Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Philips 2008 Company Financial Statements

Caricato da

Ather RamzanDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Philips 2008 Company Financial Statements

Caricato da

Ather RamzanCopyright:

Formati disponibili

124 180 192 244

US GAAP financial statements Sustainability performance IFRS financial statements Company financial statements

Company financial

statements

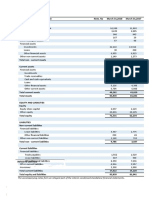

Balance sheets of Koninklijke Philips Electronics N.V. as of December 31

in millions of euros

20072) 2008

Assets

Current assets:

Cash and cash equivalents 7,519 2,675

A Receivables 17,149 1,356

24,668 4,031

Non-current assets:

B Investments in affiliated companies 17,095 17,957

C Other non-current financial assets 2,735 946

Property, plant and equipment 1 1

19,831 18,904

44,499 22,935

Liabilities and stockholders’ equity

Current liabilities:

D Other current liabilities 482 1,034

E Short-term debt 21,099 2,979

F Short-term provisions 5 −

21,586 4,013

Non-current liabilities:

G Long-term debt 1,123 3,311

F Long-term provisions 49 67

1,172 3,378

H Stockholders’ equity:

Preference shares, par value EUR 0.20 per share:

- Authorized: 2,000,000,000 shares (2007: 2,500,000,000 shares)

- Issued: none

Common shares, par value EUR 0.20 per share:

- Authorized: 2,000,000,000 shares (2007: 2,500,000,000 shares)

- Issued and fully paid: 972,411,769 shares (2007: 1,142,826,763 shares) 228 194

Capital in excess of par value − −

Legal reserve: revaluation 133 117

Legal reserve: available-for-sale securities 1,183 (25)

Legal reserve: cash flow hedges 28 (28)

Legal reserve: affiliated companies 1,343 985

Legal reserve: currency translation differences (613) (656)

Retained earnings 16,782 16,336

Net income (loss) 4,873 (91)1)

Treasury shares, at cost: 49,429,913 shares (2007: 77,933,509 shares) (2,216) (1,288)

21,741 15,544

44,499 22,935

1)

Prepared before appropriation of results. The net loss of 2008 will be accounted for in retained earnings. A distribution from retained earnings of EUR 0.70

per common share will be proposed to the Annual General Meeting of Shareholders.

2)

Prior-period amounts have been restated and revised; see Significant IFRS accounting policies, sections Change in accounting policy and Reclassifications

and revisions for more details.

244 Philips Annual Report 2008

250 254 262 266

Reconciliation of Corporate governance Ten-year overview Investor information

non-US GAAP information

Statements of income of Koninklijke Philips Electronics N.V. for the years ended December 31

in millions of euros

20071) 2008

Income (loss) after taxes from affiliated companies 999 (729)

Other income after taxes 3,874 638

Net income (loss) 4,873 (91)

1)

Prior-period amounts have been restated and revised; see Significant IFRS accounting policies, sections Change in accounting policy and Reclassifications

and revisions for more details.

Statement of changes in equity of Koninklijke Philips Electronics N.V.

in millions of euros unless otherwise stated

legal reserves

outstanding total

number of capital in available currency net treasury stock-

shares in common excess of for-sale cash flow affiliated translation retained income shares at holders’

thousands stock par value revaluation securities hedges companies differences earnings (loss) cost equity

Balance as of

January 1, 2008 1,064,893 228 − 133 1,183 28 1,343 (613) 15,546 4,655 (2,216) 20,287

Change in

accounting policy 1,270 226 1,496

Prior-period revisions (34) (8) (42)

Balance as of

January 1, 2008 - as

restated and revised1) 1,064,893 228 – 133 1,183 28 1,343 (613) 16,782 4,873 (2,216) 21,741

Net income (loss) (91) (91)

Release revaluation

reserve (16) 16 −

Net current

period change (269) (24) (358) (56) 3,201 (4,153) (1,659)

Income tax on net

current period change 18 5 406 429

Reclassification into

income (939) (50) 8 (981)

Dividend paid (720) (720)

Cancellation of

treasury shares (34) (4,062) 4,096 −

Purchase of treasury

stock (146,453) (3,298) (3,298)

Re-issuance of treasury

stock 4,542 (71) (7) 130 52

Share-based

compensation plans 106 106

Income tax share-based

compensation plans (35) (35)

Balance as of

December 31, 2008 922,982 194 − 117 (25) (28) 985 (656) 16,336 (91) (1,288) 15,544

1)

The balance as of January 1, 2008 has been restated and revised; see Significant IFRS accounting policies, sections Change in accounting policy and Reclassifications

and revisions for more details.

