Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Corporate Finance: Subject Code: IMT-61

Caricato da

Naresh GuptaDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Corporate Finance: Subject Code: IMT-61

Caricato da

Naresh GuptaCopyright:

Formati disponibili

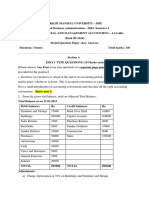

Subject Code: IMT-61

Subject Name : CORPORATE FINANCE

Notes:

a. Write answers in your own words as far as possible and refrain from copying from the text books/handouts.

b. Answers of Ist Set (Part-A), IInd Set (Part-B), IIIrd Set (Part – C) and Set-IV (Case Study) must be sent

together.

c. Mail the answer sheets alongwith the copy of assignments for evaluation & return.

d. Only hand written assignments shall be accepted.

A. First Set of Assignments: 10 Questions, each question carries .5 marks.

B. Second Set of Assignments: 5 Questions, each question carries 1 marks.

C. Third Set of Assignments: 5 Questions, each question carries 1 marks. Confine your answers to 150

to 200 Words.

D. Forth Set of Assignments: Two Case Studies : 5 Marks. Each case study carries 2.5 marks.

ASSIGNMENTS

PART– A

1. ‘Profit maximization is not an operationally feasible criterion’. Do you agree? Illustrate your views.

2. Discuss the fundamental principle behind the concept of ‘value of time’.

3. There is a direct relationship between risk and return in every area of financial management. Explain.

4. A firm is considering the following project:

CASH FLOWS (Rs) FOR FIVE YEARS

0 1 2 3 4 5

-50000 +11300 +12769 +14429 +16305 +18421

(a) Calculate the NPV for the project if the cost of capital is 10%. What is the project’s IRR?

(b) Recompute the project’s NPV assuming a cost of capital of 10% for years 1 and 2, 12% for years

3 and 4 and 13% for year 5. Can the IRR method be used for accepting or rejecting the project

under these conditions of changing cost of capital over time? Why or why not?

5. Define cost of capital. Explain its significance in financial decision-making.

Corporate Finance .................................................. Page 1 of 5 ............................................................................... IMT-61

PART– B

1. A company requires Rs 500,000 to construct a new plant. The feasible financial plans are as follows: (i)

The Company may issue 25,000 common shares at Rs 10 per share and 2,500 debentures of Rs 100

denomination bearing an 8 per cent rate of interest. (ii) The Company may issue 50,000 common

shares at Rs 10 per share. (iii) The Company may issue 25,000 common shares at Rs 10 per share

and 2,500 preference shares at Rs 100 per share bearing an 8 per cent rate of dividend.

If the company’s earnings before interest and taxes are Rs 10,000, Rs 20,000, Rs 40,000, Rs 60,000

and Rs 1,00,000, what are the earnings per share under each of the three financial plans? Which

alternative would you recommend and why?

2. Explain the NI and NOI approaches of financing the capital structure with hypothetical examples.

3. Discuss the Modigliani and Miller approach, and critically analyse the hypothesis.

4. The following is the summarized balance sheet of Philips India Ltd as on 31 March 2002 and 2003.

Prepare the cash flow statement for the year ended 2003.

Liabilities 2002 2003 Assets 2002 2003

Share Capital 1350000 1350000 Fixed Assets 1200000 960000

General Reserve 900000 930000 Investments 150000 180000

Profit & Loss a/c 168000 204000 Stock 720000 630000

Creditors 504000 402000 Debtors 630000 1365000

Provision for Taxation 225000 30000 Bank 447000 591000

Mortgage Loan - 810000

Total 3147000 3726000 Total 3147000 3726000

Additional Information:

(a) Investments costing Rs 24,000 were sold during the year for Rs 25,500.

(b) Provision for tax made during the year was Rs 27,000.

(c) During the year, a part of the fixed assets costing Rs 30,000 were sold for Rs 36,000. The profit

was included in the profit and loss account.

(d) Interim dividend paid during the year amounted to Rs 1,20,000.

