Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Finance and Its Need

Caricato da

harsh9875Descrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Finance and Its Need

Caricato da

harsh9875Copyright:

Formati disponibili

FINANCE AND ITS NEED Finance is defined as the provision of money at the time when it required.

y NEED OF FINANCEFor day to day operations For creation of production facilities SOURCES OF FINANCE y Short term Bank credit Customer advances Trade credit y Medium term Issue of debentures Issue of preference shares Bank loan Fixed deposit y Long term Issue of shares Issue of debentures Ploughing back of profit Loans from specialized financial institution

SHARES The capital of a company is divided into a number of equal parts is called shares. y Type of sharesEquity or ordinary shares

Preference shares Along with this company can also issueBonus shares Right shares Sweat equity EQUITY OR ORDINARY SHARES y y y y Represents the ownership position in company Source of permanent capital Shareholders are entitled for dividend Rate of dividend is not fixed, therefore called variable income security.

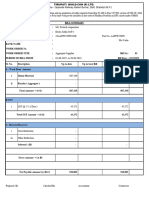

REPORTING OF EQUITY SHARES y y Capital represented by equity shares is called equity capital. It appears on the left side of account form balance sheet, & on the top of source of capital in the step-form balance sheet. Table below showing the GNFC s share capital as on 31st march, 2003

(Rs in lakh) (a) Authorized 250,000,000 equity shares of Rs 10 each (b) Issued 148,565,000 equity shares of Rs 10 each (c) Subscribed and paid up 146,476,214 equity shares of Rs 10 each fully paid up (d) Reserve and surplus (e) Net worth(c+d) 25,000.00 14,865.00 14,647.62 58,377.39 73,025.01

FEATURES OF EQUITY SHARES y Claim on income Residual ownership claim No legal obligation to the company to pay dividend y Claim on asset Residual claim at the time of liquidation of company y Right to control Legal power to elect directors y Voting right Vote on important matters like x x y y Election of directors Change in memorandum of association

Pre-emptive right Limited liability

PROS AND CONS OF EQUITY FINANCING y AdvantagesPermanent capital Borrowing base Dividend payment discretion y DisadvantagesCost Risk Earning dilution Ownership dilution PUBLIC ISSUE OF EQUITY

y y y

Public issue of equity means raising of share capital directly from the public. Company can raise fund through IPO (initial public offer) or through FPO (follow on public offer). Underwriting of issuesIt is legally obligatory Underwriters are generally- banks, financial institutions, brokers etc. In underwriting, underwriter guarantee to buy shares if the issue is not fully subscribed by the public. Company has to pay an underwriting commission to underwriters .

PRIVATE PLACEMENT OF EQUITY Involves sale of shares to few selected investors, particularly the institutional investors like the UTI, LIC, IDBI etc. y Advantages of private placementCost x Speed x PREFERENCE SHARES Often considered to be a hybrid security since it has many features of both ordinary shares and debentures. y Similar to equity shares in thatDividends are not deductible for tax purposes Non payment of dividend does not force the company to insolvency In some cases, it has no maturity date y Similar to debenture in thatDividend rate is fixed Preference shareholders do not share in residual earning Take less time to raise funds It is less expensive

Have claim on income and asset prior to ordinary shareholders Usually do not have voting right TYPE OF PREFERENCE SHARES y y y y y y y y Cumulative preference shares Non-cumulative preference shares Redeemable preference shares Irredeemable preference shares Participating preference shares Non-participating preference shares Convertible preference shares Non-convertible preference shares

FEATURES OF PREFERENCE SHARES y Claim on income and assets Prior claim on company s income as compared to ordinary shares Prior claim on assets in the event of liquidation Usually cannot participate in extraordinary income y Fixed dividend Dividend rate is fixed Preference shares are called fixed-income security Payment of dividend is not a legal obligation y y Cumulative dividend Redemption Redeemable preference shares Irredeemable preference shares y Call feature

Permits company to buy back shares at a stipulated buy-back price or call price y Participating feature Participating preference shares Non-participating preference shares y Voting right Conditional voting right y Convertibility Convertible preference shares Non-convertible preference shares PROS AND CONS OF PREFERENCE SHARES y AdvantagesRiskless leverage advantage Dividend postponability Fixed dividend Limited voting right y DisadvantagesNon-deductibility of dividends Commitment to pay dividend RIGHT ISSUE OF EQUITY SHARES Right issue involves selling of ordinary shares to the existing shareholders of the company. y y Shares are issued on pro-rata (proportional ratio) basis. Shareholders through a special resolution can forfeit this pre-emptive right.

