Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Heineken Case Study

Caricato da

alka murarkaCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Heineken Case Study

Caricato da

alka murarkaCopyright:

Formati disponibili

CASES

CASE 13

HEINEKEN*

Dutch brewer Heineken was expanding its presence around At the same time, Heineken has maintained its leading

the globe in response to the merger of Anheuser-Busch InBev position across Europe. It had made a high-profile acquisi-

with SABMiller, which would give the combined firm a tion in 2008 of Scottish-based brewer Scottish & Newcastle,

commanding 30 percent of global beer sales. On March 19, the brewer of well-known brands such as Newcastle Brown

2019, it opened its first Mozambique brewery in the pres- Ale and Kronenbourg 1664. Although the purchase had

ence of His Excellency Filipe Nyusi, the President of the been made in partnership with Carlsberg, Heineken was

Republic of Mozambique. The new brewery, incorporating able to gain control of the Scottish & Newcastle’s opera-

the latest technologies, represents a $100 million invest- tions in several crucial European markets such as the

ment. Among its products will be Txilar, a local beer spe- United Kingdom, Ireland, Portugal, Finland, and Belgium.

cifically made with a maize that is grown in the region. These decisions to acquire brewers that operate in dif-

“The construction of Heineken’s first brewery is a major ferent parts of the world have been a part of a series of

step for the company’s presence in the country,” said Jean- changes that the Dutch brewer has been making to raise

Francois van Boxmeer, CEO of the firm.1 its stature in the various markets and respond to growing

The move comes on the heels of acquisitions and capac- consolidation within the industry and changes occurring

ity investments that Heineken has been making in other in the global market for beer. Even as sales of beer have

developing markets. In 2013, the firm had strengthened its stagnated in the United States and Europe, demand has

position as the world’s third largest brewer by taking full been growing in other developing countries. This has led

ownership of Asian Pacific Breweries, the owner of Tiger, the largest brewers to expand across the globe through ac-

Bintang, and other popular Asian beer brands. With this quisitions of smaller regional and national players (see

deal, Heineken added 30 breweries across several countries Exhibits 1 and 2).

in the Asia Pacific region. A few years earlier, the firm had The need for change was clearly reflected in the appoint-

acquired Mexican brewer FEMSA Cervesa, producer of ment in October 2005 of Jean-Francois van Boxmeer as

Dos Equis, Sol, and Tecate beers, to become a stronger, Heineken’s first non-Dutch CEO. He was brought in to re-

more competitive player in Latin America. place Anthony Ruys, who had decided to resign because of

his failure to improve performance. Prior to the appoint-

ment of Ruys in 2002, Heineken had been run by three gen-

* Case prepared by Jamal Shamsie, Michigan State University, with the

assistance of Professor Alan B. Eisner, Pace University. Material has been

erations of Heineken ancestors whose portraits still adorn

drawn from published sources to be used for purposes of class discussion. the dark paneled office of the CEO in its Amsterdam head-

Copyright © 2019 Jamal Shamsie and Alan B. Eisner. quarters. Like Ruys, van Boxmeer has tried to handle the

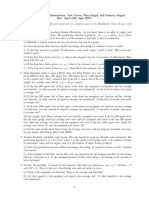

EXHIBIT 1

Income Statement 2018 2017 2016 2015

(millions of euros) Total Revenue 22,471 21,888 20,792 20,511

Operating Profit 3,062 3,276 2,709 2,664

Net Income 1,903 1,935 1,540 1,892

Source: Heineken.

EXHIBIT 2

Balance Sheet (millions 2018 2017 2016 2015

of euros) Assets 41,956 41,034 39,321 37,714

Liabilities 26,416 26,513 24,748 22,664

Equity 15,540 14,521 14,573 15,050

Source: Heineken.

C76 CASE 13 :: HEINEKEN

Strategic Management: Text and

Cases

challenge of preserving the firm’s family-driven traditions, evolved into one of the world’s largest brewers, operating

while addressing threats that have never been faced before. more than 190 breweries in over 70 countries in the world,

claiming about 10 percent of the global market for beer (see

Confronting a Globalizing Industry Exhibits 3 & 4).

