Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Empowerment of Women Through Micro Finance

Caricato da

SumitasDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Empowerment of Women Through Micro Finance

Caricato da

SumitasCopyright:

Formati disponibili

EMPOWERMENT OF WOMEN THROUGH MICRO FINANCE: A BOON FOR DEVELOPMENT OF

ECONOMY

DR. SHEFALI VERMA THAKRAL

DESK EDITOR, M. M. UNIVERSITY JOURNAL OF MANAGEMENT PRACTICES (ISSN 0974

7257) ASSOCIATE PROFESSOR MAHARISHI MARKANDESHWAR UNIVERSITY

MULLANA – 133 203

MS. NITIMA UPPAL

LECTURER M.M. INSTITUTE OF

MANAGEMENT MAHARISHI

MARKANDESHWAR UNIVERSITY

MULLANA – 133 203

MS. ESHA CHAWLA

LECTURER M.M. INSTITUTE OF

MANAGEMENT MAHARISHI

MARKANDESHWAR UNIVERSITY

MULLANA – 133 203

ABSTRACT

There is growing interest in microfinance as one of the avenues to enable low income population to access financial services. India with a

population of around 300 million poor people has emerged as a large potential opportunity for the microfinance sector. With only 48% of the

population accessing financial services, expanding the microfinance sector is also important from the perspective of financial inclusion (World

Bank, 2008). Since 2004, the Reserve Bank of India (RBI) has emphasised financial inclusion as an important goal. Microfinance is emerging as a

powerful instrument for poverty alleviation in the new economy. In India, Microfinance scene is dominated by Self Help Group (SHGs)‐Bank

Linkage Programme as a cost effective mechanism for providing financial services to the “Unreached Poor” which has been successful not only in

meeting financial needs of the rural poor women but also strengthen collective self help capacities of the poor ,leading to their empowerment.

Rapid progress in SHG formation has now turned into an empowerment movement among women across the country. Empowerment is the

state of feelings of self‐empowered to take control of one’s own destiny. Empowering women puts the spotlight on education and employment

which are an essential element to sustainable development. The paper looks at the impact of Micro finance with respect to poverty alleviation

and socioeconomic empowerment of rural women. An effort is also made to suggest the ways to increase women empowerment.

KEYWORDS

women empowerment, poverty, rural women, microfinance.

INTRODUCTION

Micro‐finance refers to small savings, credit and insurance services extended to socially and economically disadvantaged segments of society. In

the Indian context terms like "small and marginal farmers", " rural artisans" and "economically weaker sections" have been used to broadly

define micro‐finance customers. The recent Task Force on Micro Finance has defined it as "provision of thrift, credit and other financial services

and products of very small amounts to the poor in rural, semi urban or urban areas, for enabling them to raise their income levels and improve

living standards". At present, a large part of micro finance activity is confined to credit only. Women constitute a vast majority of users of micro‐

credit and savings services. In the NSSO survey it has also been estimated that a large percentage of rural women in the age group of 15 years

and above, who are usually engaged in household work, are willing to accept work at household premises (29.3 percent), in activities such as

dairy (9.5 percent), poultry (3 percent), cattle rearing, spinning and weaving (3.4 percent), tailoring (6.1 percent) and manufacturing of wood

and cane products etc. Amongst the women surveyed, 27.5 percent rural women were seeking regular full‐time work, and 65.3 percent were

seeking part‐time work. To start or to carry on such work, 53.6 percent women wanted initial finance on easy terms, and 22.2 percent wanted

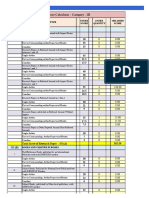

working capital facilities, as can be seen from the table below:

Assistance Required (by women marginal workers seeking Percent of Women

or available for work at their household premises). Seeking Assistance

No assistance 2.1

India

Some

SUPPLY isprogrammes

theOF country have

where

MICRO‐FINANCE developed

a collaborative

effective

SERVICESmodel

methodologies

between banks, for poverty

NGOs, MFIstargeting

and Women’s

and/or operating

organizations

in remoteis furthest

areas. advanced.

Such strategies

It therefore

have

recently

serves asbecome

a good starting

a focus of

point

interest

to lookfromat what

some we

donors

know and

so far

also about

the Microcredit

‘Best Practice’Summitin relation

RBI data shows that informal sources provide a significant part of the total credit needs of the rural population. The magnitude Campaign.

to micro‐finance

Here, gender for

lobbies

women’shave empowerment

argued for of and

the

targeting

how different

dependence women ofinstitutions

thebecause can

rural poor on Initial

of higher

work levelsfinance

together.

informal It ison

ofsources

female easy

clear terms

poverty

of that

creditgender

and

canwomen’s

strategies

be observedresponsibility

infrom

microthe finance

for 53.6

household

need

findings oftothelook

well‐being.

