Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

US Internal Revenue Service: I4797 - 1995

Caricato da

IRSDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

US Internal Revenue Service: I4797 - 1995

Caricato da

IRSCopyright:

Formati disponibili

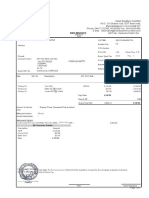

Department of the Treasury Other Forms To Use

Internal Revenue Service ●report

Use Form 4684, Casualties and Thefts, to

involuntary conversions from casualties

and thefts.

Instructions for Form 4797 ● Use Form 8824, Like-Kind Exchanges, for

each exchange of qualifying business or

investment property for property of a like kind.

Sales of Business Property For exchanges of property used in a trade or

business (and other noncapital assets), enter the

(Also Involuntary Conversions and Recapture Amounts gain or (loss) from Form 8824, if any, on line 5 or

17.

Under Sections 179 and 280F(b)(2)) ● If you sold property on which you claimed

Section references are to the Inter nal Revenue Code unless otherwise noted. investment credit, get Form 4255, Recapture of

Investment Credit, to see if you must recapture

some or all of the credit.

Paperwork Reduction Act General Instructions

Notice Special Rules

Purpose of Form

We ask for the information on this form to carry Allocation of purchase price.—If you acquire or

out the Internal Revenue laws of the United Use Form 4797 to report: dispose of assets that constitute a trade or

States. You are required to give us the ● The sale or exchange of property used in your business, the buyer and seller must allocate the

information. We need it to ensure that you are trade or business; depreciable and amortizable total purchase price using the residual method

complying with these laws and to allow us to property; oil, gas, geothermal, or other mineral and must file Form 8594, Asset Acquisition

figure and collect the right amount of tax. properties; and section 126 property. Statement.

The time needed to complete and file this form ● The involuntary conversion (from other than At-risk rules.—If you report a loss on an asset

will vary depending on individual circumstances. casualty or theft) of property used in your trade used in an activity for which you are not at risk,

The estimated average time is: or business and capital assets held in in whole or in part, see the instructions for Form

connection with a trade or business or a 6198, At-Risk Limitations. Also, get Pub. 925,

Recordkeeping 30 hr., 8 min. Passive Activity and At-Risk Rules. Losses from

transaction entered into for profit.

Learning about the law ● The disposition of noncapital assets other than passive activities are first subject to the at-risk

or the form 11 hr., 40 min. inventory or property held primarily for sale to rules and then to the passive activity rules.

Preparing the form 17 hr., 20 min. customers in the ordinary course of your trade or Installment sales.—If you sold property at a

business. gain and you will receive a payment in a tax year

Copying, assembling, and after the year of sale, you must report the sale

sending the form to the IRS 1 hr., 20 min. ● The recapture of section 179 expense

deductions for partners and S corporation on the installment method unless you elect not

If you have comments concerning the shareholders from property dispositions by to do so.

accuracy of these time estimates or suggestions partnerships and S corporations. Use Form 6252, Installment Sale Income, to

for making this form simpler, we would be happy report the sale on the installment method. Also

to hear from you. See the instructions for the tax ● The computation of recapture amounts under

sections 179 and 280F(b)(2), when the business use Form 6252 to report any payment received

return with which this form is filed. in 1995 from a sale made in an earlier year that

use of section 179 or listed property drops to

50% or less. you reported on the installment method.

To elect out of the installment method, report

the full amount of the gain on a timely filed

return (including extensions).

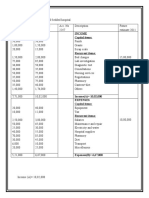

Where To Make First Entry for Certain Items Reported on This Form Get Pub. 537, Installment Sales, for more

(b) (c) details.

(a)

Held 1 year Held more Involuntary conversion of property.—You may

Type of property

or less than 1 year not have to pay tax on a gain from an

involuntary or compulsory conversion of

1 Depreciable trade or business property:

property. Get Pub. 544, Sales and Other

a Sold or exchanged at a gain Part II Part III (1245, 1250) Dispositions of Assets, for details.

b Sold or exchanged at a loss Part II Part I One-time exclusion on the sale of a home

2 Depreciable residential rental property: used for business.—If you rented or used part

a Sold or exchanged at a gain Part II Part III (1250) of your home for business and meet the

requirements to take the one-time exclusion for

b Sold or exchanged at a loss Part II Part I persons age 55 or older, you may be able to

3 Farmland held less than 10 years upon which soil, water, exclude part or all of the gain figured on line 26.

or land clearing expenses were deducted: For details on electing the one-time exclusion

a Sold at a gain Part II Part III (1252) and allocating the sales price, expenses of sale,

and the adjusted basis of the home, see the

b Sold at a loss Part II Part I

instructions for Form 2119, Sale of Your Home.

