Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

ABC Case Analysis

Caricato da

Chloe DingDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

ABC Case Analysis

Caricato da

Chloe DingCopyright:

Formati disponibili

COLOMBO SOFT-SERVE

F RO ZEN YOGURT

ABC Case Reoprt

AC4321 Management Accounting

Professor: Dr. Yue Zhang

Group 1

Lai Pui Yi 51492628

Wong Man Yee 51492420

Jieru Ding 40031241

Yeung Wan Nga 51816800

Oct 2010

Astronomy 101 Report

Content

Introduction 3

Competitive Environment 3

GMI’s Strategy 4

Financial Statements and Analysis 4

Suggestions 6

ABC Case Report" 2

Introduction

General Mills Inc. (GMI) was seeking adding Colombo Frozen Yogurt to their current

product lineup to increase net sales with little additional marketing cost. The product is sold

through independent shops and impulse locations. In the first couple of years, GMI focused

on impulse locations; sales from shops dropped significantly with dissatisfaction in its or-

ganization. The company allocated costs based on sales rather than by segment.

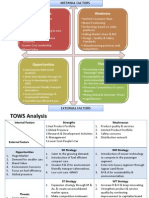

Competitive Environment

Yogurt Shops Impulse Locations

Opportunities Threats Opportunities Threats

Shops make their Franchise operations Food service opera- Soft-serve trade is

living from the soft- replaced many inde- tors are adding soft- only performance

serve business & pendent yogurt serve yogurt to their topspin to them,

must innovate -- shops -- if shops business, they ac- they are unwilling to

GMI could offer cannot sustain, it counted for 2/3 of take risks -- poten-

more innovative could eventually the soft-serve mar- tial sales growth is

products to them to hurt GMI’s sales ket -- it is a very im- limited, GMI might

boost its sales. from them. portant segment for need to target shops

GMI. more while main-

taining sales from

impulse locations.

From the table above, it clearly shows that impulse locations capture the majority of soft-

serve yogurt market, but the yogurt is not their main business and they are unwilling to put

on more risks. This implies that the potential sales growth from impulse locations is limited,

GMI should not put too much effort on boosting sales from this segment, although it is still

important for maintaining stable sales.

Compared to impulse locations, although independent shops are facing competition from

franchise operations, this actually increases their demand and makes them a high-potential

market segment for GMI. Therefore, GMI need to gradually shift their main focus from

impulse costumers to independent shops.

ABC Case Report" 3

GMI’s Strategy

GMI is using current salesforce to cover new Colombo yogurt. The salesforce is spending a

lot of time on teaching impulse customers while ignoring shops.

Colombo does not charge for merchandising and provides the same large scale merchandis-

ing to both segments. However, many impulse locations did not use the kits.

GMI offers graduated price promotions to both segments, typically $5 per case, averaged $3;

it is only targeted to impulse locations though.

Financial Statements and Analysis

Profit and Loss Statement -- Traditional Costing Method

Category Impulse segment Yogurt shops

Sales in cases 1,200,000 300,000

In 000s Per case In 000s Per case

Sales revenue $23,880 $19.90 $5,970 $19.90

Less: price promotions $3,600 $3.00 $900 $3.00

Net sales $20,280 $16.90 $5,070 $16.90

Less: COGS $13,800 $11.50 $3,450 $11.50

Gross margin $6,480 $5.40 $1,620 $5.40

Less: merchandising $1,380 $1.15 $345 $1.15

Less: SG&A $948 $0.79 $237 $0.79

Net income $4,152 $3.46 $1,038 $3.46

The statement above shows that, since the calculation is based on sales dollars, cost and net

income per case does not differ between the two segments. Based on such perception, we

observed that net incomes from both segments are the same in terms of the percentage of

sales revenue, 17.4%, which means that both segments have the same level of profitability

and efficiency.

However, solely using sales dollar to allocate costs is inappropriate in this case as some indi-

rect costs are not solely depending on sales dollars.

ABC Case Report" 4

Profit and Loss Statement -- Activity Based Costing Method

Category Impulse segment Yogurt shops

Sales in cases 1,200,000 300,000

In 000s Per case In 000s Per case

Sales revenue $23,880 $19.90 $5,970 $19.90

Less: price promotions $3,600 $3.00 $900 $3.00

Net sales $20,280 $16.90 $5,070 $16.90

Less: COGS $11,400 $9.50 $2,850 $9.50

Less: shipping $2,625 $2.19 $375 $1.25

Gross margin $6,255 $5.21 $1,845 $6.15

Less: merchandising $1,680 $1.20 $45 $0.15

Less: SG&A $3,861 $3.32 $39 $0.13

Net income $714 $0.69 $1,761 $5.87

*Items using different calculation %om last statement are shown in bold.

