Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

The Mortgage Crisis Act II

Caricato da

Robert PardesDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

The Mortgage Crisis Act II

Caricato da

Robert PardesCopyright:

Formati disponibili

The Mortgage Crisis Act II – Is the Bleeding Over?

By Robert Pardes

June 24, 2008

Robert M. Pardes is a CPA and attorney with over 20 year’s management

experience in banking, real estate finance and the mortgage capital markets. He

can be contacted at robert@pardesconsultants.com

Advisor Perspectives welcomes guest contributions. The views presented here

do not necessarily represent those of Advisor Perspectives.

Is the bleeding over for the Mortgage Crisis?

With the inventory of foreclosed properties and resulting loss severities

continuing to increase, it hardly seems so… Looking at only our major financial

institutions, most of the press would have us believe these losses have been

largely accounted for and investors should shift attention to visible cracks in other

areas of consumer finance (prime home equity lines, auto loans and leases,

marine and RV financing, etc.).

But, on a macro basis, the bleeding is not over. An important issue, largely

overlooked and not fully appreciated, will continue to adversely impact the

performance of financial institutions.

Investors are beginning to exert pressure to enforce the contractual rights

embedded in most mortgage securities. These rights represent Act II of the

Mortgage Crisis and will continue to create financial stress for many players in

the housing finance arena as the related exposure is unlikely to be adequately

reflected in existing loss reserves.

These institutions may well be reminded of the iconic Al Pacino line from the

Godfather, Part III, “Just when I thought I was out, they pull me back in.”

Generally, the referenced contractual rights relate to the obligation to require the

issuer (often referred to as the “Depositor” in the securitization structure) or some

other party to repurchase loans that support the securitization to the extent that

the loan can be documented as “defective..” Typically a defective loan is one

that does not meet the contractual representations and warranties that

accompanied the transfer of the pool of loans to the securitization, which is

generally sliced into tranches that are beneficial interests in a Trust. The Trust, in

turn is managed pursuant to the trust agreement by a Trustee. The obligation to

© Copyright 2008, Advisor Perspectives, Inc. All rights reserved.

buy back defective collateral is referred to as a “repurchase” and, for purposes of

this discussion, the overall contingent liability to repurchase loans is “recourse

exposure”.

To date, major financial institutions have reported aggregate losses in the range

of $350 billion associated with holdings in private label MBS and related

transactions. These reported losses overwhelmingly relate to write downs or

cash losses for items reflected on the balance sheet. Recourse exposure,

however, is the potential losses relating to loans previously securitized and

therefore not reflected on the balance sheet. The realization of these losses is

not a mere transfer of already recognized losses between investors and

counterparties, despite what many believe to the contrary. In light of total private

label securitizations for the years 2005-2007 in the range of two trillion, losses

relating to non recourse exposure could total hundreds of billions. These losses

will increase over time as delays in identifying and reporting the exposure has

only increased the severity of loss associated with each potential repurchase, as

interest and default related expenses continue to accrue.

In light of the above, the seminal issues that should be of concern to the financial

community, including investors and analysts are:

• The scale of exposure by institution and in the sector;

• The timing for recognizing the related exposures

Potential Losses: As noted above, the potential losses to be recognized may

be quite substantial relative to the losses already realized. Factors that will weigh

in on the scale of recourse exposure include (i) the aggregate balance of 2005-

2007 private label securitizations; (ii) the cumulative default rate and its

correlation to “defective” collateral; (iii) the expected loss severity; (iv) the

securitization structure; and (v) the nature of the counterparties in terms of

economic capacity (i.e. deep pockets).

Many of these securities are loaded with products susceptible to widespread

abuse and intentional fraud (no down payment and no verification of income or

assets). Mortgage professionals close to the issue have reported that more than

50% of the loans that have defaulted based on representative contain material

breaches of the related representations and warranties (See,” Speculators may

have accelerated Housing Downturn”, Wall Street Journal, February 6, 2008).

With reported cumulative default rates ranging from the low 20s to 35% and loss

severities of 40% - 50%, it is not difficult to arrive at an estimate that the total loss

exposure to loan repurchases well exceeds $100 billion, before accrued interest

and expenses. Major issuers and depositors with historical securitization activity

© Copyright 2008, Advisor Perspectives, Inc. All rights reserved.

in the range of several hundred billion dollars are likely to face an operating

revenue and capital impact in the billions.

Timing of Losses: There is little clarity or consistency in the accounting rules

and practices for recognizing the potential exposure to loan repurchases. Where

there is a documented claim, a basis for establishing a reserve exists. The

amount of the reserve, though, can be arrived at by a highly subjective

determination of the probability of success in having the claim rescinded on

substantive grounds and the expected loss or market value of the loan if

repurchased.

Where there is no documented claim, however, the accounting treatment

becomes murkier, often relying on historical experience rather than the

extraordinary circumstances that exemplify the current environment. The

relevance of historical experience as a basis for estimating future exposure

should be a cause of concern, due to the perceived paucity of documented

claims generated by outstanding private label securitizations in the context of

elevated default rates that are multiples of historical defaults. To a large degree,

the lack of documented claims is a function of flaws and impediments in the

securitization structures, presenting novel legal and business issues for the

secondary mortgage market.

