Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

T G, B & D R: HE Loom OOM OOM Eport

Caricato da

Yi WeiDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

T G, B & D R: HE Loom OOM OOM Eport

Caricato da

Yi WeiCopyright:

Formati disponibili

THE GLOOM, BOOM & DOOM REPORT

ISSN 1017-1371 A PUBLICATION OF MARC FABER LIMITED FEBRUARY 5, 2007

Perpetual Debt Super-cycle, or Apocalypse Now?

INTRODUCTION overbullish market conditions current bull market, which began in

[emphasis added]. October 2002, has already exceeded

My attention was caught recently by the post-World War II norm by 12

some comments made by John As can be seen from Figure 1, months (see Figure 2). Moreover, the

Hussman, along with the figure below each time the stock market advance current bull market’s magnitude

(www.hussmanfunds.com), which matured, which began in 1994, the matches the post-World War II

displays a monthly chart of the S&P 20-month moving average was median (see Figure 3). So, both

Index going back to 1994 with a set touched. This occurred in 1998 and magnitude and length would support

of “Bollinger bands” that form an again in 1999 before the market’s top Hussman’s contention that the

envelope around the 20-month in March 2000. Also, since 2005, the advance is rather mature. (The

moving average. In his December 18, moving average was touched three economic recovery that began in

2006 weekly market comment, times (in April and October 2005, November 2001 — now more than

Hussman noted that “over the last 10 and in June 2006). Now, consider five years old — would also seem to

weeks or so, the market has reflected three points. The current bull market be rather mature by historical

overvalued, overbought, and is one of the longest on record and standards.) Finally, the S&P 500

overbullish conditions (a the second longest on record without hasn’t experienced a 2% correction

combination that has historically a 10% correction. As Steve Leuthold since July 13, 2006, when the latest

been associated with market returns (www.leutholdgroup.com) shows, the rally got under way. According to Jim

below Treasury bill yields, on average

— though not in every instance)”.

Commenting on Figure 1, he admits

Figure 1 S&P 500, 1994–2006 with Bollinger Bands

that Bollinger bands don’t provide

very useful buy or sell signals.

However, he thinks that there is an

“important regularity that shouldn’t

be missed”.

Once the market has enjoyed a

mature advance (not just an initial

rally from a low, but an extended

advance that has continued for

some time, even if it turns out to

have further to go), a move to the

upper Bollinger band is almost

invariably followed at a later date

by a consolidation or a decline to

a lower level… Stated simply, it’s

never a good idea to buy the upper

band in a mature market advance

(which is where we are now). The

market seldom “runs away” for

long, and you generally have a

better entry opportunity later.

That tendency is behind the

relative poor short-term market

returns that emerge, on average,

from the combination of Source: www.hussmanfunds.com

overvalued, overbought, and

Bianco, this is the second-longest 3 of the analysts expect a decline before the crash in 1987. A chart

rallying period without a 2% of 10% or greater. Evidently, showing the 60-day moving average

correction since 1964; only in 1995 there’s not a lot of “buying of bears, as reported by the Daily

did we have a longer rally without a power” available from converting Sentiment Index Survey, revealed

2% correction. However, it should be that tiny pool of remaining bears, just 12% bears; whereas readings for

noted that the 1995 rally came from a but there’s a lot of room this gauge, going back to before the

rather depressed level (the S&P 500 available in the bearish column 1987 crash, showed that such a low

touched the lower envelope of the in order to populate a more reading was unprecedented. Figures

Bollinger band, whereas the current typical divergence of opinion. near 20% bears were the most

advance since July 13, 2006 The last time we saw this much extreme ever recorded. Therefore, his

originated from the 20-month bullishness was at the start of view was that, from a contrarian

moving average and not from the 2001, which preceded an awful interpretation, a very serious

lower envelope of the Bollinger band 2-year period for stocks [emphasis correction or crash should be

— see Figure 1). added]. expected.

In a more recent market comment Well, since then, the stock

(December 26, 2006), John Hussman The prevailing extremely positive market has continued to rally and

elaborated on the “overbullish” sentiment for equities is also evident may continue to do so for a while

condition of the market. According from the polling of clients at the longer. But, combining the mature

to him, the quarterly poll of money Global Insight Day, held by Morgan advance of the bull market both in

managers by the Russell Investment Stanley in Europe in early January. terms of duration and magnitude (see

Group, which was published in Gerard Minack, the Morgan Stanley Figures 2 and 3), the present

December, showed “a fairly stunning economist based in Sydney, noted overbought condition of the market

86% of advisors bullish for the that “one of the concerns I have for (indicated by the S&P touching the

coming year”. About 13% of money financial markets this year is simply upper envelope of the Bollinger

managers polled expected a flat that the consensus seems so solidly band), investors’ extremely bullish

market or a decline of less than 10%, positioned for a Goldilocks world”. sentiment, and the recent heavy

and just 1% expected a decline of Figure 4 shows the preferred assets for insider selling, it would seem to me

more than 10%. Hussman wrote: 2007; not surprisingly, equities were that a more favourable entry point

the overwhelming favourite. (Note than we have currently will shortly

…in the latest poll of 80 analysts the low reading for bonds.) present itself. Since the upper

by Business Week, 89% of the In mid-November 2006, I met envelope of the Bollinger band now

analysts are bullish (18% of which with Robert Prechter (Elliott Wave stands at 1435, and the moving

expect positive returns but below Financial Forecast) in New Orleans. average (the middle line, which is

the prevailing T-bill yield), 8% He told me that his sentiment periodically touched) at 1327 (while

are slightly bearish — expecting a readings were then, from a contrarian the lower band is at just 1207), a

decline of less than 10%, and just point of view, more bearish than just more meaningful correction of at

Figure 2 Already an Extended Bull Market: Duration Figure 3 Already an Extended Bull Market: Magnitude

Source: Steve Leuthold, www.leutholdgroup.com Source: Steve Leuthold, www.leutholdgroup.com

2 The Gloom, Boom & Doom Report February 2007

least 5–10% could get under way at

Figure 4 Best Asset Class for 2007 any time. The bigger issue in my

mind, however, is whether the

coming correction should be bought

aggressively (which is what investors

should have done last June/July) or

whether it will be the harbinger of

worse to come.

THE BULLISH CASE

In my opinion, the most compelling

case for asset markets to continue to

do well (corrections aside) is laid out

by the Bank Credit Analyst (BCA) in

Source: Gerard Minack, Morgan Stanley its special year-end issue entitled

“OUTLOOK 2007 — Another Year

of Riding the Liquidity Wave”

(www.BCAresearch.com). In this

issue, the editors of the BCA focus on

“global excess liquidity” and the

Figure 5 Relative Profit Margins: S&P 500 Sectors, 1995–2006 “debt supercycle”, arguing that there

is “no sign that we have reached the

limits of domestic indebtedness in the

U.S., or by extension, other

economies” (see also below).

The weakest case for the US stock

market to continue to do well rests

on the belief that record profit

margins are here to stay, that

valuations are low, and that the US is

a knowledge-based economy. As I

pointed out in last month’s report

(see GBD report of January 3, 2007,

entitled “Irreparable Cracks in the

Financial System”), the energy and

financial sectors provided 50% of the

recent profit growth and, because of

their low P/Es, these sectors pulled

Source: Ed Yardeni, www.yardeni.com down the S&P 500 Index P/E more

than is usually perceived. I may add

that profit margins in the materials

and energy sectors have increased

since 2002 by far more than the S&P

500 Industrial Composite’s profit

Figure 6 Corporate Profits and Wages, 1990–2007 margins (see Figure 5). Obviously,

these two sectors have little to do

with a knowledge-based economy or

US Corp. Profits the outsourcing of production and

services. That aside, countries such as

Finland, Sweden, Denmark,

Germany, France, Switzerland, Japan,

Singapore, and so on, are just as

Wages as Share of US

much knowledge-based economies as

Corp. Revenues is the US (if not more). Moreover, as

I have discussed in the past, one of

the reasons US corporate profits have

Source: Bridgewater Associates soared is that wages as a share of

corporate revenues have declined

February 2007 The Gloom, Boom & Doom Report 3

sharply since 2001 (see Figure 6) when discussing the “debt super- Figure 7). At the time, Barry noted

along with interest rates — thus cycle”. The first and most obvious that “incremental debt is steadily

reducing the cost of capital. one is at what point the limits of losing its ability to generate new