Philips Annual Report 2008 245

124 180 192 145

US GAAP financial statements Sustainability performance IFRS financial statements Company financial statements

- Introduction

- Notes to the Company financial statements

Introduction Notes to the Company financial statements

All amounts in millions of euros unless otherwise stated

Statutory financial statements

The chapters IFRS financial statements and Company financial

statements contain the statutory financial statements of Koninklijke A

Philips Electronics N.V. (the ‘Company’).

Receivables

Accounting policies applied

The financial statements of the Company included in this chapter 2007 2008

are prepared in accordance with Part 9 of Book 2 of the Dutch

Civil Code. Section 362 (8), Book 2, Dutch Civil Code, which allows

companies that apply IFRS as adopted by the European Union in their Trade accounts receivable 169 104

consolidated financial statements to use the same measurement

Affiliated companies 16,481 613

principles in their company financial statements. The Company has

prepared these Company financial statements using this provision. Other receivables 97 87

Advances and prepaid expenses 61 42

The accounting policies are described in the section Significant IFRS

accounting policies that begins on page 209 of this Annual Report. Deferred tax assets 65 32

Derivative instruments - assets 276 478

Subsidiaries are accounted for using the net equity value in these

Company financial statements. 17,149 1,356

Presentation of Company financial statements

The balance sheet presentation deviates from Dutch regulations and An amount of EUR 45 million included in receivables is due after one

is more in line with common practice in the US in order to achieve year (2007: EUR 65 million).

optimal transparency for Dutch and US shareholders.

Until June 2008, cash transactions with US-based group companies

Under this format, the order of presentation of assets and liabilities is were executed through Koninklijke Philips Electronics N.V. (KPENV),

based on the decreasing degree of liquidity, which is common practice which resulted in significant individual short-term intercompany

in the US. receivables and payables. As from that date, and in line with the

standard practice in other countries, these intercompany receivables

The income statement has been prepared in accordance with and payables are periodically cleared via Philips Electronics North

Section 2:402 of the Dutch Civil Code, which allows a simplified America Corporation, a subsidiary of KPENV. Consequently, the

income statement in the Company financial statements in the event intercompany receivables stated under ‘Affiliated companies’ are

a comprehensive income statement is included in the significantly lower compared to previous years.

consolidated statements.

B

Additional information

Investments in affiliated companies

For ‘Additional information’ within the meaning of Section 2:392 of the

Dutch Civil Code, please refer to the Auditor’s report on page 243, The investments in affiliated companies are included in the balance

the Auditor’s report on page 249 and the section Proposed distribution sheet based on either their net asset value in accordance with the

to shareholders on page 68 of this Annual Report. aforementioned accounting principles of the consolidated financial

statements, or at amortized cost.

equity

investments loans total

Balance as of

January 1, 20081) 16,089 1,006 17,095

Changes:

Transferred to other

non-current financial assets (1,524) − (1,524)

Acquisitions/additions 2,453 4,140 6,593

Sales/redemptions (189) (151) (340)

After-tax income (loss)

from affiliated companies (729) − (729)

Dividends received (2,216) − (2,216)

Translation differences (161) 234 73

Other (995) − (995)

Balance as of

December 31, 2008 12,728 5,229 17,957

1)

The balance as of January 1, 2008 has been restated and revised; see

Significant IFRS accounting policies, sections Change in accounting policy

and Reclassifications and revisions for more details.

246 Philips Annual Report 2008

250 254 262 266

Reconciliation of Corporate governance Ten-year overview Investor information

non-US GAAP information

A list of subsidiaries and affiliated companies, prepared in accordance E

with the relevant legal requirements (Dutch Civil Code, Book 2,

Short-term debt A

Sections 379 and 414), is deposited at the office of the Commercial

Register in Eindhoven, Netherlands. Short-term debt includes the current portion of outstanding long-term

B

debt of EUR 126 million (2007: EUR 1,840 million) and debt to other

The transfer to Other non-current financial assets mainly relates group companies totaling EUR 2,792 million (2007: EUR 19,193

C

to the financial interest in LG Display. At the end of February 2008, million). Institutional financing amounts to EUR 61 million (2007:

Philips’ influence on LG Display’s operating and financial policies EUR 66 million).