Allbeyond However

just increasing

India Debt and although women’s

Investment gender

Survey,

inequality

access

1992, to savings

which is recognised

shows and credit

that as

theanand

issue,

shareorganizing

ofthethefocusselfis help

on assistance

non‐institutionalgroupsagencies

totolook

households

strategically

(informaland atthere

sector)howinisprogrammes

a tendency

the outstandingto

cansee

actively

cashgender promote

dues issues

of theasgender

cultural

rural equality

and hence

households and

was

not

women’s

subject

36 percent. empowerment.

to outside the

However, intervention.

Moreover

dependence theoffocus

Working rural should

households

capital be onon

facilities developing

such informala diversified

sourcesmicro finance22.2

had reduced sector

of theirwhere different type

total outstanding of steadily

dues organizations,

from

NGO, MFIs andinformal

83.7 percent 2005sector

to 36banks all should

percent in have gender policies adapted to the needs of their particular target groups/institutional roles and

capacities

2008. This and

FINANCIAL collaborate

SUSTAINABILITY

is shown and work

in the table below. together to make a significant contribution to gender equality and pro‐poor development.

PARADIGM

Raw materials availability 4.6

The financial self‐sustainability paradigm (also referred to as the financial systems approach or sustainability approach) underlies the models of

microfinance promotedOutstandings sincefrom

the Informal

mid‐1990s by most

Sources asdonor agenciesofand

a Percentage theDues,

Total Best Practice

for Variousguidelines promoted

Occupational in publications

Categories of RuralbyHouseholds

USAID, World

REFERENCES

Bank, UNDP and CGAP. The ultimate Marketing

aim is large programmes which are profitable and fully self‐supporting 1.7 in competition with other private

Ackerley,

sector bankingB. (1995). Testingand

institutions the able

Toolstoofraise

Development:

funds fromCredit Programmes

international , Loan

financial Involvement

markets and Women's

rather than relying onEmpowerment. World

funds from development

Development,

agencies. The main 26(3),target

56‐68.group,

Basu,despite

P. 2008.claims

“A Financial

to reach System for India’s

the poorest, Poor”.

is the In Microfinance

‘bankable poor': small in entrepreneurs

India ed. K.G. Karmakar,

and farmers.19‐32.

ThisNew Delhi:on

emphasis

10.5

Sage Publications.

financial sustainability Della‐Giusta,

is seen asM. and Phillips,

necessary C.Year

to create 2006. “Women

institutionsCultivators

which reachNon‐Cultivators

Entrepreneurs in the Gambia:

significant ofAllpoor people

numbersChallenges and Opportunities.”

in the context ofJournal of aid

declining

International Development,

budgets and opposition 18(8): Training

to welfare 1051‐1064.

and redistributionFisher, in Thomas and M.S. Sriram

macro‐economic policy. ed., 2002,this

Within Beyond Micro‐credit:

paradigm Puttinghave

gender lobbies Development

been ableBack into

to argue

Microfinance,

for targeting women New Delhi:on the Vistaar

grounds Accommodation

Publications;

of high female Oxford: Oxfam. Harper,

repayment rates andMalcolm,

the need 2002, “Promotion

to stimulate 0.4of Selfeconomic

women’s Help Groups under

activity asthe SHG Bank

a hitherto

Linkage Program

underutilized in India”,

resource Paper presented

for economic growth.atThey the Seminar

have hadon SHG‐bank

some successLinkage

in ensuringProgramme at New Delhi,ofNovember

that considerations 25‐26, 2002.

female targeting Kabeer N

are integrated

(2001),“Conflicts

into conditions ofOver Credit: Re‐evaluation

micro‐finance delivery andthe Empowerment

programme

2005 evaluation.81.6Potential of Loans

Definitions89.5oftoempowerment

Women in Rural areBangladesh”:

83.7 in individualist World

terms with the ultimate

MICRO FINANCE INSTRUMENT OtherFOR WOMEN’S

assistance EMPOWERMENT 4.9

Development,Vol.29,No.1.

aim being the expansion ofMayoux, individualL.choice

1998a.orWomen's

capacity Empowerment

for Self‐reliance. andIt isMicro‐finance

assumed thatprogrammes : Approaches,

increasing women’s accessEvidence and Waysservices

to micro‐finance

Micro Finance for the poor and women has received extensive recognition as a strategy for poverty reduction and for economic empowerment.

Forward.

will in itselfThe Open

lead Universityeconomic

to individual Working Paper No 41.

empowerment 2006 Rahman,

through A.enabling

60.3 1999. “Micro‐Credit

women's

89.2 Initiatives

decisions For

about Equitable

savings

70.8 andAnd Sustainable

credit Development:

use, enabling women to

Increasingly in the last five years , there is questioning of whether micro credit is most effective approach to economic empowerment of

Who

set upPays?” World Development,

micro‐enterprise, increasing27(1):

incomes67‐82.under their control. It is then assumed that this increased economic empowerment will lead to

poorest and, among them, women in particular. Development practitioners in India and developing countries often argue that the exaggerated

increased well‐being of women and also to social and 2007 political36.8

empowerment. 63.3 38.8 in addressing employment and livelihood

focus on micro finance as a solution for the poor has led to neglect by the state and public institutions

needs of the poor. Credit for empowerment is about organizing people, particularly around credit and building capacities to manage money.