Heineken was one of the pioneers of an international strat- In fact, the firm’s flagship Heineken brand ranked sec-

egy, using cross-border deals to expand its distribution of its ond only to Budweiser in a global brand survey jointly un-

Heineken, Amstel, or about 300 other beer brands in more dertaken by BusinessWeek and Interbrand several years

than 100 countries around the globe. For years, it has been ago. The premier brand has achieved worldwide recognition

picking up small brewers from several countries to add according to Kevin Baker, director of alcoholic beverages at

more brands and to obtain better access to new markets. British market researcher Canadean Ltd. A U.S. wholesaler

From its roots on the outskirts of Amsterdam, the firm has recently asked a group of marketing students to identify an

EXHIBIT 3

2018 2017 2016 2015

Geographical

Western Europe 10,348 9,990 10,112 10,227 Breakdown of Sales

(millions of euros)

Americas 6,781 6,312 5,203 5,159

Africa, Middle East, & Eastern Europe 3,051 3,028 3,203 3,263

Asia Pacific 2,919 2,922 2,894 2,483

Source: Heineken.

EXHIBIT 4

Markets Brands

Significant Heineken

United States Heineken, Amstel Light, Paulaner,1 Moretti, Lagunitas Brands In Various

Markets

Netherlands Heineken, Amstel, Lingen’s Blond, Murphy’s Irish Red

France Heineken, Amstel, Buckler,2 Desperados3

Italy Heineken, Amstel, Birra Moretti

Spain Heineken, Amstel, Cruzcampo, Buckler

Poland Heineken, Krolewskie, Kujawiak, Zywiec

China Heineken, Tiger, Reeb*

Singapore Heineken, Tiger, Anchor, Baron’s

India Heineken, Arlem, Kingfisher

Indonesia Heineken, Bintang, Guinness

Kazakhstan Heineken, Amstel, Tian Shan

Egypt Heineken, Birell, Meister, Fayrouz2

Israel Heineken, Maccabee, Gold Star*

Nigeria Heineken, Star, Maltina, Gulder

South Africa Heineken, Amstel, Windhoek. Strongbow

Panama Heineken, Soberana, Crystal, Panama

Chile Heineken, Cristal, Escudo, Royal

*Minority interest

1

Wheat beer

2

Nonalcoholic beer

3

Tequila-flavored beer

Source: Heineken.

CASE 13 :: HEINEKEN C77

Strategic Management: Text and

Cases

EXHIBIT 5

Brewers Market Share

Leading Global

Brewers (2016 market 1. Anheuser-Busch InBev (ABI), Leuven, Belgium (incl. SABMiller) 27.3

share percentage

based on annual sales, 2. Heineken, Amsterdam, Netherlands 9.7

millions of U.S. dollars)

3. China Resources Enterprise, China 6.1

4. Carlsberg, Copenhagen, Denmark 5.9

5. Molson Coors 4.9

Source: Statista.

assortment of beer bottles that had been stripped of their that would be difficult to change. Even with the appoint-

labels. The stubby green Heineken container was the only ment of non-family members to manage the firm, a little

one that incited instant recognition among the group. over half of the shares of Heineken are still owned by a

But the beer industry has been undergoing significant holding company that is controlled by the family. With the

change due to a furious wave of consolidation. Most of the death of Freddy Heineken in 2002, the last family member

bigger brewers have begun to acquire or merge with their to head the Dutch brewer, control has passed to his only

competitors in foreign markets in order to become global child and heir, Charlene de Carvalho, who has insisted on

players. This has given them ownership of local brands, pro- having a say in all of the major decisions.

pelling them into a dominant position in various markets But the family members were behind some of changes

around the world. In addition, acquisitions of foreign brew- that were announced at the time of van Boxmeer’s appoint-

ers can provide the firm with the manufacturing and distri- ment. These were intended to support Heineken’s next

bution capabilities they could use to develop a few global phase of growth as a global organization. As part of the

brands. “The era of global brands is coming,” Alan Clark, a plan, dubbed Fit 2 Fight, the Executive Board was cut down

Budapest-based managing director of SABMiller Europe from five members to CEO van Boxmeer and Chief Finan-

stated some years ago (see Exhibit 5).2 cial Officer Rene Hooft Graafland. The change was ex-

Since 2000, South African Breweries, Ltd, acquired U.S.- pected to centralize control at the top so that the firm can

based Miller Brewing to become a major global brewer. They formulate a strategy that it should follow to win over

subsequently acquired Fosters, the largest Australian brewer. younger customers across different markets whose tastes

U.S.-based Coors linked with Canadian-based Molson in are still developing.

