Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

University of Veterinary and Animal Sciences

Caricato da

Akbar AbbasTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

University of Veterinary and Animal Sciences

Caricato da

Akbar AbbasCopyright:

Formati disponibili

University of Veterinary and Animal Sciences

UVAS Business School

Department of Economics and Business Management

Course Code: Course Title: Commercial Banking

Program: BBA 7 and MBA 5 Semester: Fall/Winter

Credit Hours: 3 Total Sessions: 36

Teacher’s Name: Syeda Reema Aftab Email: reema.aftab@uvas.edu.pk

Course Description:

The course is designed to equip students with knowledge of a Commercial Banking and its regulatory

framework and environments in Pakistan, and as it exists in a developed economy. On completion of the

course the students shall be able to demonstrate an understanding of the subject matter and financial

environments in Pakistan.

Learning Objectives:

On completion of the course the students shall be able to demonstrate an understanding of the

subject matter and financial environments, not only in Pakistan but in the outside developed

financial world. To critically examine the salient features of financial system and role of

commercial Banking in it. To understand the regulatory framework, the world regulatory

architecture shaping up. The strength and weaknesses of some of the regulations.

Teaching-Learning Methodology:

Lectures

Reading Material

Handouts

Project Report

Assessment & Evaluation:

Class activities (including quizzes, assignments 10%

etc)

Mid Term 30%

End Term 60%

Total 100%

Recommended Textbook and Readings:

Bank Management & Financial Services. By Peter S. Rose & Sylvia C. Hudgins. 8th

Edition

Banking Laws from Institute of Banking of Pakistan.

Banking System Review. A publication by SBP, available on SBP website

CALENDAR OF ACTIVITIES

Semester Starting Date: October 28, 2019

Week Contents Tasks/Activities

Introduction to the course and Background Knowledge

1. Assessment

Chapter 1: An Overview of the Banks and the Financial-

Services Sector

2.

What is a bank? Different kinds of financial service firms;

Leading competitors of banks

Chapter 1: An Overview Introduction of Banks and the

Financial-Services

3. Different roles played by the bank and other financial

institutions; Services offered by the banks and their closest

competitors

Products and Services offered by the Banks

4. Personal Banking (Current accounts; Savings and Term

Deposits; Bancassurance)

Products and Services offered by the Banks

5. Personal Banking (Investment services, Asset Management,

Consumer loans, Domestic remittance)

Products and Services offered by the Banks

6. Corporate Banking (Transaction and Banking accounts;

Savings and Term deposits; SME financing)

Products and Services offered by the Banks

7. Corporate Banking (Corporate and Investment Banking;

Treasury services, Trade services, Agricultural financing)

8. Products and Services offered by the Banks

Islamic Banking (Musharakah, Mudaraba, Murabaha,

Salam, Istisna, Ijarah)

9. Mid Term Examination

Chapter 5 The Financial Statements of Banks and Their

Principal Competitors

An Overview of Balance Sheets and Income Statements. Assignment

10. The Balance Sheet (Report of Condition). The Principal Announcement and

Types of Accounts. Recent Expansion of Off-Balance-Sheet Discussion

Items in Banking the Problem of Book-Value Accounting;

Auditing: Assuring Reliability of Financial Statements

Chapter 5 The Financial Statements of Banks and Their

11. Principal Competitors

A Comparison to Bank Statements.

Chapter 5 The Financial Statements of Banks and Their

Principal Competitors

12.

An Overview of Key Features of Financial Statements and

Their Consequences

Chapter 6 Measuring and Evaluating the Performance

of Banks and Their Principal Competitors

Evaluating Performance; Determining Long-Range

13. Objectives; Maximizing the Value of the Firm: A Key

Objective for Nearly All Financial-Service Institutions;

Profitability Ratios: A Surrogate for Stock Values; Using

Profitability Formulas for Banks and Other Financial’

Service Companies

Chapter 6 Measuring and Evaluating the Performance

of Banks and Their Principal Competitors

Breaking Down Equity Returns for Closer Analysis; Periodic review of

14. Breakdown Analysis of the Return on Assets; What a Assignment

Breakdown of Profitability Measures Can Tell Us;

Measuring Risk in Banking and Financial Services; Other

Goals in Banking and Financial-Services Management

15. Chapter 6 Measuring and Evaluating the Performance

of Banks and Their Principal Competitors

The Impact of Size on Performance. Size, Location, and

Regulatory Bias in Analyzing the Performance of Banks and

Competing Financial Institutions Using Financial Ratios and

Other Analytical Tools to Track Bank Performance— The

UBPR

Chapter 11 Liquidity and Reserve Management:

Strategies and Policies

Introduction; The Demand for and Supply of Liquidity; Why

16. Financial Firms Often Face Significant Liquidity Problems

Asset Liquidity Management (or Asset Conversion)

Strategies Borrowed Liquidity (Liability) Management

Strategies; Balanced Liquidity Management Strategies;