The focus is onEMPOWERMENT

WOMEN’S getting the poor to mobilize AND MICRO their own 2008 33.7DIFFERENT

funds, building

FINANCE: 44.7PARADIGMS

their capacities and empowering 36.0 them to leverage external credit.

Perception

In women is that

India organizations learning to manage

like Self‐Employed Women’s money and rotate(SEWA)

Association funds builds

amongwomen’sothers with capacities

origins andand confidence

affiliations in tothe

intervene in localand

Indian labour

PROBLEMbeyond

governance AND CHALLENGES

women’s movementsthe limited goals

identified creditofasensuring

a major accessconstraint to credit.

in their Further,

work with it combines

informalthe goals

sector of financial

women workers. sustainability

The problem withofthat

women’sof creating

access

These elements are:institutions. Before 1990’s, credit schemes for rural women were almost negligible. The concept of women’s credit was born

community

to credit wasowned given particular emphasis at the first International Women’s Conference in Mexico in 1975 as part of the emerging awareness of

on the

the insistenceofby

importance women productive

women’s oriented studies thatfor

role both highlighted the discrimination

national economies, and forand struggle

women’s of women

rights. This led intohaving the access

the setting up ofofthecredit.

Women’sHowever,

World•isBanking

there a perceptible gapand

Inadequate

network in financing

book‐keeping.

production genuine

of manualscreditfor needs

women'sof thecredit

poor provision.

especially Otherwomen in the rural

women’s sector. There

organizations are certain

world‐wide setmisconception

up credit and

about the

savings • components

worthiness

poor people both

Employment

thatastheyaof needincreasing

way

tooofmany

loan at subsidized

relatives women’s rate of interest

which incomes

increasesand

on soft terms,

bringing

social pressure women they

to share

lack education,

together to addressskill,

benefits. wider capacity

gendertoissues.

save, From

creditthe mid-

1980s thereand wastherefore

a mushrooming are notof bankable. Nevertheless,

donor, government andthe experience of several

NGO‐sponsored SHGs reveal in

credit programmes thattherural

wake poor

of theare1985

actually efficient

Nairobi women’smanagers

of credit• and(Mayoux,

conference Lack of

finance. capital.

Availability

1995a). Theof1980s

timely andand1990sadequate

also saw credit is essential and

development for them

rapid to undertake

expansion of any

largeeconomic

minimalist activity rather than credit

poverty‐targeted micro‐

subsidy.

finance • institutions

The Government

High and measures

networks

interest likehave

rates. attempted

Grameen Bank,toACCION

help the andpoor

Fincaby among

implementing

others. different poverty alleviation

In these organizations programmes

and others evidence butofwith little

success. Since

significantly mostfemale

of themrepaymentare targetrates basedled involving lengthy procedures for loan disbursement, high transaction

strategycosts, and lack of recovery.

•

supervision

A number ofand

higher

Lack of knowledge

monitoring.

donors also sawSince

of the

the credit

female‐targeted

market

to increasing

and potential

requirements

financially‐sustainable

emphasis on targeting

of theprofitability,

ruralmicro‐financethus making

poor cannot

women as an efficiency

be the choice

as aadopted

means of

of business

onmarrying

project lending

internalapp

to increase

difficult. roach as

demands

credit

forit increased

is in the case

of • becauseInventory

organized

efficiency sector, there

of declining emerged

and budgets the

inflation withneed for

accounting

demands an informal

is never credit

of theundertaken. supply through SHGs. The rural

increasingly vocal gender lobbies. The trend was further poor with the assistance fromby

reinforced NGOs have

the Micro

demonstrated their potential for self helpwhich

to secure economic and empowering

financial strength. Various case studies showafter thatpoverty

there is reduction

a positive (RESULTS

Credit • between

Summit

correlation

Campaign starting in 1997 had ‘reaching and women’ as its

Credit policies that can gradually ruin their business (many customers cannot pay cash; on the other hand, suppliers are very

credit availability and women’s empowerment.

second key goal

CONCLUSIONS

1997). harsh towardsAND

Micro‐finance for women

women). SUGGESTIONS has recently been seen as a key strategy in meeting not only Millennium Goal 3 on gender equality, but also

poverty Reduction,

Viability of micro finance Health, needsHIV/AIDS

to beand other goals.

understood from a dimension that is far broader‐in looking at its long‐term aspects too, very little

attention has been given to empowerment questions or ways in which both empowerment and sustainability aims may be accommodated.

