Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Questionp 2 Testapr 2011

Caricato da

Mira AmirrudinDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Questionp 2 Testapr 2011

Caricato da

Mira AmirrudinCopyright:

Formati disponibili

Question 1

The following draft statement of financial position relate to Batman, Superman,Spiderman and Otoman, all public limited companies as at 31 December 20X5 Batman $ 000 Non Current Asset Property, plant and equipment Investment in Superman Investment in Spiderman Investment in Otoman Current assets Inventory Trade receivables Cash at bank and on hand Total assets Equity Share capital@$1 each Retained earnings Non current liabilities Current liabilities Total equity and liabilities 20,250 4,250 1,500 1,500 800 1,200 750 30,250 8,000 18,300 2,000 1,950 30,250 Superman $ 000 15,750 Spiderman $ 000 12,500 Otoman $ 000 5,500

2,500

725 530 550 20,055 3,000 12,500 2500 2,055 20,055

625 550 350 14,025 2,500 10,150 375 1,000 14,025

250 120 100 5,970 1,000 3,250 1,000 720 5,970

The following information is relevant to the preparation of the group financial statements: (i) Batman had acquired 2,550,000 $1 ordinary shares of Superman on 1 January 20X2 when the retained earnings were $1,250,000.The fair value of the net assets of Superman was $4.45 million at 1 January 20X2. Any fair value adjustments related to the property that had been acquired by Superman on 1 January 20W2 with a useful life of 30 years. There have been no issue of ordinary shares in the Superman since Batman acquired its interest (ii) Batman had acquired 300,000 $1 ordinary shares of Otoman on 1 January 20X3 when the retained earnings were $750,000.Batman is in position to exercise significant influence over Otoman and there were no material differences between the book value and fair values of Otoman at that date (iii) Batman and Superman had acquired their holdings in Spiderman on the same date as part of an attempt to mask the true ownership of Spiderman. Batman acquired 600,000 $1 ordinary shares of Spiderman while Superman acquired 1,000,000 shares on 1 January 20X4. At this date there was a credit balance of on the retained earnings of Spiderman at $925,000. There was no revaluation surplus in the book of Spiderman on 1 January 20X4. The fair value of the net assets of Spiderman at January 20X4 was not materially different from their carrying values. (iv) During 20x5, Superman had made intragroup sales to Batman of $750,000 making a profit of 20% on cost and $225,000 of these goods were in inventories at 31 December 20X5 (v) An impairment test conducted at the year end did not reveal any impairment loss (vi) It is the group policy to value the non controlling interest at fair value at the date of acquisition. The fair value of the non controlling interest in Superman at 1 January 20X2 was $700,000. The fair value of non controlling interest in Spiderman at 1 January 20X4 was $1.8million Required: Prepare the consolidated statement of financial position of Batman group on 31 December 20X5. (15 marks)

Page | 1

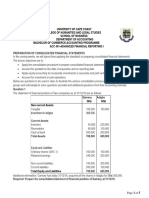

Question 2 The following draft statements of financial position relate to Green Hornet and Honey Bee, all public limited companies, as at 31 May 2010. Green Hornet $m Non-current assets: Property, plant and equipment Investment in Honey Bee Current assets 300 57 113 470 100 50 15 135 60 110 470 Honey Bee $m 40 30 70 10 20 26 4 10 70

Ordinary shares of $1 Share premium Revaluation reserve Retained profit Non-current liabilities Current liabilities

