Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Australian Dollar Outlook 19 May 2011

Caricato da

International Business Times AUCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Australian Dollar Outlook 19 May 2011

Caricato da

International Business Times AUCopyright:

Formati disponibili

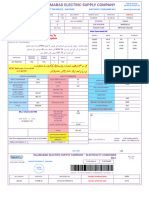

FX DAILY REPORT THURSDAY 19 MAY 2011

Bell FX Currency Outlook Australian Dollar / US Dollar

The Australian Dollar finds itself drifting in a tight trading

range, which is a bit of a first for quite some time.

1.15

1.05

Australia: As always in the last three years, there are a huge amount of 0.95

considerations in looking at our Dollar and considering how high can it go

0.85

and how long will it be this high? Some analysts are calling USD 1.7000 to

USD 2.000 in the next 18 months. We find that hard to fathom, especially 0.75

because at some stage, a couple of the key drivers for the AUD’s 0.65

ascendancy will change. Interest rate differentials and the growth rates in 0.55

China and India are what we refer to. Minutes from the April 26-27 FOMC Aug-06 Aug-07 Aug-08 Aug-09 Aug-10 Aug-11

meeting are the first sign since the GFC of the strategy of exiting the US

expansionary monetary policy, which has so contributed to the fall in the Today’s Forecast Range

USD. Equally of interest, a slowing growth in Asia is having an impact as

policy makers look to dampen inflation. Locally, today we have average

USD 1.0555– 1.0675

weekly ordinary time earnings data released which is typically not a big deal, Currencies Last High Low

as opposed to its distant cousin, the wage price index (WPI), which was

released yesterday, and is the market’s preference for analysing wage AUD / USD 1.0624 1.0666 1.0569

inflation. Yesterday’s release of the WPI showed an unexpected USD / JPY 81.64 81.73 80.94

deceleration in quarterly wage inflation to 0.8% (March was 1.1%) and

EUR / USD 1.4249 1.4288 1.4195

added to the recent run of weaker Australian economic data such as

employment, housing finance and consumer sentiment. One would suggest GBP / USD 1.6165 1.6288 1.6105

in light of this softer data and the very high A$, tightening of interest rates is NZD / USD 0.7888 0.7911 0.7840

hardly urgent…

AUD Crosses Last High Low

Majors: As mentioned above, the US Federal Reserve' s Monetary Policy AUD / JPY 86.73 86.87 85.75

Committee released minutes for its April 27 meeting last night and this was a AUD / EUR 0.7452 0.7465 0.7426

significant focus for currency traders during the offshore session. According

to the minutes, participants "generally anticipated that the higher level of AUD / GBP 0.6568 0.6577 0.6528

overall inflation would be transitory". While there had been "significant AUD / NZD 1.3463 1.3549 1.3429

increases" in energy and other commodity prices that had boosted overall AUD / CAD 1.0307 1.0357 1.0299

inflation, FOMC members expected price increases would ease once

commodity prices stabilised. Bank of England minutes reveal no change to Australian Rates Last Previous

the voting pattern. The EUR situation remains pretty much unchanged with Official Cash 4.75

pressure on Greece to solve their crisis. US equities rallied and US

3 Month Bill 4.99 4.98

Treasuries sold off as the FOMC outlined its thoughts. More interesting

times lie ahead for all of us in 2011 that’s for sure. 10 Year Bond 5.350 5.370

US Rates Last Previous

Economic Calendar

Fed Funds 0.25

19 MAY AU Average Weekly Earnings Fed Qtr

UK Retail Sales Apr 3 Month Libor 0.260 0.260

US Existing Home Sales Apr 10 Year Bond 3.180 3.114

US Initial Jobless Claims 1-May

Commodities Last - / + (%)

Important Disclaimer – This may affect your legal rights: This publication has been issued on Gold (US$ / oz) 1496.75 0.7

the basis that it is only for the information and exclusive use of the particular person to whom it is Oil (WTI) US$/bbl) 99.75 +2.9

provided by Bell Potter Securities Limited trading in the foreign exchange markets as Bell Foreign

Exchange (ACN 004 845 710). As this publication is a private communication to clients, it is not CRB Index 344.21 +2.3

intended for public circulation or for use by any third party, without the prior approval of Bell Foreign

