Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Onsite Day Care Valuation

Caricato da

jindalmanoj06Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Onsite Day Care Valuation

Caricato da

jindalmanoj06Copyright:

Formati disponibili

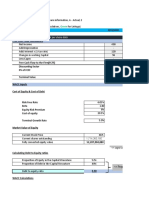

Input Current Year NTPC Valuation based on discounted future cash flows of firm

General Parameters Input Data Forecasted Year Generated Data For Future Investments Calculations

Cost of per MW

capacity

Addition 5 Year 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021

Tax Rate 25 Capacity 31000 34100 37510 41261 45387.1 49925.81 54918.39 60410.23 64034.84 67876.9345404 71949.55061278 76266.52

Depriciation %

of fixed Assets 4 % Growth in Capacity 10 10 10 10 10 10 10 6 6 6 6

Principal Repayme 6 Capacity Addition 3100 3410 3751 4126.1 4538.71 4992.581 5491.839 3624.614 3842.09063436 4072.616072422 4316.973

Working Capital Investment

% of Revenue 12 (10:25:30:25:10) 18865.98 20752.58 22827.836 23902.4148 23199.65247 21636.93 20289.08 18120.06 13487.2749629 7432.524332169 2158.487

Number of

Outstanding

Shares(In

crores) 824.5 Equity Proportion 0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.3

Debt Proportion 0.7 0.7 0.7 0.7 0.7 0.7 0.7 0.7 0.7 0.7 0.7 0.7

Equity Financing 5659.794 6225.773 6848.3507 7170.72443 6959.895742 6491.079 6086.724 5436.018 4046.18248886 2229.757299651 647.546

Growth Parameters Debt Financing 13206.19 14526.8 15979.485 16731.6903 16239.75673 15145.85 14202.36 12684.04 9441.092474 5202.767032519 1510.941

EBITDA Growth

% per year 0.25 Utilization % 80 80.5 81 81.5 82 82.5 83 83.5 Valuation Output

Utlilization

Growth % per PV of future

year 0.5 Merchant power % 4 5 6 7 8 9 10 11 cash flows 38869.53705451

Merchant Power

% growth per PV of Terminal

year 1 Long Term PPA % 96 95 94 93 92 91 90 89 Value 153013.5601096

Growth after

terminal Merchant Rate per Enterprise

Year(2017) 6 unit 4 4 4 4 4 4 4 4 value(EV) 191883.0971641

Add Cash &

Other Operating Long Term PPA rate cash

Income Growth 0 per unit 2 2 2 2 2 2 2 2 equivalent 16053

Subtract

Capital Parameters EBITDA % 30 30.25 30.5 30.75 31 31.25 31.5 31.75 Current Debt 44148.64

Equity

Beta 0.7 Valuation 163787.4571641

Risk Free Units Produced(in Per Share

Rate(rf) 8 crores) 21724.8 22953.61 25405.8 28118.884 31120.5316 34441.32003 38115.06 42179.14 Valuation 198.6506454385

Market Price

Risk on Thursday

Premium(rm-rf) 8 Revenue 45187.584 48202.58 53860.29 60174.411 67220.3482 75082.07766 83853.13 93637.68 1st July 2010 199.15

Valuation

Cost of Debt 9 EBITDA in crores 13556.2752 14581.28 16427.39 18503.632 20838.308 23463.14927 26413.74 29729.96 Status OVERVALUED

Other Operating

Current Debt 44148.64 Income 1900 1900 1900 1900 1900 1900 1900 1900

Depriciation &

Current Equity 64808.26 Amortisation 2894 3059.44 3691.702 4374.1367 5112.28462 5863.889828 6557.32 7160.505

Total Assets 108956.9 EBIT 12562.2752 13421.84 14635.69 16029.495 17626.0233 19499.25944 21756.42 24469.46

Debt/

(Equity+Debt) 0.4051936133 Interest 2078 4923.532 5935.532 7017.5539 8102.35282 9077.789753 9896.249 10580.69

Equity/

(Debt+Equity) 0.5948063867 Tax 2621.0688 2124.577 2175.038 2252.9852 2380.91763 2605.367422 2965.042 3472.193

NOPAT(Net Operating

WACC 10.824423749 Profit after tax) 9941.2064 11297.26 12460.65 13776.51 15245.1057 16893.89202 18791.37 20997.27

Add Back Depriciation

& Amortization 2894 3059.44 3691.702 4374.1367 5112.28462 5863.889828 6557.32 7160.505

Subtract Principal

Repayment of long

Investment Plan Parameters term Debt 2648.918 3282.354 3957.0215 4678.36928 5401.568544 6051.86 6597.499