PROS AND CONS OF RIGHT ISSUE y AdvantagesShareholder s control is maintained

Less floatation cost Can be more successful in case of profitable companies, as subscription price is much below the current market price y DisadvantageMain disadvantage is to the shareholders who fails to exercise their rights BONUS SHARES y y They are additional shares issues given without any cost to existing shareholders. These shares are issued in a certain proportion to the existing holding. So, a 2 for 1 bonus would mean you get two additional shares -- free of cost -- for the one share you hold in the company. Bonus shares are issued by cashing in on the free reserves of the company. A company builds up its reserves by retaining part of its profit over the years (the part that is not paid out as dividend). After a while, these free reserves increase, and the company wanting to issue bonus shares converts part of the reserves into capital.

y y

SWEAT EQUITY y Sweat equity means equity shares issued by a company to its employees or directors at a discount. The idea behind the issue of sweat equity is that an employee or director works best when he has sense of belongingness and is amply rewarded. It is termed as sweat equity as it is earned by hardwork (sweat) of employees. Also referred to as sweet equity , as employee become happy on the issue of such shares.

y y

CONDITIONS FOR ISSUING SWEAT EQUITY SHARES y y y Must be of a class of shares already issued by the company Issue must be authorized by a special resolution passed by the company in general meeting. All the limitations, restrictions and provisions relating to equity shares shall be applicable to sweat equity shares. If company s equity shares are listed on recognized stock exchange, shares will be issued as per the regulations of SEBI. If company s shares is not listed, shares will be issued in accordance with guidelines prescribed by central govt.

Potrebbero piacerti anche

- Textbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingDa EverandTextbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingNessuna valutazione finora

- Types of CapitalDocumento24 pagineTypes of CapitalAnkita N VyasNessuna valutazione finora

- Equity Share DebentureDocumento21 pagineEquity Share DebenturePramod PatjoshiNessuna valutazione finora

- Dividend Decisions: Dividend: Cash Distribution of Earnings Among ShareholdersDocumento33 pagineDividend Decisions: Dividend: Cash Distribution of Earnings Among ShareholdersKritika BhattNessuna valutazione finora

- Fundraising: Prof. Surekha BhargavDocumento47 pagineFundraising: Prof. Surekha BhargavNick ShahuNessuna valutazione finora

- Presented by - Parikshit Saha Pankaj Lokesh Randeep Garg Sahil Aggarwal Nishant AdlakhaDocumento70 paginePresented by - Parikshit Saha Pankaj Lokesh Randeep Garg Sahil Aggarwal Nishant AdlakhaRandeep Garg100% (1)

- Financial Accounting TopicsDocumento3 pagineFinancial Accounting Topics99shaam99Nessuna valutazione finora

- What Is It?: Dividend PolicyDocumento13 pagineWhat Is It?: Dividend PolicySwati SharmaNessuna valutazione finora

- Sources of Finance by Jasveen KaurDocumento4 pagineSources of Finance by Jasveen KaurJasveen SawhneyNessuna valutazione finora

- Sources of Long Term FinanceDocumento30 pagineSources of Long Term FinanceManu Mallikarjun NelagaliNessuna valutazione finora

- Share, Capital & BorrowingDocumento26 pagineShare, Capital & BorrowingshahneelahmedNessuna valutazione finora

- Preference Share Capital Report - Group 2Documento6 paginePreference Share Capital Report - Group 2Chirag GoyalNessuna valutazione finora

