Director of Splash PLC has asked you to draft a memorandum, briefly explaining the following: (i) Why it is important to remove unrealised profits arising from transactions between companies in a group? (3 marks)

(ii) (iii)

Whether it is possible for a business to make losses year after year but still increase its bank balance? (3 marks)

The difference between the direct method and indirect methods of calculating the net cash flow from operating activities. (2 marks) [Total: 30 Marks]

3.

REQUIREMENTS: Give your answer to each section in the answer sheet provided. 1. (a) (b) (c) (d)

The following multiple choice question contains eight sections, each of which is followed by a choice of answers. Only one of each set of answers is strictly correct. [Total: 20 Marks]

At what amount does IAS 17 Leases require a leasee to capitalise a finance lease?

2.

Margo Ltd purchased a specialist piece of equipment on 1 March 2003 for 800,000. The equipment has a useful life of 8 years with an expected residual value of 220,000. On 1 March 2007, the equipment was revalued to its fair value of 650,000 with no revision to its remaining useful life. On 1 March 2008 the equipment was sold for 750,000. In accordance with IAS 16 Property, Plant and Equipment, what was the profit on disposal to be included in Margo Ltds statement of comprehensive income for the year ended 28 February 2009? (a) (b) (c) (d) 240,000 262,500 207,500 100,000

The assets fair value. The cash price of the asset. The minimum lease payments less the residual value of the asset. The lower of the assets fair value and the present value of the minimum lease payments.

3.

(a) (b) (c) (d)

In accordance with IAS 7 Statement of Cash Flows, what amount for purchase of property, plant and equipment would be included in the statement of cash flows for the year ended 31 December 2009? 147,000 234,000 215,000 98,000

Page 4

Property, plant and equipment at 31 December 2008 Sale proceeds Profit on sale of property, plant and equipment Depreciation charged on property, plant and equipment Property, plant and equipment at 31 December 2009

The records of Helen PLC for the year ended 31 December 2009 are as follows:

622,000 106,000 19,000 210,000 540,000

4.

According to IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors, which of the following would qualify as a change in accounting estimate? (i) (ii) (iii) (iv) (a) (b) (c) (d) Provision for obsolescence of inventory Correction necessitated by a material error A change as a result of adoption of a new International Accounting Standard A change in the useful life of a non-current asset. All the above (ii) and (iii) (i) and (ii) (i) and (iv)

5.

During the current accounting period Ryan PLC incurred the following costs: (i) (ii) iii) (iv) (a) (b) (c) (d)

Under IAS 38 Intangible Assets what amount can be recognised as intangible assets? 148,000 154,000 88,000 82,000

8,000 legal costs in connection with registering a patent 14,000 on commissioning a research report on future product design 80,000 on acquiring a brand name 60,000 on developing a brand internally

6.

Block Ltd is a large construction company based in Cork. Details of a two year government building contract, at the year ended 31 January 2010, are as follows: Final contract price Cost of work completed to date Value of work certified to date Progress payments invoiced and received to date Estimated cost to completion 000s 3,000 1,400 1,200 1,000 800

It is company policy that profit is to be recognised by Block Ltd, on its contracts in accordance with IAS11 Construction Contracts using the value of work certified (as a percentage of contract value) to estimate the percentage completion of each contract.

How much profit should be recognised in the statement of comprehensive income in relation to the above contract for the year ended 31 January 2010? (a) (b) (c) (d) 480,000 190,000 800,000 320,000

7.

(a) (b) (c) (d)

Calculate the amount of borrowing costs that Texet PLC can capitalise, for the year ended 31 May 2011, as per IAS 23 Borrowing Costs 38,400 36,480 30,400 24,320

Loan A of 500,000 with an interest rate of 6% Loan B of 900,000 with an interest rate of 4% Loan C of 600,000 with an interest rate of 8%

Texet PLC has commissioned a new piece of equipment to be constructed at a cost of 640,000. It is expected that the work will commence on 1 October 2010 and be completed by the year ended 31 May 2011. The cost will be met from the companys existing borrowings which are as follows:

Page 5

8.

Nectar PLC has a balance of 800,000 on its retained earnings at 1 July 2009. During the year ended 30 June 2010 the company:

In accordance with IAS1, (revised) Presentation of Financial Statements, what is the closing balance on retained earnings in Nectar PLCs statement of changes in equity for the year ended 30 June 2010? (a) (b) (c) (d) 1,400,000 1,700,000 1,300,000 1,000,000

In addition, an interim dividend of 300,000 was paid during the year ended 30 June 2010.

Revalued property with a cost of 2 million and accumulated depreciation of 1.2 million, to 2.5 million. No annual transfers between reserves are to be made. Issued shares at a premium of 100,000 Made a profit for the year of 500,000

4.

IAS16 Property, Plant and Equipment and IAS40 Investment Property outlines the accounting treatment of tangible non-current assets.

Answer either question 4 or 5

1.