Concerning the current corporate indebtedness are reached. They were GDP, and reaches zero in the year

earnings boom and record profit certainly not reached at 200% of US 2015”, and that the inevitability of

margins, I should like to introduce a GDP and may still be manageable at higher inflation rates would benefit

heretic thought! Security analysis 330% of GDP. But who knows hard asset companies and companies

courses will emphasise the careful whether these limits will be reached serving the commodity industries

analysis of corporations and at 350% — or 1000% — of GDP? such as machinery, engineering firms,

industries with the view that rising One point needs to be clear. Just and oil servicing companies. I might

corporate profits will drive as copper prices were hitting all-time add that just because the trend-line

companies’ shares higher. But very highs in April 2006, GaveKal points to 2015 as the “zero hour”,

little analysis has gone into the Research, which then called for a that hour could approach much

impact of rising stock and other asset drop in copper prices, made a valid sooner (see also “The Bearish Case”).

markets on corporate profits. In an point: the higher an asset market A second issue that is important

increasingly “financial economy” moves, the more money is required to to understand is that, whereas the

driven by the debt super-cycle, I sustain its advance. In other words, if debt super-cycle is highly conducive

suppose that “excess liquidity” a debt super-cycle drives asset to asset bubbles, there is a

leading to rising stock prices is similar markets and the economy, credit continuous rotation of assets that

to an aphrodisiac and turbo-charged must expand at an accelerating rate are inflating and those that are

profits. In any event, it will be (see also under “The Bearish Case”, deflating. Easy money and

interesting to see how corporate below). Barry Bannister, an analyst continuous debt growth didn’t

profits behave once asset markets and historian at Stifel Nicolaus, who prevent the Florida land boom of the

decline. If recent weakness in the has been right on the mark with his 1920s collapsing in 1926. Nor could

housing market is any guidance, the recent positive call on grain prices the Fed’s ultra-expansionary

S&P 500 record profit margins could (bbbannister@stifel.com), published monetary policies, which have led to

shrink much faster than the bullish in early 2003 a report entitled “Zero extremely rapid credit growth over

camp expects! Hour 2015: Diminishing Returns the last six years, prevent the high-

But, as indicated above, there are from New Debt, and the Inevitability tech debacle. So, even if we give the

grounds for being positive if one of a U.S. Inflation Cycle” in which benefit of the doubt to the debt

believes that the “debt super-cycle” he produced a figure showing the super-cycle protagonists, who will

will continue to expand. However, diminishing returns from each $1 of argue that “there are no signs that we

there are numerous issues to consider new debt in the US economy (see have reached the limits of domestic

Figure 7 The Diminishing Impact of Debt Growth on the Economy, 1966–2015

Source: Barry B. Bannister, Stifel Nocolaus

4 The Gloom, Boom & Doom Report February 2007

indebtedness in the US, or by “inflationary” impact of total debt in place, the worse the eventual

extension, in other economies”, the expanding from 140% of GDP in outcome will be. If we define a debt

selection of the correct asset class 1980 to 260% in 2000, commodities super-cycle as a long period during

will still be crucial in order to would have declined by about as which credit growth far exceeds

capitalise on the debt super-cycle (a much as they did in real terms — nominal GDP growth (see Figure 10)

point that the Bank Credit Analyst down 80% (see Figure 10). Also, I and Barry Bannister’s “zero hour”, it

also makes). If a particular market suppose that without this colossal should be clear that there is a point

becomes glutted, even rapid debt expansion, from 1980 the world at which easy monetary policies and

monetary expansion and credit would have been not just in a dis- debt growth becomes totally

growth won’t prevent prices in that inflationary environment, but in a ineffective (see Figure 7). When that

market from deflating — at least in deflationary one (declining CPI). point is reached, all the world’s

real terms. Huge price increases for The point is simply this: if the debt printing presses cannot lift real

commodities in the 1970s led to super-cycle continues to accelerate, economic activity. Hyperinflation,

overproduction. Therefore, even as the conclusion that all asset prices accompanied by economic

the debt super-cycle gained will increase is far from certain. Even depression, social unrest, and war,

momentum in the 1980s and 1990s, far less certain is that all asset classes then follows. It’s not exactly a very

commodity prices trended down after (stocks, bonds, commodities, real desirable option, but it would seem to

1980 in nominal terms (see Figure 8) estate, etc.) will increase in real me that it is one that market

and in real terms after 1974 (see terms. (“Real terms” would have to participants are perfectly happy to

Figure 9). However, it should be be defined, since core CPI figures accept.

noted that had the debt super-cycle don’t seem to reflect the reality of As has been the case for the last

not been in place in the 1980s and paper money’s loss of purchasing few years, in a moment of weakness

1990s, commodity prices in nominal power.) Alan Abelson, the author of the

terms would have deflated far more The last point that a responsible scathing “Up and Down Wall Street”

than they did (see Figure 10). In fact, citizen should consider is that the column in Barron’s, invited me to

I suppose that without the longer the debt super-cycle remains participate in this year’s Barron’s

Figure 8 Reuters/CRB Continuous Futures Index, 1956–2006

Source: Ron Griess, www.thechartstore.com

February 2007 The Gloom, Boom & Doom Report 5

Figure 9 Reuters/CRB Continuous Futures Index (adjusted for inflation using the Consumer Price Index –

all items), 1956–2006

Source: Ron Griess, www.thechartstore.com

Figure 10 Total Debt-to-GDP, 1960–2006

Source: Bridgewater Associates

6 The Gloom, Boom & Doom Report February 2007

Roundtable, which took place in properties, and currencies, they will admits to having been wrong about

early January. The participants are all remain complacent and optimistic the prospects in 2006, which may

very successful investment managers, about the future of asset markets. So, account for the fact that his views are

analysts, and strategists, and some of the bearish case, as opined by people now largely ignored by the bullish

them are worth over a billion dollars. such as Kurt Richebächer, is crowd who are self-contentedly

But do you think that any one of the dismissed because “so what, the sleeping the slumber of confidence.

American participants touched on — markets are rising”! “Apocalypse Now” is a 52-page

even just en passant — the problem of My friend Jim Walker, the Hong document and, therefore, I shall only

credit growing far more rapidly than Kong-based chief economist at CLSA be able to touch very superficially on

GDP, and of the resulting asset (www.clsa.com), recently published a its, at times, difficult-to-understand

bubbles? That issue, and the report entitled “Apocalypse Now”. I content and Jim’s rather gloomy

deepening problems in the Middle met Jim in the 1990s and, in my predictions. Jim Walker’s principal

East, weren’t even mentioned. view, he is one of the most reason for recommending caution is

accomplished economists I know. He “the strange pattern of behaviour in

THE BEARISH CASE is also a likable Scotsman, a good and sectors and markets that permeate

considerate friend, and a person I today’s global economy. Through

The bullish case based on the debt enjoy going out with at night from Austrian eyes markets appear to be

super-cycle is easy to explain and easy time to time. He also happens to be at one of their most dangerous

to understand. The central bank one of the more courageous people I junctures in recent financial

pursues expansionary monetary know in the investment business, in history. Global monetary

policies, credit grows, and asset prices that he dares to take career risks by management is at the heart of our

increase. Consumer price inflation making unpopular calls that run concerns.” (By Austrian eyes, he

stays low because of globalisation and against the consensus. Prior to the means based on the Austrian School

productivity improvements. A 1997 Asian crisis, he was — along of Economists.)

Goldilocks economic scenario is in with Andrew Sharpe (now at What concerns Jim in particular is

place! The Goldilocks scenario is in Redburn Partners, an independent that “confidence in global central

fact so “obvious” that, as I have research broker in London — banks has never been stronger nor

shown above, it is widely accepted by andrew.sharpe@redburn.com) — one more misplaced. The Greenspan–

the investment community. The of the very few economists who Bernanke Fed has achieved almost

bullish sentiment among investors warned of the impending crisis. The the impossible: the death of risk.

(see above), low volatility, tight yield years preceding the Asian crisis — Investors express bearish concerns

spreads, and the willingness to use and particularly in Hong Kong — but they are 100% invested (in many

high leverage are all symptoms of the were very similar to the current instances 200–500% invested). Their

acceptance of the mantra that “the environment in the US: growing faith in the Fed and its guarantee that

good times for asset markets will roll current account deficits, wild liquidity will flow regardless is at all

on” — if not forever, then at least in property and stock market time highs — emerging market and

2007. speculation, enormous optimism junk bond spreads are testament to

The widespread optimism among (although most Asian stock markets this fact. It has become unfashionable

individual and institutional investors were well below their 1990 or 1994 to be negative, especially on China.

is that much more surprising given peaks), and the endless saga about We are confident that these are the

the fact that the high-tech-loaded how the business cycle had been best late-cycle indicators of all.”