- Unit 4 - Company Accounts Lecture NotesDocumento12 pagineUnit 4 - Company Accounts Lecture NotesTan TaylorNessuna valutazione finora

- Cbi 01 MFS PPT2Documento18 pagineCbi 01 MFS PPT2rishi raj modiNessuna valutazione finora

- Seminar On SOurces of FinanceDocumento35 pagineSeminar On SOurces of FinanceBrinda AsokanNessuna valutazione finora

- Shares: Presentation BY Mahender VijaypalDocumento24 pagineShares: Presentation BY Mahender VijaypalHemant AgarwalNessuna valutazione finora

- Final AssignmentDocumento51 pagineFinal AssignmentNaveeda RiazNessuna valutazione finora

- If Possible Feel Free To Add Any Relevant Material Including Real Life Example or Examples On BD Perspective To Enrich Your PresentationDocumento4 pagineIf Possible Feel Free To Add Any Relevant Material Including Real Life Example or Examples On BD Perspective To Enrich Your Presentationraju01723031884Nessuna valutazione finora

- Equity and DebtDocumento30 pagineEquity and DebtsandyNessuna valutazione finora

- Dividend Policy2Documento21 pagineDividend Policy2Priya UllasNessuna valutazione finora

- Legal Aspect of Business AssignmentDocumento25 pagineLegal Aspect of Business AssignmentUBSHimanshu KumarNessuna valutazione finora

- Chapter 4 LopezDocumento4 pagineChapter 4 LopezMarivic VNessuna valutazione finora

- Long Term Sources of FinancingDocumento10 pagineLong Term Sources of FinancingAlbali AquariiNessuna valutazione finora

- Preference SharesDocumento5 paginePreference ShareshasnaglowNessuna valutazione finora

- What Are Preferred SharesDocumento9 pagineWhat Are Preferred SharesMariam LatifNessuna valutazione finora

- 2 Stock and BondDocumento18 pagine2 Stock and BondHarris NarbarteNessuna valutazione finora

- Sources of FinanceDocumento65 pagineSources of FinanceVinayak SaxenaNessuna valutazione finora

- Mod 5 Dividend Decisions Handout SNDocumento7 pagineMod 5 Dividend Decisions Handout SNAkhilNessuna valutazione finora

- Preference SharesDocumento3 paginePreference SharesDipti AryaNessuna valutazione finora

- Introduction To Company AccountingDocumento19 pagineIntroduction To Company AccountingIsra GhousNessuna valutazione finora

- Financial Assets, Money, Financial Transactions, and Financial InstitutionsDocumento18 pagineFinancial Assets, Money, Financial Transactions, and Financial InstitutionsSyeda DilawaizNessuna valutazione finora

- Finance PPT FinalDocumento106 pagineFinance PPT FinalAkhil GaurNessuna valutazione finora

- Bus 143 (1) The Need For CapitalDocumento33 pagineBus 143 (1) The Need For CapitalItsme ShemNessuna valutazione finora

- Dividend Decission Profit - Vs-Dividend: Income Distribution in A CompanyDocumento6 pagineDividend Decission Profit - Vs-Dividend: Income Distribution in A CompanyShyam MaariNessuna valutazione finora

- Sources of Finance: Section: ADocumento32 pagineSources of Finance: Section: AAhmad NaseerNessuna valutazione finora

- Hybrid Financing: Preference Shares and Convertibles: D The Annual Dividend, I The Interest Rate in Decimal FormDocumento5 pagineHybrid Financing: Preference Shares and Convertibles: D The Annual Dividend, I The Interest Rate in Decimal FormJericho_Jauod_9677Nessuna valutazione finora

- Funds Presentation in AccountingDocumento17 pagineFunds Presentation in Accountingवैभव शिरोडेNessuna valutazione finora

- No Issue of Voting Rights: Referential Hares Dvantages AND DisadvantagesDocumento5 pagineNo Issue of Voting Rights: Referential Hares Dvantages AND DisadvantagesVijay MishraNessuna valutazione finora

