Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Ekerson v. MERS, CitiMortgage Inc., Et Al

Caricato da

Foreclosure FraudCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Ekerson v. MERS, CitiMortgage Inc., Et Al

Caricato da

Foreclosure FraudCopyright:

Formati disponibili

Case 3:11-cv-00178-BR Document 8 Filed 02/11/11 Page 1 of 12 Page ID#: 37

IN THE UNITED STATES DISTRICT COURT

FOR THE DISTRICT OF OREGON

PORTLAND DIVISION

DAVID EKERSON, 11-CV-178-HU

Plaintiff,

TEMPORARY RESTRAINING

v. ORDER

MORTGAGE ELECTRONIC

REGISTRATION SYSTEM, a

foreign corporation;

CITIMORTGAGE, INC., a foreign

corporation; and CAL-WESTERN

RECONVEYANCE, a foreign

conrporation,

Defendants.

ALEX GOLUBITSKY

Case Dusterhoff LLP

9800 S.W. Beavterton-Hillsdale Hwy

Suite 200

Beaverton, OR 97005

(503) 641-7222

Attorneys for Plaintiff

1 - TEMPORARY RESTRAINING ORDER

Case 3:11-cv-00178-BR Document 8 Filed 02/11/11 Page 2 of 12 Page ID#: 38

BROWN, Judge.

This matter comes before the Court on Plaintiff's Motion

(#3) for a Temporary Restraining Order Pursuant to FRCP 65. For

the reasons that follow, the Court GRANTS Plaintiff's Motion and

temporarily RESTRAINS Defendants from proceeding with the

February 16, 2011, foreclosure sale of Plaintiff's property.

BACKGROUND

The following facts are taken from Plaintiff's Complaint:

On November 21, 2006, Plaintiff David Ekerson entered into a

promissory note secured by property located at 622 S.E. 71st

Street, Hillsboro, Oregon, pursuant to one or more deeds of trust

recorded December 5, 2006. According to title records, Citibank

was the original mortgagee.

At some point, it appears Defendant Mortgage Electronic

Resolution System (MERS) became an assignee of the original

lender under the Notes, and on October 12, 2010, MERS "grant[ed],

assign[ed], and transfer[red]" to Defendant Citimortgage, Inc.,

"all beneficial interest under" the November 21, 2006, deed of

trust. Decl. of Alex Golubitsky, Ex. D. Also on October 12,

2010, MERS evidently issued a Notice of Default to Plaintiff.

MERS's assignment to Citimortgage, however, was not recorded in

Washington County's records until two days later on October 14,

2010.

2 - TEMPORARY RESTRAINING ORDER

Case 3:11-cv-00178-BR Document 8 Filed 02/11/11 Page 3 of 12 Page ID#: 39

In his Complaint, Plaintiff alleges he believes Citimortgage

is the "current servicer or owner of the loan, having been

assigned the loan by Freddie Mac." Plaintiff also believes

Defendant Cal-Western Reconveyance (CWR) is the trustee in charge

of the foreclosure sale.

Plaintiff's property is scheduled to be sold at public

auction on February 16, 2011, based on the Notice of Default that

Plaintiff contends was improperly issued by MERS.

On February 10, 2011, Plaintiff filed a Complaint in this

Court alleging Defendants violated Oregon's Unfair Trade

Practices Act, Or. Rev. Stat. §§ 646.608(1)(k) and

646.608(2)(n). Plaintiff seeks damages and a declaration as to

(1) whether Defendants have standing to foreclose; (2) whether

MERS "duly and appropriately recorded all assignments of the

beneficial interest in the trust deeds" pursuant to Oregon

Revised Statute § 86.735 and whether a nonjudicial foreclosure is

allowed by statute; and (3) whether the right of the lender to

impose a delinquency charge was properly disclosed in the initial

loan agreement pursuant to the Truth in Lending Act (TILA), 15

U.S.C. § 1601, Regulation Z, Part 266.18.

On February 10, 2011, Plaintiff also filed a Motion for

Temporary Restraining Order in which Plaintiff moves for the

entry of an order preventing Defendants from proceeding with the

3 - TEMPORARY RESTRAINING ORDER

Case 3:11-cv-00178-BR Document 8 Filed 02/11/11 Page 4 of 12 Page ID#: 40

proposed foreclosure sale of Plaintiff's property on February 16,

2011.

STANDARDS

A party seeking a temporary restraining order or preliminary

injunction must demonstrate (1) it is likely to succeed on the

merits, (2) it is likely to suffer irreparable harm in the

absence of preliminary relief, (3) the balance of equities tips

in its favor, and (4) an injunction is in the public interest.

Winter v. Natural Res. Def. Council, 129 S. Ct. 365, 374 (2008).

"The elements of [this] test are balanced, so that a stronger

showing of one element may offset a weaker showing of another.

