Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Monopoly PefectCompetition

Caricato da

Hugo Layard HorsfallDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Monopoly PefectCompetition

Caricato da

Hugo Layard HorsfallCopyright:

Formati disponibili

James

MARKET STRUCTURE

MONOPOLY AND PERFECT

COMPETITION

THE MARKET STRUCTURE SPECTRUM

Oligopoly: 3+ big firms in an industry, dominating production. E.g.

Tesco, ASDA, Sainsbury’s, Morrisons (“The Big Four”).

Duopoly: 2 big firms in an industry, dominating production. E.g.

Pepsi and Coca Cola.

PERFECT COMPETITION

Four Characteristics

An increase in the supply by ONE firm would result

(1) All firms are producing a

in a small rightward movement along the demand homogenous product.

curve, and therefore demand will not change.

(2) There are many buyers

If output was doubled, the price would fall. If one and sellers (contribute little

perfectly competitive firm raises their prices, then to the final output of an

there are many other substitutes available to industry).

consumers. Likewise, it would be pointless to sell for

below the market price – they would lose potential (3) Buyers and sellers have

profit. the same information &

knowledge of the market.

The demand curve is horizontal – perfectly elastic.

(4) Few/no barriers to

THE GROWTH OF FIRMS

Why do firms want to A concentration ratio is a method of measuring

grow? the potential power of the largest and most

important companies in a particular market.

• Greater Market Share. They

can buy more products with They look at a firm’s market share in the

less competition.

industry, and how many workers are employed.

• Economies of Scale. This

ensures a firm can reduce its A three-firm concentration ratio would be the

average costs and maximize total share of the market (output, employment

profits. etc).

• Stifle Competition. Allows a

firm to reach a greater

Page 1

James

MERGER TAKEOVER

When two companies competing in When a firm takes over another firm in

HORIZONTAL

the same market join together. the same industry.

E.g. Ford and Volvo. E.g. Fullers takeover Gales.

When two firms, each working at When one firm takeover another firm,

VERTICAL

different stages in the production of operating in another stage of the

the same good, combine. production process.

E.g. Time Warner and Turner E.g. Wolverhampton & Dudley brewery

Corporation. takes over Pitcher & Piano brewery.

When a firm merges with a When a firm buys out a different firm in

CONGLOMERATE

different firm in another industry. another industry.

E.g. Virgin merging with NTL, to E.g. Orange taking over Wanadoo (ISP).

become Virgin Media.

FOR EXTERNAL GROWTH AGAINST EXTERNAL GROWTH

• Growth in both size and economic • Lack of expertise in a new field.

power.

• Risk of becoming too big

• Easier to infiltrate foreign countries. Diseconomies of scale (e.g.

McDonalds).

• Easier to diversify.

• Safety risks (e.g. BP & and the oil

• Achieve faster economies of scale. accident).

• Greater control over the productive • Only an option for large firms

process. lack of funds for small companies.

• Fend off a takeover. • Only ¼ of mergers/takeovers

MONOPOLY Sources of Monopoly

Pure Monopoly: A company who is the sole Power

supplier of a particular good/service. E.g. Letter

deliveries. 1. Availability of

substitutes/ potential

Monopoly Power: Spectrum of power – exists competitors.

where several firms share the market power 2. Advertising and

(legally, 25%). E.g. Eurotunnel, SWT, Tesco. Product

Differentiation/Brandi

Local Monopoly: Firms with monopoly power on a ng.

local scale. E.g. Village shop/pub. 3. Barriers to entry:

Natural Monopoly: When extensive economies of Innocent: Exist naturally

scale already exist. E.g. SWT – Rail network already exists.