Subtract Capital

Expenditure for new

1st yr 0.1 capacity Addition 5659.794 6225.773 6848.3507 7170.72443 6959.895742 6491.079 6086.724

Net Working Capital

2nd yr 0.25 Change 361.7994 678.925 757.69493 845.512412 943.4075298 1052.527 1174.146

3rd yr 0.3

4thyr 0.25 Free Cash Flow 5686.191 5965.296 6587.5792 7662.7842 9452.910031 11753.23 14299.4

PV of future Cash

Flows discounted at

5th yr 0.1 WACC 5130.811 4856.921 4839.7107 5079.77724 5654.420672 6343.725 6964.172

Terminal Value 314179.8

Other Financial Details

Uses of Funds :

Fixed Assets 76486 92292.54 109353.4 127807.12 146597.246 163933.0083 179012.6 192141.2

Long Term

Investments 11777 11777 11777 11777 11777 11777 11777 11777

Current Assets 20693.9 21055.7 21734.62 22492.319 23337.8317 24281.23924 25333.77 26507.91

Sources of Funds :

Long term Debt 44148.64 54705.91 65950.36 77972.821 90026.1424 100864.3306 109958.3 117563.2

Equity 64808.26 70419.33 76914.68 84103.614 91685.935 99126.91699 106165.1 112862.9

Input Current Year Day care valuation

General Parameters Input Data Forecasted Year Generated Data

Cost per child

capacity

Addition in

thousand 15 Year 2010 2011 2012 2013 2014 2015 2016 2017

Capacity (No. of

Tax Rate 30 children) 0 200 400 800 1600 2400 3600 5400

Depriciation %

of fixed Assets 20 % Growth in Capacity 0 100 100 100 50 50 50

Working Capital Capacity Addition(No

% of Revenue 12 of child per year) 200 200 400 800 800 1200 1800

Investment (In

Interest 10 thousands) 3000 3000 6000 12000 12000 18000 27000

Growth Parameters Equity Proportion (%) 0.8 0.8 0.8 0.8 0.8 0.8 0.8 0.8

EBITDA Growth

% per year 0.5 Debt Proportion (%) 0.2 0.2 0.2 0.2 0.2 0.2 0.2 0.2

Growth after

terminal

Year(2017) 6 Equity Financing 2400 2400 4800 9600 9600 14400 21600

Debt Financing 600 600 1200 2400 2400 3600 5400

Capital Parameters Cummulative Debt 600 1200 2400 4800 7200 10800 16200

Revenue per child (In

Beta 1.5 thousands) 60 60 60 60 60 60 60 60

Risk Free

Rate(rf) 8 EBITDA % 26 26.5 27 27.5 28 28.5 29 29.5

Risk

Premium(rm-rf) 8

Cost of Debt 10

Debt/ Revenue (In

(Equity+Debt) 0.2 thousands) 0 6000 18000 36000 72000 120000 180000 270000

Equity/ EBITDA ( In

(Debt+Equity) 0.8 thousands) 0 1590 4860 9900 20160 34200 52200 79650

WACC 17.4

Depriciation &

Amortisation 0 600 1200 2400 4800 7200 10800 16200

EBIT 0 990 3660 7500 15360 27000 41400 63450

Interest 0 60 120 240 480 720 1080 1620

Tax 0 279 1062 2178 4464 7884 12096 18549

NOPAT(Net Operating

Profit after tax) 0 711 2598 5322 10896 19116 29304 44901

Add Back Depriciation

& Amortization 0 600 1200 2400 4800 7200 10800 16200

Subtract Capital

Expenditure for new

capacity Addition 2400 2400 4800 9600 9600 14400 21600

Net Working Capital

Change 720 1440 2160 4320 5760 7200 10800

Free Cash Flow -1809 -42 762 1776 10956 18504 28701

PV of future Cash

Flows discounted at

WACC -1540.886 -30.47285 470.92384 934.911655 4912.601529 7067.357 9337.279

Terminal Value 266868.9

Final Valuation (In

thousands) 288020.6621

Potrebbero piacerti anche

- 2001 Ford F150 ManualDocumento296 pagine2001 Ford F150 Manualerjenkins1100% (2)

- BurtonsDocumento6 pagineBurtonsKritika GoelNessuna valutazione finora

- Quantamental Research - ITC LTDDocumento1 paginaQuantamental Research - ITC LTDsadaf hashmiNessuna valutazione finora

- New Heritage Doll Capital Budgeting Case SolutionDocumento5 pagineNew Heritage Doll Capital Budgeting Case Solutionalka murarka50% (14)