For example, a stronger showing of irreparable harm to plaintiff

might offset a lesser showing of likelihood of success on the

merits." Alliance For The Wild Rockies v. Cottrell,

No. 09-35756, 2011 WL 208360, at *4 (9th Cir. Jan. 25,

2011)(citing Winter, 129 S. Ct. at 392). Accordingly, the Ninth

Circuit has held "'serious questions going to the merits' and a

balance of hardships that tips sharply towards the plaintiff can

support issuance of a preliminary injunction, so long as the

plaintiff also shows that there is a likelihood of irreparable

injury and that the injunction is in the public interest." Id.,

at *7.

"An injunction is a matter of equitable discretion" and is

4 - TEMPORARY RESTRAINING ORDER

Case 3:11-cv-00178-BR Document 8 Filed 02/11/11 Page 5 of 12 Page ID#: 41

"an extraordinary remedy that may only be awarded upon a clear

showing that the plaintiff is entitled to such relief." Winter,

129 S. Ct. at 376, 381.

DISCUSSION

I. Merits

Plaintiff seeks an order preventing Defendants from

proceeding with the proposed foreclosure sale of Plaintiff's

property as scheduled because, among other things, Defendants

"have not followed the appropriate procedures for recording all

the deeds and assignments for this property, and therefore lack

standing to foreclosure [sic] this property." Specifically,

Plaintiff contends MERS assigned its apparent beneficial interest

in the property "to other parties who were not recorded in

violation" of Oregon Revised Statute § 86.735.

In Burgett v. Mortgage Electronic Registration Systems,

District Judge Michael Hogan explained the mortgage practice

engaged in by MERS as follows:

"In 1993, the Mortgage Bankers Association, Fannie

Mae, Freddie Mac, the Government National Mortgage

Association (Ginnie Mae), the Federal Housing

Administration, and the Department of Veterans

Affairs created MERS. MERS provides ‘electronic

processing and tracking of [mortgage] ownership

and transfers.’ Mortgage lenders, banks,

insurance companies, and title companies become

members of MERS and pay an annual fee. They

appoint MERS as their agent to act on all

mortgages that they register on the system. A

MERS mortgage is recorded with the particular

5 - TEMPORARY RESTRAINING ORDER

Case 3:11-cv-00178-BR Document 8 Filed 02/11/11 Page 6 of 12 Page ID#: 42

county's office of the recorder with ‘Mortgage

Electronic Registration System, Inc.’ named as the

lender's nominee or mortgagee of record' on the

mortgage. The MERS member who owns the beneficial

interest may assign those beneficial ownership

rights or servicing rights to another MERS member.

These assignments are not part of the public

record, but are tracked electronically on MERS's

private records. Mortgagors are notified of

transfers of servicing rights, but not of

transfers of beneficial ownership."

2010 WL 4282105, at *2 (D. Or. Oct. 20, 2010)(quoting Gerald

Korngold, Legal and Policy Choices in the Aftermath of the

Subprime and Mortgage Financing Crisis, 60 S.C. L.Rev. 727,

741-42 (2009)). In Burgett, the plaintiff, a mortgagee, brought

an action against MERS and the servicer of the plaintiff's

mortgage loan alleging, among other things, a claim for breach of

contract and seeking declaratory relief to prevent a foreclosure

sale of his property. The plaintiff contended the MERS practice

set out above was not permitted under Oregon trust-deed law

because it allowed assignment of beneficial interests without

recording. Id. The defendants moved for summary judgment.

Judge Hogan noted the plaintiff's contention did not "necessarily

mean that the arrangement violates the Oregon Trust Deed Act such

that foreclosure proceedings could not be initiated by MERS or

its substitute trustee." Id. Judge Hogan, however, denied the

defendants' motion for summary judgment as to the plaintiff's

request for declaratory relief and claim for breach of contract

on the ground that the defendants failed to "record assignments

6 - TEMPORARY RESTRAINING ORDER

Case 3:11-cv-00178-BR Document 8 Filed 02/11/11 Page 7 of 12 Page ID#: 43

necessary for the foreclosure." Id., at *3. Judge Hogan

reasoned:

Under ORS 86.705(1) a "'Beneficiary' means the

person named or otherwise designated in a trust

deed as the person for whose benefit a trust deed

is given, or the person's successor in interest,

and who shall not be the trustee unless the

beneficiary is qualified to be a trustee under ORS

86.790(1)(d)." Plaintiff contends that MERS

cannot meet this definition because there is no

evidence that the trust deed was made to benefit

MERS. However, the trust deed specifically

designates MERS as the beneficiary. Judge Henry

C. Breithaupt provides a persuasive discussion

related to this issue:

[T]he interest of MERS, and those for whom it

was a nominee, in question here was recorded

and known to Plaintiff when it received the

litigation guarantee document prior to

starting this action.

The Statutes do not prohibit liens to be

recorded in the deed of records of counties

under an agreement where an agent will appear

as a lienholder for the benefit of the

initial lender and subsequent assignees of

that lender-even where the assignments of the

beneficial interest in the record lien are

not recorded. It is clear that such

unrecorded assignments of rights are

permissible under Oregon's trust deed statute

because ORS 86.735 provides if foreclosure by

sale is pursued all prior unrecorded

assignments must be filed in connection with

the foreclosure. The trust deed statutes

therefore clearly contemplate that

assignments of the beneficial interests in

obligations and security rights will occur

and may, in fact, not have been recorded

prior to foreclosure. The legislature was

clearly aware such assignments occurred and

nowhere provided that assignments needed to

be recorded to maintain rights under the lien

statutes except where foreclosure by sale was

pursued.

