Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Monthly Market Report

Caricato da

miguelnunezDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Monthly Market Report

Caricato da

miguelnunezCopyright:

Formati disponibili

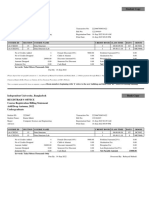

Monday February 21, 2011

Your Local Executive RANCHO SANTA FE, CA

Summary Single Family Homes

This Week

Real-Time Market Profile Trend

Median List Price $ 2,950,000 ±+

Asking Price Per Square Foot $ 1,384 ==

The median list price in RANCHO SANTA FE, CA 92067 this week is Average Days on Market (DOM) 256 ==

$2,950,000.

Percent of Properties with Price Decrease 33 %

Percent Relisted (reset DOM) 10 %

Even though the days-on-market is trending higher, so is the Market

Action Index at these inventory levels, providing a neutral outlook Percent Flip (price increased) 1%

for the market. Median House Size (sq ft) 953

Median Lot Size 1.0 - 2.5 acres

Median Number of Bedrooms 5.0

Median Number of Bathrooms 6.0

Supply and Demand Market Action Index Strong Buyer's 15.4 ==

Home sales have been exceeding new inventory for several weeks. ±+ No change == Strong upward trend ≠≠ Strong downward trend

Since this is a Buyer's market prices are not yet moving higher as

excess inventory is consumed. However, as the supply and demand = Slight upward trend ≠ Slight downward trend

trends continue, the market moves into the Seller's zone, and we are

likely to see upward pressure on pricing.

Price

Market Action Index We continue to see prices in this zip code hovering around these

current levels, even though they bumped up a bit this week.

Look for a persistent up-shift in the Market Action Index before

we see prices move significantly from here.

Price Trends

7-Day Rolling Average 90-Day Rolling Average Buyer/Seller Cutoff

The Market Action Index answers the question "How's the

Market?" by measuring the current rate of sale versus the

amount of the inventory. Index above 30 implies Seller's

Market conditions. Below 30, conditions favor the buyer.

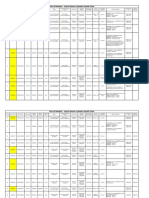

Quartiles

7-Day Rolling Average 90-Day Rolling Average

Characteristics per Quartile Investigate the market in quartiles -

where each quartile is 25% of homes

ordered by price.

Quartile Median Price Sq. Ft. Lot Size Beds Baths Age Inventory New Absorbed DOM

2.5 - 5.0

Top/First $ 6,174,000 6015 acres 6.0 8.0 14 54 3 1 300 Most expensive 25% of properties

1.0 - 2.5

Upper/Second $ 3,499,000 2138 acres 5.0 7.0 16 55 5 1 229 Upper-middle 25% of properties

1.0 - 2.5

Lower/Third $ 2,445,000 3224 acres 4.0 5.0 25 55 1 3 238 Lower-middle 25% of properties

1.0 - 2.5

Bottom/Fourth $ 1,675,000 719 acres 4.0 4.0 25 55 2 4 258 Least expensive 25% of properties

Pickford Escrow and The Escrow Firm

Powered by Altos Research LLC | www.altosresearch.com | Copyright ©2010 Altos Research LLC

Potrebbero piacerti anche

- A level Economics Revision: Cheeky Revision ShortcutsDa EverandA level Economics Revision: Cheeky Revision ShortcutsValutazione: 3 su 5 stelle3/5 (1)

- Monthly Market ReportDocumento1 paginaMonthly Market ReportmiguelnunezNessuna valutazione finora

- Market OverviewDocumento1 paginaMarket OverviewmiguelnunezNessuna valutazione finora

- Rancho Santa Fe Market ReportDocumento1 paginaRancho Santa Fe Market ReportmiguelnunezNessuna valutazione finora

- This Week: Valley Center, CaDocumento1 paginaThis Week: Valley Center, Caapi-26216409Nessuna valutazione finora