- Air Thread ConnectionsDocumento31 pagineAir Thread ConnectionsJasdeep SinghNessuna valutazione finora

- DCF ModelDocumento6 pagineDCF ModelKatherine ChouNessuna valutazione finora

- P1 Chp12 DifferentiationDocumento56 pagineP1 Chp12 DifferentiationbobNessuna valutazione finora

- DCF ModellDocumento7 pagineDCF Modellsandeep0604Nessuna valutazione finora

- Tutorial On How To Use The DCF Model. Good Luck!: DateDocumento9 pagineTutorial On How To Use The DCF Model. Good Luck!: DateTanya SinghNessuna valutazione finora

- BHEL Valuation of CompanyDocumento23 pagineBHEL Valuation of CompanyVishalNessuna valutazione finora

- Airthread SolutionDocumento30 pagineAirthread SolutionSrikanth VasantadaNessuna valutazione finora

- Nyambe African Adventures An Introduction To African AdventuresDocumento5 pagineNyambe African Adventures An Introduction To African AdventuresKaren LeongNessuna valutazione finora

- Route Clearence TeamDocumento41 pagineRoute Clearence Teamctenar2Nessuna valutazione finora

- The Discounted Free Cash Flow Model For A Complete BusinessDocumento5 pagineThe Discounted Free Cash Flow Model For A Complete BusinessSanket DubeyNessuna valutazione finora

- Power Plant Financial AnalysisDocumento16 paginePower Plant Financial AnalysisGaurav BasnyatNessuna valutazione finora

- VerificationManual en PDFDocumento621 pagineVerificationManual en PDFurdanetanpNessuna valutazione finora

- Narayana Hrudayalaya-Group 8Documento26 pagineNarayana Hrudayalaya-Group 8jindalmanoj06100% (3)

- To the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioDa EverandTo the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioNessuna valutazione finora

- AirThread CalcDocumento15 pagineAirThread CalcSwati VermaNessuna valutazione finora

- Thesis On Retail Management of The Brand 'Sleepwell'Documento62 pagineThesis On Retail Management of The Brand 'Sleepwell'Sajid Lodha100% (1)

- Valuing A Cross Border LBO PDFDocumento17 pagineValuing A Cross Border LBO PDFjhuaranccac0% (1)

- M&A Valuation Expanded BV SSDocumento4 pagineM&A Valuation Expanded BV SSvardhan73% (11)

- Strategic Asset Allocation in Fixed Income Markets: A Matlab Based User's GuideDa EverandStrategic Asset Allocation in Fixed Income Markets: A Matlab Based User's GuideNessuna valutazione finora

- Corporate Accounting ExcelDocumento6 pagineCorporate Accounting ExcelshrishtiNessuna valutazione finora

- Chapter 1: Investment Recommendation: How We Have Derived The Summed Up ValueDocumento4 pagineChapter 1: Investment Recommendation: How We Have Derived The Summed Up ValueMd. Mehedi HasanNessuna valutazione finora

- DCF ModellDocumento7 pagineDCF ModellVishal BhanushaliNessuna valutazione finora

- DCF ModellDocumento7 pagineDCF ModellziuziNessuna valutazione finora

- Calculation of Free Cashflow To The Firm: DCF Valuation (Amounts in Millions)Documento1 paginaCalculation of Free Cashflow To The Firm: DCF Valuation (Amounts in Millions)Prachi NavghareNessuna valutazione finora

- 1 - BK - Can Fin HomesDocumento9 pagine1 - BK - Can Fin HomesGirish Raj SankunnyNessuna valutazione finora

- Module 3 Chapter 15 DCF ModelDocumento5 pagineModule 3 Chapter 15 DCF ModelAvinash GanesanNessuna valutazione finora

- Performance AGlanceDocumento1 paginaPerformance AGlanceHarshal SawaleNessuna valutazione finora

- IRCON International 2QFY20 Result Review 14-11-19Documento7 pagineIRCON International 2QFY20 Result Review 14-11-19Santosh HiredesaiNessuna valutazione finora

- Particulars (INR in Crores) FY2015A FY2016A FY2017A FY2018ADocumento6 pagineParticulars (INR in Crores) FY2015A FY2016A FY2017A FY2018AHamzah HakeemNessuna valutazione finora

- MECWIN Investment ProposalDocumento4 pagineMECWIN Investment ProposalVamsi PavuluriNessuna valutazione finora

- TVS Motors Live Project Final 2Documento39 pagineTVS Motors Live Project Final 2ritususmitakarNessuna valutazione finora