2005, rising to a leading position among the world’s biggest Heineken has also created management positions that

brewers with their combined operations. In 2008, Belgium’s would be responsible for five different operating regions

Interbrew, Brazil’s AmBev, and U.S.-based Anheuser Busch and several different functional areas. These positions were

all merged to become the largest global brewer with opera- created to define more clearly different spheres of responsi-

tions across most of the continents. Finally, Anheuser-Busch bility. Van Boxmeer argued that the new structure also pro-

InBev made a move in 2016 to acquire SABMiller to become vides incentives for people to be accountable for their

an even more dominant player in the industry. performance: “There is more pressure for results, for

Since its acquisition of Anheuser Busch, InBev has in- achievement.”4 He claimed the new structure has already

cluded Budweiser along with Stella Artois, Brahma, and encouraged more risk taking and boosted the level of en-

Becks in its lineup of what it is promoting as its global flag- ergy within the firm.

ship brands. Each of these brands originated in different The Executive Committee of Heineken was also cut

locations, with Budweiser coming from the United States, down from 36 to 12 members in order to speed up the

Stella Artois coming from Belgium, Brahma from Brazil, decision-making process. Besides the two members of

and Becks from Germany. Similarly, SABMiller has been the Executive Board, this management group consists of

attempting to develop the Czech brand Pilsner Urquell into the managers who are responsible for the different operat-

a global brand. Exports of this pilsner doubled shortly after ing regions and several of the key functional areas. Van Box-

SAB acquired it in 1999, but sales have since plateaued. meer has hoped that the reduction in the size of this group

John Brock, the CEO of InBev, commented: “Global will allow the firm to combat the cumbersome consensus

brands sell at significantly higher prices, and the margins culture that has made it difficult for Heineken to respond

are much better than with local beers.”3 swiftly to various challenges even as its industry has been

experiencing considerable change.

Wrestling with Change Finally, all of the activities of Heineken have been over-

Although the management of Heineken has moved away seen by a Supervisory Board, which currently consists of

from the family for the first time, they have been well aware 10 members. Individuals that make up this board are drawn

of the longstanding and well-established family traditions from different countries and cover a wide range of expertise

C78 CASE 13 :: HEINEKEN

Strategic Management: Text and

Cases

and experience. They set up policies for the firm to use in Maintaining a Premium Position

making majors decisions in its overall operations. Members

For decades, Heineken has been able to rely upon the suc-

of the Supervisory Board are rotated on a regular basis.

cess of its flagship Heineken brand, which has enjoyed a

leading position among premium beers in many markets

Developing a Global Presence around the world. It had been the best-selling imported beer

Van Boxmeer has been well aware of the need for Heineken in the United States for several decades, giving it a steady

to use its brands to build upon its existing stature across source of revenues and profits from the world’s biggest mar-

global markets. In spite of its formidable presence in mar- ket. But by the late 1990s, Heineken had lost its 65-year-old

kets around the world with its flagship Heineken brand, the leadership among imported beers in the United States to

firm has been reluctant to match the recent moves of formi- Group Modelo’s Corona. The Mexican beer has been able

dable competitors such as Belgium’s InBev and the UK’s to reach out to the growing Hispanic Americans who repre-

SABMiller, which have grown significantly through mega- sent one of the fastest growing segments of beer drinkers.

acquisitions. In large part, it is assumed that the firm has Furthermore, the firm was also concerned that Heineken

been reluctant to make such acquisitions because of the di- was being perceived as an obsolete brand by many young

lution of family control. drinkers. John A. Quelch, a professor at Harvard Business

For many years, Heineken had limited itself to snapping School who has studied the beer industry said of Heineken:

up small national brewers such as Italy’s Moretti to Spain’s “It’s in danger of becoming a tired, reliable, but unexciting

Cruzcampo that have provided it with small, but profitable brand.”5 Therefore, the firm has been working hard to in-

avenues for growth. In 1996, for example, Heineken had ac- crease awareness of their flagship brand among younger

quired Fischer, a small French brewer, whose Desperados drinkers. Heineken also introduced a light beer, Heineken

brand had been quite successful in niche markets. Similarly, Premium Light, to target the growing market for such beers