- Chapter 11: Corporations: Organization, Share Transactions, Dividends, and Retained EarningsDocumento57 pagineChapter 11: Corporations: Organization, Share Transactions, Dividends, and Retained EarningsJihen SmariNessuna valutazione finora

- Sources Fof Business Finance - CH-8Documento53 pagineSources Fof Business Finance - CH-8Ayesha SardarNessuna valutazione finora

- Module 2 - Sources of FinanceDocumento50 pagineModule 2 - Sources of FinanceBheemeswar ReddyNessuna valutazione finora

- Sweda Arifah (1862201120)Documento7 pagineSweda Arifah (1862201120)Sweda ArifahNessuna valutazione finora

- Lecture - Sources of FinanceDocumento27 pagineLecture - Sources of FinanceNelson MapaloNessuna valutazione finora

- Screenshot 2024-03-11 at 11.25.37 AMDocumento130 pagineScreenshot 2024-03-11 at 11.25.37 AM230292601135Nessuna valutazione finora

- Advantages and Disadvantages of Equity SharesDocumento2 pagineAdvantages and Disadvantages of Equity Sharespiyush chauhanNessuna valutazione finora

- Corporate Securities: Ma. Pamela Z. Sepulveda Bsa 4 Financial Management 102 AUGUST 23, 2018Documento51 pagineCorporate Securities: Ma. Pamela Z. Sepulveda Bsa 4 Financial Management 102 AUGUST 23, 2018anon_855990044Nessuna valutazione finora

- Corporate Finance Assignment 2Documento7 pagineCorporate Finance Assignment 2manishapatil25Nessuna valutazione finora

- Advantages and Disadvantages of Preferred StockDocumento5 pagineAdvantages and Disadvantages of Preferred StockVaibhav Rolihan100% (2)

- Mathematical Modeling in Finance: Assignment # 01Documento10 pagineMathematical Modeling in Finance: Assignment # 01Shahban ktkNessuna valutazione finora

- Today PresentationDocumento19 pagineToday PresentationSarthak PandeyNessuna valutazione finora

- 5.2 Alternative Sources of FundsDocumento4 pagine5.2 Alternative Sources of FundsJerson AgsiNessuna valutazione finora

- Long Term Finance Sources 2020Documento50 pagineLong Term Finance Sources 2020Rudraksh PareyNessuna valutazione finora

- Fa Unit 4Documento13 pagineFa Unit 4VTNessuna valutazione finora

- Capital of The CompanyDocumento28 pagineCapital of The CompanyLusajo MwakibingaNessuna valutazione finora

- Types of SharesDocumento10 pagineTypes of Sharesinsomniac_satanNessuna valutazione finora

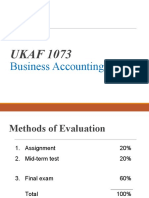

- UKAF 1073: Business Accounting IIDocumento61 pagineUKAF 1073: Business Accounting IIalibabaNessuna valutazione finora

- FINANCIAL MANAGEMENT - ORDINARY Week 9Documento42 pagineFINANCIAL MANAGEMENT - ORDINARY Week 9Syrell NaborNessuna valutazione finora

- Public FinanceDocumento26 paginePublic FinanceVarshini NagarajuNessuna valutazione finora

- Financed by LectureDocumento5 pagineFinanced by LectureEng Abdikarim WalhadNessuna valutazione finora

- EquityDocumento17 pagineEquityItronix MohaliNessuna valutazione finora

- Rules of Debit & CreditDocumento16 pagineRules of Debit & CreditVidhya UnniNessuna valutazione finora

- Picard Vs Avellino and BienesDocumento111 paginePicard Vs Avellino and BienesjpeppardNessuna valutazione finora

- Project ReportDocumento21 pagineProject Reportmasif_janooNessuna valutazione finora

- Trutech Stone Crusher KubariDocumento7 pagineTrutech Stone Crusher Kubarigolu23_1988Nessuna valutazione finora

- Wec14 01 Que 20240113Documento32 pagineWec14 01 Que 20240113randyrengaoleiNessuna valutazione finora

