Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Datas

Caricato da

Lekha DeshpandeDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Datas

Caricato da

Lekha DeshpandeCopyright:

Formati disponibili

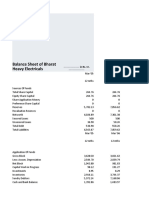

12 mths 12 mths 12 mths

Capital and Liabilities:

Total Share Capital 1,239.83 1,249.34 1,462.68

Equity Share Capital 889.83 899.34 1,112.68

Share Application Money 0.00 0.00 0.00

Preference Share Capital 350.00 350.00 350.00

Reserves 21,316.16 23,413.92 45,357.53

Revaluation Reserves 0.00 0.00 0.00

Net Worth 22,555.99 24,663.26 46,820.21

Deposits 165,083.17 230,510.19 244,431.05

Borrowings 38,521.91 51,256.03 65,648.43

Total Debt 203,605.08 281,766.22 310,079.48

Other Liabilities & Provisions 25,227.88 38,228.64 42,895.39

Total Liabilities 251,388.95 344,658.12 399,795.08

Mar '06 Mar '07 Mar '08

12 mths 12 mths 12 mths

Assets

Cash & Balances with RBI 8,934.37 18,706.88 29,377.53

Balance with Banks, Money at Call 8,105.85 18,414.45 8,663.60

Advances 146,163.11 195,865.60 225,616.08

Investments 71,547.39 91,257.84 111,454.34

Gross Block 5,968.57 6,298.56 7,036.00

Accumulated Depreciation 1,987.85 2,375.14 2,927.11

Net Block 3,980.72 3,923.42 4,108.89

Capital Work In Progress 147.94 189.66 0.00

Other Assets 12,509.57 16,300.26 20,574.63

Total Assets 251,388.95 344,658.11 399,795.07

Contingent Liabilities 119,895.78 177,054.18 371,737.36

Bills for collection 15,025.21 22,717.23 29,377.55

Book Value (Rs) 249.55 270.37 417.64

Finished Products ---------------------- in Rs. Cr. --------------------- Mar 20

Product Name Unit Installed Production Sales Sal

Capacity Quantity Quantit Val

y

Interest & Discount on Advances & Bills - NA NA NA 17,372.

Income From Investment - NA NA NA 6,466.

Commission,Exchange & Brokerage - NA NA NA 4,830.

Interest - NA NA NA 1,242.

Interest On Balances with RBI and Other - NA NA NA 624.

Inter-Bank Funds

Income From Sale Of Share & Securities - NA NA NA 546.

Dividend - NA NA NA 369.

Total 31453.

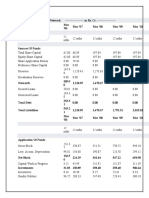

Profit & Loss account ------------------- in Rs. Cr. -------------------

Mar '06 Mar '07 Mar '08

12 mths 12 mths 12 mths

Income

13,784.5

Interest Earned 22,994.29 30,788.34

0

Other Income 5,036.62 6,962.95 8,878.85

18,821.1

Total Income 29,957.24 39,667.19

2

Expenditure

Interest expended 9,597.45 16,358.50 23,484.24

Employee Cost 1,082.29 1,616.75 2,078.90

Selling and Admin Expenses 2,360.72 4,900.67 5,834.95

Depreciation 623.79 544.78 578.35

Miscellaneous Expenses 2,616.78 3,426.32 3,533.03

Preoperative Exp Capitalised 0.00 0.00 0.00

Operating Expenses 5,274.23 8,849.86 10,855.18

Provisions & Contingencies 1,409.35 1,638.66 1,170.05

16,281.0

Total Expenses 26,847.02 35,509.47

3

Mar '06 Mar '07 Mar '08

12 mths 12 mths 12 mths

Net Profit for the Year 2,540.07 3,110.22 4,157.73

Extraordionary Items 0.00 0.00 0.00

Profit brought forward 188.22 293.44 998.27

Total 2,728.29 3,403.66 5,156.00

Preference Dividend 0.00 0.00 0.00

Equity Dividend 759.33 901.17 1,227.70

Corporate Dividend Tax 106.50 153.10 149.67

Per share data (annualised)