- This Week: Rancho Santa Fe, CaDocumento1 paginaThis Week: Rancho Santa Fe, Caapi-26526570Nessuna valutazione finora

- Market Report NovemberDocumento1 paginaMarket Report NovembermiguelnunezNessuna valutazione finora

- This Week: Rancho Santa Fe, CaDocumento1 paginaThis Week: Rancho Santa Fe, Caapi-26526570Nessuna valutazione finora

- Your Local Executive SummaryDocumento1 paginaYour Local Executive Summaryapi-19054998Nessuna valutazione finora

- This Week: San Diego, CaDocumento1 paginaThis Week: San Diego, Caapi-26437180Nessuna valutazione finora

- November Market ReportDocumento1 paginaNovember Market ReportmiguelnunezNessuna valutazione finora

- Market Report NovemberDocumento1 paginaMarket Report NovembermiguelnunezNessuna valutazione finora

- Monthly Market ReportDocumento1 paginaMonthly Market ReportmiguelnunezNessuna valutazione finora

- This Week: Del Mar, CaDocumento1 paginaThis Week: Del Mar, Caapi-26526570Nessuna valutazione finora

- Your Local Executive SummaryDocumento1 paginaYour Local Executive Summaryapi-26526570Nessuna valutazione finora

- This Week: Vista, CaDocumento1 paginaThis Week: Vista, Caapi-26216409Nessuna valutazione finora

- This Week: San Diego, CaDocumento1 paginaThis Week: San Diego, Caapi-26437180Nessuna valutazione finora

- Your Local Executive SummaryDocumento1 paginaYour Local Executive Summaryapi-25884946Nessuna valutazione finora

- Your Local Executive SummaryDocumento1 paginaYour Local Executive Summaryapi-26216409Nessuna valutazione finora

- This Week: San Diego, CaDocumento1 paginaThis Week: San Diego, Caapi-26437180Nessuna valutazione finora

- Your Local Executive SummaryDocumento1 paginaYour Local Executive Summaryapi-26216409Nessuna valutazione finora

- This Week: La Jolla, CaDocumento1 paginaThis Week: La Jolla, Caapi-26526570Nessuna valutazione finora

- Your Local Executive SummaryDocumento1 paginaYour Local Executive Summaryapi-22871972Nessuna valutazione finora

- This Week: CARLSBAD, CA 92009Documento1 paginaThis Week: CARLSBAD, CA 92009api-25884946Nessuna valutazione finora

- Monthly Market ReportDocumento1 paginaMonthly Market ReportmiguelnunezNessuna valutazione finora

- This Week: San Diego, Ca 92130Documento1 paginaThis Week: San Diego, Ca 92130api-26526570Nessuna valutazione finora

- This Week: Earlysville, VaDocumento1 paginaThis Week: Earlysville, Vaapi-26934540Nessuna valutazione finora

- Your Local Executive SummaryDocumento1 paginaYour Local Executive Summaryapi-26216409Nessuna valutazione finora

- Geneva Jul05 ExecSum SFDocumento1 paginaGeneva Jul05 ExecSum SFlebersoleNessuna valutazione finora

- Your Local Executive SummaryDocumento1 paginaYour Local Executive Summaryapi-26216409Nessuna valutazione finora

- This Week: Rancho Santa Fe, CaDocumento1 paginaThis Week: Rancho Santa Fe, Caapi-26526570Nessuna valutazione finora

- Lake Forest - CondoDocumento7 pagineLake Forest - CondoDeborah Lynn ThomasNessuna valutazione finora

- Jul 05 Exec Summary Saint Charles IL 60175 SFDocumento1 paginaJul 05 Exec Summary Saint Charles IL 60175 SFlebersoleNessuna valutazione finora

- Your Local Executive SummaryDocumento1 paginaYour Local Executive Summaryapi-26216409Nessuna valutazione finora