Failure to take into account impact on income also has potentially adverse implications for both repayment and outreach, and hence also for

LITERATURE

FEMINIST

financial REVIEW

EMPOWERMENT

sustainability. An effort is made PARADIGM here to present some of these aspects to complete the picture.

Microfinance

This paradigm didenjoyed

A conclusion has

that emerges

not originate afrom

wealth this

as aof literature

account

Northern in the

isimposition,

that past,

micro and

finance

but is can

quitecontribute

is firmly often in

rooted seen toas

the one ofthe

solving

development theproblems

most

of somesignificant tools developed

ofofinadequate

the earliest housing and

micro‐finance(in urban

recent

history)

services

programmes to

as combat thepoverty

aninintegral South, at poverty

partincluding

of the grassroots in level.

alleviation

SEWA India. This proposalThe

programmes.

It currently focuses on

challenge

underlies thefiveliesselected

gender in finding studies

policies the in order

of level

many ofNGOs to and

survey

flexibility in athe

the representative

credit instrument

perspectives sample

of some of of

that the

literature

could make addressing

it match issues

the faced

multiple by the

credit formal

requirements microfinance

of the sector.

low income Today concerns

consultants and researchers looking at gender impact of micro‐finance programmes (e.g. Chen 1996, Johnson, 1997). Here the underlying end

borrower are

without abound

imposing regarding

unbearably the sustainability

high cost of of the

monitoring its

microfinance

use upon are

concerns enterprises,

the gender The specifically

lenders.equality organizations

and women’s because

involved of the

human nature

inrights.

micro of the

credit

Women’s lending

initiatives itself.

empowermentshouldLoanstake are constantly

account

is seen the being

as anofintegral factand made

that: to high‐risk

inseparable part low

of aincome

wider

individuals,

process with unique

of social and innovative

transformation. The main methods

targetbeinggrouputilized

is poorto createand

women re‐payment

women capable incentives. Thus, thealternative

of providing most significant femaleconcern

role models at thefor

moment is whetherattention

change. Increasing the formal hasmicrofinance

also been paid institutions

to men's are roleactually impacting

in challenging genderpoverty in a significant

inequality. manner.

Micro‐finance It is with this

is promoted idea

as an in mind

entry pointthat

in

the •

the context

literature of was

a selected.

wider strategy for women’s economic and socio‐political empowerment

Credit is important for development but cannot by itself enable very poor women to overcome their poverty. which focuses on gender awareness and feminist

organization. As developed by Chen in her proposals for a sub sector approach to micro credit, based partly on SEWA's strategy and promoted

•

METHODOLOGY

by

Making credit available to women does not automatically mean they have control over its use and over any income they might

UNIFEM, microfinance must be: Economic empowerment is however defined in more than individualist terms to include issues such as

generate

The paperrights, from

takes changes micro

a close look enterprises.

into the life experiences

property intra‐household relations andoftransformation

a few women to ofexplore the pressing question

the macro‐economic context. of, Manywhat makes ‘poor’gowomen

organisations further than

•

entrepreneurs?

interventions Initsituations

at Is

the support

industry from of chronic

level their poverty

husbands;

to include it their

is more

gender‐specific important

parents tofor

and siblings

strategies provide saving

or extended

social services

and political than

kin; their to offer credit.

education;

empowerment. their

Somework experience;

programmes have their

health;

developed• natural

veryand othermeans

effective

A useful infrastructural

indicator theresource

forofintegrating

tangible availability

gender

impact awarenessand access;

of micro into

credit what combination

programmes

schemes and number

is the of these

for organizing factors

women

of additional work andasmen

proposals motivating factors?

to challenge

and demands andWhat

pushes her

change to participate

gender discrimination. in incomeSome generation;

also have to withstand

legal rights shocksforinwomen

support it and toand continue

engage with

in it or what

gender factorsThese

advocacy. lead to failure? Theto

interventions diversity

increasein

presented by local villagers to public authorities.

•social

theNevertheless

combination

and political ensuring

ofempowerment

factors thatthatthe micro‐finance

contribute

are seento aswomen’ssector continues

essential experiences

prerequisites to move

infor

incomeforward

economic in

generation relation to gender

is high

empowerment. and beyond equalitytheand scope women’s empowerment

of this paper or any

research

will require forathat matter.strategic

long‐term Nevertheless,process this

of paper

the same based orderon the

as thesecondary data. to poverty if gender is not to continue to ‘evaporate’ in a

one in relation

combination of complacency and resistance within donor agencies and the micro‐finance sector. This will involve:

POVERTY

OBJECTIVEREDUCTION PARADIGM

This underlies many NGO integrated poverty‐targeted community development programmes. Poverty alleviation here is defined in broader

• than

terms market incomes

Ongoing exchange

To know

toof

the

encompass

experienceincreasing capacities

and innovation

Sources ofsustainable

Credit for Rural

and choices

between

Households.

and decreasing the vulnerability of poor people. The main focus of

practitioners

programmes as a whole is on developing livelihoods, community development and social service provision like literacy, healthcare

•and infrastructure

Constant

Toawareness

Analyze the

development.

and questioning

women

There seeking

is not

of ‘bad practice’

only financial

a concernassistance.

with reaching the poor, but also the poorest. Policy debates have focused

•particularlyon the importance of small savings andfinance

lobbyingTo Analyze

donors for the impact

sufficient of Micro

funding for with respect

empowerment

loan provision to poverty alleviation

forstrategies

consumption as well as and socioeconomic

production, empowerment

group formation of possible

and the rural women.