Hegarty PLC is a Limerick based computer manufacturer and during the year ended 31 October 2009 the following transactions in relation to property, plant and equipment took place. On 1 April 2009, a new machine was purchased by Hegarty PLC in order to improve productivity. The cost of the machine was 600,000, but the company also incurred the following: Delivery costs Labour installation costs (Note i) Management and supervision costs (allocated from head office) Material costs used for the installation -inclusive of 223 recoverable VAT. Cost of testing of new machine (Note ii) Maintenance service contract costs per annum Proceeds from sale of by-products produced as a result of the testing process Notes: (i) (ii) These were 20% higher than budgeted due to an industrial dispute at the time of installation. 4,000 15,000 10,000 1,500 3,000 400 (100)

2.

3.

On 1 November 2008, Hegarty PLC purchased a property in Ennis, Co. Clare costing 500,000 for its investment potential. The amount attributable to land was negligible, and the buildings are expected to have a useful life of 40 years. Local property indices indicate that property prices in this area have gone against the downward national trend, and that the fair value of the property has increased during the year to 31 October 2009.

Hegarty PLCs head office building was originally acquired on 1 November 2003 for 2m, and is depreciated at 4% per annum straight line. On 1 November 2007, it was revalued to 2.5m. Due to the recent downturn in commercial property prices, valuers acting for the company have advised that the valuation on 31 October 2009 should be 2m.

Plant and equipment are depreciated at 25% straight line. The cost of plant and equipment at 1 November 2008 amounted to 300,000 and the accumulated depreciation was 180,000 at that date.

Included in the testing costs of the machine was 150 in connection with a quarterly diagnostic check of machinery.

Page 6

REQUIREMENTS: (a)

(b) (c)

In relation to the machinery and head office building, draft the non-current asset note showing the movements on property, plant and equipment for the year to 31 October 2009. (12 marks) Define the term Investment Property and explain why it may not be appropriate to charge depreciation in relation to such a property. (4 marks)

Assuming that Hegarty PLC adopts a fair value policy for the property in Ennis, explain how the property would be presented in the financial statements for the year to 31 October 2009, if the property has risen in value by 5% during the year. (Disclosure notes are not required). (4 marks) [Total: 20 marks]

5.

(a) (b) (c)

In accordance with IAS37 Provisions, Contingent Liabilities and Contingent Assets, define a contingent asset and explain how they should be treated in the financial statements. (4 marks) In accordance with IAS10 Events After the Reporting Period, distinguish between an adjusting event and a nonadjusting event. (4 marks)

IAS37 and IAS10 provides guidance on the accounting treatment of Provisions, Contingent Liabilities and Contingent Assets and Events After the Reporting Period.

OR

You have been approached by the Financial Controller of Severn PLC. You have been asked to provide some advice in relation to the companys draft financial statements for the year ended 31 March 2010. You should assume that the Directors had agreed to sign the companys financial statements on 2 June 2010. 1. At a board meeting of Severn PLC in March 2010, a decision was taken in principle to dispose of a subsidiary company, Trent Ltd. This investment was valued in the statement of financial position of Severn PLC, at 31 March 2010, at 1,500,000. On 25 April, the management of Trent Ltd decided to buy the company for 2,200,000.

2.

3. 4. 5.

Five hundred customers are bringing an action against Severn PLC for the supply of faulty goods. Severn PLCs solicitors have confirmed that in their opinion, 20% of the claims are defendable at no cost. The average level of damages per successful claim is estimated at 2,000. A similar provision, amounting to 600,000 was in place at 31 March 2009, and was disclosed in the statement of financial position at that date. 400,000 was paid out for such claims during the year ended 31 March 2010. On 28 April 2010, 150,000 was paid to John Waldon as compensation for his removal as HR Director. Mr. Waldon had been dismissed by a majority vote at a board meeting in March 2010. The reasons for his dismissal were in relation to professional misconduct.

You are required to prepare a memorandum to the Board of Directors of Severn PLC in which you explain how each of the above items should be reflected in the companys financial statements for the year ended 31 March 2010. (You may assume that each of the items is material). (12 marks) END OF PAPER

Page 7

REQUIREMENTS:

Materials used in the production of one of the companys key products were included in year-end inventory at a cost of 105,000. In May 2010, the auditors indicated that the materials could have been purchased for 60,000 in April 2010, due to a fall in world commodity prices.

Severn PLC has renewed the unlimited guarantee given in respect of the bank overdraft of a company in which it holds significant investment. The companys overdraft amounted to 450,000 at 31 March 2010 and it has net assets of 1.5 million.

[Total: 20 marks]

SUGGESTED SOLUTIONS

THE INSTITUTE OF CERTIFIED PUBLIC ACCOUNTANTS IN IRELAND

CORPORATE REPORTING

PROFESSIONAL 1 EXAMINATION AUGUST 2010

SOLUTION 1 (a)

Goodwill attributable to parent Goodwill attributable to non controlling interest Full goodwill

Consideration 10m * 75% * 2/4 * 4 Less Shares Retained earnings Fair value adjustment

000s 15,000

10,000 9,000 (1,000) 18,000 * 75%

13,500 1,500 200

(b)

(4 marks)

1,700

Profit for the period Other Comprehensive Income Revaluation gain Total Comprehensive Income Attributable to: Owners of the parent Non controlling interest W5

Revenue W1 Cost of sales W2 Gross profit Other income 3,100+1,800 Operating expenses W3 Operating profit Income from associates W4 Interest payable and similar charges 1,800+1,400 Profit on ordinary activities before taxation Taxation 2,100+1,800