The following information is relevant to the preparation of the group financial statements: (i) Green Hornet acquired the ordinary shares in Honey Bee as follows: Date of Purchase Holdings acquired Purchase Fair value of net assets consideration $m $m 1 June 2007 30% 15 40 1 June 2008 50% 30 50 1 June 2009 10% 12 52 Fair value of one ordinary share of Honey Bee was $6 on 1 June 2008 and $7 on 1 June 2009. (ii) Honey Bee has not issued any new shares since the acquisition on 1 June 2007 by Green Hornet. The excess of the fair value of the net assets of Honey Bee over the carrying amount at the date of acquisition is due to an increase in the fair value of Honey Bee s non-depreciable land of $14 million at 1 June 2008. There has been no change in the value of non-depreciable land after that date. $2 million of the inventories of Honey Bee were purchased from Green Hornet, which made a profit of 25% on cost. On 1 June 2009, Green Hornet sold goods costing $13 million to Honey Bee for $19 million. Honey Bee used the goods in constructing a machine which began service on 1 December 2009. Honey Bee is a cash-generating unit and at 31 May 2010, Green Hornet determined that the recoverable amount of Honey Bee is $64 million. Group policy is to depreciate plant and equipment over 10 years. Depreciation is calculated on a timeapportioned basis. It is the group policy to measure non-controlling interests at fair value (full goodwill method).

(iii)

(iv)

(v)

(vii)

(vii)

Required: Prepare the consolidated statement of financial position of Green Hornet group on 31 May 2010. (15 marks)

Page | 2

Question 3 Gaseng, a public limited company, operates in the manufacturing sector. The draft statements of comprehensive income and statements of changes in equity of the group companies are as follows at 31 December 2010: Statements of Comprehensive Income for the year ended 31 December 2010 Gaseng $m Revenue Cost of sales Gross profit Other operating cost Profit before tax Taxation Profit for the year Other Comprehensive income Total Comprehensive income The Statement of Changes in Equity on page 5 The following information is relevant to the preparation of the group financial statements: 1. On 1 July 2009, Gaseng acquired a 100% of the equity interests of Layang for a cash consideration of $350 million when the total provisional fair value of $325 million. At the same time, the retained earnings and revaluation reserves were $50 million and $5 million respectively. The above provisional amount were estimated including all fair value adjustment on property, plant and equipment and contingent liabilities. At the time of the business combination, Layang had a contingent liability with a fair value of $50 million. At 31 December 2009, the contingent liability met the recognition criteria of IAS 37 Provisions, Contingent Liabilities and Contingent Assets and the revised estimate of this liability was $40 million. The accountant of Layang is yet to account for this revised liability. However, Gaseng had not completed the valuation of an element of property, plant and equipment of Layang at 1 July 2009 and the valuation was not completed by 31 December 2009. The valuation was received on 31 January 2010 and the excess of the fair value over the provisional value at the date of acquisition was estimated at $10 million. The asset had a useful economic life of 10 years at 1 July 2009 on time- apportioned basis. On 1 October 2010, Gaseng disposed of 60% of its equity interest in Layang for a consideration of $390 million. The remaining equity interest was fair valued at $260 million and the disposal proceeds had been accounted into bank and the cost of investment in Layang. Gaseng could still exert significant influence after the disposal of his interest. 2. On 1 July 2009, Gaseng had acquired a 100% interest in Congkark, a public limited company, for a cash consideration of $300 million. Congkark s identifiable net assets at 1 July 2009 were fair valu ed at $280 million with the retained earnings and revaluation reserves were $100 million and $5 million respectively. On 31 December 2010, Gaseng disposed of 30% of the equity of Congkark for $150 million. The only accounting entry made in Gaseng s financial statements was to increase cash and reduce the cost of the investment in Congkark. Gaseng sold Congkark goods for $50 million during the year end and $25 million of these goods are included in the inventory of Glove at 31 December 2010. The profit made by Gaseng on these sales was $10 million. Profits for all companies are deemed to be accrued evenly throughout the year. 550.00 (300.00) 250.00 (90.00) 160.00 (45.00) 115.00 10.00 125.00 Layang $m 250.00 (170.00) 80.00 (25.00) 55.00 (10.00) 45.00 5.00 50.00 Congkark $m 350.00 (200.00) 150.00 (70.00) 80.00 (25.00) 55.00 2.00 57.00

3.

Page | 3

4.

There were no new issues of share capital for all the companies after 1 July 2009 and no necessary impairment for the goodwill for the year ended 31 December 2010.

