Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Session 1 2011

Caricato da

M H Brian LaDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Session 1 2011

Caricato da

M H Brian LaCopyright:

Formati disponibili

1

Investment Analysis Project

Aston Business School

May, 4

th

, 2011

Dr Cesario MATEUS

www.cesariomateus.com

2

Aim

Conduct an in-depth investment analysis case study on a single

company drawn from FTSE 100 and been listed at least for the last

three years. The case study exercise aims to provide students with

the opportunity to demonstrate, in the development of a detailed

analyst's company report, the skills and knowledge acquired in the

area of investment analysis

In the project the students should address besides others the

following questions/issues:

Introductory Material: Company Description, Ticker Symbol,

Industry (Type of the industry), officers/Directors Holdings, Partners,

etc.

3

Corporate Governance Analysis: Is this a company where there is a

separation between management and ownership?

Economy Analysis: Discuss the general economy, Economic life cycle,

Economic indicators, Macro-economic forecast and the future

expectations from an economy

Industry Analysis: Discuss the industry of the company, Industry life

cycle, Macro and micro level of industry forecast and future expectations

from an industry.

Company Information: Copy of any relevant articles that appear in the

written media, summarize the listed articles and discuss the effects of the

articles to the companys financial structure. Follow the company news

and information presented to the Stock Exchange, discuss the effects of

the news to the companys stock price.

4

Stockholder Analysis: Who is the average investor in this stock?

(Individual or pension fund, small or large, domestic or foreign)

Risk and Return: Is the risk of the coming from market, firm,

industry or currency? What return would you have earned investing in

this company's stock? Would you have under or outperformed the

market? How risky is this company's equity? Why? What is its cost of

equity? How risky is this company's debt? What is its cost of debt?

What is this company's current cost of capital

Capital Structure Choices: What types of financing that this

company has used to raise funds. Advantages or disadvantages for

the firm in using debt. Does your firm have too much or too little debt

comparing with the industry and the market?

5

Dividend Policy: How has this company returned cash to its owners?

How would you recommend that they return cash to stockholders?

Financial Information: Monthly Stock Prices of the last 3 years.

Adjusted and Unadjusted. Monthly Stock Price Graph of the last 3 years,

compare it to the FTSE 100 monthly returns. Fundamental Values with

fundamental analysis (Last 3 years balance sheet and income statement

with the most important accounts and headings, discuss the companys

past performance in-terms of financial statements).

Valuation: What type of cash flow would you choose to discount for this

firm? What is your estimate of value of equity in this firm? How does this

compare to the market value? What is the value of the firm? Is the firm

over or undervalued?

6

Most recent: Market Value, Book Value, Beta, ROE, ROA, ROI, Profit

Margin, Current Ratio, Dividends, P/E approach, and other important

ratios of your choice from Leverage, Liquidity, Efficiency, Profitability, and

Market-Value approaches.

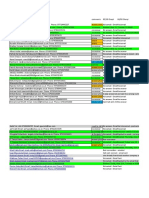

Timetable

Date Hours

May, 4

th

Lecture 10-13

May, 4

th

Lecture 14-17

May, 25

th

Lecture 10-13

May, 25

th

Office Hours 14-17

June, 22

nd

Lecture 10-13

June, 22

nd

Office Hours 14-17

7

Last year results

Nr Students 46

Average Mark 63.8

Median Mark 64

Std deviation 9.84

Maximum 88

Minimum 45

8

Risk Analysis and CAPM

9

Security Market Line

Return

Risk

Risk Free Return

Efficient Portfolio

10

Unsystematic and Systematic Risk

Adding securities reduces portfolio risk, if they are not perfectly

positively correlated.

No. of securities in portfolio

Unsystematic risk (unique risk)

Total

risk

Systematic risk (market

risk)

11

Efficient Risky Portfolios

Variance of return - a poor measure of risk

Investors can only expect compensation

for systematic risk

Asset pricing models aim to define and

quantify systematic risk

Begin developing pricing model by asking:

Are some portfolios better than others?

12

Beta ()

j

Covariance of asset j with market portfolio

Beta of Asset

Variance of the market portfolio

=

( )

2

Cov Rj, Rm

m

|

o

=

In the CAPM, a stocks systematic risk is captured by beta

The higher the beta, the higher the expected return on the stock

13

Beta ()

The basic features of Beta are:

= 1 A 1% change in the market index leads to a 1% change

in the return on a specific share.

0< <1 A 1% change in the market index leads to a less than

1% change in the return on a specific share.

>1 A 1% change in the market index leads to a greater than

1% change in the return on a specific share.

14

Beta And Expected Return

Beta measures a stocks exposure to market risk

The market risk premium is the reward for bearing market

risk:

R

m

- R

f

E(R

i

) = R

f

+ [E(R

m

) R

f

]

Return for bearing

no market risk

Stocks exposure

to market risk

Reward for bearing

market risk

15

Security Market Line

Return

Risk Free Return

BETA

Security Market Line

(SML)

16

Security Market Line

Return

BETA

f

1.0

SML

SML Equation = r

f

+ B ( r

m

- r

f

)

Rf

17

The Security Market Line

Plots the relationship between expected return and betas

In equilibrium, all assets lie on this line

If stock lies above the line

Expected return is too high

Investors bid up price until expected return falls

If stock lies below the line

Expected return is too low

Investors sell stock, driving down price until

expected return rises

18

The Security Market Line

|

i

E(R

P

)

R

F

SML

Slope = E(R

m

) - R

F

= Market

Risk Premium (MRP)

A - Undervalued

R

M

| =1.0

B - Overvalued

19

Estimating Betas

Collect data on a stocks returns and returns on a market index

Plot these points on a graph

Yaxis measures stocks return

X-axis measures markets return

Plot a line (using regression) through the points

Slope of line equals beta

R-square value measures the percentage of risk that is systematic

20

Measuring Betas

Dell Computer

Slope determined from plotting the

line of best fit.

Price data Aug 88- Jan 95

Market return (%)

D

e

l

l

r

e

t

u

r

n

(

%

)

R

2

= .11

= 1.62

21

Measuring Betas

Dell Computer

Slope determined from plotting the

line of best fit.

Price data Feb 95 Jul 01

Market return (%)

D

e

l

l

r

e

t

u

r

n

(

%

)

R

2

= .27

= 2.02

22

Classifying shares by their beta

Aggressive shares (i.e. such shares rise faster in a bull market

and fall more in a bear market): >1

Defensive shares (i.e. such shares enjoy less of a rise than

the market in a bull market and fall less in a bear market): <1

Neutral shares (i.e. share price fluctuates in line with the

market): = 1

23

Basic Valuation Models

Core Concepts

1. Apply dividend discount models (DDM) to equity valuation.

2. Apply relative valuation models to equity valuation ( P/E, P/BV

& P/CF)

3. Explain the components of an investors required rate of

return and the process for determining the inputs in the DDM

including the required rate of return and expected dividend

growth rate.

24

Estimating the Intrinsic Value

Most investment valuation involves:

Estimating the amount and timing of the cash flows

Interest, dividends, and capital gains

Estimating the growth rate of returns

common stock / Real estate

(Can grow over time)

Preferred Stock / Bonds

(fixed)

Applying an appropriate discount rate to the cash flows to estimate

the investments intrinsic value

The required return for the risk assumed Amount & timing of cash flow

Comparing the intrinsic value to the market price

If estimated intrinsic value > market price, then BUY!