4 Disposition of cost-sharing payment property described

To report the sale and the one-time exclusion

in section 126 Part II Part III (1255)

on Form 4797, figure the gain on the part that

Held less than Held 24 months was rented or used for business in Part III. Do

5 Cattle and horses used in a trade or business for draft, not take the exclusion into account when

breeding, dairy, or sporting purposes: 24 months or more

figuring the gain on line 26, but do take it into

a Sold at a gain Part II Part III (1245) account when figuring section 1250 recapture, if

b Sold at a loss Part II Part I any, on line 28g. On line 2 of Part I, write

“Section 121 exclusion” and enter the amount of

c Raised cattle and horses sold at a gain Part II Part I the exclusion in column (g). Complete Part II of

Form 2119 and attach it and Form 4797 to your

6 Livestock other than cattle and horses used in a trade or Held less than Held 12 months

return.

business for draft, breeding, dairy, or sporting purposes: 12 months or more

Passive loss limitations.—If you have an overall

a Sold at a gain Part II Part III (1245) loss from passive activities, and you report a

b Sold at a loss Part II Part I loss on an asset used in a passive activity, use

c Raised livestock sold at a gain Part II Part I Form 8582, Passive Activity Loss Limitations, to

see how much loss is allowed before entering it

on Form 4797.

Cat. No. 13087T

You cannot claim unused passive activity These conversions may result from (a) part or Line 11.—Report other ordinary gains and

credits when you dispose of your interest in an total destruction, (b) theft or seizure, or losses, including property held 1 year or less, on

activity. However, if you dispose of your entire (c) requisition or condemnation (whether this line.

interest in an activity, you may elect to increase threatened or carried out). If any recognized Section 1244 (small business) stock.—

the basis of the credit property by the original losses were from involuntary conversions from Individuals report ordinary losses from the sale

basis reduction of the property to the extent that fire, storm, shipwreck, or other casualty, or from or exchange (including worthlessness) of section

the credit has not been allowed because of the theft, and they exceed the recognized gains from 1244 (small business) stock on

passive activity rules. Make the election on Form the conversions, do not include them when line 11.

8582-CR, Passive Activity Credit Limitations, or figuring your net section 1231 losses.

Form 8810, Corporate Passive Activity Loss and To qualify as section 1244 stock, all of the

Section 1231 transactions do not include: following requirements must be met:

Credit Limitations. No basis adjustment may be

elected on a partial disposition of your interest in ● Sales or exchanges of inventory or property 1. You acquired the stock after June 30, 1958,

an activity. held primarily for sale to customers. upon original issuance from a domestic

Recapture of preproductive expenses.—If you ● Sales or exchanges of copyrights, literary, corporation (or the stock was acquired by a

elected out of the uniform capitalization rules of musical, or artistic compositions, letters or partnership in which you were a partner

section 263A, any plant that you produce is memoranda, or similar property (a) created by continuously from the date the stock was issued

treated as section 1245 property. For your personal efforts, (b) prepared or produced until the time of the loss).

dispositions of plants reportable on Form 4797, for you (in the case of letters, memoranda, or 2. If the stock was issued before November 7,

enter the recapture amount taxed as ordinary similar property), or (c) that you received from 1978, it was issued under a written plan that met

income on line 24 of Form 4797. Get Pub. 225, someone who created them or for whom they the requirements of Regulations section

Farmer’s Tax Guide, for more details. were created, as mentioned in (a) or (b), in a 1.1244(c)-1(f), and when that plan was adopted,

way (such as by gift) that entitled you to the the corporation was treated as a small business

Section 197(f)(9)(B)(ii) election.—If you elected basis of the previous owner.

under section 197(f)(9)(B)(ii) to recognize gain on corporation under Regulations section

the disposition of a section 197 intangible and to ● Sales or exchanges of U.S. Government 1.1244(c)-2(c).

pay a tax on that gain at the highest tax rate, publications, including the Congressional 3. If the stock was issued after November 6,

report the additional tax on Form 1040, line 39 Record, that you received from the Government, 1978, the corporation was treated as a small

