Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

US Internal Revenue Service: Fw2as - 1992

Caricato da

IRSDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

US Internal Revenue Service: Fw2as - 1992

Caricato da

IRSCopyright:

Formati disponibili

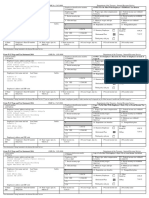

1 Control number

22222 OMB No. 1545-0008 For Paperwork Reduction Act Notice and instructions, see Form W-3SS.

2 Employer’s name, address, and ZIP code 3 Employer’s identification number 4

5 Statutory Pension 942 Deferred

employee plan employee Subtotal compensation Void

6 (See Form W-3SS instructions.) 7

8 Employee’s social security number 9 Samoa income tax withheld 10 Wages, tips, other compensation 11 Social security tax withheld

12a Employee’s name (first, middle, last) 13 Social security wages 14 Social security tips

15 Medicare wages and tips 16 Medicare tax withheld

17 Employer’s use 18 Benefits included in Box 10

12b Employee’s address and ZIP code Copy 1—For American Samoa Treasurer

Cat. No. Department of the Treasury

Form W-2AS American Samoa Wage and Tax Statement 1992 10140H Internal Revenue Service

Do NOT Cut or Separate Forms on This Page

1 Control number

22222 OMB No. 1545-0008

2 Employer’s name, address, and ZIP code 3 Employer’s identification number 4

5 Statutory Pension 942 Deferred

employee plan employee Subtotal compensation Void

6 7

8 Employee’s social security number 9 Samoa income tax withheld 10 Wages, tips, other compensation 11 Social security tax withheld

12 Employee’s name, address, and ZIP code 13 Social security wages 14 Social security tips

15 Medicare wages and tips 16 Medicare tax withheld

17 Employer’s use 18 Benefits included in Box 10

Copy A—For Social Security Administration

Department of the Treasury

Form W-2AS American Samoa Wage and Tax Statement 1992 Internal Revenue Service

Do NOT Cut or Separate Forms on This Page

1 Control number

OMB No. 1545-0008 This information is being furnished to Tax Dept., American Samoa Govt.

2 Employer’s name, address, and ZIP code 3 Employer’s identification number 4

5 Statutory Pension 942 Deferred

employee plan employee Subtotal compensation Void

6 7

8 Employee’s social security number 9 Samoa income tax withheld 10 Wages, tips, other compensation 11 Social security tax withheld

12 Employee’s name, address, and ZIP code 13 Social security wages 14 Social security tips

15 Medicare wages and tips 16 Medicare tax withheld

17 Employer’s use 18 Benefits included in Box 10

Copy B—To be filed with employee’s American Samoa tax return

Department of the Treasury

Form W-2AS American Samoa Wage and Tax Statement 1992 Internal Revenue Service

1 Control number

OMB No. 1545-0008 This information is being furnished to Tax Dept., American Samoa Govt.

2 Employer’s name, address, and ZIP code 3 Employer’s identification number 4

5 Statutory Pension 942 Deferred

employee plan employee Subtotal compensation Void

6 7

8 Employee’s social security number 9 Samoa income tax withheld 10 Wages, tips, other compensation 11 Social security tax withheld

12 Employee’s name, address, and ZIP code 13 Social security wages 14 Social security tips

15 Medicare wages and tips 16 Medicare tax withheld

17 Employer’s use 18 Benefits included in Box 10

Copy C—For EMPLOYEE’S RECORDS

Department of the Treasury

Form W-2AS American Samoa Wage and Tax Statement 1992 Internal Revenue Service

Notice to Employee Amounts over that must be included in income.

Caution: The elective deferral dollar limitation of

File Copy B of this form with your 1992 $8,475 under section 402(g) is subject to change

American Samoa income tax return. Please keep for 1992.

Copy C for your records. You can use it to prove

your right to social security benefits. If your Box 18.—This amount has already been

name or social security number (SSN) is included as wages in Box 10. Do not add this

incorrect, correct Copies B and C, and ask your amount to Box 10. If there is an amount in this

employer to revise your employment record. Be box, you may be able to deduct expenses that

sure to tell your employer that if Form W-2AS are related to fringe benefits; see the

has already been filed with the Social Security instructions for your income tax return.