25

Discounted Cash Flow Models

Preferred Stock

pdf

P

DIV

P

r

=

Fixed/Perpetual Income-never matures

Market Rate

Common Stock

1 2

2

...

(1 ) (1 ) (1 )

n

CS

cs

n

CE CE

DIVn P

DIV DIV

P

R R RCE

+

= + + +

+ + +

Projected (not fixed)

1

n

DIV

r g

+

=

Constant (Gordon) Growth DDM

g s g economy

1

CS

CE DIV

DIV

P

R g

=

0

(1 ) DIV g +

1

Payout Rate EPS

Retention Rate ROE

26

Robert Tolson is valuing a preferred stock issued by XYZ Corporation. The preferred

stock has a rating of AA and pays an annual 8% dividend on a $25 par value. Robert

estimates that the required return on a share of XYZs common stock is 14%. The 1-

year Treasury bill is currently yielding 3%. Also, Robert has the following market

information on otherwise equivalent preferred stock issuances:

Company Rating Yield

Pacific and Northern Inc. AA 7.0%

Great Widgets Inc. AA+ 6.2%

Spacely Rockets Corp. AA 6.5%

Amalgamated Combined Inc. AAA 6.7%

Based on this information, Roberts best estimate of the value of one share of the XYZ

preferred stock to be:

a. $14.29

b. $30.77

c. $66.67

d. $25.00

27

Choice b is correct. Absent any other information such as information that call

options or convertibility options are embedded in the preferred stock), this preferred

stock can be valued as a perpetuity. A perpetuity is an instrument that pays a

constant, regularly scheduled payment that continues forever. In this case, the

regular payment is the annual dividend payment. The applicable formula for the

value of a perpetuity is:

Where: Div

1

is the annual dividend payment, and rp is the required return on the

preferred stock. The annual dividend payment is equal to the dividend rate multiplied

by the par value, or:

DIV

1

= .08 $25 = $2.0

In this problem, the correct required return to use is the market yield on the most

similar preferred stock, which in this case is the AA Spacely Rockets Corp.

preferred stock with a yield in the market of 6.5%

Plugging in the values, the price is calculated as:

1

$2

$30.77

0.65

P

DIV

P

r

= = =

28

Marie Aparecida is valuing the stock of a mature company, XYZ corp.

Maria has the following estimates and market information about XYZ

corp:

Estimated Earnings per share at t=1 $1.65

Estimated Dividend per share at t=1 $0.95

Current Market Price per share $13.40

Required Return 12%

Estimated Dividend Growth rate 3.0%

Current risk free rate 3.5%

Using the Gordon constant growth dividend discount model, what value

does Marie place on a share of XYZ stock.

a. $7.92

b. $13.40

c. $18.33

d. $10.55

29

Choice d is the correct. The constant growth model uses the simplifying

assumption that dividends grow at a constant rate forever. The formula for the

constant growth model is a compact way of calculating the present value today of

all these future dividend payments that extend out of infinity. The formula is:

1

CS

CS DIV

DIV

P

R G

=

1

$0.95

$10.55

.12 .03

CS

CS DIV

DIV

P

R G

= = =

Where DIV

1

is the dividend the company is expected to pay in one year (t=1)

R

CE

is the required return on common equity

g

DIV

is the estimated sustainable dividend growth rate

Choice a is incorrect. This result ignores the dividend growth rate and simply

divides the expected dividend by the required return.

30

Choice b is incorrect. This is the market price of the stock. Note that Marie is

using the constant growth model to make her own estimation of the value of the

stock. Using the constant growth model, Marie has estimated the stock to be

worth $10.55 per share ; however, it is selling in the market at $13.40. in this

case, XYZ stock is overvalued in the market and Marie would not buy the

security.

Choice c is incorrect. This is the result if the expected earnings per share are

used in the numerator. The expected dividend per share should be used

because the dividends reflect the actual cash flows made to the shareholder.

31

Jane Wakeman is using the constant Growth Dividend Discount Model to value a

share common stock issued by National Amalgamated Corp. She has made the

following estimates regarding the stock and market rates;

Estimated Dividend Growth Rate: 3%

Expected Return on the Market 9%

Risk-free Rate 4%

Expected Dividend at t=1 $1.75

Beta 1.2

If Jane changes the risk-free rate in her valuation calculations from 4% to 5% and

the market risk premium expected to remain constant, then Janes estimate of the

value of National Amalgamated Corp. will most likely:

a. Decrease by $3.13

b. Increase by $0.74

c. Decrease by $0.75

d. Stay the same

32

Choice a is correct. The first step is to find the value of the stock when the risk-

free rate is 4%. Give the information provided, use the Security Market Line (SML)

of the Capital Asset Pricing Model (CAPM) to determine the stocks required of

return. The basic equation for finding a stocks required return, E(R

i

), using the

SML is:

Where R

F

is the risk-free rate

i

is the stocks beta

R

M

is the expected return on the market

Plugging in the numbers to the SML equation, one gets:

Next, use the estimated required return of 10% (along with the other inputs) in the

Gordon Growth Model to arrive to the value

( )

CE F M F

r R R R | = +

( )

CE F M F

r R R R | = +

.04 1.2(.09 .04) 10% = + =

$1.75

$25.00

.10 .03

CS

P = =

33

The next step is to find the value of a share of National Amalgamated Corp. if the

risk free rate shifts to 5%. However, the fact pattern in the problem indicates that

the market risk premium remains constant. Therefore, the return on the market

must increase to 10% to keep R

M

-R

F

constant at 5%. Using a risk free rate of 5%,

the required rate of return is now:

( )

CE F M F

r R R R | = +

.05 1.2(.10 .05) 11% = + =

Next, use the revised estimated required return of 11% (along with the other

inputs) in the Gordon Growth Model to arrive at a value of:

$1.75

$21.875

0.11 .03

CS

P = =

Comparing the value of the stock when the risk-free rate is 4% ($25.00) to the

value when the risk-free rate is 5% ($21.875), it is seen that the value has

decreased by $3.13.

34

Supernormal Growth

Two-Stage dividend Discount Model

Compute the dividends based on the growth rate during the

supernormal growth period finite period

DIV

1

= DIV

0

(1+g

HIGH

)

DIV

2

= DIV

1

(1+g

HIGH

)

Periods of

supernormal growth

Compute the terminal value of the stock

- GGM can be applied

once constant growth has

been reached

4

3

CE LOW

DIV

P

r g

=

= DIV

3

=(1+g

normal

)

= Normal/Sustainable/Infinite

35

Discount the cash flows to determine the current stock value

3 3 1

CS

2

2 3

CE CE CE

DIV +P DIV DIV

+ +

(1+r ) (1+r ) (1+r

P

)

=

36

Jason Cicatello is analysing the stock XYZ International. Jason estimates that XUZ

International will experience a period of supernormal growth of 20% for the next

two years. Thereafter, the growth rate will be the long-run growth rate. Jason has

the following estimates and market information about XYZ International.