7 - TEMPORARY RESTRAINING ORDER

Case 3:11-cv-00178-BR Document 8 Filed 02/11/11 Page 8 of 12 Page ID#: 44

Letter Decision in Parkin Electric, Inc. v.

Saftencu, No. LV08040727, dated March 12, 2009

(attached as Exhibit C to the second declaration

of David Weibel (# 60)).

The problem that defendants run into in this case

is an apparent failure to record assignments

necessary for the foreclosure. As Judge

Breithaupt notes, ORS § 86.735 provides that if

foreclosure by sale is pursued, all prior

unrecorded assignments must be filed in connection

with the foreclosure. ORS § 86.735(1)

specifically provides

The trustee may foreclose a trust deed by

advertisement and sale in the manner provided

in ORS 86.740 to 86.755 if:

(1) The trust deed, any assignments of the

trust deed by the trustee or the beneficiary

and any appointment of a successor trustee

are recorded in the mortgage records in the

counties in which the property described in

the deed is situated.

Id., at *2-*3. Judge Hogan noted Oregon Revised Statute § 86.735

requires any assignments of the trust deed by the trustee or the

beneficiary and any appointment of a successor trustee to be

recorded. The record in Burgett, however, did not reflect all

transfers to the subsequent lenders/servicers had been recorded.

Id.

Similarly, in Rinegard-Guirma v. Bank of America, District

Judge Garr M. King granted the plaintiff, a mortgagee, a

temporary restraining order against the defendants, MERS and

others, prohibiting the defendants from conducting a foreclosure

sale of the plaintiff's home because the plaintiff established

"nothing [was] recorded with Multnomah County [that] demonstrates

8 - TEMPORARY RESTRAINING ORDER

Case 3:11-cv-00178-BR Document 8 Filed 02/11/11 Page 9 of 12 Page ID#: 45

that LSI Title Company of Oregon, LLC is the successor trustee."

No. 10-CV-1065-PK, 2010 WL 3655970, at *2 (D. Or. Sept. 15,

2010). Judge King reasoned:

Pursuant to ORS 86.790, the beneficiary may

appoint a successor trustee. However, only “[i]f

the appointment of the successor trustee is

recorded in the mortgage records of the county or

counties in which the trust deed is recorded” is

the successor trustee “vested with all the powers

of the original trustee.” ORS 86.790(3).

Accordingly, unless the appointment of LSI Title

Company of Oregon, LLC was recorded, the purported

successor trustee has no “power of sale”

authorizing it to foreclose Rinegard-Guirma's

property. See ORS 86.710 (describing trustee's

power of sale); ORS 86.735 (permitting foreclosure

by advertisement and sale but only if “any

appointment of a successor trustee [is] recorded

in the mortgage records in the counties in which

the property described in the deed is situated”).

Similarly, she is likely to experience irreparable

harm if her home is foreclosed upon.

Id.

Plaintiff also contends this foreclosure proceeding is

defective because there has not been established any basis in law

for Defendants to have assessed a $77,000.00 delinquency charge

which far exceeds the actual loan balance. Plaintiff contends

this is a violation of TILA.

The Court finds persuasive the reasoning in Burgett and

Rinegard-Guirma as to MERS status in the case on this record.

The Court, therefore, concludes Plaintiff has established he is

likely to succeed at least as to his request for declaratory

judgment related to Defendants' failure to comply with Oregon

9 - TEMPORARY RESTRAINING ORDER

Case 3:11-cv-00178-BR Document 8 Filed 02/11/11 Page 10 of 12 Page ID#: 46

Revised Statute § 86.735. Plaintiff also has established MERS,

who was the recorded beneficiary of the trust deed, assigned

successor trustees to the trust deed but failed to record the

appointment of any successor trustee as required before a

nonjudicial foreclosure sale may be conducted under Oregon law.

The Court also finds there is a legitimate basis to be concerned

that the alleged $77,000.00 delinquency has been assessed

improperly.

Plaintiff also has established he is likely to experience

irreparable harm if the scheduled foreclosure proceeds unabated.

The Court, therefore, concludes the balance of hardships tips

sharply in Plaintiff's favor, and there are at least serious

questions as to the merits of Plaintiff's request for declaratory

judgment.

Accordingly, the Court GRANTS Plaintiff's Motion for a

Temporary Restraining Order and hereby RESTRAINS Defendants from

proceeding with the February 16, 2011, foreclosure sale of

Plaintiff's property.