Administration (SSA), Form W-2c should be filed Credit for Excess Social Security and

with the SSA to correct your name or SSN. Also, Medicare Taxes.—If more than one employer

let your employer know of any address change. paid you wages during 1992 and more than the

Box 5.—If the “Pension plan” box is marked, maximum social security tax or Medicare tax

special limits may apply to the amount of IRA was withheld, you can have the excess refunded

contributions you may deduct on your return. If by filing Form 843, Claim for Refund and

the “Deferred compensation” box is marked, Request for Abatement, with the Internal

then the elective deferrals shown in Box 6 (for Revenue Service Center in Philadelphia. (If you

all employers, and for all such plans to which must file Form 1040 with the United States,

you belong) are generally limited to $8,475 however, you should claim the excess credit on

($9,500 for certain section 403(b) contracts). Form 1040.)

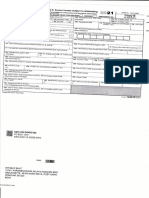

1 Control number

OMB No. 1545-0008

2 Employer’s name, address, and ZIP code 3 Employer’s identification number 4

5 Statutory Pension 942 Deferred

employee plan employee Subtotal compensation Void

6 (See Form W-3SS instructions.) 7

8 Employee’s social security number 9 Samoa income tax withheld 10 Wages, tips, other compensation 11 Social security tax withheld

12 Employee’s name, address, and ZIP code 13 Social security wages 14 Social security tips

15 Medicare wages and tips 16 Medicare tax withheld

17 Employer’s use 18 Benefits included in Box 10

Copy D—For employer

Department of the Treasury

Form W-2AS American Samoa Wage and Tax Statement 1992 Internal Revenue Service

Instructions for Preparing Form W-2AS

Note: A minimum income tax of 2% must be employee asks for Form W-2AS, give him or her

withheld on wages and other compensation. the completed copies within 30 days of the

Prepare a Form W-2AS for each employee request or the final wage payment, whichever is

from whom Samoa income tax or U.S. social later. Send Copy A to the Social Security

security and Medicare taxes were withheld or Administration, Wilkes-Barre Data Operations

required to be withheld during 1992. Center, Wilkes-Barre, PA 18769, by March 1,

1993. (For more information, please see Form

By February 1, 1993, give Copies B and C to 941SS and Circular SS.) Send Copy 1 to the

each person who was your employee during American Samoa Tax Office.

1992. For anyone who stopped working for you

before the end of 1992, you may give them See Form W-3SS for more information on how

copies any time after employment ends. If the to complete Form W-2AS.

Potrebbero piacerti anche

- 2023 Tax Deduction Cheat Sheet and LoopholesDocumento24 pagine2023 Tax Deduction Cheat Sheet and LoopholesKrisstian AnyaNessuna valutazione finora

- Copy B - To Be Filed With Employee's FEDERAL Tax Return. Copy 2 - To Be Filed With Employee's State, City or Local Income Tax ReturnDocumento1 paginaCopy B - To Be Filed With Employee's FEDERAL Tax Return. Copy 2 - To Be Filed With Employee's State, City or Local Income Tax ReturnmaliktaimoorsurahNessuna valutazione finora

- Return Postage Guaranteed: Employee Reference Copy Wage and Tax StatementDocumento2 pagineReturn Postage Guaranteed: Employee Reference Copy Wage and Tax StatementEvelin De NunezNessuna valutazione finora

- OMB No. 1545-0008 OMB No. 1545-0008Documento2 pagineOMB No. 1545-0008 OMB No. 1545-0008Robert Taylor50% (2)

- PDF DocumentDocumento1 paginaPDF DocumentAngelo DiloneNessuna valutazione finora

- Ioana w2 PDFDocumento1 paginaIoana w2 PDFBlueberry13KissesNessuna valutazione finora

- 6th Central Pay Commission Salary CalculatorDocumento15 pagine6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 pagine6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 pagine6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 pagine6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 pagine6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 pagine6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 pagine6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 pagine6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 pagine6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 pagine6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 pagine6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 pagine6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 pagine6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 pagine6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 pagine6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 pagine6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 pagine6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 pagine6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 pagine6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 pagine6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 pagine6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Devin J Simon 2004 MOHAWK RD APT. 321 Pueblo, Co 81001: Employer Use Only Corp. DeptDocumento2 pagineDevin J Simon 2004 MOHAWK RD APT. 321 Pueblo, Co 81001: Employer Use Only Corp. DeptemtteachNessuna valutazione finora

- TWC LIS01 LIS - B AU20161205 P: Aqeel Haider 1 Maple Ave APT. #106 Patchogue, Ny 11772Documento2 pagineTWC LIS01 LIS - B AU20161205 P: Aqeel Haider 1 Maple Ave APT. #106 Patchogue, Ny 11772sana shahidNessuna valutazione finora

- W21225760934 0 PDFDocumento2 pagineW21225760934 0 PDFAnonymous czHLQeLPB4Nessuna valutazione finora

