Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

EconomyUpdate 270611

Caricato da

krisharissDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

EconomyUpdate 270611

Caricato da

krisharissCopyright:

Formati disponibili

Macro Implications

June 27, 2011 Empowered Group of Ministers (EGoM) raised the prices of

Diesel by Rs3/litre, LPG by Rs50/cylinder and kerosene by Rs2/ litre

Customs duty reduction: 5% to nil on crude; 7.5% to 2.5% on

petrol and diesel; Excise duty on diesel lowered from Rs4.60 per litre to Rs2 a litre 25-40bps indirect increase through power and freight costs ~Rs222bn or 24bps

We expect a ~85-100bps increase in the inflation including

We expect the move to impact the government finances by

Impact on inflation could be ~85-100bps

We estimate the EGOMs decision to result in 100bps upward pressure on the inflation. Of this ~60bps will be driven by direct impact of these three products on the WPI with weights of 6.4% and another 25-40bps to come from indirect impact due to increase in the power and fuel and freight charges for the manufacturing companies. Table I: Impact on inflation

Direct LPG Kerosene Diesel Total Weights (%) 0.9 0.7 4.8 6.4 Increasse (%) 14.3 16.3 7.1 Wtd avg (bps) 13.1 12.0 34.2 59.2

Source: Office of the Economic Adviser, Emkay Research

Impact of diesel price hike on WPI historically

Date 05.11.04 21.06.05 06.06.06 05.06.08 02.07.09 27.02.10 26.06.10 % increase in Diesel Prices 8.8 7.6 6.6 9.4 6.5 7.7 5.2 Mom change in WPI 0.8 1.1 1.1 2.6 1.1 0.8 0.9 Fuel & power 0.6 0.4 0.3 1.0 0.5 0.3 0.4 WPI Ex fuel 0.2 0.7 0.8 1.6 0.6 0.5 0.4

Negative Impact of 24bps on fiscal finances

The above measures to result in overall revenue loss of Rs490bn to the government

on account of Rs230bn revenue loss in excise duty collections and Rs260 revenue loss in custom revenue collections. As a result the overall revenue collection target for FY12 will fall by 6.2% to Rs7,409bn.

Revenue loss on account of above measures to increase the fiscal deficit target for

FY12 to 5.1% from 4.6% initially targeted in the budget.

However at the same time on account of the above measures, the subsidy burden of

the government will get reduced by Rs268bn for FY12 from Rs897bn. (Assuming 52.4% govt sharing, similar to last year ). Despite that the government will have to bear additional subsidy burden of Rs332 over and above of Rs297bn accounted in the budget. As a result we believe the government will overshoot its revised fiscal deficit target by 14%.

Emkay Global Financial Services Ltd

Economy Update

Economy

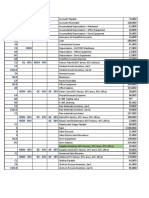

Economy Government Accounts (FY12)

Rs bn Revenue receipt Tax (net) Non tax Capital receipt Recovery of loans Others Total receipt Non-plan expenditure Revenue Interest Capital Plan expenditure Revenue Capital Total expenditure Revenue Capital Fiscal surplus/(deficit) As % of GDP Revenue surplus/(deficit) As % of GDP Primary surplus/(deficit) As % of GDP

Source: Controller General of Accounts, Emkay Research

Economy Update

Budgeted 7,899 6,645 1,254 550 150 400 8,449 8,162 7,336 2,680 826 4,415 3,636 779 12,577 10,972 1,606 -4,128 -4.6 -3,073 -3.4 -1,448 -1.6

Now 7,409 6,155 1,254 550 150 400 7,959 8,162 7,336 2,680 826 4,415 3,636 779 12,577 10,972 1,606 -4,618 -5.1 -3,563 -4.0 -1,938 -2.2

% change (6.2) (7.4) (5.8) 11.9 15.9 33.8

Impacts expected fiscal deficit by 24bps to 5.8%

Rs bn FY12 Estimates Earlier Budgeted fiscal deficit target Budgeted subsidies Fuel Fertilisers Total 297 203 500 297 203 500 -4,128 Now -4,618