Required: (a) Calculate the gain or loss arising on the disposal of the equity interest in Layang and Congkark. (8 marks) (b) Prepare a consolidated financial statements of Gaseng Group at 30 November 2009 in accordance with International Financial Reporting Standards. (7 marks) (Total: 15 marks)

Page | 4

Statement of Changes in Equity for the year ended 31 December 2010 Gaseng Share Capital $m Balance at 1 January 2010 Dividends Total comprehensive income for the year Balance at 31 December 2010 500.00 Retained Earnings $m 250.00 (70.00) 123.00 500.00 303.00 2.00 27.00 Reval. Reserves $m 25.00 Share Capital $m 300.00 Retained Earnings $m 55.00 Layang Reval. Reserves $m 5.00 Share Capital $m 250.00 Retained Earnings $m 70.00 Congkark Reval. Reserves $m 25.00

Total $m 775.00 (70.00) 125.00 830.00

Total $m 360.00

Total $m 345.00

50.00 300.00 105.00 5.00

50.00 410.00 250.00

57.00 127.00 25.00

57.00 402.00

Page | 5

Question 4 Butter is a company incorporated in Malaysia. The functional currency is the Ringgit Malaysia (RM) and its financial year ends on 31 March each year. On 1 January 2010,Butter purchased on credit, a machine costing S$60,000, from Cream a company based in Singapore.On 1 February 2010, Butter paid S$20,000 as part settlement, with S$40,000 outstanding as at 31 March 2010. The relevant exchange rates are: 1 March 2009 RM1 1 January 2010 RM1 1 February 2010 RM1 31 March 2010 RM1 -

S$0.50 S$0.40 S$0.38 S$0.35

Required: Show the necessary computations to record the above transactions in the books of Butter as at 31 March 2010. (5 marks)

END OF QUESTION PAPER

Page | 6

Potrebbero piacerti anche

- Matter and Materials (Grade 6 English)Documento80 pagineMatter and Materials (Grade 6 English)Primary Science Programme100% (5)

- People Vs CorreaDocumento2 paginePeople Vs CorreaRmLyn Mclnao100% (1)

- Auditing Problems Midterm - 2021 - DDocumento17 pagineAuditing Problems Midterm - 2021 - DjasfNessuna valutazione finora

- Welcome Speech For Seminar in College 2Documento4 pagineWelcome Speech For Seminar in College 2Niño Jay C. GastonesNessuna valutazione finora

- 13 Week Cash Flow ModelDocumento16 pagine13 Week Cash Flow ModelASChipLeadNessuna valutazione finora

- Fruit Brearing CropsDocumento177 pagineFruit Brearing CropsJoshua G. Sapin100% (1)

- Buscom Midterm PDF FreeDocumento29 pagineBuscom Midterm PDF FreeheyNessuna valutazione finora

- ACCA Strategic Business Reporting (SBR) Achievement Ladder Step 6 Questions & AnswersDocumento18 pagineACCA Strategic Business Reporting (SBR) Achievement Ladder Step 6 Questions & AnswersAdam M100% (1)

- CHAPTER 5 Ground ImprovementDocumento47 pagineCHAPTER 5 Ground ImprovementBeman EasyNessuna valutazione finora

- AFAR Summative Assessment Problems (Kay Jared)Documento75 pagineAFAR Summative Assessment Problems (Kay Jared)jajajaredred100% (1)

- Set B Cluster 3 (Final) (Aug102015)Documento4 pagineSet B Cluster 3 (Final) (Aug102015)Kuo Sarong100% (1)

- Basic DWDM Components.Documento16 pagineBasic DWDM Components.Pradeep Kumar SahuNessuna valutazione finora

- Computer ArchitectureDocumento46 pagineComputer Architecturejaime_parada3097100% (2)

- 2015.15009.fundamental Principles of Physical Chemistry - Text PDFDocumento782 pagine2015.15009.fundamental Principles of Physical Chemistry - Text PDFAnoif Naputo Aidnam100% (1)

- Linberg V MakatiDocumento2 pagineLinberg V MakatiChimney sweepNessuna valutazione finora