Clock group Consolidated statement of comprehensive income for the year ended 30 June 2009

000s 47,100 (26,900) 20,200 4,900 (8,000) 17,100 165 (3,200) 14,065 (3,900) 10,165 600 10,765

Attributable to: Owners of the parent Non controlling interest W6

9,340 825 10,165 9,790 975 10,765

Page 9

W1

Less management charges Less intra group sales W2 Cost of sales Clock Mouse Less: Intra group sales Plus: URP on inventories (1.2m/133.3*33.3) Operating expenses Clock Mouse Less management charges

Revenue Clock Mouse

000s

000s

32,600 18,200 50,800 (500) (3,200) 47,100 18,400 11,400

(3,200)

W3

000s

300 26,900 6,400 2,100 (500) 8,000

W4

Income from associates Profit after taxation 1,100 * 6/12 * 30% Non controlling interest Profit 3,300*25% Non controlling interest Profit (w5) NCI in subsidiarys other Comprehensive income (600*25%)

000s

165

W5

000s

3,300 825

W6

000s 825 150 975

(19 marks) Presentation 1 mark

Page 10

(c)

Significant influence is highlighted in IAS28 as a situation where the investor holds, directly or indirectly through subsidiaries, 20% or more of the voting power of the investee and that if such a situation exists significant influence will be presumed. Significant influence can be evidenced by: o Representation on the board of directors or equivalent, o Participation in policy making processes o Material transactions between investor and investee o Provision of essential technical information

Defined as power to participate in the financial and operating policy decisions of investee but not control over these policies.

Equity accounting is a method of accounting that brings an associate investment into the parent companys financial statements initially at cost. The carrying amount of the investment is then adjusted in each period for the group share of profit of the associate. The investment is calculated at: Cost of investment Add group share of post acquisition retained profit. Less any impairment losses.

IAS28 does not allow the use of proportionate consolidation of associates.

(6 marks) [Total: 30 Marks]

Page 11

SOLUTION 2

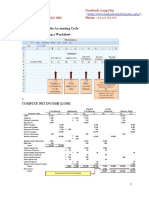

Consolidated Statement of cash flows for the year ended 31 December 2009 000 2,222 (100) (347) (3,002) (177.5) 220 680 800 (326.5) (14) 000

Cash flows from operating activities Cash generated from operations Interest paid Income tax paid (w1) Net cash from operating activities

Note: Reconciliation of profit before tax to cash generated from operations Profit before tax Finance cost Depreciation charge Amortisation charge (w3) Loss on disposal of property plant and equipment Share of profits from associates Decrease in inventories (740-610-150) Decrease in trade and other receivables (390-350-85) Decrease in trade and other payables (520-480-75) Cash generated from operations W1 Cash Bal c/d W2 Bal b/d Acquisition of sub (610+90) Cash Income Tax 000 347 Bal b/d 455 Income statement Acquisition taxation 802 PPE

Cash flows from financing activities Loan Dividends paid to Non controlling interest (w8) Dividends paid (w5) Net cash used in financing activities Net increase in cash and cash equivalents Cash and cash equivalents at beginning of period Cash and cash equivalents at end of period

Cash flows from investing activities Purchase of property plant and equipment (w2) Acquisition of subsidiary Muck ltd net of cash acquired (w7) Dividends received from associates (w6) Proceeds from sale of property plant and equipment Net cash used in investing activities

1,775

(2,279.5)

459.5 (45) 85 40 1,350 100 782 80 120 (240) 20 45 (35) 2,222

000 210 482 110 802

000 2,610 700 3,002 6,312

Disposals

Income statement: depreciation Bal c/f

782 4,730 6,312

000 800

Page 12

W3 Bal b/d Acquisition W4 Bal c/d (1,400+300) W5 Dividends paid Bal c/d W6 Bal b/d IS W7 Acquisition of subsidiary PPE (610+90) Inventories Trade receivables Cash and cash equivalents Trade payables Taxation Non controlling interest Goodwill

Intangibles 000 310 IS amortised 120 Bal c/f 430 Share capital and premium 000 Bal b/d (1,000 +200) 1,700 Acquisition of Muck Ltd 1,700 Retained earnings 000 14 Bal b/d 1,615 IS 1,629 Investments in Associates 000 500 Cash 240 Bal c/f 740 700 150 85 20 (75) (110) (192.50) 577.50 120 697.50 (20) (500) 177.50 697,500 577,500 120,000

000 80 350 430

000 1,200 500 1,700

000 865 764 1,629

000 220 520 740

500,000+197,500 680,000+90,000=770,000*.75 Goodwill W8

Less: cash and cash eq. Non cash consideration (400 *1.25) Cash flow on acquisition: net of cash acquired

= =

Cash

Bal c/d

Non-controlling interest 000 326.50 Bal b/d Acquisition of subsidiary (865-185+90)*25% 580 IS 906.50

(21 marks) Presentation (1 mark)

000 610 192.50 104 906.50

Page 13

(b) To: From: Date: Re: (i)

On consolidation of the accounts of H and S, it should be recognised that a sale from H to S couldnt give rise to a profit as far as the group income statement is concerned, as the sale is in effect an internal group transfer. In order for the group to realise a profit on sale, the sale must be made to a customer outside the group. If at the end of the year, S has bought from goods from H at cost plus and the goods have not been sold outside the group by S. Then, as far as the group is concerned, the profit made by H has not been realised, since it is still in the inventory of S. Both the group profit and inventory will be overstated and will require adjusting as follows: Reduce the group profit by the amount of unrealised profit Reduce the group inventory by the amount of unrealised profit.