Exchange. The Information contained in this publication has been obtained from sources considered Equities Last - / + (%)

and believed to be both reliable and accurate, and no responsibility is accepted for any error or

omission, that may have occurred, or for any opinion expressed. The Information is general in ASX 200 4693 +0.2

nature, and does not take into account, the particular investment objectives or financial situation of Dow Jones 12560 0.6

any potential reader. It does not constitute, and should not be relied on, as financial or investment

advice, or recommendations (expressed or implied), and is not an invitation to take up securities or FTSE 5923 +1.1

other financial products or services. No decision should be made on the basis of the information

without seeking expert financial advice. Ranges in this publication are indicative ranges over the Hang Seng 23011 +0.5

past 24 hours. Last is around 9.00am Sydney. Please speak with Bell Foreign Exchange if you

require latest pricing and ranges. Nikkei 9662 +1.0

Sally Fisher 08 8224 2771 sfisher@bellfx.com.au Bill Giffen 02 9255 7473 bgiffen@bellfx.com.au

Kimberly Limbert 08 8224 2725 klimbert@bellfx.com.au Scott Hill 02 8243 3504 shill@bellfx.com.au

Rebecca Kelly 08 8224 2772 rkelly@bellfx.com.au Bronson Livingston 02 8243 3503 blivingston@bellfx.com.au

Nick White 08 8224 2770 nwhite@bellfx.com.au Scott Fleming 03 9235 1912 sfleming@bellfx.com.au

BELL POTTER SECURITIES LIMITED GPO BOX 4718 TOLL FREE 1800 003 815 ABN 25 006 390 772

MELBOURNE VIC 3001 INFO@BELLPOTTER.COM.AU AFS LICENCE NO.243480

AUSTRALIA WWW.BELLPOTTER.COM.AU

Potrebbero piacerti anche

- Australian Dollar Outlook 03 June 2011Documento1 paginaAustralian Dollar Outlook 03 June 2011International Business Times AUNessuna valutazione finora

- Australian Dollar Outlook 24 May 2011Documento1 paginaAustralian Dollar Outlook 24 May 2011International Business Times AUNessuna valutazione finora

- Australian Dollar Outlook 20 May 2011Documento1 paginaAustralian Dollar Outlook 20 May 2011International Business Times AUNessuna valutazione finora

- Australian Dollar Outlook 01 June 2011Documento1 paginaAustralian Dollar Outlook 01 June 2011International Business Times AUNessuna valutazione finora

- Australian Dollar Outlook 08/29/2011Documento1 paginaAustralian Dollar Outlook 08/29/2011International Business Times AUNessuna valutazione finora

- FX Daily Report: Bell FX Currency OutlookDocumento1 paginaFX Daily Report: Bell FX Currency OutlookInternational Business Times AUNessuna valutazione finora

- Australian Dollar Outlook 16 May 2011Documento1 paginaAustralian Dollar Outlook 16 May 2011International Business Times AUNessuna valutazione finora

- Australian Dollar OutlookDocumento1 paginaAustralian Dollar OutlookmotlaghNessuna valutazione finora

- Australian Dollar Outlook 20 June 2011Documento1 paginaAustralian Dollar Outlook 20 June 2011International Business Times AUNessuna valutazione finora

- Australian Dollar Outlook 20 July 2011Documento1 paginaAustralian Dollar Outlook 20 July 2011International Business Times AUNessuna valutazione finora

- Australian Dollar Outlook 19 July 2011Documento1 paginaAustralian Dollar Outlook 19 July 2011International Business Times AUNessuna valutazione finora

- Westpack JUL 15 Mornng ReportDocumento1 paginaWestpack JUL 15 Mornng ReportMiir ViirNessuna valutazione finora

- FX Daily Report: Bell FX Currency OutlookDocumento1 paginaFX Daily Report: Bell FX Currency OutlookInternational Business Times AUNessuna valutazione finora

- Australian Dollar Report 19 August 2011Documento1 paginaAustralian Dollar Report 19 August 2011International Business Times AUNessuna valutazione finora

- Westpack JUN 24 Mornng ReportDocumento1 paginaWestpack JUN 24 Mornng ReportMiir ViirNessuna valutazione finora

- Australian Dollar Outlook 21 June 2011Documento1 paginaAustralian Dollar Outlook 21 June 2011International Business Times AUNessuna valutazione finora

- JUL 16 DanskeDailyDocumento3 pagineJUL 16 DanskeDailyMiir ViirNessuna valutazione finora

- Australian Dollar Outlook 07/12/2011Documento1 paginaAustralian Dollar Outlook 07/12/2011International Business Times AUNessuna valutazione finora

- Westpack AUG 04 Mornng ReportDocumento1 paginaWestpack AUG 04 Mornng ReportMiir ViirNessuna valutazione finora