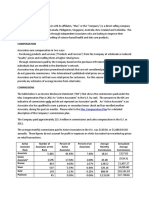

Figure 1 depicts the basic structure of the securitization process. Warranties and

representations flow to the Trust and the potential for repurchase claims flows

from the Trust back to the loan originator or issuer. From a loss exposure point of

view, mortgage related securities fall into one of three classes:

• Standard representations and warranties are provided by the originator or

securities firm having the economic capacity to honor repurchase

obligations;

• Representations and warranties flow from a party with the requisite

balance sheet to support recovery, but the representation and warranties

are diluted, resulting in considerable debate as to the merits of a demand

by the Trustee to repurchase the related collateral

• Representations and warranties flow from a party lacking economic

capacity to honor repurchase demands and the potential for recovery for

the Trust and investors based upon the structural obligations is remote.

Securitizations falling into the first category make up a considerable amount of

the total population of the relevant vintage and the parties subject to recourse

exposure are, for the most part, high profile investment banks and money center

© Copyright 2008, Advisor Perspectives, Inc. All rights reserved.

banks – the same institutions that reported the vast majority of the aggregate

losses to date.

So, why haven’t these losses been recognized to date, and when should

investors expect the exposure to be reflected in financial performance?

Increasing investor pressure to identify defective collateral has exposed

mechanical flaws in the securitization structure and has provided clarity with

respect to the role and obligations of the Trustee in this unprecedented

environment. Since the Trustee is the sole representative of the interests of

investors in the securitization structure, the inability to identify defective collateral

has crippled a fluent process for investor recoveries and is the primary culprit in

delaying the full recognition of off balance sheet exposure.

To be fair, the Trustee’s contractual obligations are limited to an essentially

passive role and the Trust Agreement to which they are subject fails to provide

the resources or specific obligations to engage in a forensic examination of the

transferred loans. Without specific knowledge as to a defect, the Trustee’s may

believe they are handicapped in their ability to demand repurchases,

notwithstanding the unusually high level of defaults and the implication that the

rate of defective collateral far exceeds the frequency of repurchase demands

from the Trustee. Finally, Trustee fees are a tiny sliver of the cash flow generated

by a securitization (as little as $10 - $20 thousand per $100 million). Trustees will

argue that their level of compensation couldn’t possibly cover anything but a

passive role as a conduit of performance reporting and cash flow administration

for the various tranches.

Several recent trends are likely to accelerate the pace of recourse demands and

the realization by financial institutions of sizable related losses. A Federal Court

in Massachusetts recently sanctioned a leading institutional trustee for having

turned a “blind eye” to the mistakes of the servicer for a securitization in

connection with bankruptcy filings. Institutional investors will latch on to the “blind

eye” theory with increasing frequency to compel forensic reviews.

Secondly, as virtually all tranches of securities from AAA through unrated have

suffered material losses and write downs, there is increasing collaboration

among investors to seek redress in the governance provisions of Trust

Agreements, which allows investors to exercise certain rights based upon pre-

established voting percentages.

The above factors portend significant increases in losses transferred from the

securitization to major financial institutions. The Federal Reserve may have

understood that these losses would ultimately bleed through when it aggressively

cut rates, allowing the gift of increased net interest margins to mask the impact to

capital and earnings. From the Fed’s perspective, an ongoing process may be

© Copyright 2008, Advisor Perspectives, Inc. All rights reserved.

preferable to immediate recognition to avoid the obvious depletion of capital,

which would result in further disruption to the markets. Real growth in revenues

for many financial institutions is likely to be retarded by recourse exposure for

many quarters to come – continuing the pressure on earnings and performance

and limiting any short term recovery in shareholder value.

As the investment community gains greater appreciation for the

recourse/repurchase issue, the risk of even greater polarization between

investors and issuers increases, further undermining the trust essential to

functional markets. The flip side is the opportunity for value investors to

strategically invest in securities that are likely to benefit from improved cash flows

as more loans are paid off in full, as issuers settle claims related to recourse

exposure.

The exposure to losses is real. As they say in Latin, “res ipsa loquitor” – the thing

speaks for itself. The record level of defaults for the 2005-2007 vintage non-

prime securities needs no further explanation. Nevertheless, investors and

issuers are best served by expediting resolution through reasonable

compromise. The adversarial route of protracted litigation over claims of fraud

and disclosure will extend the pain and delay the restoration of confidence in the

mortgage capital markets critical to a housing recovery. There is no perfection,

just the opportunity to move on as quickly as possible.

© Copyright 2008, Advisor Perspectives, Inc. All rights reserved.

FIGURE I: BASIC SECURITIZATION FLOWCHART

Originators,

Single Issuer

Asset Pool Or

(Mortgages, loans, Conduit

etc…) Rating Agencies

&

Credit

Enhancements

Representations Demand to

& Repurchase Defective

Warranties Collateral

SPV

(“Issuer” of Multi Class

Securities) Class ‘A’ Notes ((AAA)

Proceeds

Issue Class ‘B’ Notes (AA)

From Sale

Securitie

Of Notes

s INVESTORS

Class ‘C’ Notes (BBB)

Structure of Notes

www.advisorperspectives.com

For a free subscription to the Advisor Perspectives newsletter, visit:

http://www.advisorperspectives.com/subscribers/subscribe.php

© Copyright 2008, Advisor Perspectives, Inc. All rights reserved.