D

including representation on the LG Display board, was reduced.

Consequently, the 19.9% investment in LG Display was transferred Debt to other group companies is significantly lower compared to

E

from Investments in affiliated companies to Other non-current financial previous years as a result of the adoption of a new practice to clear

assets effective March 1, 2008, as Philips was no longer able to exercise cash transactions with US-based subsidiaries (see note A for a further

F

significant influence. Philips ceased to apply equity accounting for its explanation).

LG Display shares as of that date.

F

The line Acquisitions/additions especially reflects the impact of equity

Provisions

injections and intercompany funding provided by the Company to

US-based group companies. These transactions enabled the group

companies to finance the three major acquisitions in 2008 (Genlyte 2007 2008

group Inc., Respironics Inc. and VISICU Inc.).

The line Other especially reflects actuarial gains and losses related Pensions 5 −

to defined-benefit plans of group companies.

Deferred tax liabilities 37 48

C Other 12 19

Other non-current financial assets Total provisions 54 67

of which long-term 49 67

other

of which short-term 5 −

investments receivables total

Balance as of

January 1, 2008 2,730 5 2,735

Changes:

Transferred from

Investments in affiliated

companies 1,524 − 1,524

Acquisitions/additions 79 50 129

Sales/redemptions (2,515) − (2,515)

Value adjustments/

impairments (925) (2) (927)

Balance as of

December 31, 2008 893 53 946

Other non-current financial assets include available-for-sale securities

and cost method investments that generate income unrelated to the

normal business operations.

The transfer from investments in affiliated companies mainly relates

to the interest in LG Display (see note B).

Sales/redemptions reflect the reduction of Philips’ interest in TSMC,

LG Display and D&M Holdings.

Value adjustments/impairments mainly relate to the interests in

LG Display, TPO Displays, Pace Micro Technology and NXP.

D

Other current liabilities

2007 2008

Income tax payable 25 12

Other short-term liabilities 85 107

Deferred income and accrued expenses 227 209

Derivative instruments – liabilities 145 706

482 1,034

Philips Annual Report 2008 247

124 180 192 145

US GAAP financial statements Sustainability performance IFRS financial statements Company financial statements

- Notes to the Company financial statements

- Auditor’s report

G

Long-term debt

Long-term debt and short-term-debt are uncollateralized.

average

remaining amount

(range of) average amount due in due after due after term out-standing

interest rates interest rate outstanding 1 year 1 year 5 years (in years) 2007

Eurobonds 6.1% 6.1% 750 − 750 − 2.4 2,442

USD bonds 3.3-7.8% 5.9% 2,547 − 2,547 1,841 14.0 357

Convertible debentures 1.7% 1.7% 81 72 9 − 2.6 103

Intercompany financing 2.2-4.9% 3.0% 718 718 − − − 2,161

Other long-term debt 4.7-16.4% 5.9% 59 54 5 − 1.4 61

4,155 844 3,311 1,841 5,124

Corresponding data

previous year 5,124 4,001 1,123 357 4,769

The following amounts of the long-term debt as of December 31, Any difference between the cost and the cash received at the time

2008, are due in the next five years: treasury shares are issued, is recorded in capital in excess of par

value, except in the situation in which the cash received is lower

than cost, and capital in excess of par has been depleted.

2009 844

2010 8 In order to reduce potential dilution effects, the following

transactions took place:

2011 1,001

2012 3

2007 2008

2013 458

2,314

Shares acquired 27,326,969 273

Corresponding amount previous year 4,767

Average market

price EUR 29.65 EUR 24.61

Convertible debentures include Philips personnel debentures.

Amount paid EUR 810 million −

For more information, please refer to note 58 and note 59.

Shares delivered 11,140,884 4,541,969

H

Average market

Stockholders’ equity price EUR 30.46 EUR 23.44

Common shares Amount received EUR 199 million EUR 52 million

In 2008, the Company’s issued share capital was reduced by

Total shares in

170,414,994 shares, which were acquired pursuant to the EUR 5 billion

treasury at year-end 52,119,611 47,577,915

share repurchase program. As of December 31, 2008, the issued share

capital consists of 972,411,769 common shares, each share having Total cost EUR 1,393 million EUR 1,263 million

a par value of EUR 0.20, which shares have been paid-in in full.