Earning Per Share (Rs) 28.55 34.59 37.37

Equity Dividend (%) 85.00 100.00 110.00

Book Value (Rs) 249.55 270.37 417.64

Appropriations

Transfer to Statutory Reserves 248.69 1,351.12 1,342.31

Transfer to Other Reserves 1,320.34 0.00 0.01

Proposed Dividend/Transfer to Govt 865.83 1,054.27 1,377.37

Balance c/f to Balance Sheet 293.44 998.27 2,436.32

Total 2,728.30 3,403.66 5,156.01

Yearly Results ------------------- in Rs. Cr. -------------------

Mar '06 Mar '07 Mar '08

Sales Turnover 14,306.13 22,994.29 30,788.34

Other Income 4,983.14 5,929.17 8,810.77

Total Income 19,289.27 28,923.46 39,599.11

Total Expenses 6,595.22 8,916.92 11,058.77

Operating Profit 7,710.91 14,077.37 19,729.57

Profit On Sale Of Assets -- -- --

Profit On Sale Of Investments -- -- --

Gain/Loss On Foreign Exchange -- -- --

VRS Adjustment -- -- --

Other Extraordinary Income/Expenses -- -- --

Total Extraordinary Income/Expenses -- -- --

Tax On Extraordinary Items -- -- --

Net Extra Ordinary Income/Expenses -- -- --

Gross Profit 12,694.05 20,006.54 28,540.34

Interest 9,597.45 16,358.50 23,484.24

PBDT 3,096.60 3,648.04 5,056.10

Depreciation -- -- --

Depreciation On Revaluation Of Assets -- -- --

PBT 3,096.60 3,648.04 5,056.10

Tax 556.53 537.82 898.37

Net Profit 2,540.07 3,110.22 4,157.73

Prior Years Income/Expenses -- -- --

Depreciation for Previous Years Written Back/ Provided -- -- --

Dividend -- -- --

Dividend Tax -- -- --

Dividend (%) -- -- --

Earnings Per Share 28.55 34.58 37.37

Book Value -- -- --

Equity 889.83 899.34 1,112.68

Reserves 21,316.16 23,413.92 45,357.53

Face Value 10.00 10.00 10.00

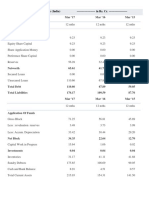

Sales Turnover 16,332.71 22,759.07 23,562.86 19,879.95 18,817.60

Other Income 4,828.28 6,449.12 5,930.05 5,586.81 5,007.23

Total Income 21,160.99 29,208.19 29,492.91 25,466.76 23,824.83

Total Expenses 6,853.04 7,960.83 8,111.78 7,730.05 6,675.01

Operating Profit 9,479.67 14,798.24 15,451.08 12,149.90 12,142.59

Profit On Sale Of Assets -- -- -- -- --

Profit On Sale Of Investments -- -- -- -- --

Gain/Loss On Foreign Exchange -- -- -- -- --

VRS Adjustment -- -- -- -- --

Other Extraordinary Income/Expenses -- -- -- -- --

Total Extraordinary Income/Expenses -- -- -- -- --

Tax On Extraordinary Items -- -- -- -- --

Net Extra Ordinary Income/Expenses -- -- -- -- --

Gross Profit 14,307.95 21,247.36 21,381.13 17,736.71 17,149.82

Interest 11,571.64 17,534.43 17,335.08 13,800.53 12,310.43

PBDT 2,736.31 3,712.93 4,046.05 3,936.18 4,839.39

Depreciation -- -- -- -- --

Depreciation On Revaluation Of Assets -- -- -- -- --

PBT 2,736.31 3,712.93 4,046.05 3,936.18 4,839.39

Tax 451.21 705.04 1,031.68 916.77 1,140.12

Net Profit 2,285.10 3,007.89 3,014.37 3,019.41 3,699.27

Prior Years Income/Expenses -- -- -- -- --

Depreciation for Previous Years Written

-- -- -- -- --

Back/ Provided