- Sipin Sapkota 28 Kossuth PL Brooklyn Ny 11221Documento2 pagineSipin Sapkota 28 Kossuth PL Brooklyn Ny 11221Suesa ThapaliyaNessuna valutazione finora

- Copy B-To Be Filed With Employee's FEDERAL Tax ReturnDocumento5 pagineCopy B-To Be Filed With Employee's FEDERAL Tax ReturnKyle im taken by cailey hand Hand100% (1)

- Copy B-To Be Filed With Employee's FEDERAL Tax ReturnDocumento1 paginaCopy B-To Be Filed With Employee's FEDERAL Tax ReturnJoshua WagonerNessuna valutazione finora

- 0070-0070L268 0000000193 - MICHIG: Copy C, For Employee's RecordsDocumento2 pagine0070-0070L268 0000000193 - MICHIG: Copy C, For Employee's RecordsDeepika RajasekarNessuna valutazione finora

- Psav Encore Global W-2Documento5 paginePsav Encore Global W-2Vincent NewsonNessuna valutazione finora

- Evans W-2sDocumento2 pagineEvans W-2sAlmaNessuna valutazione finora

- Omb No. 1545-0008 Omb No. 1545-0008Documento2 pagineOmb No. 1545-0008 Omb No. 1545-0008Luke NyeNessuna valutazione finora

- W 2Documento3 pagineW 2Bar ChenNessuna valutazione finora

- Print PreviewDocumento4 paginePrint PreviewDerrin Lee100% (1)

- Resume of Msnetty42Documento2 pagineResume of Msnetty42api-25122959Nessuna valutazione finora

- W2 W2taxdocument 2023Documento3 pagineW2 W2taxdocument 2023sywwvpdnp7Nessuna valutazione finora

- 20212Documento2 pagine20212carriemccabeNessuna valutazione finora

- Wage and Tax StatementDocumento4 pagineWage and Tax StatementMark OasayNessuna valutazione finora

- Tabag Garcia Answer Sheets 2Documento34 pagineTabag Garcia Answer Sheets 2Bea TumulakNessuna valutazione finora

- J.K. Lasser's Your Income Tax 2024, Professional EditionDa EverandJ.K. Lasser's Your Income Tax 2024, Professional EditionNessuna valutazione finora

- Nolasco W2Documento2 pagineNolasco W2MARCOS NOLASCONessuna valutazione finora

- Attention:: Not File Copy A Downloaded From This Website With The SSA. The OfficialDocumento11 pagineAttention:: Not File Copy A Downloaded From This Website With The SSA. The OfficialHaiOuNessuna valutazione finora

- W 2Documento6 pagineW 2prads1259Nessuna valutazione finora

- Wage and Tax StatementDocumento4 pagineWage and Tax StatementRich1781Nessuna valutazione finora

- Copy 2 To Be Filed With Employee's State, City, or Local Income Tax ReturnDocumento2 pagineCopy 2 To Be Filed With Employee's State, City, or Local Income Tax ReturnJim PollockNessuna valutazione finora

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineDa EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNessuna valutazione finora

- Adis Ababa UniversityDocumento88 pagineAdis Ababa UniversityMohamed BioNessuna valutazione finora

- Morehouse Morehouse Daniel Daniel J J: Copy C - For Employee'S RecordsDocumento1 paginaMorehouse Morehouse Daniel Daniel J J: Copy C - For Employee'S RecordsCorey GarrisNessuna valutazione finora

- CPA Review School of The Philippines Local Taxes, Preferential Taxation Llamado/ Dela Cruz / de VeraDocumento6 pagineCPA Review School of The Philippines Local Taxes, Preferential Taxation Llamado/ Dela Cruz / de VeraAbraham Marco De Guzman100% (1)

- Max Life Total Premium ReceiptDocumento1 paginaMax Life Total Premium ReceiptBhavik Thaker100% (1)

- Department of Education Financial Aid Template Shopping SheetDocumento2 pagineDepartment of Education Financial Aid Template Shopping SheetInstitute for Higher Education Policy0% (1)

- Coca-Cola Bottlers Phil., Inc. Vs CIRDocumento1 paginaCoca-Cola Bottlers Phil., Inc. Vs CIRRosalie RecaidoNessuna valutazione finora

- 2020 - PmaDocumento2 pagine2020 - Pmalaniya rossNessuna valutazione finora

- Wage and Tax Statement: Page 1 / 4Documento4 pagineWage and Tax Statement: Page 1 / 4blon majorsNessuna valutazione finora

- Tratamentul Total Al CanceruluiDocumento71 pagineTratamentul Total Al CanceruluiAntal98% (98)