Potrebbero piacerti anche

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Introduction SsiDocumento44 pagineIntroduction SsiSheetal IyerNessuna valutazione finora

- Accounting For General Long-Term Liabilities and Debt ServiceDocumento50 pagineAccounting For General Long-Term Liabilities and Debt Serviceመስቀል ኃይላችን ነውNessuna valutazione finora

- Chapter 6Documento57 pagineChapter 6Léo Audibert75% (4)

- FI MM OBYC ScenariosDocumento29 pagineFI MM OBYC ScenariosPawanDubeyNessuna valutazione finora

- Kraft FoodsDocumento14 pagineKraft FoodsNazish Sohail75% (4)

- Ministop Business ModelDocumento9 pagineMinistop Business ModelGizella Almeda100% (1)

- Capital in 21st Century PDFDocumento6 pagineCapital in 21st Century PDFMohammad Waqas SaramNessuna valutazione finora

- A. RecognitionDocumento9 pagineA. RecognitionMark Paul RamosNessuna valutazione finora

- 3 Phil American Life Insurance Vs Sec of Finance DIGESTDocumento2 pagine3 Phil American Life Insurance Vs Sec of Finance DIGESTMa Gabriellen Quijada-Tabuñag75% (4)

- A Mutual Fund is a Common Pool of Money in to Which Investors With Common Investment Objective Place Their Contributions That Are to Be Invested in Accordance With the Stated Investment Objective of the SchemeDocumento6 pagineA Mutual Fund is a Common Pool of Money in to Which Investors With Common Investment Objective Place Their Contributions That Are to Be Invested in Accordance With the Stated Investment Objective of the SchemeKumaran MohanNessuna valutazione finora

- Cottle-Taylor: Expanding The Oral Care Group in IndiaDocumento18 pagineCottle-Taylor: Expanding The Oral Care Group in IndiaManav LakhinaNessuna valutazione finora

- DR Ashraf Elsafty E SC 50A Samer Sohry FinalDocumento41 pagineDR Ashraf Elsafty E SC 50A Samer Sohry FinalMahmoud SaeedNessuna valutazione finora

- Chapter 9 - Valuation of StocksDocumento27 pagineChapter 9 - Valuation of StocksAnubhab GuhaNessuna valutazione finora

- Select Cases in Itd 2009Documento106 pagineSelect Cases in Itd 2009rajesh laddhaNessuna valutazione finora

- NIKE and AdidasDocumento46 pagineNIKE and AdidasJov E. AlcanseNessuna valutazione finora

- How To Trade Options - 12 Tenets of Daily Trade DisciplineDocumento2 pagineHow To Trade Options - 12 Tenets of Daily Trade DisciplineHome Options TradingNessuna valutazione finora

- TVM Assignment 1Documento1 paginaTVM Assignment 1Mohammad TayyabNessuna valutazione finora

- Max International Income Disclosure Statement - enDocumento2 pagineMax International Income Disclosure Statement - enDialllNessuna valutazione finora

- Mock QuizDocumento11 pagineMock QuizMichelle MarquezNessuna valutazione finora

- Income Tax MCQ PDFDocumento26 pagineIncome Tax MCQ PDFSachin PanchalNessuna valutazione finora

- Intangible AssetsDocumento42 pagineIntangible AssetsC SNessuna valutazione finora

- Far110full 140911091633 Phpapp02Documento56 pagineFar110full 140911091633 Phpapp02Is FarezNessuna valutazione finora

- Gordon - Small Scale Vegetable Oil Extraction (Book) 1995Documento126 pagineGordon - Small Scale Vegetable Oil Extraction (Book) 1995Andres ValderramaNessuna valutazione finora

- Form 12cDocumento2 pagineForm 12cmansooralikhan ANessuna valutazione finora

- Fabm Module 3 PowerpointDocumento70 pagineFabm Module 3 PowerpointCharlene Mae BorromeoNessuna valutazione finora

- 2011 Accounting Standards in NigeriaDocumento70 pagine2011 Accounting Standards in Nigeriaoluomo1100% (1)

- Cashflow A. Indirect Method: KM Manufacturing CompanyDocumento2 pagineCashflow A. Indirect Method: KM Manufacturing CompanyArnold AdanoNessuna valutazione finora

- Competencies and EnterpurshipDocumento160 pagineCompetencies and EnterpurshipkormeadeyNessuna valutazione finora

- IBM Business Perspective 0912Documento30 pagineIBM Business Perspective 0912InvestorPresentationNessuna valutazione finora

- Phil. Consolidated Coconut Industries V CIR (70 SCRA 22)Documento15 paginePhil. Consolidated Coconut Industries V CIR (70 SCRA 22)Kaye Miranda LaurenteNessuna valutazione finora