- F3 Practice Questions Consolidation.Documento9 pagineF3 Practice Questions Consolidation.Nikesh KunwarNessuna valutazione finora

- Basic Consol - Tutorial Q 82022Documento10 pagineBasic Consol - Tutorial Q 82022ZhaoYing TanNessuna valutazione finora

- Week 7 Seminar QuestionsDocumento4 pagineWeek 7 Seminar QuestionsBhanu TejaNessuna valutazione finora

- Complex and Disposal of Sub (4416)Documento5 pagineComplex and Disposal of Sub (4416)zeeshan sikandarNessuna valutazione finora

- National University of Science and TechnologyDocumento8 pagineNational University of Science and TechnologyPATIENCE MUSHONGANessuna valutazione finora

- Vacational SchoolDocumento11 pagineVacational SchoolPatrick ArazoNessuna valutazione finora

- Complex and Disposal of Sub (4416)Documento5 pagineComplex and Disposal of Sub (4416)Ahmad vlogsNessuna valutazione finora

- F3 Practice Questions1Documento10 pagineF3 Practice Questions1Nikesh KunwarNessuna valutazione finora

- Lecture 4 Exercises Sofp 1Documento2 pagineLecture 4 Exercises Sofp 1Ziyodullo IsroilovNessuna valutazione finora

- Tutorial 6 Consolidated Statement of Financial Position (Csofp) - Part 2 - Question 1 (Q10.11)Documento8 pagineTutorial 6 Consolidated Statement of Financial Position (Csofp) - Part 2 - Question 1 (Q10.11)cynthiama7777Nessuna valutazione finora

- Consolidation QuestionsDocumento16 pagineConsolidation QuestionsUmmar FarooqNessuna valutazione finora

- PE Jan 2011Documento7 paginePE Jan 2011nawwar ukeyNessuna valutazione finora

- Prelim Exam - Doc2Documento16 paginePrelim Exam - Doc2alellie100% (1)

- COA Unit 4 Amalgamation ProblemsDocumento7 pagineCOA Unit 4 Amalgamation ProblemsGayatri Prasad BirabaraNessuna valutazione finora

- Consolidation - WorkbookDocumento15 pagineConsolidation - WorkbookKhaihoan DuongNessuna valutazione finora

- What Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Documento12 pagineWhat Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Nguyễn HoàngNessuna valutazione finora

- Consolidation BasicsDocumento5 pagineConsolidation Basicspoonamemrith22Nessuna valutazione finora

- Lesson 3. CONSOLIDATED FINANCIAL STATEMENTSDocumento5 pagineLesson 3. CONSOLIDATED FINANCIAL STATEMENTSangelinelucastoquero548Nessuna valutazione finora

- Use The Following Information For The Next Two Items:: 1. Prepare The Consolidated Statement of Financial PositionDocumento15 pagineUse The Following Information For The Next Two Items:: 1. Prepare The Consolidated Statement of Financial PositionJacqueline OrtegaNessuna valutazione finora

- PE Jan 2012Documento9 paginePE Jan 2012nawwar ukeyNessuna valutazione finora

- Acc401-202324 Ga2-Even GroupsDocumento3 pagineAcc401-202324 Ga2-Even Groupsisaacbediako82Nessuna valutazione finora

- Assignment 1Documento5 pagineAssignment 1Loveness MphandeNessuna valutazione finora

- PRBA003 Week 10 Tutorialsolutions 10 EdDocumento29 paginePRBA003 Week 10 Tutorialsolutions 10 EdWang ChoiNessuna valutazione finora

- SBR Consolidation Mock QueDocumento7 pagineSBR Consolidation Mock QuePratham BarotNessuna valutazione finora

- IAS 28 AssociatesDocumento7 pagineIAS 28 AssociatesRumbidzai Mapanzure100% (1)

- HorsefieldDocumento2 pagineHorsefieldMarie Xavier - FelixNessuna valutazione finora

- Cash Flow StatementsDocumento21 pagineCash Flow StatementsAnaya KaleNessuna valutazione finora