Expected subsidies Fuel Fertilisers Total 897 500 1,397 629 500 1,129

Extra subsidies needed Likely fiscal deficit As % of GDP

897 -5,025 -5.6

629 -5,247 -5.8

Emkay Research

27 June 2011

Economy

Economy Update

Emkay Global Financial Services Ltd. Paragon Center, H -13 -16, 1st Floor, Pandurang Budhkar Marg, Worli, Mumbai 400 013. Tel No. 6612 1212. Fax: 6624 2410

DISCLAIMER: This document is not for public distribution and has been furnishe d to you solely for your information and may not be reproduced or redistributed to any other person. The manner

of circulation and distribution of this document may be restricted by law or regulation in certain countries, including the United States. Perso ns into whose possession this document may come are required to inform themselves of, and to observe, such restrictions. This material is for the personal information of the authorized recipient, and we are not soliciting any action based upon it. This report is not to be construed as an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. No person associated with Emkay Global Financial Services Ltd. is obligated to call or initiate contact with you for the purposes of elaborating or following up on the information contained in this document. The material is based upon information that we consider reliable, but we do not represent that it is accurate or complete, and it s hould not be relied upon. Neither Emkay Global Financial Services Ltd., nor any person connected with it, accepts any liability arising from the use of this document. The recipient of this material should rely on their own investigations and take their own professional advice. Opinions expressed are our current opinions as of the date appearing on this material only. While we endeavor to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. We and our affiliates, officers, directors, and employees world wide, including persons involved in the preparation or issuance of this material may; (a) from time to time, have long or short positions in, and buy or sell the securities thereof, of company (ies) mentioned herein or (b) be engaged in any other transaction invo lving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company (ies) discussed herein or may perform or seek to perform investment banking services for such company(ies)or act as advisor or lender / borrower to such company(ies) or have other potential conflict of interest with respect to any recommendation and related information and opinions. The same persons may have acted upon the information contained here. No part of this material may be duplicated in any form and/or redistributed without Emkay Global Financial Services Ltd.'s prior written consent. No part of this document may be distributed in Canada or used by private customers in the United Kingdom. In so far as this report includes current or historical information, it is believed to be reliable, although its accuracy and completeness cannot be guaranteed.

Emkay Research

27 June 2011

3 www.emkayglobal.com

Potrebbero piacerti anche

- er20130409BullPhatDragon PDFDocumento3 pagineer20130409BullPhatDragon PDFCatherine LawrenceNessuna valutazione finora

- Restructuring Term SheetDocumento3 pagineRestructuring Term SheetFrancisco GarcíaNessuna valutazione finora

- Demystifying Union Budget 2011-2012Documento3 pagineDemystifying Union Budget 2011-2012Vaibhav RusiaNessuna valutazione finora

- RE Udget Xpectation: Key Expectations From Budget FY12Documento4 pagineRE Udget Xpectation: Key Expectations From Budget FY12nnsriniNessuna valutazione finora

- Er 20130320 Bull Leading IndexDocumento3 pagineEr 20130320 Bull Leading IndexBelinda WinkelmanNessuna valutazione finora

- Ratings On Australia Not Affected by Government's Fiscal 2015 BudgetDocumento3 pagineRatings On Australia Not Affected by Government's Fiscal 2015 Budgetapi-239404108Nessuna valutazione finora

- Report On Budget 2012-13Documento4 pagineReport On Budget 2012-13Kunal JainNessuna valutazione finora

- State Bank of India: Play On Economic Recovery Buy MaintainedDocumento4 pagineState Bank of India: Play On Economic Recovery Buy MaintainedPaul GeorgeNessuna valutazione finora

- FINC3015 Cash Flows 70%Documento10 pagineFINC3015 Cash Flows 70%Matthew RobinsonNessuna valutazione finora

- Stock Research Report For WLT As of 3/26/2012 - Chaikin Power ToolsDocumento4 pagineStock Research Report For WLT As of 3/26/2012 - Chaikin Power ToolsChaikin Analytics, LLCNessuna valutazione finora

- Research - Note - 2012 06 13 - 12 01 08 000000Documento2 pagineResearch - Note - 2012 06 13 - 12 01 08 000000adithyauNessuna valutazione finora

- ENEVA Corporate Presentation ? July 2015Documento18 pagineENEVA Corporate Presentation ? July 2015MPXE_RINessuna valutazione finora

