Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Afs Mock Paper Final

Caricato da

Mohsin AzizDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Afs Mock Paper Final

Caricato da

Mohsin AzizCopyright:

Formati disponibili

IQRA UNIVERSITY, QUETTA

ANALYSIS OF FINANCIAL STATEMENTS MOCK PAPER

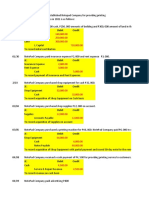

Q. Waqar Fans (Pvt.) Limited manufactures fans and sells in open market. As per estimates, per fan manufacturing cost includes Direct Material of Rs. 1000/-, Direct Labor of Rs. 500/- and variable Factory overhead of Rs. 300/-. Waqar Fans (Pvt.) Limited is having Fixed Factory Overhead of Rs. 3 Million per year. During the 2009 - 10, Waqar Fans manufactured 15,000 fans and sold 8000 fans @ Rs. 3200/- per fan. During the year under review Admin & Selling expenses (excluding FFOH) were Rs. 5 Million. Prevailing corporate Tax rate in the country is 35%. Required: i. Prepare Income Statement and Balance Sheet for the year 2009-10, using a) Absorption Costing b) Marginal Costing ii. iii. iv. v. vi. vii. Q3. Assuming NIL production during the year 2010 11 and sales of all the left over fans (7000 in number) prepare Income Statement & Balance Sheet for the year 2010 11, with the same assumptions. Perform Vertical / Common Size analysis of Income Statement for the year 2009-10 and comment on NP Ratio if Industry Average is 40%. What was the amount of Deferred Tax during the year 2009-10? Mention the situations in which Waqar Fans would like to opt for Absorption Costing. Mention the situations in which Waqar Fans would like to opt for Marginal Costing. Are there any ratios that may be affected with the change in Costing Method?

Imran Fabrics (Pvt.) Limited had purchased locally manufactured new machinery costing Rs. 5 Millions during the year 2005. Expected useful life of Machine was 5 years. After 5 years of usage the machine was sold at Rs 2,218,527/-. The company had adopted Straight Line Method for calculating depreciation. However in compliance with Tax Laws of Pakistan the financial statements for the purpose of taxation had been prepared using Written Down Value Method at the rate of 15% per annum. Required: i. Prepare Depreciation Schedules for the year 2005 2009, using both methods (mentioned above) in the following format. S. No Year Starting Value Book Depreciation During the year Ending Book Value

ii. iii. iv. v.

Taking GP at Rs. 5 Million, Tax Rate 35% and All other P&L expense (excluding depreciation) at Rs. 3 Million, prepare Income Statements and Balance Sheets for the years 2005 2009. Discuss the year wise Tax Impact / Deferred Taxes. Ignoring useful life of machinery, perform trend analysis graphically on Net Profit and predict NP for the year 2010. List the situations in which a) The Company would like to opt Straight Line Method b) The Company would opt WDV for computing depreciation.

Q:

Following is a comparison of the affairs of Habib Pvt. Ltd. and Ahmed Karim Pvt. Ltd. as on 3006-2010.

Balance Sheet (Rs. Million)

COMPANY Cash & Equivalent* Receivables* Inventories* Other Cur Assets Total Cur Assets Gross Fixed Assets Accumulated Depreciation Net Fixed Assets Other Non-Cur Asset Tot Non-Cur Asset Total Assets Accounts Payable* Short-Term Debt Other Cur Liabilities Total Cur Liabilities* Long-Term Debt Deferred Taxes Other Non-Cur Liabilities Habib Pvt Ltd 4,102.0 3,438.0 1,697.0 6,630.0 15,867.0 18,127.0 7,461.0 10,666.0 2,347.0 13,013.0 28,880.0 1,407.0 322.0 4,291.0 6,020.0 448.0 1,076.0 2,041.0 Ahmed Karim Pvt. Ltd 4,165.0 3,723.0 1,293.0 4,503.0 13,684.0 14,262.0 5,775.0 8,487.0 1,564.0 10,051.0 23,735.0 969.0 389.0 3,505.0 4,863.0 728.0 997.0 275.0