- This Week: Crozet, VaDocumento1 paginaThis Week: Crozet, Vaapi-26934540Nessuna valutazione finora

- The Local Market Executive SummaryDocumento1 paginaThe Local Market Executive Summaryapi-26128632Nessuna valutazione finora

- This Week: POWAY, CA 92064Documento1 paginaThis Week: POWAY, CA 92064api-27645880Nessuna valutazione finora

- Your Local Executive SummaryDocumento1 paginaYour Local Executive Summaryapi-26216409Nessuna valutazione finora

- This Week: PASADENA, CA 91105Documento1 paginaThis Week: PASADENA, CA 91105api-26327314Nessuna valutazione finora

- This Week: San Diego, Ca 92129Documento1 paginaThis Week: San Diego, Ca 92129api-27645880Nessuna valutazione finora

- This Week: La Jolla, CaDocumento1 paginaThis Week: La Jolla, Caapi-26526570Nessuna valutazione finora

- Lake Forest - SFDocumento7 pagineLake Forest - SFDeborah Lynn ThomasNessuna valutazione finora

- Lake Forest - CondoDocumento7 pagineLake Forest - CondoDeborah Lynn ThomasNessuna valutazione finora

- Batavia Jul 03 2010 Exec SumDocumento1 paginaBatavia Jul 03 2010 Exec SumlebersoleNessuna valutazione finora

- Your Local Executive SummaryDocumento1 paginaYour Local Executive Summaryapi-26216409Nessuna valutazione finora

- Monthly Market ReportDocumento1 paginaMonthly Market ReportmiguelnunezNessuna valutazione finora

- Your Local Executive SummaryDocumento1 paginaYour Local Executive Summaryapi-22871972Nessuna valutazione finora

- Monthly Market ReportDocumento1 paginaMonthly Market ReportmiguelnunezNessuna valutazione finora

- Thursday September 17, 2009Documento1 paginaThursday September 17, 2009api-27591084Nessuna valutazione finora

- Your Local Executive SummaryDocumento1 paginaYour Local Executive Summaryapi-26216409Nessuna valutazione finora

- Market OverviewDocumento1 paginaMarket OverviewmiguelnunezNessuna valutazione finora

- Your Local Executive SummaryDocumento1 paginaYour Local Executive Summaryapi-26327314Nessuna valutazione finora

- Mission Viejo - CondoDocumento17 pagineMission Viejo - CondoDeborah Lynn ThomasNessuna valutazione finora

- Thursday September 17, 2009Documento1 paginaThursday September 17, 2009api-27591084Nessuna valutazione finora

- Thursday September 17, 2009Documento1 paginaThursday September 17, 2009api-27591084Nessuna valutazione finora

- Rancho Santa Margarita - CondoDocumento7 pagineRancho Santa Margarita - CondoDeborah Lynn ThomasNessuna valutazione finora

- Rancho Santa Margarita Condo & Single Family Weekly UpdateDocumento14 pagineRancho Santa Margarita Condo & Single Family Weekly UpdateDeborah Lynn ThomasNessuna valutazione finora

- St. Louis Area Real Estate Market ReportsDocumento1 paginaSt. Louis Area Real Estate Market Reportsapi-27591084Nessuna valutazione finora

- This Week: San Diego, CaDocumento1 paginaThis Week: San Diego, Caapi-26437180Nessuna valutazione finora

- Lake Forest - CondoDocumento7 pagineLake Forest - CondoDeborah Lynn ThomasNessuna valutazione finora

- Press Release 1Documento1 paginaPress Release 1miguelnunezNessuna valutazione finora

- Press Release 1Documento1 paginaPress Release 1miguelnunezNessuna valutazione finora

- Monthly Market ReportDocumento1 paginaMonthly Market ReportmiguelnunezNessuna valutazione finora

- Monthly Market ReportDocumento1 paginaMonthly Market ReportmiguelnunezNessuna valutazione finora