(or the appropriate line of other income tax other than by purchase at the normal sales business corporation, at the time the stock was

returns). On the dotted line next to that line, price, or that you got from someone who had issued, under Regulations section 1.1244(c)-2(b).

write “197.” The additional tax is the amount received it in a similar way, if your basis is To be treated as a small business corporation,

that, when added to any other income tax on the determined by reference to the previous owner’s the total amount of money and other property

gain, equals the gain multiplied by the highest basis. received by the corporation for its stock as a

tax rate. Line 9—Nonrecaptured net section 1231 contribution to capital and paid-in surplus

Transfer of appreciated property to political losses.—Part or all of your section 1231 gains generally may not exceed $1 million.

organizations.—Treat a transfer of property to a on line 8 may be taxed as ordinary income 4. The stock was issued for money or other

political organization as a sale of property on the instead of receiving long-term capital gain property (excluding stock or securities).

date of transfer if the property’s fair market value treatment. These net section 1231 gains are

treated as ordinary income to the extent of the 5. The corporation, for its 5 most recent tax

when transferred is more than your adjusted years ending before the loss, derived more than

basis. Apply the ordinary income or capital gains “nonrecaptured section 1231 losses.” The

nonrecaptured losses are net section 1231 50% of its gross receipts from sources other

provisions as if a sale had actually occurred. See than royalties, rents, dividends, interest,

section 84. losses deducted during the 5 preceding tax

years that have not yet been applied against any annuities, and gains from sales and exchanges

of stocks or securities. (If the corporation was in

Specific Instructions net section 1231 gain for determining how much

gain is ordinary income under these rules. existence for at least 1 tax year but fewer than 5

To show losses, enclose figures in (parentheses). tax years ending before the loss, the 50% test

Example. If you had net section 1231 losses applies for the tax years ending before the loss.

of $4,000 and $6,000 in 1990 and 1991 and net

Part I section 1231 gains of $3,000 and $2,000 in 1994

If the corporation was not in existence for at

least 1 tax year ending before the loss, the 50%

Section 1231 transactions are: and 1995, line 8 would show the 1995 gain of test applies for the entire period ending before

● Sales or exchanges of real or depreciable $2,000, and line 9 would show nonrecaptured the loss.) However, the 50% test does not apply

property used in a trade or business and held for net section 1231 losses of $7,000 ($10,000 net if the corporation’s deductions (other than the

more than 1 year. To figure the holding period, section 1231 losses minus the $3,000 that was net operating loss and dividends-received

begin counting on the day after you received the recaptured because of the 1994 gain). The deductions) exceeded its gross income during

property and include the day you disposed of it. $2,000 gain on line 8 is all ordinary income and that period.

would be entered on line 13 of Form 4797. For

● Cutting of timber that the taxpayer elects to recordkeeping purposes, the $4,000 loss from 6. If the stock was issued before July 19,

treat as a sale or exchange under section 631(a). 1990 is all recaptured ($3,000 in 1994 and 1984, it must have been common stock.

● Disposal of timber with a retained economic $1,000 in 1995) and you have $5,000 left to The maximum amount that may be treated as

interest that is treated as a sale under section recapture from 1991 ($6,000 minus the $1,000 an ordinary loss is $50,000 ($100,000 if married

631(b). recaptured this year). filing jointly). Special rules may limit the amount

● Disposal of coal (including lignite) or domestic Figuring the prior year losses.—You had a net of your ordinary loss if (a) you received section

iron ore with a retained economic interest that is section 1231 loss if section 1231 losses 1244 stock in exchange for property with a basis

treated as a sale under section 631(c). exceeded section 1231 gains. Gains are in excess of its fair market value or (b) your

included only to the extent taken into account in stock basis increased from contributions to

● Sales or exchanges of cattle and horses, capital or otherwise. See Pub. 550, Investment

regardless of age, used in a trade or business by figuring gross income. Losses are included only

to the extent taken into account in figuring Income and Expenses, for more details. Report

the taxpayer for draft, breeding, dairy, or on Schedule D losses in excess of the maximum

sporting purposes and held for 24 months or taxable income except that the limitation on

capital losses does not apply. amount that may be treated as an ordinary loss

more from acquisition date. (and gains from the sale or exchange of section

● Sales or exchanges of livestock other than Line 10.—For recordkeeping purposes, if line 10 1244 stock).