II. Notice under Federal Rule of Civil Procedure 65

Federal Rule of Civil Procedure 65(b) provides in pertinent

part:

(1) Issuing Without Notice. The court may issue a

temporary restraining order without written or

oral notice to the adverse party or its attorney

only if:

10 - TEMPORARY RESTRAINING ORDER

Case 3:11-cv-00178-BR Document 8 Filed 02/11/11 Page 11 of 12 Page ID#: 47

(A) specific facts in an affidavit or a

verified complaint clearly show that

immediate and irreparable injury, loss, or

damage will result to the movant before the

adverse party can be heard in opposition; and

(B) the movant's attorney certifies in

writing any efforts made to give notice and

the reasons why it should not be required.

Here the Court issues the order temporarily restraining

Defendants from proceeding with the proposed foreclosure sale of

Plaintiff's property without notice to Defendants because there

is insufficient time before the scheduled foreclosure sale to

compel Defendants to appear and to respond to the Motion. In

addition, Plaintiff's counsel has made reasonable efforts to

notify Defendants and has been unsuccessful in securing the

presence of a responsive party. Finally, the Court concludes the

risk of irreparable harm to Plaintiff is significant when weighed

against the temporary delay authorized by this Order.

III. Security

Pursuant to Rule 65(c), the Court requires Plaintiff to post

a $500.00 bond by 4 p.m., Monday, February 14, 2011, as a

reasonable security for any costs or damages sustained by any

party found to have been wrongfully restrained.

CONCLUSION

For these reasons, the Court GRANTS Plaintiff's Motion (#3)

for a Temporary Restraining Order and hereby RESTRAINS Defendants

11 - TEMPORARY RESTRAINING ORDER

Case 3:11-cv-00178-BR Document 8 Filed 02/11/11 Page 12 of 12 Page ID#: 48

from proceeding with the February 16, 2011, foreclosure sale of

Plaintiff's property. The Court DIRECTS Plaintiff to post a

$500.00 bond by 4 p.m., Monday, February 14, 2011.

IT IS SO ORDERED.

DATED this 11th day of February, 2011.

This order is issued on February 11, 2011, at 5:00 p.m., and

expired on February 25, 2011, at 5:00 p.m., unless extended by

order of the Court.

/s/ Anna J. Brown

ANNA J. BROWN

United States District

12 - TEMPORARY RESTRAINING ORDER

Potrebbero piacerti anche

- CA Homeowner Comes Away With A WIN!Documento52 pagineCA Homeowner Comes Away With A WIN!Mortgage Compliance Investigators75% (4)

- Petition for Certiorari Denied Without Opinion: Patent Case 98-1151Da EverandPetition for Certiorari Denied Without Opinion: Patent Case 98-1151Nessuna valutazione finora

- Defeat Foreclosure: Save Your House,Your Credit and Your Rights.Da EverandDefeat Foreclosure: Save Your House,Your Credit and Your Rights.Nessuna valutazione finora

- D C O A O T S O F: Cesar A. Vidal and Ruth VidalDocumento5 pagineD C O A O T S O F: Cesar A. Vidal and Ruth VidalForeclosure FraudNessuna valutazione finora

- MERS POLICY BULLETIN - Number 2011-5Documento1 paginaMERS POLICY BULLETIN - Number 2011-5Foreclosure FraudNessuna valutazione finora

- Arkansas RulingDocumento12 pagineArkansas RulingForeclosure FraudNessuna valutazione finora

- MFPO AlbertelliDocumento13 pagineMFPO AlbertelliForeclosure Fraud100% (3)

- MERS V Cabrera Order of Dismissal Judge Jon Gordon Miami Dade Co FLDocumento17 pagineMERS V Cabrera Order of Dismissal Judge Jon Gordon Miami Dade Co FLWilliam A. Roper Jr.Nessuna valutazione finora

- Cover Letter and Brief To Court 08-15-11 12-30 Am - 10Documento2 pagineCover Letter and Brief To Court 08-15-11 12-30 Am - 10jack1929Nessuna valutazione finora

- James Scheider, Jr. v. Deutsche Bank National Trust, 4th Cir. (2014)Documento13 pagineJames Scheider, Jr. v. Deutsche Bank National Trust, 4th Cir. (2014)Scribd Government DocsNessuna valutazione finora

- WaMu Settlement Date ExtensionDocumento1 paginaWaMu Settlement Date ExtensionForeclosure FraudNessuna valutazione finora

- California Homeowner Bill of Rights Blocks BofA ForeclosureDocumento3 pagineCalifornia Homeowner Bill of Rights Blocks BofA ForeclosureHelpin HandNessuna valutazione finora

- JUDGE WRIGHT DENIES CHASE'S (WAMU) MOTION TO DISMISS 5 CAUSES OF ACTION-JAVAHERI CASE - FEDERAL COURT CALIF. - wrongful foreclosure, quiet title, violation of Cal Civ. Code Sec. 2923.5, quasi contract, and declaratory relief.Documento93 pagineJUDGE WRIGHT DENIES CHASE'S (WAMU) MOTION TO DISMISS 5 CAUSES OF ACTION-JAVAHERI CASE - FEDERAL COURT CALIF. - wrongful foreclosure, quiet title, violation of Cal Civ. Code Sec. 2923.5, quasi contract, and declaratory relief.83jjmackNessuna valutazione finora