5. What are the important ratios used to assess the financial position of a company?

Corporate Finance .................................................. Page 2 of 5 ............................................................................... IMT-61

PART – C

1. What is the difference between hire purchase and lease finance?

2. A firm has applied for working capital finance from a commercial bank. You are requested by the bank

to prepare an estimate of the working capital requirements of the firm. You may add 10% to your

estimated figure to account for exigencies. The following is the firm’s projected profit and loss account:

Particulars Rupees

Sales 2247000

Cost of Goods Sold 1637100

Gross Profit 609900

Administrative expenses 149800

Selling expenses 139100

Profit before tax 321000

Tax Provision 107000

Profit after Tax 214000

The cost of goods sold is calculated as follows:

Particulars Rupees

Material Used 898800

Wages & other mfg. expenses 668750

Depreciation 251450

1819000

Less: Stock of finished goods 181900

(10% product not yet sold)

Cost of Goods Sold 1637100

The figures given above relate only to the goods that have been finished, and not to work in progress;

goods equal to 15% of the year’s production (in terms of physical units) are in progress, on an average

requiring full material but only 40% of other expenses. The firm has a policy of keeping two months’

consumption of materials in stock. All expenses are paid one month in arrear. Suppliers of material

grant one and a half month’s credit; 20% sales are made in cash while the remaining is sold on two

months’ credit. 70% of income tax has to be paid in advance in quarterly instalments.

3. What synergies exist in a (a) horizontal merger, (b) vertical merger and (c) conglomerate merger?

4. What are the different forms of public-sector enterprises? Explain with the help of a chart.

5. Explain overcapitalization. What are the advantages & evils of overcapitalization?

Corporate Finance .................................................. Page 3 of 5 ............................................................................... IMT-61

CASE STUDY-1

The following is the capital structure of Simon co.as on 31st March 2008

Equity Shares : 10000 shares ( of Rs 100 each) 10,00,000

12% Preference Shares ( of Rs 100 each) 4,00,000

10% Debentures 6,00,000

20,00,000

The market price of the company’s share is Rs 110 & it is expected that a dividend of Rs 10 per share would be

declared at the end of current year . The dividend growth rate is 6%.

(i) If the tax rate is 35% compute the WACC by book value & market value weights

(ii) For expansion the company intends to borrow a fund of Rs 10 lakh bearing 12% rate of interest,

what will be revised WACC ? The financing decision is expected to increase dividend from Rs 10 to

Rs 12 per share & the market price of share will reduce to Rs 105 per share

CASE STUDY-2

While corporate finance is concerned with treasury operations; working capital management; and project

evaluation and investor relations, cash management refers to the collection, concentration and disbursement

of cash. It encompasses a company‘s level of liquidity, its management of cash balance and its short-term

investment strategies. The need for effective cash flow management is felt due to uncertainty in cash flows

and the lack of synchronization of inflows and outflows. Although companies want to hold as little cash as

possible, they would also keep enough reserves to face contingencies that may occur.

At CPL Ltd, a study was conducted on the measures used for collections management.

The Company was aware of the benefits of a cash management system. They realized that a CMS would help

optimize working capital management, speed up the realization of receivables, allow the Company to stress on

core competency and make use of their bankers’ sophisticated technology and expertise. CPL realized that as

banks have centres at many locations, CMS would be an additional revenue generator and they would not

charge high amounts from companies for their service.

The Company had very recently started working on Real Time Gross Settlement (RTGS) for collections and

1.5 per cent of their business, i.e., about Rs 2 crore, was being handled through RTGS. There were two ways

of implementing RTGS, one was through taking mandate from dealers and triggering a file for billing and

debiting their account. This was in tandem with the dealer’s stock management system which was maintained

by the Company. There was always a chance of legal issues as the dealer could later accuse the Company of

making numerous debit entries. Therefore, this option was avoided and the Company opted for the method

wherein the money was first transferred by the stockist as and when required by crediting the Company’s

account; subsequently a mail was sent by the company’s bankers along with a PDF file attachment which was

password protected. After processing this file, the order was sent to the warehouse and shipments were

effected.

On an average, there were forty to fifty RTGS transactions per month. None of the dealers were forced to shift

to RTGS. It was totally voluntary.