The reconsolidated statement above using ABC method clearly shows that two segments

actually did not perform similarly.

First, In COGS, although the cost to produce is the same for both segments, since the pick/

pack and shipping costs vary with whether the order was for a pallet, and impulse segment

placed majority of its orders individually whereas yogurt shops in full pallets. Since individ-

ual orders are more expensive to ship than pallets, so this leads to 88 percent of the shipping

cost consumed by impulse costumers. Apparently, there is space to reduce this cost.

Second, impulse segment also consumed 97 percent of total merchandising cost, compared

with 80 percent of total sales they contribute. And the real problem is that these customers

are actually not so interested in those kits GMI’s offered for free. Therefore, the majority of

this cost is really an unnecessary waste; GMI’s could have spent the money else where.

Third, the SG&A allocation was too low as sales representatives actually used three times as

much time on the yogurt than estimated. Therefore, using sales dollars would inflate net in-

ABC Case Report" 5

come figure. This implies that there is problem in the company's organization -- very ineffi-

cient. And according to the case, the sales-force has been performing unprofessionally -- sale

representatives spent 99 percent of their time on impulse customers, teaching them how to

use those machinery.

In addition to the over-weighted cost consume by impulse segment, sales from shops are too

low. We believe that this is because our sales representatives ignored them in order to focus

on impulse segment. However there’s opportunity to boost its sales in the future.

Overall, profitability of yogurt shops, $5.87, overrides impulse segment, $0.69. Although im-

pulse segment contributed 80% of total sales, it only generated 28.8% of total profit. Obvi-

ously, GMI should think about how to reduce costs of impulse segment and further boost

sales of yogurt shops.

Suggestions

From all the analysis above, we suggest that GMI should solve the following problems to

operate more efficiently and increase its profits:

1. Reducing marketing cost of impulse locations.

• Reduce the time sales representatives spent on impulse customers, e.g. providing train-

ing for salesforce to increase efficiency and cut SG&A costs.

• Consolidate individual orders into larger ones to reduce shipping costs -- an example is

offering extra price cut when impulse locations buy cases in pallets.

• Only offer marketing kits based upon request or start charging them for the kits to re-

duce marketing expenses, which is aimed at cutting merchandising costs.

2. Boosting sales from shops.

• Establish new training program for salesforce or set up a separate team to specialize in

the area and rebuild the relationship with shops.

• Offer incentives to boost the sales, e.g. graduated discount based on size of the order.

• Offer more recipes to raise their interest in the product and therefore boost the sales.

ABC Case Report" 6

Potrebbero piacerti anche

- Jay Abraham - How To Think Like A Marketing Genius NOTESDocumento29 pagineJay Abraham - How To Think Like A Marketing Genius NOTESRyan S. Nickel100% (2)

- Charity Business PlanDocumento47 pagineCharity Business Planjesicalarson123Nessuna valutazione finora

- A Sample Digital Marketing Agency Business Plan TemplateDocumento24 pagineA Sample Digital Marketing Agency Business Plan TemplateSoulFront Attack50% (2)

- Register of Cash in Bank and Other Related Financial TransactionsDocumento10 pagineRegister of Cash in Bank and Other Related Financial TransactionsJoel Dawn Tumanda Sajorga100% (1)

- Variance Swaps PrimerDocumento104 pagineVariance Swaps PrimerVitaly ShatkovskyNessuna valutazione finora

- Business Math - Q1 - Week 6 - Module 4 - MARGINS AND DISCOUNTS REPRODUCTIONDocumento20 pagineBusiness Math - Q1 - Week 6 - Module 4 - MARGINS AND DISCOUNTS REPRODUCTIONJhudiel Dela ConcepcionNessuna valutazione finora

- 08 Investmentquestfinal PDFDocumento13 pagine08 Investmentquestfinal PDFralphalonzo0% (1)

- Tata Motors SWOT TOWS CPM MatrixDocumento6 pagineTata Motors SWOT TOWS CPM MatrixPreetam Pandey33% (3)