Tot Non-Cur Liabilities Total Liabilities Preferred Equity Common Equity* Retained Earnings* Total Equity Tot Liab & SH Equity

3,565.0 9,585.0 0.0 19,295.0 15,984.0 19,295.0 28,880.0

2,000.0 6,863.0 0.0 16,872.0 13,975.0 16,872.0 23,735.0

Income Statement (Rs. Millions)

COMPANY Revenues/Sales Cost of Sales* Gross Operating Profit S&A Expenses* Op Prof before Depreciation Depreciation & Amortization Op Income after Depreciation Other Income EBIT Interest Expense* Pretax Income Income Taxes Total Net Income Preferred Div Net Income (for Common SH) Habib Pvt Ltd 25,070.0 7,753.0 17,317.0 5,238.0 12,079.0 2,192.0 9,887.0 799.0 10,686.0 27.0 10,659.0 3,714.0 6,945.0 0.0 6,945.0 Ahmed Karim Pvt. Ltd 20,847.0 7,276.0 13,571.0 4,130.0 9,441.0 1,888.0 7,553.0 406.0 7,959.0 25.0 7,934.0 2,777.0 5,157.0 0.0 5,157.0

Required:

a. Perform Common Size Analysis for the aforementioned TEN rows shown in italic (marked with *) and comment on the results / percentages.

Q2.

XYZ (Pvt.) Limited manufactures fans and sells in open market. As per estimates, per fan manufacturing cost includes Direct Material of Rs. 500/-, Direct Labor of Rs. 200/- and variable Factory overhead of Rs. 100/-. XYZ (Pvt.) Limited is having Fixed Factory Overhead of Rs. 1 Million per year. During the 2009 - 10, the company manufactured 25,000 fans and sold 18000 fans @ Rs. 2200/- per fan. During the year under review Admin & Selling expenses (excluding FFOH) were Rs. 3 Million. Prevailing corporate Tax rate in the country is 35%. Required: viii. Prepare Income Statement and Balance Sheet for the year 2009-10, using a) Absorption Costing b) Marginal Costing ix. Assuming NIL production during the year 2010 11 and sales of all the left over fans (7000 in number) prepare Income Statement & Balance Sheet for the year 2010 11, with the same assumptions. What was the amount of Deferred Tax during the year 2009-10? Are there any ratios that may be affected with the change in Costing Method? Perform Vertical / Common Size Analysis and comment.

x. xi. xii. Q3.

KK (Pvt.) Limited purchased new machinery costing Rs. 2 Millions during the year 2005. Expected useful life of Machine was 5 years. After 5 years of usage the machine was sold at Rs 887,410/-. The company had adopted Straight Line Method for calculating depreciation. However in compliance with Tax Laws of Pakistan the financial statements for the purpose of taxation had been prepared using Written Down Value Method at the rate of 15% per annum. Required: vi. Prepare Depreciation Schedules for the year 2005 2009, using both methods (mentioned above) in the following format. Year Starting Book Value Depreciation Ending During the Book year Value

vii.

viii. ix. x.

Taking GP at Rs. 2 Million, Tax Rate 35% and All other P&L expense (excluding depreciation) at Rs. .8 Million, prepare Income Statements and Balance Sheets for the years 2005 2009. Discuss the Tax Impact / Deferred Taxes. Perform Horizontal / Trend Analysis and predict NP for the year 2010. List the situations in which c) The Company would like to opt Straight Line Method d) The Company would opt WDV for computing depreciation.