The Company had been using both cheques and demand drafts as collection instruments; the discretion being

made based on the credit history of the stocklist. The Company accepted only DDs from new stockists for a

period of three to six months and only after that, depending on their payment record, could they use either of

the two instruments. They used RTGS only for stockists paying through the DD mode and not through

cheques.

Corporate Finance .................................................. Page 4 of 5 ............................................................................... IMT-61

The turnaround time for RTGS was two to three hours but in order to avail the facility, the transaction had to

be made before a fixed time every day, that is, 10 a.m., the Mumbai account would be credited between 10

a.m. and 12 noon. However, in remote areas, the transfer would take place between 1 and 3 p.m. In case of

clogging of transactions, the RBI would use the priority assigned by sending the banks to their transactions as

per their value.

CPL planned to run both the cheque-based system and RTGS parallely because it did not want to compel the

dealers to travel from remote areas just for remitting through RTGS.

It would be advantageous for stockists to shift to RTGS because a commitment was made to them that their

orders would be shipped the same day in case of payments through RTGS, which otherwise was not made.

The Company wished to encourage their bankers to provide RTGS free of cost to itself as well as its dealers

or offer it at a very low price.

The legal issues related to RTGS were solved by taking cheques from dealers. If the dealers failed to pay post

dispatch, the Company had the right to deposit the cheques. If the cheques were dishonoured, the Company

could sue that dealer.

The percentage of collection under RTGS was 1.5 per cent, but which was estimated to increase to at least 10

per cent in the short run and 40 per cent in the long run as soon as viewing rights were given.

The mapping of dealer information was in bad shape and at times CP Ltd had to just respond on the basis of

guesswork.

CPL soon began to benefit from the use of RTGS. Not only did costs come down by Rs 1.25 (to Rs 2) per

1000 but DD making charges were also eliminated. The administration charges for RTGS were prohibitive.

The Company felt that RTGS was the way ahead but for that they would first have to map RTGS entries

manually which was not a bright proposition. So automatic mapping of data was required. In addition, it was

discovered that since charges for T+1 transactions were very high, they had arrangements with two banks,

one handling T+1 and the other handling T+6. They were receiving customized MIS from their two bankers.

The time lag of two to three days for making DDs was done away with. The Company was facing the following

problems:

(i) Often, important information related to the sender’s identification was missing.

(ii) In the absence of an automatic update system, they had to manually update the system into ERP.

(iii) No mapping was being done during reconciliation.

(iv) Dealers were unwilling to share the expenditure on RTGS. So they were unaffected by the charges by

the bank for the RTGS.

(v) There were many sender banks and they all followed different formats. Therefore, to match them

manually was difficult.

(vi) The file sent by the bankers did not contain sufficient information and could not be directly linked to

ERP which necessitated manual intervention which was laborious and expensive.

It was found that although the transition of the Company to RTGS seemed a little troublesome due to the

collection network, on the whole, it was better to be a part of the system at the formation stage so that it could

be customized according to the needs instead of allowing others to get the system organized or designed.

Questions:

1. What is the role of a CMS in corporate finance?

2. What drawbacks in the existing collection system did the RTGS system seek to improve on?

3. In your opinion, was the RTGS system able to improve the Company’s collection management?

Analyse.

Corporate Finance .................................................. Page 5 of 5 ............................................................................... IMT-61

Potrebbero piacerti anche

- F9 RM QuestionsDocumento14 pagineF9 RM QuestionsImranRazaBozdar0% (1)

- Accounting Assignment PDFDocumento18 pagineAccounting Assignment PDFMohammed SafwatNessuna valutazione finora

- StatementDocumento3 pagineStatementAmbrish (gYpr.in)0% (2)

- StatementDocumento3 pagineStatementAmbrish (gYpr.in)0% (2)

- StatementDocumento3 pagineStatementAmbrish (gYpr.in)0% (2)

- Q and As-Corporate Financial Management - June 2010 Dec 2010 and June 2011Documento71 pagineQ and As-Corporate Financial Management - June 2010 Dec 2010 and June 2011chisomo_phiri72290% (2)

- FMGT 1321 Midterm 1 Review Questions: InstructionsDocumento7 pagineFMGT 1321 Midterm 1 Review Questions: InstructionsAnnabelle Wu0% (1)