(ii)

(iii)

The direct method involves showing the individual operating cash receipts from customers and cash payments to suppliers and employees. To use the latter method, cash receipts from customers and cash payments to suppliers and other cash payments will have to be calculated. The direct method is easiest to understand because it deals with the natural cycle of cash flows.

Indirect method involves starting with the operating profit and adjusting it for non-cash charges and credits so that one figure of operating cash flows is shown. In essence, the indirect method, starts from operating profit, and adjusts for movements in working capital and non cash items such as depreciation.

Likewise, losses do not necessarily result in a decrease in bank balances. Purchase of inventory on credit will increase cost of sales but there will be no outflow of cash. Depreciation and amortisation will decrease profits but they will not affect cash/bank. Closing inventory may fall, which although increasing cost of sales, it would imply inventory has been sold, so increasing cash. Also, could discuss the effect of losses on sale of non-current assets. (3 marks)

The reason why profit does not necessarily result in an increase in cash is due to the fact that profit is determined by comparing income and expenditure and not receipts and payments (i.e. accruals/matching principle).

Other things being equal, in the longer term profits do have the effect of increasing the bank balance. However, in the short term, the making of profit will not necessarily result in an increased bank balance. Profit and an increase in cash/bank are not the same.

If subsidiary sells goods to H, the principle is exactly the same, unrealised profit will have to be eliminated, but this time there will be a non-controlling interest to be accounted for. Reduce group profit by majority share Reduce non-controlling interest Reduce group inventory Same principles hold true for transfer of non-current assets.

(3 marks)

The reason most companies use the indirect method is because cash flow statement is prepared from the existing statement of comprehensive income and statement of financial position. Additionally, the direct method requires more work to analyse the constituent cash flows. (2 marks) [Total: 30 Marks]

Page 14

SOLUTION 3 1. 2. (d) (c)

Revalued on 1 March 2007 Accumulated depreciation at 28 February 2007 650,000-220,000 / 4 years remaining life Carrying value at 1 March 2008 Sale proceeds Profit on disposal Balance brought forward Less depreciation Less disposals (106,000 19,000) = WDV closing balance Therefore purchases

107,500 542,500 750,000 207,500

650,000

3.

(c)

4. 5. 6.

(d)

622,000 210,000 87,000 325,000 540,000 215,000

(c)

8,000+ 80,000 = 88,000 000s 3,000

(d)

Final contract price Costs to date Costs to complete Expected profit

1,400 800

Profit recognised 7.

Work certified Contract value

800* 40%

1,200 3,000

2,200 800

* 100

= =

40% complete 320

(d) (500,000* .06) + (900,000* .04) + (600,000 *.08) *100 = 5.7% 500,000+900,000+600,000 640,000 * .057 * 8/12 = 24,320 (d) Balance 1/1/2009 Profit 2009 Less dividends 800,000 500,000 1,300,000 300,000 1,000,000

8.

Page 15

SOLUTION 4 (a) Head Office 000 2,500 Plant & equipment 000 300 620.53 920.53 Total 000 2,800 620.53 (500) 2,920.53 280 265.494 (200) 345.494 2,575.036 2,520

Depreciation At 1 November 2008 Charge for year Revaluation At 31 October 2009 At 31 October 2009 W1 Carrying amount At 31 October 2008

Cost/valuation At 1 November 2008 Additions (w1) Revaluation At 31 October 2009

(500) 2,000

100 100 (200) 2,000 2,400

180 165.494 345.494 575.036 120

Additions to plant and equipment External costs Delivery costs Labour costs (15 x 100/120) Materials (1.5 0.223) Testing (3 0.15) Sale of by-products Depreciation 7/12 X 25% X 620.53 25% X 300,000 000 600 4 12.5 1.28 2.85 (0.1) 620.53 = = 90,494 75,000 165,494

W2

Head office revaluation Original cost 1 Nov 2003 Depreciation 4 years @ 4% Carrying value at 1 November 2007 Revaluation gain Revalued amount 1 November 2007 Depreciation (4% for 2 years) Balance 1 November 2009 Revaluation loss (2,300 2,000) Carrying value 31 October 2009 000 2,000 (320) 1,680 820 2,500 (200) 2,300 (300) 2,000

Page 16

(12 marks)

(b)

(c)

The purpose of depreciation is to spread the cost of an asset over its useful life as it is consumed in an entity's operations. But property which is acquired as an investment rather than for use is not consumed in this way and does not have a useful life. In consequence, the charging of depreciation is not appropriate for investment property. (4 marks) On 1 November 2008, the building has a carrying amount of 500,000 and should be recognised as an investment property. The property should be revalued to the fair value, at 31 October 2009, amounting to (525,000 - 500,000) = 25,000 increase.