- Motion - Substantiated Allegations of Foreclosure Fraud That Implicates The Florida Attorney General's Office and The Florida Default Law GroupDocumento38 pagineMotion - Substantiated Allegations of Foreclosure Fraud That Implicates The Florida Attorney General's Office and The Florida Default Law GroupForeclosure Fraud100% (1)

- Investors Suing Chase - Includes List of Mortgage Backed Securities - Various Originators Like New Century, WAMU, Wells Fargo, ResMae, Greenpoint, Countrywide, Ownit, Accredited Home Lenders Etc.Documento124 pagineInvestors Suing Chase - Includes List of Mortgage Backed Securities - Various Originators Like New Century, WAMU, Wells Fargo, ResMae, Greenpoint, Countrywide, Ownit, Accredited Home Lenders Etc.83jjmack100% (1)

- Alex Remick Fraud Case, KHDocumento34 pagineAlex Remick Fraud Case, KHWait What?100% (1)

- Angela Sacchi V Mers June 24 2011 - HOMEOWNER SURVIVES MOTION TO DISMISS FAC IN CALIFORNIA-THIS JUDGE GETS ITDocumento18 pagineAngela Sacchi V Mers June 24 2011 - HOMEOWNER SURVIVES MOTION TO DISMISS FAC IN CALIFORNIA-THIS JUDGE GETS IT83jjmackNessuna valutazione finora

- Glaski Affidavit Thomas Adams 5 15Documento8 pagineGlaski Affidavit Thomas Adams 5 15raphinologyNessuna valutazione finora

- Case File Arkansas Class ActionDocumento156 pagineCase File Arkansas Class ActionForeclosure Fraud100% (2)

- Lender Processing Services (F/k/a FIS) Newsletter The Summit Dec. '07Documento20 pagineLender Processing Services (F/k/a FIS) Newsletter The Summit Dec. '07lizinsarasota50% (2)

- Washington Mutual Bank FA Status 1996-2007Documento13 pagineWashington Mutual Bank FA Status 1996-2007Brenda ReedNessuna valutazione finora

- Chase-Wamu Answer To Amended Complaint by Deutsche Bank-Ma 2011 - Fdic Also DefendantDocumento25 pagineChase-Wamu Answer To Amended Complaint by Deutsche Bank-Ma 2011 - Fdic Also Defendant83jjmack100% (1)

- Adversary ComplaintDocumento7 pagineAdversary Complaintchessplayer5Nessuna valutazione finora

- Deutsche Bank Natl. Trust Co. V VasquezDocumento10 pagineDeutsche Bank Natl. Trust Co. V VasquezForeclosure FraudNessuna valutazione finora

- Complaint RICO Case Against JP Morgan-Chase - LINDA ZIMMERMAN V JPMORGAN CHASE BANK NA Foreclosure Fraud - Fighting Foreclosure Fraud by Sharing The KnowledgeDocumento16 pagineComplaint RICO Case Against JP Morgan-Chase - LINDA ZIMMERMAN V JPMORGAN CHASE BANK NA Foreclosure Fraud - Fighting Foreclosure Fraud by Sharing The Knowledgefreddiefletcher24830% (1)

- Case Against US Bnk-BollingbrieffinalDocumento104 pagineCase Against US Bnk-BollingbrieffinalNoraNessuna valutazione finora

- A159998 OpinionDocumento12 pagineA159998 OpinionDinSFLANessuna valutazione finora

- Doble V Deutsche BankDocumento14 pagineDoble V Deutsche BankRobert SalzanoNessuna valutazione finora

- EasyKnock v. Feldman and Feldman - Memorandum and OrderDocumento12 pagineEasyKnock v. Feldman and Feldman - Memorandum and OrderrichdebtNessuna valutazione finora

- Useful Mortgage Case-LawsDocumento5 pagineUseful Mortgage Case-LawsMarcellus MasonNessuna valutazione finora

- APPEAL WIN FOR HOMEOWNER - Reversal and Remand Nevada Supreme Court - FOUST V WELLS FARGO, MERS Et Al. July 2011Documento7 pagineAPPEAL WIN FOR HOMEOWNER - Reversal and Remand Nevada Supreme Court - FOUST V WELLS FARGO, MERS Et Al. July 201183jjmack100% (2)

- JPMC and Wamu MTD MPSJDocumento39 pagineJPMC and Wamu MTD MPSJMike MaunuNessuna valutazione finora

- Attorney General Pam Bondi Ethics Complaint No. 13-201 DismissedDocumento140 pagineAttorney General Pam Bondi Ethics Complaint No. 13-201 DismissedNeil GillespieNessuna valutazione finora

- Merrigan v. Bank of New York - Petition Challenging Constitutionality of Lee County, FL Foreclosure CourtDocumento52 pagineMerrigan v. Bank of New York - Petition Challenging Constitutionality of Lee County, FL Foreclosure CourtForeclosure FraudNessuna valutazione finora