- Alpha-Win: Company Research ReportDocumento5 pagineAlpha-Win: Company Research Reportchoiand1Nessuna valutazione finora

- A E L (AEL) : Mber Nterprises TDDocumento8 pagineA E L (AEL) : Mber Nterprises TDdarshanmadeNessuna valutazione finora

- PGPF - 01 - 017 - CV - Assignment - 5 - Keshav v1Documento26 paginePGPF - 01 - 017 - CV - Assignment - 5 - Keshav v1nidhidNessuna valutazione finora

- IcsiDocumento12 pagineIcsiUday NegiNessuna valutazione finora

- VA Tech Wabag-KotakDocumento9 pagineVA Tech Wabag-KotakADNessuna valutazione finora

- Income Statement Projections: Step 2: Calculate Historical Growth Rates and MarginsDocumento2 pagineIncome Statement Projections: Step 2: Calculate Historical Growth Rates and MarginsNamitNessuna valutazione finora

- KFin Technologies - Flash Note - 12 Dec 23Documento6 pagineKFin Technologies - Flash Note - 12 Dec 23palakNessuna valutazione finora

- Airthread Acquisition Operating AssumptionsDocumento27 pagineAirthread Acquisition Operating AssumptionsnidhidNessuna valutazione finora

- AirThread SecBC Group9Documento4 pagineAirThread SecBC Group9Vishal BhanushaliNessuna valutazione finora

- TVS Motor Company: CMP: INR549 TP: INR548Documento12 pagineTVS Motor Company: CMP: INR549 TP: INR548anujonwebNessuna valutazione finora

- Contoh Simple FCFFDocumento5 pagineContoh Simple FCFFFANNY KRISTIANTINessuna valutazione finora

- Financial Performance Trend: Sno. ParticularsDocumento2 pagineFinancial Performance Trend: Sno. ParticularsASHOK JAINNessuna valutazione finora

- DISH TV India - Financial Model - May 28 2010Documento29 pagineDISH TV India - Financial Model - May 28 2010Sandeep HsNessuna valutazione finora

- TV18 BroadcastDocumento30 pagineTV18 Broadcastrishabh jainNessuna valutazione finora

- Student May Add To The List of AssumptionsDocumento10 pagineStudent May Add To The List of AssumptionsAbhilash NNessuna valutazione finora

- PublishDocumento1 paginaPublishfejeti3409Nessuna valutazione finora

- 2021Documento12 pagine2021Shalu PurswaniNessuna valutazione finora

- SL2-Corporate Finance Ristk ManagementDocumento17 pagineSL2-Corporate Finance Ristk ManagementKrishantha WeerasiriNessuna valutazione finora

- 2 - BK City Union Bank - 3QFY20Documento8 pagine2 - BK City Union Bank - 3QFY20Girish Raj SankunnyNessuna valutazione finora

- Business Analysis and Valuation Using Financial Statements Text and Cases Palepu 5th Edition Solutions ManualDocumento19 pagineBusiness Analysis and Valuation Using Financial Statements Text and Cases Palepu 5th Edition Solutions ManualStephanieParkerexbf100% (43)

- Narration Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18Documento38 pagineNarration Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18AbhijitChandraNessuna valutazione finora

- Tata MotorsDocumento5 pagineTata Motorsinsurana73Nessuna valutazione finora

- Tgs Ar2020 Final WebDocumento157 pagineTgs Ar2020 Final Webyasamin shajiratiNessuna valutazione finora

- LBO Assignment (AIM)Documento20 pagineLBO Assignment (AIM)prachiNessuna valutazione finora

- Airthread Acquisition: Income StatementDocumento31 pagineAirthread Acquisition: Income StatementnidhidNessuna valutazione finora

- K10 SFMDocumento6 pagineK10 SFMSrijan AgarwalNessuna valutazione finora

- Name of The Company Last Financial Year First Projected Year CurrencyDocumento15 pagineName of The Company Last Financial Year First Projected Year CurrencygabegwNessuna valutazione finora

- Review: Ten Year (Standalone)Documento10 pagineReview: Ten Year (Standalone)maruthi631Nessuna valutazione finora

- FMO M5 Soln.sDocumento16 pagineFMO M5 Soln.sVishwas ParakkaNessuna valutazione finora

- 6 Years at A Glance: 2015 Operating ResultsDocumento2 pagine6 Years at A Glance: 2015 Operating ResultsHassanNessuna valutazione finora

- Delivering Utility Computing: Business-driven IT OptimizationDa EverandDelivering Utility Computing: Business-driven IT OptimizationNessuna valutazione finora