Nasdaq 100, where most investors eliminated. At that time it took great To validate his “Austrian” views,

were positioned in 2000, is still down courage, as it would still today, for an Jim explains that the Austrian

by 61% from its high, and that the economist at CLSA who was (and School of Economists has had a much

S&P measured in Euros is, as of this still is) surrounded by a pack of better record of forecasting business

January, down by 37% in Euros and hungry and short-term-oriented cycle problems than any other school

by more than 50% against gold. But salespeople to express a negative view of economists. So, whereas John

to the average American, a dollar is a about Asia. But Jim was able to Maynard Keynes believed in 1927

dollar; the concept of dollar weakness defend his negative views and was that “we will not have any more

offsetting the gains on his dollar eventually proved to have been 100% crashes in our time”, and Irving

assets is incomprehensible. The smart on the mark (although, like me at the Fisher thought a few days before the

people in the professional financial time, he may have underestimated October crash in 1929 that “stocks

community are well aware of this the severity of the crisis). So, when had reached what looks like a

relationship, but they don’t care Jim Walker, who certainly cannot be permanent plateau”, Austrians such

much because their performance is labelled as a “perma-bear”, takes a as Friedrich Hayek and Ludwig Van

measured in US dollars or against a very negative stance on the economic Mises warned of impending serious

US dollar benchmark. Moreover, for prospects of the world, and in problems. According to Jim, Ludwig

as long as they can benefit from particular of China, I take notice. Van Mises exclaimed in 1929, on

investing in foreign equities, bonds, This in particular because he himself being offered a senior post at the then

February 2007 The Gloom, Boom & Doom Report 7

largest Austrian bank, Credit rapid technological innovation, This is a very important point. In

Anstalt: “A great crash is coming, rising productivity, rapid order for an “inflating” economy to

and I do not want my name in any increases in the prices of equity just maintain its altitude, the rate of

way connected with it.” (Two years and real estate and strong fixed money and credit growth needs to

later, Credit Anstalt failed along with investments… Still more be continuously expanded. This

thousands of other financial recently, attention could be phenomenon is clearly visible from

institutions in the Great Depression.) drawn to the financial crisis in Figure 7 on page 4. The moment

The Austrian economists South East Asia in the late credit growth no longer expands or,

(including Kurt Richebächer) are, 1990s… Similar to the US and worse, decelerates, asset prices stall,

according to Jim, the most pessimistic Japanese cases, these difficulties decline, or more likely collapse and a

commentators today because of the were not preceded by any recession becomes unavoidable.

way they define “inflation” and how inflationary excesses but rather Jim believes that because new

“inflation” affects relative prices by sharp increases in credit, technologies (Nasdaq) and housing

within the economy: “Inflation is not asset prices and fixed are played out as bubble sectors —

about rises in core consumer prices, investment. even if the Fed were “to start relaxing

the metric on which markets and policy and pushing households and

most central bankers today are As an aside, I should mention businesses to take on more debt there

focused. Rather, inflation is about that at its peak in 1929, the US stock is no obvious sector for the bubble to

the increase in money and credit market sold for just 13 times earnings. move into (except private equity,

aggregates (since credit in its myriad Jim Walker is particularly M&A activity and even bigger

forms is the final determinant of concerned about three different, but bubbles overseas perhaps?). In order

malinvestments Austrians have in my opinion rather closely to do so, interest rates would probably

tended to focus on it and the role correlated, issues: excessive debt have to be reduced towards the

that fractional reserve banking plays growth in the US, which led to previous low as well.”

in its creation as the source of malinvestments in the US (first the According to Jim Walker, the

fluctuations in the real economy).” Nasdaq bubble and then the housing 2007 China malinvestment crisis will

In other words, as the Austrians boom); malinvestments in China; come about because China’s depressed

would do, Jim takes no comfort from and finally, the failure of the Bank of exchange rate attracts too much

the fact that core inflation in the last Japan to move swiftly to normalise capital most of which is speculative —

few years has been benign. He interest rates. hoping to benefit from an

believes that excessive money and Concerning the excessive credit appreciation of the currency. But at

credit growth will lead to a growth in the US, Jim expresses the same time it is “distorting: it adds

“malinvestment crisis”, particularly in similar views to ours (see the to domestic demand, particularly

China and the US. He then quotes discussion of the debt super-cycle) by investment, when it is the most

William White BIS Working Paper quoting Friedrich Hayek’s “A Tale by dangerous to do so”. The danger Jim

No. 2005, April 2006, entitled “Is the Tail”: sees is that corporate profit growth in

Price Stability Enough?” to explain a China is slowing down at a time when

point that I have tried to make on If the current level of output and excessive money and credit growth

numerous occasions in the past. employment is made to depend on (inflation) has, through

Consumer prices stability is no inflation [As explained above, malinvestments, produced excessive

guarantee whatsoever of the inflation, as defined by the capacities in capital goods industries

avoidance of economic crises. Austrians, is about the increase in such as steel, base metal refining, cars,

Moreover, in the end, asset inflation money and credit aggregates — etc. In fact, Jim explains that profits

periods are far more destructive than ed. note], a slowing-down in the are likely to be overstated because of

consumer price inflation periods. pace of inflation will produce increasing domestic competition and

White writes: recessionary symptoms. Moreover, likely waning productivity growth.

as the economy becomes adjusted Moreover, “to suggest that Chinese

The historical record provides to a particular rate of inflation, profitability is improving in the face of

stark evidence that a preceding the rate must itself be rapidly rising commodity prices and

period of price stability is not continuously increased if rapidly rising labour cost, neither of

sufficient to avoid serious symptoms of a depression are to which are in dispute, makes no sense”.

macroeconomic downturns. be avoided: to inflate is to have “a Jim also notes that malinvestments

Perhaps, the most telling example tiger by the tail”. (In the US, are exacerbated when public sector

is that of the Great Depression in financial and non-financial credit agencies play a significant role in the

the United States in the 1930s… expanded by $2.8 trillion in 2004, investment process: “indeed, history

The crucial point is that the when the first interest rate has shown that the public sector

outturn was not preceded by any increases took place. In the third excels at malinvesting”. (This seems

noticeable inflation… Rather, quarter of 2006, total credit grew to be particularly true with respect to

the period was characterized by at an annual rate of $4.4 trillion.) warfare.)

8 The Gloom, Boom & Doom Report February 2007

Concerning Chinese monetary immediate cash holdings are less than following: move money out of cash

policies, Jim anticipates that 2007 11% of GDP (see Figure 12). deposits and bonds into equities,

will bring about a much tighter According to Jim, “the lower the boost confidence, and repatriate

monetary environment than was the ratio the higher the confidence in the money that was invested overseas

case at the beginning of 2006: “the future and the system’s financial into Japanese equities and properties

slower growth in monetary institutions (ie, the lower (since the bond market would be

aggregates already built in to the precautionary cash balances)… The declining). However, as Jim believes

system will produce a surprising Japanese ratio, following 15 years of — and I agree with him — bold

degree of business failures and bad grim deflation, is three times larger actions by the Bank of Japan are

debts in the Chinese banking system than it was at the beginning of the unlikely to happen. Therefore, the

over the next 2–3 quarters.” 1990s.” Japanese carry trade could one day

I must stress that Jim Walker Jim believes that, in order to unwind for other reasons than bold

doesn’t expect Chinese GDP growth restore confidence among consumers interest rate increases in Japan (see

to turn negative in 2007. But, based in the system, interest rates must also below).

on his rather negative views about therefore be increased. I have a The most important investment

the US economy (he expects GDP slightly different take on this. If the implications Jim sees if his

growth of 1% in both 2007 and Bank of Japan were to increase “Apocalypse Now” scenario comes to

2008), he forecasts growth to slow interest rates meaningfully, it would pass in 2007 are as follows. If, in

down considerably: at the same time kill the Japanese Japan, interest rates were to increase

bond market and the carry trade, and significantly, this would diminish the

Our view of the US economy with increase consumers’ interest income. attractiveness of the carry trade.

its direct (export) and indirect At one stroke, this would achieve the Since the carry trade “is one of the

(capital flow) effects are now

critical elements in our 5–7%

forecast for China in 2007… Figure 11 Japan’s Real GDP Growth, 1946–1973

China suffers the same policy

failings as every other country and

it will suffer the same cyclical

fluctuations as any other

capitalistic economy although, in

the early stages of transition to

industrialization, when capital

investment plays a lead role, the

fluctuations are likely to be more

severe than in more mature

economies.