Dividend -- -- -- -- --

Dividend Tax -- -- -- -- --

Dividend (%) -- -- -- -- --

Earnings Per Share 25.56 27.04 27.08 27.10 32.13

Book Value -- -- -- -- --

Equity 894.08 1,112.27 1,113.29 1,114.17 1,151.47

Reserves 23,550.80 45,401.25 48,922.00 51,126.33 54,277.68

Face Value 10.00 10.00 10.00 10.00 10.00

Cash Flow of ICICI ------------------- in Rs. Cr. -------------------

Bank

Mar '06 Mar '07 Mar '08 Mar '09 Mar '10

12 mths 12 mths 12 mths 12 mths 12 mths

Net Profit Before Tax 3096.61 3648.04 5056.10 5116.97 5345.32

Net Cash From Operating Activities 4652.93 23061.95 -11631.15 -14188.49 1869.21

Net Cash (used in)/from

-7893.98 -18362.67 -17561.11 3857.88 6150.73

Investing Activities

Net Cash (used in)/from Financing

7350.90 15414.58 29964.82 1625.36 1382.62

Activities

Net (decrease)/increase In Cash and

4110.25 20081.10 683.55 -8074.57 8907.13

Cash Equivalents

Opening Cash & Cash Equivalents 12929.97 17040.22 37357.58 38041.13 29966.56

Closing Cash & Cash Equivalents 17040.22 37121.32 38041.13 29966.56 38873.69

Key Financial Ratios ------------------- in Rs. Cr. -------------------

of ICICI Bank

Mar

Mar '07 Mar '08 Mar '09 Mar '10

'06

Investment Valuation Ratios

Face Value 10.00 10.00 10.00 10.00 10.00

Dividend Per Share 8.50 10.00 11.00 11.00 12.00

Operating Profit Per Share (Rs) 36.75 42.19 51.29 48.58 49.80

196.8

Net Operating Profit Per Share (Rs) 316.45 354.71 343.59 293.74

7

193.2

Free Reserves Per Share (Rs) 199.52 346.21 351.04 356.94

4

Bonus in Equity Capital -- -- -- -- --

Profitability Ratios

Interest Spread 2.67 3.43 3.51 3.66 5.66

Adjusted Cash Margin(%) 17.55 12.30 11.81 11.45 13.64

Net Profit Margin 14.12 10.81 10.51 9.74 12.17

Return on Long Term Fund(%) 56.24 82.46 62.34 56.72 44.72

Return on Net Worth(%) 14.33 13.17 8.94 7.58 7.79

Adjusted Return on Net Worth(%) 11.40 12.31 8.80 7.55 7.53

Return on Assets Excluding Revaluations 1.01 270.37 417.64 444.94 463.01

Return on Assets Including Revaluations 1.01 270.37 417.64 444.94 463.01

Management Efficiency Ratios

Interest Income / Total Funds 8.36 9.55 10.60 9.82 8.82

Net Interest Income / Total Funds 3.78 4.06 4.29 3.99 4.08

Non Interest Income / Total Funds 0.22 0.10 0.02 0.08 0.08

Interest Expended / Total Funds 4.58 5.49 6.31 5.83 4.74

Operating Expense / Total Funds 2.22 2.79 2.76 2.60 2.59

Profit Before Provisions / Total Funds 1.49 1.19 1.40 1.30 1.41

Net Profit / Total Funds 1.21 1.04 1.12 0.96 1.08

Loans Turnover 0.15 0.17 0.20 0.18 0.17

Total Income / Capital Employed(%) 8.58 9.65 10.62 9.90 8.90

Interest Expended / Capital Employed(%) 4.58 5.49 6.31 5.83 4.74

Total Assets Turnover Ratios 0.08 0.10 0.11 0.10 0.09

Asset Turnover Ratio 2.94 4.52 5.61 5.14 4.60

Profit And Loss Account Ratios

Interest Expended / Interest Earned 69.62 71.14 76.28 73.09 68.44

Other Income / Total Income 2.59 1.07 0.17 0.86 0.92