Current market price per share $16.75

Dividend per share at t=0 $1.10

Historical 1-year return on equity (ROE) 15%

Estimated cost of equity capital 14%

Estimated supernormal dividend growth rate 20%

Current risk-free rate 4.0%

Estimated long-run dividend growth rate 3.5%

Using these estimates and the two stage dividend discount model. What is the

value of a share of YZ international?

a. $14.40

b. $12.92

c. $13.13

d. $11.65

37

Step 1:

GGM can be applied after two years

Dividend per share at t=0 current dividend

1.10 1.20 = 1.32 DIV

1

1.321.20 = 1.584 DIV

2

Estimated long-run dividend growth rate 3.5%

1.5841.035 = 1.64 DIV

3

Step 2:

Step 3:

$1.32 CF

1

$1.584 + $15.62 =$17.20 CF

2

Estimated cost of equity capital 14%

NPV = $14.39

3

2 CS

DIV

P

r g

=

2

1.64

$15.62 Terminal Value

14% 3.5%

CS

P = =

38

Relative Valuation Approaches

If the multiple is less than the mean for the peer group, stock

appears relatively undervalued

Earnings Multiplier Approach

0

1

P

E

Net Income-Preferred Dividends

# Common Shares Outstanding

=

Lower side of the peer group the stock is relatively undervalued

Based on the principle that dividends are paid out of earnings

DIV

t

= K E

t

Payout rate

39

1 1

CS

CE DIV CE E

DIV K E

P = =

r -g r -g

1

CE E

K

P/E =

r -g

= justifiable / appropriate P/E

1

multiple

P/E

1

EPS

1

= intrinsic value

Limitations:

Accounting Methods / non-recurring items

Management Bias / Estimates

Earnings tend to be Volatile / Negative

40

Other Multiples

Price-to-Cash Flow

Harder for management to manipulate than earnings

t

i

t+1

P

P/CF=

CF

Projected CF per Common Share

Lower side of the peer group the stock is relatively undervalued

Price-to-Book

t

i

t+1

P

P/BV=

BV

Assets-Liabilities-Preferred Stock

# CSO

=

Projected

Better for companies with liquid assets that reflect current

values (e.g. Banks) Less volatile & Cant be negative

41

Price-to-Sales

t

i

t+1

P

P/S =

S

1

1

Sales

=

# CSO

Sales are more stable than earnings and can be used to

value early-stage companies not yet earning profits

Sales:

Cant be negative

Less management bias general rule (everybody is using

accrual basis)

42

Tony Fong is estimating the appropriate P/E ratio for Slate Quarry Inc, a

mature, open-pit mining company. Tony has made the following

estimates about Slate Quarry Inc:

Required return 14%

Past 1-year return on equity 16%

Dividend growth rate 3%

Earnings retention rate 30%

Current stock price / share $8.00

Based on this data and an applying the constant growth dividend

discount model, an appropriate P/E ratio for the Slate Quarry is:

a. 2.7

b. 5.4

c. 6.4

d. 2.3

43

Choice c is the correct. The key to converting the constant growth model

(CGM) to a P/E model is to recognize that the dividend at t=1 (DIV

1

) will equal

the dividend payout ratio K times the t=1 earnings. In general:

Thus, assuming the dividend payout ratio is constant over time, KE

1

can be

substituted for DIV

1

. The CGM is now rewritten as:

Next, to turn the formula into a P/E ratio, divide both sides by E

1

Note that this problem provides the retention ratio (1-k) and not the payout ratio.

The payout ratio is 70% (1-30%).

t t t

DIV =K +E

1 1

CS

CE E CE E

DIV KE

P = =

r -g r -g

1

CE E

K

P/E =

r -g

44

The formula can now be used for Slate Querry:

Tony could then multiply this P/E estimate by his year 1 estimated earnings to

arrive at a stock price today. This value will be the same number as if Tony simply

computed the stocks value using the basic CGM and substituting his estimate of

KE

1

for DIV

1

.

Choice a is incorrect. This answer incorrectly uses the retention rate in the

numerator (instead of the dividend payout ratio).

Choice b is incorrect. This answer incorrectly uses the past 1-year ROE in the

denominator (instead of the required return). The past ROE does not indicate the

return investors will require on the stock going forward.

Choice d is incorrect. This answer incorrectly uses both the past 1-year ROE in

the denominator (instead of the required return) and the retention rate in the

numerator (insteda of the dividend payout ratio)

1

70%

P/E = =6.4%

0.14-0.03

45

Estimating the inputs to Valuation Models

Memorizing the models is easy, correctly estimating the inputs

is more challenging.

CE F ERP

r =(1+R )(1+r )-1

Equity Risk Premium-Compensate for market

risk and business risk, financial liquidity, country,

currency, etc

The discount rate is the nominal risk-free rate plus a risk premium

The growth rate is a function of ROE and earnings retention

E

g =ROE(1-K)

Payout rate

0

0

DIV

EPS

| |

|

\ .

Profit Margin + Asset Turnover + Financial Leverage (Dupont Model)

46

Janet Schoettinger is estimating the required return to use in valuing the

stock of Flintrock Industries. Janet has the following estimates about the

stock and the interest rates:

Flintrocks stock beta 0.8

Real risk-free rate 2%

Expected inflation rate 3%

Flintrocks equity risk premium 6%

Based on this information and using a build-up approach, the exact

discount rate Janet should use for Flintrock Industries is:

a. 9.18%

b. 11.36%

c. 9.86%

d. 8.12%

47

Choice b is the correct. The stocks required return will be based on the three

components:

Real risk-free rate

Expected inflation rate

Equity risk premium

In finding the required return for the stock, one can think of building up from the

base real risk-free rate. In this building up process, the real risk-free rate and the

expected inflation rate are first combined to get the nominal risk-free rate. This is

done as follows:

F F

r =(1+rr )[1+E(INFL)]-1

(1.02)(1.03) 1

0.0506 5.06% =

Where r

F

, is the nominal interest rate, rr

F

is the real risk-free rate E(INFL) is the

expected inflation rate.

48

Next, the nominal risk free rate and the equity risk premium (r

ERP

) are then

combined to arrive at r

CE

, the required return (or, cost of common equity) for

Flintrock stock:

CE F ERP

r =(1+r )(1+r )-1

=(1.0506)(1.06)-1

=0.1136=11.36%

Note that the approximate answer would simply be the sum of the three numbers:

Approximate

CE F ERP

r =rr +E(INFL)+r

=.02+.03+.06

=.11=11%

49

Market and Industry Analysis

Core Concepts

A. Explain the process of valuing a stock market using

fundamental analysis

B. Identify the investment opportunities associated with the

business cycle stages.

C. Discuss the impact of the industry life cycle, competitive

structure and risk considerations on global industry

analysis

D. Explain the relationship between company analysis and

stock selection.