Preference shares In order to reduce capital stock, the following transactions took

The ‘Stichting Preferente Aandelen Philips’ has been granted the right place in 2007 and 2008:

to acquire preference shares in the Company. Such right has not been

exercised. As a means to protect the Company and its stakeholders

2007 2008

against an unsolicited attempt to (de facto) take over control of the

Company, the General Meeting of Shareholders in 1989 adopted

amendments to the Company’s articles of association that allow the

Shares acquired 25,813,898 146,453,094

Board of Management and the Supervisory Board to issue (rights to

acquire) preference shares to a third party. As of December 31, 2008, Average market

no preference shares have been issued. price EUR 31.87 EUR 22.52

Amount paid EUR 823 million EUR 3,298 million

Option rights/restricted shares

The Company has granted stock options on its common shares Reduction of capital

and rights to receive common shares in the future. Please refer stock − 170,414,994

to note 33, which is deemed incorporated and repeated herein

Total shares in

by reference.

treasury at year-end 25,813,898 1,851,998

Treasury shares Total cost EUR 823 million EUR 25 million

In connection with the Company’s share repurchase programs, shares

which have been repurchased and are held in treasury for (i) delivery

upon exercise of options and convertible personnel debentures and Net income (loss) and distribution to shareholders

under, restricted share programs and employee share purchase The net loss of 2008 will be accounted for in retained earnings.

programs, and (ii) capital reduction purposes are accounted for as A distribution of EUR 0.70 per common share will be proposed

a reduction of stockholders’ equity. Treasury shares are recorded at to the 2009 Annual General Meeting of Shareholders.

cost, representing the market price on the acquisition date. When

issued, shares are removed from treasury stock on a FIFO basis.

248 Philips Annual Report 2008

250 254 262 266

Reconciliation of Corporate governance Ten-year overview Investor information

non-US GAAP information

Legal reserves Auditor’s report

As of December 31, 2008, legal reserves relate to the revaluation of

assets and liabilities of acquired companies in the context of multi-stage

acquisitions of EUR 117 million (2007: EUR 133 million), unrealized To the Supervisory Board and Shareholders of Koninklijke Philips

losses on available-for-sale securities of EUR 25 million (2007: gains of Electronics N.V.:

EUR 1,183 million), unrealized losses on cash flow hedges of

EUR 28 million (2007: gains of EUR 28 million), ‘affiliated companies’ of Report on the Company financial statements

EUR 985 million (2007: EUR 1,343 million) and currency translation We have audited the accompanying Company financial statements

losses of EUR 656 million (2007: losses of EUR 613 million). 2008 which are part of the financial statements 2008 of Koninklijke

Philips Electronics N.V., Eindhoven, the Netherlands, which comprise

The movement in unrealized results on available-for-sales securities the balance sheet as at December 31, 2008, statement of income and

are especially due to the sale of shares (TSMC and LG Display) and the statement of changes in equity for the year then ended, and the

the recognition of impairment charges (see note 48). The item notes as set out on page 244 to 249.

‘affiliated companies’ relates to the ‘wettelijke reserve deelnemingen’,

G

which is required by Dutch law. Management’s responsibility

The Board of Management is responsible for the preparation and

H

Limitations in the distribution of stockholders’ equity fair presentation of the Company financial statements and for the

Pursuant to Dutch law, limitations exist relating to the distribution of preparation of the Management report, both in accordance with

I

stockholders’ equity of EUR 1,296 million (2007: EUR 2,915 million). Part 9 of Book 2 of the Dutch Civil Code. This responsibility includes:

At December 31, 2008, such limitations relate to common stock of designing, implementing and maintaining internal control relevant

J

EUR 194 million (2007: EUR 228 million) as well as to legal reserves to the preparation and fair presentation of the Company financial

included under ‘affiliated companies’ of EUR 985 million (2007: statements that are free from material misstatement, whether due

K

EUR 1,343 million) and ‘revaluation’ of EUR 117 million (2007: to fraud or error; selecting and applying appropriate accounting

EUR 1,344 million). policies; and making accounting estimates that are reasonable in

L

the circumstances.

In general, gains related to available-for-sale securities, cash flow

M

hedges and currency translation differences reduce the distributable Auditor’s responsibility

stockholders’ equity. By their nature, losses relating to available-for- Our responsibility is to express an opinion on the Company financial

sale securities, cash flow hedges and currency translation differences statements based on our audit. We conducted our audit in accordance

automatically reduce stockholders’ equity, and thereby distributable with Dutch law. This law requires that we comply with ethical

amounts. requirements and plan and perform the audit to obtain reasonable

assurance whether the Company financial statements are free from

I material misstatement.