To level

studyofthe problems & challengesworking

faced bywith

ruralparticular

women. client groups or in particular context.

•

justification

for some

bringingTo

together

suggestthe

subsidy for

thedifferent

programmes

players inwomen

ways to increase the sector to develop coherent policies and for gender

empowerment.

advocacy.

INTERNATIONAL

INTERNATIONAL JOURNAL JOURNAL OF RESEARCH

OF RESEARCH IN COMMERCE IN COMMERCE & MANAGEMENT & MANAGEMENT148

149

150

147

A Monthly

A Monthly Double‐Blind

Double‐BlindPeer

PeerReviewed

ReviewedRefereed

RefereedOpen

OpenAccess

AccessInternational

Internationale‐Journal ‐Included

e‐Journal ‐Includedin

inthe

theInternational

InternationalSerial

SerialDirectories

Directories

www.ijrcm.org.in

Potrebbero piacerti anche

- Impact of Microfinance On Women Empowerment Through Kudumbashree UnitsDocumento65 pagineImpact of Microfinance On Women Empowerment Through Kudumbashree UnitsBishal BhandariNessuna valutazione finora

- Total ProjectDocumento77 pagineTotal Projectamitsonawane67% (3)

- Shg-Self Help GroupDocumento56 pagineShg-Self Help Groupkaivalya chaaitanya ugale100% (2)

- Micro Finance in IndiaDocumento22 pagineMicro Finance in IndiaGeet SinghiNessuna valutazione finora

- A Study On Women Empowerment Through Micro Finance With Reference To Thiruvallur DistrictDocumento16 pagineA Study On Women Empowerment Through Micro Finance With Reference To Thiruvallur DistrictReeta DeviNessuna valutazione finora

- Empowerment of Women Through MicrofinanceDocumento22 pagineEmpowerment of Women Through MicrofinanceKevin Jacob100% (2)

- Women Empowerment and Micro FinanceDocumento31 pagineWomen Empowerment and Micro Financekrishnan100% (1)

- A Research Study On Overall Performance of Kudumbashree Unit With Reference To Beeranthabail of Kasargod District, Kerala StateDocumento5 pagineA Research Study On Overall Performance of Kudumbashree Unit With Reference To Beeranthabail of Kasargod District, Kerala StateIOSRjournalNessuna valutazione finora

- Women EmpowermentDocumento59 pagineWomen EmpowermentJatin kumar jaiswalNessuna valutazione finora

- Assam SHG Study Report - FinalDocumento110 pagineAssam SHG Study Report - FinalChanchal GautamNessuna valutazione finora

- A Study On Kudumbashree in Kerala: ArticleDocumento9 pagineA Study On Kudumbashree in Kerala: Articlesanskriti kathpaliaNessuna valutazione finora

- Final ProjectDocumento104 pagineFinal Projectiamdayma100% (6)

- A Study On The Micro Enterprises Promoted by Kudumbashree and Their Marketing Strategies in Malappuram DistrictDocumento5 pagineA Study On The Micro Enterprises Promoted by Kudumbashree and Their Marketing Strategies in Malappuram DistrictBONFRINGNessuna valutazione finora

- Micro Finance & Women EmpowermentDocumento32 pagineMicro Finance & Women EmpowermentMegha Solanki67% (3)

- Kudumbasree PDFDocumento6 pagineKudumbasree PDFSatheesh VagiNessuna valutazione finora

- Sonata Finance PVTDocumento23 pagineSonata Finance PVTArunima Naithani100% (2)

- Origin of SHG in IndiaDocumento2 pagineOrigin of SHG in IndiaVicky Patel60% (5)

- Impact Assessment of Self Help Groups On SHG Members in Madhya PradeshDocumento5 pagineImpact Assessment of Self Help Groups On SHG Members in Madhya PradeshInternational Journal of Application or Innovation in Engineering & ManagementNessuna valutazione finora

- Role of Microfinance in Women EmpowermentDocumento25 pagineRole of Microfinance in Women EmpowermentDevansh MoyalNessuna valutazione finora

- Harticulture DevelopmentDocumento68 pagineHarticulture Developmentgmk100% (1)

- Role of Financial Institutions For The Development of Women Entrepreneurship in IndiaDocumento8 pagineRole of Financial Institutions For The Development of Women Entrepreneurship in IndiaEditor IJTSRDNessuna valutazione finora