Top/Down Approach

50

Summarize

1. Analyze macroeconomic data to identify favorable

countries

2. Identify favorable markets and industry growth prospects

3. Select individual companies for investment

51

Analysing the Stock Market

Based on a broad market index like the S&P 500

The goal is to forecast the earnings for the index:

Relate sales to a macroeconomic variable like GDP (IV)

Regression analysis

Estimate profitability by relating margin (EBITDA) to

macroeconomic profitability margins

Capacity utilization, unit labor costs

1

% Sales Index = + (% GDP) o A A

0 1

Sales (1+% Sales) = Sales

52

Forecast the indexs earnings based on the sales forecast, the

margin forecast, and estimation of depreciation and interest

expenses:

1

[Sales EBITDA margin]- Depr.-Interest (1-tax rate)

Projected net Income

Divided by nr shares outstanding to have EPS

Finally, estimate a growth rate based on ROE and payouts ratios

for the index:

INDEX

g = ROE (1 - K)

1

EPS Payout

Value Index =

r g

53

Jae Kim, an equity strategist, is estimating the next years average sales

per share for a major stock market index. He has the following estimates

including the results of index regression analysis (based on 20 years of

annual data).

1 N

1

% Sales Index = + (% GDP )

= 3.2 and = 1.25

Where GDP

N

is the nominal gross domestic product

Average Index ROE (last five years) 13.5%

Nominal 1-year GDP growth (estimate) 3%

Average GDP growth (last five years) 2%

Index current average sales per share $400

Average Index Retention Rate 55%

Based on Jaes regression analysis, what is the 1-year estimated average sales

per share for the index?

a. $422.60, b. $427.80, c. $429.70 or d. $415.00

54

Choice b is correct. Jaes approach first uses regression analysis and the historical

data to estimate the relationship between GDP growth and sales growth for the

index. Historically, the relationship between the percentage change in average sales

brought about by the percentage change in GDP is:

N

% Sales Index = 3.2 + 1.25 (% GDP ) A A

Note that the regression estimate should be based on data that cover between

one and five complete business cycles.

Plugging in the estimate for nominal GDP growth (3%), the estimated

percentage change in average sales is:

% Sales Index = 3.2 + 1.25 (3) = 6.95% A

With an expected growth rate in sales of 6.95%, the average sales for next year is

estimated to be:

Estimated average sales next year = (current average sales) (1+ estimated growth rate)

$400 (1+ 0.0695) = $427.80

55

Choice a is incorrect. This answer is found by using the average GDP growth rate

over the last five years (instead of the estimate for next years GDP growth)

Choice c is incorrect. The provided answer is found by using the estimated growth

earnings: g = retention rate ROE. This growth rate is not applicable to sales.

Choice d is incorrect. This answer omits the intercept in the regression equation.

56

Keith Miller, an equity market strategist, is attempting to estimate the expected

P/E ratio of the Russel 2000. Keiths approach is to use the Gordon Growth model

and the Capital Asset Pricing Model to estimate the earnings multiplier. Keith has

made the following estimates.

Russel 2000: Projected average effective rate 20%

Long term treasury bond yield 10%

Russel 2000: Projected average ROE 15%

Russel 2000: expected Index market risk premium 5%

Russel 2000: Projected pretax earnings per share $100

Based on this information, the expected P/E ratio for Russel 2000 is closest to,

a. 4.4

b. 4.0

c. 10.0

d. 6.7

57

Choice d is correct. For this problem, the constant growth dividend discount

model is:

R2000

R2000

R2000

CE

DIV

V =

r -g

The dividend at any period will be equal to:

t t t

DIV = K E

Given this, and assuming that the dividend payout ratio is constant over time KE

R2000

can be substituted for DIVR2000 and then the CGM model is rewritten as:

R2000 R2000

R2000 R2000

R2000

CE CE

DIV KE

V =

r -g r -g

=

To turn the formula into a P/E ratio, divide both sides by E

R2000

:

R2000

R2000 R2000 R2000

CE

K

V /E =P/E =

r -g

58

Next, to use the formula, the various inputs need to be calculated:

The average dividend payout ratio is 1 minus the average retention rate:

1-0.4 = 0.6

The required return on the Russel 2000 is computed using CAPM and recognizing

that the beta estimate of the Russel 2000 is 1:Thus:

R2000

CE f R2000 R2000

r =r +Beta (Market Premium )=.10+1(.05)=15%

The estimated dividend growth rate will equal:

R2000 R2000 R2000

g =ROE Retention Ratio =.15.4=6%

Plugging in these numbers the estimated P/E ratio is:

R2000

R2000

CE

K .6

P/E = = = 6.7

r -g .15-.6

59

Industry Life Cycle

Stage 1: Low Volume / No profits (Pioneering Development) Price to

sales

Stage 2: High Profits ( Rapid Accelerating Growth)

Stage 3: More Competition (Mature Growth) Profit Margin goes down

Stage 4: Small Margins (Stabilization an Market Maturity) - Longest

Gordon Growth Model Applies growth s GDP

Stage 5: Consolidation (Deceleration of Growth and Decline)

Economies of Scale Large firms survive

Small Firms Liquidation Value Small firms will worth more dead

than alive (Price to book value)

Stages 2, 3 and 4 3 stage DDM

60

Competitive Structure

As number of competitors goes up, rivalry intensify goes up and

profit margins goes down

N-Firm Concentration ratio

The sum of the n largest firms percentage market shares

As ratio rivalry EBITDA margins

Herfindhal Index (H) The sum of the squares of the market shares

of the firms that constitute the industry

2

1

H = (M )

n

i

i=

H = more concentrated the industry, rivalry PM

61

Reciprocal of the index gives the equivalent number of firms within the

industry if each had an equal share

1

= Equivalente # of firms

H

Rivalry PM

62

Risk Considerations - Porters 5 Forces

Threat of new entrants - Barriers to entry

Pure competition none

Monopoly Competition low

Oligopoly / Monopoly - high

High profits attract new competitors

Rivalry among firms within the industry

Price wars low concentration

Availability of substitutes

Price elasticity

Bargaining power to customers

Pushes down prices Thus, profit margins goes down

Bargaining power of suppliers

Pushes up costs - Thus, profit margins goes down

D

% Q

=e e 1 elastic

% P

,

Affect Firms Competitive structure

63

SWOT Analysis

SWOT analysis is a strategic planning method used to evaluate the

Strengths, Weaknesses, Opportunities, and Threats involved in a project

or in a business venture. It involves specifying the objective of the

business venture or project and identifying the internal and external

factors that are favorable and unfavorable to achieve that objective

Strengths: characteristics of the business or team that give it an

advantage over others in the industry.

Weaknesses: are characteristics that place the firm at a disadvantage

relative to others.

Opportunities: external chances to make greater sales or profits in the

environment.

Threats: external elements in the environment that could cause trouble for

the business.

64

PESTEL Analysis of the macro-environment

There are many factors in the macro-environment that will effect the

decisions of the managers of any organization. Tax changes, new laws,

trade barriers, demographic change and government policy changes are

all examples of macro change. To help analyze these factors managers

can categorize them using the PESTEL model. This classification

distinguishes between:

Political factors

Economic factors

Social factors

Technological

Environmental

65

Company Analysis and Stock Selection

Good companies do not necessarily make

good stocks

Is it already

priced in the

stock?

i.e. undervalued

Growth companies vs. Growth Stock

Sales Stock Price

Defensive company vs. Defensive stock

Stable Earnings

Stable Price

Low Beta

Cyclical company vs. cyclical stock

Earnings

correlated with

Business Cycle

Volatile Price

High Beta

66

What is the stocks intrinsic value?

