Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

ABS Risk Simulator v1.1 Performance

Caricato da

User0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

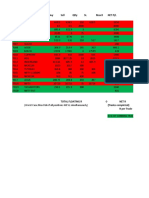

69 visualizzazioni5 pagineThe document presents the output of a risk management simulator showing the input parameters for a potential trade including the portfolio value, value at risk, estimated allocation, entry and stop loss prices, and target price. It then shows the output of four simulated cases - losing with the stop loss being hit, losing due to slippage, breaking even, and winning by hitting the target price. The legend and reminders at the bottom provide guidance on interpreting the results and ensuring parameters like the value at risk and risk reward ratio are within acceptable limits.

Descrizione originale:

Titolo originale

ABS Risk Management Simulator Beta Version 1.1

Copyright

© © All Rights Reserved

Formati disponibili

XLSX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoThe document presents the output of a risk management simulator showing the input parameters for a potential trade including the portfolio value, value at risk, estimated allocation, entry and stop loss prices, and target price. It then shows the output of four simulated cases - losing with the stop loss being hit, losing due to slippage, breaking even, and winning by hitting the target price. The legend and reminders at the bottom provide guidance on interpreting the results and ensuring parameters like the value at risk and risk reward ratio are within acceptable limits.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato XLSX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

69 visualizzazioni5 pagineABS Risk Simulator v1.1 Performance

Caricato da

UserThe document presents the output of a risk management simulator showing the input parameters for a potential trade including the portfolio value, value at risk, estimated allocation, entry and stop loss prices, and target price. It then shows the output of four simulated cases - losing with the stop loss being hit, losing due to slippage, breaking even, and winning by hitting the target price. The legend and reminders at the bottom provide guidance on interpreting the results and ensuring parameters like the value at risk and risk reward ratio are within acceptable limits.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato XLSX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 5

ABS Risk Management Simulator v1.

Total Port Upon Entering on Trade 100,000.00

Value at Risk (VAR) % 1.00%

Value at Risk (VAR) Amount 1,000.00

Estimated Portfolio Allocation 24.79%

Estimated Amount to Trade 24,790.83

Suggested No. of Shares 250

Stop loss % -4.03%

Entry Price 96.0000

Stop loss 93.2700

Target Price 103.0000

Risk Reward Ratio (RRR) 1.51

Simulation Output Total Bought Market/ Average

Shares Price Sold Price Price

Case 1: Lose - Stop Loss Hit 250 96.00 93.27 96.2832

Case 2: Lose - Loss by Slippage 250 96.00 96.00 96.2832

Case 3: Neutral - Breakeven 250 96.00 97.14 96.2832

Case 4: Win - TP Hit 250 96.00 103.00 96.2832

Legend

Input

Calculated Data

Trade Reminders

VAR %. OK.

8K Rule. OK.

Risk Reward Ratio (RRR) should

1:2 or better.

Total Cost Market (+/-) % % Port

Value Gain/Loss Gain/Loss Damage/Recovery

24,070.80 23,108.81 -961.99 -4.00% -0.96%

24,070.80 23,785.20 -285.60 -1.19% -0.29%

24,070.80 24,068.24 -2.56 -0.01% 0.00%

24,070.80 25,519.54 1,448.74 6.02% 1.45%

SN User's feedback

1 Tenhnical cut instead of %wise cutloss;

2 Slippage includes on suggested No. of shares to be bought computation

3 Flash message on 8K rule

4 Flash message on < 2.0 RRR

5 Simulated Error in other MS Office Version

6 Breakeven scenario and case arrangement

Status Remark Review by

Done Available Aedrick Yanga

Done Available Aedrick Yanga

Done Available Developer

Done Available Wilbur Adrian Elicot

Done Available Paul Jovena

Done Available Jimmy Angeles

Potrebbero piacerti anche

- Risk Reward Ratio Excel TemplateDocumento3 pagineRisk Reward Ratio Excel TemplateDindin KamaludinNessuna valutazione finora