In fact, Jim favours Japan’s

industrialisation roadmap as a proxy

Source: Jim Walker, CLSA

for the kind of violent cyclical

economic swings one should expect

in China (see Figure 11). As can be

seen from this figure, Japan didn’t

experience negative GDP growth Figure 12 Effective Cash Holdings as Percentage of GDP, 1990–2006

between the 1940s and the 1970s, but

it certainly didn’t feel good when

growth was halved, as happened four

times over this period. Jim also

expects the Chinese Yuan to weaken

once Chinese GDP growth slows to

less than 7%.

With respect to Japan, Jim

believes that “in order to secure the

recovery the Bank of Japan must

raise rates”. His reasoning goes as

follows. Japan, the world’s second-

richest economy, has effective cash

holdings equivalent to almost 76% of Source: Jim Walker, CLSA

GDP compared to the US where

February 2007 The Gloom, Boom & Doom Report 9

largest sources of excess capital in the in the system banks curtail credit. In accelerating rate, although, as the

global system today” and has been turn, the constant increase in capital BCA pointed out, asset price

“instrumental in supplying leveraged flow that is required to make markets inflation will rotate.

funds for bets on high yield go up is not forthcoming. Equity There is one point that Jim

currencies, commodities, emerging markets fall, even when rates are Walker makes that I haven’t

market debt and fashionable stock falling.” mentioned, but which may yield

markets”, all these assets would some clues as to what an investor

decline significantly in value. At the PERSONAL THOUGHTS should do. According to Jim “one of

same time, Jim expects the Yen and the most worrying features in global

Japanese asset prices to increase. He Both the Bank Credit Analyst’s central banking today” is that central

therefore advises, “sell high yield “Another Year of Riding the bankers don’t want to take

currencies, commodity funds, Liquidity Wave” (see “The Bullish responsibility: “when the US Federal

emerging market debt and fad and Case”, above) and Jim Walker’s Reserve, ECB and Bank of Japan talk

fashion stocks, eg, Chinese banks”. contrarian “Apocalypse Now” reports about appropriate monetary policies

The expected China are well-thought-out analyses of the they do so in a national context. The

malinvestment crisis will slow the current global economic and Fed has stopped raising rates because

economy significantly (to a GDP financial environment. The BCA of the US housing market slump; the

growth rate of 5–7%), and “any sign study outlines the more likely ECB has been slow to raise rates

that the economy is slowing below a outcome in the near future, the because of sluggish EU growth; and

7% growth rate would put the skids Apocalypse report the certain the Bank of Japan has dragged out

under the renminbi… We would eventuality at some point in the the process of interest rate

expect the renminbi to move back future. But when — this year, next normalisation because of the lack of

above Rmb 8/US$1 perhaps towards year, or in five to ten years? inflation in Japan.”

the Rmb 8.2/US$1 mark by the end Moreover, unlike Jim Walker, I doubt But, as Jim explains, in a world

of 2008. Commodity prices, that in the event of the apocalyptic where globalisation is acknowledged

especially for base metals and oil, scenario, US GDP growth will in every speech a central banker

would fall sharply… There will be a remain at 1% and Chinese growth at makes, “there is no attempt to

cooling in the notion that China 5–7% per annum. If one really thinks recognise — because that would

constitutes a ‘core holding’ in through the combination of rising mean taking responsibility — the

international portfolios.” interest rates in Japan, the end of the effects of their national monetary

The blow-up of the US super- carry trade, the US economy blowing policies on economies, commodities,

boom, which Jim believes is more up, a Chinese malinvestment crisis, and assets around the world. This is

likely to happen in 2007 “than at any and collapsing commodity and stock what makes the current state of

time in the last fifteen years”, would prices, the perfect cocktail of events financial markets possibly the most

have “the most serious consequences should be in place to bring about a dangerous in history” (emphasis

for the region”. Capital flows to Asia terrific deflationary depression added).

and elsewhere would be cut through around the world where, with the But what are the implications of

“the twin effects of a declining exception of the highest-quality the unwillingness (and, in some

current account deficit and the ‘home bonds (but where are they?) and, cases, the inability) of central

bias’ that occurs when a large possibly, precious metals, every type bankers to assume responsibility?

domestic economy runs into trouble. of asset should be avoided. Quite simply, it means that if the US

The easy money that seems to be Depending on one’s investment cuts interest rates and takes

willing to increasingly buy emerging strategy, the debt super-cycle or the “extraordinary measures” in order to

market and commodity assets would apocalypse will make or break one’s support the housing market and

dry up immediately (just as it did in wealth. Under the economic consumption, the other central

May and June 2006).” apocalypse scenario, bonds will do bankers will all, to a larger or smaller

Lower capital flows to China well in absolute terms (declining extent, do the same thing and print

would exacerbate the effect of the interest rates) and fantastically well money.

expected China malinvestment crisis, in relative terms (as all other asset So, for one, my view would be

lower the demand for commodities, prices collapse, with the possible that, at least for now, a mild

and diminish risk appetite. US exception of precious metals and apocalyptic scenario may occur in the

interest rates would decline, but part farmland). “real economy”, but that the “asset

of the interest rate decline in the US Under the debt super-cycle economy” could continue to inflate

would be offset by risk premium scenario, the worst investments will — albeit interrupted by severe

increases. “But much more be cash and bonds, because paper corrections and with fewer asset

important, compared to interest rates, money will continue to lose its classes participating (that is, without

nothing destroys liquidity like a purchasing power compared to asset housing and industrial commodities).

recession. When companies begin to prices such as real estate, Under this scenario (some kind of

go bust and non-performing loans rise commodities, stocks, and art at an stagflation), the worst investments

10 The Gloom, Boom & Doom Report February 2007

would be long-dated bonds (see

Figure 13). Inevitably, the asset Figure 13 Thirty-year T-Bond Yield ($TYX), 1980–2007

inflation will in time also lead to

more consumer price inflation,

because if the debt super-cycle

remains in full force and credit

continues to expand at an

accelerating rate, commodity prices

will have nowhere else to go but up!

(The supply of commodities will

decline relative to the supply of

money and credit.)

Therefore, in a mild apocalyptic

scenario for the real economy, a far

more desirable alternative to long-

term bonds would be to buy short-

dated, high-quality bonds and

Treasury bills. But should investors go

short long-dated US bonds? As a

secular long-term bet, T bonds should

be an excellent short, but in the near

term yields may not rise much as the

US dollar could strengthen somewhat

more and because of the very low Source: www.decisionpoint.com

bullish consensus about bonds (see

Figure 4).

I have one further observation of a depression are to be avoided.” warning signal that commodities

about long-dated bonds. Investors In the December 2006 GBD were likely to peak out in 2006. The

who either sold or avoided bonds in report, entitled “Irreparable Cracks in price of crude oil is down 34% from

1982, when 30-year T bonds were the Financial System”, I suggested its July 2006 high, and the CRB

yielding more than 15%, were totally that some cracks had appeared in the Index is now down 21% from its May

misguided, as they were discounting US sub-prime lending market, in 2006 peak (see Figure 14). (Please

consumer price increases to either households’ liquidity, and in the note that the difference in

accelerate or remain around 13% per performance of some of the asset performance between the Ron Griess

annum (providing a real yield of shufflers and the collapse of the CRB Continuous Futures Index —

about 2% — see Figure 13). Now, Middle Eastern stock markets. But, Figure 8 — and Figure 14 is because

investors who buy 30-year T bonds now we can add to those cracks some Figure 14 is based on the Revised

seem to expect inflation to average at new ones. Since its early January high Reuters/Jefferies CRB Index, which

most 2.5% per annum for the next 30 the Venezuelan stock market is down has a higher energy weighting.)

years — a bold assumption, indeed, 33% within just a few days, and the Unless FRODOR reaccelerates, I

given that, as Jim explained, “central Thai stock market has dropped by would expect the following scenario

bankers do not want to take 15% since mid-December. It is highly for the next three to six months.

responsibility”. probable that the emerging markets, Equities globally will top out shortly

I suppose that a mild apocalyptic which just recently began to stall or and decline in a sharp sell-off.