- The Lonely Trader: Date GMT Event Import Forecast Previous RemarksDocumento5 pagineThe Lonely Trader: Date GMT Event Import Forecast Previous RemarksJay SchneiderNessuna valutazione finora

- Australian Dollar Outlook 17 August 2011Documento1 paginaAustralian Dollar Outlook 17 August 2011International Business Times AUNessuna valutazione finora

- ScotiaBank AUG 03 Daily FX UpdateDocumento3 pagineScotiaBank AUG 03 Daily FX UpdateMiir ViirNessuna valutazione finora

- Etoro Weekly Market Review, Oct 10, 2010Documento6 pagineEtoro Weekly Market Review, Oct 10, 2010chlscNessuna valutazione finora

- Australian Dollar Outlook 22 June 2011Documento1 paginaAustralian Dollar Outlook 22 June 2011International Business Times AUNessuna valutazione finora

- Westpack JUL 28 Mornng ReportDocumento1 paginaWestpack JUL 28 Mornng ReportMiir ViirNessuna valutazione finora

- CPI, Interest Rates and Employment Rates Affecting AUD/USDDocumento15 pagineCPI, Interest Rates and Employment Rates Affecting AUD/USDuchiha_rhenzakiNessuna valutazione finora

- Australian Dollar Outlook 23 August 2011Documento1 paginaAustralian Dollar Outlook 23 August 2011International Business Times AUNessuna valutazione finora

- Australian Dollar Outlook11/30/2011Documento1 paginaAustralian Dollar Outlook11/30/2011International Business Times AUNessuna valutazione finora

- Barclays FX Weekly Brief 20100902Documento18 pagineBarclays FX Weekly Brief 20100902aaronandmosesllcNessuna valutazione finora

- Westpack JUL 29 Mornng ReportDocumento1 paginaWestpack JUL 29 Mornng ReportMiir ViirNessuna valutazione finora

- JYSKE Bank AUG 09 Market Drivers CurrenciesDocumento5 pagineJYSKE Bank AUG 09 Market Drivers CurrenciesMiir ViirNessuna valutazione finora

- Westpack AUG 10 Mornng ReportDocumento1 paginaWestpack AUG 10 Mornng ReportMiir ViirNessuna valutazione finora

- Australian Dollar Outlook 22 August 2011Documento1 paginaAustralian Dollar Outlook 22 August 2011International Business Times AUNessuna valutazione finora

- Westpack JUL 20 Mornng ReportDocumento1 paginaWestpack JUL 20 Mornng ReportMiir ViirNessuna valutazione finora

- G10 FX Week Ahead: Tailgating Treasury YieldsDocumento8 pagineG10 FX Week Ahead: Tailgating Treasury YieldsrockieballNessuna valutazione finora

- JUL 02 DanskeDailyDocumento4 pagineJUL 02 DanskeDailyMiir ViirNessuna valutazione finora

- ScotiaBank JUL 27 Daily FX UpdateDocumento3 pagineScotiaBank JUL 27 Daily FX UpdateMiir ViirNessuna valutazione finora

- Westpack AUG 11 Mornng ReportDocumento1 paginaWestpack AUG 11 Mornng ReportMiir ViirNessuna valutazione finora

- Australian Dollar Outlook 06 July 2011Documento1 paginaAustralian Dollar Outlook 06 July 2011International Business Times AUNessuna valutazione finora

- ING Think FX Daily Patient Rba Remains A Secondary Driver For AudDocumento4 pagineING Think FX Daily Patient Rba Remains A Secondary Driver For AudzushiiiNessuna valutazione finora

- Daily Currency Briefing: Waiting For Godot?Documento4 pagineDaily Currency Briefing: Waiting For Godot?timurrsNessuna valutazione finora

- JUL 13 Danske Research DanskeDailyDocumento3 pagineJUL 13 Danske Research DanskeDailyMiir ViirNessuna valutazione finora

- ScotiaBank AUG 04 Daily FX UpdateDocumento3 pagineScotiaBank AUG 04 Daily FX UpdateMiir ViirNessuna valutazione finora

- AUG 11 UOB Global MarketsDocumento3 pagineAUG 11 UOB Global MarketsMiir ViirNessuna valutazione finora

- Global FX StrategyDocumento4 pagineGlobal FX StrategyllaryNessuna valutazione finora

- Westpack JUN 29 Mornng ReportDocumento1 paginaWestpack JUN 29 Mornng ReportMiir ViirNessuna valutazione finora