- Real Traders II: How One CFO Trader Used the Power of Leverage to make $110k in 9 WeeksDa EverandReal Traders II: How One CFO Trader Used the Power of Leverage to make $110k in 9 WeeksNessuna valutazione finora

- Boomie Bounce PlaybookDocumento9 pagineBoomie Bounce PlaybookJustin LimNessuna valutazione finora

- Bigot Es Wabe Guide 01Documento3 pagineBigot Es Wabe Guide 01Jms JmsNessuna valutazione finora

- Lifespan Investing: Building the Best Portfolio for Every Stage of Your LifeDa EverandLifespan Investing: Building the Best Portfolio for Every Stage of Your LifeNessuna valutazione finora

- Zeefreak's Trade in JournalDocumento47 pagineZeefreak's Trade in Journaljoseph bernard de leonNessuna valutazione finora

- Spyfrat KISS OF MA50Documento1 paginaSpyfrat KISS OF MA50Blu KurakaoNessuna valutazione finora

- Technical Trading Strategies Primer 1Documento10 pagineTechnical Trading Strategies Primer 1JonNessuna valutazione finora

- ZF Trend Following Mini Thesis v2Documento15 pagineZF Trend Following Mini Thesis v2jom teeoneNessuna valutazione finora

- Risk and Portfolio Management Spring 2011: Statistical ArbitrageDocumento66 pagineRisk and Portfolio Management Spring 2011: Statistical ArbitrageSwapan ChakrabortyNessuna valutazione finora

- Spyfrat PlaybookDocumento1 paginaSpyfrat PlaybookDhenzel AntonioNessuna valutazione finora

- Commodity Channel IndexDocumento2 pagineCommodity Channel IndexMeet Darji100% (1)

- AOTSDocumento167 pagineAOTSMark Rasonabe100% (2)

- Boh Philippines Black Box - 2019.07.31Documento289 pagineBoh Philippines Black Box - 2019.07.31Phi Consistent TraderNessuna valutazione finora

- Bigote Trading Workshop - Primer - v2Documento33 pagineBigote Trading Workshop - Primer - v2Abcede IloiloNessuna valutazione finora

- Autochartist enDocumento6 pagineAutochartist enAnonymous fE2l3DzlNessuna valutazione finora

- Terms and Jargons For Trading by EmperorBTCDocumento9 pagineTerms and Jargons For Trading by EmperorBTCsaptovicnemanjaNessuna valutazione finora

- AlExOnZe Ebook Ever 2017 Release 2018 Part 2 PDFDocumento119 pagineAlExOnZe Ebook Ever 2017 Release 2018 Part 2 PDFqwedaNessuna valutazione finora

- ROC Technical IndicatorDocumento14 pagineROC Technical Indicatorbhanu.chanduNessuna valutazione finora

- Building Schedule of Rates Volume - IIDocumento988 pagineBuilding Schedule of Rates Volume - IIA M100% (1)

- Fib Retracement ToolDocumento9 pagineFib Retracement ToolSharma compNessuna valutazione finora

- B07mykddjy Ebok PDFDocumento179 pagineB07mykddjy Ebok PDFLê Minh Thuận0% (3)

- Technical Analysis TutorialDocumento34 pagineTechnical Analysis TutorialFahimNessuna valutazione finora

- 16.volatility Calculation (Historical) - Zerodha VarsityDocumento24 pagine16.volatility Calculation (Historical) - Zerodha Varsityravi4paperNessuna valutazione finora

- Standard Deviation (Volatility) : AverageDocumento7 pagineStandard Deviation (Volatility) : AverageSachin SahooNessuna valutazione finora

- 1649497527678investing Strategies To Create Wealth 61445e8aDocumento31 pagine1649497527678investing Strategies To Create Wealth 61445e8aVimalahar rajagopalNessuna valutazione finora

- Technical AnalysisDocumento39 pagineTechnical AnalysisharishNessuna valutazione finora