cattle and horses, regardless of age, used by the is zero, the amount on line 8 is the amount of

net section 1231 loss recaptured in 1995. If line Keep adequate records to distinguish section

taxpayer for draft, breeding, dairy, or sporting 1244 stock from any other stock owned in the

purposes and held for 12 months or more from 10 is more than zero, you have recaptured in

1995 all your net section 1231 losses from prior same corporation.

acquisition date.

years. Line 18.—Enter any recapture of section 179

Note: Livestock does not include poultry, expense deduction included on Schedule K-1

chickens, turkeys, pigeons, geese, other birds, Part II (Form 1065), line 25, and on Schedule K-1 (Form

fish, frogs, reptiles, etc. 1120S), line 23, but only if it is due to a

If a transaction is not reportable in Part I or Part

● Sales or exchanges of unharvested crops. See III and the property is not a capital asset disposition. Include it only to the extent that you

section 1231(b)(4). reportable on Schedule D, report the transaction took a deduction for it in an earlier year. See

● Involuntary conversions of trade or business in Part II. instructions for Part IV if you have section 179

property or capital assets held in connection recapture when the business use percentage of

If you receive ordinary income from a sale or the property dropped to 50% or less.

with a trade or business or a transaction entered other disposition of your interest in a partnership,

into for profit, and kept more than 1 year. get Pub. 541, Tax Information on Partnerships. Line 20b(1).—You must complete this line if

there is a gain on Form 4797, line 3; a loss on

Page 2

Form 4797, line 12; and a loss on Form 4684, 3. The downward basis adjustment under transportation, communications, or certain public

line 35, column (b)(ii). Enter on this line and on section 50(c) (or the corresponding provision of utility services.

Schedule A (Form 1040), line 22, the smaller of prior law); 2. As a research facility in these activities.

the loss on Form 4797, line 12; or the loss on 4. The deduction for qualified clean-fuel

Form 4684, line 35, column (b)(ii). To figure 3. For the bulk storage of fungible

vehicle property or refueling property; and commodities (including commodities in a liquid

which loss is smaller, treat both losses as

positive numbers. 5. Deductions claimed under section 190, 193, or gaseous state) used in these activities.

or 1253(d)(2) or (3) (as in effect before the ● A single purpose agricultural or horticultural

Part III enactment of P.L. 103-66). structure (as defined in section 168(i)(13)).

Generally, do not complete Part III for property Step 2.—From the step 1 total, subtract the ● A storage facility (not including a building or

held 1 year or less; use Part II instead. For following amounts: its structural components) used in connection

exceptions, see the chart on page 1. 1. Any investment credit recapture amount if with the distribution of petroleum or any primary

Part III is used to figure recapture of the basis of the property was reduced for the tax petroleum product.

depreciation and certain other items that must year the property was placed in service under ● Any railroad grading or tunnel bore (as defined

be reported as ordinary income on the section 50(c)(1) (or the corresponding provision in section 168(e)(4)).

disposition of property. Fill out lines 21 through of prior law). See section 50(c)(2) (or the

corresponding provision of prior law). See section 1245(b) for exceptions and limits

26 to determine the gain on the disposition of involving:

the property. If you have more than four 2. Any section 179 or 280F(b)(2) recapture

properties to report, use additional forms. For amount included in gross income in a prior tax ● Gifts.

more details on depreciation recapture, see Pub. year because the business use of the property ● Transfers at death.

544. dropped to 50% or less. ● Certain tax-free transactions.

Note: If the property was sold on the installment 3. Any qualified clean-fuel vehicle property or ● Certain like-kind exchanges, involuntary

sale basis, see the Instructions for Form 6252 refueling property deduction you were required conversions, etc.

before completing this part. Also, if you have to recapture because the property ceased to be

both installment sales and noninstallment sales, eligible for the deduction. ● Sales or exchanges before January 17, 1995

you may want to use a separate Form 4797, Part (except as provided in section 2(d) of P.L. 104-7)

You may have to include depreciation allowed to carry out FCC policies.

III, for each installment sale and one Form 4797, or allowable on another asset (and refigure the

Part III, for the noninstallment sales. basis amount for line 23) if you use its adjusted ● Exchanges to comply with SEC orders.