(i) (ii) (iii)

Investment property consists of land or buildings held to earn rentals or held for capital appreciation (or both) rather than held: for use in the production or supply of goods or services, or for administrative purposes, or for sale in the ordinary course of business.

Gain/loss should be taken directly to the statement of comprehensive income. It is not shown under revaluation reserve/ other comprehensive income. (4 marks) [Total: 20 Marks]

SOLUTION 5 (a)

An example of such an asset may arise if the entity is involved in a legal case and will receive damages if the case is won. IAS37 requires that contingent assets should not be recognised in the statement of financial position. However, they should be disclosed in the notes, if the inflow of economic benefits is judged to be probable. (4 marks)

A contingent asset is defined as a possible asset that arises from past events and whose existence will be confirmed only on the occurrence or non occurrence of one or more uncertain future events not wholly within the control of the entity.

(b)

Non-adjusting events: - those that are indicative of conditions which arose after the reporting period e.g. announcement of a major restructuring programme ( 4 marks)

Adjusting events: - those that provide evidence of conditions that existed at the end of the reporting period e.g. sales of inventories held at the reporting date.

Page 17

(c)

To: From: Date: Re: (i) 1.

2.

The decision in principle was taken to sell Trent Ltd before the year end. The asset should be classified as held for resale if it is made available for immediate sale, management are actively marketing the asset and it is expected the sale will be completed within 12 months. The investment should be included at the lower of cost, 1,500,000 and the fair value of 2,200,000. A justification could be made to treat this as a discontinued operation. Provision re faulty goods: 0.80 x 2,000 x 500 = 800,000 Provision re Faulty goods 000 600 (400) 600 800

3. 4.

5.

At the statement of financial position date, the value of inventory will be the lower of cost or net realisable value. The market price fall occurred after the statement of financial position date and thus is non adjusting event. If the fall in market price results in the finished product sale price being reduced, there will be a case for NRV to be re-evaluated under IAS2. (12 marks) [Total: 20 marks]

Severn plc has guaranteed the overdraft in respect of a company in which it holds a significant investment. It is not considered likely that the guarantee will be called upon. That companys overdraft was 450,000 at 30 June 2009.

There should be a note under Contingent Liabilities:

John Waldons dismissal took effect before the year end. As a consequence, the compensation of 150,000 will be an adjusting event and will be charged in the financial statements for the year end 30 June 2009.

At 1 July 2008 Utilised in year SCI charge (bal figure) At 31 June 2009

Page 18

Potrebbero piacerti anche

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosDa EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNessuna valutazione finora

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosDa EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNessuna valutazione finora

- P1 - Corporate Reporting April 09Documento21 pagineP1 - Corporate Reporting April 09IrfanNessuna valutazione finora

- P1 - Corporate Reporting April 11Documento20 pagineP1 - Corporate Reporting April 11Abdurrazaq PanhwarNessuna valutazione finora

- 2009-Financial Reporting Main EQP and CommentariesDocumento46 pagine2009-Financial Reporting Main EQP and CommentariesBryan SingNessuna valutazione finora

- 2010 LCCI Level 3 Series 2 Question Paper (Code 3012)Documento8 pagine2010 LCCI Level 3 Series 2 Question Paper (Code 3012)mappymappymappyNessuna valutazione finora

- April 2013 PDFDocumento22 pagineApril 2013 PDFJasonSpringNessuna valutazione finora

- Financial Accounting: Formation 2 Examination - April 2008Documento11 pagineFinancial Accounting: Formation 2 Examination - April 2008Luke ShawNessuna valutazione finora

- Financial Accounting December 2009 Exam PaperDocumento10 pagineFinancial Accounting December 2009 Exam Paperkarlr9Nessuna valutazione finora

- 2010 LCCI Bookkeeping and Accounts Series 3Documento8 pagine2010 LCCI Bookkeeping and Accounts Series 3Fung Hui Ying75% (4)

- ABE Dip 1 - Financial Accounting JUNE 2005Documento19 pagineABE Dip 1 - Financial Accounting JUNE 2005spinster40% (1)

- AC1025 2008-Principles of Accounting Main EQP and Commentaries AC1025 2008-Principles of Accounting Main EQP and CommentariesDocumento59 pagineAC1025 2008-Principles of Accounting Main EQP and Commentaries AC1025 2008-Principles of Accounting Main EQP and Commentaries전민건Nessuna valutazione finora

- Accounting-2009 Resit ExamDocumento18 pagineAccounting-2009 Resit ExammasterURNessuna valutazione finora

- Albion Technology & General VCT PLCDocumento70 pagineAlbion Technology & General VCT PLCalbionventuresNessuna valutazione finora

- P1 - Corporate Reporting April 08Documento25 pagineP1 - Corporate Reporting April 08IrfanNessuna valutazione finora

- 025 Za 2010Documento13 pagine025 Za 2010gurpreet_mNessuna valutazione finora

- Accounting/Series-2-2005 (Code3001)Documento20 pagineAccounting/Series-2-2005 (Code3001)Hein Linn Kyaw100% (1)