- Trucar - In: Finding A Position in An Emerging Online Market: The Automobile Industry in IndiaDocumento11 pagineTrucar - In: Finding A Position in An Emerging Online Market: The Automobile Industry in IndiaAmbrish (gYpr.in)Nessuna valutazione finora

- Marketing Strategy of Maruti SuzukiDocumento87 pagineMarketing Strategy of Maruti SuzukiSaurabh Lohal82% (17)

- IMT 61 Corporate Finance M1Documento5 pagineIMT 61 Corporate Finance M1solvedcareNessuna valutazione finora

- Business Analysis: (B) What Is An Operating Turnaround Strategy ? 4Documento4 pagineBusiness Analysis: (B) What Is An Operating Turnaround Strategy ? 4Davies MumbaNessuna valutazione finora

- Importanat Questions - Doc (FM)Documento5 pagineImportanat Questions - Doc (FM)Ishika Singh ChNessuna valutazione finora

- IGNOU MBA MS - 04 Solved Assignment 2011Documento16 pagineIGNOU MBA MS - 04 Solved Assignment 2011Kiran PattnaikNessuna valutazione finora

- IGNOU MBA MS - 04 Solved Assignment 2011Documento12 pagineIGNOU MBA MS - 04 Solved Assignment 2011Nazif LcNessuna valutazione finora

- Interpretation of Financial Statements - Use This Copy.Documento38 pagineInterpretation of Financial Statements - Use This Copy.muzaire solomon100% (1)

- BComDocumento3 pagineBComChristy jamesNessuna valutazione finora

- Accf 2204Documento7 pagineAccf 2204Avi StrikyNessuna valutazione finora

- Assignments: Program: Mba Ib Semester-IiDocumento13 pagineAssignments: Program: Mba Ib Semester-IiSekla ShaqdieselNessuna valutazione finora

- General Electric - Finance - Task - SolutionDocumento11 pagineGeneral Electric - Finance - Task - SolutionJehanzaibNessuna valutazione finora

- Accounting For ManagersDocumento14 pagineAccounting For ManagersKabo Lucas67% (3)

- FinancialManagement MB013 QuestionDocumento31 pagineFinancialManagement MB013 QuestionAiDLo50% (2)

- MB0041 MQP Answer KeysDocumento21 pagineMB0041 MQP Answer Keysajeet100% (1)

- Revised BDM - Sample Q&A SolveDocumento13 pagineRevised BDM - Sample Q&A SolveSonam Dema DorjiNessuna valutazione finora

- IMT-59 Financial Management M2Documento6 pagineIMT-59 Financial Management M2solvedcareNessuna valutazione finora

- Great Zimbabwe University Faculty of CommerceDocumento5 pagineGreat Zimbabwe University Faculty of CommerceTawanda Tatenda HerbertNessuna valutazione finora

- Finance Question Papers Pune UniversityDocumento12 pagineFinance Question Papers Pune UniversityJincy GeevargheseNessuna valutazione finora

- University of Tunis Tunis Business School: Corporate FinanceDocumento3 pagineUniversity of Tunis Tunis Business School: Corporate FinanceArbi ChaimaNessuna valutazione finora

- 301 FMDocumento3 pagine301 FMSamrudhi ZodgeNessuna valutazione finora

- Assignment # 2 MBA Financial and Managerial AccountingDocumento7 pagineAssignment # 2 MBA Financial and Managerial AccountingSelamawit MekonnenNessuna valutazione finora

- Imt 41Documento4 pagineImt 41Nothing786Nessuna valutazione finora

- Assignment of Corporate FinanceDocumento3 pagineAssignment of Corporate FinanceSakshi PanwarNessuna valutazione finora

- © The Institute of Chartered Accountants of IndiaDocumento0 pagine© The Institute of Chartered Accountants of IndiaamitmdeshpandeNessuna valutazione finora

- J8. CAPII - RTP - June - 2023 - Group-IIDocumento162 pagineJ8. CAPII - RTP - June - 2023 - Group-IIBharat KhanalNessuna valutazione finora