- Tratamentul Total Al CanceruluiDocumento71 pagineTratamentul Total Al CanceruluiAntal98% (98)

- Tratamentul Total Al CanceruluiDocumento71 pagineTratamentul Total Al CanceruluiAntal98% (98)

- Tratamentul Total Al CanceruluiDocumento71 pagineTratamentul Total Al CanceruluiAntal98% (98)

- Tratamentul Total Al CanceruluiDocumento71 pagineTratamentul Total Al CanceruluiAntal98% (98)

- US Internal Revenue Service: Fw2as - 1995Documento10 pagineUS Internal Revenue Service: Fw2as - 1995IRSNessuna valutazione finora

- US Internal Revenue Service: Fw2as - 2000Documento10 pagineUS Internal Revenue Service: Fw2as - 2000IRSNessuna valutazione finora

- US Internal Revenue Service: Fw2gu - 1998Documento10 pagineUS Internal Revenue Service: Fw2gu - 1998IRSNessuna valutazione finora

- US Internal Revenue Service: Fw2vi - 1995Documento10 pagineUS Internal Revenue Service: Fw2vi - 1995IRSNessuna valutazione finora

- US Internal Revenue Service: Fw2gu - 2000Documento10 pagineUS Internal Revenue Service: Fw2gu - 2000IRSNessuna valutazione finora

- US Internal Revenue Service: fw2 - 2000Documento12 pagineUS Internal Revenue Service: fw2 - 2000IRSNessuna valutazione finora

- US Internal Revenue Service: Fw2vi - 2000Documento10 pagineUS Internal Revenue Service: Fw2vi - 2000IRSNessuna valutazione finora

- US Internal Revenue Service: fw3ss - 1995Documento6 pagineUS Internal Revenue Service: fw3ss - 1995IRSNessuna valutazione finora

- UnknownDocumento4 pagineUnknownnayla marie santiago cuadradoNessuna valutazione finora

- US Internal Revenue Service: fw3 - 1998Documento4 pagineUS Internal Revenue Service: fw3 - 1998IRSNessuna valutazione finora

- US Internal Revenue Service: fw3ss - 1996Documento6 pagineUS Internal Revenue Service: fw3ss - 1996IRSNessuna valutazione finora

- Wage and Tax Statement Wage and Tax StatementDocumento1 paginaWage and Tax Statement Wage and Tax StatementFabiola UrgilésNessuna valutazione finora

- Atla - Adn SplashDocumento1 paginaAtla - Adn Splashnatali jimenezNessuna valutazione finora

- US Internal Revenue Service: fw3ss - 1993Documento6 pagineUS Internal Revenue Service: fw3ss - 1993IRSNessuna valutazione finora

- US Internal Revenue Service: fw3ss - 2001Documento6 pagineUS Internal Revenue Service: fw3ss - 2001IRS100% (1)

- US Internal Revenue Service: p15 - 1994Documento64 pagineUS Internal Revenue Service: p15 - 1994IRSNessuna valutazione finora

- w2 hh83UtqU4WlQsBEvVnOTDocumento1 paginaw2 hh83UtqU4WlQsBEvVnOTDutchavelli5thNessuna valutazione finora

- Attention:: Not File Copy A Downloaded From This Website With The SSA. The OfficialDocumento11 pagineAttention:: Not File Copy A Downloaded From This Website With The SSA. The OfficialMia JacksonNessuna valutazione finora

- 5 MTihh 4271 H 1914120242901191102202Documento2 pagine5 MTihh 4271 H 1914120242901191102202elena.69.mxNessuna valutazione finora

- W2 ExportDocumento1 paginaW2 ExportenderjosNessuna valutazione finora

- Gwmain RDocumento1 paginaGwmain Rfznq9n4rkrNessuna valutazione finora

- US Internal Revenue Service: fw3ss - 2003Documento6 pagineUS Internal Revenue Service: fw3ss - 2003IRSNessuna valutazione finora

- US Internal Revenue Service: fw3ss - 1992Documento6 pagineUS Internal Revenue Service: fw3ss - 1992IRSNessuna valutazione finora

- DNSP 0000003971Documento2 pagineDNSP 0000003971negrapujolsNessuna valutazione finora

- US Internal Revenue Service: fw3pr 05Documento3 pagineUS Internal Revenue Service: fw3pr 05IRSNessuna valutazione finora

- 779 Ihh 403 H 6754020242226102101202Documento2 pagine779 Ihh 403 H 6754020242226102101202elena.69.mxNessuna valutazione finora

- Kenndal D Crawford 109 Inwood Court Spartanburg, SC 29302: Employer Use Only Corp. DeptDocumento2 pagineKenndal D Crawford 109 Inwood Court Spartanburg, SC 29302: Employer Use Only Corp. Depttaylorizabella1Nessuna valutazione finora