- Burberry: Mayuresh Sharma (65) S - Raveesh (79) Sameer Gupta (83) Venkataramana G (108) Manoj JindalDocumento16 pagineBurberry: Mayuresh Sharma (65) S - Raveesh (79) Sameer Gupta (83) Venkataramana G (108) Manoj Jindaljindalmanoj06Nessuna valutazione finora

- Presented By: Manoj Jindal (APT1-09/114)Documento17 paginePresented By: Manoj Jindal (APT1-09/114)jindalmanoj06Nessuna valutazione finora

- Construction Linked Property ValuationDocumento3 pagineConstruction Linked Property Valuationjindalmanoj06Nessuna valutazione finora

- DTH Market India ReportDocumento19 pagineDTH Market India Reportjindalmanoj06100% (2)

- Indian DTH Market PresentationDocumento32 pagineIndian DTH Market Presentationjindalmanoj06100% (1)

- SKF Shaft Alignment Tool TKSA 41Documento2 pagineSKF Shaft Alignment Tool TKSA 41Dwiki RamadhaniNessuna valutazione finora

- Reference by John BatchelorDocumento1 paginaReference by John Batchelorapi-276994844Nessuna valutazione finora

- Bustax Midtem Quiz 1 Answer Key Problem SolvingDocumento2 pagineBustax Midtem Quiz 1 Answer Key Problem Solvingralph anthony macahiligNessuna valutazione finora

- Introduction To Designing An Active Directory InfrastructureDocumento18 pagineIntroduction To Designing An Active Directory InfrastructurepablodoeNessuna valutazione finora

- Profibus Adapter Npba-02 Option/Sp Profibus Adapter Npba-02 Option/SpDocumento3 pagineProfibus Adapter Npba-02 Option/Sp Profibus Adapter Npba-02 Option/Spmelad yousefNessuna valutazione finora

- Lifting PermanentmagnetDocumento6 pagineLifting PermanentmagnetShekh Muhsen Uddin Ahmed100% (1)

- Wins Salvacion Es 2021Documento16 pagineWins Salvacion Es 2021MURILLO, FRANK JOMARI C.Nessuna valutazione finora

- Sickle Cell DiseaseDocumento10 pagineSickle Cell DiseaseBrooke2014Nessuna valutazione finora

- Zigbee Technology:19-3-2010: Seminor Title DateDocumento21 pagineZigbee Technology:19-3-2010: Seminor Title Dateitdep_gpcet7225Nessuna valutazione finora

- ProspDocumento146 pagineProspRajdeep BharatiNessuna valutazione finora

- Weg CFW500 Enc PDFDocumento32 pagineWeg CFW500 Enc PDFFabio Pedroso de Morais100% (1)

- 2432 - Test Solutions - Tsol - 2432 - 21702Documento5 pagine2432 - Test Solutions - Tsol - 2432 - 21702Anmol PanchalNessuna valutazione finora

- Cpar ReviewerDocumento6 pagineCpar ReviewerHana YeppeodaNessuna valutazione finora

- Vishal: Advanced Semiconductor Lab King Abdullah University of Science and Technology (KAUST) Thuwal, Saudi Arabia 23955Documento6 pagineVishal: Advanced Semiconductor Lab King Abdullah University of Science and Technology (KAUST) Thuwal, Saudi Arabia 23955jose taboadaNessuna valutazione finora

- Level Swiches Data SheetDocumento4 pagineLevel Swiches Data SheetROGELIO QUIJANONessuna valutazione finora

- Agm 1602W-818Documento23 pagineAgm 1602W-818Daniel BauerNessuna valutazione finora

- User ManualDocumento96 pagineUser ManualSherifNessuna valutazione finora

- ASHRAE Elearning Course List - Order FormDocumento4 pagineASHRAE Elearning Course List - Order Formsaquib715Nessuna valutazione finora

- Yarn HairinessDocumento9 pagineYarn HairinessGhandi AhmadNessuna valutazione finora

- Catalog Tu ZG3.2 Gian 35kV H'MunDocumento40 pagineCatalog Tu ZG3.2 Gian 35kV H'MunHà Văn TiếnNessuna valutazione finora

- Shift in Business Strategy of 10 Minute School - B2B To B2CDocumento40 pagineShift in Business Strategy of 10 Minute School - B2B To B2CSadiaNessuna valutazione finora

- Ariba Collaborative Sourcing ProfessionalDocumento2 pagineAriba Collaborative Sourcing Professionalericofx530Nessuna valutazione finora

- Module 2Documento7 pagineModule 2karthik karti100% (1)

- English For General SciencesDocumento47 pagineEnglish For General Sciencesfauzan ramadhanNessuna valutazione finora