scenario would equate to stagflation decline (exceptions are Vietnam up Emerging markets will underperform

for the majority of households except, 30% so far in 2006, and China up the US. The dollar rallies as US

perhaps, the asset shufflers. However, between 5% and 27% depending on liquidity shrinks due to far worse

that the latter would continue to the index), are the canary in the coal conditions in the housing market

thrive is far from certain. Why? If mine for global liquidity. Foreign than are perceived, which brings

interest rates were to rise and credit Official Dollar Reserves (FRODOR), about further failures among sub-

growth remained constant and failed which is a reliable indicator of prime lenders.

to expand, not only the economy international liquidity, is still growing Once the US stock market

could remain stagnant but also most at about 15% per annum, but growth declines by 5% from its peak, the Fed

asset markets. After all, Mises is no longer accelerating. (As I will start to cut interest rates and

pointed out that, “as the economy mentioned above, the rate of money embark once again on massive

becomes adjusted to a particular rate and credit growth must continuously liquidity creation in order to protect

of inflation [money and credit growth increase if recession is to be avoided.) its friends on Wall Street. Whether

— ed. note], the rate must itself be When FRODOR growth began to the Fed succeeds at that time in

continuously increased if symptoms decelerate in late 2005, it gave a stabilising the markets will depend on

February 2007 The Gloom, Boom & Doom Report 11

INVESTMENT

Figure 14 Reuters/Jefferies CRB Index ($CRB), 2001–2007 CONSIDERATIONS

Given the over-bought and over-

bullish position of most equity

markets, my preferred investment for

now is US Treasury bills with a

maturity of three to six months. As

John Hussman said, there is presently

not much buying power left from

converting a tiny pool of bears into

buying equities, but there is a lot of

room available in the bearish column

in order to populate a more typical

divergence of opinion.

While I remain very negative

about the prospects of the US dollar

for the long term, based on FRODOR

not growing at an accelerating rate

and strong money supply growth in

Europe as well, the dollar should hold

at least for now and may even

strengthen somewhat. The problem

Source: www.decisionpoint.com with being overly negative about the

US dollar against other currencies is

that they are also fiat currencies. I

don’t agree with Jim Walker’s

negative views concerning the

Figure 15 Asian Equities, 1988–2006

Chinese Renminbi and I continue to

like Asian currencies.

For investors who need — or wish

— to own equities, I continue to

recommend exposure to Singapore

and Malaysia. Thai stocks are

inexpensive and are supported by

high dividends, but they are unlikely

to perform well for now.

A friend of ours, Chris Roberts, a

technical analyst at CLSA, recently

published a figure showing that Asian

equities have now broken out to new

highs (see Figure 15). Chris expects a

25% correction to get under way

Sources: CLSA Asia-Pacific Markets and Chris Roberts

shortly, which will provide a “major

buying opportunity”. From the 2007

lows, the Asian markets should then

a number of factors, including risky assets, any decline in their value advance by more than 100%. If Chris

whether the Japanese Yen carry trade could violently reverse the trade and is right and the BCA debt super-cycle

avoids going into a massive spread like a bushfire through the continues unabated, it would seem to

liquidation. And here I have a asset markets. Whether at that point me that the risk of not owning Asian

slightly different take on the situation massive liquidity creation by all the equities is higher than having to

than Jim Walker. The Yen carry trade central banks (not only the US Fed) endure possibly an intermediate 25%

can also end if foreign assets suddenly will bring about a strong recovery in correction. As a result, I am still long

start to decline or under-perform equity prices remains to be seen! Asian stocks, although I have

Japanese assets — not just because However, it is likely that precious reduced my positions. In the

Japanese interest rates increase. Since metals will perform well during this meantime, Jim Walker thinks that

much of the carry trade is invested in act of monetary desperation. the companies that will perform best

12 The Gloom, Boom & Doom Report February 2007

through the next cyclical downturn

“will be the true winners in China Figure 16 S&P 500 Relative to MSCI World, 1990–2006

and Asia. At this stage in the cycle

there is too much liquidity ‘noise’ to

make a reasonable assessment.”

I might add that Chris Roberts

believes in a secular de-rating of the

US stock market compared to the

rest of the world (see Figure 16). As

mentioned above, if a sharp

correction gets under way, I would

expect US equities to outperform the

world for a while by declining less

than other stock markets. Regular

readers of this report will know that I

have been very negative about sub- Sources: CLSA Asia-Pacific Markets and Chris Roberts

prime lenders such as Accredited

Home Lenders (LEND) and New

Homes Financial (NEW). I continue

to maintain this negative view. In

addition, I believe in a higher Figure 17 Broker/Dealer Index – AMEX ($XBD), 2003–2007

vulnerability of brokerage companies.

Buying puts or selling short brokerage

stocks in the period directly ahead

should be considered (see Figure 17).

Kenneth Ng, who has an

accounting background and whom I

met in the mid-1990s when he was a

senior analyst and head of research at

Baring Securities in Bangkok (he

later worked at Macquarie

Securities), now runs an Asian micro

cap value fund, NTAsian Discovery

Fund (Kenneth@ntasset.com), in

which I have invested some money

(the minimum investment is

US$100,000). Kenneth has provided

the following comments about

opportunities in very small

companies in Asia.

Source: www.decisionpoint.com

February 2007 The Gloom, Boom & Doom Report 13

Frontier Investing in our Backyard

Kenneth Ng, CEO, NTAsset

NTAsian Discovery Fund (Bloomberg code: NTASIAN KY Equity)

Tel: +662 343 1771; Fax: +662 343 1774; Email: kenneth@ntasset.com; www.ntasset.com

How much would you pay for a It is noteworthy that the market is deeper value than that. So, what’s the

company that is effectively a holding only valuing this portfolio of catch? No catch, except the fact that

company of some of the top brand companies at 9x FY07 earnings and most institutional investors are

names in Asia with earnings growth 1.8x PBV. That would put the unlikely to have heard of these

of 42% and 16% in 2007 and 2008, dividend yield also at 4%. The companies, nor is it worth their while

respectively, a debt to equity ratio of management of these companies are a to risk going so far off the

20%, and generating an ROE of 24%? collection of some of the best benchmark, because their market

Throw in a healthy dividend also! If entrepreneurs that Asia can offer capitalisation is just too small for a

an analyst were to write a research today. Against average Asian market large fund to invest in.

report on this company, it might look valuations of 15x FY07 earnings and When anyone mentions frontier

something like this: EPS growth of 11%, you can’t get investing, three different types come

14 The Gloom, Boom & Doom Report February 2007

to mind: investing in (1) new asset strategies, made popular by Benjamin have to analyse the structure of the

classes; (2) new markets; or (3) stocks Graham, have now outperformed the industry between the sell side and the

that most investors haven’t heard of. market for seven years in a row across buy side.

Investors invest in frontier markets the developed world and for There is no denying that markets

for one reason alone: better returns, companies of all sizes. According to in Asia are better covered now than

because there are fewer bidders for MSCI, its world value index grew they were 20 years ago; on the other

that particular asset class. Fewer 22.2% in 2006 while its growth index hand, if we compare the number of

buyers = less bids = lower pricing. grew by 13.8%. Figure 18 illustrates good-quality analysts now and ten

Some fund managers excel in new how rewarding the returns for small/ years ago (pre-crisis), especially post

asset classes; others love exploring micro cap funds have been over the the consolidation of foreign market

new countries and emerging past six years when measured against players, there are probably fewer

economies. We like looking a little aggregate hedge fund returns as well today. In addition, the structure of

closer to home. However, the as the Russell 2000 index, one of the the research industry has changed

investment philosophy remains the most widely recognised indexes for significantly, with fewer analysts

same, look to seek “value” and invest small cap stocks. catering to a larger number of funds.

where others aren’t looking, for all If we break down the performance Inevitably, with pressure from

the reasons explained in the previous for small/micro cap funds, we find management for sell-side analysts to

paragraph. Is it higher risk? Only if that emerging markets small cap focus on “tier 1” clients, pitching a

you get it wrong. That would seem funds continue to be the most US$100 million market

obvious, but because there are fewer rewarding, returning more than 2–5 capitalisation stock to a US$3 billion

bidders, if you get it wrong, you often times the returns offered by small/ index relative fund is probably not

have no option but to ride it all the micro cap funds in the US, Europe, or going to be much value added,

way down. That’s the main risk in Japan over the past six years (see meaning coverage will continue to

this game. Figure 19). focus on large market cap stocks.