- Chapter 08Documento46 pagineChapter 08Ivo_NichtNessuna valutazione finora

- Expertravel & Tours, Inc. vs. Court of Appeals and KOREAN AIRLINES, G.R. No. 152392, May 26, 2005, Callejo, SR., JDocumento17 pagineExpertravel & Tours, Inc. vs. Court of Appeals and KOREAN AIRLINES, G.R. No. 152392, May 26, 2005, Callejo, SR., JRaymarc Elizer AsuncionNessuna valutazione finora

- Group 22 Principles of ManagementDocumento31 pagineGroup 22 Principles of Management7apesNessuna valutazione finora

- Free Trade and Free ArtDocumento6 pagineFree Trade and Free ArtJulian StallabrassNessuna valutazione finora

- Latin Words in Business Law Simplified Explanation - WPS OfficeDocumento2 pagineLatin Words in Business Law Simplified Explanation - WPS OfficeRheu Reyes50% (2)

- Pakistan Strategy 2022Documento148 paginePakistan Strategy 2022Sulman Bin KhurshidNessuna valutazione finora

- Cost of Capital Project PDFDocumento50 pagineCost of Capital Project PDFPreet PreetNessuna valutazione finora

- Ipcr - Recio 1st Sem 2022Documento2 pagineIpcr - Recio 1st Sem 2022Angelic RecioNessuna valutazione finora

- Cost Estimation PDFDocumento16 pagineCost Estimation PDFemadsabriNessuna valutazione finora

- Hire PurchaseDocumento49 pagineHire PurchasePriya SinghNessuna valutazione finora

- Full Download Test Bank For Fundamentals of Investing 14th by Smart PDF Full ChapterDocumento36 pagineFull Download Test Bank For Fundamentals of Investing 14th by Smart PDF Full Chaptercarex.craker9rpwo100% (15)

- How To Calculate Warehouse Storage CostsDocumento2 pagineHow To Calculate Warehouse Storage CostsRIC NOYANessuna valutazione finora

- FAR1 CASH & CASH EQUIVALENTS - StudentsDocumento4 pagineFAR1 CASH & CASH EQUIVALENTS - StudentsCHRISTIAN BETIANessuna valutazione finora

- Wellspring Capital LawsuitDocumento32 pagineWellspring Capital LawsuitWIS Digital News StaffNessuna valutazione finora

- Module 6 - Profit Planning (Budgeting)Documento82 pagineModule 6 - Profit Planning (Budgeting)CristineNessuna valutazione finora

- Abu L&T SoaDocumento2 pagineAbu L&T Soaமானங்கெட்ட மனசுNessuna valutazione finora

- Periyar University: Periyar Palkalai Nagar SALEM - 636011Documento48 paginePeriyar University: Periyar Palkalai Nagar SALEM - 636011sureshkumarNessuna valutazione finora

- Civil Law Bar QsDocumento31 pagineCivil Law Bar QsLeigh VillegasNessuna valutazione finora

- Wells Far Go Trustee CertDocumento3 pagineWells Far Go Trustee CertCharles Baldwin100% (1)

- Public Finance Research Paper TopicsDocumento6 paginePublic Finance Research Paper Topicshanamituzil2100% (1)

- 3.5 Decision Making To Improve Financial PerformanceDocumento2 pagine3.5 Decision Making To Improve Financial Performancex SwxyxM xNessuna valutazione finora

- Assignment 3Documento2 pagineAssignment 3Rotin ChamdalNessuna valutazione finora

- Khelo India Scheme-Mission Directorate - Sports Development PDFDocumento24 pagineKhelo India Scheme-Mission Directorate - Sports Development PDFSTATUS WORLDNessuna valutazione finora

- DDM Tutorial Questions 1Documento2 pagineDDM Tutorial Questions 1phuongfeoNessuna valutazione finora

- 2nd Quater - Gen Math - Quiz No 1Documento1 pagina2nd Quater - Gen Math - Quiz No 1MA. JEMARIS SOLISNessuna valutazione finora