- Imt 07Documento4 pagineImt 07Prasanta Kumar NandaNessuna valutazione finora

- # 2 Assignment On Financial and Managerial Accounting For MBA StudentsDocumento7 pagine# 2 Assignment On Financial and Managerial Accounting For MBA Studentsobsa alemayehuNessuna valutazione finora

- Financial Management - Sem Ii - Question BankDocumento11 pagineFinancial Management - Sem Ii - Question BankHIDDEN Life OF 【शैलेष】Nessuna valutazione finora

- Financial Management (MBOF 912 D) 1Documento5 pagineFinancial Management (MBOF 912 D) 1Siva KumarNessuna valutazione finora

- Financial Management Tutorial QuestionsDocumento8 pagineFinancial Management Tutorial QuestionsStephen Olieka100% (2)

- Exam SampleDocumento10 pagineExam Samplejedwebb9156360Nessuna valutazione finora

- Accts Class 11Documento9 pagineAccts Class 11sarthak.arora281212Nessuna valutazione finora

- MB0045Documento3 pagineMB0045Wael AlsawafiriNessuna valutazione finora

- L4 Auditing Q&ADocumento23 pagineL4 Auditing Q&AChiso PhiriNessuna valutazione finora

- What Are Incomplete RecordsDocumento8 pagineWhat Are Incomplete Recordssatish ThamizharNessuna valutazione finora

- Documents - CAAH2013 - MBA 2 Acc Dec Making Workbook Jan 2013 PDFDocumento96 pagineDocuments - CAAH2013 - MBA 2 Acc Dec Making Workbook Jan 2013 PDFSatyabrataNayak100% (1)

- Time-Bound Home Exam-2020: Purbanchal UniversityDocumento2 pagineTime-Bound Home Exam-2020: Purbanchal UniversityAakash RegmiNessuna valutazione finora

- Analysis of Financial StatementsDocumento6 pagineAnalysis of Financial StatementsMandeep SharmaNessuna valutazione finora

- Financial Statement 2Documento5 pagineFinancial Statement 2k61.2211155018Nessuna valutazione finora

- Strategic Corporate Finance AssignmentDocumento6 pagineStrategic Corporate Finance AssignmentAmbrish (gYpr.in)0% (1)

- IGNOU MCA MCS-35 Solved Question Papers June 2009Documento14 pagineIGNOU MCA MCS-35 Solved Question Papers June 2009Pankaj BassiNessuna valutazione finora

- Instructions To CandidatesDocumento3 pagineInstructions To CandidatesSchoTestNessuna valutazione finora

- Midterm Review Term 3 2011 - 2012Documento4 pagineMidterm Review Term 3 2011 - 2012Milles ManginsayNessuna valutazione finora

- PREP COF Sample Exam QuestionsDocumento10 paginePREP COF Sample Exam QuestionsLNessuna valutazione finora

- Advanced Financial Management: Tuesday 3 June 2014Documento13 pagineAdvanced Financial Management: Tuesday 3 June 2014SajidZiaNessuna valutazione finora

- International Financial Management V1Documento13 pagineInternational Financial Management V1solvedcareNessuna valutazione finora

- Question BankDocumento18 pagineQuestion BankTitus ClementNessuna valutazione finora

- Baumol Miller ModelDocumento34 pagineBaumol Miller ModelShuvro RahmanNessuna valutazione finora

- Financial ManagementDocumento3 pagineFinancial ManagementMRRYNIMAVATNessuna valutazione finora

- Vakev Entrepreneurship Examination of The Third Term 2021 For s6Documento13 pagineVakev Entrepreneurship Examination of The Third Term 2021 For s6vigiraneza0Nessuna valutazione finora

- MB045Documento5 pagineMB045rajwantsingh123Nessuna valutazione finora

- Advanced AccountingDocumento13 pagineAdvanced AccountingprateekfreezerNessuna valutazione finora

- Wiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)Da EverandWiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)Nessuna valutazione finora

- Guide to Management Accounting CCC (Cash Conversion Cycle) for managersDa EverandGuide to Management Accounting CCC (Cash Conversion Cycle) for managersNessuna valutazione finora