Paulaner, a wheat beer that the firm picked up in Germany a in the United States. Through such efforts, the firm has

few years ago, has been making inroads into the U.S. market. managed to reduce the average age of the Heineken drinker

But as other brewers have been reaching out to make from about 40 years old to about 30 years old.

acquisitions from all over the globe, Heineken has been run- At the same time, Heineken has also been pushing other

ning the risk of falling behind its more aggressive rivals. To brands that would reduce its reliance on its core Heineken

deal with this growing challenge, the firm has broken out of brand. It has already achieved considerable success with

its play-it-safe corporate culture to make a few big deals. In Amstel Light, which has become the leading imported light

2003, Heineken spent $2.1 billion to acquire BBAG, a family- beer in the United States and has been selling well in many

owned company based in Linz, Austria. Because of BBAG’s other countries. But many of the other brands that it carries

extensive presence in Central Europe, Heineken has are strong local brands added through its string of acquisi-

become the biggest beer maker in seven countries across tions of smaller breweries around the globe. It has managed

Eastern Europe. The acquisition of Scottish & Newcastle in to develop a relatively small but loyal base of consumers

2008 similarly reinforced the firm’s dominance in Western by promoting some of these as specialty brands, such as

Europe. Murphy’s Irish Red and Moretti.

At the same time, Heineken has been making a string of Finally, Heineken has been stepping up its efforts to tar-

acquisitions in other parts of the world. Its recent acquisi- get Hispanics, who account for one-quarter of U.S. sales.

tions in Ethiopia, Singapore, and Mexico have allowed it to Besides developing specific marketing campaigns for them,

build its position in these growing markets. The firm has it added popular Mexican beers such as Tecate and Dos

also made an aggressive push into Russia with the acquisi- Equis to its line of offerings. For years, these had been mar-

tion of mid-sized brewing concerns. Through several acqui- keted and distributed by Heineken in the United States un-

sitions since 2002, Russia has become one of Heineken’s der a license from FEMSA Cervesa. In 2010, the firm

largest markets by volume. Heineken now ranks as the decided to acquire the firm, giving them full control over all

third-largest brewer in Russia, behind Sweden’s Baltic of their brands. Benj Steinman, publisher and editor of Beer

Beverages Holding and InBev. Marketer’s Insight newsletter, believed their relationship

Rene Hooft Graafland, the company’s Chief Financial with FEMSA had been quite beneficial: “This gives

Officer, has stated that Heineken will continue to partici- Heineken a commanding share of the U.S. import business

pate in the consolidation of the $460 billion global retail and . . . gives them a bigger presence in the Southwest . . .

beer industry, by targeting many different markets around and better access to Hispanic consumers,” he stated.6

the world. During the last decade, the firm has also added Above all, Heineken wants to maintain its leadership in

several labels to Heineken’s shelf, pouncing on brewers in the premium beer industry, which represents the most profit-

far flung places like Belarus, Panama, Egypt, and Kazakh- able segment of the beer business. In this category, the firm’s

stan. In Egypt, Ruys bought a majority stake in Al Ahram brands face competition in the United States from domestic

Beverages Co. and had been using the Cairo-based brewer’s beers such as Anheuser’s Budweiser Select and imported

fruit-flavored, nonalcoholic malts as an avenue into other beers such as InBev’s Stella Artois. Although premium brews

Muslim countries. often have slightly higher alcohol content than standard

CASE 13 :: HEINEKEN C79

Strategic Management: Text and

Cases

beers, they are developed through a more exclusive position- its existing culture. “Since 1952 history has proved it is the

ing of the brand. This allows the firm to charge a higher price right concept,” he stated about the Heineken’s ownership

for these brands. A six-pack of Heineken, for example, costs $9, structure. “The whole business about family restraint on us

versus around $6 for a six-pack of Budweiser. Furthermore, is absolutely untrue. Without its spirit and guidance, the