Operating Expense / Total Income 25.86 28.87 26.00 26.22 29.05

Selling Distribution Cost Composition 4.80 6.12 4.43 1.74 0.72

Balance Sheet Ratios

Capital Adequacy Ratio 13.35 11.69 13.97 15.53 19.41

Advances / Loans Funds(%) 84.89 77.72 72.67 69.86 58.57

Debt Coverage Ratios

Credit Deposit Ratio 87.59 83.83 84.99 91.44 90.04

Investment Deposit Ratio 46.07 41.15 42.68 46.35 53.28

Cash Deposit Ratio 5.77 6.99 10.12 10.14 10.72

Total Debt to Owners Fund 7.45 9.50 5.27 4.42 3.91

Financial Charges Coverage Ratio 1.39 1.25 1.25 0.25 0.33

Financial Charges Coverage Ratio Post Tax 1.33 1.22 1.20 1.20 1.26

Leverage Ratios

Current Ratio 0.08 0.09 0.11 0.13 0.14

Quick Ratio 6.64 6.04 6.42 5.94 14.70

Cash Flow Indicator Ratios

Dividend Payout Ratio Net Profit 34.08 33.89 33.12 36.60 37.31

Dividend Payout Ratio Cash Profit 27.36 28.84 29.08 31.00 32.33

Earning Retention Ratio 65.82 64.80 66.35 63.23 61.40

Cash Earning Retention Ratio 72.58 70.22 70.51 68.87 66.70

AdjustedCash Flow Times 52.30 65.12 52.34 49.41 44.79

Mar

Mar '07 Mar '08 Mar '09 Mar '10

'06

Earnings Per Share 28.55 34.59 37.37 33.76 36.10

249.5

Book Value 270.37 417.64 444.94 463.01

5

Potrebbero piacerti anche

- 14 - Karan Singh - BHELDocumento12 pagine14 - Karan Singh - BHELrajat_singlaNessuna valutazione finora

- Balance Sheet of Cholamandalam Investment and Finance CompanyDocumento7 pagineBalance Sheet of Cholamandalam Investment and Finance CompanyTaranjit Singh SohalNessuna valutazione finora

- Balance Sheet of HDFC BankDocumento5 pagineBalance Sheet of HDFC BankSonica RajputNessuna valutazione finora

- Dion Global Solutions Limited: SourceDocumento1 paginaDion Global Solutions Limited: SourceAnonymous aHLT8NNessuna valutazione finora

- PNB Balance Sheet Analysis 2007-2011Documento4 paginePNB Balance Sheet Analysis 2007-20114760rkNessuna valutazione finora

- Balance Sheet of Tata MotorsDocumento2 pagineBalance Sheet of Tata MotorsPRIYAM XEROXNessuna valutazione finora

- Balance Sheet and Financials of Grasim IndustriesDocumento7 pagineBalance Sheet and Financials of Grasim IndustriesHiren KariyaNessuna valutazione finora

- Balance Sheet of Ambuja CementsDocumento7 pagineBalance Sheet of Ambuja CementsHiren KariyaNessuna valutazione finora

- Sources of Funds: Balance Sheet - in Rs. Cr.Documento10 pagineSources of Funds: Balance Sheet - in Rs. Cr.mayankjain_90Nessuna valutazione finora

- Aditya nuVODocumento12 pagineAditya nuVOPriyanshi yadavNessuna valutazione finora

- Hero Honda PNL &balanceDocumento5 pagineHero Honda PNL &balanceMukul AliNessuna valutazione finora

- IciciDocumento9 pagineIciciChirdeep PareekNessuna valutazione finora

- Project On SbiDocumento4 pagineProject On Sbijini03Nessuna valutazione finora

- Balance Sheet of DLFDocumento2 pagineBalance Sheet of DLFbhupi16Nessuna valutazione finora