However, if you do get it right, What is the explanation? In order To put some numbers to this, we

the returns can be rewarding. An to see how we can find value in collected some data on the level of

article in the Financial Times recently relatively “mature” (and I’m using coverage in Asia of the top 30 market

concluded that “value” investing this sparingly) emerging markets, we cap stocks against the level of

Figure 18 Twelve-month Rolling Returns, January 2001 – October 2006

200

HFN Small/Micro

HFN Aggregate

150

Russell 2000

100

Percentage

50

-50

May-2001

May-2002

May-2003

May-2004

May-2005

May-2006

Jan-2001

Jan-2002

Jan-2003

Jan-2004

Jan-2005

Jan-2006

Sep-2001

Sep-2002

Sep-2003

Sep-2004

Sep-2005

Sep-2006

Source: Hedgefund.net, a division of Channel Capital Group Inc.

February 2007 The Gloom, Boom & Doom Report 15

Figure 19 Cumulative Returns for Small/Micro Cap Hedge Funds by Regions in Which They Invest,

January 2001 – October 2006

300

SmCap EM

250

SmCap Global

SmCap US

200 SmCap Europe

SmCap Japan

150

Percentage

100

50

-50

May 1, 2001

May 1, 2002

May 1, 2003

May 1, 2004

May 1, 2005

May 1, 2006

Jan 1, 2001

Jan 1, 2002

Jan 1, 2003

Jan 1, 2004

Jan 1, 2005

Jan 1, 2006

Sep 1, 2001

Sep 1, 2002

Sep 1, 2003

Sep 1, 2004

Sep 1, 2005

Sep 1, 2006

Source: Hedgefund.net, a division of Channel Capital Group Inc.

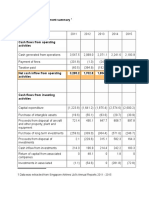

coverage for 30 stocks with market

capitalisation of US$100 million and Table 1 Level of Coverage for Large and Small Cap Stocks in Asia

lower (see Table 1).

The level of coverage for what I

Big caps Small cap (≤ US$100m)*

would consider “below institutional

investor radar” companies (a market Country % of top 30 stks Avg. no. of % of total % of 30 small Avg. no. of % of total

with coverage analysts/stock mkt cap caps w/coverage analysts/stock mkt cap

capitalisation cut-off derived from

more than a decade of sell-side Hong Kong 100 19 59 0 0 0

experience trying to pitch smaller cap China 90 7 80 7 1 0

companies to buy-side fund India 100 9 86 33 1 0

managers) remains insignificant Indonesia 93 11 79 27 2 2

compared to the top 30 capitalised Korea 93 6 63 13 3 0

stocks. In addition, the analysts that

Malaysia 100 16 79 50 1 1

are looking at the small cap stocks

Philippines 93 5 76 17 1 3

tend to be junior or recent graduates,

coming from mainly local houses, Singapore 97 11 81 47 1 1

implying little in-depth analysis or Taiwan 100 9 57 10 1 1

relatively inaccurate forecast data. Thailand 100 16 69 70 2 2

As a result of this, there can be #1 #2 #3 #1 #2 #3

significant differentials in pricing

with a stock that may have the same * — 30 small caps starting from US$100m market capitalisation and lower were used

growth rate, but where the public #1 — denotes how many of the top 30 stocks have minimum of 1 analyst covering

#2 — denotes average number of analysts covering a top/small cap stock

relations machine isn’t working as #3 — denotes how much of total market capitalisation the top 30 capitalised/30 small cap

well in one company as in another. stock accounts for

As such, a US$100 million company Source: Bloomberg

that is growing at 15% p.a. and

16 The Gloom, Boom & Doom Report February 2007

trading on 5 times earnings could references are from competitors; valuation filters (see Figure 20).

potentially be in a “value trap”. so, where we can, we also tend to

However, if it were trading at 10 sniff around the competition in 2) Branding: Whether it is B2B or

times earnings, implying a $200 order not only to get a better B2C branding, we tend towards

million market capitalisation, it is understanding of the industry but companies that have built a brand

suddenly “more investable” and could also to see how the company is for their products, if not through

trade up to even 12–15 times PER as seen by its competition. aggressive advertising and

it is now liquid enough to attract Because of the above factor, marketing expenditure, then

larger funds. Of course, a value we tend to do a great number of through longevity. As such,

investor is a patient investor, but a company visits, as it is pretty around 70% of the stocks the fund

little helping hand doesn’t do any much the only way we are able to holds have strong brands if not in

harm, and the management of such gather information (given the their products, then in the

firms are often not that market savvy little coverage from brokerage company itself. Why the focus on

and need to be urged into action in houses). In fact, last year, we brand? Partly because Asian

order to increase the profile of their clocked up 269 company visits investors don’t tend to put much

companies. Quite often the key to (most of which were face-to-face value on brands (in the same way

unlocking the value in these meetings with senior or top that investors don’t put much

companies isn’t a question of the management), and given we held value on research and

fundamentals of the company but, around 15 stocks in the portfolio development expenditure,

rather, of increasing market at the end of the year, that’s a hit something which we consider to

awareness. rate of 5–6% — lower if you be an essential component of

consider that this list was already building a good brand); as such,

ANATOMY OF INVESTING IN shortlisted from several hundred we feel that branded companies,

MICRO CAPS stocks screened using our or those with a strong brand, tend

Our criteria for selection of

investments aren’t significantly

different to investing in larger Figure 20 Number of Company Meetings

companies; however, because any

60

such investments tend to be less 55

diversified and the ability to exit is

50

quite often more limited, we exercise

extreme caution in pulling the trigger

40

on any investments. Our science is 35

33

filtering the markets with our 30

30 28

valuation screens for a list of cheap

23

stocks with fast-growing prospects.

Our art is selecting the ones most 20 16 16

likely to re-rate over the foreseeable 11 12

10 8

future. Our qualitative criteria help

to narrow down our selections 2

further. 0

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

1) Management, management,

management: Given the hands- 70

on nature of most entrepreneurs, 59

and given the size of the 60

businesses we tend to invest in, 51

50

this category is by far the single 43

most important factor, and at a 40

guess, its weighting probably 33

accounts for around 60–70% of 30 27

our investment decision. Because 20 19

this is so important for us, we 20

don’t undertake any investment 11

10 6

until we have, at the very least,

talked with management, if not 0

met them eye to eye, or visited Thailand HK/China Malaysia Korea Taiwan India Singapore Philippines Indonesia

the factory. Quite often, the best

February 2007 The Gloom, Boom & Doom Report 17

to be undervalued in Asia. In for us, given our value and steady However, we do tend to find that

addition, brands tend to be more returns orientation, which is socially responsible management

resilient in downturns. They tend probably why more than 50% of tend to practise better corporate

to command higher margins, the companies in the fund are governance than their peers, so

giving lower operating leverage, consumer-related businesses. We we don’t focus on social

and therefore are better able to have found that even in the most responsibility just because it’s the

withstand a drop in volumes; they competitive of segments, if the trend!

have a better ability to adjust management focus,

pricing to reflect higher costs; and determination, and expertise are Finally, we find that if we look at

they have more loyalty among there, a company can thrive, so the fund as an investment company,

their customers. we don’t tend to rule out any it tends to focus our attention even

industry. more. Would we want to be in this

3) Industry: Naturally, the industry business ourselves (assuming we had

sector, dynamics, competition, 4) Corporate governance and the expertise), or are we buying it

types of business, and so on, are social responsibility: Of course, because we think the share price will

all important considerations, but this goes back to management. go up? Putting some reality in our

dynamics are significantly However, trying to determine investment decision, rather than

different for different sectors whether the management of a looking at purely the share prices,

across Asia, so it is difficult to small cap company will have forces us to consider how viable the

generalise for this criterion. corporate governance issues is like long-term prospects are. As such, we

However, earnings predictability trying to forecast the direction of consider ourselves a partner, rather a

and steady income is a prime focus the market using astrology. visitor, in all our investments.

THE GLOOM, BOOM & DOOM REPORT

© Marc Faber, 2007

DISCLAIMER: The information, tools and material presented herein are provided for informational purposes only and are not to be used or

considered as an offer or a solicitation to sell or an offer or solicitation to buy or subscribe for securities, investment products or other

financial instruments, nor to constitute any advice or recommendation with respect to such securities, investment products or other financial

instruments. This research report is prepared for general circulation. It does not have regard to the specific investment objectives, financial

situation and the particular needs of any specific person who may receive this report. You should independently evaluate particular investments

and consult an independent financial adviser before making any investments or entering into any transaction in relation to any securities

mentioned in this report.