- Fag 3qcy2012ruDocumento6 pagineFag 3qcy2012ruAngel BrokingNessuna valutazione finora

- Market Outlook 20th December 2011Documento4 pagineMarket Outlook 20th December 2011Angel BrokingNessuna valutazione finora

- Nestlé India (NESIND) : Royalty To Increase To 4.5% by CY18Documento1 paginaNestlé India (NESIND) : Royalty To Increase To 4.5% by CY18drsivaprasad7Nessuna valutazione finora

- Refinery Site Visit PresentationDocumento57 pagineRefinery Site Visit PresentationClive GibsonNessuna valutazione finora

- GSK Strategic Report 2015Documento75 pagineGSK Strategic Report 2015nolovNessuna valutazione finora

- Market Outlook 26th September 2011Documento3 pagineMarket Outlook 26th September 2011Angel BrokingNessuna valutazione finora

- Lending Club Q4 2014 ResultsDocumento29 pagineLending Club Q4 2014 ResultsCrowdfundInsiderNessuna valutazione finora

- Initiating Coverage Ruchi Soya Industries LTDDocumento20 pagineInitiating Coverage Ruchi Soya Industries LTDShruti SharmaNessuna valutazione finora

- Budget Impact Debt Mutual FundDocumento2 pagineBudget Impact Debt Mutual FundnnsriniNessuna valutazione finora

- Maintain Buy' On M&M - TP Rs.800: Research Notes - Buy M&M, Aban Offshore, L&T, Hold DLF, Reduce Rpower (June 01, 2012)Documento3 pagineMaintain Buy' On M&M - TP Rs.800: Research Notes - Buy M&M, Aban Offshore, L&T, Hold DLF, Reduce Rpower (June 01, 2012)Nas Mall RegisterNessuna valutazione finora

- Market Outlook 12th March 2012Documento4 pagineMarket Outlook 12th March 2012Angel BrokingNessuna valutazione finora

- Manila Water Company: Arbitration Brings Uncertainty - : Wednesday, 25 September 2013Documento3 pagineManila Water Company: Arbitration Brings Uncertainty - : Wednesday, 25 September 2013RoseAnnFloriaNessuna valutazione finora

- Fossil Fuel Subsidies in Indonesia: Trends, Impacts, and ReformsDa EverandFossil Fuel Subsidies in Indonesia: Trends, Impacts, and ReformsNessuna valutazione finora

- Capital Market Daily: Pakistan EconomyDocumento2 pagineCapital Market Daily: Pakistan EconomyImran Khan SharNessuna valutazione finora

- Hindustan Construction CompanyDocumento18 pagineHindustan Construction CompanySudipta BoseNessuna valutazione finora

- Monthly Market Outlook February 2014Documento26 pagineMonthly Market Outlook February 2014Win VitNessuna valutazione finora

- IDFC - Poor Start To Q3 - Dec 12, 2014Documento5 pagineIDFC - Poor Start To Q3 - Dec 12, 2014KCNessuna valutazione finora

- Review of Capital StructureDocumento3 pagineReview of Capital StructureIzhamKhairiNessuna valutazione finora

- Investor Presentation (Dec2011) ENG FVDocumento24 pagineInvestor Presentation (Dec2011) ENG FVyazminislahudinNessuna valutazione finora

- FOMC Expects Strong Pick Up in GrowthDocumento12 pagineFOMC Expects Strong Pick Up in GrowthDavid SmithNessuna valutazione finora

- Refinancing Savings Round 2: Frasers Commercial TrustDocumento5 pagineRefinancing Savings Round 2: Frasers Commercial Trustcentaurus553587Nessuna valutazione finora

- Gathering Speed - Update On The Monetary Policy - June 2022Documento5 pagineGathering Speed - Update On The Monetary Policy - June 2022Huzefa BharmalNessuna valutazione finora

- Er 20130228 Bull Phat DragonDocumento2 pagineEr 20130228 Bull Phat DragonBelinda WinkelmanNessuna valutazione finora

- Investor PresentationDocumento23 pagineInvestor Presentationhedgie58Nessuna valutazione finora