- Cash Flow of ICICI Bank - in Rs. Cr.Documento12 pagineCash Flow of ICICI Bank - in Rs. Cr.Neethu GesanNessuna valutazione finora

- HTTP WWW - MoneycontrolDocumento1 paginaHTTP WWW - MoneycontrolPavan PoliNessuna valutazione finora

- Hero Honda Motors balance sheet analysis 2006-2010Documento2 pagineHero Honda Motors balance sheet analysis 2006-2010kaushal_bishtNessuna valutazione finora

- JSW SteelDocumento15 pagineJSW Steelsubhankar daNessuna valutazione finora

- Bata India Balance Sheet Data for Previous YearsDocumento1 paginaBata India Balance Sheet Data for Previous YearsSanket BhondageNessuna valutazione finora

- Marico BSDocumento2 pagineMarico BSAbhay Kumar SinghNessuna valutazione finora

- Balance Sheet of Balrampur Chini MillsDocumento1 paginaBalance Sheet of Balrampur Chini MillsAsrar Ahmed HamidaniNessuna valutazione finora

- Adani Power Balance Sheet Data for 5 YearsDocumento2 pagineAdani Power Balance Sheet Data for 5 YearsPriyankar RaiNessuna valutazione finora

- Balance Sheet of Essar Oil: - in Rs. Cr.Documento7 pagineBalance Sheet of Essar Oil: - in Rs. Cr.sonalmahidaNessuna valutazione finora

- Marico Combined FinalDocumento9 pagineMarico Combined FinalAbhay Kumar SinghNessuna valutazione finora

- Usa Courtney Downs Leaseco, LLC Balance Sheet Books Accrual Sep 2006Documento51 pagineUsa Courtney Downs Leaseco, LLC Balance Sheet Books Accrual Sep 2006MarcyNessuna valutazione finora

- Fianacial Analysis of Cement Industry (Ultratech, Ambuja, ACC)Documento32 pagineFianacial Analysis of Cement Industry (Ultratech, Ambuja, ACC)mayank0963Nessuna valutazione finora

- Balance Sheet of Union Bank of IndiaDocumento2 pagineBalance Sheet of Union Bank of Indiajini02Nessuna valutazione finora

- ICICI Bank balance sheet analysisDocumento13 pagineICICI Bank balance sheet analysisNaresh KumarNessuna valutazione finora

- Usa Courtney Downs Leaseco, LLC Balance Sheet Books Accrual Aug 2006Documento52 pagineUsa Courtney Downs Leaseco, LLC Balance Sheet Books Accrual Aug 2006MarcyNessuna valutazione finora

- Balance Sheet of Cipla 1Documento6 pagineBalance Sheet of Cipla 1anjalipawaskarNessuna valutazione finora

- Company Info - Print FinancialsDocumento2 pagineCompany Info - Print FinancialsPreethaNessuna valutazione finora

- Balance Sheet of Allahabad BankDocumento26 pagineBalance Sheet of Allahabad BankMemoona RizviNessuna valutazione finora

- Shareholders and financial highlights of HDFC BankDocumento10 pagineShareholders and financial highlights of HDFC BankVinod KananiNessuna valutazione finora

- Balance Sheet of Larsen and Toubro: - in Rs. Cr.Documento3 pagineBalance Sheet of Larsen and Toubro: - in Rs. Cr.Ashirvad MayekarNessuna valutazione finora

- Balance Sheet of Sun TV NetworkDocumento2 pagineBalance Sheet of Sun TV NetworkMehadi NawazNessuna valutazione finora

- Sadik Sir HWDocumento6 pagineSadik Sir HWSani Ǐbne BariNessuna valutazione finora

- Jet AirwaysDocumento5 pagineJet AirwaysKarthik SrmNessuna valutazione finora

- Chapter:-3 Finance Department: 3.1. Trading and P&L Account (How They Maintain, What Is The Present Status Etc.)Documento6 pagineChapter:-3 Finance Department: 3.1. Trading and P&L Account (How They Maintain, What Is The Present Status Etc.)Ashfaq ShaikhNessuna valutazione finora