- Micro Finance in Assam Debabrata-DasDocumento24 pagineMicro Finance in Assam Debabrata-DasSanju LangthasaNessuna valutazione finora

- SKDRDP DairyDocumento18 pagineSKDRDP DairyrajyalakshmiNessuna valutazione finora

- L & T Financial Holding Social Transformation of The Rural CommunitiesDocumento49 pagineL & T Financial Holding Social Transformation of The Rural CommunitiesNitin PolNessuna valutazione finora

- Establishing and Running An Advocacy NGODocumento159 pagineEstablishing and Running An Advocacy NGOWa Lei Gan100% (1)

- "A Project On Recruitment Process With Special Reference To Dream Job Placement, Pune" PDFDocumento74 pagine"A Project On Recruitment Process With Special Reference To Dream Job Placement, Pune" PDFAMIT K SINGHNessuna valutazione finora

- CAG Report On Local Governments in Kerala 2012 - 13Documento115 pagineCAG Report On Local Governments in Kerala 2012 - 13K RajasekharanNessuna valutazione finora

- The Role of Women Micro and Small Enterprenuers in Poverty ReductionDocumento51 pagineThe Role of Women Micro and Small Enterprenuers in Poverty ReductionAbdulaziz Tersemu Mosa100% (2)

- A Study On "Children Welfare" With Special Reference To Shashtri School For Deaf & Dumb ChildrenDocumento47 pagineA Study On "Children Welfare" With Special Reference To Shashtri School For Deaf & Dumb ChildrenMurali PrasathNessuna valutazione finora

- Self Help GroupsDocumento13 pagineSelf Help GroupsSomya AggarwalNessuna valutazione finora

- Internship Report: Vidyalaxmi Group of InstitutionDocumento19 pagineInternship Report: Vidyalaxmi Group of InstitutionRashmitha BhandaryNessuna valutazione finora

- Social Project On Mahila Housing Sewa TrustDocumento50 pagineSocial Project On Mahila Housing Sewa TrustAkshay JadavNessuna valutazione finora

- Empowering SME Women Entrepreneurs in Lao PDRDocumento12 pagineEmpowering SME Women Entrepreneurs in Lao PDRADBGADNessuna valutazione finora

- A Friendly Rest Room: Developing Toilets of The Future For Disabled and Elderly PeopleDocumento304 pagineA Friendly Rest Room: Developing Toilets of The Future For Disabled and Elderly PeopleCarla OlivellaNessuna valutazione finora

- KudumbashreeDocumento12 pagineKudumbashreeamarsxcran100% (1)

- 1.format - Man-An Study of Microfinance Schemes and Its Awareness in PDFDocumento9 pagine1.format - Man-An Study of Microfinance Schemes and Its Awareness in PDFImpact JournalsNessuna valutazione finora

- A Study OnKudumbashree ProjectA Poverty Eradication Programme in Kerala PerformanceDocumento67 pagineA Study OnKudumbashree ProjectA Poverty Eradication Programme in Kerala PerformanceBaggio YesudasNessuna valutazione finora

- Grant ProposalDocumento18 pagineGrant Proposalapi-382605551Nessuna valutazione finora

- Impact of Microfinance Institution On Women EmpowerntDocumento74 pagineImpact of Microfinance Institution On Women EmpowerntJohn AbdulNessuna valutazione finora

- Orisaa Tribal Empowerment and Livelihood Project Mid Term ReviewDocumento97 pagineOrisaa Tribal Empowerment and Livelihood Project Mid Term ReviewRatnesh JhaNessuna valutazione finora

- Executive MBA Project - Self Help Allowance - FinalDocumento55 pagineExecutive MBA Project - Self Help Allowance - FinalKumar SourabhNessuna valutazione finora

- UNDP Women Impowerment and Gender Equality Project Report 2013 PDFDocumento30 pagineUNDP Women Impowerment and Gender Equality Project Report 2013 PDFБилгүүдэй ТөмөрNessuna valutazione finora

- Synopsis For Analysis of Microfinance in India: BY Jose T George 092103104Documento5 pagineSynopsis For Analysis of Microfinance in India: BY Jose T George 092103104Jose GeorgeNessuna valutazione finora

- Empowering Young Women For Community Development ProposalDocumento13 pagineEmpowering Young Women For Community Development ProposalSana MahmoodNessuna valutazione finora

- Himalayan System IndiaDocumento24 pagineHimalayan System IndiaNamkha Wangden LhasungpaNessuna valutazione finora

- Chapter 4 Rural Banking and Micro Financing 1Documento16 pagineChapter 4 Rural Banking and Micro Financing 1saloniNessuna valutazione finora

- Women Empowerment Through Micro FinanceDocumento15 pagineWomen Empowerment Through Micro FinancemerinNessuna valutazione finora

- Example Synopsis MicrofinanceDocumento9 pagineExample Synopsis MicrofinanceKaran Raj DeoNessuna valutazione finora