Forecast Sales

1

% Sales = + (X) o A

1 0

Sales Sales (1+% Sales) =

Forecast Profit Margin - Competitive Structure

Forecast Earnings (EPS)

1

1

Sales [EBITDA margin]- Depr.-Interest (1-tax rate)

Estimate Multiplier (P/E

1

)

K

r g

Value the Stock

1 1

V = EPS +P/E

If V > P

market

= BUY

Plots above SML - undervalued

67

Bob Michaels, an equity analyst, has information on four different industries

Industry Average of: Industry 1 Industry 2 Industry 3 Industry 4

R&D Expenses as a percentage of sales 1% 4% 1.5% 2%

Percentage of Industry market share held 8% 70% 65% 38%

Fixed expenses/Variable Expenses 5:1 4:1 2:1 1:1

Average Sales Growth over last four years 3% 12% 11% 8%

Based on this information and Porters Five Forces, which industry should

have lowest average EBITDA margin?

a. One

b. Two

c. Three

d. Four

68

Step 1: Thus - most competition / intense rivalry

R&D Expenses as a percentage of sales

Industry 1

R&D barriers to enter Competition lower margins

% competition lower margins

Fixed costs barriers to exit rivalry competition lower margins

Growth rate rivalry competition lower margins

Choice a is correct

69

Regina Flemming, a portfolio manager, is analyzing the stock of a large

consumer durables manufacturer, XYZ Inc. Regina has summarized XYZs

business as follows:

XYZ manufacturers a limited range of luxury consumer-durable goods. The

company enjoys an excellent reputation for innovation and customer service.

Historically, sales have been strongly correlated with fluctuations in the

economy, as sales decline in economic downturns and increase in economic

upturns. The firms operations and finances continue to be among the strongest

in the industry with minimal debt, high liquidity, low operating leverage, and a

stock beta of 0.85. The long-run prospects for this company is very strong.

Based on this information, which of the following is true about XYZ company

and XYZ stock?

a. Cyclical; Cyclical

b. Non-Cyclical; Cyclical

c. Cyclical, Non-Cyclical

d. Non-Cyclical; Non-Cyclical

70

Choice c is the correct. The key point is that the analyst needs to distinguish

between the company and the stock. A cyclical companys sales and earnings will

rise and fall with the business cycle. As described, XYZ is clearly a cyclical

company. Note that the extent of the cyclicality of the companys earnings will be

affected by the extent of the companys fixed costs (operating leverage) and the

extent of its debt expenses (financial leverage).

As described, XYZs stock is not cyclical. A cyclical stock is one with changes in

returns that are greater than the markets changes in return. For instance, if the

market is up 10%, a cyclical stock will be up more than 10%. Or, for example, if

the market is down 12%, a cyclical stock will be down more than 12%. Given, that

XYZ has a beta of 0.85 (less than one), XYZ is not considered a cyclical stock.

In summary, XYZ is a cyclical company but not a cyclical stock.

71

What is Financial Leverage?

What mix of debt and equity (ordinary shares) should be used to finance

a firms operations?

How much financial leverage should a firm have in its capital structure?

The main questions we address are

Can the firms value be affected by its capital structure choices?

Does the value of the firms cash flows depend on how it is divided

between payments to shareholders and debtholders?

Is there an optimal capital structure that maximizes the value of the

firm?

72

What is Financial Leverage?

Two main risks faced by firms

Business (or operational) risk

The variability of future net cash flows attributed to the nature of the

firms operations

It is the risk faced by shareholders if the firm is financed only by

equity

Financial risk

The risk attributed to the use of debt as a source of financing a firms

operations

73

Do Managers Care About Leverage?

Source: Damodaran Online, pages.stern.nyu.edu/~adamodar. Based on survey

of CFOs of large US firms who ranked the factors that they considered important

in their financing decisions. A 0 is least important and a 5 is most important.

74

What Managers Use

Source: Damodaran Online, pages.stern.nyu.edu/~adamodar. Based on

survey of CFOs of large US firms who ranked the sources of long term

capital used by their firm.

75

Effects of Financial Leverage

Financial risk exists if the firms operations are financed using debt, that

is, when there is financial leverage

How much debt and equity does the firm have in its capital

structure?

Measured as the debt-to-equity or the debt-to-total-assets ratios

Effects of financial leverage?

Expected rate of return on equity increases

The variability of returns to shareholders also increases

Increasing leverage involves a trade-off between risk and return

Note that leverage varies both within and between industries

76

Effects of Financial Leverage

77

Key Concepts

Business risk is the variability of future net cash flows attributed to the

nature of the firms operations

Financial risk is the risk attributed to the use of debt as a source of

financing a firms operations

The level of financial leverage varies across firms in the same industry

as well as across firms in different industries

Modigliani and Millers proposition 1 states that the market value of a

firm is independent of its capital structure

78

Key Relationships/Formula Sheet

79

Capital Structure

80

Can a firm increase its value by choosing the right mix of debt and

equity (i.e., the right capital structure) to finance its operations?

Capital structures vary across firms, industries, and countries.

Is debt better than equity because it is cheaper?

Is equity better than debt because firms that borrow may go

bankrupt?

Capital Structure

81

1) More profitable firms tend to use less leverage.

2) High-growth firms borrow less than mature firms do.

3) Firms product market strategies and asset bases influence capital structure

choice.

4) Stock market generally views leverage-increasing events positively.

5) Tax deductibility of interest gives firms an incentive to use debt.

Evidence on Capital Structure

82

Theoretical Models of Capital Structure

Modigliani and Millers (M&M) capital structure model

The agency cost/tax shield trade-off model

The pecking order theory

The signaling model

83

MM and Market Imperfections

Modigliani and Millers original analysis ignores capital market

imperfections including

Corporate and personal taxes

Transaction costs

Costs associated with financial distress

Different cost of borrowing for firms and individuals

Changing cost of debt due to changing risk

Agency costs

We focus on the major market imperfections of taxes, financial

distress and agency costs

84

MM and Corporate Taxes

The value of the leveraged firm, V

L

now is

V

L

= V

U

+ PV (Tax shield)

V

L

= V

U

+ (t

c

D k

D

)/k

D

VL = V

U

+ t

c

D

Implication?

With the introduction of corporate taxes in the MM analysis the

existence of debt matters!

The natural conclusion is that firm should maximize the level of

debt in their capital structure as this will maximize the value of

the firm

Does this make sense (especially in the current market

environment)?

Whats missing from this analysis?

85

MM with Corporate and Personal Taxes

Corporate taxes is only part of the tax picture

The existence of personal taxes on interest income can reduce

the tax advantage associated with debt financing

Firms save on corporate taxes via the interest tax shield by

increasing the debt-to-equity ratio

However, investors will pay additional personal taxes and will

require higher rates of return to compensate them for this and for the

higher risk associated with debt

Under a classical tax system, the tax advantage of debt

at the firm level may be reduced or even eliminated at the

shareholder level!

86

MM and Other Market Imperfections

There are non-tax factors that can cause a firms value to depend

on its capital structure as well

Financial distress and bankruptcy costs

Agency costs

Financial distress is the state where a firm is in breach of its debt

obligations, which may not necessarily result in bankruptcy

Note also that the following analysis assumes a classical tax

system

87

MM and Other Market Imperfections

Direct costs of financial distress

Fees associated with advisors, lawyers, accountants, etc.