Page 2

Potrebbero piacerti anche

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Schedule 1 For 2019 Form 1040Documento1 paginaSchedule 1 For 2019 Form 1040CNBC.comNessuna valutazione finora

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Surface CatalogDocumento76 pagineSurface CatalogAnonymous KzJcjGCJbNessuna valutazione finora

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

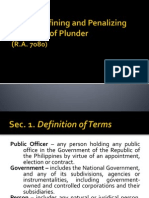

- An Act Defining and Penalizing The Crime of Plunder PPT VersionDocumento14 pagineAn Act Defining and Penalizing The Crime of Plunder PPT Versionimwishie11100% (1)

- Electronic Money License in The UKDocumento4 pagineElectronic Money License in The UKHarry KhanNessuna valutazione finora

- Partnership ReviewerDocumento53 paginePartnership ReviewerYerdXX100% (1)

- Important Data PAN IndiaDocumento206 pagineImportant Data PAN IndiaGirish SharmaNessuna valutazione finora

- Nozzle UL Certificate AileDocumento2 pagineNozzle UL Certificate Ailewarung1bensin100% (2)

- Child-Resistant Packages: Standard Classification ofDocumento5 pagineChild-Resistant Packages: Standard Classification ofAlevj Db100% (1)

- Project On Mitsubishi MotorsDocumento33 pagineProject On Mitsubishi MotorsBinu Nair67% (3)

- SALN2018 RevisedDocumento4 pagineSALN2018 RevisedButz LuceroNessuna valutazione finora

- Jamshedpur (: Help InfoDocumento10 pagineJamshedpur (: Help InfoI-am MotuNessuna valutazione finora

- Request For Qualificatio (RFQ) Document For Development of Aquamarine Park in Visakhapatnam On PPP Mode by Tourism Department (Government of Andhra Pradesh)Documento62 pagineRequest For Qualificatio (RFQ) Document For Development of Aquamarine Park in Visakhapatnam On PPP Mode by Tourism Department (Government of Andhra Pradesh)PrathikNageshNessuna valutazione finora

- TJN-A Academy - Sol PicciottoDocumento33 pagineTJN-A Academy - Sol PicciottoKwesi_WNessuna valutazione finora

- Final Preboard TaxDocumento8 pagineFinal Preboard TaxYaj Cruzada100% (1)

- Biz Ethics PPT 1Documento41 pagineBiz Ethics PPT 1Anjana BaruahNessuna valutazione finora

- Tendeing IntroductionDocumento7 pagineTendeing IntroductionAmulieNessuna valutazione finora

- Bruce R. Barringer R. Duane Ireland: Fourth Edition Global EditionDocumento10 pagineBruce R. Barringer R. Duane Ireland: Fourth Edition Global EditionWin BoNessuna valutazione finora

- ACSA JournalDocumento96 pagineACSA JournalACSA AdminNessuna valutazione finora

- Director of Human ResourcesDocumento3 pagineDirector of Human Resourcesapi-121656428Nessuna valutazione finora

- GST NumbersDocumento143 pagineGST Numbersparwindersingh9066Nessuna valutazione finora

- SBI Life - EWealth Insurance 300415 V2Documento16 pagineSBI Life - EWealth Insurance 300415 V2Tejas JasaniNessuna valutazione finora

- Asif Khan Resume (Feb 2014)Documento2 pagineAsif Khan Resume (Feb 2014)Asif Khan100% (1)

- Characteristics of Small Business EnterprisesDocumento2 pagineCharacteristics of Small Business EnterprisesTolulope DorcasNessuna valutazione finora

- TNT ExpressDocumento8 pagineTNT ExpressNikhil BoggarapuNessuna valutazione finora

- SM AppaDocumento15 pagineSM AppaMark OreschnickNessuna valutazione finora

- Education in KeralaDocumento5 pagineEducation in KeralaBharathi MariappanNessuna valutazione finora

- Mini Case - Chapter 10Documento6 pagineMini Case - Chapter 10mfitani75% (4)

- Kotak Mahindra Mutual FundDocumento30 pagineKotak Mahindra Mutual FundSandeep KhatwaniNessuna valutazione finora

- Financial Statement Analysis For Cash Flow StatementDocumento5 pagineFinancial Statement Analysis For Cash Flow StatementOld School Value100% (3)

- State Bank of India - India's Largest BankDocumento4 pagineState Bank of India - India's Largest Bankvamsi_rsNessuna valutazione finora