Line 22.—The gross sales price includes money, basis in determining the adjusted basis of the ● Property distributed by a partnership to a

the fair market value of other property received, property described on line 21. An example is partner.

and any existing mortgage or other debt the property acquired by a trade-in. See Regulations

● Transfers to tax-exempt organizations where

buyer assumes or takes the property subject to. section 1.1245-2(a)(4).

the property will be used in an unrelated

For casualty or theft gains, include insurance or Partnerships should enter the deductions business.

other reimbursement you received or expect to allowed or allowable for depreciation,

receive for each item. Include on this line your ● Timber property.

amortization, or depletion on line 24. Enter the

insurance coverage, whether or not you are section 179 expense deduction on Form 1065, See the following sections for special rules:

submitting a claim for reimbursement. Schedule K, line 24. Partnerships should make ● Section 1245(a)(4) for player contracts and

For section 1255 property disposed of in a the basis adjustment required under section section 1056(c) for information required from the

sale, exchange, or involuntary conversion, enter 50(c) (or the corresponding provision of prior transferor of a franchise of any sports enterprise

the amount realized. For section 1255 property law). Partners adjust the basis of their interest in if the sale or exchange involves the transfer of

disposed of in any other way, enter the fair the partnership to take into account the basis player contracts.

market value. adjustments made at the partnership level.

● Section 1245(a)(5) (repealed) for property

Line 23.—Reduce the cost or other basis of the S corporations should enter the deductions placed in service before 1987, when only a

property by the amount of any qualified electric allowed or allowable for depreciation, portion of a building is section 1245 recovery

vehicle credit, diesel-powered highway vehicle amortization, or depletion on line 24. Enter the property.

credit, enhanced oil recovery credit, or disabled section 179 expense deduction on Form 1120S,

● Section 1245(a)(6) (repealed) for qualified

access credit. Schedule K, line 21, but only if the corporation

leased property placed in service before 1987.

However, do not reduce the cost or other disposed of property acquired in a tax year

beginning after 1982. Line 28—Section 1250 property.—Section 1250

basis on this line by any of the following

S corporations should make the basis property is depreciable real property (other than

amounts:

adjustment required under section 50(c) (or the section 1245 property). Section 1250 recapture

1. Deductions allowed or allowable for corresponding provision of prior law). applies when an accelerated depreciation

depreciation, amortization, depletion, or Shareholders adjust the basis in their stock in method was used.

preproductive expenses; the corporation to take into account the basis Section 1250 recapture does not apply to

2. The section 179 expense deduction; adjustments made at the S corporation level dispositions of the following property placed in

3. The downward basis adjustment under under section 50(c) (or the corresponding service after 1986 (or after July 31, 1986, if

section 50(c) (or the corresponding provision of provision of prior law). elected).

prior law); Line 25.—For section 1255 property, enter the 1. 27.5-year (or 40-year, if elected) residential

4. The deduction for qualified clean-fuel adjusted basis of the section 126 property rental property.

vehicle property or refueling property; or disposed of.

2. 22-, 31.5-, or 39-year (or 40-year, if elected)

5. Deductions claimed under section 190, 193, Line 27—Section 1245 property.—Section 1245 nonresidential real property.

or 1253(d)(2) or (3) (as in effect before the property is depreciable (or amortizable under

section 185 (repealed), 197, or 1253(d)(2) or (3) Real property depreciable under ACRS

enactment of P.L. 103-66). (pre-1987 rules) is subject to recapture under

(as in effect before the enactment of P.L.

Instead, include these amounts on line 24. 103-66)) and is one of the following: section 1245, except for the following, which are

They will be used to determine the property’s treated as section 1250 property:

● Personal property.

adjusted basis on line 25. ● 15-, 18-, or 19-year real property and

Increase the cost or other basis by any ● Elevators and escalators placed in service low-income housing that is residential rental

qualified electric vehicle credit recapture amount. before 1987. property.

Line 24.—For a taxpayer other than a ● Real property (other than property described ● 15-, 18-, or 19-year real property and

partnership or an S corporation, complete the under tangible real property below) subject to low-income housing that is used mostly outside

following steps to figure the amount to enter on amortization or deductions under section 169, the United States.

179, 185 (repealed), 188 (repealed), 190, 193, or

line 24:

194. ● 15-, 18-, or 19-year real property and

Step 1.—Add the following amounts: low-income housing for which a straight line

● Tangible real property (except buildings and election was made.

1. Deductions allowed or allowable for their structural components) if it is used in any of

depreciation, amortization, depletion, or the following ways: ● Low-income rental housing described in

preproductive expenses; clause (i), (ii), (iii), or (iv) of section 1250(a)(1)(B).