- IFRS 17 Module 7 - Revision Pack V3 30-06-2012Documento35 pagineIFRS 17 Module 7 - Revision Pack V3 30-06-2012JasonSpringNessuna valutazione finora

- Summer 2010 QuestionsDocumento5 pagineSummer 2010 QuestionstaubushNessuna valutazione finora

- ABC L3 Past Paper Series 3 2013Documento7 pagineABC L3 Past Paper Series 3 2013b3nzyNessuna valutazione finora

- Accounting A2 Jan 2005Documento11 pagineAccounting A2 Jan 2005Orbind B. ShaikatNessuna valutazione finora

- 6002 Source Booklet January 2011Documento12 pagine6002 Source Booklet January 2011Sausan AliNessuna valutazione finora

- P1 - Financial Accounting April 07Documento23 pagineP1 - Financial Accounting April 07IrfanNessuna valutazione finora

- PL Financial Accounting and Reporting IFRS Exam June 2019Documento10 paginePL Financial Accounting and Reporting IFRS Exam June 2019scottNessuna valutazione finora

- Exam Financial Statement AnalysisDocumento18 pagineExam Financial Statement AnalysisBuketNessuna valutazione finora

- Lcci Level3 Solution Past Paper Series 3-10Documento14 pagineLcci Level3 Solution Past Paper Series 3-10tracyduckk67% (3)

- P1 FA April 2006Documento17 pagineP1 FA April 2006IrfanNessuna valutazione finora

- Lancaster University: January 2014 ExaminationsDocumento6 pagineLancaster University: January 2014 Examinationswhaza7890% (1)

- Assignment 3 20042023 103711pmDocumento5 pagineAssignment 3 20042023 103711pmahmed aliNessuna valutazione finora

- Series 2 2013Documento8 pagineSeries 2 2013Apollo YapNessuna valutazione finora

- ICAEW Financial Accounting Past Papers Combined 2010-2013Documento130 pagineICAEW Financial Accounting Past Papers Combined 2010-2013Ahmed Raza Tanveer100% (3)

- Financial Management and Control: Time Allowed 3 HoursDocumento9 pagineFinancial Management and Control: Time Allowed 3 HoursnsarahnNessuna valutazione finora

- Code 2007 Accounting Level 2 2010 Series 4Documento15 pagineCode 2007 Accounting Level 2 2010 Series 4apple_syih100% (1)

- EC GroupDocumento5 pagineEC Groupsaqlain khanNessuna valutazione finora

- Tutorial 4Documento3 pagineTutorial 4LIM WEI LIANGNessuna valutazione finora

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Documento11 pagine3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid Ali100% (1)

- P1-Q and As-Advanced Financial Accounting and Reporting - June 2010 Dec 2010 and June 2011Documento93 pagineP1-Q and As-Advanced Financial Accounting and Reporting - June 2010 Dec 2010 and June 2011HAbbuno100% (1)

- Pravinn Mahajan CA FINAL SFM-NOV2011 Ques PaperDocumento9 paginePravinn Mahajan CA FINAL SFM-NOV2011 Ques PaperPravinn_MahajanNessuna valutazione finora

- IAS 16 and 40 PDFDocumento11 pagineIAS 16 and 40 PDFWaqas Younas BandukdaNessuna valutazione finora

- MB2 2013 Ap Set BDocumento6 pagineMB2 2013 Ap Set BMary Queen Ramos-UmoquitNessuna valutazione finora

- 2.4 Mock Exam Jun 06 Question-AJDocumento15 pagine2.4 Mock Exam Jun 06 Question-AJsaeed_r2000422Nessuna valutazione finora

- CPA IRELAND Accounting Framework April 07Documento14 pagineCPA IRELAND Accounting Framework April 07Luke ShawNessuna valutazione finora

- MCQs PPEDocumento10 pagineMCQs PPEfrieda20093835100% (1)

- (Workshops Sem 1 Questions For Students Bman 21020) 2017-18Documento10 pagine(Workshops Sem 1 Questions For Students Bman 21020) 2017-18patrickNessuna valutazione finora

- Institute of Cost and Management Accountants of Pakistan Spring (Summer) 2010 ExaminationsDocumento4 pagineInstitute of Cost and Management Accountants of Pakistan Spring (Summer) 2010 ExaminationsIrfanNessuna valutazione finora

- Edexcel Unit 2 Jun 2014 QPDocumento14 pagineEdexcel Unit 2 Jun 2014 QPcyberdeadmanNessuna valutazione finora

- Depreciation MCQsDocumento5 pagineDepreciation MCQsAsaduzzaman LimonNessuna valutazione finora

- Higher Level Paper 2 2010Documento8 pagineHigher Level Paper 2 2010Mark MoloneyNessuna valutazione finora

- Advanced Financial Accounting: Professional 2 Examination - April 2007Documento12 pagineAdvanced Financial Accounting: Professional 2 Examination - April 2007Muhammad QamarNessuna valutazione finora

- F7uk 2010 Jun QDocumento9 pagineF7uk 2010 Jun QKathleen HenryNessuna valutazione finora

- Homework Financial MNGTDocumento3 pagineHomework Financial MNGTArka Narayan DashguptaNessuna valutazione finora