- Balance SheetDocumento1 paginaBalance SheetsarvodayaprintlinksNessuna valutazione finora

- Advanced Financial ManagementDocumento5 pagineAdvanced Financial ManagementAkshay KapoorNessuna valutazione finora

- Subject-Corporate Finace Name- Niraj .R. Ẩngara Rollno- 14 SybfmDocumento11 pagineSubject-Corporate Finace Name- Niraj .R. Ẩngara Rollno- 14 SybfmNiraj AngaraNessuna valutazione finora

- Aman FM Tp2003 FMDocumento9 pagineAman FM Tp2003 FMAmandeep SinghNessuna valutazione finora

- Introduction of DLF LimitedDocumento15 pagineIntroduction of DLF LimitedArun Kumar SinghNessuna valutazione finora

- Titan Balance-SheetDocumento2 pagineTitan Balance-SheetDt.vijaya ShethNessuna valutazione finora

- HCL Technologies Consolidated Balance SheetDocumento2 pagineHCL Technologies Consolidated Balance SheetSachin SinghNessuna valutazione finora

- MBA06070 VinayJaju AsianPaintsDocumento15 pagineMBA06070 VinayJaju AsianPaintsVinay JajuNessuna valutazione finora

- Cost of CapitalDocumento9 pagineCost of Capital2K19/ME/186 RAKSHIT GUPTANessuna valutazione finora

- Balance Sheet of DR Reddys Laboratories: - in Rs. Cr.Documento14 pagineBalance Sheet of DR Reddys Laboratories: - in Rs. Cr.Anand MalashettiNessuna valutazione finora

- Company Info - Print FinancialsDocumento1 paginaCompany Info - Print FinancialsUtkarshNessuna valutazione finora

- Balance Sheet of Suzlon EnergyDocumento4 pagineBalance Sheet of Suzlon Energyashishgrover80Nessuna valutazione finora

- Money Control 11Documento1 paginaMoney Control 11Sai Ram BachuNessuna valutazione finora

- Previous YearsDocumento9 paginePrevious YearsBhat Ashiq AzizNessuna valutazione finora

- Balance Sheet of Reliance IndustriesDocumento6 pagineBalance Sheet of Reliance IndustrieskushkheraNessuna valutazione finora

- Renata Limited Financial Position and PerformanceDocumento12 pagineRenata Limited Financial Position and PerformanceHM FarhanNessuna valutazione finora

- ICICI Bank Is IndiaDocumento6 pagineICICI Bank Is IndiaHarinder PalNessuna valutazione finora

- Accltd.: Balance Sheet Summary: Dec 2010 - Dec 2019: Non-Annualised: Rs. CroreDocumento59 pagineAccltd.: Balance Sheet Summary: Dec 2010 - Dec 2019: Non-Annualised: Rs. Crorehardik aroraNessuna valutazione finora

- Reliance CommunicationsDocumento117 pagineReliance Communicationsrahul m dNessuna valutazione finora

- Balance Sheet of State Bank of IndiaDocumento5 pagineBalance Sheet of State Bank of Indiakanishtha1Nessuna valutazione finora

- Financial Modelling CIA 2Documento45 pagineFinancial Modelling CIA 2Saloni Jain 1820343Nessuna valutazione finora

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionDa EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionValutazione: 5 su 5 stelle5/5 (1)

- Accounting Assignment 02A 207Documento5 pagineAccounting Assignment 02A 207Aniyah's RanticsNessuna valutazione finora

- Chapter 04Documento5 pagineChapter 04Madina SuleimenovaNessuna valutazione finora

- Tata AigDocumento9 pagineTata AigAtharva ShirodkarNessuna valutazione finora

- Variable - Online Mock ExamDocumento11 pagineVariable - Online Mock ExamMitziRawrrNessuna valutazione finora

- Bank One Vs Ward (Transcripts)Documento11 pagineBank One Vs Ward (Transcripts)Pat Riot100% (1)