Net income

An audit involves performing procedures to obtain audit evidence

Net income in 2008 amounted to a loss of EUR 91 million about the amounts and disclosures in the Company financial statements.

(2007: a profit of EUR 4,873 million). The procedures selected depend on the auditor’s judgment, including

the assessment of the risks of material misstatement of the Company

J financial statements, whether due to fraud or error. In making those

risk assessments, the auditor considers internal control relevant to

Employees

the entity’s preparation and fair presentation of the Company financial

The number of persons employed by the Company at year-end 2008 statements in order to design audit procedures that are appropriate

was 11 (2007: 13) and included the members of the Board of in the circumstances, but not for the purpose of expressing an opinion

Management and most members of the Group Management Committee. on the effectiveness of the entity’s internal control. An audit also

includes evaluating the appropriateness of accounting policies used

For the remuneration of past and present members of both the Board and the reasonableness of accounting estimates made by management,

of Management and the Supervisory Board, please refer to note 34, as well as evaluating the overall presentation of the Company

which is deemed incorporated and repeated herein by reference. financial statements.

K We believe that the audit evidence we have obtained is sufficient

and appropriate to provide a basis for our audit opinion.

Obligations not appearing in the balance sheet

General guarantees as referred to in Section 403, Book 2, of the Opinion

Dutch Civil Code, have been given by the Company on behalf of In our opinion, the Company financial statements give a true and fair

several group companies in the Netherlands. The liabilities of these view of the financial position of Koninklijke Philips Electronics N.V.

companies to third parties and equity-accounted investees totaled as at December 31, 2008, and of its result for the year then ended

EUR 1,249 million as of year-end 2008 (2007: EUR 1,232 million). in accordance with Part 9 of Book 2 of the Dutch Civil Code.

Guarantees totaling EUR 266 million (2007: EUR 256 million) have

also been given on behalf of other group companies, and guarantees Report on other legal and regulatory requirements

totaling EUR 42 million (2007: EUR 44 million) on behalf of Pursuant to the legal requirement under 2:393 sub 5 part f of the

unconsolidated companies and third parties. The Company is the Dutch Civil Code, we report, to the extent of our competence, that

head of a fiscal unity that contains the most significant Dutch the Management report as set out on page 192 to 197, is consistent

wholly-owned group companies. The company is therefore jointly with the Company financial statements as required by 2:391 sub 4

and severally liable for the tax liabilities of the tax entity as a whole. of the Dutch Civil Code.

For additional information, please refer to note 62.

Amsterdam, February 23, 2009

L

KPMG Accountants N.V.

Audit fees

For a summary of the audit fees, please refer to the Report of the M.A. Soeting RA

Supervisory Board, table ‘Aggregated fees KPMG’ in the section

‘Report of Audit Committee’.

M

Subsequent events

On January 26, 2009, the Company announced that it had stopped

the EUR 5 billion share repurchase program, which was announced

on December 19, 2007, until further notice.

February 23, 2009

The Supervisory Board

The Board of Management

Philips Annual Report 2008 249

Potrebbero piacerti anche

- The Buffettology WorkbookDocumento6 pagineThe Buffettology WorkbookSimon and Schuster25% (4)

- Case Thompson DataDocumento108 pagineCase Thompson DataRupesh JainNessuna valutazione finora

- Range WS NR4 NR5 NR7: Toby Crabel's Day Trading Price PatternsDocumento5 pagineRange WS NR4 NR5 NR7: Toby Crabel's Day Trading Price Patternsanon-98189100% (11)

- Multibagger StudiesDocumento47 pagineMultibagger StudiesRam0% (1)

- Cost of CapitalDocumento4 pagineCost of Capitalkomal mishraNessuna valutazione finora

- Strategic Analysis and Action 8th Edition Crossan Test BankDocumento25 pagineStrategic Analysis and Action 8th Edition Crossan Test BankMarioAbbottojqd100% (48)

- Intermarket Analysis Cheat SheetDocumento1 paginaIntermarket Analysis Cheat SheetrexNessuna valutazione finora

- Equity Valuation: Models from Leading Investment BanksDa EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNessuna valutazione finora

- Forex Volume IndicatorDocumento6 pagineForex Volume IndicatorfaridNessuna valutazione finora