- Analyze Historical Data Trends to Predict Future PerformanceDocumento3 pagineAnalyze Historical Data Trends to Predict Future PerformanceMahesh SavaliyaNessuna valutazione finora

- ARMSDocumento4 pagineARMSWorld NewNessuna valutazione finora

- Technical Analysis IndicatorsDocumento21 pagineTechnical Analysis IndicatorsvgvpplNessuna valutazione finora

- CTI Half Day - Outline PDFDocumento1 paginaCTI Half Day - Outline PDFRommel Angelo KirongNessuna valutazione finora

- Accord Capital Equities Corporation:: First Philippine Holdings, Inc (Pse: FPH)Documento1 paginaAccord Capital Equities Corporation:: First Philippine Holdings, Inc (Pse: FPH)JC CalaycayNessuna valutazione finora

- 30 Trades Sample SizeDocumento13 pagine30 Trades Sample SizePraful AroraNessuna valutazione finora

- Strategy BookDocumento25 pagineStrategy BookjustshubhamsharmaNessuna valutazione finora

- Basic Technical AnalysisDocumento35 pagineBasic Technical AnalysismoxbNessuna valutazione finora

- Game Plan: Scenario 1 - Highs Made First Break All Time High 2480.50 With Buying of Good QualityDocumento3 pagineGame Plan: Scenario 1 - Highs Made First Break All Time High 2480.50 With Buying of Good QualityRICARDONessuna valutazione finora

- PinoyInvestor Academy - Technical Analysis Part 3Documento18 paginePinoyInvestor Academy - Technical Analysis Part 3Art JamesNessuna valutazione finora

- Tweezer TopDocumento5 pagineTweezer Topkarthick sudharsanNessuna valutazione finora

- Proper Trading Strategy v.1Documento4 pagineProper Trading Strategy v.1Akash Biswal100% (1)

- Product Guide - Buy Today Sell Tomorrow (BTST)Documento5 pagineProduct Guide - Buy Today Sell Tomorrow (BTST)SivaAgathamudiNessuna valutazione finora

- BTC Options: Dissecting Volatility TrendsDocumento38 pagineBTC Options: Dissecting Volatility TrendsVishvendra SinghNessuna valutazione finora

- Trading Journal BeginnersDocumento48 pagineTrading Journal BeginnersadelinNessuna valutazione finora

- Advance through day trading levels and boost profits with position size limitsDocumento15 pagineAdvance through day trading levels and boost profits with position size limitssarav10Nessuna valutazione finora

- How To Successfully Use Pitchforks and Median Lines To TradeDocumento60 pagineHow To Successfully Use Pitchforks and Median Lines To TradekhangphongnguyengmaiNessuna valutazione finora

- Hermitage Centralis Luxury HomesDocumento15 pagineHermitage Centralis Luxury HomesPKCL033 Balwinder SinghNessuna valutazione finora

- Ichimoku Kinko Hyo StrategiesDocumento3 pagineIchimoku Kinko Hyo StrategiesCarlos Jose MárquezNessuna valutazione finora

- Technical Webinar 6 - Analyst Rajendra - (23-Aug-2020)Documento46 pagineTechnical Webinar 6 - Analyst Rajendra - (23-Aug-2020)RajanmanuVarada0% (1)

- Full Guide On Support and Resistance: by Crypto VIP SignalDocumento11 pagineFull Guide On Support and Resistance: by Crypto VIP SignalSaroj PaudelNessuna valutazione finora

- Mang Kanor Trading Blueprint (10!19!15)Documento237 pagineMang Kanor Trading Blueprint (10!19!15)Getto Pangandoyon0% (1)

- 24 June Trade SheetDocumento24 pagine24 June Trade Sheetrajendraa1981Nessuna valutazione finora

- TECHNICAL STUDIEs (3794)Documento102 pagineTECHNICAL STUDIEs (3794)DakshNessuna valutazione finora

- RSI Divergence Types & Strategies ExplainedDocumento11 pagineRSI Divergence Types & Strategies ExplainedGoogleuser googleNessuna valutazione finora