Potrebbero piacerti anche

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Colgate Estados Financieros 2021Documento3 pagineColgate Estados Financieros 2021Lluvia RamosNessuna valutazione finora

- Projected Income Statement: 1.0 Gross SalesDocumento5 pagineProjected Income Statement: 1.0 Gross SalesNEGOSYO CENTER ESTANCIANessuna valutazione finora

- Chapter 30 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Documento25 pagineChapter 30 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNessuna valutazione finora

- Chapter 2Documento27 pagineChapter 2Mary MarieNessuna valutazione finora

- Ifrs 16Documento227 pagineIfrs 16Yandhi SuryaNessuna valutazione finora

- Chapter 15Documento14 pagineChapter 15Snow TurnerNessuna valutazione finora

- HMSP LK TW Iii 2020Documento92 pagineHMSP LK TW Iii 202022RETNO DWI PERMATA AJUSANessuna valutazione finora

- International Financial Reporting Standards (IFRS) : An OverviewDocumento10 pagineInternational Financial Reporting Standards (IFRS) : An Overviewsanjay guptaNessuna valutazione finora

- Sayidah Maryam Sinosi 4517013057Documento101 pagineSayidah Maryam Sinosi 4517013057AlbrtousNessuna valutazione finora

- Accounting For Receivables Practice SolutionsDocumento3 pagineAccounting For Receivables Practice SolutionsNgân GiangNessuna valutazione finora

- Fasb 157 PDFDocumento2 pagineFasb 157 PDFTinaNessuna valutazione finora

- Asm NLKTDocumento4 pagineAsm NLKTK59 DAM NGOC MINH ANHNessuna valutazione finora

- Statement of Cash FlowsDocumento14 pagineStatement of Cash Flowsheart lelim100% (1)

- A Practical Guide To Accounting For Agricultural Assets: November 2009Documento24 pagineA Practical Guide To Accounting For Agricultural Assets: November 2009Otilia Florina Munteanu-StamateNessuna valutazione finora

- CR Ma 21Documento22 pagineCR Ma 21Sharif MahmudNessuna valutazione finora

- Management Accounting I: Debarati@xlri - Ac.inDocumento22 pagineManagement Accounting I: Debarati@xlri - Ac.inSimran JainNessuna valutazione finora

- AHM13e Chapter - 03 - Solution To Problems and Key To CasesDocumento24 pagineAHM13e Chapter - 03 - Solution To Problems and Key To CasesGaurav ManiyarNessuna valutazione finora

- A Level Accounting (9706) IAS Booklet v1 0Documento58 pagineA Level Accounting (9706) IAS Booklet v1 0Mei Yi YeoNessuna valutazione finora

- Ratio Analysis 1Documento2 pagineRatio Analysis 1yogeshgharpureNessuna valutazione finora

- Olivia Ogilvy - Resume - Accountant-3Documento2 pagineOlivia Ogilvy - Resume - Accountant-3Ian Henrich De LeonNessuna valutazione finora

- Finaco1 Mid Term ExaminationDocumento11 pagineFinaco1 Mid Term ExaminationbLaXe AssassinNessuna valutazione finora

- Cash Base VS Accrual BaseDocumento8 pagineCash Base VS Accrual BaseCheryl FuentesNessuna valutazione finora

- SOLMAN Chapter 3Documento18 pagineSOLMAN Chapter 3Na JaeminNessuna valutazione finora

- CHAPTER 14 - Consolidated Statement - Date of AcquisitionDocumento63 pagineCHAPTER 14 - Consolidated Statement - Date of AcquisitionErina KimNessuna valutazione finora

- CH 1 - Business - CombinationsDocumento41 pagineCH 1 - Business - CombinationsAzakia 103Nessuna valutazione finora

- Solution Chapter 10Documento48 pagineSolution Chapter 10Mike Alexander100% (1)

- Allowance - RavinathanDocumento4 pagineAllowance - RavinathanRavi NathanNessuna valutazione finora

- Balance Sheet s8 Shared 2021Documento18 pagineBalance Sheet s8 Shared 2021nikhil gangwarNessuna valutazione finora

- Comprehensive Problem-Analysis of TransactionDocumento43 pagineComprehensive Problem-Analysis of TransactionJoanna DandasanNessuna valutazione finora

- Chapter 2 - FINANCIAL ACCOUNTING & REPORTING 24th Edition (2022) - Zeneida Cruz Veda ManuelDocumento32 pagineChapter 2 - FINANCIAL ACCOUNTING & REPORTING 24th Edition (2022) - Zeneida Cruz Veda ManuelRodolfo ManalacNessuna valutazione finora