Author & Publisher Subscriptions and enquiries

DR MARC FABER MARC FABER LTD

Unit 3311–3313, 33/F Two International Finance Centre, 8 Finance Street, Central, Hong Kong

Research Editor & Subscription Tel: (852) 2801 5410 / 2801 5411; Fax: (852) 2845 9192;

LUCIE WANG E-mail: markus_fab@pacific.net.hk; Website: www.gloomboomdoom.com

Copyeditor Design/Layout/Production

ROBYN FLEMMING POLLY YU PRODUCTION LTD

E-mail: robynfle@bigpond.net.au Tel: (852) 2526 0206; Fax: (852) 2526 0378; E-mail: pollyu@netvigator.com

Potrebbero piacerti anche

- Faber 1Documento11 pagineFaber 1scribrenemNessuna valutazione finora

- Predicting the Markets: A Professional AutobiographyDa EverandPredicting the Markets: A Professional AutobiographyNessuna valutazione finora

- Marc Fabers The Gloom Boom Doom ReportDocumento20 pagineMarc Fabers The Gloom Boom Doom ReportMikle196950% (2)

- Strategic and Tactical Asset Allocation: An Integrated ApproachDa EverandStrategic and Tactical Asset Allocation: An Integrated ApproachNessuna valutazione finora

- Marc Faber - The Performance of Gold During Inflation and Deflation (2005.04.20)Documento20 pagineMarc Faber - The Performance of Gold During Inflation and Deflation (2005.04.20)contulmmivNessuna valutazione finora

- Financial Fine Print: Uncovering a Company's True ValueDa EverandFinancial Fine Print: Uncovering a Company's True ValueValutazione: 3 su 5 stelle3/5 (3)

- Three Questions For The Year Ahead: GavekalresearchDocumento29 pagineThree Questions For The Year Ahead: GavekalresearchZerohedge100% (1)

- Capital Flows and the Emerging Economies: Theory, Evidence, and ControversiesDa EverandCapital Flows and the Emerging Economies: Theory, Evidence, and ControversiesNessuna valutazione finora

- Grants Interest Rate Observer 2009W-BreakDocumento33 pagineGrants Interest Rate Observer 2009W-BreakChris BeckerNessuna valutazione finora

- mentary.2009.08.RETAiL - Ebook sUppLeXDocumento20 paginementary.2009.08.RETAiL - Ebook sUppLeXsidjain89Nessuna valutazione finora

- My Investment Journey: How I failed in stock trading and the lesson learnedDa EverandMy Investment Journey: How I failed in stock trading and the lesson learnedValutazione: 5 su 5 stelle5/5 (1)

- Marc FaberDocumento20 pagineMarc Faberapi-26094277Nessuna valutazione finora

- The Boom of 2021Documento4 pagineThe Boom of 2021Jeff McGinnNessuna valutazione finora

- Tail Risk Killers: How Math, Indeterminacy, and Hubris Distort MarketsDa EverandTail Risk Killers: How Math, Indeterminacy, and Hubris Distort MarketsValutazione: 3 su 5 stelle3/5 (1)

- Baseeds 15-30Documento4 pagineBaseeds 15-30api-276766667Nessuna valutazione finora

- 9.3.12 Grants Interest Rate ObserverDocumento11 pagine9.3.12 Grants Interest Rate ObserverElizabeth RasskazovaNessuna valutazione finora

- Where From HereDocumento9 pagineWhere From Heretkling607414Nessuna valutazione finora

- Handbook of Investors' Behavior during Financial CrisesDa EverandHandbook of Investors' Behavior during Financial CrisesFotini EconomouNessuna valutazione finora

- Chris Cole Artemis Vega - Grants Interest Rate Observer Oct232012 - FINAL - v8Documento34 pagineChris Cole Artemis Vega - Grants Interest Rate Observer Oct232012 - FINAL - v8augtour4977100% (1)

- Gloom Boom Doom September 2009Documento24 pagineGloom Boom Doom September 2009alicia-poladian-6146Nessuna valutazione finora

- Marathon Asset Management - European Sovereign & Financial Crisis Paper - 2Q11Documento135 pagineMarathon Asset Management - European Sovereign & Financial Crisis Paper - 2Q11Kamen AtanassovNessuna valutazione finora

- Fat Tails and Nonlinearity: Legg Mason Legg MasonDocumento7 pagineFat Tails and Nonlinearity: Legg Mason Legg Masontradersmag100% (1)

- Hoisington Q3Documento6 pagineHoisington Q3ZerohedgeNessuna valutazione finora

- Lessons From Cycles, Crises, Clients and Colleagues: The Conceptual IssuesDocumento18 pagineLessons From Cycles, Crises, Clients and Colleagues: The Conceptual IssuesJoyce Dick Lam Poon100% (2)

- Napier - Identifying Market Inflection Points CFADocumento9 pagineNapier - Identifying Market Inflection Points CFAAndyNessuna valutazione finora

- Artemis - Rise of The Dragon - April 2021Documento9 pagineArtemis - Rise of The Dragon - April 2021BerchadesNessuna valutazione finora

- Around The World With Kennedy WilsonDocumento48 pagineAround The World With Kennedy WilsonBroyhill Asset ManagementNessuna valutazione finora

- Grant's Interest Rate Observer X-Mas IssueDocumento27 pagineGrant's Interest Rate Observer X-Mas IssueCanadianValueNessuna valutazione finora

- Value Investing Opportunities in Korea (Presentation by Petra)Documento49 pagineValue Investing Opportunities in Korea (Presentation by Petra)Mike ChangNessuna valutazione finora

- Securities in An Insecure World - Benjamin GrahamDocumento14 pagineSecurities in An Insecure World - Benjamin Grahamneo269100% (3)

- BridgewaterDocumento7 pagineBridgewaterkirksoNessuna valutazione finora

- Carlson Capital Q4Documento13 pagineCarlson Capital Q4Zerohedge100% (3)

- Paper On Mcap To GDPDocumento20 paginePaper On Mcap To GDPgreyistariNessuna valutazione finora

- Economics - Microeconomics of Banking - Freixas, RochetDocumento323 pagineEconomics - Microeconomics of Banking - Freixas, RochetGabriel MerloNessuna valutazione finora

- Marcato Capital 4Q14 Letter To InvestorsDocumento38 pagineMarcato Capital 4Q14 Letter To InvestorsValueWalk100% (1)

- Siegal CAPEDocumento10 pagineSiegal CAPEJeffrey WilliamsNessuna valutazione finora

- Forecasting The Term Structure of Government Bond Yields: Article in PressDocumento28 pagineForecasting The Term Structure of Government Bond Yields: Article in Pressstan32lem32Nessuna valutazione finora

- Bridgewater: Daily ObservationsDocumento15 pagineBridgewater: Daily Observationssidg29100% (1)

- Bwa M 03272018Documento8 pagineBwa M 03272018asdf100% (1)

- Kase Fund LTR To Investors-Q2 14Documento4 pagineKase Fund LTR To Investors-Q2 14CanadianValueNessuna valutazione finora

- Horizon Kinetics Study of Owner OperatorsDocumento18 pagineHorizon Kinetics Study of Owner OperatorsCanadianValueNessuna valutazione finora

- Tudor Investments Letter October 2010Documento14 pagineTudor Investments Letter October 2010danno52000Nessuna valutazione finora

- Klarman WorryingDocumento2 pagineKlarman WorryingSudhanshuNessuna valutazione finora

- John Maynard Keynes As An Investor Timeless Lessons and PrinciplesDocumento5 pagineJohn Maynard Keynes As An Investor Timeless Lessons and PrincipleskwongNessuna valutazione finora

- Private Debt Investor Special ReportDocumento7 paginePrivate Debt Investor Special ReportB.C. MoonNessuna valutazione finora

- Russell Napier Transcript Jan 23rdDocumento17 pagineRussell Napier Transcript Jan 23rdmdorneanuNessuna valutazione finora

- Dthe Great Investors, Their Methods and How We Evaluate Them - Wilmott Magazine ArticleDocumento6 pagineDthe Great Investors, Their Methods and How We Evaluate Them - Wilmott Magazine ArticleKelvin SumNessuna valutazione finora

- Where's The Bar - Introducing Market-Expected Return On InvestmentDocumento17 pagineWhere's The Bar - Introducing Market-Expected Return On Investmentpjs15Nessuna valutazione finora

- Active Value Investing Process by Vitaliy Katsenelson, CFADocumento16 pagineActive Value Investing Process by Vitaliy Katsenelson, CFAVitaliyKatsenelsonNessuna valutazione finora