Just-drinks.com, a London-based online research service, esti- company would not have been able to build a world leader.”7

mates that the market for premium beer will continue to In fact, van Boxmeer’s devotion to the firm is quite evi-

expand over the next decade. dent. Since he took over, Heineken has shown steady

growth in revenues and profits, even with little growth in

Building on Its Past the global market for beer. Before he took over as Heineken’s

first non-Dutch CEO, van Boxmeer had spent 20 years

The recent acquisitions in different parts of the world—Asia,

working his way up within the firm. Even his cufflinks are

Africa, Latin America and Europe—represent an important

silver miniatures of a Heineken bottle top and opener. “We

step in Heineken’s quest to build upon its existing global

are in the logical flow of history,” he explained. “Every time

stature. Van Boxmeer and his team have made an effort to

you have a new leader you have a new kind of vision. It is

enter new markets and build upon the firm’s position in ex-

not radically different, because you are defined by what

isting markets. In November 2018, Heineken signed an

your company is and what your brands are.”8

agreement with China Resources Enterprise and China Re-

sources Beer to create a long-term strategic partnership for

mainland China, Hong Kong, and Macau. The partnership ENDNOTES

will give the firm a 40 percent share in the Chinese firm that 1. GlobeNewswire. 2019. Heineken opens up first brewery in

Mozambique, a US$100 million investment. March 13.

controls CR beer, the undisputed market leader in China,

2. Ewing, J. and G. Khermouch. 2003. Waking up Heineken.

which represents the world’s largest beer market. BusinessWeek, September 8, p. 68.

In order to accompany this global expansion, van Box- 3. Tomlinson, R. 2004. The new king of beers. Fortune, October 18,

meer has also been committed to working on the company’s p. 238.

culture in order to accelerate the speed of decision making. 4. Bickerton, I. and J. Wiggins. 2006. Accelerated change is brewing at

This led many people both inside and outside the firm to Heineken. Financial Times, May 8, p. 12.

5. Ewing, J. and G. Khermouch. 2003. Waking up Heineken.

expect the new management to try and break loose from the

BusinessWeek, September 8, p. 69.

conservative style that has resulted from the family’s tight 6. Kaplan, A. 2004. Border crossings. Beverage World, July 15, p. 6.

control. Instead, the affable 46-year-old Belgian indicated 7. Bickerton, I. and J. Wiggins. 2006. Accelerated change is brewing at

that he has been trying to focus on changes to the firm’s Heineken. Financial Times, May 8, p. 12.

decision-making process rather to make any drastic shifts in 8. Ibid.

C80 CASE 13 :: HEINEKEN

Strategic Management: Text and

Cases

Potrebbero piacerti anche

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Sonnedix Case Study (FA Entry Level)Documento15 pagineSonnedix Case Study (FA Entry Level)alka murarkaNessuna valutazione finora

- Kaplan Capital City Finance and Mortgage Broker Part 3: Oral Response To QuestionsDocumento2 pagineKaplan Capital City Finance and Mortgage Broker Part 3: Oral Response To Questionsalka murarkaNessuna valutazione finora

- HBS Marketing Simulation - Marker MotionDocumento3 pagineHBS Marketing Simulation - Marker Motionalka murarkaNessuna valutazione finora

- Micro Economics - Cost Minimization, Cost Curves, Firm Supply and Industry SupplyDocumento2 pagineMicro Economics - Cost Minimization, Cost Curves, Firm Supply and Industry Supplyalka murarkaNessuna valutazione finora

- FNCE 627 Week 7 Case Study 1 Financial PlanningDocumento2 pagineFNCE 627 Week 7 Case Study 1 Financial Planningalka murarka0% (1)

- FinMod FIN4350 TeamHW3 Fall2021 Sensitivity&Stochastic Analysis AdvertisingBudgetDecisionDocumento12 pagineFinMod FIN4350 TeamHW3 Fall2021 Sensitivity&Stochastic Analysis AdvertisingBudgetDecisionalka murarkaNessuna valutazione finora

- FIN4350 Team HW2 Fall2021 Modeling in Excel Office Building PlanningDocumento9 pagineFIN4350 Team HW2 Fall2021 Modeling in Excel Office Building Planningalka murarkaNessuna valutazione finora

- BlubberMaid Mini Case MGT 3500 Baruch ZicklinDocumento1 paginaBlubberMaid Mini Case MGT 3500 Baruch Zicklinalka murarkaNessuna valutazione finora

- C006 SRPING 21 Operations Management Queue ManagementDocumento2 pagineC006 SRPING 21 Operations Management Queue Managementalka murarkaNessuna valutazione finora