Indirect costs of financial distress - Financial distress leads a

range of stakeholders to behave in ways that can disrupt a firms

operations and reduce its value

Effect of lost sales

Reduced operating efficiency

Cost of managerial time devoted to averting failure

Indirect costs are typically much higher than the direct costs

The case of Enron

Direct costs estimated as high as $500 million

Indirect costs in terms of lost market value exceeded $25

billion!

88

Agency Costs of Capital Structure

Agency costs arise from the potential for conflicts of interest

between the parties forming the contractual relationships of the firm

Management may make decisions that transfer wealth from

debtholders to shareholders

The sources of potential conflict are

Dilution of claims

Dividend payout

Asset substitution

Underinvestment

89

Agency Costs of Capital Structure

Dilution of claims

A firm may issue new debt which ranks higher than existing

debt The claim of old debtholders on the firms assets now less

secure

New debtholders earn what theyre promised so theres a

wealth transfer from old debtholders to shareholders

Dividend payout

A firm may significantly increase its dividend payout which

decreases the firms assets and increases the riskiness of its

debt

Wealth transfer from debtholders to shareholders

90

Agency Costs of Capital Structure

Asset substitution

A firms incentive to undertake risky (and even negative NPV)

investments increases with the use of debt there is limited

ilability associated with equity

If risky investments are successful most of the benefits go to

shareholders

If risky investments fail most of the costs are borne by

debtholders

Undertaking such (negative NPV) investments will result in total

firm value falling, but the relative value of equity will rise and the

value of the debt will fall

Wealth transfer from debtholders to shareholders

91

Agency Costs of Capital Structure

Underinvestment

A firm may potentially reject low risk investments even if they are

positive NPV investments

With risky debt, it may not be in the interest of shareholders to

contribute additional capital to finance these new (positive NPV)

investments

Although the investments are profitable and will increase firm

value, shareholders may still lose because the risk of the debt will

fall and its value will increase

92

An Optimal Capital Structure

Incorporating the benefits and costs of debt, leads to the following

expression of the value of a leveraged firm

The present value of expected bankruptcy costs depends on the

probability of bankruptcy and present value of costs incurred if

bankruptcy occurs

The trade-off theory of capital structure

The possibility of a trade-off between the opposing effects of

the benefits of debt finance and the costs of financial distress

may imply that an optimal capital structure exists

Management should aim to maintain a target debt-equity ratio

93

Key Concepts

Modigliani and Millers proposition 2 states that the expected return

on equity of a leveraged firm increases in direct proportion to its debt-

to-equity ratio

With corporate taxes, the MM analysis shows that the higher the

level of debt the higher the firms value

Under the imputation tax system, introducing personal taxes may

result in a tax neutrality between debt and equity or even a bias

towards those shareholders whose personal tax rates are higher than

the corporate tax rate

Introducing bankruptcy costs and agency costs results in a

trade-off between the costs and benefits associated with debt

and an optimal capital structure

94

Key Relationships/Formula Sheet

95

the weighted average cost of capital

Estimate the weighted average cost of capital

Use the weighted average cost of capital in capital

budgeting

Examine the limitations of the weighted average cost of

capital

Weighted Average Cost of Capital

96

The Weighted Average Cost of Capital

The weighted average cost of capital (WACC or k

0

) is the

benchmark required rate of return used by a firm to evaluate its

investment opportunities

The discount rate used to evaluate projects of similar risk to

the firm

It takes into account how a firm finances its investments

How much debt versus equity does the firm employ?

The WACC depends on

Qualitative factors

The market values of the alternative sources of funds

The market costs associated with these sources of funds

97

Estimating the WACC

The main steps involved in the estimation of the WACC are

Identify the financing components

Estimate the current (or market) values of the financing

components

Estimate the cost of each financing component

Estimate the WACC

We will consider each step for typical financing components

98

Identify the Financing Components

Debt

Identify all externally supplied debt items

Do not include creditors and accruals as these costs are

already included in net cash flows

Ordinary shares

Obtain number of issued shares from the balance sheet

Do not include reserves and retained earnings

Preference shares

Obtain number of issued shares from the balance sheet

99

Valuing the Financing Components

Use market values and not book values

Value coupon paying debt using the following pricing relation

100

Valuing Long Term Debt

Example: BLD Ltd has 10,000 bonds outstanding and each bond

has a face value of $1,000 with two years remaining to maturity.

The bonds pay coupons (or interest) at a rate of 10% p.a. every

six months. If the market interest rate appropriate for the bond is

15% p.a., what is the current price of each bond? What is the total

market value of debt in BLD Ltds capital structure?

101

Valuing Long Term Debt

Coupon (or interest) payments are made every six months

Number of payments, n = 4, semi-annual payments

Annual interest payments = 0.10(1000) = $100.00

So, semi-annual interest payments = $50.00

Repayment of principal at the end of year 2 = $1000.00

Required return on debt, k

d

= 15% p.a.

So, semi-annual required return on debt, k

d

= 7.5%

102

Valuing Long Term Debt

The price of the bond is

P

0

= $916.27

So, total value of debt = 10000(916.27) = $9,162,700

Note: As the coupon rate is lower than the market rate, the

price is less than the face value, that is, the bond is selling at a

discount to face value

If the coupon rate is greater than the market rate,

the price would be at a premium to face value

103

Valuing Ordinary Shares

Example: ABC Ltd has 300,000 shares on issue which each have

a par value of $1.00. If the shares are currently trading at $3.50

each what is the total market value of ABCs ordinary shares?

There are 300,000 shares on issue with a market value of $3.50

per share

Market value of equity = 300000 3.50 = $1,050,000

The par (or book) value of shares is not relevant here

104

Valuing Preference Shares

Preference shares pay a fixed dividend at regular intervals

If the shares are non-redeemable, then the cash flows

represent a perpetuity and the market value can be computed

as

P

0

= D

p

/k

p

Where

P

0

= The current market price

D

p

= Value of the periodic dividend

k

p

= Required return on preference shares

105

Valuing Preference Shares

Example: Assume the preference shares of XYZ Ltd pay a

dividend of $0.40 p.a. and the cost of preference shares is 10%

p.a. What is the price of the preference shares? If XYZ Ltd has

500,000 preference shares outstanding, what is the market value

of these shares?

The cash flows from the preference shares are

D

p

= $0.40 per share

So, P

0

= 0.40/0.10 = $4.00

Market value of shares = 500000 4.00 = $2,000,000

106

Estimating the Costs of Capital

The costs of a firms financing instruments can be obtained as

follows

Use observable market rates - may need to be estimated

Use effective annual rates

For the cost of debt use the market yield

Focus here is on the costs of debt, ordinary shares and

preference shares

Note: We ignore the complications of flotation costs and

franking credits associated with dividends (sections 15.5.3 and

15.5.5 of the text)

107

Cost of Debt

Example: The bonds of ABD Ltd have a face value of $1,000 with

one year remaining to maturity. The bonds pay coupons at the rate

of 10 percent p.a. If the current market price of the bonds is

$1,018.50, what is the firms cost of debt?