- Monthly Market ReportDocumento1 paginaMonthly Market ReportmiguelnunezNessuna valutazione finora

- Palacio Del Mar Snow Day 2011Documento1 paginaPalacio Del Mar Snow Day 2011miguelnunezNessuna valutazione finora

- Monthly Market ReportDocumento1 paginaMonthly Market ReportmiguelnunezNessuna valutazione finora

- How To Insure A Living TrustDocumento1 paginaHow To Insure A Living TrustmiguelnunezNessuna valutazione finora

- Your Local Executive SummaryDocumento1 paginaYour Local Executive Summaryapi-26216409Nessuna valutazione finora

- Monthly Market ReportDocumento1 paginaMonthly Market ReportmiguelnunezNessuna valutazione finora

- Monthly Market ReportDocumento1 paginaMonthly Market ReportmiguelnunezNessuna valutazione finora

- Monthly Market ReportDocumento1 paginaMonthly Market ReportmiguelnunezNessuna valutazione finora

- Your Local Executive SummaryDocumento1 paginaYour Local Executive Summaryapi-26216409Nessuna valutazione finora

- Your Local Executive SummaryDocumento1 paginaYour Local Executive Summaryapi-26216409Nessuna valutazione finora

- Monthly Market ReportDocumento1 paginaMonthly Market ReportmiguelnunezNessuna valutazione finora

- Monthly Market ReportDocumento1 paginaMonthly Market ReportmiguelnunezNessuna valutazione finora

- Your Local Executive SummaryDocumento1 paginaYour Local Executive Summaryapi-26216409Nessuna valutazione finora

- HomeDex Report For DecemberDocumento21 pagineHomeDex Report For DecembermiguelnunezNessuna valutazione finora

- San Diego County: A Normal Market Begins With Great InvestmentsDocumento4 pagineSan Diego County: A Normal Market Begins With Great InvestmentsmiguelnunezNessuna valutazione finora

- Your Local Executive SummaryDocumento1 paginaYour Local Executive Summaryapi-26216409Nessuna valutazione finora

- Home Dex ReportDocumento20 pagineHome Dex ReportmiguelnunezNessuna valutazione finora

- Your Local Executive SummaryDocumento1 paginaYour Local Executive Summaryapi-26216409Nessuna valutazione finora

- Never Been Abetter Time To Invest in Real Estate AgentDocumento1 paginaNever Been Abetter Time To Invest in Real Estate AgentKim HalversonNessuna valutazione finora

- November Market ReportDocumento1 paginaNovember Market ReportmiguelnunezNessuna valutazione finora

- Your Local Executive SummaryDocumento1 paginaYour Local Executive Summaryapi-26216409Nessuna valutazione finora

- Market Report NovemberDocumento1 paginaMarket Report NovembermiguelnunezNessuna valutazione finora

- Market Report NovemberDocumento1 paginaMarket Report NovembermiguelnunezNessuna valutazione finora

- Unit 1 TQM NotesDocumento26 pagineUnit 1 TQM NotesHarishNessuna valutazione finora

- Level 3 Repair PBA Parts LayoutDocumento32 pagineLevel 3 Repair PBA Parts LayoutabivecueNessuna valutazione finora

- Reg FeeDocumento1 paginaReg FeeSikder MizanNessuna valutazione finora

- AgentScope: A Flexible Yet Robust Multi-Agent PlatformDocumento24 pagineAgentScope: A Flexible Yet Robust Multi-Agent PlatformRijalNessuna valutazione finora

- Maverick Brochure SMLDocumento16 pagineMaverick Brochure SMLmalaoui44Nessuna valutazione finora

- CR Vs MarubeniDocumento15 pagineCR Vs MarubeniSudan TambiacNessuna valutazione finora

- Wasserman Chest 1997Documento13 pagineWasserman Chest 1997Filip BreskvarNessuna valutazione finora