- Survey of Literature Volume IDocumento105 pagineSurvey of Literature Volume Ijosepaul0099Nessuna valutazione finora

- Project Work On Rural Development of The NagasDocumento16 pagineProject Work On Rural Development of The NagasHukuyi Venuh100% (1)

- CSR PRESENTATION FinalDocumento14 pagineCSR PRESENTATION FinalMansi SrivastavaNessuna valutazione finora

- A Proposal To Pioneer Public Power: By: Liam Patrick AP English G, Ms. Kirkpatrick, Due 02/26/2016Documento23 pagineA Proposal To Pioneer Public Power: By: Liam Patrick AP English G, Ms. Kirkpatrick, Due 02/26/2016api-311411786Nessuna valutazione finora

- Aditya Project Work 2Documento42 pagineAditya Project Work 2aditya mayukh100% (1)

- Rural Banking and Agricultural FinancingDocumento17 pagineRural Banking and Agricultural FinancingNilanshi MukherjeeNessuna valutazione finora

- 1 ANAND DISSERTATION (AutoRecovered)Documento50 pagine1 ANAND DISSERTATION (AutoRecovered)narendraNessuna valutazione finora

- 1.overview: Project Title: Youth For Change InitiaveDocumento8 pagine1.overview: Project Title: Youth For Change InitiaveVedaste NdayishimiyeNessuna valutazione finora

- Promoting Financial Inclusion Can The Constraints of Political Economy Be OvercomeDocumento98 paginePromoting Financial Inclusion Can The Constraints of Political Economy Be OvercomeEti Chiranjeevi100% (1)

- An Analytical Study of Microfinance & Its Impact On Indian EconomyDocumento51 pagineAn Analytical Study of Microfinance & Its Impact On Indian EconomyNikhil YadavNessuna valutazione finora

- A Study of Role of Micro-Finance in Rural Empowerment in IndiaDocumento5 pagineA Study of Role of Micro-Finance in Rural Empowerment in IndiaSugandNessuna valutazione finora

- Arima ModelDocumento18 pagineArima ModelSumitasNessuna valutazione finora

- List of Stationary Items: PresentDocumento3 pagineList of Stationary Items: PresentKaushik BalachandarNessuna valutazione finora

- DeaDocumento12 pagineDeaSumitasNessuna valutazione finora

- Deal Tracker DocumentDocumento36 pagineDeal Tracker DocumentSumitasNessuna valutazione finora

- Management StudiesDocumento73 pagineManagement StudiesSumitasNessuna valutazione finora

- Zero Base BudgetingDocumento15 pagineZero Base BudgetingSumitasNessuna valutazione finora

- Accounting Standard: 2: Valuation of InventoriesDocumento10 pagineAccounting Standard: 2: Valuation of InventoriesSumitasNessuna valutazione finora

- Saturn Effects and RemediesDocumento3 pagineSaturn Effects and RemediesSumitasNessuna valutazione finora

- CCase Commentary Anita SharmaDocumento2 pagineCCase Commentary Anita SharmaSumitasNessuna valutazione finora

- API Calculator 2016Documento3 pagineAPI Calculator 2016SumitasNessuna valutazione finora

- Venus Maha DashaDocumento7 pagineVenus Maha DashaSumitasNessuna valutazione finora

- Horngren Ima16 stppt16Documento66 pagineHorngren Ima16 stppt16SumitasNessuna valutazione finora

- Role of Earnings Management and Capital Structure in Signalling Early Stage of Financial DistressDocumento8 pagineRole of Earnings Management and Capital Structure in Signalling Early Stage of Financial DistressSumitasNessuna valutazione finora

- Mars Effects and RemediesDocumento3 pagineMars Effects and RemediesSumitasNessuna valutazione finora

- Rahu Effects and RemediesDocumento3 pagineRahu Effects and RemediesSumitas100% (1)

- The Divine Bhrgu SamhitaDocumento4 pagineThe Divine Bhrgu SamhitaSumitasNessuna valutazione finora

- Jupiter Effects and RemediesDocumento3 pagineJupiter Effects and RemediesSumitas100% (1)

- Mercury Effects and RemediesDocumento3 pagineMercury Effects and RemediesSumitas100% (1)

- Ketu Effects and RemediesDocumento4 pagineKetu Effects and RemediesSumitasNessuna valutazione finora

- Saturn Maha DashaDocumento6 pagineSaturn Maha DashaSumitas100% (1)

- Moon Maha DashaDocumento7 pagineMoon Maha DashaSumitasNessuna valutazione finora

- Yellow SapphireDocumento5 pagineYellow SapphireSumitasNessuna valutazione finora

- Jupiter Maha DashaDocumento6 pagineJupiter Maha DashaSumitasNessuna valutazione finora

- Mars Maha DashaDocumento6 pagineMars Maha DashaSumitasNessuna valutazione finora