- W2 Taco BellDocumento3 pagineW2 Taco BellJuan Diego Velandia DuarteNessuna valutazione finora

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineDa EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNessuna valutazione finora

- US Internal Revenue Service: 2290rulesty2007v4 0Documento6 pagineUS Internal Revenue Service: 2290rulesty2007v4 0IRSNessuna valutazione finora

- 2008 Objectives Report To Congress v2Documento153 pagine2008 Objectives Report To Congress v2IRSNessuna valutazione finora

- 2008 Credit Card Bulk Provider RequirementsDocumento112 pagine2008 Credit Card Bulk Provider RequirementsIRSNessuna valutazione finora

- 2008 Data DictionaryDocumento260 pagine2008 Data DictionaryIRSNessuna valutazione finora

- Andrew Weiman and Mei Lee Are Discussing Accounting For Income PDFDocumento2 pagineAndrew Weiman and Mei Lee Are Discussing Accounting For Income PDFLet's Talk With HassanNessuna valutazione finora

- Factura - L MKTP 370973 PDFDocumento1 paginaFactura - L MKTP 370973 PDFAlexandru MarinaNessuna valutazione finora

- EWT/DST-Real Property Date of TransactionDocumento7 pagineEWT/DST-Real Property Date of TransactionHanabishi RekkaNessuna valutazione finora

- First StepDocumento5 pagineFirst StepBhupendra Nagesh67% (3)

- Concepts in Federal Taxation 2013 20th Edition Murphy Solutions Manual DownloadDocumento102 pagineConcepts in Federal Taxation 2013 20th Edition Murphy Solutions Manual DownloadDavid Clark100% (21)

- Patterns of Philippine ExpenditureDocumento4 paginePatterns of Philippine ExpenditureChelsi Christine TenorioNessuna valutazione finora

- Hours 40 Rate 50 Gross Pay 2000 Tax and Deductions 200 Net Pay 1800Documento5 pagineHours 40 Rate 50 Gross Pay 2000 Tax and Deductions 200 Net Pay 1800Nickey DickeyNessuna valutazione finora

- Citibank vs. CA, 280 SCRA 459Documento1 paginaCitibank vs. CA, 280 SCRA 459SURITA, FLOR DE MAE PNessuna valutazione finora

- Tax2 Seatworks-03.23.2020Documento2 pagineTax2 Seatworks-03.23.2020Allen Fey De JesusNessuna valutazione finora

- Room 205Documento1 paginaRoom 205Hotel EkasNessuna valutazione finora

- Liquidation Report Template - 001Documento12 pagineLiquidation Report Template - 001Des GallegoNessuna valutazione finora

- New Income Tax Law - Albania-1Documento17 pagineNew Income Tax Law - Albania-1wolfotterdogNessuna valutazione finora

- COVID 19 and Its Tax Implications 20200508 - v1.0Documento108 pagineCOVID 19 and Its Tax Implications 20200508 - v1.0Richard CaneteNessuna valutazione finora

- Syam Bhat BioDocumento5 pagineSyam Bhat BioSanjay BhatNessuna valutazione finora

- Asus Laptop2 Invoice Ganesh Prasad HDocumento1 paginaAsus Laptop2 Invoice Ganesh Prasad HganeshNessuna valutazione finora

- Income Taxation On Individuals ModuleDocumento18 pagineIncome Taxation On Individuals ModuleCza PeñaNessuna valutazione finora

- Suggested Anser CAP II ITVATDocumento14 pagineSuggested Anser CAP II ITVATNirmal ShresthaNessuna valutazione finora

- Suggested Solutions To Homework 3 - Deductible ExpensesDocumento2 pagineSuggested Solutions To Homework 3 - Deductible ExpensesLIAW ANN YINessuna valutazione finora

- Toward The Adoption of A Governance Model in Zakat Foundations The Case of The Algerian Zakat FundDocumento15 pagineToward The Adoption of A Governance Model in Zakat Foundations The Case of The Algerian Zakat FundFaizal RaffaliNessuna valutazione finora

- Manual Das TesourariasDocumento195 pagineManual Das TesourariasFebrinha ShalmaNessuna valutazione finora

- How To Do Country AnalysisDocumento22 pagineHow To Do Country Analysisdisp867100% (1)

- Aso SyllabusDocumento5 pagineAso SyllabusMuniNessuna valutazione finora

- Public Expenditure Management and BudgetDocumento15 paginePublic Expenditure Management and BudgetShihab HasanNessuna valutazione finora