- Sample Text: Understanding Union BudgetDocumento7 pagineSample Text: Understanding Union BudgetedelweissretailNessuna valutazione finora

- First Resources: Singapore Flash NoteDocumento4 pagineFirst Resources: Singapore Flash NotephuawlNessuna valutazione finora

- Credit Access Grameen After AcquisationDocumento63 pagineCredit Access Grameen After AcquisationNihal YnNessuna valutazione finora

- SAI FY13 - Results Investor PresentationDocumento29 pagineSAI FY13 - Results Investor PresentationdigifiNessuna valutazione finora

- Corporate Presentation November 2012Documento25 pagineCorporate Presentation November 2012TamilTower LiveMoviesNessuna valutazione finora

- Fossil Fuel Subsidies in Thailand: Trends, Impacts, and ReformsDa EverandFossil Fuel Subsidies in Thailand: Trends, Impacts, and ReformsNessuna valutazione finora

- Er 20130722 Bull Phat DragonDocumento3 pagineEr 20130722 Bull Phat DragonDavid SmithNessuna valutazione finora

- Ratings On New Zealand Unaffected by Government's 2015 BudgetDocumento3 pagineRatings On New Zealand Unaffected by Government's 2015 Budgetapi-239404108Nessuna valutazione finora

- COVID-19 Relief HandbookDocumento19 pagineCOVID-19 Relief HandbookVo DanhNessuna valutazione finora

- er20130306BullPhatDragon PDFDocumento2 pagineer20130306BullPhatDragon PDFBrian FordNessuna valutazione finora

- Er 20130417 Bull Leading IndexDocumento3 pagineEr 20130417 Bull Leading IndexBelinda WinkelmanNessuna valutazione finora

- Summary of Budget FY 2012-13Documento3 pagineSummary of Budget FY 2012-13sajid_huq2585Nessuna valutazione finora

- Budget Brief Head 55Documento36 pagineBudget Brief Head 55Anonymous UpWci5Nessuna valutazione finora

- Summers 12-15-08 MemoDocumento57 pagineSummers 12-15-08 MemochenjiayuhNessuna valutazione finora

- The Future of Your Wealth: How the World Is Changing and What You Need to Do about It: A Guide for High Net Worth Individuals and FamiliesDa EverandThe Future of Your Wealth: How the World Is Changing and What You Need to Do about It: A Guide for High Net Worth Individuals and FamiliesNessuna valutazione finora

- Pakistan Economy - 09-Jul-2019 - AlfalahDocumento2 paginePakistan Economy - 09-Jul-2019 - Alfalahmuddasir1980Nessuna valutazione finora

- Budget PLUS 2011Documento108 pagineBudget PLUS 2011Meenu Mittal SinghalNessuna valutazione finora

- Q2 FY17 Results Update: Power Grid: Company Details: Quarterly HighlightsDocumento4 pagineQ2 FY17 Results Update: Power Grid: Company Details: Quarterly Highlightsnabamita pyneNessuna valutazione finora

- Avila Energy: Established and DiversifiedDocumento23 pagineAvila Energy: Established and DiversifiedJames HudsonNessuna valutazione finora

- Hexaware CompanyUpdateDocumento3 pagineHexaware CompanyUpdateAngel BrokingNessuna valutazione finora

- Er 20130220 Bull Leading IndexDocumento2 pagineEr 20130220 Bull Leading IndexBelinda WinkelmanNessuna valutazione finora

- 2019 Riverside County Pension Advisory Review Committee ReportDocumento20 pagine2019 Riverside County Pension Advisory Review Committee ReportThe Press-Enterprise / pressenterprise.comNessuna valutazione finora

- 2016 Budget Proposal Review: Individual AssignmentDocumento11 pagine2016 Budget Proposal Review: Individual AssignmentNipuna KoralageNessuna valutazione finora

- SonaDocumento5 pagineSonaApple StarkNessuna valutazione finora

- Part 1-FinObj MCQDocumento21 paginePart 1-FinObj MCQdigitalbooksNessuna valutazione finora

- Powerponit Presentation of Mr. Dolce RamirezDocumento65 paginePowerponit Presentation of Mr. Dolce RamirezCharisse Ann MonsaleNessuna valutazione finora