- Mid Term ExamDocumento6 pagineMid Term Examaika9maikaNessuna valutazione finora

- BusCom Seatwork - 05 15 2021Documento4 pagineBusCom Seatwork - 05 15 2021Joshua UmaliNessuna valutazione finora

- IAS 29 FINANCIAL REPORTING IN HYPERINFLATIONERY ECONOMIES (2021 Latest)Documento5 pagineIAS 29 FINANCIAL REPORTING IN HYPERINFLATIONERY ECONOMIES (2021 Latest)Tawanda Tatenda HerbertNessuna valutazione finora

- ACC401-Basic Conso-Basic QuestionsDocumento5 pagineACC401-Basic Conso-Basic Questionsisaacbediako82Nessuna valutazione finora

- HI5020 Corporate Accounting: Session 7c Accounting For Group StructuresDocumento30 pagineHI5020 Corporate Accounting: Session 7c Accounting For Group StructuresFeku RamNessuna valutazione finora

- Horizontal Groups (2021)Documento5 pagineHorizontal Groups (2021)Tawanda Tatenda HerbertNessuna valutazione finora

- Day 6 P2 MockDocumento8 pagineDay 6 P2 MockAbdul HaseebNessuna valutazione finora

- Business Combination Exercises StudentDocumento7 pagineBusiness Combination Exercises StudentDenise RoqueNessuna valutazione finora

- Learning Unit 5 Consolidation of A Partly Owned Subsidiary AfterDocumento20 pagineLearning Unit 5 Consolidation of A Partly Owned Subsidiary AfterThulani NdlovuNessuna valutazione finora

- Consolidated BS - Date of AcquisitionDocumento2 pagineConsolidated BS - Date of AcquisitionKharen Valdez0% (1)

- Adv Accounts - AmalgamationDocumento31 pagineAdv Accounts - Amalgamationmd samser50% (2)

- Problem Based On Ratio Analysis - Part - 2Documento1 paginaProblem Based On Ratio Analysis - Part - 2Mohd shariqNessuna valutazione finora

- NM - LLCS, Issue of SharesDocumento3 pagineNM - LLCS, Issue of SharesRymlah MirNessuna valutazione finora

- Consolidation Question PaperDocumento42 pagineConsolidation Question PaperNick VincikNessuna valutazione finora

- COM203 AmalgamationDocumento10 pagineCOM203 AmalgamationLogeshNessuna valutazione finora

- Finals Quiz No. 1 AnswersDocumento4 pagineFinals Quiz No. 1 AnswersMergierose DalgoNessuna valutazione finora

- Illustrations AmalgamationDocumento4 pagineIllustrations Amalgamationajay2741100% (1)

- Business Combination Case StudyDocumento3 pagineBusiness Combination Case StudyHuỳnh Minh Gia HàoNessuna valutazione finora

- ABC Company DEF Company: Book Fair Book FairDocumento15 pagineABC Company DEF Company: Book Fair Book FairJonas Avanzado TianiaNessuna valutazione finora

- Paper - 1: Financial Reporting: AssetsDocumento43 paginePaper - 1: Financial Reporting: AssetsTisha AggarwalNessuna valutazione finora

- 2019 Paper - DSE5.1A Sub - Corporate Accounting Time - 3 Hours Full Marks - 80Documento4 pagine2019 Paper - DSE5.1A Sub - Corporate Accounting Time - 3 Hours Full Marks - 80tanmoy sardarNessuna valutazione finora

- Accountancy Review: Detailed Reconciliation of Opening and Closing Retained EarningsDocumento5 pagineAccountancy Review: Detailed Reconciliation of Opening and Closing Retained EarningsEricha MutiaNessuna valutazione finora

- Accounts ProblemsDocumento30 pagineAccounts ProblemsBalasaranyasiddhuNessuna valutazione finora

- Test 2 QPDocumento8 pagineTest 2 QPDharmateja ChakriNessuna valutazione finora

- Consolidated Statement of Financial PositionDocumento2 pagineConsolidated Statement of Financial PositionEvita Ayne TapitNessuna valutazione finora