- Financial Accounting Sample Paper 21Documento31 pagineFinancial Accounting Sample Paper 21Jayasankar SankarNessuna valutazione finora

- 2-4 2005 Jun QDocumento10 pagine2-4 2005 Jun QAjay TakiarNessuna valutazione finora

- AccA P4/3.7 - 2002 - Dec - QDocumento12 pagineAccA P4/3.7 - 2002 - Dec - Qroker_m3Nessuna valutazione finora

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionDa EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNessuna valutazione finora

- Drycleaning Plant Revenues World Summary: Market Values & Financials by CountryDa EverandDrycleaning Plant Revenues World Summary: Market Values & Financials by CountryNessuna valutazione finora

- Property Boom and Banking Bust: The Role of Commercial Lending in the Bankruptcy of BanksDa EverandProperty Boom and Banking Bust: The Role of Commercial Lending in the Bankruptcy of BanksNessuna valutazione finora

- Strategy, Value and Risk: A Guide to Advanced Financial ManagementDa EverandStrategy, Value and Risk: A Guide to Advanced Financial ManagementNessuna valutazione finora

- Chapter 18 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Documento10 pagineChapter 18 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNessuna valutazione finora

- Financial Reporting IIDocumento478 pagineFinancial Reporting IIIrfan100% (3)

- Process CostingDocumento48 pagineProcess CostingIrfanNessuna valutazione finora

- Who Assissainated BENAZIR BHUTTODocumento213 pagineWho Assissainated BENAZIR BHUTTOIrfanNessuna valutazione finora

- Right of Parents, Wife and TeachersDocumento176 pagineRight of Parents, Wife and TeachersIrfanNessuna valutazione finora

- (Umaira Ahmed) Hum Kahan Kay Sachay Thay (Novel # 0083)Documento96 pagine(Umaira Ahmed) Hum Kahan Kay Sachay Thay (Novel # 0083)Muhammad Usman Khan81% (21)

- Suggested Answers Certificate in Accounting and Finance - Autumn 2014Documento6 pagineSuggested Answers Certificate in Accounting and Finance - Autumn 2014IrfanNessuna valutazione finora

- Ifrs 16 (Property, Plant and Equpement)Documento82 pagineIfrs 16 (Property, Plant and Equpement)Irfan100% (7)

- (Umaira Ahmed) Kiss Jahan Kaa Zar Liya (Novel # 0004)Documento91 pagine(Umaira Ahmed) Kiss Jahan Kaa Zar Liya (Novel # 0004)Muhammad Usman Khan100% (3)

- Ifrs 36 (Impairement of Assets)Documento33 pagineIfrs 36 (Impairement of Assets)Irfan100% (4)

- Borrowing CostsDocumento19 pagineBorrowing CostsIrfan100% (20)

- Leases IAS 17Documento56 pagineLeases IAS 17Irfan100% (4)

- Leases IAS 17Documento56 pagineLeases IAS 17Irfan100% (4)

- Topic Wise Taxation Icap Past Papers (Pak) of C.ADocumento30 pagineTopic Wise Taxation Icap Past Papers (Pak) of C.AIrfan33% (3)

- Institute of Cost and Management Accountants of Pakistan Fall (Winter) 2009 ExaminationsDocumento4 pagineInstitute of Cost and Management Accountants of Pakistan Fall (Winter) 2009 ExaminationsIrfanNessuna valutazione finora

- Financial Reporting (S-501) : Stage-5 / Professional IIIDocumento4 pagineFinancial Reporting (S-501) : Stage-5 / Professional IIIIrfanNessuna valutazione finora

- Institute of Cost and Management Accountants of Pakistan Fall (Winter) 2010 ExaminationsDocumento4 pagineInstitute of Cost and Management Accountants of Pakistan Fall (Winter) 2010 ExaminationsIrfanNessuna valutazione finora

- F7-FINANCIAL REPORTING - ACCA (INT) 2011 JunDocumento9 pagineF7-FINANCIAL REPORTING - ACCA (INT) 2011 JunIrfanNessuna valutazione finora

- P1 FA April 2006Documento17 pagineP1 FA April 2006IrfanNessuna valutazione finora

- P1 - Corporate Reporting April 08Documento25 pagineP1 - Corporate Reporting April 08IrfanNessuna valutazione finora

- Institute of Cost and Management Accountants of Pakistan Spring (Summer) 2010 ExaminationsDocumento4 pagineInstitute of Cost and Management Accountants of Pakistan Spring (Summer) 2010 ExaminationsIrfanNessuna valutazione finora

- Financial RportingDocumento4 pagineFinancial RportingIrfanNessuna valutazione finora

- P1 - Financial Accounting April 07Documento23 pagineP1 - Financial Accounting April 07IrfanNessuna valutazione finora

- Wiley CPAexcel - FAR - 13 Disclosure RequirementsDocumento2 pagineWiley CPAexcel - FAR - 13 Disclosure RequirementsAimeeNessuna valutazione finora

- PQ 2019 - Financial Accounting SyllabusDocumento5 paginePQ 2019 - Financial Accounting SyllabusUmeesh NantakumarNessuna valutazione finora