1. As an integral part of manufacturing, See instructions for line 28b.

2. The section 179 expense deduction; production, extraction, or furnishing

See section 1250(d) for exceptions and limits

involving:

Page 3

● Gifts. and 182 (land clearing) (repealed). Skip line 29 if excluded from income. Use 100% minus 10%

● Transfers at death. you dispose of such farmland during the 10th or for each year, or part of a year, that the property

later year after you acquired it. was held over 10 years after receipt of the

● Certain tax-free transactions. excluded payments. Use zero if 20 years or

Gain from disposition of certain farmland is

● Certain like-kind exchanges, involuntary subject to ordinary income rules under section more.

conversions, etc. 1252 before being considered under section Line 31b.—If any part of the gain shown on line

● Sales or exchanges before January 17, 1995 1231 (Part I). 26 is treated as ordinary income under sections

(except as provided in section 2(d) of P.L. 104-7) When filling out line 29b, enter 100% of line 1231 through 1254 (e.g., section 1252), enter the

to carry out FCC policies. 29a on line 29b, except as follows: smaller of (a) line 26 reduced by the part of the

gain treated as ordinary income under the other

● Exchanges to comply with SEC orders. ● 80% if the farmland was disposed of within provision or

● Property distributed by a partnership to a the 6th year after it was acquired. (b) line 31a.

partner. ● 60% if disposed of within the 7th year.

● Disposition of a main home. ● 40% if disposed of within the 8th year.

Part IV

● Disposition of qualified low-income housing. ● 20% if disposed of within the 9th year. Section 179 property—column (a).—If you took

● Transfers of property to tax-exempt a section 179 expense deduction for property

Line 30—Section 1254 property.—If you had a placed in service after 1986 (other than listed

organizations where the property will be used in gain on the disposition of oil, gas, or geothermal

an unrelated business. property, as defined in section 280F(d)(4)), and

property placed in service before 1987, you must the business use of the property was reduced to

● Dispositions of property as a result of treat all or part of the gain as ordinary income. 50% or less this year, complete column (a) of

foreclosure proceedings. Include on line 24 of Form 4797 any depletion lines 35 through 37 to figure the recapture

Special rules: allowed (or allowable) in determining the amount.

adjusted basis of the property.

● For additional depreciation attributable to Listed property—column (b).—If you have

rehabilitation expenditures, see section If you had a gain on the disposition of oil, gas, listed property that you placed in service in a

1250(b)(4). geothermal, or other mineral properties (section prior year and the business use dropped to 50%

1254 property) placed in service after 1986, you or less this year, figure the amount to be

● If substantial improvements have been made, must recapture all expenses that were deducted recaptured under section 280F(b)(2). Complete

see section 1250(f). as intangible drilling costs, depletion, mine column (b), lines 35 through 37. Get Pub. 917,

Line 28a.—Enter the additional depreciation exploration costs, and development costs, under Business Use of a Car, for more details on

for the period after 1975. Additional sections 263, 616, and 617. recapture of excess depreciation.

depreciation is the excess of actual Exception. Property placed in service after 1986 Note: If you have more than one property

depreciation over depreciation figured using the and acquired under a written contract entered subject to the recapture rules, use separate

straight line method. For this purpose, do not into before September 26, 1985, and binding at statements to figure the recapture amounts and

reduce the basis under section 50(c)(1) (or the all times thereafter is treated as placed in service attach the statements to your tax return.

corresponding provision of prior law) in figuring before 1987.

straight line depreciation. Line 35.—In column (a), enter the section 179

Note: In the case of a corporation that is an expense deduction claimed when the property

Line 28b.—Use 100% as the percentage for integrated oil company, amounts amortized was placed in service. In column (b), enter the

this line, except for low-income rental housing under section 291(b)(2) are treated as a depreciation allowable on the property in prior

described in clause (i), (ii), (iii), or (iv) of section deduction under section 263(c) when completing tax years. Include any section 179 expense

1250(a)(1)(B). For this type of low-income rental line 30a. deduction you took as depreciation.

housing, see section 1250(a)(1)(B) for the

percentage to use. Line 30a.—If the property was placed in Line 36.—In column (a), enter the depreciation

service before 1987, enter the total expenses that would have been allowable on the section

Line 28d.—Enter the additional depreciation after 1975 that: 179 amount from the year it was placed in

after 1969 and before 1976. If straight line

depreciation exceeds the actual depreciation for ● Were deducted by the taxpayer or any other service through the current year. Get Pub. 946,

person as intangible drilling and development How To Depreciate Property. In column (b), enter

the period after 1975, reduce line 28d by the

costs under section 263(c). (Previously expensed the depreciation that would have been allowable

excess. Do not enter less than zero on line 28d.