- Bank Pertanian Malaysia Berhad (811810-U) Hartani-IDocumento4 pagineBank Pertanian Malaysia Berhad (811810-U) Hartani-IDANARAJ A/L MUTHUSAMY MoeNessuna valutazione finora

- 401 Prelim&Midterm QuestionnaireDocumento6 pagine401 Prelim&Midterm QuestionnaireEly DoNessuna valutazione finora

- Financial AnalysisDocumento20 pagineFinancial AnalysisKylie Luigi Leynes BagonNessuna valutazione finora

- ASSIGNMENT 2 Financial Market &institution - Docx To BeDocumento2 pagineASSIGNMENT 2 Financial Market &institution - Docx To BealemayehuNessuna valutazione finora

- Chapter-4 Organizational Structure of HDFC BankDocumento17 pagineChapter-4 Organizational Structure of HDFC Bankshraddha100% (1)

- Exercise 3-9 - Multiple Choice-Determine The Balances (Huang, Aaron)Documento11 pagineExercise 3-9 - Multiple Choice-Determine The Balances (Huang, Aaron)Aaron HuangNessuna valutazione finora

- New TeDocumento9 pagineNew Tephillip19wa88Nessuna valutazione finora

- Worksheet With FSDocumento8 pagineWorksheet With FSMilrosePaulinePascuaGudaNessuna valutazione finora

- Presentation On Indian Debt MarketDocumento55 paginePresentation On Indian Debt Marketpriya_12345632369100% (9)

- PB Enterprise - Main Page WALL PLUS RM2700Documento2 paginePB Enterprise - Main Page WALL PLUS RM2700Lokyee WaiNessuna valutazione finora

- Inheritance EssayDocumento2 pagineInheritance EssaySanm SidhuNessuna valutazione finora

- Drill 1 - Notes ReceivableDocumento2 pagineDrill 1 - Notes ReceivableVincent AbellaNessuna valutazione finora

- REO CPA Review: Separate and Consolidated FsDocumento10 pagineREO CPA Review: Separate and Consolidated FsCriza MayNessuna valutazione finora

- Journalizing-3-Laarni-Pascua MAINDocumento7 pagineJournalizing-3-Laarni-Pascua MAINJohn DelaPazNessuna valutazione finora

- WEEK 5 ACCT444 Group Project 14-34Documento6 pagineWEEK 5 ACCT444 Group Project 14-34Spencer Nath100% (2)

- Philippine National Bank - Audited Financial Statements - 31dec2022 - PSEDocumento153 paginePhilippine National Bank - Audited Financial Statements - 31dec2022 - PSEElsa MendozaNessuna valutazione finora

- Exercise 1 - Overview of Working Capital Management (Not Graded)Documento11 pagineExercise 1 - Overview of Working Capital Management (Not Graded)Van Errl Nicolai SantosNessuna valutazione finora

- Balance Sheet of Shakti PumpsDocumento2 pagineBalance Sheet of Shakti PumpsAnonymous 3OudFL5xNessuna valutazione finora

- BS1Documento5 pagineBS1Von Andrei MedinaNessuna valutazione finora

- Banking Regulations OverviewDocumento45 pagineBanking Regulations OverviewNishat Ali PardhanNessuna valutazione finora

- Allahabad Bank Auction of Mortgaged Property in BhubaneswarDocumento1 paginaAllahabad Bank Auction of Mortgaged Property in BhubaneswarDesikanNessuna valutazione finora

- Sacco Borrower DetailsDocumento35 pagineSacco Borrower Detailsseth uwitonzeNessuna valutazione finora

- Microfinance in India Scopes and LimitationsDocumento41 pagineMicrofinance in India Scopes and Limitationsspy67% (3)

- Corporate Briefing Nov 28 2022Documento26 pagineCorporate Briefing Nov 28 2022ivanpushkarevNessuna valutazione finora

- Everyday bank deposits and transactionsDocumento2 pagineEveryday bank deposits and transactionsChloe Amanda BeresfordNessuna valutazione finora