- S&P 500 Index: Line ChartDocumento11 pagineS&P 500 Index: Line Chartreena_h_107776Nessuna valutazione finora

- Stock Market Course ContentDocumento12 pagineStock Market Course ContentSrikanth SanipiniNessuna valutazione finora

- Presentation 1Documento47 paginePresentation 1sanjay patidarNessuna valutazione finora

- Hester Bio-Sciences StockDocumento2 pagineHester Bio-Sciences Stockdrsivaprasad7Nessuna valutazione finora

- Japanese Candlestick Charting Techniques: A Contemporary Guide To The Ancient Investment Techniques of The Far East, Second Edition - Steve NisonDocumento4 pagineJapanese Candlestick Charting Techniques: A Contemporary Guide To The Ancient Investment Techniques of The Far East, Second Edition - Steve NisoncyjokuzuNessuna valutazione finora

- Investagram Champion 2017 PresentationDocumento16 pagineInvestagram Champion 2017 PresentationJedson VizcaynoNessuna valutazione finora

- MicrosoftDocumento17 pagineMicrosoftshailendraNessuna valutazione finora

- Microsoft Prep4sure AZ-103 v2019-11-03 by - Tyler - 88q PDFDocumento114 pagineMicrosoft Prep4sure AZ-103 v2019-11-03 by - Tyler - 88q PDFKevin S. SánchezNessuna valutazione finora

- Mcafee Endpoint Product Removal Tool User Guide: Method of ProcedureDocumento11 pagineMcafee Endpoint Product Removal Tool User Guide: Method of ProcedureUserNessuna valutazione finora

- Gap and Gap Analysis (2000) PDFDocumento5 pagineGap and Gap Analysis (2000) PDFRavi KherNessuna valutazione finora

- May 2020 Moving Average Notes/TITLEDocumento50 pagineMay 2020 Moving Average Notes/TITLEUserNessuna valutazione finora

- Az 900Documento185 pagineAz 900User100% (2)

- Technical AnalysisDocumento111 pagineTechnical Analysisapi-3803915100% (10)

- Blue Minimalist Resume TemplateDocumento2 pagineBlue Minimalist Resume TemplateUserNessuna valutazione finora

- Estimated Time of Completion: TBD: DescriptionDocumento7 pagineEstimated Time of Completion: TBD: DescriptionUserNessuna valutazione finora

- Moving Average: A Reaction Paper by Francine Grad Monleon TI49Documento21 pagineMoving Average: A Reaction Paper by Francine Grad Monleon TI49UserNessuna valutazione finora

- Omega Trading Tools v2.0 (Beta)Documento62 pagineOmega Trading Tools v2.0 (Beta)UserNessuna valutazione finora

- The safer way to pass IT examsDocumento23 pagineThe safer way to pass IT examsUser100% (1)

- Azure Fundamentals - Condensed Prep NotesDocumento105 pagineAzure Fundamentals - Condensed Prep NotesUserNessuna valutazione finora

- Backtracking algorithm for solving Knight's tour problemDocumento7 pagineBacktracking algorithm for solving Knight's tour problemAtul GargNessuna valutazione finora

- Gender Recognition From ImageDocumento22 pagineGender Recognition From ImagePråshãnt ShärmãNessuna valutazione finora

- Hybrid Encryption For Cloud Database Security-AnnotatedDocumento7 pagineHybrid Encryption For Cloud Database Security-AnnotatedClaireNessuna valutazione finora

- Chapter 18Documento9 pagineChapter 18KANIKA GORAYANessuna valutazione finora

- Application of Logistic Regression To People-AnalyticsDocumento30 pagineApplication of Logistic Regression To People-AnalyticsSravan KrNessuna valutazione finora

- ML AI Main BrochureDocumento7 pagineML AI Main BrochuresrivatsaNessuna valutazione finora