- Dividend Policy at FPLDocumento24 pagineDividend Policy at FPLKinnari PandyaNessuna valutazione finora

- HD Consolidated Financials PDFDocumento6 pagineHD Consolidated Financials PDFDWNessuna valutazione finora

- Financial Report 30 09 2019 ENDocumento38 pagineFinancial Report 30 09 2019 ENVenture ConsultancyNessuna valutazione finora

- 6 Supplementary Accounting StatementDocumento11 pagine6 Supplementary Accounting StatementNithinMannepalliNessuna valutazione finora

- Royal Dutch Shell PLC Annual Report and Form 20-F 2018: Consolidated Balance SheetDocumento1 paginaRoyal Dutch Shell PLC Annual Report and Form 20-F 2018: Consolidated Balance SheetSonia CrystalNessuna valutazione finora

- Digi Malay Co SofpDocumento1 paginaDigi Malay Co SofpCherry BlasoomNessuna valutazione finora

- FA AssignmentDocumento21 pagineFA AssignmentMuzammil khanNessuna valutazione finora

- Balance Sheet VW Ar18Documento1 paginaBalance Sheet VW Ar18Sneha SinghNessuna valutazione finora

- Shell PLC Annual Report and Accounts 2021: AssetsDocumento1 paginaShell PLC Annual Report and Accounts 2021: AssetsSonia CrystalNessuna valutazione finora

- Annual Financial Statements of Volkswagen AG As of December 31, 2022Documento307 pagineAnnual Financial Statements of Volkswagen AG As of December 31, 2022Karen NinaNessuna valutazione finora

- Particulars 2Documento2 pagineParticulars 2AshwinNessuna valutazione finora

- Telkom - FS TW I 2023 Eng - RilisDocumento113 pagineTelkom - FS TW I 2023 Eng - RilisSyafrizal ThaherNessuna valutazione finora

- Consolidated Balance Sheet As at June 30, 2021: AssetsDocumento2 pagineConsolidated Balance Sheet As at June 30, 2021: Assetsshannia dcostaNessuna valutazione finora

- Chapter 3 108-117Documento10 pagineChapter 3 108-117Leony SantikaNessuna valutazione finora

- 2022 Full Year Balance SheetDocumento2 pagine2022 Full Year Balance Sheetmathewalina225Nessuna valutazione finora

- Balance Sheet For The Year Ended March 31, 2021Documento45 pagineBalance Sheet For The Year Ended March 31, 2021parika khannaNessuna valutazione finora

- Cash Flow Questions RucuDocumento5 pagineCash Flow Questions RucuWalton Jr Kobe TZNessuna valutazione finora

- Sample 10KDocumento29 pagineSample 10KabhishekNessuna valutazione finora

- Bitfarms Q4 2021 FS FinalDocumento46 pagineBitfarms Q4 2021 FS FinalAlexandru IonescuNessuna valutazione finora

- Balance Sheet For The Year Ended March 31, 2021Documento43 pagineBalance Sheet For The Year Ended March 31, 2021parika khannaNessuna valutazione finora

- RTH Financial Statements Interim 2020 - FinalDocumento15 pagineRTH Financial Statements Interim 2020 - FinalPali GallNessuna valutazione finora

- BS 2018Documento1 paginaBS 2018Maanvee JaiswalNessuna valutazione finora

- Consolidated Balance SheetDocumento1 paginaConsolidated Balance SheetSukhmanNessuna valutazione finora

- Ifrs Consolidated Financials q3 Fy22Documento37 pagineIfrs Consolidated Financials q3 Fy22Bharath Gowda VNessuna valutazione finora

- PIOCORE 2022 - ThousandDocumento7 paginePIOCORE 2022 - ThousandAbhishek RaiNessuna valutazione finora

- Consolidated Balance Sheet: December 31, 2022 2021 (In Millions, Except Per Share Data)Documento2 pagineConsolidated Balance Sheet: December 31, 2022 2021 (In Millions, Except Per Share Data)Maanvee JaiswalNessuna valutazione finora

- Unaudited Condensed Consolidated Financial ReportsDocumento33 pagineUnaudited Condensed Consolidated Financial ReportsinforumdocsNessuna valutazione finora

- Disclosure No. 507 2019 Audited Financial Statements As of December 31 2018 PDFDocumento159 pagineDisclosure No. 507 2019 Audited Financial Statements As of December 31 2018 PDFJopel BasNessuna valutazione finora