The annual interest (coupon) paid on the debt is

1000 0.10 = $100

So, 1018.50 = (1000 + 100)/(1 + kd)

k

d

= (1100/1018.50) 1 = 8.0%

108

Cost of Ordinary Shares

It is common to use CAPM to estimate the cost of equity capital,

where the cost of equity is

Note that the equity beta is the estimate of the firms relative

risk compared to movements in the market portfolio

The market risk premium is typically estimated using

historical market data

The riskfree rate is typically based on the long term

government bond rate

109

Cost of Ordinary Shares

Example: Assume that the risk free rate is 6 percent, the expected

market risk premium is 8 percent and the equity beta of XYW Ltds

equity is 1.2. What is the firms cost of equity capital?

Using the CAPM, we have

Note: Can also use the dividend discount models covered in Lecture 4

(but not commonly used by managers)

110

Cost of Preference Shares

Recall that, P

0

= D

p

/k

p

Thus, k

p

= D

p

/P

0

Example: The preference shares of DBB Ltd pay a dividend of $0.50

p.a. If the preference shares are currently selling for $4.00 per share,

what is the cost of these shares to the firm?

The cost of preference shares is given as

k

p

= D

p

/P

0

So, k

p

= 0.50/4.00 = 12.5%

111

Weighted Average Cost of Capital

The weighted average cost of capital (ko) uses the cost of each

component of the firms capital structure and weights these according to

their relative market values

Assuming that only debt and equity are used, we have

112

Weighted Average Cost of Capital

Assuming that preference shares are used as well as debt and equity

Be careful of rounding errors in initial calculations

Be careful to work in consistent terms

Calculations in percentages versus decimals

Check your answers with some common sense logic

113

Taxes and the WACC

Under the classical tax system

Interest on debt is tax deductible

Dividends have no tax effect for the firm

The after-tax cost of debt, k'

d

= (1 t

c

) k

d

where t

c

corporate tax rate

The cost of equity (ke) is unaffected

The after-tax WACC is defined as

114

Calculating and Using the WACC

Example: You are given the following information for BCA Ltd. Note that

book values are obtained from the firms balance sheet while market

values are based on market data.

The firms marginal tax rate is 30%. Estimate the firms before-tax and

after-tax weighted average costs of capital

115

Calculating and Using the WACC

Before-tax weighted average cost of capital

WACC weights are based on market values so book values are not

relevant

Note: Weight in bonds, D/V = 50/150 = 0.333, and so on

Before-tax cost of capital = 11.47%

116

Calculating and Using the WACC

The after-tax cost of capital requires the after tax cost of debt

Note: Weight in bonds, D/V = 50/150 = 0.333, and so on

After-tax cost of capital = 10.67%

117

Calculating and Using the WACC

Example: Assume that a firm is financed by 60 percent equity, 10

percent preference shares and the remainder by debt. The

corporate tax rate is 30 percent. The costs of capital for debt,

preference and equity capital are 10 percent, 12 percent and 15

percent, respectively. What is the firms after-tax weighted

average cost of capital? If the firm is considering three

independent projects with IRRs of 10%, 12% and 14% which of

these projects should it accept?

118

Calculating and Using the WACC

The debt ratio is

D/V = 1 0.60 0.10 = 0.30

k

0

= [0.10 (1 0.30) 0.30] + (0.12 0.10) + (0.15 0.60)

k

0

= 12.3%

The firm should accept all projects with an IRR greater than the cost of

capital (why?)

Accept the project with an IRR of 14%

Reject the projects with IRRs of 10% and 12%

119

Calculating and Using the WACC

Example: ASL Ltd has a debt-to-equity ratio of 25%. The cost of debt is

8 percent and the corporate tax rate is 30 percent. If the after-tax

weighted average cost of capital is 20 percent, what is the firms cost of

equity?

The cost of equity can be obtained using the weighted average cost of

capital relationship

Note that were given a D/E ratio of 0.25

We need the D/V = D/(D + E) ratio

120

Calculating and Using the WACC

D/E = 0.25 implies

D = 0.25(E)

So, D/(D + E) = 0.25(E)/[0.25(E) + E] = 0.25(E)/1.25(E)

D/(D + E) = 0.20 and E/(D + E) = 1 0.20 = 0.80

The weighted average cost of capital is

k

0

= 0.20 = 0.08(1 0.30)(0.20) + k

e

(0.80)

So, k

e

= [0.20 0.08(1 0.30)(0.20)]/(0.80)

k

e

= 23.6%

121

Limitations on Using the WACC

Recall: The weighted average cost of capital is the discount rate

that is used to evaluate projects of similar risk to the firm

The WACC cannot be used in the following situations

If the project alters the operational (or business) risk of the

firm

If the project alters the financial risk of the firm by

dramatically altering its capital structure

Examples of risk altering projects?

What should the firm do if the WACC cannot be used?

122

Key Concepts

The weighted average cost of capital is the discount rate that is

used to evaluate projects of similar risk to the firm

There are four main steps involved in the estimation of the

weighted average cost of capital

Identify the financing instruments

Estimate the current (or market) values of the financing

components

Estimate the cost of each financing component

Estimate the weighted average cost of capital

The WACC cannot be used to evaluate projects that alter the

business or financial risks of the firm

123

Key Relationships/Formula Sheet

124

Dividend Fundamentals

Announcement

date

The day the firm announces the dividend,

dividend record, and payment dates

Date of record

All persons recorded as stockholders on

this date receive the declared dividend.

Relevant dates for dividend payments

Ex dividend date

The persons that buy the stock before ex

dividend date will receive the current

dividend.

Several business days before date of

record

125

Types of Dividends

Regular Cash Dividend

Special Cash Dividend

National Differences in payment Methods

Constant Payout Ratio Policy

Constant Nominal Payments (Standard

Worldwide)

Low Regular and Extra Dividend

Stock Dividend: Payment of a Dividend in the Form of

Stock

Stock Splits affect firms shares similarly to Stock

Dividends

Buying shares on the market

Tender Offer to Shareholders

Private Negotiation (Green Mail)

Cash Dividends

Types of Dividend Policies

Stock Dividends

and Stock Slits

Stock

Repurchases

126

Patterns In Dividend Policies Worldwide

Companies in common law countries have

higher payouts than those from civil law

countries.

US companies are now near global average

The same worldwide

Profitable firms in mature industries tend to

pay out much larger fractions of their earnings

Within industries, dividend payout tends to be directly related to asset

intensity and the presence of regulation.

Almost all firms maintain constant nominal dividend payments per share for

long periods of time.

Distinct national

patterns

Pronounced industry

patterns

127

Patterns Observed In Dividend Policies Worldwide

The stock market reacts positively to dividend increases and

negatively to decreases or cuts.

It is unclear how dividends affect the required return on a firm's

common stock.

Taxes influence dividend payouts, but the net effect is

ambiguous.

Firms paid dividends before and after income tax.

Empirical evidence shows that tax increases lead to higher

payouts, rather than lower.

128

Models Of Dividend Payments

Several competing theories are advanced to explain observed

patterns in dividend policies.

The Agency Cost /

Contracting Model

The Signaling Model

Mainstream favorite: the agency cost/contracting model

The signaling model of dividends: firms pay dividends to burn

money, separate from weaker rivals

129

The Agency Cost / Contracting Model Of Dividend

Payments

Dividends exist to overcome agency problems between

managers and shareholders.