- Writing A Travel EssayDocumento2 pagineWriting A Travel EssayJohnmark Dagsa FalcoteloNessuna valutazione finora

- The-Stakeholders-of-Education-and-Funding-CapabilitiesDocumento15 pagineThe-Stakeholders-of-Education-and-Funding-CapabilitiesKaren May Urlanda80% (5)

- Case Study On Vicco Turmeric and Sunsilk Fruit Am InsDocumento24 pagineCase Study On Vicco Turmeric and Sunsilk Fruit Am InsFaheem Kv0% (1)

- Benchmarking Open Government - An Open Data PerspectiveDocumento13 pagineBenchmarking Open Government - An Open Data PerspectiveMurad AmerNessuna valutazione finora

- Equal Safe and Strong Victoria Police Gender Equality Strategy 2020-2030Documento28 pagineEqual Safe and Strong Victoria Police Gender Equality Strategy 2020-2030Michael SmithNessuna valutazione finora

- The Business Case For Process SafetyDocumento24 pagineThe Business Case For Process SafetyzainonayraNessuna valutazione finora

- EAPP SurveyDocumento4 pagineEAPP SurveyDridge AndradeNessuna valutazione finora

- Upper Intermediate: KeynoteDocumento2 pagineUpper Intermediate: KeynoteLexieNessuna valutazione finora

- Advance in Cognitive TheoryDocumento72 pagineAdvance in Cognitive TheoryBRAIN TRAINING CLUBNessuna valutazione finora

- Marketing of Services Assignment: TOPIC: The Gap Model of Service QualityDocumento2 pagineMarketing of Services Assignment: TOPIC: The Gap Model of Service QualityKuldip BarmanNessuna valutazione finora

- Quarter 3 Module 5Documento47 pagineQuarter 3 Module 5Ashlie AbalaNessuna valutazione finora

- Mba-110 Full Solved AssementDocumento4 pagineMba-110 Full Solved AssementAnkitKumarJha33% (3)

- E-Mail User Registration Form 12Documento2 pagineE-Mail User Registration Form 12herandevakiNessuna valutazione finora

- 14 Ms. Dhartiben P. Rami, Dr. Kamini Shah & Prof (DR) Sandip Bhatt PDFDocumento6 pagine14 Ms. Dhartiben P. Rami, Dr. Kamini Shah & Prof (DR) Sandip Bhatt PDFRajeshNessuna valutazione finora

- Organizational Capability As A Competitive Advantage: Human Resource Professionals As Strategic PartnersDocumento3 pagineOrganizational Capability As A Competitive Advantage: Human Resource Professionals As Strategic PartnersFaraz ShakoorNessuna valutazione finora

- Production of Creative Game Based Learning Scenarios PDFDocumento43 pagineProduction of Creative Game Based Learning Scenarios PDFSyams FathurNessuna valutazione finora

- Cultural Variations and Social Differences (Gender) Gender and Gender RolesDocumento26 pagineCultural Variations and Social Differences (Gender) Gender and Gender RolesAnonymousNessuna valutazione finora

- Marketing Presentatio N: CadburyDocumento17 pagineMarketing Presentatio N: CadburyHARSH SHUKLANessuna valutazione finora

- High CourtDocumento13 pagineHigh CourtSyed Kashif PervezNessuna valutazione finora

- Us - Uk History and CultureDocumento59 pagineUs - Uk History and CultureMohamed BouladamNessuna valutazione finora

- Be Able To - GrammarDocumento1 paginaBe Able To - GrammarbrunaNessuna valutazione finora

- What Is Demand Forecasting? and Why It Is Important For Your BusinessDocumento10 pagineWhat Is Demand Forecasting? and Why It Is Important For Your BusinessSadaqat AkNessuna valutazione finora

- Jurnal Hukum Laut Kel.2 (Bahasa Inggris)Documento18 pagineJurnal Hukum Laut Kel.2 (Bahasa Inggris)Muhammad IqbalNessuna valutazione finora

- The Problem and Its BackgroundDocumento6 pagineThe Problem and Its BackgroundMa Yong RuiNessuna valutazione finora

- Counselling in A Digital WorldDocumento2 pagineCounselling in A Digital WorldIhin Nur FarihinNessuna valutazione finora

- Rakesh KR Das (073-BAE-24) Public Market DesignDocumento12 pagineRakesh KR Das (073-BAE-24) Public Market DesignRakesh KumarNessuna valutazione finora

- NyayabindutikaDocumento163 pagineNyayabindutikaJinyue LiuNessuna valutazione finora

- 5 Feladatsor Nyelvhelyesség PDFDocumento3 pagine5 Feladatsor Nyelvhelyesség PDFCseh GyöngyiNessuna valutazione finora

- Filipino Creativity and InnovationDocumento3 pagineFilipino Creativity and Innovationcyrene rufoNessuna valutazione finora

- Safety ExercisessDocumento1 paginaSafety ExercisessAvralinetine EpinNessuna valutazione finora