- JUN 08 Westpack Morning ReportDocumento1 paginaJUN 08 Westpack Morning ReportMiir ViirNessuna valutazione finora

- Global FX Strategy: Summer DullDocumento9 pagineGlobal FX Strategy: Summer Dulljesus davidNessuna valutazione finora

- Westpack JUL 08 Mornng ReportDocumento1 paginaWestpack JUL 08 Mornng ReportMiir ViirNessuna valutazione finora

- Cacib FX DailyDocumento5 pagineCacib FX DailyNova AnnuristianNessuna valutazione finora

- ETFS Outlook September 2016 - in Sync Gold and The USDDocumento3 pagineETFS Outlook September 2016 - in Sync Gold and The USDAnonymous Ht0MIJNessuna valutazione finora

- FX Weekly Commentary - Oct 9 - Oct 15 2011Documento5 pagineFX Weekly Commentary - Oct 9 - Oct 15 2011James PutraNessuna valutazione finora

- Australian Dollar Outlook 03 August 2011Documento1 paginaAustralian Dollar Outlook 03 August 2011International Business Times AUNessuna valutazione finora

- ScotiaBank AUG 06 Daily FX UpdateDocumento3 pagineScotiaBank AUG 06 Daily FX UpdateMiir ViirNessuna valutazione finora

- Risk Event For This Week September 5-9-2016 2Documento5 pagineRisk Event For This Week September 5-9-2016 2randz8Nessuna valutazione finora

- FX Insights: Global Foreign Exchange ResearchDocumento9 pagineFX Insights: Global Foreign Exchange ResearchMyDoc09Nessuna valutazione finora

- Market Drivers - Currencies: Today's Comment Today's Chart - EUR/USDDocumento5 pagineMarket Drivers - Currencies: Today's Comment Today's Chart - EUR/USDMiir ViirNessuna valutazione finora

- Westpack JUN 28 Mornng ReportDocumento1 paginaWestpack JUN 28 Mornng ReportMiir ViirNessuna valutazione finora

- Aussie Dollar at The CrossroadsDocumento30 pagineAussie Dollar at The CrossroadsGreg McKennaNessuna valutazione finora

- Australian Dollar Outlook11/30/2011Documento1 paginaAustralian Dollar Outlook11/30/2011International Business Times AUNessuna valutazione finora

- Australian Dollar Outlook 22 August 2011Documento1 paginaAustralian Dollar Outlook 22 August 2011International Business Times AUNessuna valutazione finora

- Australian Dollar Outlook 24 August 2011Documento1 paginaAustralian Dollar Outlook 24 August 2011International Business Times AUNessuna valutazione finora

- Australian Dollar Outlook 23 August 2011Documento1 paginaAustralian Dollar Outlook 23 August 2011International Business Times AUNessuna valutazione finora

- NAB's Quarterly SME Business Survey June 2011 (Release Date: 03 August 2011)Documento11 pagineNAB's Quarterly SME Business Survey June 2011 (Release Date: 03 August 2011)International Business Times AUNessuna valutazione finora

- Australian Dollar Outlook 17 August 2011Documento1 paginaAustralian Dollar Outlook 17 August 2011International Business Times AUNessuna valutazione finora

- Australian Dollar Report 19 August 2011Documento1 paginaAustralian Dollar Report 19 August 2011International Business Times AUNessuna valutazione finora

- Australian Dollar Outlook 03 August 2011Documento1 paginaAustralian Dollar Outlook 03 August 2011International Business Times AUNessuna valutazione finora

- Forex Market Report 26 July 2011Documento4 pagineForex Market Report 26 July 2011International Business Times AUNessuna valutazione finora

- Australian Dollar Outlook 19 July 2011Documento1 paginaAustralian Dollar Outlook 19 July 2011International Business Times AUNessuna valutazione finora

- Australian Dollar Outlook 20 July 2011Documento1 paginaAustralian Dollar Outlook 20 July 2011International Business Times AUNessuna valutazione finora

- Forex Market Report 25 July 2011Documento4 pagineForex Market Report 25 July 2011International Business Times AUNessuna valutazione finora

- (Ons-Cleared) - 5 Digital 2021 Infographics - ONS-signedDocumento1 pagina(Ons-Cleared) - 5 Digital 2021 Infographics - ONS-signedjcNessuna valutazione finora

- Kingfisher: The King of Good TimesDocumento15 pagineKingfisher: The King of Good Timesharshpatel927Nessuna valutazione finora