- Marketing Plan TemplateDocumento12 pagineMarketing Plan TemplateAzra KhattalNessuna valutazione finora

- Customer Profitability AnalysisDocumento1 paginaCustomer Profitability AnalysisAdrianaNessuna valutazione finora

- Answer Key To Test #3 - ACCT-312 - Fall 2019Documento8 pagineAnswer Key To Test #3 - ACCT-312 - Fall 2019Amir ContrerasNessuna valutazione finora

- IPSAS Explained: A Summary of International Public Sector Accounting StandardsDa EverandIPSAS Explained: A Summary of International Public Sector Accounting StandardsNessuna valutazione finora

- Case 5-2 - ColumboDocumento3 pagineCase 5-2 - ColumboKhang HuynhNessuna valutazione finora

- ACCT 5-2case (YuMingTing)Documento3 pagineACCT 5-2case (YuMingTing)丁玉旻Nessuna valutazione finora

- 10 Exercises BE Solutions-1Documento40 pagine10 Exercises BE Solutions-1loveliangel0% (2)

- Soal Lab 8-24Documento1 paginaSoal Lab 8-24bellaNessuna valutazione finora

- Comprehensive Master Budget Accounting 2302 Professor Norma JacobsDocumento5 pagineComprehensive Master Budget Accounting 2302 Professor Norma JacobsOmar Gibson0% (1)

- Divisi Kompresor Tidak Boleh Menjual Kompresor $50Documento6 pagineDivisi Kompresor Tidak Boleh Menjual Kompresor $50irga ayudiasNessuna valutazione finora

- Kode QDocumento11 pagineKode QatikaNessuna valutazione finora

- Chapter 05 Solution of Fundamental of Financial Accouting by EDMONDS (4th Edition)Documento196 pagineChapter 05 Solution of Fundamental of Financial Accouting by EDMONDS (4th Edition)Awais Azeemi100% (3)

- Long-Term Assets and Liabilities Management International FinanceDocumento8 pagineLong-Term Assets and Liabilities Management International FinanceG Ruggy JonesNessuna valutazione finora

- TUGAS KELOMPOK AKUNTANSI MANAJEMEN / LDocumento3 pagineTUGAS KELOMPOK AKUNTANSI MANAJEMEN / LMuhammad Rizki NoorNessuna valutazione finora

- 3, Fa1 Question Book 2021 (Gen 5) - G I Cho Sinh ViênDocumento76 pagine3, Fa1 Question Book 2021 (Gen 5) - G I Cho Sinh ViênHoàng Vũ HuyNessuna valutazione finora

- Ujian Akhir Semester 2014/2015: Akuntansi InternasionalDocumento5 pagineUjian Akhir Semester 2014/2015: Akuntansi InternasionalRatnaKemalaRitongaNessuna valutazione finora

- International Investment AppraisalDocumento6 pagineInternational Investment AppraisalZeeshan Jafri100% (1)

- Master Budget for Royal CompanyDocumento3 pagineMaster Budget for Royal CompanyPrayogoNessuna valutazione finora

- Chapter 3 - Behavior in OrganizationsDocumento20 pagineChapter 3 - Behavior in OrganizationsSarah Laras Wita100% (2)

- Question and Answer - 44Documento30 pagineQuestion and Answer - 44acc-expertNessuna valutazione finora

- Tutorial 3Documento1 paginaTutorial 3Feyb Riyanna100% (1)

- Lecture 2 - Answer Part 2Documento6 pagineLecture 2 - Answer Part 2Thắng ThôngNessuna valutazione finora

- CH 05Documento16 pagineCH 05Idris100% (1)

- 13 1Documento5 pagine13 1AdinIhtisyamuddin100% (1)

- Cash BudgetingDocumento3 pagineCash BudgetingAngel Kitty Labor67% (3)

- MGT 2281 Fall 2019 Assignment Solution Outline: Page 1 of 13Documento13 pagineMGT 2281 Fall 2019 Assignment Solution Outline: Page 1 of 13BessieDuNessuna valutazione finora

- Chapter Review and Self-Test Problem: 692 Part SevenDocumento15 pagineChapter Review and Self-Test Problem: 692 Part SevenRony RahmanNessuna valutazione finora

- Chapter 17 - Weygandt Financial and Managerial Accounting, 3e Challenge ExercisesDocumento2 pagineChapter 17 - Weygandt Financial and Managerial Accounting, 3e Challenge ExercisesTien Thanh DangNessuna valutazione finora