- A Compendium of Mortgage CasesDocumento54 pagineA Compendium of Mortgage CasesCarrieonicNessuna valutazione finora

- FEDERAL JUDGE DENISE COTE'S 361 PAGE OPINION OF MAY 11, 2015 ON THE CASE: FHFA v. Nomura Decision 11may15Documento361 pagineFEDERAL JUDGE DENISE COTE'S 361 PAGE OPINION OF MAY 11, 2015 ON THE CASE: FHFA v. Nomura Decision 11may1583jjmack100% (1)

- Deutsche Bank Natl. Trust Co. v. NajarDocumento38 pagineDeutsche Bank Natl. Trust Co. v. NajarRicharnellia-RichieRichBattiest-CollinsNessuna valutazione finora

- Too Many Jobs - Linda Green, Tywanna Thomas, Korell Harp and Shelly ScheffeyDocumento8 pagineToo Many Jobs - Linda Green, Tywanna Thomas, Korell Harp and Shelly ScheffeyForeclosure FraudNessuna valutazione finora

- MRS V JPMC Doc 151-1, Fourth Amended Complaint, March 6, 2017Documento88 pagineMRS V JPMC Doc 151-1, Fourth Amended Complaint, March 6, 2017FraudInvestigationBureau100% (2)

- Mers Losses Again - Appeal Decision - Indiana May 2011 - Citibank V BarabasDocumento15 pagineMers Losses Again - Appeal Decision - Indiana May 2011 - Citibank V Barabas83jjmackNessuna valutazione finora

- Hudson - Brief That Goes With ComplaintDocumento14 pagineHudson - Brief That Goes With ComplaintDavid PerlmanNessuna valutazione finora

- A Collection of NY Judge Arthur SchackDocumento3 pagineA Collection of NY Judge Arthur Schackwinstons2311100% (1)

- The Case Against Allowing Mortgage Electronic Registration Systems, Inc. (MERS) To Initiate Foreclosure ProceedingsDocumento34 pagineThe Case Against Allowing Mortgage Electronic Registration Systems, Inc. (MERS) To Initiate Foreclosure ProceedingsForeclosure FraudNessuna valutazione finora

- Congressional Oversight Panel Report On Foreclosure FraudDocumento127 pagineCongressional Oversight Panel Report On Foreclosure FraudForeclosure FraudNessuna valutazione finora

- US BANK v. Ibanez - Amicus Manson BriefDocumento53 pagineUS BANK v. Ibanez - Amicus Manson Briefwinstons2311Nessuna valutazione finora

- Bayview Loan Servicing, LLC V Bozymowski WDocumento8 pagineBayview Loan Servicing, LLC V Bozymowski WDinSFLANessuna valutazione finora

- America's Wholesale Lender - NY FilingDocumento2 pagineAmerica's Wholesale Lender - NY FilingStephen DibertNessuna valutazione finora

- Borrowers Authorization/Certification/Info Form: of Specified Loan Closing DocumentsDocumento9 pagineBorrowers Authorization/Certification/Info Form: of Specified Loan Closing DocumentsChloe Nicole WilliamsNessuna valutazione finora

- Request For Production of Note and Mortgage For Forensic Testing SupplementDocumento7 pagineRequest For Production of Note and Mortgage For Forensic Testing Supplementjohngault100% (2)

- Foreclosure Prevention & Refinance Report: Federal Property Manager'S Report Second Quarter 2021Documento50 pagineForeclosure Prevention & Refinance Report: Federal Property Manager'S Report Second Quarter 2021Foreclosure FraudNessuna valutazione finora

- Petition for Certiorari – Patent Case 01-438 - Federal Rule of Civil Procedure 52(a)Da EverandPetition for Certiorari – Patent Case 01-438 - Federal Rule of Civil Procedure 52(a)Nessuna valutazione finora

- Navigating Failure: Bankruptcy and Commercial Society in Antebellum AmericaDa EverandNavigating Failure: Bankruptcy and Commercial Society in Antebellum AmericaValutazione: 2 su 5 stelle2/5 (3)

- Quantum of Justice - The Fraud of Foreclosure and the Illegal Securitization of Notes by Wall Street: The Fraud of Foreclosure and the Illegal Securitization of Notes by Wall StreetDa EverandQuantum of Justice - The Fraud of Foreclosure and the Illegal Securitization of Notes by Wall Street: The Fraud of Foreclosure and the Illegal Securitization of Notes by Wall StreetNessuna valutazione finora

- Anti-SLAPP Law Modernized: The Uniform Public Expression Protection ActDa EverandAnti-SLAPP Law Modernized: The Uniform Public Expression Protection ActNessuna valutazione finora

- Beating Banks At Their Own Game: Don't fear Big Brother; fear Big BanksDa EverandBeating Banks At Their Own Game: Don't fear Big Brother; fear Big BanksNessuna valutazione finora