- Analisis Rasio Keuangan Sebagai Tolok Ukur Kinerja Keuangan Badan Usaha Milik Desa (Bumdes) Arum Dalu NgabarDocumento12 pagineAnalisis Rasio Keuangan Sebagai Tolok Ukur Kinerja Keuangan Badan Usaha Milik Desa (Bumdes) Arum Dalu NgabarWindy FeeNessuna valutazione finora

- Day 2 Finman p2Documento6 pagineDay 2 Finman p2Ericka DeguzmanNessuna valutazione finora

- Financial Statements PLDT and GLobeDocumento18 pagineFinancial Statements PLDT and GLobeArnelli GregorioNessuna valutazione finora

- User Manual Asset AccountingDocumento47 pagineUser Manual Asset AccountinginasapNessuna valutazione finora

- LCCI Accounting Concepts-1Documento51 pagineLCCI Accounting Concepts-1Khin Lay HtetNessuna valutazione finora

- P13 2aDocumento2 pagineP13 2aNaeem Arshad Arshad AliNessuna valutazione finora

- The Financial Statement Auditing Environment: © 2017 Mcgraw-Hill Education (Malaysia) SDN BHDDocumento30 pagineThe Financial Statement Auditing Environment: © 2017 Mcgraw-Hill Education (Malaysia) SDN BHDSarannyaRajendraNessuna valutazione finora

- At Quizzer 3 - 2018 Code of Ethics For Professional Accountants in The Phils T1AY2122Documento15 pagineAt Quizzer 3 - 2018 Code of Ethics For Professional Accountants in The Phils T1AY2122Rena NervalNessuna valutazione finora

- The Accounting Equation and The Double-Entry SystemDocumento24 pagineThe Accounting Equation and The Double-Entry SystemJohn Mark MaligaligNessuna valutazione finora

- PETRONAS PIR2021 Financial Report 2021Documento174 paginePETRONAS PIR2021 Financial Report 2021Ez BzNessuna valutazione finora

- Chapter 3 NotesDocumento6 pagineChapter 3 NotesmatthewNessuna valutazione finora

- Name: Date: NPM: Course:: INSTRUCTION: Determine Depreciation For Partial PeriodsDocumento5 pagineName: Date: NPM: Course:: INSTRUCTION: Determine Depreciation For Partial PeriodsHernando Maulana100% (1)

- Accounts 9 Grade Question PaperDocumento5 pagineAccounts 9 Grade Question PaperHeena KaurNessuna valutazione finora

- Acc407 Accounting EquationDocumento2 pagineAcc407 Accounting EquationAidil Idham100% (1)

- GTI 2012 Chapter 1 Horizon MarkedDocumento9 pagineGTI 2012 Chapter 1 Horizon MarkedArizal Zul LathiifNessuna valutazione finora

- Overview of Ops Aud Part 2 - MARPDocumento25 pagineOverview of Ops Aud Part 2 - MARPRNessuna valutazione finora

- Fixed Assets PDFDocumento21 pagineFixed Assets PDFSrihari GullaNessuna valutazione finora

- Chapter 4: Completing The Accounting Cycle 1. Steps in Prepareing A WorksheetDocumento8 pagineChapter 4: Completing The Accounting Cycle 1. Steps in Prepareing A WorksheetNguyễn Quỳnh AnhNessuna valutazione finora

- Accounting For Merchandising Operations: Weygandt - Kieso - KimmelDocumento62 pagineAccounting For Merchandising Operations: Weygandt - Kieso - KimmelMaidah NaeemNessuna valutazione finora

- Accounting Australian 9th Edition 2015 by Hoggett Et AlDocumento44 pagineAccounting Australian 9th Edition 2015 by Hoggett Et AlConglomerateZ60% (10)

- ACFEIC - BPKRI - SeminarOnline - Materi Pak Budi SantosoDocumento36 pagineACFEIC - BPKRI - SeminarOnline - Materi Pak Budi SantosoAchmad SuryamanNessuna valutazione finora

- 44CTP Result Audit & Accounts Services 0Documento5 pagine44CTP Result Audit & Accounts Services 0Muhammad Faisal100% (1)

- 02 FabmDocumento28 pagine02 FabmMavs MadriagaNessuna valutazione finora

- Problem 1. Prepare AJE From The Books of Silent As of Consider The FF InformationDocumento10 pagineProblem 1. Prepare AJE From The Books of Silent As of Consider The FF InformationYuan LoganNessuna valutazione finora

- Ebook College Accounting Chapters 1 30 13Th Edition Price Solutions Manual Full Chapter PDFDocumento67 pagineEbook College Accounting Chapters 1 30 13Th Edition Price Solutions Manual Full Chapter PDFconvive.unsadden.hgp2100% (12)

- Question in Auditing TheoryDocumento20 pagineQuestion in Auditing TheoryJeric YangNessuna valutazione finora

- Intermediate Accounting 11th Edition Nikolai Solutions ManualDocumento22 pagineIntermediate Accounting 11th Edition Nikolai Solutions ManualMichaelJohnsonatgdp100% (17)

- Advanced-Accounting Fischer 11e - Ch01 TBDocumento18 pagineAdvanced-Accounting Fischer 11e - Ch01 TBgilli1tr100% (1)