mining costs that have been included in income if the property had not been used more than

Line 28f—Corporations subject to section upon reaching the producing state are not taken 50% in a qualified business. Figure the

291.—The amount treated as ordinary income into account in determining recapture.); and depreciation from the year it was placed in

under section 291 is 20% of the excess, if any, service until the current year. See Pub. 917 and

of the amount that would be treated as ordinary ● Would have been reflected in the adjusted

basis of the property if they had not been Pub. 946.

income if such property were section 1245

deducted. Line 37.—Subtract line 36 from line 35 and enter

property, over the amount treated as ordinary

If the property was placed in service after the recapture amount as “other income” on the

income under section 1250. If you used the

1986, enter the total expenses that: same form or schedule on which you took the

straight line method of depreciation, the ordinary

deduction. For example, if you took the

income under section 291 is 20% of the amount ● Were deducted under section 263, 616, or deduction on Schedule C (Form 1040), report the

figured under section 1245. 617 by the taxpayer or any other person; and recapture amount as other income on Schedule

Line 29—Section 1252 property.— Partnerships ● Which, but for such deduction, would have C (Form 1040).

should skip this section. Partners should enter been included in the basis of the property; plus Note: If you filed Schedule C or F (Form 1040)

on the applicable lines of Part III amounts

subject to section 1252 according to instructions ● The deduction under section 611 that reduced and the property was used in both your trade or

the adjusted basis of such property. business and for the production of income, the

from the partnership.

portion attributable to your trade or business is

You may have ordinary income on the If you disposed of a portion of section 1254

subject to self-employment tax. Allocate the

disposition of certain farmland held more than 1 property or an undivided interest in it, see

amount on line 37 before entering the recapture

year but less than 10 years. section 1254(a)(2).

amount on the appropriate schedule.

Refer to section 1252 to determine if there is Line 31.—Section 1255 property.— Be sure to increase the basis of the property

ordinary income on the disposition of certain by the recapture amount.

Line 31a.—Use 100% if the property is disposed

farmland for which deductions were allowed

of less than 10 years after receipt of payments

under sections 175 (soil and water conservation)

Page 4 Printed on recycled paper

Potrebbero piacerti anche

- Tratamentul Total Al CanceruluiDocumento71 pagineTratamentul Total Al CanceruluiAntal98% (98)

- 6th Central Pay Commission Salary CalculatorDocumento15 pagine6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 pagine6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 pagine6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 pagine6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 pagine6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 pagine6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 pagine6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 pagine6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 pagine6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 pagine6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 pagine6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 pagine6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 pagine6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 pagine6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 pagine6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 pagine6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 pagine6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- US Internal Revenue Service: 2290rulesty2007v4 0Documento6 pagineUS Internal Revenue Service: 2290rulesty2007v4 0IRSNessuna valutazione finora

- Tratamentul Total Al CanceruluiDocumento71 pagineTratamentul Total Al CanceruluiAntal98% (98)

- 2008 Objectives Report To Congress v2Documento153 pagine2008 Objectives Report To Congress v2IRSNessuna valutazione finora

- 6th Central Pay Commission Salary CalculatorDocumento15 pagine6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Credit Card Bulk Provider RequirementsDocumento112 pagine2008 Credit Card Bulk Provider RequirementsIRSNessuna valutazione finora

- 6th Central Pay Commission Salary CalculatorDocumento15 pagine6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Tratamentul Total Al CanceruluiDocumento71 pagineTratamentul Total Al CanceruluiAntal98% (98)

- Tratamentul Total Al CanceruluiDocumento71 pagineTratamentul Total Al CanceruluiAntal98% (98)

- 6th Central Pay Commission Salary CalculatorDocumento15 pagine6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Data DictionaryDocumento260 pagine2008 Data DictionaryIRSNessuna valutazione finora

- Tratamentul Total Al CanceruluiDocumento71 pagineTratamentul Total Al CanceruluiAntal98% (98)

- 6th Central Pay Commission Salary CalculatorDocumento15 pagine6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Over Not Over Tax: Basic Income Table (Tax Code, Section 24 A)Documento2 pagineOver Not Over Tax: Basic Income Table (Tax Code, Section 24 A)Juliana ChengNessuna valutazione finora

- Tax Calculation Tool for IndividualsDocumento50 pagineTax Calculation Tool for IndividualsPani NiNessuna valutazione finora