- Arrow Funds RElative StrengthDocumento30 pagineArrow Funds RElative Strengthompomp13Nessuna valutazione finora

- Discounted Cash Flow ModelDocumento21 pagineDiscounted Cash Flow Modelvaibhavsachdeva0326Nessuna valutazione finora

- CMT Level 1Documento2 pagineCMT Level 1Raj KumarNessuna valutazione finora

- Long-Term Capital Management: Masa Juma - Harris Memon - Harry NG - Hugh Wang - Tom WellsDocumento18 pagineLong-Term Capital Management: Masa Juma - Harris Memon - Harry NG - Hugh Wang - Tom WellsTsunNessuna valutazione finora

- Preview Chartbook in Gold We Trust Report 2021Documento88 paginePreview Chartbook in Gold We Trust Report 2021TFMetalsNessuna valutazione finora

- Understanding DrawdownsDocumento12 pagineUnderstanding DrawdownsRodolpho Cammarosano de LimaNessuna valutazione finora

- The Importance of Research in Real Estate DecisionsDocumento12 pagineThe Importance of Research in Real Estate DecisionsEnp Gus AgostoNessuna valutazione finora

- NESTLE BHD Financial Analysis: Group 4Documento14 pagineNESTLE BHD Financial Analysis: Group 4Ct TanNessuna valutazione finora

- Application Form For Student Admission To The Institute and Faculty of ActuariesDocumento17 pagineApplication Form For Student Admission To The Institute and Faculty of ActuariesNunoNessuna valutazione finora

- Internship Report AB BankDocumento70 pagineInternship Report AB BankS M Mazharul KarimNessuna valutazione finora

- NoidaDocumento23 pagineNoidaAmmar Tambawala100% (1)

- Components of A Compensation PlanDocumento13 pagineComponents of A Compensation PlanBarbara GatumutaNessuna valutazione finora

- 500 Banking Awareness MCQ Questions With AnswerDocumento33 pagine500 Banking Awareness MCQ Questions With AnswerAchievers RuleNessuna valutazione finora

- b689 w08Documento15 pagineb689 w08Meet Desai100% (1)

- Fairness, Disclosure and Future Trends in AccountingDocumento67 pagineFairness, Disclosure and Future Trends in AccountingRyan Yogy100% (1)

- Investment and Security Laws ProjectDocumento3 pagineInvestment and Security Laws ProjectUmesh Kumar33% (3)

- Unlocking Cities Report BCG UberDocumento54 pagineUnlocking Cities Report BCG UberNurul Hilalussodik Al FauzaniNessuna valutazione finora

- BP Amoco (A)Documento8 pagineBP Amoco (A)BhartiMahawarNessuna valutazione finora

- Annotated Bibliography 2Documento6 pagineAnnotated Bibliography 2api-453197840Nessuna valutazione finora

- dp12220 PDFDocumento564 paginedp12220 PDFJini ClubNessuna valutazione finora

- John Gokongwei and Henry Sy - Case StudyDocumento6 pagineJohn Gokongwei and Henry Sy - Case StudyJoan Guevarra67% (3)

- Colonialism and Underdevelopment of The Indian EconomyDocumento17 pagineColonialism and Underdevelopment of The Indian EconomysinghnaikNessuna valutazione finora

- Holding and Subsidiary CompaniesDocumento10 pagineHolding and Subsidiary CompaniesNilesh Yadav0% (1)

- PESTLE AnalysisDocumento3 paginePESTLE AnalysisSneha Agarwal100% (1)

- Order in The Matter of Sarang Viniyog Ltd. (Formerly Known As Pincon Spirit LTD.)Documento10 pagineOrder in The Matter of Sarang Viniyog Ltd. (Formerly Known As Pincon Spirit LTD.)Shyam SunderNessuna valutazione finora

- India Fintech Opportunities 2020Documento56 pagineIndia Fintech Opportunities 2020Piyush Kulkarni100% (3)

- 4 - Flows in The Supply Chain Term IVDocumento27 pagine4 - Flows in The Supply Chain Term IVBashishth GuptaNessuna valutazione finora

- Commercial BanksDocumento37 pagineCommercial Banksshanpearl100% (2)

- Raghee Horner Daily Trading EdgeDocumento53 pagineRaghee Horner Daily Trading Edgepsoonek100% (8)

- 5 Year Cash FlowDocumento5 pagine5 Year Cash FlowRith TryNessuna valutazione finora

- Ebook Below Bank Value How To Buy and Own 4 PropertiesDocumento16 pagineEbook Below Bank Value How To Buy and Own 4 PropertiesKhairul Fahmi100% (2)

- Composition of Cash and Cash EquivalentDocumento20 pagineComposition of Cash and Cash EquivalentYenelyn Apistar CambarijanNessuna valutazione finora

- TECHNOPRENEURSHIP WK12 OnlyDocumento59 pagineTECHNOPRENEURSHIP WK12 OnlyJuvill VillaroyaNessuna valutazione finora

- Financial Management - Exercise 2 (NPV & IRR)Documento7 pagineFinancial Management - Exercise 2 (NPV & IRR)Tanatip VijjupraphaNessuna valutazione finora

- Balance Sheet Template ExcelDocumento1 paginaBalance Sheet Template Exceljewel2008Nessuna valutazione finora

- Accounting For Build-Operate-Transfer (BOT)Documento4 pagineAccounting For Build-Operate-Transfer (BOT)Junior SantosNessuna valutazione finora

- The Compound Effect by Darren Hardy - Book Summary: Jumpstart Your Income, Your Life, Your SuccessDa EverandThe Compound Effect by Darren Hardy - Book Summary: Jumpstart Your Income, Your Life, Your SuccessValutazione: 5 su 5 stelle5/5 (456)

- Summary: Atomic Habits by James Clear: An Easy & Proven Way to Build Good Habits & Break Bad OnesDa EverandSummary: Atomic Habits by James Clear: An Easy & Proven Way to Build Good Habits & Break Bad OnesValutazione: 5 su 5 stelle5/5 (1636)

- Summary of 12 Rules for Life: An Antidote to ChaosDa EverandSummary of 12 Rules for Life: An Antidote to ChaosValutazione: 4.5 su 5 stelle4.5/5 (294)

- Summary of The New Menopause by Mary Claire Haver MD: Navigating Your Path Through Hormonal Change with Purpose, Power, and FactsDa EverandSummary of The New Menopause by Mary Claire Haver MD: Navigating Your Path Through Hormonal Change with Purpose, Power, and FactsNessuna valutazione finora

- Summary of The Anxious Generation by Jonathan Haidt: How the Great Rewiring of Childhood Is Causing an Epidemic of Mental IllnessDa EverandSummary of The Anxious Generation by Jonathan Haidt: How the Great Rewiring of Childhood Is Causing an Epidemic of Mental IllnessNessuna valutazione finora

- Mindset by Carol S. Dweck - Book Summary: The New Psychology of SuccessDa EverandMindset by Carol S. Dweck - Book Summary: The New Psychology of SuccessValutazione: 4.5 su 5 stelle4.5/5 (328)

- The War of Art by Steven Pressfield - Book Summary: Break Through The Blocks And Win Your Inner Creative BattlesDa EverandThe War of Art by Steven Pressfield - Book Summary: Break Through The Blocks And Win Your Inner Creative BattlesValutazione: 4.5 su 5 stelle4.5/5 (274)

- Can't Hurt Me by David Goggins - Book Summary: Master Your Mind and Defy the OddsDa EverandCan't Hurt Me by David Goggins - Book Summary: Master Your Mind and Defy the OddsValutazione: 4.5 su 5 stelle4.5/5 (386)

- The Body Keeps the Score by Bessel Van der Kolk, M.D. - Book Summary: Brain, Mind, and Body in the Healing of TraumaDa EverandThe Body Keeps the Score by Bessel Van der Kolk, M.D. - Book Summary: Brain, Mind, and Body in the Healing of TraumaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The One Thing: The Surprisingly Simple Truth Behind Extraordinary ResultsDa EverandThe One Thing: The Surprisingly Simple Truth Behind Extraordinary ResultsValutazione: 4.5 su 5 stelle4.5/5 (709)

- Essentialism by Greg McKeown - Book Summary: The Disciplined Pursuit of LessDa EverandEssentialism by Greg McKeown - Book Summary: The Disciplined Pursuit of LessValutazione: 4.5 su 5 stelle4.5/5 (188)