- Extreme Value Hedging: How Activist Hedge Fund Managers Are Taking on the WorldDa EverandExtreme Value Hedging: How Activist Hedge Fund Managers Are Taking on the WorldValutazione: 2.5 su 5 stelle2.5/5 (1)

- Management of Odontogenic Infection of Primary Teeth in Child That Extends To The Submandibular and Submental Space Case ReportDocumento5 pagineManagement of Odontogenic Infection of Primary Teeth in Child That Extends To The Submandibular and Submental Space Case ReportMel FANessuna valutazione finora

- Differentialequations, Dynamicalsystemsandlinearalgebra Hirsch, Smale2Documento186 pagineDifferentialequations, Dynamicalsystemsandlinearalgebra Hirsch, Smale2integrationbyparths671Nessuna valutazione finora

- 2-Amino-5-Aryl-2-Oxazolines.: (,ee TableDocumento7 pagine2-Amino-5-Aryl-2-Oxazolines.: (,ee TableChristopher HowellNessuna valutazione finora

- Graph 1: Temperature,° C of Mixture 1 (Naoh-Hcl) Against Time Taken, (Min)Documento8 pagineGraph 1: Temperature,° C of Mixture 1 (Naoh-Hcl) Against Time Taken, (Min)LeeshaaLenee Paramanantha KumarNessuna valutazione finora

- HGP Year End Report 2021-2022 NewDocumento169 pagineHGP Year End Report 2021-2022 Newangelica sungaNessuna valutazione finora

- Focus: Optimised Efficiency For The Paper IndustryDocumento24 pagineFocus: Optimised Efficiency For The Paper IndustryZoran BadurinaNessuna valutazione finora

- TTD Accommodation ReceiptDocumento2 pagineTTD Accommodation ReceiptDharani KumarNessuna valutazione finora

- Popis Na OK KoziDocumento325 paginePopis Na OK KoziViktor ArsovNessuna valutazione finora

- D'Shawn M. Haines: 423 East Fox Trail, Williamstown, NJ 08094 (856) 366-7049Documento2 pagineD'Shawn M. Haines: 423 East Fox Trail, Williamstown, NJ 08094 (856) 366-7049dshawnNessuna valutazione finora

- MAF 451 Suggested Solutions - A) I) Process 1Documento9 pagineMAF 451 Suggested Solutions - A) I) Process 1anis izzatiNessuna valutazione finora

- Review Women With Moustaches and Men Without Beards - Gender and Sexual Anxieties of Iranian Modernity PDFDocumento3 pagineReview Women With Moustaches and Men Without Beards - Gender and Sexual Anxieties of Iranian Modernity PDFBilal SalaamNessuna valutazione finora

- Keepa ApiDocumento55 pagineKeepa ApiQazi Sohail AhmadNessuna valutazione finora

- Proposal Mini Project SBL LatestDocumento19 pagineProposal Mini Project SBL Latestapi-310034018Nessuna valutazione finora

- Appendix h6 Diffuser Design InvestigationDocumento51 pagineAppendix h6 Diffuser Design InvestigationVeena NageshNessuna valutazione finora

- Coca-Cola BeverageDocumento17 pagineCoca-Cola BeverageMahmood SadiqNessuna valutazione finora

- Search WaiverDocumento1 paginaSearch WaiverHacer Gungoray100% (1)

- Dual Nature and RadiationDocumento39 pagineDual Nature and RadiationWedger RealmeNessuna valutazione finora

- Pex 03 02Documento5 paginePex 03 02aexillis0% (1)

- Proceedings IndexDocumento3 pagineProceedings IndexHumberto FerreiraNessuna valutazione finora

- Fluid Mechanics and Machinery Laboratory Manual: by Dr. N. Kumara SwamyDocumento4 pagineFluid Mechanics and Machinery Laboratory Manual: by Dr. N. Kumara SwamyMD Mahmudul Hasan Masud100% (1)