- Financial analysis – Tesco Plc: Model Answer SeriesDa EverandFinancial analysis – Tesco Plc: Model Answer SeriesNessuna valutazione finora

- PFADocumento16 paginePFAAmbrish (gYpr.in)Nessuna valutazione finora

- Rahul Sankrityayan and The Buddhism of Nepal PDFDocumento26 pagineRahul Sankrityayan and The Buddhism of Nepal PDFAmbrish (gYpr.in)Nessuna valutazione finora

- PFADocumento10 paginePFAAmbrish (gYpr.in)Nessuna valutazione finora

- AbhinavDocumento1 paginaAbhinavAmbrish (gYpr.in)Nessuna valutazione finora

- PCX ReportDocumento3 paginePCX ReportAmbrish (gYpr.in)Nessuna valutazione finora

- 2 SetDocumento1 pagina2 SetAmbrish (gYpr.in)Nessuna valutazione finora

- Financial Statement and Their Analysis Based On DataDocumento7 pagineFinancial Statement and Their Analysis Based On DataAmbrish (gYpr.in)Nessuna valutazione finora

- To Do TomorrowDocumento1 paginaTo Do TomorrowAmbrish (gYpr.in)Nessuna valutazione finora

- Universal Responsibility and The GlobalDocumento4 pagineUniversal Responsibility and The GlobalAmbrish (gYpr.in)Nessuna valutazione finora

- Weekly Summary2.1Documento12 pagineWeekly Summary2.1Ambrish (gYpr.in)Nessuna valutazione finora

- Internationalisation of High-Tech Start-Ups and Fast Growth - Evidence For UK and GermanyDocumento26 pagineInternationalisation of High-Tech Start-Ups and Fast Growth - Evidence For UK and GermanyAmbrish (gYpr.in)Nessuna valutazione finora

- Greentech EnergyDocumento34 pagineGreentech EnergyAmbrish (gYpr.in)Nessuna valutazione finora

- Chapter 9 ACQDHLDocumento6 pagineChapter 9 ACQDHLAmbrish (gYpr.in)Nessuna valutazione finora

- Account Payable & Receivable Work SampleDocumento35 pagineAccount Payable & Receivable Work SampleNAZMUL HAQUENessuna valutazione finora

- 09 - Chapter 4 PDFDocumento126 pagine09 - Chapter 4 PDFAmbrish (gYpr.in)Nessuna valutazione finora

- Ch7 Sampling Techniques PDFDocumento23 pagineCh7 Sampling Techniques PDFAmbrish (gYpr.in)Nessuna valutazione finora

- Bell-LaPadula, Clark-Wilson, and Biba Integrity.Documento1 paginaBell-LaPadula, Clark-Wilson, and Biba Integrity.Ambrish (gYpr.in)Nessuna valutazione finora

- Bell-LaPadula, Clark-Wilson, and Biba IntegrityDocumento1 paginaBell-LaPadula, Clark-Wilson, and Biba IntegrityAmbrish (gYpr.in)Nessuna valutazione finora

- 02fme Project Scope PDFDocumento58 pagine02fme Project Scope PDFAdi SilitongaNessuna valutazione finora

- Hippa RegulationDocumento39 pagineHippa RegulationAmbrish (gYpr.in)Nessuna valutazione finora

- Internationalisation of High-Tech Start-Ups and Fast Growth - Evidence For UK and GermanyDocumento26 pagineInternationalisation of High-Tech Start-Ups and Fast Growth - Evidence For UK and GermanyAmbrish (gYpr.in)Nessuna valutazione finora

- Project Portfolio Management in The Pharmaceutical IndustryDocumento85 pagineProject Portfolio Management in The Pharmaceutical IndustryAmbrish (gYpr.in)Nessuna valutazione finora

- Project Portfolio Management in The Pharmaceutical IndustryDocumento85 pagineProject Portfolio Management in The Pharmaceutical IndustryAmbrish (gYpr.in)Nessuna valutazione finora

- Hippa RegulationDocumento39 pagineHippa RegulationAmbrish (gYpr.in)Nessuna valutazione finora

- Bharat DesaiDocumento6 pagineBharat DesaiAmbrish (gYpr.in)Nessuna valutazione finora