- Foreclosure Prevention & Refinance Report: Federal Property Manager'S Report Second Quarter 2021Documento50 pagineForeclosure Prevention & Refinance Report: Federal Property Manager'S Report Second Quarter 2021Foreclosure FraudNessuna valutazione finora

- SCOTUS Docket No. 21A23Documento16 pagineSCOTUS Docket No. 21A23Chris GeidnerNessuna valutazione finora

- Response in OppositionDocumento36 pagineResponse in OppositionForeclosure FraudNessuna valutazione finora

- Alabama Association of Realtors, Et Al.,: ApplicantsDocumento19 pagineAlabama Association of Realtors, Et Al.,: ApplicantsForeclosure FraudNessuna valutazione finora

- State of New York: The People of The State of New York, Represented in Senate and Assem-Bly, Do Enact As FollowsDocumento2 pagineState of New York: The People of The State of New York, Represented in Senate and Assem-Bly, Do Enact As FollowsForeclosure FraudNessuna valutazione finora

- Harvard Jchs Covid Impact Landlords Survey de La Campa 2021Documento50 pagineHarvard Jchs Covid Impact Landlords Survey de La Campa 2021Foreclosure FraudNessuna valutazione finora

- In The United States District Court For The Northern District of Illinois Eastern DivisionDocumento13 pagineIn The United States District Court For The Northern District of Illinois Eastern DivisionForeclosure FraudNessuna valutazione finora

- Alabama Association of Realtors, Et Al.,: ApplicantsDocumento52 pagineAlabama Association of Realtors, Et Al.,: ApplicantsForeclosure FraudNessuna valutazione finora

- Hyper Vac AnyDocumento41 pagineHyper Vac AnyForeclosure FraudNessuna valutazione finora

- ResponseDocumento27 pagineResponseForeclosure FraudNessuna valutazione finora

- Sixth Circuit Rent MoratoriumDocumento13 pagineSixth Circuit Rent Moratoriumstreiff at redstateNessuna valutazione finora

- Et Al. Plaintiffs-Appellees v. Et Al. Defendants-AppellantsDocumento18 pagineEt Al. Plaintiffs-Appellees v. Et Al. Defendants-AppellantsForeclosure FraudNessuna valutazione finora

- Fhfa Hud Mou - 8122021Documento13 pagineFhfa Hud Mou - 8122021Foreclosure FraudNessuna valutazione finora

- Ny Tenant Scot Us RLG 081221Documento5 pagineNy Tenant Scot Us RLG 081221Foreclosure FraudNessuna valutazione finora

- D C O A O T S O F: Merlande Richard and Elie RichardDocumento5 pagineD C O A O T S O F: Merlande Richard and Elie RichardDinSFLANessuna valutazione finora

- Eviction and Crime: A Neighborhood Analysis in PhiladelphiaDocumento26 pagineEviction and Crime: A Neighborhood Analysis in PhiladelphiaForeclosure FraudNessuna valutazione finora

- Complaint CD Cal La Eviction MoratoriumDocumento27 pagineComplaint CD Cal La Eviction MoratoriumForeclosure Fraud100% (1)

- Not For Publication Without The Approval of The Appellate DivisionDocumento9 pagineNot For Publication Without The Approval of The Appellate DivisionForeclosure FraudNessuna valutazione finora

- MFPO AlbertelliDocumento13 pagineMFPO AlbertelliForeclosure Fraud100% (3)

- 8.11.2021 Letter To President Biden Opposing Eviction MoratoriumDocumento5 pagine8.11.2021 Letter To President Biden Opposing Eviction MoratoriumForeclosure FraudNessuna valutazione finora

- Et Al.,: in The United States District Court For The District of ColumbiaDocumento8 pagineEt Al.,: in The United States District Court For The District of ColumbiaRHTNessuna valutazione finora

- No. 2D16-273Documento5 pagineNo. 2D16-273Foreclosure FraudNessuna valutazione finora

- Eviction MoratoriumDocumento20 pagineEviction MoratoriumZerohedgeNessuna valutazione finora

- D C O A O T S O F: Caryn Hall Yost-RudgeDocumento6 pagineD C O A O T S O F: Caryn Hall Yost-RudgeForeclosure Fraud100% (1)

- 11th Circuit JacksonDocumento51 pagine11th Circuit JacksonForeclosure FraudNessuna valutazione finora

- Class Action V Invitation HomesDocumento17 pagineClass Action V Invitation HomesForeclosure Fraud100% (4)

- Jackson v. Bank of AmericaDocumento50 pagineJackson v. Bank of AmericaForeclosure Fraud100% (2)

- Bills 115s2155enrDocumento73 pagineBills 115s2155enrForeclosure FraudNessuna valutazione finora

- Robo Witness DestroyedDocumento8 pagineRobo Witness DestroyedForeclosure Fraud100% (4)

- Out Reach: The High Cost of HousingDocumento284 pagineOut Reach: The High Cost of HousingForeclosure Fraud100% (1)

- Construction Material Haulage CapacityDocumento2 pagineConstruction Material Haulage CapacityMahesh ShindeNessuna valutazione finora