Managers commit to paying out free cash flow as dividends.

Based on ownership structure: private and closely held firms

rarely pay dividends; big public firms have high payouts.

Based on investment opportunity set: mature firms have high

payout; high-growth firms have low payouts.

130

Dividends Increase Value

Market Imperfections and Clientele Effect

There are natural clients for high-payout stocks, but it does not

follow that any particular firm can benefit by increasing its

dividends. The high dividend clientele already have plenty of

high dividend stock to choose from.

These clients increase the price of the stock through their

demand for a dividend paying stock.

131

Dividends Increase Value

Dividends as Signals

Dividend increases send good news about cash flows and

earnings.

Dividend cuts send bad news.

Because a high dividend payout policy will be costly to firms that

do not have the cash flow to support it, dividend increases

signal a companys good fortune and its managers confidence

in future cash flows.

132

Dividends Decrease Value

Tax Consequences

Companies can convert dividends into capital gains by shifting

their dividend policies. If dividends are taxed more heavily

than capital gains, taxpaying investors should welcome such a

move and value the firm more favorably.

In such a tax environment, the total cash flow retained by the

firm and/or held by shareholders will be higher than if dividends

are paid.

133

Taxes and Dividend Policy

Since capital gains are taxed at a lower rate than dividend

income, companies should pay the lowest dividend possible.

Dividend policy should adjust to changes in the tax code.

134

Next session:

Financial Analysis

Financial performance

Financial Reporting Analysis

Balance sheet

Income statement

Cash flow statement

Ratio Analysis

Liquidity

Profitability

Debt

Performance

Cash Flow

Investment

135

Valuation

Concept

Scenarios

The financial Model

Assumptions underlying the financial Model

Risk

Risk Free Rate & Market risk Premium

Cost of Equity

Cost of Debt

Weighted average Cost of Capital

136

Intrinsic Valuation

Abnormal Earnings

Dividend Discount Model

Discounted Cash Flow Model

Black Scholes option Pricing Model

Relative Valuation

Trading Multiples

137

Dr Cesario Mateus

Senior Lecturer in Finance and Banking

Programme Leader Msc Financial Management

Email: c.mateus@greenwich.ac.uk

Skype ID: cmateus1

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Two 2 Page Quality ManualDocumento2 pagineTwo 2 Page Quality Manualtony sNessuna valutazione finora

- Black BookDocumento28 pagineBlack Bookshubham50% (2)

- Characteristics of Planetary Candidates Observed by Kepler, IIDocumento106 pagineCharacteristics of Planetary Candidates Observed by Kepler, IIRick FeedNessuna valutazione finora

- Seminar Report of Automatic Street Light: Presented byDocumento14 pagineSeminar Report of Automatic Street Light: Presented byTeri Maa Ki100% (2)

- Supply Chain Risk Management: Resilience and Business ContinuityDocumento27 pagineSupply Chain Risk Management: Resilience and Business ContinuityHope VillonNessuna valutazione finora

- Strength and Microscale Properties of Bamboo FiberDocumento14 pagineStrength and Microscale Properties of Bamboo FiberDm EerzaNessuna valutazione finora

- How To Attain Success Through The Strength of The Vibration of NumbersDocumento95 pagineHow To Attain Success Through The Strength of The Vibration of NumberszahkulNessuna valutazione finora

- A Perspective Study On Fly Ash-Lime-Gypsum Bricks and Hollow Blocks For Low Cost Housing DevelopmentDocumento7 pagineA Perspective Study On Fly Ash-Lime-Gypsum Bricks and Hollow Blocks For Low Cost Housing DevelopmentNadiah AUlia SalihiNessuna valutazione finora

- The April Fair in Seville: Word FormationDocumento2 pagineThe April Fair in Seville: Word FormationДархан МакыжанNessuna valutazione finora

- Erickson Transformer DesignDocumento23 pagineErickson Transformer DesigndonscogginNessuna valutazione finora

- Chapter03 - How To Retrieve Data From A Single TableDocumento35 pagineChapter03 - How To Retrieve Data From A Single TableGML KillNessuna valutazione finora

- Deshidratador Serie MDQDocumento4 pagineDeshidratador Serie MDQDAIRONessuna valutazione finora

- Database Management System and SQL CommandsDocumento3 pagineDatabase Management System and SQL Commandsdev guptaNessuna valutazione finora

- Software Testing Notes Prepared by Mrs. R. Swetha M.E Unit I - Introduction at The End of This Unit, The Student Will Be Able ToDocumento30 pagineSoftware Testing Notes Prepared by Mrs. R. Swetha M.E Unit I - Introduction at The End of This Unit, The Student Will Be Able ToKabilan NarashimhanNessuna valutazione finora

- 19-2 Clericis LaicosDocumento3 pagine19-2 Clericis LaicosC C Bờm BờmNessuna valutazione finora

- How Can You Achieve Safety and Profitability ?Documento32 pagineHow Can You Achieve Safety and Profitability ?Mohamed OmarNessuna valutazione finora

- Bell WorkDocumento26 pagineBell WorkChuột Cao CấpNessuna valutazione finora

- Module 5 - Multimedia Storage DevicesDocumento10 pagineModule 5 - Multimedia Storage Devicesjussan roaringNessuna valutazione finora

- The Website Design Partnership FranchiseDocumento5 pagineThe Website Design Partnership FranchiseCheryl MountainclearNessuna valutazione finora

- Financial StatementDocumento8 pagineFinancial StatementDarwin Dionisio ClementeNessuna valutazione finora

- Press Release - INTRODUCING THE NEW LAND ROVER DEFENDER PDFDocumento6 paginePress Release - INTRODUCING THE NEW LAND ROVER DEFENDER PDFJay ShahNessuna valutazione finora

- Learner Guide HDB Resale Procedure and Financial Plan - V2Documento0 pagineLearner Guide HDB Resale Procedure and Financial Plan - V2wangks1980Nessuna valutazione finora

- Usha Unit 1 GuideDocumento2 pagineUsha Unit 1 Guideapi-348847924Nessuna valutazione finora

- Atom Medical Usa Model 103 Infa Warmer I - 2 PDFDocumento7 pagineAtom Medical Usa Model 103 Infa Warmer I - 2 PDFLuqman BhanuNessuna valutazione finora

- Stainless Steel 1.4404 316lDocumento3 pagineStainless Steel 1.4404 316lDilipSinghNessuna valutazione finora

- RFM How To Automatically Segment Customers Using Purchase Data and A Few Lines of PythonDocumento8 pagineRFM How To Automatically Segment Customers Using Purchase Data and A Few Lines of PythonSteven MoietNessuna valutazione finora

- POM 3.2 Marketing Management IIDocumento37 paginePOM 3.2 Marketing Management IIDhiraj SharmaNessuna valutazione finora

- Alphacenter Utilities: Installation GuideDocumento24 pagineAlphacenter Utilities: Installation GuideJeffersoOnn JulcamanyanNessuna valutazione finora

- scx4521f SeriesDocumento173 paginescx4521f SeriesVuleticJovanNessuna valutazione finora

- Org ChartDocumento1 paginaOrg Chart2021-101781Nessuna valutazione finora