- Investment Management Homework Set 2 BUSFIN 1321Documento1 paginaInvestment Management Homework Set 2 BUSFIN 1321alka murarkaNessuna valutazione finora

- MGT 8000 - Assignment 7 HR AnalyticsDocumento5 pagineMGT 8000 - Assignment 7 HR Analyticsalka murarkaNessuna valutazione finora

- Insurance and Pensions 354FIN Homework Assignment - Personal Protection, Business ProtectionDocumento3 pagineInsurance and Pensions 354FIN Homework Assignment - Personal Protection, Business Protectionalka murarkaNessuna valutazione finora

- FNCE623 Solution To Final Exam 2021 WinterDocumento4 pagineFNCE623 Solution To Final Exam 2021 Winteralka murarkaNessuna valutazione finora

- HBS Thunderbird Improving The Online Experience Web Performance AnalyticsDocumento16 pagineHBS Thunderbird Improving The Online Experience Web Performance Analyticsalka murarkaNessuna valutazione finora

- Rhone Poulenc Rorer, Inc Case StudyDocumento1 paginaRhone Poulenc Rorer, Inc Case Studyalka murarka0% (1)

- Spotify Direct Listing IPO Case Study SolutionDocumento2 pagineSpotify Direct Listing IPO Case Study Solutionalka murarka100% (1)

- Baruch College Harry Davis 2101 Final Test BankDocumento9 pagineBaruch College Harry Davis 2101 Final Test Bankalka murarkaNessuna valutazione finora

- FIN30014 Financial Risk Management Group Assignment - Semester 2, 2020Documento8 pagineFIN30014 Financial Risk Management Group Assignment - Semester 2, 2020alka murarkaNessuna valutazione finora

- UVa Hospital System The Long Term Acute Care Hospital ProjectDocumento2 pagineUVa Hospital System The Long Term Acute Care Hospital Projectalka murarka50% (2)

- Hypothetical Denver Colorado Mortgage QuestionDocumento2 pagineHypothetical Denver Colorado Mortgage Questionalka murarkaNessuna valutazione finora

- Harvard's Case Solution: Blackstone and The Sale of Citigroup 'S Loan PortfolioDocumento2 pagineHarvard's Case Solution: Blackstone and The Sale of Citigroup 'S Loan Portfolioalka murarka0% (8)

- Stony Brook University David F Green Applied Mathematics & Statistics AMS 210 Homework 4 Solution Fall 2020Documento6 pagineStony Brook University David F Green Applied Mathematics & Statistics AMS 210 Homework 4 Solution Fall 2020alka murarkaNessuna valutazione finora

- Capital City Finance and Mortgage BrokersDocumento19 pagineCapital City Finance and Mortgage Brokersalka murarka0% (1)

- Philly LTD Management Accounting CaseDocumento9 paginePhilly LTD Management Accounting Casealka murarkaNessuna valutazione finora

- Harvard Publishing Case Study - Darden Business Publishing - University of Virginia - Calaveras VineyardDocumento2 pagineHarvard Publishing Case Study - Darden Business Publishing - University of Virginia - Calaveras Vineyardalka murarkaNessuna valutazione finora

- ACC102 - Fundamentals of Accounting IIDocumento10 pagineACC102 - Fundamentals of Accounting IIalka murarkaNessuna valutazione finora

- Harvard Case Study Jones Electrical DistributionDocumento4 pagineHarvard Case Study Jones Electrical Distributionalka murarka0% (1)

- Halfords Group CaseDocumento1 paginaHalfords Group Casealka murarkaNessuna valutazione finora

- Tulsa Memorial Hospital, Santa FE Healthcare, Copperline HealthcareDocumento4 pagineTulsa Memorial Hospital, Santa FE Healthcare, Copperline Healthcarealka murarka50% (2)

- Introduction To Management Science - Chapter 14 SimulationDocumento6 pagineIntroduction To Management Science - Chapter 14 Simulationalka murarkaNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Alcohol From Yam CassavaDocumento15 pagineAlcohol From Yam Cassavadinba123Nessuna valutazione finora

- Downstream Process For The Production of Yeast Extract Using Brewer's Yeast CellsDocumento6 pagineDownstream Process For The Production of Yeast Extract Using Brewer's Yeast Cells321Nessuna valutazione finora