- Indian Economy: An OverviewDocumento46 pagineIndian Economy: An OverviewArpit Srivastava100% (2)

- Affordable Housing Is A Priority in The Philippines - Philippines 2015 - Oxford Business GroupDocumento1 paginaAffordable Housing Is A Priority in The Philippines - Philippines 2015 - Oxford Business GroupjeffersonNessuna valutazione finora

- Principles of Banking: Sample Questions and AnswersDocumento15 paginePrinciples of Banking: Sample Questions and Answersmaninder_6Nessuna valutazione finora

- PrintDocumento7 paginePrintZemin MorenoNessuna valutazione finora

- 5 Different Interpretations of Globalization According To John ScholteDocumento3 pagine5 Different Interpretations of Globalization According To John ScholteMaLuisa FontejonNessuna valutazione finora

- KHK Newsletter V5 2022Documento2 pagineKHK Newsletter V5 2022A JoshiNessuna valutazione finora

- Acct Statement - XX9665 - 05052022Documento40 pagineAcct Statement - XX9665 - 05052022nosNessuna valutazione finora

- Pt. Mulia Bakti Famili: Purchase OrderDocumento2 paginePt. Mulia Bakti Famili: Purchase Ordergames rggaNessuna valutazione finora

- New Small Scale Industrial PolicyDocumento1 paginaNew Small Scale Industrial PolicyPrachi BharadwajNessuna valutazione finora

- Calculating GDP-Practice Problems 19-20Documento3 pagineCalculating GDP-Practice Problems 19-20Jill C100% (1)

- Brics: Who They Are, Where They're Going & Why They MatterDocumento27 pagineBrics: Who They Are, Where They're Going & Why They Matterdrlov_20037767Nessuna valutazione finora

- Foreign Capital and Economic Growth of IndiaDocumento23 pagineForeign Capital and Economic Growth of IndiaMitesh ShahNessuna valutazione finora

- Shoe IndustryDocumento8 pagineShoe IndustryYasir NasimNessuna valutazione finora

- MobilePe MoRE PPT FinalDocumento33 pagineMobilePe MoRE PPT FinalNavya VaddimukkalaNessuna valutazione finora

- Topic 1 - Introduction To Double Taxation ProblemDocumento25 pagineTopic 1 - Introduction To Double Taxation ProblemWinston 葉永隆 DiepNessuna valutazione finora

- Stake Holder Analysis - ExxonmobilDocumento8 pagineStake Holder Analysis - Exxonmobilshalabhs4uNessuna valutazione finora

- Development of Iron & Steel Industry in IndiaDocumento9 pagineDevelopment of Iron & Steel Industry in IndiaAbhishek SinghNessuna valutazione finora

- International Business AssignmentDocumento5 pagineInternational Business AssignmentCeline cheahNessuna valutazione finora

- MSI-20-006 Mask InvoiceDocumento1 paginaMSI-20-006 Mask Invoicetranshind overseasNessuna valutazione finora

- 2-The Multinational Enterprise Chapter # 2 (International Business)Documento5 pagine2-The Multinational Enterprise Chapter # 2 (International Business)Asjad Jamshed100% (2)

- 大萧条:历史与经验Documento54 pagine大萧条:历史与经验吴宙航Nessuna valutazione finora

- January BillDocumento1 paginaJanuary Billy4919952Nessuna valutazione finora

- Transaksi Dengan Pihak Berelasi Dan Praktik Transfer Pricing Di IndonesiaDocumento19 pagineTransaksi Dengan Pihak Berelasi Dan Praktik Transfer Pricing Di IndonesiaAntony SantosoNessuna valutazione finora

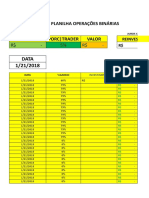

- Querino Dicas Banca Opções BináriasDocumento60 pagineQuerino Dicas Banca Opções BináriasLeonardo PinheiroNessuna valutazione finora

- Ho Hup ConstructionDocumento2 pagineHo Hup ConstructionChaiYeeLingNessuna valutazione finora

- GSMA MobileEconomy 2020 Global InfographicDocumento1 paginaGSMA MobileEconomy 2020 Global InfographicNirenjNessuna valutazione finora

- Deficit FinancingDocumento2 pagineDeficit FinancingArfiya MubeenNessuna valutazione finora

- An Overview of Indian Banking SectorDocumento24 pagineAn Overview of Indian Banking Sectorrahulsaha1986100% (3)