- The Finance Director of Stenigot Is Concerned About The LaxDocumento1 paginaThe Finance Director of Stenigot Is Concerned About The LaxAmit PandeyNessuna valutazione finora

- PT Sepatu Bata Financial Analysis and 2008 Financial CrisisDocumento6 paginePT Sepatu Bata Financial Analysis and 2008 Financial CrisisOlim BariziNessuna valutazione finora

- Tugas Variable Costing and The Measurement of ESG and Quality Costs (Irga Ayudias Tantri - 120301214100011)Documento2 pagineTugas Variable Costing and The Measurement of ESG and Quality Costs (Irga Ayudias Tantri - 120301214100011)irga ayudias0% (1)

- Tugas Chapter 6 - Sandra Hanania - 120110180024Documento4 pagineTugas Chapter 6 - Sandra Hanania - 120110180024Sandra Hanania PasaribuNessuna valutazione finora

- Profitability of Products and Relative ProfitabilityDocumento5 pagineProfitability of Products and Relative Profitabilityshaun3187Nessuna valutazione finora

- Euro Disney and The First Five Steps of Accounting AnalysisDocumento8 pagineEuro Disney and The First Five Steps of Accounting AnalysisblackraidenNessuna valutazione finora

- BMGT 321 Chapter 13 HomeworkDocumento11 pagineBMGT 321 Chapter 13 Homeworkarnitaetsitty100% (1)

- Income Statements For Xcel Energy From 2011 To 2013 AppearDocumento1 paginaIncome Statements For Xcel Energy From 2011 To 2013 AppearHassan JanNessuna valutazione finora

- RudiSetiadi 16AKJ ManagementAuditDocumento2 pagineRudiSetiadi 16AKJ ManagementAuditRudi SetiadiNessuna valutazione finora

- Tugas Cost AccountingDocumento7 pagineTugas Cost AccountingRudy Setiawan KamadjajaNessuna valutazione finora

- IVplast Is Still Debating Whether It Should Introduce Y28Documento2 pagineIVplast Is Still Debating Whether It Should Introduce Y28Elliot RichardNessuna valutazione finora

- Chapter 13 Homework Assignment #2 QuestionsDocumento8 pagineChapter 13 Homework Assignment #2 QuestionsCole Doty0% (1)

- Chapter 7Documento5 pagineChapter 7Saleemah Msskinnyfiber0% (1)

- Garrison 11ce SM ch11 FinalDocumento90 pagineGarrison 11ce SM ch11 FinalCoco ZaideNessuna valutazione finora

- Statement of Cash Flows Lecture Questions and AnswersDocumento9 pagineStatement of Cash Flows Lecture Questions and AnswersSaaniya AbbasiNessuna valutazione finora

- Skyview ManorDocumento4 pagineSkyview ManorDwi Handoyo MiharjoNessuna valutazione finora

- FINAL EXAM SOLUTIONDocumento4 pagineFINAL EXAM SOLUTIONHaliza Nabila PutriNessuna valutazione finora

- HKICPA QP Exam (Module A) Feb2008 AnswerDocumento10 pagineHKICPA QP Exam (Module A) Feb2008 Answercynthia tsui100% (1)

- Basic Boards Makes Keyboards That Are Sold To Different Customers in Two Main Distribution ChannelsDocumento2 pagineBasic Boards Makes Keyboards That Are Sold To Different Customers in Two Main Distribution ChannelsElliot RichardNessuna valutazione finora

- Weisberg Corporation Has 10 000 Shares of 100 Par Value 6 PDFDocumento1 paginaWeisberg Corporation Has 10 000 Shares of 100 Par Value 6 PDFAnbu jaromiaNessuna valutazione finora

- Analyzing and Interpreting Financial Statements: Learning Objectives - Coverage by QuestionDocumento37 pagineAnalyzing and Interpreting Financial Statements: Learning Objectives - Coverage by QuestionpoollookNessuna valutazione finora

- Akuntansi Manajemen Absoprtion CostingDocumento7 pagineAkuntansi Manajemen Absoprtion CostingMuhammad SyahNessuna valutazione finora

- Analyzing Depreciation MethodsDocumento2 pagineAnalyzing Depreciation MethodsMartono TampubolonNessuna valutazione finora