- Financial Analysis Hewlett Packard Corporation 2007Documento24 pagineFinancial Analysis Hewlett Packard Corporation 2007SAMNessuna valutazione finora

- Consol FY16 Year FinstatementDocumento38 pagineConsol FY16 Year Finstatementtaranjeet.17024Nessuna valutazione finora

- Contentdamnexuseninvestorquarterly Results2020 2021q4fy21consolidated Financial Statement q4 Fy21Documento33 pagineContentdamnexuseninvestorquarterly Results2020 2021q4fy21consolidated Financial Statement q4 Fy21Prasad RohitNessuna valutazione finora

- Adidas - Financial Statements With NotesDocumento104 pagineAdidas - Financial Statements With NotesJammie ObenitaNessuna valutazione finora

- Supplementary Accounting Statement ECPLDocumento15 pagineSupplementary Accounting Statement ECPLdeepNessuna valutazione finora

- Tenant Management Organisation: Balance SheetDocumento11 pagineTenant Management Organisation: Balance SheetTonyHatNessuna valutazione finora

- Annual Report of INFOSYS LimitedDocumento16 pagineAnnual Report of INFOSYS LimitedAman SinghNessuna valutazione finora

- Investor Relations Annual Report 2022 LRholdingDocumento15 pagineInvestor Relations Annual Report 2022 LRholdingkristina backaNessuna valutazione finora

- Cons Financial Statements Adidas Ar22Documento10 pagineCons Financial Statements Adidas Ar22Mónica Jaramillo GonzálezNessuna valutazione finora

- DTCC Annual Financial Statements 2020 and 2019Documento51 pagineDTCC Annual Financial Statements 2020 and 2019EvgeniyNessuna valutazione finora

- Annual Financial Statements 2020 WebDocumento42 pagineAnnual Financial Statements 2020 WebNiyati TiwariNessuna valutazione finora

- tcs-22 PNL - RotatedDocumento3 paginetcs-22 PNL - RotateduefqyaufdQNessuna valutazione finora

- Ifrs Consolidated Financials q4 Fy22Documento35 pagineIfrs Consolidated Financials q4 Fy22Midhun ManoharNessuna valutazione finora

- Cfs Balance Sheet VW Ar22Documento2 pagineCfs Balance Sheet VW Ar22alvaro.dwiandika123Nessuna valutazione finora

- Pakistan Refinery Limited (Annual Report 2008)Documento84 paginePakistan Refinery Limited (Annual Report 2008)Monis Ali100% (1)

- T Systems (Report)Documento219 pagineT Systems (Report)Prachi SaklaniNessuna valutazione finora

- Extracted Pages From PVR Ltd. - 19Documento1 paginaExtracted Pages From PVR Ltd. - 19jadgugNessuna valutazione finora

- Assets: PAYNET, Inc. Consolidated Balance SheetsDocumento3 pagineAssets: PAYNET, Inc. Consolidated Balance Sheetschemicalchouhan9303Nessuna valutazione finora

- CompleteDocumento17 pagineCompletesanket patilNessuna valutazione finora

- 20 03 12 Financial Statements of RWE AG 2019Documento66 pagine20 03 12 Financial Statements of RWE AG 2019HoangNessuna valutazione finora

- 001 Apple-Quarterly-Balance-Sheet-1Documento1 pagina001 Apple-Quarterly-Balance-Sheet-1hullegulkadNessuna valutazione finora

- Extracted Pages From PVR LTD - 20Documento6 pagineExtracted Pages From PVR LTD - 20jadgugNessuna valutazione finora

- Cadbury Schweppes DF 2006Documento1 paginaCadbury Schweppes DF 2006JORGENessuna valutazione finora

- Tesla Inc Financial Statements (Extract)Documento10 pagineTesla Inc Financial Statements (Extract)Abhishek BatraNessuna valutazione finora

- Wipro Limited and SubsidiariesDocumento34 pagineWipro Limited and SubsidiariesLyca SorianoNessuna valutazione finora

- Rado Financials FY 21-22Documento29 pagineRado Financials FY 21-22ഗോക്Nessuna valutazione finora

- Paul R. Castro ACIEM - CastoDocumento51 paginePaul R. Castro ACIEM - CastoJhon NarvaezNessuna valutazione finora

- Consolidated Statement of Comprehensive Income: For The Year Ended 31 DecemberDocumento5 pagineConsolidated Statement of Comprehensive Income: For The Year Ended 31 DecemberVajri Varun GuturuNessuna valutazione finora