- Service and Maintenance Manual: Models 600A 600AJDocumento342 pagineService and Maintenance Manual: Models 600A 600AJHari Hara SuthanNessuna valutazione finora

- Radio Frequency Transmitter Type 1: System OperationDocumento2 pagineRadio Frequency Transmitter Type 1: System OperationAnonymous qjoKrp0oNessuna valutazione finora

- DNA Gel Electrophoresis Lab Solves MysteryDocumento8 pagineDNA Gel Electrophoresis Lab Solves MysteryAmit KumarNessuna valutazione finora

- Axe Case Study - Call Me NowDocumento6 pagineAxe Case Study - Call Me NowvirgoashishNessuna valutazione finora

- CMC Ready ReckonerxlsxDocumento3 pagineCMC Ready ReckonerxlsxShalaniNessuna valutazione finora

- STAT100 Fall19 Test 2 ANSWERS Practice Problems PDFDocumento23 pagineSTAT100 Fall19 Test 2 ANSWERS Practice Problems PDFabutiNessuna valutazione finora

- Audit Acq Pay Cycle & InventoryDocumento39 pagineAudit Acq Pay Cycle & InventoryVianney Claire RabeNessuna valutazione finora

- Web Api PDFDocumento164 pagineWeb Api PDFnazishNessuna valutazione finora

- Casting Procedures and Defects GuideDocumento91 pagineCasting Procedures and Defects GuideJitender Reddy0% (1)

- Guidelines On Occupational Safety and Health in Construction, Operation and Maintenance of Biogas Plant 2016Documento76 pagineGuidelines On Occupational Safety and Health in Construction, Operation and Maintenance of Biogas Plant 2016kofafa100% (1)

- Energy AnalysisDocumento30 pagineEnergy Analysisca275000Nessuna valutazione finora

- Mercedes BenzDocumento56 pagineMercedes BenzRoland Joldis100% (1)

- (23005319 - Acta Mechanica Et Automatica) A Study of The Preload Force in Metal-Elastomer Torsion SpringsDocumento6 pagine(23005319 - Acta Mechanica Et Automatica) A Study of The Preload Force in Metal-Elastomer Torsion Springsstefan.vince536Nessuna valutazione finora

- TheEconomist 2023 04 01Documento297 pagineTheEconomist 2023 04 01Sh FNessuna valutazione finora

- Family Service and Progress Record: Daughter SeptemberDocumento29 pagineFamily Service and Progress Record: Daughter SeptemberKathleen Kae Carmona TanNessuna valutazione finora

- ASMOPS 2016 - International Invitation PHILIPPINEDocumento4 pagineASMOPS 2016 - International Invitation PHILIPPINEMl Phil0% (3)

- EIN CP 575 - 2Documento2 pagineEIN CP 575 - 2minhdang03062017Nessuna valutazione finora

- Rohit Patil Black BookDocumento19 pagineRohit Patil Black BookNaresh KhutikarNessuna valutazione finora

- Polyol polyether+NCO Isupur PDFDocumento27 paginePolyol polyether+NCO Isupur PDFswapon kumar shillNessuna valutazione finora

- April 26, 2019 Strathmore TimesDocumento16 pagineApril 26, 2019 Strathmore TimesStrathmore Times100% (1)

- Describing-Jobs-British-English StudentDocumento3 pagineDescribing-Jobs-British-English Studentrenata pedroso100% (1)

- MID TERM Question Paper SETTLEMENT PLANNING - SEC CDocumento1 paginaMID TERM Question Paper SETTLEMENT PLANNING - SEC CSHASHWAT GUPTANessuna valutazione finora

- Agricultural Engineering Comprehensive Board Exam Reviewer: Agricultural Processing, Structures, and Allied SubjectsDocumento84 pagineAgricultural Engineering Comprehensive Board Exam Reviewer: Agricultural Processing, Structures, and Allied SubjectsRachel vNessuna valutazione finora