- Hops Feasibility Study PDFDocumento325 pagineHops Feasibility Study PDFDragan KranjčićNessuna valutazione finora

- The Boston Beer Company, IncDocumento7 pagineThe Boston Beer Company, IncVikrant Sharma0% (1)

- ADAM - The Art of Making MeadDocumento5 pagineADAM - The Art of Making MeadrmedinaparedesNessuna valutazione finora

- Serve Beverage OrdersDocumento4 pagineServe Beverage OrdersNemyueru Letana100% (1)

- GCB 02 2013Documento16 pagineGCB 02 2013Ketan LingayatNessuna valutazione finora

- Brewing The Drink of The Gods: Basic Mead RecipesDocumento19 pagineBrewing The Drink of The Gods: Basic Mead RecipesChelsea Green Publishing100% (1)

- EBC Poster A0 090511Documento1 paginaEBC Poster A0 090511bartekguzikNessuna valutazione finora

- Procedure For Follow Up of Fermentation Process - FinalDocumento9 pagineProcedure For Follow Up of Fermentation Process - FinalMilosStojanovicNessuna valutazione finora

- Bibliografia MaltaDocumento1 paginaBibliografia MaltakevinNessuna valutazione finora

- Beer in Classroom - Case Study On Location &distribution DecisionDocumento13 pagineBeer in Classroom - Case Study On Location &distribution Decisionrajesh laddhaNessuna valutazione finora

- Kingfisher BeerDocumento7 pagineKingfisher BeerMuskan RaneyNessuna valutazione finora

- Journal Pre-Proof: Trends in Food Science & TechnologyDocumento52 pagineJournal Pre-Proof: Trends in Food Science & TechnologyA SierraNessuna valutazione finora

- Malting and Brewing ScienceDocumento6 pagineMalting and Brewing ScienceBruno MelandriNessuna valutazione finora

- Cd4057 Production of Bioethanol From Tapioca StarchDocumento25 pagineCd4057 Production of Bioethanol From Tapioca StarchKroya HunNessuna valutazione finora

- Yeast Management PropagationDocumento39 pagineYeast Management PropagationPatricio LazcanoNessuna valutazione finora

- Application of Enzymes in Brewing: January 2018Documento6 pagineApplication of Enzymes in Brewing: January 2018umunera2997Nessuna valutazione finora

- BeerDocumento7 pagineBeerRam Prasad NyaupaneNessuna valutazione finora

- Preoces de DezalcoolizareDocumento18 paginePreoces de DezalcoolizareMarina ButuceaNessuna valutazione finora

- Beer 101Documento25 pagineBeer 101Juan Jose Garcia OrnelasNessuna valutazione finora

- CIPguidlineline73707 N3Documento9 pagineCIPguidlineline73707 N3Yen NguyenNessuna valutazione finora

- Vodka: RI Aylott, Aylott Scientific, Dunblane, UKDocumento4 pagineVodka: RI Aylott, Aylott Scientific, Dunblane, UKFer ChicoNessuna valutazione finora

- Carnival Bar Drink Menu OutdoorDocumento2 pagineCarnival Bar Drink Menu OutdoorttNessuna valutazione finora

- Approved Methodologies: To Which LECO Instruments ConformDocumento5 pagineApproved Methodologies: To Which LECO Instruments ConformG_ASantosNessuna valutazione finora

- Biocouture Grow Your Own Material Recipe Creative Common LicenseDocumento2 pagineBiocouture Grow Your Own Material Recipe Creative Common LicenseGiada DaolioNessuna valutazione finora

- International Business: Case Study 5 BEER For All: Sabmiller in MozambiqueDocumento3 pagineInternational Business: Case Study 5 BEER For All: Sabmiller in Mozambiquesatyapal yadavNessuna valutazione finora

- Unit 2.20 - Determination of Solids by Imhoff Cone AnalysisDocumento6 pagineUnit 2.20 - Determination of Solids by Imhoff Cone AnalysisRiyanNessuna valutazione finora

- Task 1 ForageDocumento2 pagineTask 1 ForageAditya KatareNessuna valutazione finora

- Licenses Required For Opening A Microbrewery in India - Ipleaders PDFDocumento24 pagineLicenses Required For Opening A Microbrewery in India - Ipleaders PDFanilks3Nessuna valutazione finora