- Dec 22 Management ConsolidatedDocumento23 pagineDec 22 Management ConsolidatedKhalid KhanNessuna valutazione finora

- Expressed in Canadian Dollars ($ CAD), Unaudited: Digital Bull Technologies LTDDocumento5 pagineExpressed in Canadian Dollars ($ CAD), Unaudited: Digital Bull Technologies LTDDishant KhanejaNessuna valutazione finora

- Zomato Annual Report 2022 1659701415938Documento5 pagineZomato Annual Report 2022 1659701415938Mahak SarawagiNessuna valutazione finora

- Aspen Colombiana Sas (Colombia) : SourceDocumento5 pagineAspen Colombiana Sas (Colombia) : SourceCatalina Echeverry AldanaNessuna valutazione finora

- A. Declaration, Record, Payment: The Correct Answer Is "A". Your Choice of "B" Was IncorrectDocumento5 pagineA. Declaration, Record, Payment: The Correct Answer Is "A". Your Choice of "B" Was IncorrectJere Mae MarananNessuna valutazione finora

- Iqmethod ValuationDocumento48 pagineIqmethod ValuationAkash VaidNessuna valutazione finora

- The Resolution Trust CorporationDocumento5 pagineThe Resolution Trust Corporationjakobks13Nessuna valutazione finora

- Comm 308 Final Exam (Winter 2015)Documento18 pagineComm 308 Final Exam (Winter 2015)Mike TremblayNessuna valutazione finora

- HSC Commerce March 2018 Board Question Paper SPDocumento2 pagineHSC Commerce March 2018 Board Question Paper SPRaj Mishra0% (2)

- SEC RulesDocumento316 pagineSEC RulesravisseNessuna valutazione finora

- Lecture 9 - Pricing - Understanding and Capturing Customer ValueDocumento22 pagineLecture 9 - Pricing - Understanding and Capturing Customer ValueBridivaNessuna valutazione finora

- Mutual Fund in NepalDocumento6 pagineMutual Fund in NepalBitaran Jang Maden100% (1)

- Study of Performance & Correlation of EURUSD With The Cross Currency Pairs of EuroDocumento74 pagineStudy of Performance & Correlation of EURUSD With The Cross Currency Pairs of EuroSuneesh Lazar0% (1)

- Tutorial 1 Bond ValuationDocumento2 pagineTutorial 1 Bond Valuationtai kianhongNessuna valutazione finora

- N130 NIKUNJ PACHISIA. (Phone: 40077000) (Mobile No.: 9820085300)Documento12 pagineN130 NIKUNJ PACHISIA. (Phone: 40077000) (Mobile No.: 9820085300)sandip joshiNessuna valutazione finora

- What Are NFT StocksDocumento9 pagineWhat Are NFT StocksWeb3oclockNessuna valutazione finora

- Summer Project at Jainam.Documento143 pagineSummer Project at Jainam.Soyeb JindaniNessuna valutazione finora

- Behavioral Finance and The Psychology of Investing: Mcgraw-Hill/IrwinDocumento54 pagineBehavioral Finance and The Psychology of Investing: Mcgraw-Hill/IrwinNINDI VAULIANessuna valutazione finora

- Chapter 15 (Equity Portfolio Management Strategies)Documento24 pagineChapter 15 (Equity Portfolio Management Strategies)Abuzafar Abdullah100% (1)

- Planetnewbie Digital Art: Turn It Around Violently (Taking Your Stoplosses Out in The Process)Documento8 paginePlanetnewbie Digital Art: Turn It Around Violently (Taking Your Stoplosses Out in The Process)indra_f04Nessuna valutazione finora

- Chapter 3 Solution ManualDocumento14 pagineChapter 3 Solution ManualAhmed FathelbabNessuna valutazione finora

- FINA3303 Lecture 4 Post PDFDocumento26 pagineFINA3303 Lecture 4 Post PDFTsui KelvinNessuna valutazione finora

- Chapter 4 LopezDocumento4 pagineChapter 4 LopezMarivic VNessuna valutazione finora

- Classification of MarketDocumento15 pagineClassification of MarketAgrimaNessuna valutazione finora

- Robert Prechter Is Awaiting A DepressionDocumento6 pagineRobert Prechter Is Awaiting A Depressionabcd1234Nessuna valutazione finora