- Buehler Stoch Prop DividendsDocumento21 pagineBuehler Stoch Prop DividendserererehgjdsassdfNessuna valutazione finora

- Algorithmic Trading and Quantitative StrategiesDocumento7 pagineAlgorithmic Trading and Quantitative StrategiesSelly YunitaNessuna valutazione finora

- ACTBFAR Exercise Set #1 - Ex 5 - FS ClassificationsDocumento1 paginaACTBFAR Exercise Set #1 - Ex 5 - FS ClassificationsNikko Bowie PascualNessuna valutazione finora

- Nadia Hamouda - CVDocumento2 pagineNadia Hamouda - CVMarlon DelfinoNessuna valutazione finora

- Payroll AreaDocumento92 paginePayroll AreaPranav KumarNessuna valutazione finora

- Agricultural & Applied Economics AssociationDocumento10 pagineAgricultural & Applied Economics AssociationfenderaddNessuna valutazione finora

- Unit 4 Dividend DecisionsDocumento17 pagineUnit 4 Dividend Decisionsrahul ramNessuna valutazione finora

- Financial Accounting The Impact On Decision Makers 10th Edition Porter Solutions ManualDocumento41 pagineFinancial Accounting The Impact On Decision Makers 10th Edition Porter Solutions Manualhildabacvvz100% (27)

- Alananga&Lucian2016 PDFDocumento18 pagineAlananga&Lucian2016 PDFSamwel Alananga SangaNessuna valutazione finora

- Understanding Planned GivingDocumento1 paginaUnderstanding Planned GivingFood and Water WatchNessuna valutazione finora

- Banking Memory AidDocumento10 pagineBanking Memory AidEdz Votefornoymar Del RosarioNessuna valutazione finora

- Probablity QuestionsDocumento14 pagineProbablity QuestionsSetu Ahuja100% (1)

- Macroeconomics FinalDocumento6 pagineMacroeconomics FinalNgọc Hân TrầnNessuna valutazione finora

- Masterlist - Course - Offerings - 2024 (As at 18 July 2023)Documento3 pagineMasterlist - Course - Offerings - 2024 (As at 18 July 2023)limyihang17Nessuna valutazione finora

- Factors Affecting The Success Failure of PDFDocumento12 pagineFactors Affecting The Success Failure of PDFavishain1Nessuna valutazione finora

- Banking TerminologyDocumento23 pagineBanking TerminologyRashik Bhandari100% (1)

- Preeti Singh PDF Final ProjectDocumento113 paginePreeti Singh PDF Final Project0911Preeti SinghNessuna valutazione finora

- Changes in The Indian Financial System Since 1991Documento8 pagineChanges in The Indian Financial System Since 1991Samyra RathoreNessuna valutazione finora

- SD Mock TestDocumento35 pagineSD Mock TestSAPCertificationNessuna valutazione finora

- IPONote - Shyam MetalicsDocumento1 paginaIPONote - Shyam MetalicsAnamika GputaNessuna valutazione finora

- Accounting For Business Combination PART 1Documento30 pagineAccounting For Business Combination PART 1Niki DimaanoNessuna valutazione finora

- Financial AccountingDocumento4 pagineFinancial AccountingManish KushwahaNessuna valutazione finora

- Revitalization of Shahjahanabad (Walled City of Delhi) : - Project Concept ProposalDocumento98 pagineRevitalization of Shahjahanabad (Walled City of Delhi) : - Project Concept ProposalVismay WadiwalaNessuna valutazione finora

- Step by Step Procedure For Creation of IDOCDocumento34 pagineStep by Step Procedure For Creation of IDOCjolliestNessuna valutazione finora

- Hex NutsDocumento1 paginaHex NutsAgung SYNessuna valutazione finora

- Exercise E3-10 and E3-22Documento4 pagineExercise E3-10 and E3-22api-269347566Nessuna valutazione finora

- Financial Accounting Information For Decisions 6th Edition Wild Solutions ManualDocumento44 pagineFinancial Accounting Information For Decisions 6th Edition Wild Solutions Manualfinnhuynhqvzp2c100% (23)

- Mumbai Port Trust Land DevelopmentDocumento69 pagineMumbai Port Trust Land DevelopmentAniruddh Kanade100% (2)