- Supply Chain Management of Pharmaceuticals: "Working Together For Healthier World"Documento19 pagineSupply Chain Management of Pharmaceuticals: "Working Together For Healthier World"Shahrukh Ghulam NabiNessuna valutazione finora

- Financial Reporting and Management Reporting Systems ReviewerDocumento7 pagineFinancial Reporting and Management Reporting Systems ReviewerSohfia Jesse Vergara100% (1)

- Miguel Angel Ariza SalazarDocumento3 pagineMiguel Angel Ariza SalazarGreen InkNessuna valutazione finora

- ROFIT RATES - SAVINGS ACCOUNT Historical Rates Remained Applicable On Savings Account From1st January, 2000 To OnwardsDocumento3 pagineROFIT RATES - SAVINGS ACCOUNT Historical Rates Remained Applicable On Savings Account From1st January, 2000 To OnwardsShahid Majeed ChaudhryNessuna valutazione finora

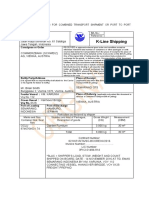

- Bill of Lading AustriaDocumento2 pagineBill of Lading AustriaTitik KurniyatiNessuna valutazione finora

- Chiefdissertation 161006221902 PDFDocumento59 pagineChiefdissertation 161006221902 PDFManoj Kumar100% (1)

- Culinarian CookwareDocumento8 pagineCulinarian CookwarePratip BeraNessuna valutazione finora

- 08 - The - Presentation Layer - ENGLISH (2nd Edt V0.2)Documento52 pagine08 - The - Presentation Layer - ENGLISH (2nd Edt V0.2)Ankur GuptaNessuna valutazione finora

- A Research Paper On Investment Awareness Among IndianDocumento18 pagineA Research Paper On Investment Awareness Among IndianElaisa AurinNessuna valutazione finora

- Copyright in ChinaDocumento237 pagineCopyright in ChinaccoamamaniNessuna valutazione finora

- Microeconomic Theory - 2 (2023)Documento15 pagineMicroeconomic Theory - 2 (2023)Mudassir HanifNessuna valutazione finora

- Rheostats OCT2010Documento16 pagineRheostats OCT2010youplaiNessuna valutazione finora

- Ifrs at A Glance IAS 21 The Effects of Changes In: Foreign Exchange RatesDocumento4 pagineIfrs at A Glance IAS 21 The Effects of Changes In: Foreign Exchange Ratesمعن الفاعوريNessuna valutazione finora

- Sulalitha Economics EMDocumento74 pagineSulalitha Economics EMrakeshsi563100% (1)

- Powerful Questions To Ask Your Network Marketing ProspectsDocumento4 paginePowerful Questions To Ask Your Network Marketing Prospectspawan kumarNessuna valutazione finora

- Business Continuity & IT Disaster Recovery - Document Business Continuity Requirements Course Dubai - Business Continuity Plan Course Dubai - RDocumento4 pagineBusiness Continuity & IT Disaster Recovery - Document Business Continuity Requirements Course Dubai - Business Continuity Plan Course Dubai - Rnader aliNessuna valutazione finora

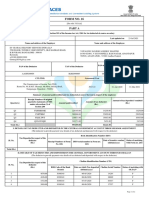

- Form No. 16: Part ADocumento6 pagineForm No. 16: Part AVinuthna ChinnapaNessuna valutazione finora

- Inland Fish Farming URDUDocumento17 pagineInland Fish Farming URDUbaloch75100% (4)

- Commercial Lease Jan 2022Documento12 pagineCommercial Lease Jan 2022Aniella94Nessuna valutazione finora

- Phrasal Verbs DialogueDocumento5 paginePhrasal Verbs DialogueAna NedeljkovicNessuna valutazione finora

- Vogel v. Sink Suit - Mecklenburg County Superior CourtDocumento32 pagineVogel v. Sink Suit - Mecklenburg County Superior CourtBen SchachtmanNessuna valutazione finora

- PhilipsVsMatsushit Case AnalysisDocumento7 paginePhilipsVsMatsushit Case AnalysisGaurav RanjanNessuna valutazione finora

- Disruptive TechnologyDocumento3 pagineDisruptive TechnologyNeetu GoyalNessuna valutazione finora

- 1 - Finance Short NotesDocumento12 pagine1 - Finance Short NotesSudhanshu PatelNessuna valutazione finora

- Ethno StoriesDocumento38 pagineEthno StoriesjcaylaNessuna valutazione finora

- Implementation of CMMS Software For A Maintenance Plan in A Manufacturing IndustryDocumento4 pagineImplementation of CMMS Software For A Maintenance Plan in A Manufacturing IndustryZegera MgendiNessuna valutazione finora

- VoucherDocumento1 paginaVoucherAdriana ChitezNessuna valutazione finora

- SC Licensing HandbookDocumento75 pagineSC Licensing HandbookYff DickNessuna valutazione finora

- Al A7 Ingot Fco - 20201212Documento2 pagineAl A7 Ingot Fco - 20201212Uchral Tse100% (2)