- Simplification of Calibration of Low-Cost MEMS Accelerometer and Its Temperature Compensation Whitout Accurate Laboratory EquipmentDocumento10 pagineSimplification of Calibration of Low-Cost MEMS Accelerometer and Its Temperature Compensation Whitout Accurate Laboratory EquipmentLorenaNessuna valutazione finora

- Numerical Methods and Optimization Practical Exam QuestionsDocumento12 pagineNumerical Methods and Optimization Practical Exam QuestionsRavi ParkheNessuna valutazione finora

- Ensemble Learning: HARIS JAMIL (FA18-RCS-003) HOOIRA ANAM (FA18-RCS-004)Documento14 pagineEnsemble Learning: HARIS JAMIL (FA18-RCS-003) HOOIRA ANAM (FA18-RCS-004)suppiNessuna valutazione finora

- CISSP Exam Study PlanDocumento7 pagineCISSP Exam Study Planravi kantNessuna valutazione finora

- Bisection MethodDocumento31 pagineBisection MethodxREDCivicCometxNessuna valutazione finora

- Local and Stochastic Volatility: Johannes RufDocumento62 pagineLocal and Stochastic Volatility: Johannes Rufvenkraj_iitmNessuna valutazione finora

- ANSYS Motion Theory Introduction - PresentationDocumento20 pagineANSYS Motion Theory Introduction - PresentationRama BaruvaNessuna valutazione finora

- Homework 1Documento3 pagineHomework 1keoxxNessuna valutazione finora

- McCulloch-Pitts NeuronDocumento14 pagineMcCulloch-Pitts NeuronRajib DebnathNessuna valutazione finora

- Lecture 7&8 (Brute Force)Documento35 pagineLecture 7&8 (Brute Force)DeependraNessuna valutazione finora

- Topic 4 Decision AnalysisDocumento45 pagineTopic 4 Decision AnalysisKiri SorianoNessuna valutazione finora

- Swarm Intelligence-Based Approach For Educational Data ClassificationDocumento18 pagineSwarm Intelligence-Based Approach For Educational Data ClassificationsamNessuna valutazione finora

- Assignment 4.solutionDocumento7 pagineAssignment 4.solutionMohammad SharifNessuna valutazione finora

- Monte Carlo Simulation SoccerDocumento9 pagineMonte Carlo Simulation Soccerdaselknam100% (1)

- CNN, RNN & HAN Text Classification ReportDocumento15 pagineCNN, RNN & HAN Text Classification Reportpradeep_dhote9Nessuna valutazione finora

- Getting Started With Data Science Using PythonDocumento25 pagineGetting Started With Data Science Using PythonJatin Borah100% (1)

- Delft: Matlab and Simulink For Modeling and ControlDocumento12 pagineDelft: Matlab and Simulink For Modeling and Controlawan_krNessuna valutazione finora

- Linear and Nonlinear Programming With Maple An Interactive, Applications-Based ApproachDocumento419 pagineLinear and Nonlinear Programming With Maple An Interactive, Applications-Based ApproachMohammad AbdelaalNessuna valutazione finora

- Operations Management Solution ManualDocumento1 paginaOperations Management Solution ManualAtif Idrees14% (22)

- EIE410 Digital Control SystemDocumento3 pagineEIE410 Digital Control SystemgurusaravanaNessuna valutazione finora

- Digital - SignatureDocumento28 pagineDigital - SignatureRishabh GuptaNessuna valutazione finora

- Trees and Forests: Machine Learning With Python CookbookDocumento5 pagineTrees and Forests: Machine Learning With Python CookbookJayod RajapakshaNessuna valutazione finora

- State-Space Modeling of Control SystemsDocumento11 pagineState-Space Modeling of Control SystemsSyed Hussain Akbar MosviNessuna valutazione finora

- Graphs Breadth First Search & Depth First Search: by Shailendra UpadhyeDocumento21 pagineGraphs Breadth First Search & Depth First Search: by Shailendra Upadhyeجعفر عباسNessuna valutazione finora