Guidelines for Liquidity Managers

Chapter 11 Strategies for Liquidity Managers

Estimating Liquidity Needs. The Sources and Uses of Funds

Approach... The Structure of Funds Approach. Liquidity

Indicator Approach. The Ultimate Standard for Assessing Assignment

17. Liquidity Needs: Signals from the Marketplace. Legal Submission and

Reserves and Money Position Management. Regulations on Evaluation

Calculating Legal Reserve Requirements; Factors

Influencing the Money Position. Factors in Choosing among

the Different Sources of Reserves Central Bank Reserve

Requirements around the Globe

18. Final Term Examination

Potrebbero piacerti anche

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Reaching Different Learning Styles ThrouDocumento29 pagineReaching Different Learning Styles ThrouKENNETH HERRERANessuna valutazione finora

- Guidelines For New Students - 2022Documento14 pagineGuidelines For New Students - 2022Ria Faye PaderangaNessuna valutazione finora

- Performance Ratio Analysis Based On Energy Production For Large-Scale Solar PlantDocumento22 paginePerformance Ratio Analysis Based On Energy Production For Large-Scale Solar PlantPrateek MalhotraNessuna valutazione finora

- Indian Ordnance FactoryDocumento2 pagineIndian Ordnance FactoryAniket ChakiNessuna valutazione finora

- Philippine Multimodal Transportation and Logistics Industry Roadmap - Key Recommendations - 2016.04.14Documento89 paginePhilippine Multimodal Transportation and Logistics Industry Roadmap - Key Recommendations - 2016.04.14PortCalls50% (4)

- People/Occupancy Rules of Thumb: Bell - Ch10.indd 93 8/17/07 10:39:31 AMDocumento8 paginePeople/Occupancy Rules of Thumb: Bell - Ch10.indd 93 8/17/07 10:39:31 AMPola OsamaNessuna valutazione finora

- Baterías YuasaDocumento122 pagineBaterías YuasaLuisNessuna valutazione finora

- LESSON - STEM-based Research ProblemsDocumento49 pagineLESSON - STEM-based Research ProblemsLee JenoNessuna valutazione finora

- Navi Mumbai C.A. ListDocumento48 pagineNavi Mumbai C.A. ListManish Shetty67% (9)

- LOVDocumento43 pagineLOVMei FadillahNessuna valutazione finora

- Heirs of Tancoco v. CADocumento28 pagineHeirs of Tancoco v. CAChris YapNessuna valutazione finora

- Odontogenic CystsDocumento5 pagineOdontogenic CystsBH ASMRNessuna valutazione finora

- Spectrochem Chemindex 2016 17Documento122 pagineSpectrochem Chemindex 2016 17Nivedita Dube0% (1)

- Modeling Cover Letter No ExperienceDocumento7 pagineModeling Cover Letter No Experienceimpalayhf100% (1)

- D.E.I Technical College, Dayalbagh Agra 5 III Semester Electrical Engg. Electrical Circuits and Measurements Question Bank Unit 1Documento5 pagineD.E.I Technical College, Dayalbagh Agra 5 III Semester Electrical Engg. Electrical Circuits and Measurements Question Bank Unit 1Pritam Kumar Singh100% (1)

- Project of Consumer BehaviourDocumento28 pagineProject of Consumer BehaviourNaveed JuttNessuna valutazione finora

- Beneparts Quotation BYBJ192388 20191024Documento1 paginaBeneparts Quotation BYBJ192388 20191024احمد عبدهNessuna valutazione finora

- Pub 005940 PDFDocumento31 paginePub 005940 PDFkurniaNessuna valutazione finora

- Lich King Chorus PDFDocumento21 pagineLich King Chorus PDFMacgy YeungNessuna valutazione finora

- Rectangular Wire Die Springs ISO-10243 Standard: Red Colour Heavy LoadDocumento3 pagineRectangular Wire Die Springs ISO-10243 Standard: Red Colour Heavy LoadbashaNessuna valutazione finora

- Splunk Certification: Certification Exam Study GuideDocumento18 pagineSplunk Certification: Certification Exam Study GuidesalemselvaNessuna valutazione finora

- Ra 11521 9160 9194 AmlaDocumento55 pagineRa 11521 9160 9194 Amlagore.solivenNessuna valutazione finora

- Blockchain Unit Wise Question BankDocumento3 pagineBlockchain Unit Wise Question BankMeghana50% (4)

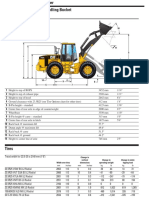

- Cat It62hDocumento4 pagineCat It62hMarceloNessuna valutazione finora

- Pepsico IncDocumento26 paginePepsico IncYKJ VLOGSNessuna valutazione finora

- Management by ObjectivesDocumento30 pagineManagement by ObjectivesJasmandeep brar100% (4)

- Determination of Sales Force Size - 2Documento2 pagineDetermination of Sales Force Size - 2Manish Kumar100% (3)

- Solved Suppose That The Velocity of Circulation of Money Is VDocumento1 paginaSolved Suppose That The Velocity of Circulation of Money Is VM Bilal SaleemNessuna valutazione finora

- Nature Hill Middle School Wants To Raise Money For A NewDocumento1 paginaNature Hill Middle School Wants To Raise Money For A NewAmit PandeyNessuna valutazione finora

- KINDRED HEALTHCARE, INC 10-K (Annual Reports) 2009-02-25Documento329 pagineKINDRED HEALTHCARE, INC 10-K (Annual Reports) 2009-02-25http://secwatch.comNessuna valutazione finora