- AccountingDocumento2 pagineAccountingJahanzaib ButtNessuna valutazione finora

- ITR-1 Acknowledgement for AY 2022-23Documento1 paginaITR-1 Acknowledgement for AY 2022-23VINAY verma100% (1)

- III/IV Semester 5 Year B.A., LL.B. (Major - Minor) Examination, June/July 2016 Major III / Minor II: Paper - 3: ECONOMICS Economic Theory and Public FinanceDocumento2 pagineIII/IV Semester 5 Year B.A., LL.B. (Major - Minor) Examination, June/July 2016 Major III / Minor II: Paper - 3: ECONOMICS Economic Theory and Public FinanceRichardNessuna valutazione finora

- 稅務局 Inland Revenue Department: Business Registration Fee and Levy TableDocumento1 pagina稅務局 Inland Revenue Department: Business Registration Fee and Levy Table彭黑郎Nessuna valutazione finora

- Ca Final: Paper 8: Indirect Tax LawsDocumento499 pagineCa Final: Paper 8: Indirect Tax LawsMaroju Rajitha100% (1)

- Ram BillDocumento1 paginaRam BillHarish Babu N KNessuna valutazione finora

- Assessment ProcedureDocumento14 pagineAssessment ProcedurePragnya mahapatroNessuna valutazione finora

- Tax - MCITDocumento3 pagineTax - MCITTtlrpqNessuna valutazione finora

- VAT RETAIL INVOICE FOR NATURAL GASDocumento2 pagineVAT RETAIL INVOICE FOR NATURAL GASHarDik PatelNessuna valutazione finora

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Documento1 paginaTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)praveen867Nessuna valutazione finora

- 74824bos60500 cp15Documento90 pagine74824bos60500 cp15soni12c2004Nessuna valutazione finora

- Radzi & Co Profile - June 2017Documento11 pagineRadzi & Co Profile - June 2017MohdRsysNessuna valutazione finora

- Taxes and Cash Flow AnalysisDocumento12 pagineTaxes and Cash Flow AnalysismrohaizamNessuna valutazione finora

- Tax ReviewerDocumento10 pagineTax ReviewerZtrick 1234100% (2)

- Account Number Account Description Balance As at 28 February 2023 Total Credit Interest Total Debit InterestDocumento1 paginaAccount Number Account Description Balance As at 28 February 2023 Total Credit Interest Total Debit InterestBakang Brian MothobiNessuna valutazione finora

- Tax Law and JurisprudenceDocumento9 pagineTax Law and JurisprudenceMeanne Maulion-EbeNessuna valutazione finora

- UST GN 2011 - Taxation Law IndexDocumento2 pagineUST GN 2011 - Taxation Law IndexGhost100% (1)

- Law of Taxation - Important QuestionsDocumento5 pagineLaw of Taxation - Important QuestionsMaybe 007Nessuna valutazione finora

- PRINCIPLES OF TAXATIONDocumento28 paginePRINCIPLES OF TAXATIONMarco Rvs100% (1)

- According To Section 44AA and Rule 6F of The Income Tax ActDocumento2 pagineAccording To Section 44AA and Rule 6F of The Income Tax ActAmruta SharmaNessuna valutazione finora

- Income Capital ItemsDocumento2 pagineIncome Capital ItemsDeepti KukretiNessuna valutazione finora

- Pov 5509783Documento3 paginePov 5509783Sameer MahajanNessuna valutazione finora

- Sap Payroll: Payroll SpecificationsDocumento4 pagineSap Payroll: Payroll SpecificationsmuraliNessuna valutazione finora

- Solved Assume Gail Is A Wealthy Widow Whose Husband Died Last PDFDocumento1 paginaSolved Assume Gail Is A Wealthy Widow Whose Husband Died Last PDFAnbu jaromiaNessuna valutazione finora

- Indian Tax System - An: Habibullah & Co. Chartered Accountants IndiaDocumento17 pagineIndian Tax System - An: Habibullah & Co. Chartered Accountants IndiaAnonymous reIq4DHr2Nessuna valutazione finora

- Deferred Compensation PlansDocumento5 pagineDeferred Compensation Plansreggie1010Nessuna valutazione finora

- Test Soal AdjustingDocumento2 pagineTest Soal AdjustingNicolas ErnestoNessuna valutazione finora

- Advace Audit ReportDocumento10 pagineAdvace Audit ReportDILIP VISHWAKARMANessuna valutazione finora