- CH 22 - Lu Solution-Intermediate Acct - Acct ChangesDocumento9 pagineCH 22 - Lu Solution-Intermediate Acct - Acct Changesdaotam0% (1)

- Case 5-1Documento4 pagineCase 5-1fitriNessuna valutazione finora

- Reigis Steel CompanyDocumento3 pagineReigis Steel CompanyDesy BodooNessuna valutazione finora

- Soal P 7.2, 7.3, 7.5Documento3 pagineSoal P 7.2, 7.3, 7.5boba milkNessuna valutazione finora

- CH 21Documento144 pagineCH 21fiorensaNessuna valutazione finora

- Case Study: Colombo Frozen YogurtDocumento3 pagineCase Study: Colombo Frozen YogurtandresuminhNessuna valutazione finora

- Divisional Performance MeasuresDocumento7 pagineDivisional Performance MeasuresNicole TaylorNessuna valutazione finora

- The Business Case For Product RationalizationDocumento19 pagineThe Business Case For Product RationalizationitspossblNessuna valutazione finora

- Innovation SlidesDocumento282 pagineInnovation SlidesAnna LarsenaNessuna valutazione finora

- Metal Art Value Chain99 FinalDocumento76 pagineMetal Art Value Chain99 FinalBesufekad Belayneh100% (6)

- GR Apwgraph AnswersDocumento7 pagineGR Apwgraph AnswersEzra Denise Lubong Ramel73% (15)

- Pragmatic Marketing FrameworkDocumento2 paginePragmatic Marketing FrameworkohgenryNessuna valutazione finora

- Product Market Strategy of LGDocumento23 pagineProduct Market Strategy of LGbhavna60% (5)

- Pasa-BUY: " " Opportunity SectionDocumento3 paginePasa-BUY: " " Opportunity SectionPeter Cranzo MeisterNessuna valutazione finora

- Marketing Plan Industry AnalysisDocumento14 pagineMarketing Plan Industry Analysisbakhtawar soniaNessuna valutazione finora

- Al Malkawi (2010) Dividend Policy A Review of Theories and Empirical EvidenceDocumento30 pagineAl Malkawi (2010) Dividend Policy A Review of Theories and Empirical Evidenceafridi650% (1)

- Unit 12 Capitalist Industrialization: StructureDocumento20 pagineUnit 12 Capitalist Industrialization: StructureAbhijeet JhaNessuna valutazione finora

- PI Foods Case Study: Resolving Distribution IssuesDocumento3 paginePI Foods Case Study: Resolving Distribution Issuessushil messiNessuna valutazione finora

- Bows Tie Die For Sy15 Businessplanpresentation Patricia Eusantos Allyssa SuarezDocumento14 pagineBows Tie Die For Sy15 Businessplanpresentation Patricia Eusantos Allyssa Suarezapi-358820386Nessuna valutazione finora

- HGS Recognized As A Leader in Digital Marketing (Company Update)Documento2 pagineHGS Recognized As A Leader in Digital Marketing (Company Update)Shyam SunderNessuna valutazione finora

- Sweet Cravings Targets StudentsDocumento46 pagineSweet Cravings Targets StudentsEman MazharNessuna valutazione finora

- Course File For Marketing Management 1 NewDocumento19 pagineCourse File For Marketing Management 1 NewAjay SamyalNessuna valutazione finora

- Understanding the Economics of Religion Through ReligeconomicsDocumento17 pagineUnderstanding the Economics of Religion Through ReligeconomicsArief Mulyawan ThoriqNessuna valutazione finora

- EC11PS6Documento2 pagineEC11PS6jamesNessuna valutazione finora

- A03Documento16 pagineA03Vũ Hồng NhungNessuna valutazione finora

- The Concept of Marketing: Lesson 1.1Documento22 pagineThe Concept of Marketing: Lesson 1.1SnowNessuna valutazione finora

- Bee Travelers IMC Plan SummaryDocumento46 pagineBee Travelers IMC Plan SummaryTanvir TonoyNessuna valutazione finora

- BBF Assignment Within 500 WordsDocumento3 pagineBBF Assignment Within 500 WordsMuhammad RubelNessuna valutazione finora

- Practice Question -2 Portfolio ManagementDocumento5 paginePractice Question -2 Portfolio Managementzoyaatique72Nessuna valutazione finora

- WFS Item LabelingDocumento2 pagineWFS Item LabelingAhsanur KabirNessuna valutazione finora